Global Plastic Drums Market

Market Size in USD Billion

CAGR :

%

USD

3.24 Billion

USD

5.95 Billion

2024

2032

USD

3.24 Billion

USD

5.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.24 Billion | |

| USD 5.95 Billion | |

|

|

|

|

Plastic Drums Market Size

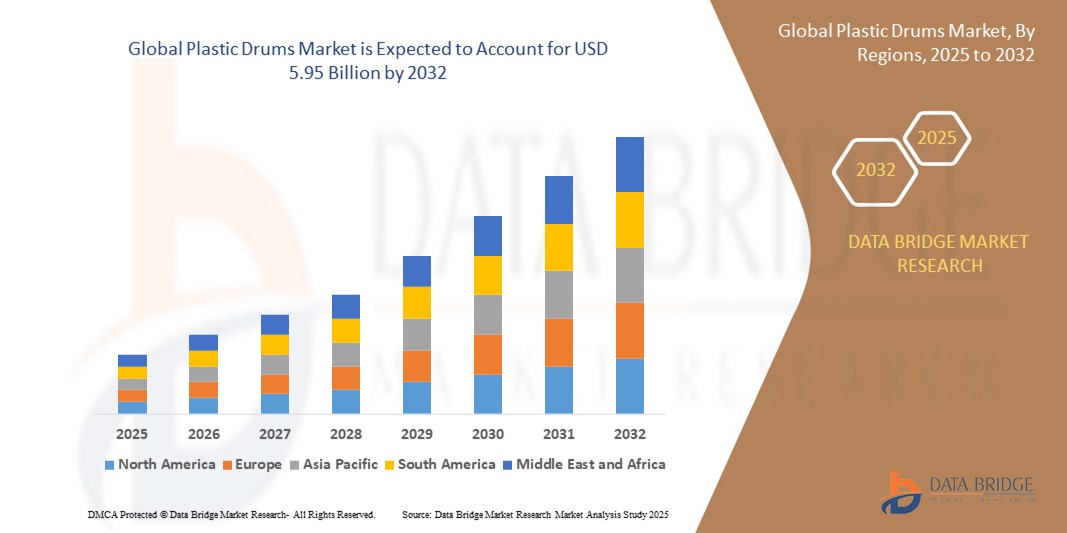

- The global plastic drums market size was valued at USD 3.24 billion in 2024 and is expected to reach USD 5.95 billion by 2032, at a CAGR of 7.9% during the forecast period

- The Market growth is driven by increasing demand for cost-effective, durable, and lightweight packaging solutions across industries such as food and beverages, chemicals, and pharmaceuticals

- Rising awareness of sustainable packaging and the recyclability of plastic drums, particularly HDPE and LDPE, is further propelling market demand in both industrial and commercial applications

Plastic Drums Market Analysis

- The plastic drums market is experiencing steady growth due to their versatility, corrosion resistance, and ability to meet stringent regulatory standards for safe storage and transportation

- The chemical and petrochemicals segment is a key driver, as plastic drums are widely used for storing hazardous materials, supported by innovations in high-density polyethylene (HDPE) for enhanced durability

- North America dominates the plastic drums market with the largest revenue share of 35.6% in 2024, driven by a robust automotive OEM market, strong industrial base, and high demand for reliable packaging solutions in chemicals and food industries

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing manufacturing activities, and growing demand for bulk packaging in countries such as China, India, and Southeast Asian nations

- The high-density polyethylene (HDPE) segment dominated the market with a revenue share of approximately 48% in 2024, owing to its superior strength, chemical resistance, and recyclability, making it ideal for storing and transporting hazardous chemicals, food products, and pharmaceuticals

Report Scope and Plastic Drums Market Segmentation

|

Attributes |

Plastic Drums Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic Drums Market Trends

“Rising Preference for High-Density Polyethylene (HDPE) Drums”

- High-Density Polyethylene (HDPE) dominates the plastic drums market, holding approximately 48% of the market share due to its superior strength, chemical resistance, and recyclability. It is widely preferred across industries such as chemicals, pharmaceuticals, and food and beverages for its durability and compliance with regulatory standards such as UN/DOT

- HDPE drums are favored for their ability to store and transport hazardous and non-hazardous materials, including chemicals, oils, and food products, without compromising integrity. Their leak-proof and impact-resistant properties make them ideal for demanding industrial applications

- The recyclability of HDPE drums aligns with increasing global demand for sustainable packaging, with around 35% of manufacturers shifting toward recycled plastic materials to meet environmental regulations

- In regions with harsh climates, such as the Middle East and Asia Pacific, HDPE drums are preferred for their UV resistance and ability to withstand extreme temperatures, ensuring product safety during storage and transportation

- High-end sectors such as pharmaceuticals and food and beverages increasingly opt for HDPE drums to meet stringent safety and hygiene standards, with companies such as Pfizer utilizing them for vaccine distribution

- Automotive OEMs and chemical manufacturers are incorporating HDPE drums as standard packaging solutions, with some offering customized designs to enhance safety and efficiency in logistics.

Plastic Drums Market Dynamics

Driver

“Rising Demand for Safe and Cost-Effective Packaging Solutions”

- The chemical and petrochemical sector, which accounted for USD 1.8 billion in market value in 2024, drives demand for plastic drums due to their ability to safely store and transport hazardous and non-hazardous liquids, solvents, and chemicals

- The food and beverage industry, holding a 37.3% market share, relies on plastic drums for hygienic and cost-effective storage of oils, syrups, juices, and sauces, with compliance to FDA and UN standards boosting adoption

- Plastic drums reduce reliance on heavier, less sustainable metal drums, offering lightweight, durable, and recyclable alternatives that improve fuel efficiency in transportation and lower logistics costs

- North America’s dominance in the automotive OEM market fuels demand for plastic drums to store lubricants, oils, and raw materials, with Asia Pacific’s rapid industrialization driving further growth

- The rise of electric vehicles, requiring efficient thermal management and lightweight packaging, increases the adoption of plastic drums for storing coolants and lubricants, enhancing energy efficiency

Restraint/Challenge

“Environmental Concerns and Regulatory Restrictions”

- The use of plastic drums contributes to environmental challenges, as they take years to decompose, raising concerns about landfill accumulation and marine pollution. This limits market growth in regions with strict environmental policies

- Fluctuations in the prices of raw materials such as HDPE and polypropylene (PP), driven by petrochemical market instability, pose challenges for manufacturers in maintaining cost-effectiveness

- Alternative packaging solutions, such as intermediate bulk containers (IBCs) and flexible packaging, compete with plastic drums, particularly in industries seeking lower-cost or more sustainable options

- Stringent regulations, such as those in Europe and Taiwan under the Taiwan Toxic and Concerned Chemical Substances Control Act (TCCSCA), impose strict standards on chemical storage and transportation, increasing production costs for compliant plastic drums

- Varying environmental and safety regulations across countries complicate standardization efforts for manufacturers, limiting market expansion in regions with restrictive policies

Plastic Drums Market Scope

The market is segmented on the basis of material type, head type, capacity, and end user.

- By Material Type

On the basis of material type, the market is segmented into polyethylene (PE), polypropylene (PP), high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and others. The high-density polyethylene (HDPE) segment dominated the market with a revenue share of approximately 48% in 2024, owing to its superior strength, chemical resistance, and recyclability, making it ideal for storing and transporting hazardous chemicals, food products, and pharmaceuticals. HDPE’s high strength-to-weight ratio and compliance with regulatory standards, such as UN/DOT, further drive its adoption across industries such as chemicals and food and beverages.

The polypropylene (PP) segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight properties, high heat resistance, and durability in demanding industrial environments. PP drums are increasingly preferred in pharmaceuticals and high-temperature applications due to their sterility and robustness.

- By Head type

On the basis of head type, the market is segmented into open head and tight head. The open head drums held the largest market revenue share of 58% in 2024, attributed to their versatility and ease of access for solid and semi-solid products. These drums are widely used in industries such as agriculture and food and beverages for storing and transporting bulk goods such as powders, granules, and pastes.

The tight head drums segment is projected to experience significant growth from 2025 to 2032, driven by their leak-proof design and suitability for liquid storage, particularly in the chemical, petrochemical, and pharmaceutical industries. Their robust sealing capabilities ensure safe transportation of hazardous materials, meeting stringent safety regulations.

- By Capacity

On the basis of capacity, the market is segmented into less than 10 gallons, 10-30 gallons, 30-55 gallons, and 55 gallons and above. The 30-55 gallons segment dominated the market with a revenue share of 39.3% in 2024, due to its optimal balance of capacity and portability, making it suitable for bulk storage and transportation across industries such as chemicals, food and beverages, and pharmaceuticals.

The 55 gallons and above segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for large-capacity drums in industries such as petrochemicals and agriculture, where bulk storage of liquids, such as oils, fertilizers, and chemicals, is critical. The scalability and cost-effectiveness of these drums support their growing adoption.

- By End User

On the basis of end user, the market is segmented into food and beverages, chemical and petrochemicals, building and construction, agriculture, pharmaceuticals, oil and lubricants, and others. The Food and Beverages segment held the largest market revenue share of 37.3% in 2024, driven by the need for hygienic, food-grade, and cost-effective packaging solutions for products such as oils, syrups, juices, and sauces. Plastic drums’ compliance with FDA and UN standards ensures their suitability for safe storage and transportation.

The Chemical and Petrochemicals segment is expected to witness robust growth from 2025 to 2032, fueled by the rising demand for safe and durable packaging for hazardous and non-hazardous chemicals. Plastic drums’ chemical resistance and compliance with safety regulations, such as UN/DOT, make them indispensable for this sector.

Plastic Drums Market Regional Analysis

- North America dominates the plastic drums market with the largest revenue share of 35.6% in 2024, driven by a robust automotive OEM market, strong industrial base, and high demand for reliable packaging solutions in chemicals and food industries

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing manufacturing activities, and growing demand for bulk packaging in countries such as China, India, and Southeast Asian nations

- The automotive original equipment manufacturer (OEM) market’s growth in North America further supports demand for plastic drums for lubricants and chemicals

U.S. Plastic Drums Market Insight

The U.S. holds the largest share of the North American plastic drums market, driven by strong demand from the chemical and petrochemical sector, which accounts for nearly 50% of national demand. The increasing adoption of sustainable and recyclable plastic drums, with a 20% rise in their usage, supports market expansion. Both OEM and aftermarket applications, particularly in food and beverage and pharmaceutical industries, contribute to robust growth.

Europe Plastic Drums Market Insight

The European market is expected to witness significant growth, driven by stringent regulations on chemical transportation and a focus on sustainable packaging. Countries such as Germany and France show strong uptake due to their advanced industrial sectors and emphasis on eco-friendly materials. The demand for HDPE and PP drums is rising for applications in chemicals, pharmaceuticals, and food and beverages, supported by innovations in recyclable materials.

U.K. Plastic Drums Market Insight

The U.K. market is anticipated to experience steady growth, fueled by demand for secure packaging in the food and beverage and chemical industries. The adoption of plastic drums for safe storage and transportation, particularly in urban settings, is driven by their durability, cost-effectiveness, and compliance with safety standards. Rising awareness of recyclability and environmental concerns further supports market growth.

Germany Plastic Drums Market Insight

Germany’s plastic drums market is expected to grow significantly, driven by its robust chemical and pharmaceutical industries. The preference for HDPE drums, which offer chemical resistance and compliance with safety regulations, supports their adoption in these sectors. Innovations in drum design and a focus on sustainability, such as the use of recycled materials, enhance market growth.

Asia-Pacific Plastic Drums Market Insight

The Asia-Pacific region dominates the global plastic drums market with a revenue share of 42% in 2024, driven by rapid industrialization, increasing petrochemical demand, and expanding food and beverage sectors in countries such as China, India, and Japan. The region’s growing logistics and trade activities, coupled with government support for sustainable packaging, fuel market growth. The 30-55 gallon capacity segment is particularly dominant due to its versatility across industries.

Japan Plastic Drums Market Insight

Japan’s market is expected to witness robust growth, driven by its advanced manufacturing sector and high demand for food-grade and chemical-resistant plastic drums. The adoption of HDPE and PP drums in food and beverage and pharmaceutical applications is supported by stringent safety and quality standards. The growing focus on sustainable packaging solutions further accelerates market penetration.

China Plastic Drums Market Insight

China holds the largest share of the Asia-Pacific plastic drums market, driven by rapid urbanization, increasing industrial output, and rising demand for cost-effective packaging solutions. The chemical and petrochemical sector’s growth, along with the expanding food and beverage industry, fuels demand for HDPE and Tight Head drums. Competitive pricing and strong domestic manufacturing capabilities enhance market accessibility.

Plastic Drums Market Share

The plastic drums industry is primarily led by well-established companies, including:

- Greif (U.S.)

- Industrial Quick Search, Inc. (U.S.)

- Schütz GmbH & Co. KGaA (Germany)

- COEXCELL (U.S.)

- KODAMA PLASTICS Co., Ltd. (Japan)

- Interplastica Pvt. Ltd. (India)

- Orlando Drum (U.S.)

- TPL Plastech Limited (India)

- CurTec Nederland B.V. (Netherlands)

- REMCON Plastics Inc. (U.S.)

- Hazmatpac, Inc. (U.S.)

- BWAY Corporation (U.K.)

- AST Kunststoffverarbeitung (Germany)

- The Cary Company (U.S.)

- United States Plastic Corp. (U.S.)

Latest Developments in Global Plastic Drums Market

- In October 2024, Fries KT GmbH introduced a new line of plastic drums made from recycled materials, utilizing a state-of-the-art extrusion blow molding machine. This innovation aligns with the growing demand for sustainable packaging solutions, ensuring durability and compliance with environmental standards. The launch reinforces Fries KT GmbH’s position in the eco-conscious segment of the plastic drums market, particularly in Europe, as the company continues to advance its sustainability goals

- In August 2024, Mauser Packaging Solutions acquired a plastic drum manufacturing business in Pinetown, Kwa-Zulu Natal, South Africa, expanding its production capacity and market reach in the African region. This acquisition strengthens Mauser’s ability to meet the growing demand for industrial packaging in chemicals and petrochemicals. The newly acquired facility produces UN-certified tight-head and open-head plastic drums, ensuring compliance with industry standards. The move aligns with Mauser’s global expansion strategy, reinforcing its competitive edge in sustainable packaging solutions

- In April 2024, Greif, Inc. completed the acquisition of iPACKCHEM, a leader in sustainable packaging solutions, to strengthen its portfolio in the specialty chemicals market. This strategic move expands Greif’s offerings in plastic drums and enhances its focus on eco-friendly packaging. The acquisition positions Greif to meet growing global demand for sustainable industrial packaging, particularly in North America and Europe. The integration of iPACKCHEM’s expertise supports Greif’s commitment to innovation and environmental responsibility

- In March 2024, Berry Global launched a new range of eco-friendly plastic drums made from recyclable materials, catering to the food and beverage and chemical sectors. These drums prioritize sustainability while maintaining durability, addressing consumer and regulatory demands for greener packaging solutions. The initiative strengthens Berry Global’s leadership in sustainable packaging and expands its market presence in the Asia Pacific region. The company continues to innovate in circular packaging and emission reduction strategies

- In January 2024, Schütz GmbH & Co. KGaA partnered with local startups to develop smart plastic drums featuring integrated tracking technology. These drums improve inventory management and logistics efficiency through advanced telematics, catering to industries such as pharmaceuticals and chemicals. The collaboration enhances Schütz’s innovation pipeline, positioning it to expand its market share in the smart packaging segment. By leveraging cutting-edge technology, Schütz aims to optimize supply chain operations and sustainability in industrial packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Drums Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Drums Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Drums Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.