Global Plastic Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

16.50 Billion

USD

35.62 Billion

2025

2033

USD

16.50 Billion

USD

35.62 Billion

2025

2033

| 2026 –2033 | |

| USD 16.50 Billion | |

| USD 35.62 Billion | |

|

|

|

|

Plastic Surgery Devices Market Size

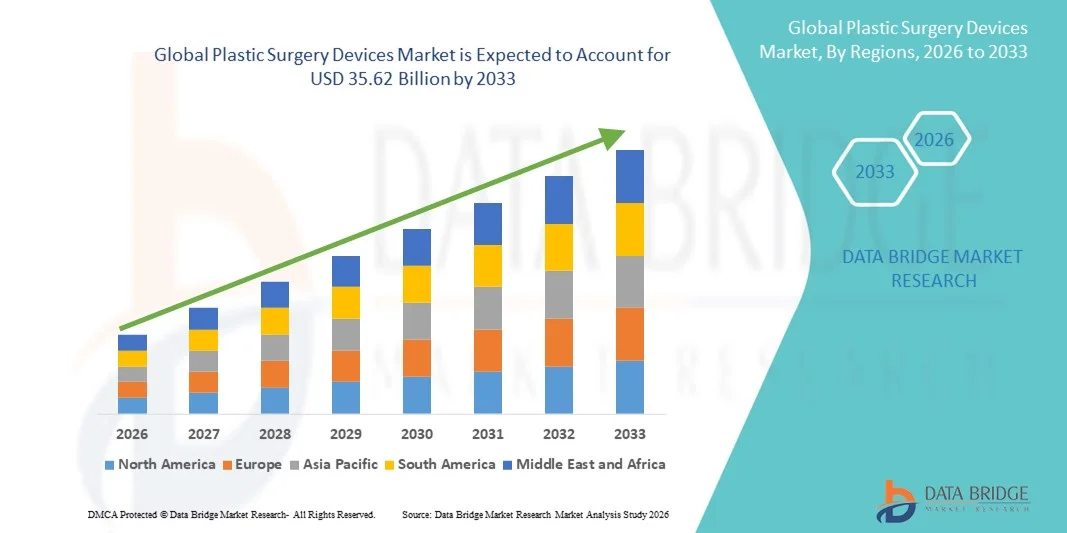

- The global Plastic surgery devices market size was valued at USD 16.50 billion in 2025 and is expected to reach USD 35.62 billion by 2033, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing smart locks as the modern access control system of choice. These converging factors are accelerating the uptake of Plastic Surgery Devices solutions, thereby significantly boosting the industry's growth

Plastic Surgery Devices Market Analysis

- Plastic Surgery Devices, including implantable and energy-based devices, are increasingly vital components of modern cosmetic and reconstructive procedures in both hospitals and specialized clinics due to their enhanced precision, safety, and minimally invasive capabilities

- The escalating demand for plastic surgery devices is primarily fueled by the growing awareness of aesthetic procedures, rising disposable incomes, and a preference for minimally invasive, technology-driven solutions among patients globally

- North America dominated the plastic surgery devices market with the largest revenue share of 39.5% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key industry players, with the U.S. experiencing substantial growth in device adoption across implantable, laser, and body contouring procedures

- Asia-Pacific is expected to be the fastest-growing region in the plastic surgery devices market during the forecast period, owing to increasing urbanization, rising disposable incomes, and growing popularity of cosmetic procedures in countries such as China, India, and South Korea

- The Instruments segment dominated the largest market revenue share of 44.5% in 2025, driven by its essential role in both invasive and non-invasive procedures

Report Scope and Plastic Surgery Devices Market Segmentation

|

Attributes |

Plastic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Plastic Surgery Devices Market Trends

Rising Demand for Minimally Invasive and Aesthetic Procedures

- A major and accelerating trend in the global plastic surgery devices market is the growing preference for minimally invasive and non-invasive cosmetic procedures, such as dermal fillers, laser-based treatments, and energy-assisted contouring devices

- These procedures reduce recovery times, minimize scarring, and offer patients greater convenience compared to traditional surgical interventions

- For instance, the adoption of energy-based body contouring devices such as CoolSculpting and radiofrequency-assisted lipolysis has expanded rapidly in both clinics and medspas worldwide, reflecting the trend toward non-surgical aesthetic solutions

- Manufacturers are increasingly developing devices with enhanced precision, ergonomics, and user-friendly interfaces to meet growing patient and physician demands. The trend is also supported by rising awareness of aesthetic procedures via social media and celebrity endorsements, as well as advances in imaging and simulation technologies that improve pre-operative planning

- The increasing focus on personalized treatment plans, shorter recovery periods, and safety innovations in device design is reshaping the competitive landscape. Clinics are investing in multi-modality platforms capable of performing multiple aesthetic procedures, catering to the rising patient demand for comprehensive and efficient solutions

- This trend is driving continuous innovation in plastic surgery devices, with companies emphasizing compact, versatile, and efficient tools that address both therapeutic and cosmetic applications

Plastic Surgery Devices Market Dynamics

Driver

Growing Popularity of Cosmetic and Reconstructive Procedures

- The global rise in disposable incomes, changing lifestyle preferences, and increasing awareness of aesthetic enhancements are major drivers for the Plastic Surgery Devices market. Patients are seeking both cosmetic improvements and reconstructive interventions, fueling demand for advanced devices

- For instance, in March 2024, Allergan Aesthetics announced the global expansion of its portfolio of injectables and body contouring devices, aiming to meet the rising demand for non-invasive aesthetic procedures in emerging markets such as India and Brazil

- In addition, the surge in reconstructive surgeries following trauma, burns, or congenital defects contributes to market expansion, with healthcare institutions increasingly investing in state-of-the-art surgical and laser-based equipment

- Technological advancements in surgical navigation, imaging, and precision instruments are enhancing procedural accuracy, patient safety, and outcomes, further motivating clinics and hospitals to upgrade their existing devices

- The growing acceptance of aesthetic treatments among younger demographics, alongside targeted marketing campaigns and medical tourism, continues to drive adoption across both developed and developing regions

Restraint/Challenge

High Costs and Regulatory Barriers

- The relatively high cost of advanced plastic surgery devices and associated consumables presents a challenge for broader adoption, particularly in developing countries or for small clinics with limited budgets. Premium devices such as robotic-assisted surgical tools, laser systems, and 3D imaging platforms often require significant capital investment and maintenance costs

- For instance, reports in 2023 highlighted that smaller clinic in Southeast Asia were delaying adoption of laser-assisted liposuction equipment due to the initial investment and training costs required for staff

- Furthermore, stringent regulatory requirements for device approval and certification across multiple regions slow the market entry of new technologies. Regulatory compliance with agencies such as the FDA, CE, or TGA can extend product launch timelines and add substantial costs

- The need for specialized training to safely operate complex devices may also limit adoption in some regions. Clinics must invest in physician education and ongoing training programs to ensure proper use, which can act as a barrier for smaller healthcare providers

- Overcoming these challenges will require strategies such as offering modular devices, leasing programs, or cost-effective versions of advanced systems, alongside continuous regulatory support and professional training initiatives

Plastic Surgery Devices Market Scope

The market is segmented on the basis of type, end-user, and distribution channel.

- By Type

On the basis of type, the Plastic Surgery Devices market is segmented into Instruments, Consumables, and Implants. The Instruments segment dominated the largest market revenue share of 44.5% in 2025, driven by its essential role in both invasive and non-invasive procedures. These devices are crucial for high-precision surgeries such as facial augmentations, body contouring, and reconstructive procedures. Hospitals and clinics prioritize instruments due to their safety, reliability, and reusability, which ensures cost-efficiency over time. The segment benefits from established procurement channels and long-term supply contracts, especially in high-volume hospitals. Technological advancements in minimally invasive tools and ergonomic designs further strengthen demand. Instruments are widely adopted in medical spas, dermatology clinics, and cosmetic centers for both surgical and non-surgical applications. Training programs and certifications also enhance practitioner confidence in using these tools. Rising awareness of aesthetic procedures in developed markets fuels consistent adoption. Surgeons prefer standardized instruments for predictable outcomes. The segment also benefits from regulatory approvals and quality certifications that build trust among end-users. Emerging markets are increasingly investing in modern surgical instruments to expand healthcare infrastructure, contributing to market leadership.

The Implants segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, fueled by growing demand for cosmetic enhancements such as breast augmentation, facial implants, and reconstructive procedures. Rising disposable incomes and increasing awareness of aesthetic treatments in emerging regions are key growth drivers. Advanced implant materials and customization options allow surgeons to provide natural-looking results with improved safety. Marketing campaigns and social media influence are boosting patient demand, particularly among young adults. Regulatory approvals and clinical trials are supporting wider adoption in hospitals and clinics. The growing trend of minimally invasive surgeries has expanded implant usage across outpatient clinics and medical spas. Technological innovations, such as 3D-printed implants, further drive segment growth. Rising medical tourism in countries like India and South Korea is increasing implant procedures. Aesthetic preferences and body image awareness contribute to steady adoption. The segment is benefiting from collaborations between implant manufacturers and leading cosmetic surgery chains. Continuous R&D is enabling more durable and biocompatible implants, further enhancing their market potential.

- By End-User

On the basis of end-user, the market is segmented into Clinics, Medical Spa and Beauty Centers, Hospitals, Dermatology Clinics, and Others. Hospitals dominated the largest market revenue share of 46.2% in 2025, as they handle both complex reconstructive and elective cosmetic procedures. Hospitals offer advanced surgical suites, skilled personnel, and comprehensive post-operative care, supporting the high adoption of instruments, implants, and consumables. Long-term contracts and bulk procurement from hospitals ensure steady demand and market stability. The segment also benefits from strong insurance coverage in developed markets, enabling more procedures. Patient trust, high procedural volume, and extensive procedural offerings strengthen hospital dominance. Hospitals are equipped to handle advanced surgeries requiring specialized devices, unlike smaller clinics. Surgical innovation, training programs, and research activities further consolidate hospital leadership. Hospital infrastructure and regulatory compliance support the continuous use of advanced plastic surgery devices. Developed regions rely on hospitals for reconstructive surgeries post-trauma or congenital disorders. Hospitals also serve as training centers for upcoming surgeons, maintaining instrument utilization. Consistent technological upgrades in hospitals keep demand stable. Partnerships with device manufacturers ensure ready access to the latest devices.

The Medical Spa and Beauty Centers segment is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by rising demand for non-invasive and minimally invasive procedures. Urbanization, disposable income growth, and cosmetic awareness are accelerating adoption. Consumers prefer shorter recovery times and affordability, making medical spas ideal for treatments. The segment is supported by innovative device offerings such as laser and filler systems. Increasing trend of preventive aesthetic treatments is further boosting device usage. Marketing campaigns and social media influence enhance patient visits. Regulatory approvals for non-invasive devices reduce barriers for clinics. Rising number of standalone cosmetic centers provides easier access to treatments. Technological improvements increase safety and effectiveness of procedures. Collaboration with dermatology experts and training workshops enhance practitioner adoption. Patient convenience, flexible scheduling, and competitive pricing drive preference. Growing healthcare tourism targeting cosmetic procedures in Asia-Pacific and Latin America fuels segment expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender and Retail Sales. The Direct Tender segment dominated the largest market revenue share of 52.7% in 2025, primarily due to bulk procurement by hospitals and clinics. Direct agreements ensure consistent supply, lower costs per unit, and quality assurance. Hospitals and large clinics prefer direct procurement for critical surgical instruments, implants, and consumables. Established supply chains, contracts with manufacturers, and long-term partnerships contribute to stable demand. Direct Tender also allows better after-sales support, maintenance, and training programs. Bulk purchasing reduces operational disruptions during surgeries. In addition, compliance with local regulatory requirements is easier through direct procurement. Larger healthcare institutions trust manufacturer-authorized channels for authenticity. Direct Tender ensures timely delivery for high-volume procedures. Hospitals benefit from negotiated pricing and warranties. Manufacturer-led training and demonstration programs strengthen adoption. High-volume end-users across regions contribute to market share dominance.

The Retail Sales segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by online medical device platforms and specialty distributors. Smaller clinics, dermatology centers, and beauty spas increasingly use retail channels for convenience and cost-efficiency. Rising e-commerce penetration, logistics improvements, and wider product availability support segment growth. Retail channels offer easy access to both consumables and surgical instruments. Marketing and online promotions help clinics discover new devices. Growing number of small-to-medium cosmetic centers are boosting retail demand. Flexible payment and delivery options encourage adoption in emerging markets. Retail availability increases competition and product innovation. Direct-to-consumer awareness campaigns are further driving demand. Retail sales also enable faster introduction of innovative devices to the market. Access to professional-grade products without large tenders supports smaller end-users.

Plastic Surgery Devices Market Regional Analysis

- North America dominated the plastic surgery devices market with the largest revenue share of 39.5% in 2025, driven by advanced healthcare infrastructure, high patient awareness, and a strong presence of key industry players specializing in implantable, laser, and body contouring devices

- The U.S., in particular, experienced substantial growth due to rising demand for aesthetic and reconstructive procedures, along with the adoption of innovative surgical tools and minimally invasive technologies across hospitals and clinic

- High healthcare spending, well-established reimbursement frameworks, and the availability of skilled plastic surgeons further supported market expansion. Clinics and hospitals invested heavily in modern equipment, including laser treatment systems, fat reduction platforms, and implantable devices for reconstructive surgeries. Widespread adoption of cosmetic procedures, increasing prevalence of aging populations seeking rejuvenation treatments, and growing awareness of advanced minimally invasive options contributed to robust regional growth. In addition, the integration of multi-modality devices in clinics, capable of performing both therapeutic and cosmetic procedures, strengthened North America’s position as the leading region globally

U.S. Plastic Surgery Devices Market Insight

The U.S. plastic surgery devices market accounted for the majority of North America’s demand, capturing the largest revenue share in 2025 within the region. This growth was driven by a high volume of aesthetic and reconstructive procedures, significant adoption of laser-assisted and non-invasive body contouring devices, and the use of implantable systems for facial and breast reconstruction. Strong clinical infrastructure, extensive medical training programs, and collaborations between device manufacturers and leading hospitals and academic centers facilitated the rapid deployment of advanced plastic surgery technologies. Rising popularity of cosmetic procedures among millennials and the increasing number of medical tourism patients seeking high-quality treatments further contributed to market expansion. Overall, the U.S. remains the epicenter of innovation and adoption in North America, supporting the development and commercialization of new devices and technologies in the plastic surgery domain.

Europe Plastic Surgery Devices Market Insight

The Europe plastic surgery devices market is projected to expand at a notable CAGR during the forecast period, driven by increasing patient demand for cosmetic and reconstructive procedures, particularly in Germany, France, and Italy. Growing urbanization, higher disposable incomes, and rising awareness about minimally invasive aesthetic procedures are key factors promoting adoption. Healthcare providers are investing in laser devices, body contouring systems, and advanced surgical instruments to meet both therapeutic and aesthetic patient needs. Stringent regulatory standards and emphasis on patient safety ensure that devices introduced in Europe are technologically advanced and clinically validated. The increasing prevalence of reconstructive procedures, such as post-trauma or post-cancer interventions, further strengthens the market outlook across hospitals, clinics, and specialized aesthetic centers.

U.K. Plastic Surgery Devices Market Insight

The U.K. plastic surgery devices market is anticipated to grow steadily, supported by rising demand for cosmetic enhancements, reconstructive surgeries, and body contouring treatments. Increasing patient awareness, the availability of high-end aesthetic clinics, and a strong medical infrastructure contribute to growth. Integration of multi-functional devices capable of performing multiple procedures is becoming increasingly common in hospitals and clinics. Medical tourism, particularly from Europe and the Middle East, also fuels adoption of advanced plastic surgery devices. The emphasis on minimally invasive procedures and post-surgical recovery efficiency continues to drive equipment upgrades across healthcare facilities.

Germany Plastic Surgery Devices Market Insight

Germany’s plastic surgery devices market is expected to expand at a considerable CAGR during the forecast period, supported by technological innovation, high healthcare spending, and demand for advanced reconstructive and cosmetic procedures. Clinics and hospitals are increasingly adopting laser systems, body contouring platforms, and implantable devices to cater to both local and international patients. Awareness campaigns about aesthetic procedures, coupled with a growing senior population seeking rejuvenation treatments, contribute to strong market demand. Manufacturers emphasize precision, safety, and ergonomics in their device offerings, aligning with the high standards of German healthcare facilities. The country’s robust medical infrastructure and focus on sustainable, high-quality surgical technologies bolster growth across private and public healthcare settings.

Asia-Pacific Plastic Surgery Devices Market Insight

The Asia-Pacific plastic surgery devices market is expected to be the fastest-growing region during the forecast period, with a projected CAGR from 2026 to 2033. Growth is fueled by increasing urbanization, rising disposable incomes, and growing popularity of cosmetic procedures in countries such as China, India, and South Korea. Expanding healthcare investments, rising numbers of aesthetic clinics and training institutes, and increasing demand for minimally invasive procedures and laser-based treatments are key drivers. Government initiatives supporting medical tourism and private healthcare facilities further enhance accessibility to advanced devices. China and India are emerging as significant markets due to the expanding middle class, higher healthcare awareness, and adoption of innovative cosmetic and reconstructive procedures.

Japan Plastic Surgery Devices Market Insight

Japan’s market is gaining momentum due to high healthcare standards, rapid urbanization, and increasing patient preference for minimally invasive and aesthetic procedures. Advanced laser-based devices, energy-assisted body contouring systems, and implantable devices for facial reconstruction are witnessing growing adoption. The aging population, combined with rising disposable incomes, is driving demand for rejuvenation and reconstructive treatments. Clinics and hospitals are increasingly investing in multi-modality platforms to deliver efficient, personalized treatments. The country’s emphasis on precision, safety, and advanced technology adoption supports steady market growth.

China Plastic Surgery Devices Market Insight

China plastic surgery devices market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, increasing disposable incomes, and strong demand for cosmetic and reconstructive procedures. The country’s growing middle class and emphasis on appearance and aesthetics have accelerated the adoption of laser devices, non-invasive body contouring technologies, and implantable surgical tools. Expansion of medical tourism and the availability of domestic, cost-effective devices are further boosting market penetration. Healthcare providers are investing in advanced surgical platforms to cater to both local and international patients, ensuring rapid adoption of innovative devices. Government initiatives supporting private healthcare and aesthetic services strengthen the growth trajectory across the region.

Plastic Surgery Devices Market Share

The Plastic Surgery Devices industry is primarily led by well-established companies, including:

• Johnson & Johnson (U.S.)

• AbbVie Inc. (U.S.)

• Medtronic (Ireland)

• Stryker Corporation (U.S.)

• BD (U.S.)

• GC Aesthetics (Ireland)

• Mentor Worldwide LLC (U.S.)

• Sinclair Pharma (U.K.)

• Lumenis Ltd. (Israel)

• Cynosure (U.S.)

• Cutera Inc. (U.S.)

• Hologic Inc. (U.S.)

• Venus Concept Inc. (Canada)

• Alma Lasers (Israel)

• Pollogen Ltd. (Israel)

• Machida Company (Japan)

• Hironic Co. Ltd. (South Korea)

• L’Oreal Medical (France)

Latest Developments in Global Plastic Surgery Devices Market

- In September 2023, Allergan Aesthetics announced the launch of Revanesse, a targeted dermal filler specifically developed for the tear troughs and nasolabial folds, leveraging advanced hyaluronic acid technology to provide longer‑lasting, natural‑looking aesthetic results with fewer side effects. This launch was aimed at addressing increasing demand for non‑surgical rejuvenation procedures, particularly in affluent markets where patients seek precise and customizable aesthetic enhancements. The introduction of Revanesse expanded Allergan’s aesthetic portfolio and intensified competition among manufacturers to deliver more refined, procedure‑specific solutions for facial contouring and anti‑aging treatments, reflecting a broader industry focus on personalization and efficacy in cosmetic interventions.

- In April 2025, Spectra Medical India Pvt. Ltd., in collaboration with Italy’s Eufoton, launched EndoliftX in India — an advanced non‑surgical laser treatment designed to tighten skin, reduce fat, and contour the face and body with minimal discomfort and recovery time. This innovation demonstrates the strong trend toward energy‑based aesthetic devices gaining traction in emerging markets, as practitioners adopt technology that enables effective body and facial contouring without invasive surgery. EndoliftX’s entry into the Indian market underscores both the geographic expansion of high‑technology aesthetic devices and the accelerating preference among patients for minimally invasive treatments that deliver significant cosmetic improvements with shorter downtimes

- In June 2025, Lynch Regenerative Medicine completed a significant Series A financing round to commercialize a pure platelet‑derived growth factor (PDGF) technology for aesthetic applications, marking a major investment milestone in regenerative approaches within the plastic surgery device space. The newly funded Ariessence Pure PDGF+ product is designed to enhance outcomes from procedures such as micro‑needling and laser treatments by improving tissue regeneration and healing. This development reflects growing investor confidence in biologically driven aesthetic enhancements and the integration of regenerative medicine principles into plastic surgery devices, a shift that is expected to influence product pipelines and treatment protocols in the coming years

- In July 2025, XERF, a monopolar radiofrequency device by Cynosure Lutronic, received Health Canada approval for the treatment of facial contouring and skin laxity, with over 100 units contracted in Korea within five months of launch. This regulatory milestone highlights the increasing regulatory recognition and international adoption of cutting‑edge aesthetic technologies beyond traditional Western markets. The entry of XERF into Canadian and Korean clinical settings illustrates how next‑generation radiofrequency and energy‑based devices are reshaping non‑invasive contouring and tightening procedures globally, driving both clinician adoption and patient access to advanced aesthetic options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.