Global Plastic Solenoid Valves Market

Market Size in USD Billion

CAGR :

%

USD

4.64 Billion

USD

6.16 Billion

2024

2032

USD

4.64 Billion

USD

6.16 Billion

2024

2032

| 2025 –2032 | |

| USD 4.64 Billion | |

| USD 6.16 Billion | |

|

|

|

|

Plastic Solenoid Valves Market Size

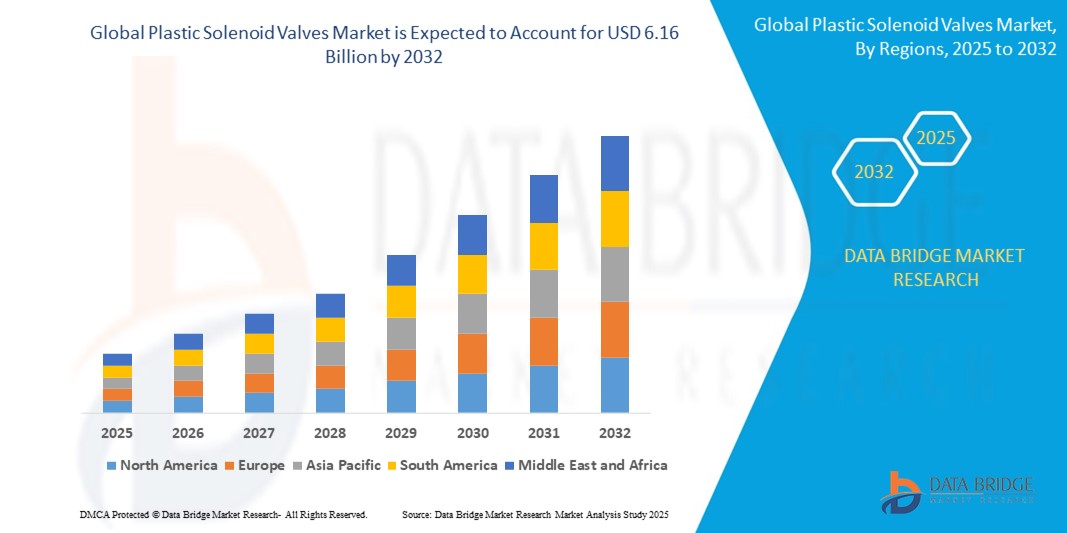

- The global plastic solenoid valves market size was valued at USD 4.64 billion in 2024 and is expected to reach USD 6.16 billion by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is primarily driven by increasing demand for automation across industries, advancements in valve technology, and the need for cost-effective, corrosion-resistant solutions in harsh environments

- Rising adoption in water and wastewater treatment, coupled with growing applications in chemical and petrochemical industries, is boosting the demand for plastic solenoid valves as reliable and efficient flow control solutions

Plastic Solenoid Valves Market Analysis

- Plastic solenoid valves, known for their lightweight, corrosion-resistant, and cost-effective properties, are critical components in fluid control systems across various industries, including water treatment, chemical processing, and automotive applications

- The surge in demand is fueled by the need for efficient and durable valve solutions in automated systems, increasing focus on water conservation, and stringent regulations in industries such as food and beverages and pharmaceuticals

- North America dominated the plastic solenoid valves market with the largest revenue share of 38.5% in 2024, driven by advanced industrial automation, strong presence of key manufacturers, and high adoption in water and wastewater treatment facilities

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing investments in water treatment infrastructure, and rising demand in automotive and pharmaceutical sectors

- The 2 Way segment dominated the largest market revenue share of 42.93% in 2024, driven by its widespread use in on/off fluid control applications across industries such as water systems, HVAC, and medical devices due to its simple design and ease of installation

Report Scope and Plastic Solenoid Valves Market Segmentation

|

Attributes |

Plastic Solenoid Valves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Plastic Solenoid Valves Market Trends

“Integration of Smart and IoT-Enabled Valve Technologies”

- The global plastic solenoid valves market is experiencing a notable trend toward the integration of smart and Internet of Things (IoT)-enabled technologies

- These advancements allow for real-time monitoring, remote control, and predictive maintenance, enhancing operational efficiency and reducing downtime

- Smart plastic solenoid valves equipped with sensors can collect data on flow rates, pressure, and valve performance, enabling proactive issue detection and optimization

- For instances, companies are developing IoT-enabled valves that integrate with industrial automation systems to provide insights for optimizing fluid control in water treatment and food processing industries

- This trend is increasing the appeal of plastic solenoid valves for industries seeking cost-effective, lightweight, and corrosion-resistant solutions with advanced functionality

- IoT integration also supports data-driven decision-making, such as predictive maintenance schedules, reducing operational costs and improving system reliability

Plastic Solenoid Valves Market Dynamics

Driver

“Growing Demand for Cost-Effective and Corrosion-Resistant Solutions”

- The rising demand for cost-effective, durable, and corrosion-resistant fluid control systems is a key driver for the global plastic solenoid valves market

- Plastic solenoid valves are increasingly favored in industries such as water and wastewater, food and beverages, and chemical processing due to their resistance to corrosive chemicals and lower cost compared to metal alternatives

- Government initiatives promoting sustainable water management and stringent regulations in food safety are boosting the adoption of plastic solenoid valves in these sectors

- The expansion of 5G and IoT technologies is enabling faster and more reliable data transmission, supporting advanced applications of plastic solenoid valves in automated industrial processes

- Manufacturers are increasingly offering plastic solenoid valves as standard components in equipment for industries such as medical and automotive, meeting the demand for lightweight and efficient solutions

Restraint/Challenge

“Limited Durability and High-Pressure Limitations”

- The lower durability of plastic solenoid valves compared to metal counterparts, particularly in high-pressure or high-temperature environments, poses a significant challenge to market growth

- The integration of smart technologies into plastic solenoid valves increases initial costs for hardware, software, and system integration, which can deter adoption in cost-sensitive markets

- Data security and privacy concerns are a major restraint, as IoT-enabled plastic solenoid valves collect sensitive operational data, raising risks of breaches or misuse, particularly in industries such as pharmaceuticals and food processing

- The varying regulatory standards across countries for industrial automation and data protection create complexities for manufacturers operating globally, impacting scalability

- These challenges can limit market expansion, especially in regions with stringent durability requirements or heightened awareness of data security issues

Plastic Solenoid Valves market Scope

The market is segmented on the basis of type, operating type, and end user.

- By Type

On the basis of type, the global plastic solenoid valves market is segmented into 2 Way, 3 Way, 4 Way, and 5 Way. The 2 Way segment dominated the largest market revenue share of 42.93% in 2024, driven by its widespread use in on/off fluid control applications across industries such as water systems, HVAC, and medical devices due to its simple design and ease of installation.

The 4 Way segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in complex control systems requiring multiple flow paths, such as in automotive and chemical processing applications. Advancements in valve technology and automation further accelerate adoption.

- By Operating Type

On the basis of operating type, the global plastic solenoid valves market is segmented into Direct, Semi-Direct, and Indirect. The Direct operating type segment is expected to hold the largest market revenue share of 45% in 2024, primarily due to its simple working principle and suitability for a wide range of pressure conditions, from 0 bar to maximum allowable pressure, making it ideal for applications in water treatment and food processing.

The Indirect operating type segment is anticipated to experience the fastest growth rate of 4.2% from 2025 to 2032, driven by its ability to handle high-pressure environments and its integration with IoT-enabled systems for enhanced control and efficiency in industries such as chemical and petrochemical.

- By End User

On the basis of end user, the global plastic solenoid valves market is segmented into Chemical and Petrochemical, Water and Wastewater, Automotive, Medical, Pharmaceutical, Power Generation, and Food and Beverages. The Chemical and Petrochemical segment dominated the market with a revenue share of 40.5% in 2024, driven by the critical role of plastic solenoid valves in regulating fluid flow and ensuring safety in handling aggressive chemicals.

The Water and Wastewater segment is expected to witness rapid growth from 2025 to 2032, with a CAGR of 4.8%, fueled by increasing investments in water treatment facilities and the need for precise fluid control to address water scarcity and pollution concerns. The use of plastic solenoid valves in tank filling, water softening, and piloting larger actuated valves supports this growth.

Plastic Solenoid Valves Market Regional Analysis

- North America dominated the plastic solenoid valves market with the largest revenue share of 38.5% in 2024, driven by advanced industrial automation, strong presence of key manufacturers, and high adoption in water and wastewater treatment facilities

- Consumers prioritize plastic solenoid valves for their cost-effectiveness, corrosion resistance, and reliability in controlling fluid and gas flow, particularly in harsh environments across various industries

- Growth is supported by advancements in valve technology, including IoT-enabled and energy-efficient designs, alongside rising adoption in both OEM and aftermarket applications

U.S. Plastic Solenoid Valves Market Insight

The U.S. plastic solenoid valves market captured the largest revenue share of 74.6% in 2024 within North America, fueled by strong demand in industries such as water and wastewater treatment, chemical processing, and automotive. Growing awareness of the benefits of plastic solenoid valves, such as durability and low maintenance, drives market expansion. Regulatory emphasis on energy efficiency and automation further supports adoption, with both OEM integrations and aftermarket installations contributing to a diverse market ecosystem.

Europe Plastic Solenoid Valves Market Insight

The Europe plastic solenoid valves market is expected to witness significant growth, supported by stringent regulations on industrial automation and environmental sustainability. Consumers seek valves that offer precise flow control and corrosion resistance for applications in chemical and food processing industries. Growth is prominent in both new installations and retrofit projects, with countries such as Germany and France showing strong uptake due to increasing focus on energy-efficient and safe fluid control systems.

U.K. Plastic Solenoid Valves Market Insight

The U.K. market for plastic solenoid valves is expected to experience rapid growth, driven by demand for reliable fluid control in water treatment and food and beverage sectors. Increased focus on industrial automation and environmental compliance encourages adoption. In addition, evolving regulations on energy efficiency and safety influence consumer preferences, balancing performance with regulatory compliance.

Germany Plastic Solenoid Valves Market Insight

Germany is expected to witness a high growth rate in the plastic solenoid valves market, attributed to its advanced industrial manufacturing sector and emphasis on automation and energy efficiency. German industries prioritize technologically advanced valves that ensure precise fluid control and reduce operational costs. The integration of these valves in chemical, pharmaceutical, and automotive applications, along with strong aftermarket demand, supports sustained market growth.

Asia-Pacific Plastic Solenoid Valves Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, expanding manufacturing sectors, and rising investments in water treatment and energy projects in countries such as China, India, and Japan. Increasing awareness of automation benefits, cost-effectiveness, and corrosion resistance boosts demand. Government initiatives promoting sustainable industrial practices and energy efficiency further encourage the adoption of advanced plastic solenoid valves.

Japan Plastic Solenoid Valves Market Insight

Japan’s plastic solenoid valves market is expected to grow rapidly due to strong consumer preference for high-quality, technologically advanced valves that enhance operational efficiency and safety. The presence of major industrial manufacturers and the integration of plastic solenoid valves in OEM applications accelerate market penetration. Growing interest in aftermarket automation solutions also contributes to market expansion.

China Plastic Solenoid Valves Market Insight

China holds the largest share of the Asia-Pacific plastic solenoid valves market, propelled by rapid urbanization, increasing industrial output, and growing demand for cost-effective fluid control solutions. The country’s expanding manufacturing sector and focus on automation support the adoption of advanced plastic solenoid valves. Strong domestic production capabilities and competitive pricing enhance market accessibility, particularly in chemical, water treatment, and power generation industries.

Plastic Solenoid Valves Market Share

The plastic solenoid valves industry is primarily led by well-established companies, including:

- CEME S.p.A. (Italy)

- CKD Corporation (Japan)

- ODE S.r.l. (Italy)

- KANEKO SANGYO Co., Ltd. (Japan)

- Takasago Electric Industry Co., Ltd. (Japan)

- Curtiss-wright Corporation (U.S.)

- ALFA LAVAL (Sweden)

- IMI plc (U.K.)

- LESER GmbH & Co.KG (Germany)

- The Weir Group PLC (Scotland)

- Forbes Marshall (India)

- Bosch Rexroth AG (Germany)

- Spirax Sarco Limited (U.K.)

- Danfoss A/S (Denmark)

- GSR Ventiltechnik GmbH & Co. KG (Germany)

- ASCO Valve, Inc. (U.S.)

- Christian Bürkert GmbH & Co. KG (Germany)

- KANEKO SANGYO Co., Ltd. (Japan)

What are the Recent Developments in Global Plastic Solenoid Valves Market?

- In August 2023, SMC Corporation unveiled a new line of stainless steel 2-port solenoid valves designed specifically for potable water applications. These valves, part of the HF3-JSX series, are NSF/ANSI 61 certified and IP67 rated, ensuring safety and durability in drinking water systems. Available in three sizes—HF3-JSX10, HF3-JSX20, and HF3-JSX30—they offer flow rates of 5, 15, and 25 L/min respectively. The design features a 25% smaller valve volume and 30% weight reduction compared to previous models, along with a 14% drop in power consumption. Enhanced coil engagement and a 360° rotatable coil improve installation flexibility and longevity

- In October 2022, Kendrion introduced its 63.0 bistable solenoid valve at COMPAMED 2022, showcasing a compact and energy-efficient solution for fluid control in medical and analytical devices. This valve features an integrated permanent magnet that allows it to maintain its position—open or closed—without continuous power, significantly reducing energy consumption and heat generation. A brief electrical pulse is all it takes to switch states, making it ideal for battery-powered or mobile applications. Available in 2/2- and 3/2-way configurations, the valve supports flow rates up to 40 L/min and can be customized with various sealing materials and connection types

- In June 2022, CKD Corporation introduced its “Multifit Valve” series, a line of direct-acting 2- and 3-port solenoid valves engineered for versatile fluid control across various industrial applications. These valves are built with high durability—lasting up to 20 million cycles—and incorporate corrosion-resistant materials to ensure long-term reliability. The design simplifies selection and installation, while features such as integrated full-wave rectifier coils and energy-efficient operation (reducing power consumption by up to 60%) support carbon neutrality goals. Applications range from compressed air and coolant control to water supply and vacuum switching

- In April 2022, Emerson expanded its ASCO Series 090 line by introducing a three-way miniature solenoid valve configuration, enhancing flexibility in compact medical device design. Originally developed as a two-way valve for air and inert gases, the new three-way version enables mixing and diverting functions within a single unit—replacing the need for two separate valves. This innovation supports lighter, more space-efficient gas control systems used in oxygen therapy, gas analyzers, and compression therapy devices. With a 10.8 mm footprint, 50-million-cycle life, and low power consumption, it’s ideal for portable, battery-powered applications

- In February 2021, GF Piping Systems launched the NeoFlow pressure regulating valve, co-developed with OFUI, to simplify and enhance water management in utility networks. This polymer-based valve is nine times lighter and requires 40% less installation time than traditional metal PRVs. Its axial flow design ensures precise pressure control, even at low differentials, while reducing leakage, mechanical stress, and energy consumption. With only three main components and a single moving part, NeoFlow offers low maintenance, corrosion resistance, and long-term reliability, aligning with GF’s vision for sustainable and efficient fluid control systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastic Solenoid Valves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastic Solenoid Valves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastic Solenoid Valves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.