Global Plastic Optical Fiber Market

Market Size in USD Billion

CAGR :

%

USD

4.32 Billion

USD

10.77 Billion

2024

2032

USD

4.32 Billion

USD

10.77 Billion

2024

2032

| 2025 –2032 | |

| USD 4.32 Billion | |

| USD 10.77 Billion | |

|

|

|

|

Plastic Optical Fiber Market Size

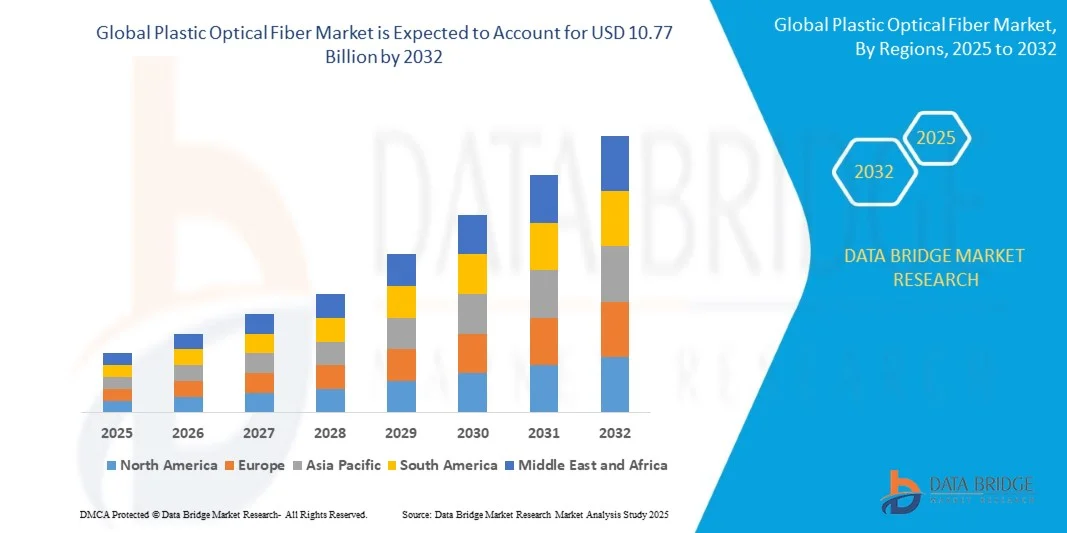

- The global plastic optical fiber market size was valued at USD 4.32 billion in 2024 and is expected to reach USD 10.77 billion by 2032, at a CAGR of 12.1% during the forecast period

- The market growth is largely fueled by the rising adoption of high-speed data communication, increasing integration of optical fibers in automotive lighting and infotainment systems, and the growing use of fiber-based solutions in medical and industrial applications

- Furthermore, the demand for cost-effective, flexible, and durable alternatives to glass fibers is positioning plastic optical fibers as a preferred choice in short-distance communication and illumination systems. These converging factors are accelerating deployment across multiple industries, thereby significantly boosting the market’s expansion

Plastic Optical Fiber Market Analysis

- Plastic optical fibers are flexible, polymer-based optical transmission media designed for short-distance, high-bandwidth communication, illumination, and sensing applications. They are widely used in automotive, consumer electronics, medical devices, industrial automation, and data communication systems, owing to their ease of installation, bending resistance, and cost efficiency

- The escalating demand for plastic optical fibers is primarily fueled by the need for lightweight and economical connectivity solutions, increasing automotive production incorporating fiber-based lighting, and growing reliance on digital communication networks across industrial and healthcare sectors

- Asia-Pacific dominated the plastic optical fiber market with a share of 49.7% in 2024, due to the growing adoption of advanced communication networks, rapid industrialization, and strong demand from the automotive and consumer electronics sectors

- North America is expected to be the fastest growing region in the plastic optical fiber market during the forecast period due to robust demand in data communication, automotive lighting, and healthcare technologies

- PMMA (Polymer Polymethylmethacrylate) segment dominated the market with a market share of 62.2% in 2024, due to its cost-effectiveness, wide availability, and excellent optical clarity. Its lightweight nature and durability make it suitable for diverse applications such as automotive interiors, consumer electronics, and medical devices. Moreover, its ease of processing and compatibility with mass production methods have strengthened its dominance in plastic optical fiber manufacturing

Report Scope and Plastic Optical Fiber Market Segmentation

|

Attributes |

Plastic Optical Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Plastic Optical Fiber Market Trends

“Rising Use of POF in Automotive and Industrial Applications”

- The plastic optical fiber (POF) market is expanding due to growing adoption in automotive and industrial applications where flexibility, cost-effectiveness, and ease of installation are highly valued. POFs are increasingly replacing copper for in-vehicle networking and industrial communication due to their lightweight structure and immunity to electromagnetic interference

- For instance, Mitsubishi Rayon has developed high-quality POFs that are being integrated into automotive multimedia systems, enabling reliable data and signal transmission within vehicles. Similarly, Asahi Kasei is promoting POF-based solutions for industrial control systems where mechanical flexibility and easy cabling are essential

- Automotive manufacturers are utilizing POF to enable high-speed communication for in-car infotainment, lighting control, and advanced driver-assistance systems (ADAS). Their ability to support robust in-vehicle networking at lower cost makes them an attractive alternative to traditional wiring solutions in the automotive sector

- In industrial settings, POFs are being used for applications such as factory automation, sensor connectivity, and robotics. Their resistance to vibration, interference, and bending enables reliable operations in harsh industrial environments where consistent performance is critical

- The demand for smart factories and intelligent automotive systems is further enhancing the role of POFs, as they offer both durability and affordability. Their easy termination and installation continue to reduce deployment times, aligning them well with high-growth communication requirements inside vehicles and industrial facilities

- The rising use of POF in automotive and industrial applications illustrates a broader trend toward economical, durable, and EMI-resistant solutions. Their unique benefits are expected to sustain adoption as industries push for more reliable short-distance communication technologies to meet digital transformation goals

Plastic Optical Fiber Market Dynamics

Driver

“Demand for Cost-Effective Short-Distance Connectivity”

- The demand for low-cost short-distance communication solutions is a primary driver of the POF market. Compared to glass fibers, POFs are cheaper to produce, easier to install, and provide sufficient performance over short transmission ranges, making them well-suited for automotive, residential, and industrial networks

- For instance, Chromis Fiberoptics offers POF solutions optimized for data communication, supporting cost-efficient networking for industries and in-vehicle connectivity. Companies such as Toray are also providing POF products targeting multimedia networks and industrial setups that require short-range, high-density communication affordability

- POFs excel in systems where flexibility, lightweight structure, and simple installation are priorities, especially in localized networks where extreme performance is not required. These characteristics make them widely used in short-distance links such as in consumer electronics, vehicle dashboards, and factory automation systems

- The growing deployment of IoT assets is supporting POF adoption as devices demand reliable yet economical communication backbones. Their resistance to electrical interference ensures dependable connectivity in environments with high-density electrical equipment

- The broader demand for affordable connectivity technologies emphasizes the growing recognition of POFs as reliable solutions for short-range communication applications. By striking the right balance between cost, ease of use, and performance, POFs are set to hold their place as a practical choice in multiple industries

Restraint/Challenge

“Lower Performance than Glass Fibers”

- A key challenge restraining the POF market is the lower performance of plastic fibers compared to traditional glass optical fibers. Limitations in bandwidth capacity, attenuation rates, and transmission distance make POF unsuitable for long-distance or high-capacity data transmission requirements

- For instance, companies such as Corning and Prysmian, which dominate the glass fiber market, highlight the superior capabilities of glass in supporting high-speed communication networks such as broadband and telecommunications. This performance gap limits plastic fibers largely to niche short-distance applications rather than large infrastructure projects

- High attenuation levels in POF restrict their use to only a few hundred meters, which narrows their capability in meeting advanced internet connectivity or extensive networking demands. This limitation becomes more prominent as industries move toward high-bandwidth and low-latency connectivity frameworks

- Another challenge is the perception of POF as an inferior substitute to glass fiber, which hinders confidence among customers looking for long-term investment in critical communication infrastructure. Despite their affordability, this perception continues to restrict wider adoption in performance-sensitive markets

- To overcome these challenges, research efforts are focused on improving POF materials, lowering attenuation losses, and enhancing performance through advanced coatings and polymers. Addressing these gaps will be vital for expanding POF applications beyond short-distance networks and achieving broader adoption in high-growth sectors

Plastic Optical Fiber Market Scope

The market is segmented on the basis of type, material, application, and industry vertical.

• By Type

On the basis of type, the market is segmented into glass optical fiber and plastic optical fiber. The plastic optical fiber segment dominated the largest market revenue share in 2024, owing to its cost-effectiveness, flexibility, and ease of installation compared to glass alternatives. Its resilience against bending, vibrations, and mechanical stress makes it widely preferred in short-distance communication, automotive lighting, and consumer electronics. Growing adoption in industries requiring robust yet economical solutions is driving consistent demand.

The glass optical fiber segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its superior bandwidth capacity and low signal loss over long distances. Increasing usage in high-speed internet, long-haul telecommunications, and advanced data centers is accelerating its expansion. Furthermore, rising global investment in fiber-to-the-home (FTTH) networks and 5G infrastructure boosts the need for glass optical fibers, making it the fastest-growing type.

• By Material

On the basis of material, the market is segmented into PMMA (Polymer Polymethylmethacrylate), perfluorinated polymers, and others. The PMMA segment dominated the market with a share of 62.2% in 2024 due to its cost-effectiveness, wide availability, and excellent optical clarity. Its lightweight nature and durability make it suitable for diverse applications such as automotive interiors, consumer electronics, and medical devices. Moreover, its ease of processing and compatibility with mass production methods have strengthened its dominance in plastic optical fiber manufacturing.

The perfluorinated polymers segment is projected to record the fastest CAGR from 2025 to 2032, attributed to their superior optical transmission properties and ability to support high data rates. They are increasingly used in advanced telecommunication networks and high-performance industrial systems where signal reliability is crucial. With rising demand for low-loss fibers in high-speed communication and specialty applications, perfluorinated polymers are expected to gain rapid traction during the forecast period.

• By Application

On the basis of application, the market is segmented into electronic appliances, motor vehicles, illumination, medical, data communication (specialty), commercial aircraft, and others. The motor vehicles segment accounted for the largest market share in 2024, driven by rising adoption of plastic optical fibers in automotive lighting, infotainment systems, and safety features. Their flexibility, vibration resistance, and lightweight nature make them ideal for enhancing modern vehicle design and efficiency. Additionally, the growing focus on electric vehicles (EVs) has further accelerated the integration of optical fibers for communication and lighting solutions.

The data communication (specialty) segment is anticipated to register the fastest growth between 2025 and 2032, supported by the increasing demand for short-distance, high-speed communication in consumer electronics, local area networks (LANs), and industrial systems. Plastic optical fibers are favored for their ease of handling, durability, and cost-effectiveness compared to glass fibers in such applications. As data traffic surges across industries, the specialty communication segment is projected to drive strong market growth.

• By Industry Vertical

On the basis of industry vertical, the market is segmented into telecom and IT, public sector, healthcare, energy and utilities, aerospace and defense, manufacturing, and others. The telecom and IT sector dominated the market share in 2024 due to the escalating demand for cost-efficient, flexible fiber solutions in data transmission and network connectivity. The growth of high-speed broadband, 5G infrastructure rollout, and cloud computing has further reinforced the reliance on optical fiber technology in this sector.

The healthcare segment is projected to witness the fastest CAGR from 2025 to 2032, as plastic optical fibers are increasingly utilized in minimally invasive surgeries, diagnostic equipment, and medical sensing devices. Their biocompatibility, flexibility, and safety in sensitive environments make them highly suitable for medical applications. Growing investments in advanced medical infrastructure and the rising adoption of fiber-optic technology in patient monitoring and imaging systems are expected to fuel rapid growth in this segment.

Plastic Optical Fiber Market Regional Analysis

- Asia-Pacific dominated the plastic optical fiber market with the largest revenue share of 49.7% in 2024, driven by the growing adoption of advanced communication networks, rapid industrialization, and strong demand from the automotive and consumer electronics sectors

- The region’s cost-effective manufacturing environment, expanding R&D investments in optical communication, and rising deployment of fiber-based illumination in vehicles are accelerating market expansion

- Government-backed initiatives for digital infrastructure, coupled with the availability of skilled labor and expanding electronics production hubs, are contributing to increased consumption of plastic optical fiber across multiple industries

China Plastic Optical Fiber Market Insight

China held the largest share in the Asia-Pacific plastic optical fiber market in 2024, supported by its status as a leading hub for electronics manufacturing and rapid adoption of fiber optics in automotive and industrial systems. Strong government investment in digital transformation, coupled with rising demand for efficient and cost-effective communication solutions, is fueling growth. China’s large-scale automotive production and growing deployment of illumination systems further strengthen its dominant market position.

India Plastic Optical Fiber Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding telecom infrastructure, rapid growth in automotive manufacturing, and increasing investments in electronics production. Government initiatives such as “Digital India” and rising demand for affordable high-speed connectivity are boosting adoption. Additionally, increasing automotive exports and strong uptake of plastic optical fiber in medical and illumination applications are contributing to India’s robust growth trajectory.

Europe Plastic Optical Fiber Market Insight

The Europe plastic optical fiber market is expanding steadily, supported by strong demand for advanced data communication systems, increasing adoption in automotive interiors, and growing investments in smart lighting solutions. The region places high emphasis on product quality, regulatory compliance, and sustainable production practices. Rising adoption in healthcare devices, industrial automation, and aerospace systems further contributes to consistent market expansion.

Germany Plastic Optical Fiber Market Insight

Germany’s market is driven by its leadership in automotive innovation, extensive research and development infrastructure, and strong demand for advanced communication technologies. The country’s well-established manufacturing base and integration of plastic optical fibers in lighting, safety systems, and medical devices enhance its growth outlook. Partnerships between academic institutions and technology companies further drive innovation in specialty applications.

U.K. Plastic Optical Fiber Market Insight

The U.K. market is supported by its growing focus on digital infrastructure, increasing use of optical fibers in healthcare applications, and rising demand in research-driven industries. With efforts to strengthen domestic electronics and telecom supply chains, coupled with strong academic-industry collaboration, the U.K. continues to play a vital role in advancing specialty plastic optical fiber applications, particularly in medical imaging and illumination.

North America Plastic Optical Fiber Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand in data communication, automotive lighting, and healthcare technologies. Rising adoption of smart infrastructure, increased investment in fiber-based connectivity solutions, and strong emphasis on material innovation are key drivers. The reshoring of electronics and component manufacturing, along with growing collaborations in advanced telecom and medical device development, further support rapid market expansion.

U.S. Plastic Optical Fiber Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its strong telecom and IT sector, rapid adoption of connected vehicles, and increasing demand in healthcare equipment. The country’s advanced R&D capabilities, presence of leading technology companies, and strong digitalization efforts are fostering growth. Rising use of plastic optical fibers in specialty lighting, aerospace, and medical applications reinforces the U.S.’s leadership in the region.

Plastic Optical Fiber Market Share

The plastic optical fiber industry is primarily led by well-established companies, including:

- Mitsubishi Chemical Corporation (Japan)

- Industrial Fiber Optics (U.S.)

- Fiberfin (U.S.)

- TORAY INDUSTRIES INC (Japan)

- AGC Inc. (Japan)

- Asahi Kasei Corporation (Japan)

- Nanoptics (U.S.)

- OFS Fitel LLC (U.S.)

- Molex, LLC (U.S.)

- Mouser Electronics Inc (U.S.)

- Hong Kong Trade Development Council (China)

- Nexans (France)

- Jiangsu TX Plastic Optical Fibers Co., Ltd (China)

Latest Developments in Plastic Optical Fiber Market

- In May 2025, Fiber Optics Group (FOG) acquired FiberTech Optica (FTO), a Canadian company specializing in custom fiber optic assemblies for scientific, biomedical, LIDAR, and industrial applications. This acquisition expands FOG’s footprint in North America and strengthens its position in high-value optical fiber solutions. By integrating FTO’s expertise with its own, FOG is expected to drive innovation in plastic optical fiber assemblies, boosting demand across sectors requiring durable and flexible optical systems

- In May 2025, Research and Markets published a global forecast report on perfluorinated plastic optical fiber (POF), underscoring growing industry investment in this segment. The report highlights the rising preference for perfluorinated POF due to superior transmission performance and reliability, which is pushing companies like AGC Inc. and Toray Industries to increase R&D and manufacturing. This signals a shift toward premium-grade POF solutions, accelerating their adoption in telecom, medical, and industrial applications

- In April 2025, Sterlite Technologies Limited (STL) launched its 160-micron optical fiber, claimed as the world’s thinnest telecom fiber. While not exclusively plastic, this innovation directly influences the POF market by setting new benchmarks for compactness and material efficiency. The development encourages advancements in plastic optical fiber production toward lighter, smaller, and high-performance solutions, particularly in automotive, healthcare, and electronics industries where space efficiency is critical

- In 2025, AGC Inc. and Toray Industries expanded their production capabilities for perfluorinated polymer-based POFs, aiming to meet increasing demand for high-speed data communication and advanced automotive systems. These expansions enhance global supply security while reducing costs, making high-performance POF more accessible to emerging markets. By scaling production, these companies are reinforcing the transition from traditional PMMA-based fibers to more advanced perfluorinated POFs

- In 2024, companies such as Mitsubishi Chemical, Chromis Fiberoptics, and LEONI AG launched new enhanced POF products with greater bandwidth, thermal resistance, and EMI shielding. These innovations open new market opportunities in robotics, aerospace, and medical applications where traditional fibers face limitations. By delivering specialized POF solutions, these companies are positioning themselves as leaders in next-generation optical connectivity

- In 2024, Mitsubishi Rayon Co. Ltd. entered into strategic partnerships with global telecom providers to integrate plastic optical fiber into broadband networks. These collaborations help accelerate real-world deployment of POF in short-distance data transmission, bridging the gap between material innovation and infrastructure needs. The partnerships are expected to enhance POF adoption in residential and commercial connectivity, further solidifying its market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Optical Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Optical Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Optical Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.