Global Plastic Bottles Market

Market Size in USD Billion

CAGR :

%

USD

140.50 Billion

USD

195.26 Billion

2025

2033

USD

140.50 Billion

USD

195.26 Billion

2025

2033

| 2026 –2033 | |

| USD 140.50 Billion | |

| USD 195.26 Billion | |

|

|

|

|

Plastic Bottles Market Size

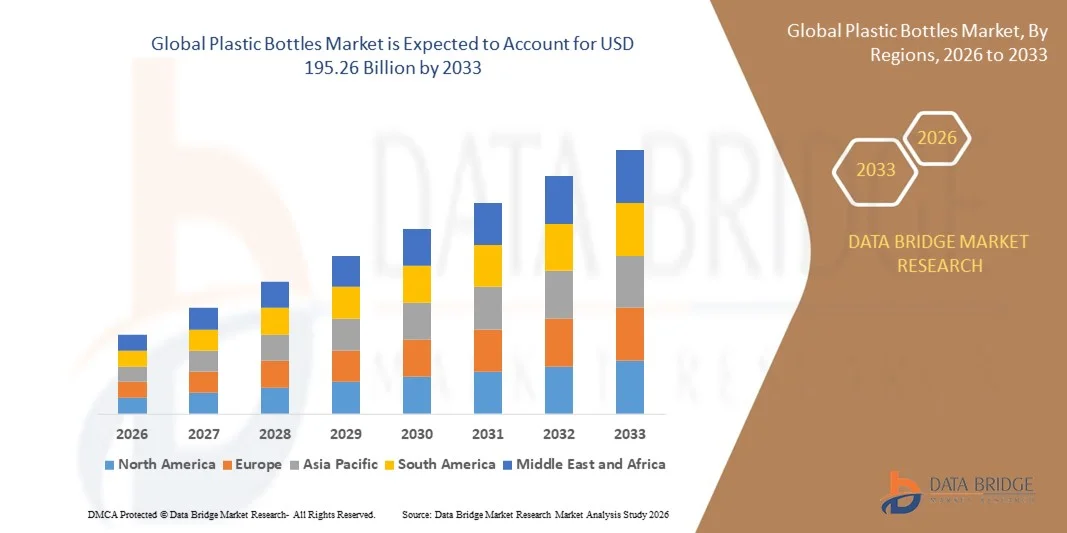

- The global plastic bottles market size was valued at USD 140.50 billion in 2025 and is expected to reach USD 195.26 billion by 2033, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by rising global demand for packaged beverages, food, personal care, and household products, which is driving higher consumption of plastic bottles across residential and commercial sectors

- Furthermore, increasing focus on lightweight, durable, and cost-effective packaging solutions is encouraging manufacturers to adopt advanced plastic bottle designs and materials. These converging factors are accelerating production and adoption of plastic bottles, thereby significantly boosting the industry’s growth

Plastic Bottles Market Analysis

- Plastic bottles, used for beverages, food, cosmetics, pharmaceuticals, and household liquids, are becoming essential packaging solutions due to their durability, lightweight nature, and ease of customization for branding and functionality

- The escalating demand for plastic bottles is primarily fueled by the growing packaged food and beverage industry, rising urbanization, and the expanding need for convenient and safe packaging solutions. In addition, increasing adoption of sustainable and recyclable plastics is further driving market expansion across multiple end-use verticals

- Asia-Pacific dominated the plastic bottles market with a share of 46.42% in 2025, due to growing beverage and packaged food consumption, rapid urbanization, and a strong presence of manufacturing hubs in the region

- North America is expected to be the fastest growing region in the plastic bottles market during the forecast period due to robust demand for bottled beverages, personal care products, and household liquids

- Polyethylene Terephthalate (PET) segment dominated the market with a market share of 75.36% in 2025, due to its excellent clarity, lightweight nature, and recyclability. PET bottles are highly preferred in beverages and food packaging due to their resistance to impact, chemical stability, and compatibility with carbonated drinks. Manufacturers favor PET for its ability to maintain product quality over extended shelf life, while consumers appreciate the convenience of lightweight and portable packaging

Report Scope and Plastic Bottles Market Segmentation

|

Attributes |

Plastic Bottles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic Bottles Market Trends

Growing Adoption of Sustainable and Recyclable Plastic Bottles

- A key trend in the plastic bottles market is the increasing adoption of sustainable and recyclable materials, driven by rising environmental awareness and consumer preference for eco-friendly packaging. Manufacturers are investing in advanced polymer formulations and recycling technologies to reduce plastic waste and enhance product lifecycle management

- For instance, companies such as Coca-Cola have introduced PlantBottle packaging, which incorporates up to 30% plant-based materials, promoting sustainability across their beverage portfolio. These initiatives are influencing industry standards and encouraging broader adoption of recyclable plastics

- The demand for biodegradable and compostable plastics is rising as brands aim to meet corporate sustainability goals and comply with evolving regulations. This trend is shaping the development of innovative packaging solutions that maintain product safety and shelf life while reducing environmental impact

- Consumer-driven demand for transparent and lightweight packaging is driving innovation in bottle design and material efficiency. High-performance plastics are being engineered to reduce weight without compromising durability, providing both environmental and logistical benefits

- Retail and e-commerce sectors are increasingly adopting recyclable bottles to align with green marketing strategies and consumer expectations. This trend is reinforcing the market shift toward materials that are easier to recycle, transport, and reuse, thereby enhancing circular economy practices

- Collaborations between packaging manufacturers, beverage companies, and waste management organizations are strengthening recycling initiatives. Efforts such as PET recycling programs and closed-loop systems are encouraging industry-wide movement toward sustainability and responsible plastic usage

Plastic Bottles Market Dynamics

Driver

Rising Global Demand for Packaged Beverages and Personal Care Products

- The growing consumption of packaged beverages and personal care products is significantly driving the plastic bottles market, as these sectors rely heavily on convenient and durable packaging. Plastic bottles provide versatility, lightweight handling, and cost efficiency, making them the preferred choice for liquid-based goods

- For instance, Nestlé Waters continues to expand its bottled water range using high-quality PET bottles, catering to rising consumer demand across multiple regions. Such packaging solutions support logistics efficiency and preserve product quality throughout the supply chain

- Increasing urbanization and the rise of on-the-go lifestyles are fueling the need for single-serve and portable packaging options. Plastic bottles meet these consumer requirements by offering resealable and lightweight alternatives for beverages and personal care items

- The expansion of retail networks and e-commerce platforms is boosting demand for packaging that ensures safe transportation, product visibility, and shelf appeal. Plastic bottles fulfill these requirements while enabling cost-effective production at scale

- Food and beverage innovations, including flavored drinks, ready-to-drink teas, and health supplements, are increasing reliance on high-performance plastic bottles. The ability to mold, shape, and customize bottles is supporting product differentiation and brand recognition

Restraint/Challenge

Increasing Regulatory Pressure on Single-Use Plastics

- The plastic bottles market faces challenges due to rising regulatory pressure targeting single-use plastics and environmental pollution concerns. Governments are implementing bans, taxes, and restrictions, which are reshaping production and consumption patterns in the industry

- For instance, the European Union’s Single-Use Plastics Directive mandates reductions in certain disposable plastic items, affecting manufacturers and prompting reformulation of packaging strategies. Compliance with such regulations increases operational complexity and costs for producers

- Consumer awareness campaigns and environmental advocacy are intensifying scrutiny on plastic waste, influencing brand reputation and purchasing decisions. Companies are compelled to adopt sustainable alternatives and recycling solutions to maintain market trust

- The cost of transitioning to biodegradable or fully recyclable materials can be high, particularly for small and medium-sized manufacturers. This financial burden can slow innovation and affect product affordability in competitive markets

- Supply chain adjustments required to meet regulatory mandates, including sourcing recycled resins or implementing closed-loop systems, present logistical challenges. These factors collectively restrain market growth while pushing the industry toward sustainable practices

Plastic Bottles Market Scope

The market is segmented on the basis of material, manufacturing process, capacity range, and end-user vertical.

- By Material

On the basis of material, the plastic bottles market is segmented into Polyethylene Terephthalate (PET), High-density Polyethylene (HDPE), Low-density Polyethylene (LDPE), Polypropylene (PP), Bio-based and Compostable Plastics, and Others. The PET segment dominated the market with the largest revenue share of 75.36% in 2025, driven by its excellent clarity, lightweight nature, and recyclability. PET bottles are highly preferred in beverages and food packaging due to their resistance to impact, chemical stability, and compatibility with carbonated drinks. Manufacturers favor PET for its ability to maintain product quality over extended shelf life, while consumers appreciate the convenience of lightweight and portable packaging.

The bio-based and compostable plastics segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing consumer demand for sustainable and environmentally friendly packaging solutions. Companies such as Amcor and Tetra Pak are investing in bio-based bottles to reduce plastic waste and carbon footprint. Growing regulatory pressures and corporate sustainability initiatives are driving adoption in food, beverage, and personal care segments, supporting significant market expansion.

- By Manufacturing Process

On the basis of manufacturing process, the plastic bottles market is segmented into Extrusion Blow Molding, Injection Blow Molding, Stretch Blow Molding, and Others. Stretch Blow Molding dominated the market in 2025, capturing the largest revenue share due to its ability to produce high-quality, durable, and lightweight PET bottles with uniform thickness and enhanced mechanical strength. This process is widely used in carbonated beverage and water bottle production, where durability and clarity are critical, ensuring product integrity and consumer satisfaction.

The Injection Blow Molding segment is anticipated to witness the fastest growth from 2026 to 2033, driven by its precision in producing small-capacity bottles for pharmaceuticals, cosmetics, and personal care products. Companies such as Berry Global are leveraging injection blow molding for intricate designs, customized shapes, and smaller batch production, catering to premium packaging requirements while reducing material waste and improving production efficiency.

- By Capacity Range

On the basis of capacity range, the plastic bottles market is segmented into Less than 100 mL, 100–250 mL, 251–500 mL, 501–1,000 mL, and More than 1,000 mL. The 251–500 mL segment dominated the market in 2025 due to the high demand for single-serve beverage bottles and personal care products, which are convenient for daily consumption and portability. This size provides an optimal balance between cost, usability, and consumer preference, making it a standard across soft drinks, bottled water, and liquid food products.

The 501–1,000 mL segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing consumer preference for family-sized or multi-use bottles. Companies such as Nestlé Waters and PepsiCo are expanding their production capacities in this range to meet the growing trend of home consumption and bulk purchasing, particularly in beverages and household cleaning products, supporting overall market growth.

- By End-user Vertical

On the basis of end-user vertical, the plastic bottles market is segmented into Beverages, Food, Cosmetics and Personal Care, Pharmaceuticals, Household Care, and Others. The beverages segment dominated the market with the largest revenue share in 2025, driven by rising consumption of bottled water, carbonated soft drinks, and juices globally. Beverage companies prioritize plastic bottles for their lightweight, impact-resistant, and cost-effective properties, while also benefiting from easy transportation and extended shelf life.

The cosmetics and personal care segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing demand for premium and travel-friendly packaging. Companies such as L’Oréal and Procter & Gamble are increasingly using plastic bottles for lotions, shampoos, and serums due to their ability to accommodate innovative shapes, pump dispensers, and sustainable materials, aligning with consumer convenience and eco-conscious trends.

Plastic Bottles Market Regional Analysis

- Asia-Pacific dominated the plastic bottles market with the largest revenue share of 46.42% in 2025, driven by growing beverage and packaged food consumption, rapid urbanization, and a strong presence of manufacturing hubs in the region

- The region’s cost-effective production capabilities, rising foreign investments in packaging manufacturing, and expanding exports of bottled products are accelerating market growth

- The availability of skilled labor, supportive government policies, and increasing adoption of sustainable and innovative packaging solutions are contributing to higher consumption of plastic bottles across both consumer and industrial sectors

China Plastic Bottles Market Insight

China held the largest share in the Asia-Pacific plastic bottles market in 2025, owing to its status as a global leader in beverage and packaged food production. The country’s robust industrial base, extensive manufacturing infrastructure, and strong export capabilities are major growth drivers. Demand is further supported by investments in high-quality PET and HDPE bottle production and growing domestic consumption of beverages and personal care products.

India Plastic Bottles Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding beverage and FMCG sector, increasing disposable income, and rising demand for packaged food and personal care products. Government initiatives such as "Make in India" and policies promoting local manufacturing are strengthening domestic production capacities. In addition, the growing awareness of lightweight and convenient packaging and the shift toward sustainable materials are supporting market expansion.

Europe Plastic Bottles Market Insight

The Europe plastic bottles market is expanding steadily, supported by high demand for packaged beverages, strict regulations on food and cosmetic packaging, and growing investments in sustainable and recyclable plastics. The region emphasizes environmental compliance, high-quality production standards, and innovative packaging designs. The increasing use of bio-based and compostable plastics is further driving market growth, particularly in western European countries.

Germany Plastic Bottles Market Insight

Germany’s plastic bottles market is driven by its advanced beverage and personal care industries, strong manufacturing infrastructure, and emphasis on sustainability. The country’s well-established R&D capabilities and collaboration between packaging manufacturers and product companies foster innovation in lightweight and recyclable bottles. Demand is particularly strong for high-quality PET and HDPE bottles in beverages and cosmetics.

U.K. Plastic Bottles Market Insight

The U.K. market is supported by a mature food and beverage industry, growing consumer preference for convenience packaging, and increasing focus on recyclable and bio-based plastics. With rising R&D initiatives and academic-industry partnerships, the U.K. continues to adopt innovative designs and sustainable materials. The market is also benefiting from government-led policies encouraging environmentally friendly packaging solutions.

North America Plastic Bottles Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust demand for bottled beverages, personal care products, and household liquids. Increasing urbanization, preference for convenience packaging, and adoption of eco-friendly plastics are boosting demand. In addition, rising reshoring of packaging manufacturing and innovation in lightweight and sustainable bottle designs are supporting market expansion.

U.S. Plastic Bottles Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive beverage and personal care industries, strong manufacturing infrastructure, and focus on sustainable packaging. The country’s investment in advanced plastics, high-quality PET production, and adoption of recyclable and bio-based materials are driving growth. Presence of key players and an established distribution network further solidify the U.S.'s leading position in the region.

Plastic Bottles Market Share

The plastic bottles industry is primarily led by well-established companies, including:

- Triumbari Corp. (U.S.)

- Greiner Packaging International GmbH (Austria)

- Graham Packaging Company (U.S.)

- Nampak Ltd. (South Africa)

- ALPLA Werke Alwin Lehner GmbH & Co KG (Austria)

- Plastipak Holdings Inc. (U.S.)

- Gerresheimer AG (Germany)

- Amcor plc (Australia)

- Richards Glass Co. Ltd. (U.K.)

- Silgan Holdings Inc. (U.S.)

- Pretium Packaging LLC (U.S.)

- Resilux NV (Belgium)

- O.Berk Company, LLC (U.S.)

- Alpha Packaging Pvt. Ltd. (India)

- Comar LLC (U.S.)

- Retal Industries Ltd. (Luxembourg)

- CoastPak Industrial Co. Ltd. (China)

- Grief, Inc. (U.S.)

- Altium Packaging LLC (U.S.)

Latest Developments in Global Plastic Bottles Market

- In February 2026, FirmaPak announced the acquisition of Easy Plastic Containers Corporation, a strategic move that broadens its blow molded packaging portfolio and strengthens its geographic footprint in the U.S. market. This acquisition allows FirmaPak to expand its product offerings across personal care, household, and specialty packaging, enabling faster innovation and customized solutions. The combined capabilities improve production efficiency, enhance customer service, and position the company to capture a larger share of the growing North American plastic bottles market

- In October 2024, Amcor completed the acquisition of Berry Global’s rigid packaging business for USD 8.43 billion, creating the world’s largest rigid packaging company. This deal significantly expands Amcor’s bottle and container manufacturing capabilities across multiple geographies and end-user segments. It enables the company to integrate operations more efficiently, scale production to meet rising demand, and strengthen its presence in beverage, personal care, and household markets globally, reinforcing its competitive leadership in rigid packaging

- In September 2024, ALPLA Group completed construction of a new USD 45 million PET facility in Vietnam, adding 1.2 billion bottles to its annual output. This facility addresses the surging demand for packaged beverages and personal care products in Southeast Asia. By expanding local production, ALPLA can offer faster delivery, reduce logistics costs, and provide customized solutions for regional customers, thereby improving market responsiveness and enhancing its position in emerging markets

- In August 2024, Graham Packaging launched a barrier-enhanced PET bottle for pharmaceuticals, improving oxygen protection by 50 percent at cost parity with conventional materials. This innovation addresses critical requirements for longer shelf life and enhanced safety of high-value liquid medications. The new bottle design supports regulatory compliance for sensitive pharmaceutical products while enabling manufacturers to differentiate their packaging in the market and meet the growing demand for high-quality, durable pharmaceutical containers

- In July 2024, Silgan Holdings acquired Weener Plastics Group for EUR 270 million (USD 293 million), strengthening its European presence and expanding its dispensing systems portfolio. This acquisition allows Silgan to offer more integrated packaging solutions for the cosmetics, personal care, and household markets. The expanded portfolio enhances design flexibility, improves supply chain efficiency, and positions the company to meet increasing demand for premium and functional packaging across Europe

- In late 2025, Biffa completed the acquisition of UK PET bottle manufacturer Esterform, creating an end-to-end PET packaging and recycling business ahead of the UK’s Deposit Return Scheme launch. This acquisition enhances the availability of recyclable PET bottles, supports circular economy initiatives, and strengthens Biffa’s sustainable packaging capabilities. It also enables the company to provide comprehensive recycling solutions to manufacturers, increasing environmental compliance and boosting its market reputation in sustainable packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Bottles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Bottles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Bottles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.