Global Plastic Ready Meal Trays Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

2.21 Billion

2025

2033

USD

1.54 Billion

USD

2.21 Billion

2025

2033

| 2026 –2033 | |

| USD 1.54 Billion | |

| USD 2.21 Billion | |

|

|

|

|

Plastic Ready Meal Trays Market Size

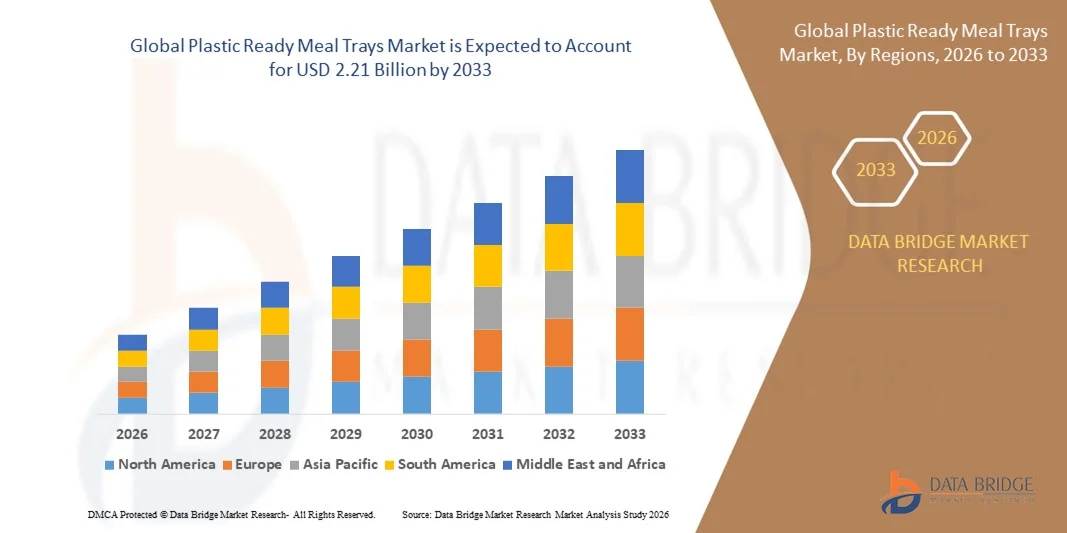

- The global plastic ready meal trays market size was valued at USD 1.54 billion in 2025 and is expected to reach USD 2.21 billion by 2033, at a CAGR of 4.63% during the forecast period

- The market growth is largely fuelled by the rising demand for convenience foods, increasing urbanization, and growing consumption of ready-to-eat meals

- Increasing adoption of plastic trays in the foodservice and retail sectors for packaging pre-cooked meals is supporting market expansion

Plastic Ready Meal Trays Market Analysis

- The market is witnessing steady growth due to changing lifestyles, higher disposable incomes, and the expanding food delivery and e-commerce sectors

- Manufacturers are innovating with lightweight, microwave-safe, and recyclable plastic tray options to meet consumer convenience and sustainability preferences

- North America dominated the plastic ready meal trays market with the largest revenue share of 38.75% in 2025, driven by growing demand for convenient, hygienic, and portion-controlled packaging in both retail and foodservice sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global plastic ready meal trays market, driven by expanding food delivery services, increasing processed food consumption, and supportive government initiatives for food packaging industries

- The polypropylene (PP) segment held the largest market revenue share in 2025, driven by its durability, heat resistance, and cost-effectiveness. PP trays are widely used across retail and foodservice sectors due to their ability to maintain meal integrity during transport and storage

Report Scope and Plastic Ready Meal Trays Market Segmentation

|

Attributes |

Plastic Ready Meal Trays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Packaging Company (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastic Ready Meal Trays Market Trends

Rise of Convenient and Sustainable Packaging

- The growing shift toward ready-to-eat (RTE) meal solutions is transforming the plastic ready meal trays market by enabling convenient, hygienic, and portion-controlled packaging. The ease of handling and storage offered by these trays allows consumers and foodservice operators to manage meals efficiently, reducing waste and improving food safety. The integration of microwavable and oven-safe trays further enhances usability for both home and commercial applications, supporting the adoption of RTE meals

- Increasing demand for plastic ready meal trays in fast-food chains, cafeterias, and home meal delivery services is accelerating market growth. These trays provide durability, leak resistance, and temperature stability, supporting efficient transport and extended shelf life of pre-prepared meals. The rising trend of online food delivery and meal kits is further boosting the requirement for standardized and safe tray packaging

- The affordability, lightweight design, and recyclability of modern plastic trays are making them attractive for diverse applications, from retail food packaging to institutional catering. Manufacturers are leveraging advanced thermoforming and biodegradable plastics to enhance tray performance and environmental compliance. The growing consumer preference for eco-friendly packaging solutions is driving innovations in materials, coatings, and design

- For instance, in 2023, several European and North American food packaging companies introduced compostable and microwavable ready meal trays, improving consumer convenience while reducing environmental impact. These developments also allowed brands to align with sustainable practices, improve product differentiation, and capture eco-conscious customers

- While ready meal trays are driving market expansion, continued innovation in sustainable materials, heat-resistant coatings, and customizable designs is essential to meet the evolving needs of retail, foodservice, and home delivery sectors. Companies focusing on product differentiation and value-added features, such as portion control and stackability, are expected to gain a competitive edge

Plastic Ready Meal Trays Market Dynamics

Driver

Rising Demand for Convenient Meal Packaging and Sustainable Solutions

- The increasing preference for ready-to-eat meals among busy consumers is driving demand for plastic ready meal trays. Convenience, portion control, and extended shelf life are critical factors for household and commercial adoption. Rising urbanization, changing lifestyles, and the expansion of foodservice channels are further fueling the consumption of ready meal solutions

- Growth in the food delivery sector and online meal services is supporting market expansion. Plastic trays offer safe, durable, and transportable solutions suitable for high-volume food distribution. The need for consistent quality, hygiene, and ease of handling during logistics has increased demand for standardized tray solutions across regions

- Adoption of recyclable, microwaveable, and eco-friendly plastics is accelerating, fueled by consumer awareness and regulatory initiatives promoting sustainable packaging solutions. Companies are increasingly investing in bioplastics and recyclable polymers to meet stringent food safety and environmental standards, which also enhances brand image

- For instance, in 2022, multiple global food chains in Asia and North America adopted BPA-free, recyclable trays to package meals, enhancing brand sustainability credentials and boosting consumer trust. This shift also drove suppliers to innovate in tray design, ensuring compatibility with multiple cooking and storage formats

- While rising demand for convenience and sustainability drives growth, manufacturers must continue developing lightweight, durable, and environmentally friendly trays to sustain long-term market expansion. Investments in R&D, automation, and eco-materials will be crucial to balance cost-effectiveness with environmental compliance

Restraint/Challenge

High Production Costs and Environmental Concerns

- The cost of producing high-quality, food-safe, and sustainable plastic trays is higher than conventional options, limiting adoption among price-sensitive manufacturers and smaller foodservice operators. Premium materials, such as biodegradable plastics, can further increase production costs and require additional processing expertise

- Increasing regulatory pressure on single-use plastics and environmental concerns about non-recyclable waste pose challenges to widespread adoption. Companies must invest in compliant materials and recycling solutions, which may necessitate restructuring supply chains and increasing operational expenditures

- Supply chain disruptions and raw material price volatility can affect tray production schedules and profitability, particularly for manufacturers relying on petrochemical-based plastics. Seasonal fluctuations in polymer availability and global logistical constraints may exacerbate cost pressures and delay product delivery

- For instance, in 2023, several food packaging firms in Europe and Asia reported increased production costs and delayed shipments due to polymer price fluctuations and compliance requirements. These challenges also forced companies to explore alternative sourcing, invest in local manufacturing, and adopt cost-efficient production methods

- While plastic ready meal tray technology continues to evolve, addressing cost, sustainability, and regulatory challenges remains critical. Stakeholders must focus on material innovation, efficient production methods, recycling initiatives, and scalable manufacturing processes to unlock full market potential and maintain competitiveness

Plastic Ready Meal Trays Market Scope

The plastic ready meal trays market is segmented on the basis of material, moulding technology, tray type, and end use

- By Material

On the basis of material, the plastic ready meal trays market is segmented into polypropylene (PP), polyethylene terephthalate (PET), and others. The polypropylene (PP) segment held the largest market revenue share in 2025, driven by its durability, heat resistance, and cost-effectiveness. PP trays are widely used across retail and foodservice sectors due to their ability to maintain meal integrity during transport and storage.

The polyethylene terephthalate (PET) segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its excellent clarity, recyclability, and suitability for microwave and chilled applications. PET trays are increasingly preferred for premium and eco-conscious ready meal offerings, supporting brand differentiation and consumer appeal.

- By Moulding Technology

On the basis of moulding technology, the market is segmented into injection moulding and thermoformed moulding. The thermoformed moulding segment held the largest market share in 2025 due to its efficiency in high-volume production and flexibility in tray shapes and sizes. Thermoformed trays provide uniform thickness, consistent performance, and reduced material waste.

The injection moulding segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to produce durable, rigid trays with intricate designs. This technology is favored for high-quality, reusable, and premium meal tray applications.

- By Tray Type

On the basis of tray type, the market is segmented into single cavity and multi cavity trays. The single cavity segment held the largest market share in 2025, supported by its suitability for individual meal portions and widespread use in retail and foodservice operations. Single cavity trays allow for portion control, hygiene, and efficient packaging.

The multi cavity segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand from catering services, meal kit providers, and bulk food distributors. Multi cavity trays enhance operational efficiency, reduce packaging time, and improve product handling.

- By End Use

On the basis of end use, the market is segmented into food producers and processors, restaurants, food courts, catering services, and online food delivery. The food producers and processors segment held the largest market revenue share in 2025 due to the scale of operations and consistent demand for ready meal packaging solutions. These trays support long shelf life, safe transport, and regulatory compliance.

The online food delivery segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising popularity of e-commerce food platforms, meal subscriptions, and home delivery services. Ready meal trays provide convenience, durability, and temperature stability for delivered meals, supporting the expansion of the online food delivery market.

Plastic Ready Meal Trays Market Regional Analysis

- North America dominated the plastic ready meal trays market with the largest revenue share of 38.75% in 2025, driven by growing demand for convenient, hygienic, and portion-controlled packaging in both retail and foodservice sectors

- Consumers in the region value the durability, microwaveability, and eco-friendly options offered by modern plastic trays, which ensure food safety and extend shelf life

- This widespread adoption is further supported by high disposable incomes, a fast-growing food delivery ecosystem, and increasing consumer preference for ready-to-eat meals, establishing plastic trays as a favored solution for both households and commercial foodservice providers

U.S. Plastic Ready Meal Trays Market Insight

The U.S. plastic ready meal trays market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of meal delivery services and growing consumption of ready-to-eat meals. Manufacturers are increasingly focusing on BPA-free, recyclable, and microwavable tray options to meet consumer expectations for convenience and sustainability. Rising adoption of online food delivery platforms, coupled with the popularity of single-serve meals, further propels market growth in the country.

Europe Plastic Ready Meal Trays Market Insight

The Europe plastic ready meal trays market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for sustainable and recyclable packaging solutions. Stringent food safety regulations, coupled with the growth of meal kit subscriptions and ready-to-eat meals in urban areas, are encouraging the adoption of innovative tray designs. European consumers are drawn to trays that combine convenience, portion control, and environmental compliance.

U.K. Plastic Ready Meal Trays Market Insight

The U.K. plastic ready meal trays market is expected to witness robust growth from 2026 to 2033, driven by the rising trend of home meal delivery and ready-to-eat options. Consumers’ growing awareness of food hygiene, convenience, and eco-friendly packaging is promoting the adoption of advanced tray materials and designs. The U.K.’s well-established retail and online distribution channels further support market expansion.

Germany Plastic Ready Meal Trays Market Insight

The Germany plastic ready meal trays market is expected to witness significant growth from 2026 to 2033, fueled by increasing adoption of environmentally friendly packaging solutions and demand for convenient meal formats. The country’s strong food processing and catering industries, combined with consumer emphasis on quality and sustainability, are encouraging manufacturers to innovate with recyclable and heat-resistant trays. Integration of modern tray solutions in institutional catering and retail segments is also on the rise.

Asia-Pacific Plastic Ready Meal Trays Market Insight

The Asia-Pacific plastic ready meal trays market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding food delivery services in countries such as China, India, and Japan. Growing demand for ready-to-eat meals, coupled with increasing awareness of food safety and convenience, is encouraging the adoption of advanced tray materials and designs. APAC is also emerging as a manufacturing hub for cost-effective, high-quality plastic trays, boosting accessibility across the region.

Japan Plastic Ready Meal Trays Market Insight

The Japan plastic ready meal trays market is expected to witness strong growth from 2026 to 2033, driven by high demand for single-serve meals, ready-to-eat convenience, and hygienic packaging solutions. Japanese consumers prioritize tray durability, microwaveability, and eco-friendly features, particularly in the context of meal delivery and on-the-go consumption. The integration of innovative tray solutions with retail and foodservice offerings further supports market expansion.

China Plastic Ready Meal Trays Market Insight

The China plastic ready meal trays market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, growing middle-class population, and the increasing popularity of ready-to-eat meals. The rise of online food delivery platforms, combined with domestic manufacturers producing cost-effective, microwavable, and sustainable tray solutions, is driving market growth. Government initiatives promoting food safety and environmentally friendly packaging are also boosting adoption across commercial and household segments.

Plastic Ready Meal Trays Market Share

The Plastic Ready Meal Trays industry is primarily led by well-established companies, including:

• Packaging Company (U.S.)

• Genpak, LLC (U.S.)

• Faerch A/S (Denmark)

• Sealed Air (U.S.)

• Sunmarks, LLC (U.S.)

• Sabert Corporation (U.S.)

• Bemis Company, Inc. (U.S.)

• Portage Plastics Corporation (U.S.)

• PLASTIPAK HOLDINGS, INC. (U.S.)

• Pinnpack (U.S.)

• MCP (U.S.)

• Amcor plc (U.K.)

• DS Smith (U.K.)

• Huhtamäki Oyj (Finland)

• Omniform (U.K.)

• Silver Plastics GmbH & Co. KG (Germany)

• Versatile Packaging (U.S.)

• Winpak LTD. (Canada)

• Berry Global Inc. (U.S.)

• Cambro (U.S.)

• Pactiv LLC (U.S.)

• Resilux NV (Belgium)

• Gerresheimer AG (Germany)

• Silgan Holdings Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Ready Meal Trays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Ready Meal Trays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Ready Meal Trays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.