Global Plastic Free Packaging Market

Market Size in USD Billion

CAGR :

%

USD

6.35 Billion

USD

11.35 Billion

2024

2032

USD

6.35 Billion

USD

11.35 Billion

2024

2032

| 2025 –2032 | |

| USD 6.35 Billion | |

| USD 11.35 Billion | |

|

|

|

|

Plastic-Free Packaging Market Size

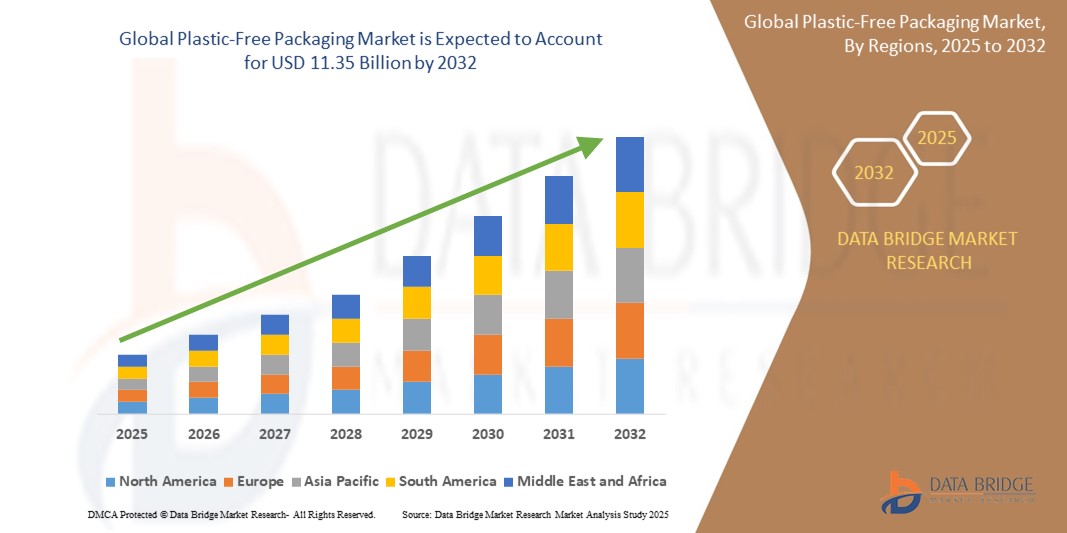

- The Global Plastic-Free Packaging Market size was valued at USD 6.35 Billion in 2024 and is expected to reach USD 11.35 Billion by 2032, at a CAGR of 4.3 % during the forecast period

- The market growth is primarily driven by the rising consumer awareness and regulatory pressures surrounding environmental sustainability, which are accelerating the shift away from conventional plastic packaging toward eco-friendly alternatives. Plastic-free packaging solutions—such as paper-based materials, compostable biopolymers, and plant-based films—are gaining traction due to their lower environmental impact, biodegradability, and compliance with evolving bans and restrictions on single-use plastics. These solutions align with the growing demand for responsible consumption, corporate sustainability goals, and circular economy initiatives across industries.

- Furthermore, the increasing adoption of plastic-free packaging in key sectors—including food and beverage, personal care, e-commerce, and retail—is propelling market expansion. This development is reinforced by changing consumer preferences, heightened demand for organic and natural products, and innovations in sustainable packaging design and barrier technology. Simultaneously, advancements in material science, printing technology, and recyclable adhesives are improving the functionality, durability, and visual appeal of plastic-free alternatives

Plastic-Free Packaging Market Analysis

- Plastic-free packaging consists of eco-friendly alternatives to traditional plastic materials, including paper-based packaging, biodegradable films, molded pulp, and plant-based biopolymers. These solutions are engineered to reduce environmental impact while maintaining essential packaging functions such as product protection, shelf stability, and visual appeal—critical for consumer satisfaction and brand differentiation

- The market is experiencing steady growth, driven by increasing consumer demand for sustainable products, rising environmental concerns, and stringent government regulations aimed at reducing plastic pollution. Additionally, brand commitments to sustainability, bans on single-use plastics, and innovations in recyclable and compostable packaging materials are further propelling market expansion

- Europe is expected to dominate the Plastic-Free Packaging Market owing to strong environmental policies, high consumer awareness, and active participation of both public and private sectors in sustainability initiatives. Countries like Germany, France, and the Netherlands are leading in adoption due to strict regulatory frameworks and green packaging mandates

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, supported by growing e-commerce activity, rising environmental awareness, and government-led campaigns to reduce plastic waste in densely populated countries such as China, India, and Indonesia. The region also benefits from emerging local manufacturers investing in sustainable packaging technologies

- Paper-based packaging is expected to hold the largest market share due to its recyclability, wide availability, and versatility across food, beverage, and consumer goods sectors. The demand for innovative, high-barrier, and aesthetically pleasing paper packaging is growing rapidly, while interest in biodegradable films and molded fiber solutions is also gaining momentum, reinforcing the segment’s long-term growth potential

Report Scope and Plastic-Free Packaging Market Segmentation

|

Attributes |

Plastic-Free Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic-Free Packaging Market Trends

“Functionality-Driven Innovation and Sustainability Focus in Plastic-Free Packaging”

- A prominent and rapidly evolving trend in the Global Plastic-Free Packaging Market is the development of advanced packaging materials that combine sustainability with enhanced functionality, such as improved barrier properties, durability, and recyclability. These innovations are expanding applications across food, beverage, cosmetics, and e-commerce sectors—shifting the market toward high-performance, eco-conscious packaging solutions.

- Leading companies like Amcor, Mondi Group, and Tetra Pak are investing heavily in bio-based polymers, compostable films, and fiber-based materials that meet stringent environmental regulations while maintaining product protection and shelf life. This aligns with increasing government policies aimed at reducing plastic waste and rising consumer demand for greener packaging options

- Sustainability is gaining significant traction, with a growing emphasis on circular economy principles, including the design for recyclability, use of renewable raw materials, and minimizing carbon footprints. Regulatory initiatives across Europe, North America, and Asia-Pacific are accelerating adoption of biodegradable, compostable, and recyclable packaging solutions to tackle plastic pollution

- Concurrently, innovations in manufacturing technologies such as extrusion coating, solvent-free lamination, and biodegradable additive integration are improving material performance, cost-efficiency, and scalability—enabling more widespread adoption of plastic-free alternatives

- Integration of digital tools like blockchain for supply chain transparency and smart labeling to inform consumers about recyclability and proper disposal is becoming more common, helping brands differentiate and promote sustainable practices

- This strategic emphasis on combining eco-friendly materials with functional innovation is reshaping market dynamics. Companies focusing on R&D in sustainable materials, compliance with evolving environmental regulations, and consumer education are poised to lead growth in markets demanding responsible and innovative packaging solutions

Plastic-Free Packaging Market Dynamics

Driver

“Rising Demand for Eco-Friendly, Functional, and Regulatory-Compliant Packaging Solutions”

- The increasing global focus on reducing plastic pollution and promoting environmental sustainability is a primary driver fueling growth in the Plastic-Free Packaging Market. Brands and manufacturers are shifting toward plastic-free alternatives that offer biodegradability, compostability, and recyclability to meet consumer demand and comply with stringent regulations

- For example, in early 2025, Amcor launched a new line of compostable packaging made from plant-based materials that maintain high barrier properties while significantly reducing environmental footprint—addressing the rising regulatory bans on single-use plastics across Europe and North America

- The surge in e-commerce and packaged food sectors is accelerating demand for innovative plastic-free packaging that not only protects products but also enhances shelf life and consumer convenience without compromising sustainability.

- Increasing government regulations and policies targeting single-use plastics, such as extended producer responsibility (EPR) schemes and outright bans, are compelling companies to invest in eco-friendly packaging solutions that comply with evolving legal frameworks worldwide

- Advances in material science and manufacturing processes—such as bio-based polymer development, solvent-free coatings, and molded fiber technologies—are enabling the production of durable, versatile, and cost-effective plastic-free packaging alternatives, driving broader adoption

- This alignment of environmental responsibility, regulatory compliance, and innovation is accelerating market expansion. Companies focusing on R&D for sustainable materials, functional design, and circular economy integration are well-positioned to capitalize on the growing demand for plastic-free packaging solutions globally

Restraint/Challenge

“High Production Costs and Complex Regulatory Landscape in Plastic-Free Packaging”

- The capital-intensive nature of producing plastic-free packaging materials, particularly those made from bio-based polymers and innovative compostable substrates, presents a significant barrier to market growth. High investments in specialized manufacturing equipment, raw material sourcing, and quality assurance systems elevate operational costs, especially for new entrants and small-scale producers.

- For example, developing packaging that meets both functional performance requirements—such as moisture and oxygen barriers—and environmental standards like ASTM D6400 or EN 13432 certification requires costly testing, validation, and process optimization, which extend time-to-market and increase expenses.

- The complex and evolving regulatory landscape across regions, including bans on single-use plastics, labeling requirements, and standards for biodegradability and compostability, creates compliance challenges for manufacturers. Navigating these diverse frameworks—such as the EU Packaging Directive, U.S. FDA regulations, and emerging policies in Asia-Pacific—demands extensive documentation, testing, and frequent audits, contributing to administrative burdens and delayed product launches.

- Variability in regional regulations often necessitates product redesign or formulation adjustments for different markets, limiting economies of scale and complicating global supply chains and distribution.

- Additionally, fluctuations in the availability and prices of renewable raw materials—such as cellulose, starch, and polylactic acid (PLA)—along with supply chain disruptions caused by geopolitical tensions and environmental factors, add pressure on manufacturing costs and profitability. These constraints challenge manufacturers’ ability to offer competitively priced plastic-free packaging solutions at scale

Plastic-Free Packaging Market Scope

The market is segmented on the basis of material, packaging product, end-use.

- By Material

On the basis of material, the Plastic-Free Packaging Market is segmented into Metal, Paper, Glass, and Others.

The Paper segment dominates the market with the largest revenue share in 2024, driven by its recyclability, versatility, and widespread acceptance across food, beverage, and consumer goods packaging. Growing consumer preference for sustainable, biodegradable, and compostable paper-based packaging solutions—combined with stringent regulations limiting plastic use—is fueling sustained growth. Innovations in high-barrier coatings and lightweight paper materials are further expanding applications while maintaining product freshness and durability

- By Packaging Product

On the basis of packaging product, the Plastic-Free Packaging Market is segmented into Pouches, Boxes, Tubes, Blisters and Strips, Bottles and Jars, Cartons, Trays, and Cans.

The Pouches segment holds the largest revenue share in 2024, primarily due to its versatility, lightweight nature, and cost-effectiveness across food, beverage, and personal care products. Pouches offer excellent shelf appeal and convenience, such as resealability and portion control, making them a preferred choice for both brands and consumers seeking sustainable alternatives to rigid packaging

- By End-Use

On the basis of end-use, the Plastic-Free Packaging Market is segmented into Cosmetics, Food and Beverages, Pharmaceutical, and Consumer Products.

The Food and Beverages segment dominates the market with the largest revenue share in 2024, driven by increasing consumer preference for sustainable and safe packaging solutions that preserve freshness and extend shelf life. The rise in demand for biodegradable, recyclable, and compostable packaging materials—especially in ready-to-eat, organic, and natural food products—is fueling growth. Regulatory pressures to reduce plastic waste in the food industry further accelerate adoption of plastic-free packaging

Plastic-Free Packaging Market Regional Analysis

- North America dominates the Plastic-Free Packaging Market with the largest revenue share of 37.2% in 2024, driven by increasing consumer demand for sustainable packaging solutions across food, beverage, and personal care sectors. The region benefits from strong environmental regulations, advanced manufacturing infrastructure, and heightened consumer awareness of plastic pollution.

- Manufacturers in North America are investing heavily in innovative bio-based and compostable packaging materials to meet stringent government regulations and rising eco-conscious consumer preferences. The U.S. leads the region, supported by aggressive policies banning single-use plastics and growing R&D activities in sustainable packaging technologies

U.S. Plastic-Free Packaging Market Insight

The U.S. Plastic-Free Packaging Market captured the largest revenue share of approximately 82% in North America in 2024, fueled by increasing e-commerce growth and demand for biodegradable packaging in food and personal care products. The country’s regulatory frameworks, including the Break Free From Plastic Pollution Act, are driving adoption of alternatives to conventional plastics. Continuous investments in recycling infrastructure and circular economy initiatives further support market expansion

Europe Plastic-Free Packaging Market Insight

Germany remains a key market in Europe due to its advanced packaging industry, focus on sustainability certifications, and consumer demand for eco-friendly products. Investments in bio-based materials and packaging innovation aimed at reducing carbon footprints are accelerating growth

U.K. Plastic-Free Packaging Market Insight

The U.K. market is expected to witness strong growth supported by government bans on single-use plastics and increased consumer advocacy for sustainable packaging. Collaborative initiatives between industry players and research organizations are driving advancements in compostable and recyclable packaging formats

Germany Plastic-Free Packaging Market Insight

Germany remains a key market within Europe, driven by its leadership in high-quality technical textiles and a strong healthcare manufacturing base. The country is investing in smart textile integration for remote patient monitoring and improving the sustainability of hospital textile supply chains through recycling programs and green certifications

Asia-Pacific Plastic-Free Packaging Market Insight

Asia-Pacific Plastic-Free Packaging Market is anticipated to record the fastest CAGR of 25.3% from 2025 to 2032, fueled by rapid urbanization, expanding retail and e-commerce sectors, and growing environmental awareness. Countries such as China, India, Japan, and South Korea are witnessing surging demand for affordable, high-quality plastic-free packaging solutions

Japan Plastic-Free Packaging Market Insight

Japan’s market growth is propelled by stringent environmental standards, a strong focus on product safety, and consumer demand for minimal-waste packaging. Innovations in sustainable glass and paper packaging, along with eco-labeling programs, are key growth drivers

China Plastic-Free Packaging Market Insight

China holds the largest revenue share in Asia-Pacific as of 2024, supported by its massive manufacturing base, increasing government mandates on plastic reduction, and rising consumer preference for sustainable packaging in food and personal care industries. Domestic policies focusing on circular economy principles are boosting innovation in biodegradable materials and packaging reuse

Plastic-Free Packaging Market Share

The speciality starches is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Mondi Group (UK)

- Tetra Pak International S.A. (Switzerland)

- DS Smith Plc (UK)

- Smurfit Kappa Group plc (Ireland)

- Huhtamaki Oyj (Finland)

- Uflex Ltd. (India)

- WestRock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Novolex Holdings, LLC (U.S.)

- Genpak, LLC (U.S.)

- Vegware Ltd. (UK)

- BioPak Pty Ltd (Australia)

- TIPA Corp Ltd. (Israel)

- PulpWorks, Inc. (U.S.)

Latest Developments in Global Plastic-Free Packaging Market

- In April 2025, EcoPack Innovations launched a new line of fully compostable paper-based pouches designed for the food and beverage sector. These pouches feature advanced barrier coatings derived from natural materials, providing extended product shelf life while supporting zero-plastic waste goals.

- In March 2025, Tetra Pak announced the expansion of its plastic-free carton packaging production capacity in Europe, incorporating renewable plant-based materials and recyclable barrier layers. This initiative aligns with growing regulatory pressures and consumer demand for sustainable packaging solutions.

- In February 2025, Amcor introduced a range of recyclable glass bottles featuring lightweight designs and eco-friendly closures, targeting the cosmetics and personal care markets. The new bottles reduce carbon footprint during transportation and are fully recyclable within existing glass recycling streams.

- In January 2025, Ball Corporation unveiled its first aluminum cans made with 100% recycled content for beverage packaging, aiming to accelerate circular economy efforts. The product launch supports increasing consumer and brand preferences for metal packaging as a sustainable alternative to plastic.

- In January 2025, Mondi Group collaborated with a major global retailer to develop plastic-free paper boxes with innovative foldable designs that minimize material use while enhancing product protection and visual appeal. This partnership focuses on scaling sustainable packaging solutions in e-commerce and retail sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Free Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Free Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Free Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.