Global Plastic Healthcare Packaging Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

3.32 Billion

2025

2033

USD

1.78 Billion

USD

3.32 Billion

2025

2033

| 2026 –2033 | |

| USD 1.78 Billion | |

| USD 3.32 Billion | |

|

|

|

|

Plastic Healthcare Packaging Market Size

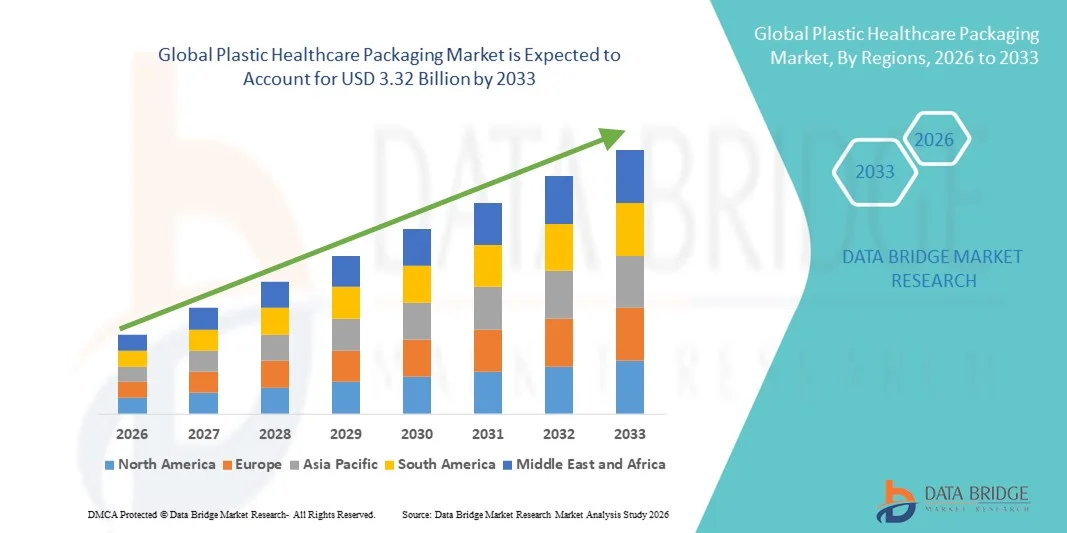

- The global plastic healthcare packaging market size was valued at USD 1.78 billion in 2025 and is expected to reach USD 3.32 billion by 2033, at a CAGR of 8.11% during the forecast period

- The market growth is largely fueled by the increasing demand for safe, sterile, and durable packaging solutions for pharmaceuticals, medical devices, and healthcare products, along with continuous technological advancements in plastic materials and packaging processes that enhance barrier protection, shelf life, and regulatory compliance across healthcare settings

- Furthermore, rising focus on patient safety, product integrity, and convenience—such as easy-to-use, tamper-evident, and lightweight packaging—combined with the growing production of pharmaceuticals and medical devices, is accelerating the adoption of plastic healthcare packaging solutions, thereby significantly boosting overall market growth

Plastic Healthcare Packaging Market Analysis

- Plastic healthcare packaging, including bottles, containers, blister packs, vials, and pouches, plays a critical role in protecting pharmaceuticals, medical devices, and healthcare products by ensuring sterility, durability, and extended shelf life across hospital, retail, and homecare settings

- The growing demand for plastic healthcare packaging is primarily driven by rising pharmaceutical production, increasing use of medical devices, and stringent regulatory requirements for safe and tamper-evident packaging, along with advancements in lightweight, high-barrier, and sustainable plastic materials

- North America dominated the plastic healthcare packaging market with the largest revenue share of approximately 34.9% in 2025, supported by a mature pharmaceutical industry, strong regulatory compliance standards, high healthcare spending, and the presence of leading packaging manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the plastic healthcare packaging market during the forecast period, driven by expanding pharmaceutical manufacturing, rising healthcare expenditure, increasing population, and rapid growth of contract manufacturing organizations in countries such as China and India

- The Pharmaceutical industry segment dominated the market with a revenue share of 68.2% in 2025, driven by large-scale drug manufacturing and distribution worldwide

Report Scope and Plastic Healthcare Packaging Market Segmentation

|

Attributes |

Plastic Healthcare Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Plastic Healthcare Packaging Market Trends

Rising Demand for Sustainable and High-Performance Plastic Healthcare Packaging

- A prominent and accelerating trend in the global plastic healthcare packaging market is the increasing shift toward sustainable, recyclable, and high-performance plastic materials driven by environmental regulations and growing awareness among healthcare providers and pharmaceutical companies. Manufacturers are actively adopting eco-friendly polymers, lightweight designs, and reduced material usage without compromising product safety and integrity

- For instance, Amcor has expanded its portfolio of recyclable polyethylene-based healthcare packaging solutions designed for medical devices and pharmaceutical products, enabling improved sustainability while maintaining strict barrier and sterility requirements. Similarly, Berry Global has introduced medical-grade packaging solutions incorporating recycled content to support circular economy goals in healthcare packaging

- Advancements in material science are enabling plastic healthcare packaging to offer enhanced properties such as superior moisture resistance, chemical stability, tamper evidence, and extended shelf life. These innovations are particularly critical for packaging sensitive products such as injectable drugs, biologics, and diagnostic kits, where contamination prevention and product stability are essential

- The growing adoption of unit-dose, blister, and pre-filled packaging formats further supports this trend, as these solutions enhance patient safety, dosing accuracy, and regulatory compliance. Plastic healthcare packaging continues to evolve to meet the increasing demand for traceability, labeling clarity, and compliance with international healthcare standards

- This trend toward safer, lighter, and more sustainable packaging solutions is reshaping purchasing decisions across pharmaceutical companies, hospitals, and medical device manufacturers. As a result, companies such as Gerresheimer and Schott are investing heavily in innovative plastic packaging designs that balance environmental responsibility with high functional performance

- The demand for advanced plastic healthcare packaging solutions is growing steadily across pharmaceutical, medical device, and diagnostic sectors, as end users increasingly prioritize safety, sustainability, and regulatory compliance

Plastic Healthcare Packaging Market Dynamics

Driver

Growing Pharmaceutical Production and Expanding Healthcare Infrastructure

- The rapid growth of the global pharmaceutical industry, combined with expanding healthcare infrastructure, is a major driver fueling demand for Plastic Healthcare Packaging. Rising production of medicines, vaccines, and medical devices has increased the need for reliable, sterile, and scalable packaging solutions

- For instance, in March 2024, West Pharmaceutical Services announced capacity expansions for its pharmaceutical packaging components to support increasing global demand for injectable drug delivery and containment systems. Such strategic developments by key players are expected to drive market growth during the forecast period

- Increasing prevalence of chronic diseases, aging populations, and rising healthcare expenditure are further accelerating the demand for packaged pharmaceuticals and medical products, directly supporting the growth of plastic healthcare packaging

- In addition, the expansion of hospital networks, diagnostic laboratories, and pharmaceutical manufacturing facilities—particularly in emerging economies—is boosting demand for cost-effective, durable, and compliant plastic packaging solutions

- The need for packaging that ensures sterility, tamper resistance, and ease of transportation, along with compatibility with automated filling and sealing systems, continues to strengthen the adoption of plastic healthcare packaging across the healthcare value chain

Restraint/Challenge

Environmental Concerns and Stringent Regulatory Compliance

- Environmental concerns related to plastic waste and sustainability pose a significant challenge to the Plastic Healthcare Packaging market. The healthcare sector’s reliance on single-use plastic packaging has drawn scrutiny from regulators and environmental organizations, increasing pressure on manufacturers to reduce environmental impact

- For instance, stricter regulations in regions such as Europe regarding plastic waste management and recyclability have increased compliance costs for packaging manufacturers, making product development more complex and time-intensive

- Compliance with stringent healthcare regulations, including FDA, EMA, and ISO standards, further adds to operational challenges, as plastic healthcare packaging must meet rigorous safety, quality, and traceability requirements. Any failure to comply can result in product recalls, financial penalties, or reputational damage

- Moreover, the higher cost associated with developing sustainable and recyclable medical-grade plastics compared to conventional materials can limit adoption, particularly among cost-sensitive healthcare providers and manufacturers in developing regions

- Overcoming these challenges through material innovation, regulatory alignment, investment in recycling technologies, and collaboration across the healthcare value chain will be critical for ensuring long-term growth and sustainability of the Plastic Healthcare Packaging market

Plastic Healthcare Packaging Market Scope

The market is segmented on the basis of type, drug delivery, industries, packaging, and applications.

- By Type

On the basis of type, the Global Plastic Healthcare Packaging market is segmented into High Density Polyethylene (HDPE), Polypropylene (PP), Polycarbonate (PC), Polyethylene Terephthalate (PET), and Others. The Polypropylene (PP) segment dominated the largest market revenue share of 34.8% in 2025, driven by its excellent chemical resistance, high durability, and suitability for pharmaceutical and medical packaging applications. Polypropylene is widely used in medical containers, caps, closures, and syringes due to its ability to withstand sterilization processes. Its lightweight nature reduces transportation costs while maintaining packaging integrity. PP offers superior moisture resistance, ensuring extended shelf life of drugs. Strong demand from injectable and oral drug packaging supports dominance. Compatibility with high-speed manufacturing lines enhances efficiency. Cost-effectiveness compared to alternative plastics boosts adoption. Increasing pharmaceutical production globally fuels consumption. Regulatory acceptance further strengthens market position. Growing use in single-use medical packaging supports demand. Continuous material innovation improves performance. These factors collectively drive PP’s leadership.

The Polyethylene Terephthalate (PET) segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by rising demand for transparent, lightweight, and recyclable healthcare packaging solutions. PET offers excellent clarity, making it ideal for visual inspection of pharmaceutical products. Growing sustainability initiatives promote PET adoption due to its recyclability. Increasing use in liquid medication and syrup bottles supports growth. PET’s strong barrier properties protect drugs from contamination. Expansion of over-the-counter (OTC) drug markets fuels demand. Improved resin formulations enhance durability. Adoption is increasing in emerging economies. Pharmaceutical brands prefer PET for premium packaging aesthetics. Lower carbon footprint compared to alternatives boosts acceptance. Investment in recycling infrastructure supports expansion. These factors accelerate PET market growth.

- By Drug Delivery

On the basis of drug delivery, the Global Plastic Healthcare Packaging market is segmented into Pulmonary, Oral Drugs, Transdermal, Injectable, Nasal, Topical, Ocular, and Intravenous (IV) Drugs. The Oral Drugs segment accounted for the largest market revenue share of 41.6% in 2025, driven by the high global consumption of tablets, capsules, and syrups. Plastic packaging such as bottles, blister packs, and closures ensures safety and dosage accuracy. Rising prevalence of chronic diseases increases oral medication usage. Convenience and patient compliance favor oral formulations. Plastic packaging offers excellent moisture and contamination protection. Cost-efficient mass production supports large-scale adoption. Increasing OTC drug availability fuels packaging demand. Strong pharmaceutical manufacturing growth supports dominance. Extended shelf life enhances drug stability. Regulatory compliance further strengthens trust. Growing aging population increases oral drug consumption. These factors support market leadership.

The Injectable Drugs segment is projected to grow at the fastest CAGR of 9.5% from 2026 to 2033, driven by rising use of biologics, vaccines, and advanced therapeutics. Increasing global vaccination programs boost demand for injectable packaging. Plastic prefilled syringes and vials reduce breakage risks compared to glass. Growing hospital-based treatments accelerate adoption. Technological advancements improve plastic barrier properties. Demand for single-dose packaging supports growth. Rising prevalence of cancer and autoimmune diseases fuels injectable therapies. Enhanced safety and sterility drive preference. Expanding biologics pipelines support market expansion. Increased healthcare spending accelerates adoption. Emerging markets show strong demand growth. These factors drive rapid expansion.

- By Industries

On the basis of industries, the Global Plastic Healthcare Packaging market is segmented into Pharmaceutical and Medical Device. The Pharmaceutical industry segment dominated the market with a revenue share of 68.2% in 2025, driven by large-scale drug manufacturing and distribution worldwide. Plastic packaging ensures product safety, compliance, and extended shelf life. Growing generic drug production boosts packaging demand. Increasing regulatory requirements support standardized packaging solutions. Rising chronic disease burden fuels pharmaceutical consumption. Plastic packaging supports tamper-evident features. Cost efficiency drives preference over alternative materials. Expanding global pharmaceutical supply chains reinforce dominance. Demand for child-resistant packaging supports growth. Strong R&D investments drive innovation. Increasing exports boost packaging volumes. These factors sustain pharmaceutical industry leadership.

The Medical Device segment is expected to grow at the fastest CAGR of 8.1% from 2026 to 2033, driven by increasing use of disposable medical devices. Growth in minimally invasive procedures boosts device usage. Plastic packaging ensures sterility and protection during transport. Rising surgical procedures fuel demand. Technological advancements improve packaging safety. Increasing home healthcare adoption supports growth. Demand for lightweight and durable packaging increases. Regulatory focus on infection control drives adoption. Expanding healthcare infrastructure supports expansion. Growth in emerging markets accelerates demand. Medical innovation fuels packaging requirements. These factors drive rapid growth.

- By Packaging

On the basis of packaging, the Global Plastic Healthcare Packaging market is segmented into Primary Packaging and Secondary Packaging. The Primary Packaging segment dominated the largest market revenue share of 59.3% in 2025, driven by its direct contact with pharmaceutical and medical products. Primary packaging ensures drug safety, stability, and contamination prevention. High demand for bottles, blister packs, and prefilled syringes supports dominance. Increasing pharmaceutical production fuels growth. Strict regulatory compliance strengthens demand. Primary packaging enhances shelf life and dosing accuracy. Technological innovations improve barrier properties. Rising biologics production increases need. High-volume consumption supports market share. Cost-effective materials drive adoption. Strong healthcare spending boosts growth. These factors sustain leadership.

The Secondary Packaging segment is anticipated to grow at the fastest CAGR of 7.6% from 2026 to 2033, driven by increasing focus on branding, labeling, and logistics protection. Growing pharmaceutical exports boost secondary packaging demand. Enhanced traceability requirements support adoption. Demand for tamper-evident solutions increases. Growth in e-commerce pharmaceutical distribution fuels need. Secondary packaging improves transportation safety. Rising regulatory labeling standards support growth. Demand for sustainable materials increases innovation. Customization trends drive expansion. Emerging markets show increasing adoption. Investment in packaging automation boosts efficiency. These factors support growth.

- By Applications

On the basis of applications, the Global Plastic Healthcare Packaging market is segmented into Blister Packs, Plastic Bottles, Plastic Packing Bags, Plastic Drums, Pre-fill Syringe, Caps and Closure, and Others. The Plastic Bottles segment held the largest market revenue share of 32.5% in 2025, driven by widespread use in liquid and solid pharmaceutical formulations. Plastic bottles provide durability, lightweight handling, and cost efficiency. High demand from oral drug packaging supports dominance. Compatibility with HDPE and PET materials boosts adoption. Bottles offer excellent barrier protection. Child-resistant and tamper-proof features increase usage. Growth in OTC drugs fuels demand. Easy transportation supports large-scale use. Strong manufacturing scalability enhances supply. Regulatory compliance strengthens trust. Growing pharmaceutical consumption drives growth. These factors sustain dominance.

The Pre-fill Syringe segment is expected to witness the fastest CAGR of 10.4% from 2026 to 2033, driven by rising demand for injectable biologics and vaccines. Prefilled syringes improve dosing accuracy and patient safety. Increasing adoption in hospitals boosts growth. Demand for self-injection therapies supports expansion. Plastic syringes reduce breakage risks. Growth in chronic disease treatment fuels usage. Technological advancements enhance sterility. Rising vaccination programs support demand. Expansion in home healthcare boosts adoption. Improved patient convenience drives preference. Emerging markets show rapid uptake. These factors accelerate growth.

Plastic Healthcare Packaging Market Regional Analysis

- North America dominated the plastic healthcare packaging market with the largest revenue share of approximately 34.9% in 2025, supported by a mature pharmaceutical industry, strong regulatory compliance standards, high healthcare spending, and the presence of leading plastic healthcare packaging manufacturers, particularly in the U.S.

- Healthcare providers and pharmaceutical companies in the region highly value plastic healthcare packaging solutions for their superior barrier protection, durability, sterility assurance, and compatibility with stringent regulatory requirements for pharmaceuticals, medical devices, and diagnostic products

- This strong market position is further reinforced by advanced healthcare infrastructure, high adoption of innovative drug delivery systems, and increasing demand for safe, tamper-evident, and patient-friendly packaging, establishing plastic healthcare packaging as a preferred solution across pharmaceutical, hospital, and medical device applications

U.S. Plastic Healthcare Packaging Market Insight

The U.S. plastic healthcare packaging market captured the largest revenue share in 2025 within North America, driven by the country’s extensive pharmaceutical manufacturing base, high consumption of prescription drugs, and strict FDA regulations governing medical packaging safety and quality. Manufacturers are increasingly focusing on high-performance plastics for applications such as blister packs, IV containers, prefilled syringes, and medical trays. The growing demand for biologics, injectables, and personalized medicine, along with strong investments in sustainable and recyclable medical packaging materials, continues to propel the U.S. plastic healthcare packaging market.

Europe Plastic Healthcare Packaging Market Insight

The Europe plastic healthcare packaging market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards related to patient safety, product traceability, and environmental sustainability. The region’s strong pharmaceutical and medical device industries are increasing the adoption of high-quality plastic packaging solutions that ensure sterility, chemical resistance, and extended shelf life. Additionally, rising emphasis on recyclable and eco-friendly healthcare packaging materials, supported by EU regulations, is encouraging innovation and adoption across pharmaceutical and healthcare sectors.

U.K. Plastic Healthcare Packaging Market Insight

The U.K. plastic healthcare packaging market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a well-established healthcare system and rising demand for pharmaceutical and medical device packaging. Increased focus on patient safety, medication adherence, and tamper-evident packaging is driving the use of advanced plastic healthcare packaging formats. Furthermore, the presence of strong pharmaceutical distribution networks and growing investments in sustainable medical packaging solutions are expected to support steady market growth in the U.K.

Germany Plastic Healthcare Packaging Market Insight

The Germany plastic healthcare packaging market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong pharmaceutical manufacturing capabilities and emphasis on quality, precision, and regulatory compliance. Germany’s advanced healthcare infrastructure and leadership in medical technology support the adoption of high-performance plastic packaging solutions for pharmaceuticals, diagnostics, and medical devices. The increasing focus on sustainable materials and recyclable medical plastics further strengthens market growth, aligning with the country’s environmental and innovation-driven approach.

Asia-Pacific Plastic Healthcare Packaging Market Insight

The Asia-Pacific plastic healthcare packaging market is expected to grow at the fastest CAGR during the forecast period, driven by expanding pharmaceutical manufacturing, rising healthcare expenditure, increasing population, and rapid growth of contract manufacturing organizations (CMOs) in countries such as China and India. Improving healthcare access, growing demand for affordable medicines, and rising production of generic drugs are significantly boosting the demand for cost-effective and scalable plastic healthcare packaging solutions across the region.

Japan Plastic Healthcare Packaging Market Insight

The Japan plastic healthcare packaging market is witnessing steady growth due to the country’s advanced healthcare system, aging population, and strong demand for high-quality pharmaceutical packaging. Japan places significant emphasis on patient safety, precision dosing, and contamination prevention, which supports the adoption of sophisticated plastic packaging solutions. The increasing use of unit-dose and blister packaging, along with innovations in lightweight and recyclable medical plastics, continues to drive market expansion in Japan.

China Plastic Healthcare Packaging Market Insight

The China plastic healthcare packaging market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid expansion of pharmaceutical manufacturing, rising healthcare spending, and strong government support for domestic drug production. China’s growing role as a global pharmaceutical manufacturing hub, combined with increasing demand for packaged medicines and medical devices, is driving large-scale adoption of plastic healthcare packaging. The presence of numerous domestic packaging manufacturers and expanding contract manufacturing activities further accelerate market growth in the country.

Plastic Healthcare Packaging Market Share

The Plastic Healthcare Packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- West Pharmaceutical Services, Inc. (U.S.)

- Gerresheimer AG (Germany)

- AptarGroup, Inc. (U.S.)

- Schott AG (Germany)

- B.D. (U.S.)

- Sealed Air Corporation (U.S.)

- Constantia Flexibles (Austria)

- RPC Group (U.K.)

- Klöckner Pentaplast (Germany)

- Huhtamaki Oyj (Finland)

- Sonoco Products Company (U.S.)

- SGD Pharma (France)

- Comar, LLC (U.S.)

- Uflex Ltd. (India)

- ALPLA Group (Austria)

- Takemoto Yohki Co., Ltd. (Japan)

- Nipro Corporation (Japan)

- CCL Industries Inc. (Canada)

Latest Developments in Global Plastic Healthcare Packaging Market

- In April 2025, Amcor opened an advanced coating facility in Malaysia dedicated to healthcare packaging, expanding its manufacturing footprint and enhancing its capacity to produce specialized plastic packaging for medical and pharmaceutical applications. This development supports faster delivery and localized production of high-performance packaging solutions in the Asia-Pacific region

- In February 2025, Systech launched UniSecure AI-powered authentication for pharma packaging, an advanced digital solution aimed at improving traceability and anti-counterfeiting in healthcare packaging. The system integrates AI to verify packaging integrity and ensure secure supply chains for pharmaceuticals

- In March 2025, JPFL Films became the first company in India to introduce BOPA nylon films for medical use, strengthening the regional supply of high-barrier plastic materials suited to sterile healthcare packaging and pharmaceutical blister applications. This launch underscores the ongoing innovation in material technologies within the industry

- In February 2025, DacklaPack introduced a new sustainable packaging solutions website, reflecting a broader industry trend toward transparency, ease of access to eco-friendly packaging offerings, and digital engagement with healthcare packaging customers

- In January 2025, Berry Global introduced new ClariPPil jars and bottles for solid oral dosage (OSD) pharmaceuticals, made from clarified polypropylene (PP) that significantly reduces CO₂ emissions and enhances moisture protection compared to traditional PET packaging, aligning with sustainability and performance priorities in healthcare packaging

- In November 2024, DuPont de Nemours, Inc. launched “Tyvek with Renewable Attribution,” a renewable-attributed polymer solution designed for medical device and pharmaceutical packaging that incorporates certified bio-circular feedstock while maintaining high microbial barrier properties, marking a significant step in sustainable material integration for healthcare plastics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.