North America Orthopedic Implants Market

Market Size in USD Billion

CAGR :

%

USD

12.20 Billion

USD

24.45 Billion

2024

2032

USD

12.20 Billion

USD

24.45 Billion

2024

2032

| 2025 –2032 | |

| USD 12.20 Billion | |

| USD 24.45 Billion | |

|

|

|

|

Orthopedic Implants Market Size

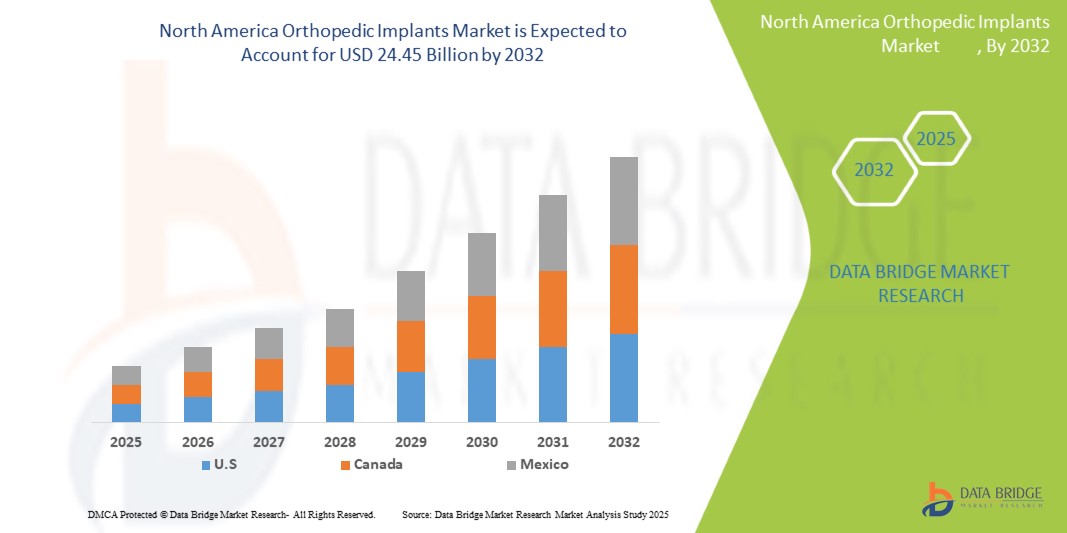

- The North America Orthopedic Implants Market was valued at USD 12.2 billion in 2024 and is expected to reach USD 24.45 billion by 2032, at a CAGR of 3.7% during the forecast period

- The rising prevalence of musculoskeletal disorders, such as osteoarthritis, osteoporosis, and fractures, particularly among the aging population. The increasing number of joint replacement procedures, such as hip and knee implants, is significantly contributing to the market growth.

North America Orthopedic Implants Market Analysis

- The demand for Orthopedic Implants in North America is primarily driven by the increasing prevalence of osteoarthritis, osteoporosis-related fractures, and musculoskeletal injuries, particularly among the aging population. This trend is further accelerated by rising awareness of the clinical and economic advantages of minimally invasive techniques. Technological advancements, such as improved implant materials and surgical precision, are reducing recovery times and expanding the use of Orthopedic Implants in clinical and outpatient settings. Additionally, the growing shift toward home-based recovery and outpatient procedures is contributing to broader market expansion.

- North America holds a dominant position in the North America Orthopedic Implants market, driven by its advanced healthcare infrastructure, rapid adoption of cutting-edge medical technologies, and supportive reimbursement policies. The United States, in particular, leads the region with its high healthcare spending, substantial elderly population, and widespread use of innovative surgical techniques that promote shorter hospital stays and improve long-term patient outcomes.

- The market is also influenced by favorable regulatory environments, including FDA approvals, which ensure the safety and efficacy of Orthopedic Implants. Growing healthcare investments, the increasing trend of outpatient care, and the transition to personalized, long-term care strategies are enhancing patient experiences and improving clinical results. The integration of advanced imaging systems, AI-powered tools, and smart surgical platforms is further enhancing the precision and effectiveness of Orthopedic Implant procedures.

Report Scope Orthopedic Implants Market Segmentation

|

Attributes |

Orthopedic Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopedic Implants Market Trends

“Minimally Invasive Innovations and Outpatient Procedure Growth”

- The market is experiencing a strong shift toward minimally invasive Orthopedic Implant procedures, driven by their ability to reduce surgical trauma, shorten recovery times, and enhance patient outcomes. Advanced imaging technologies, coupled with next-generation surgical tools, are improving procedural accuracy and efficiency, ensuring better spinal alignment and restoration, especially in the treatment of vertebral compression fractures (VCFs).

- As procedures become faster, safer, and more effective, there is a noticeable transition from traditional inpatient settings to outpatient clinics and ambulatory surgical centers (ASCs). This movement is primarily fueled by cost-saving pressures and enhanced procedural outcomes. With the support of advanced post-surgical care technologies, such as remote monitoring and rehabilitation tools, healthcare providers are increasingly confident in managing recovery outside of hospital settings, which boosts patient access and alleviates strain on healthcare facilities.

- For instance, the growing awareness around the importance of bone health and injury prevention, particularly among the aging population and athletes, has led to a surge in demand for orthopedic implants. These implants not only support the restoration of mobility but also aid in reducing the risk of future joint complications, enhancing overall quality of life for individuals with musculoskeletal conditions.

- The U.S., minimally invasive Orthopedic Implant procedures have become more widespread due to their ability to deliver rapid pain relief, restore joint integrity, and support faster recovery compared to traditional surgeries.

Orthopedic Implants Market Dynamics

Driver

“Minimally Invasive Innovations and Outpatient Procedure Growth”

- The North America Orthopedic Implants Market is experiencing robust growth, driven by the increasing prevalence of osteoporosis-related vertebral compression fractures (VCFs), particularly among the aging population. As life expectancy rises, so does the demand for minimally invasive interventions that effectively address age-related spinal conditions.

- The growing awareness of the benefits of minimally invasive procedures—such as quicker pain relief, restoration of spinal stability, and reduced hospital stays—is accelerating the adoption of Orthopedic Implants across both hospital and outpatient settings.

- With healthcare systems focusing on improving mobility and reducing long-term disability in older adults, Orthopedic Implants are becoming the preferred approach due to their proven ability to restore vertebral height and function safely and effectively.

For instance,

- For instance, the National Osteoporosis Foundation reports that approximately 1.5 million vertebral fractures occur annually in the U.S., with a significant proportion linked to osteoporosis.

- In 2024, Medtronic launched a next-generation Orthopedic Implants balloon catheter with improved navigation and enhanced bone access, facilitating safer and more effective fracture treatments.

Opportunity

“Technological Advancements and Expansion into Outpatient & Ambulatory Care Settings”

- A major opportunity in the Orthopedic Implants market lies in the continuous innovation of procedural tools and materials, including advanced balloon technologies, integrated real-time imaging systems, and refined cement delivery techniques. These advancements enhance surgical precision, safety, and overall procedural outcomes.

- The expansion of Orthopedic Implants into outpatient clinics and ambulatory surgical centers (ASCs) presents a cost-effective alternative to hospital-based care. These settings offer improved accessibility, reduced overhead costs, and greater patient convenience.

For instance,

- For instance, in early 2024, Stryker introduced a streamlined Orthopedic Implants system designed specifically for ambulatory surgery centers, reducing setup complexity and shortening procedure time.

- Collaborations between medical device companies and outpatient networks are also fostering workforce training and expanding access to Orthopedic Implants beyond urban hospitals.

Restraint/Challenge

“High Procedure Cost and Reimbursement Barriers”

- One of the primary challenges in the North America Orthopedic Implants Market is the high cost of procedures. Expenses related to specialized equipment, real-time imaging, and post-operative care can limit access to treatment, particularly for patients without comprehensive insurance coverage.

- Inconsistent reimbursement policies across public and private insurers create financial uncertainty for healthcare providers and may discourage smaller facilities from offering Orthopedic Implant procedures. Rural and underserved regions are especially affected by these disparities.

- Additionally, navigating the complex regulatory environment, which requires extensive clinical validation for new technologies, can delay product launches, increase development costs, and temporarily stifle innovation.

For instance,

- For instance, a 2023 CMS report noted variable reimbursement rates for vertebral augmentation procedures, contributing to inconsistent access across different U.S. states.

- Smaller clinics and healthcare providers often face financial challenges in adopting Orthopedic Implants systems due to low patient volumes and delayed reimbursement cycles.

Orthopedic Implants Market Scope

The market is segmented on the basis, three notable segments based on Product Type, Biomaterial, Procedure , Device Type , Application, end user.

|

. Segmentation |

Sub-Segmentation |

|

By Product type |

|

|

By Biomaterial |

|

|

By Procedure |

|

|

By Device Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the Reconstructive Joint Replacements is projected to dominate the market with a largest share in product type segment

The Reconstructive Joint Replacements is expected to lead the North America Orthopedic Implants Market in 2025 with the largest share of 32.45% in 2025 driven by the rising prevalence of joint-related disorders such as osteoarthritis and rheumatoid arthritis, particularly among the aging population. Additionally, advancements in implant materials and surgical techniques are improving outcomes and driving the adoption of joint replacement procedures.

The Open Surgery is expected to account for the largest share during the forecast period in procedure market

In 2025, Open Surgery are projected to account with the largest market share of 21.31% due to its established track record for treating complex orthopedic conditions, particularly in severe fractures and joint replacements. Despite the rise of minimally invasive techniques, open surgery remains the preferred approach for many high-risk and challenging cases due to its reliability and effectiveness.

Orthopedic Implants Market Regional Analysis

“U.S. is the Dominant Country in the Orthopedic Implants Market”

- The United States leads the North America Orthopedic Implants Market, supported by a highly developed healthcare infrastructure, broad adoption of minimally invasive surgical technologies, and the strong presence of top-tier medical device manufacturers.

- The high incidence of osteoporosis-related vertebral compression fractures (VCFs), combined with a large and aging population, is driving the demand for effective, minimally invasive spinal procedures across hospitals and ambulatory surgical centers.

- Leading companies such as Medtronic, Stryker, and Globus Medical are deeply embedded in the U.S. market, offering advanced Orthopedic Implants systems—including balloon-based kyphoplasty and precision cement delivery devices—that meet regulatory standards and clinical performance requirements.

- Favorable reimbursement frameworks, increased physician training in minimally invasive techniques, and public health initiatives aimed at reducing long-term disability further solidify the U.S.'s dominance in the regional Orthopedic Implants market.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is poised to experience the fastest growth in the North America Orthopedic Implants Market, driven by rising government investment in bone health and expanded access to spinal care services for its aging population.

- The country’s publicly funded healthcare system and growing awareness of minimally invasive alternatives for vertebral fracture management are accelerating the adoption of Orthopedic Implants procedures across clinical settings.

- Growth in ambulatory surgical centers and rehabilitation clinics—especially in urban and semi-urban areas—is fueling demand for cost-effective, low-complication spinal treatments.

- National collaboration between health ministries, orthopedic associations, and academic institutions is fostering clinical education, technology adaptation, and domestic innovation in Orthopedic Implants tools and techniques.

Orthopedic Implants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (U.S.)

- Boston Scientific (U.S.)

- Philips Healthcare (Netherlands/U.S.)

- Stryker (U.S.)

- Globus Medical (U.S.)

- Zimmer Biomet (U.S.)

- Smith & Nephew (U.K.)

- Johnson & Johnson (U.S.)

- NuVasive (U.S.)

- CareFusion (U.S.)

Latest Developments in North America Orthopedic Implants Market

- In July 2023, Parkview Regional Medical Center and Orthopedics Northeast launched an osseointegration initiative in collaboration with Integrum, the producer of the OPRA Implant System. This program marks a pioneering effort in Indiana, using advanced bone-anchored prosthesis technology to enhance the well-being of individuals who have undergone lower extremity amputations. Such advanced technologies will boost the adoption of dental implants, thereby supplementing market growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.