Global Plasticized Polyvinyl Chloride Pvc Compound Market

Market Size in USD Billion

CAGR :

%

USD

32.66 Billion

USD

46.80 Billion

2024

2032

USD

32.66 Billion

USD

46.80 Billion

2024

2032

| 2025 –2032 | |

| USD 32.66 Billion | |

| USD 46.80 Billion | |

|

|

|

|

Plasticized Polyvinyl Chloride (PVC) Compound Market Size

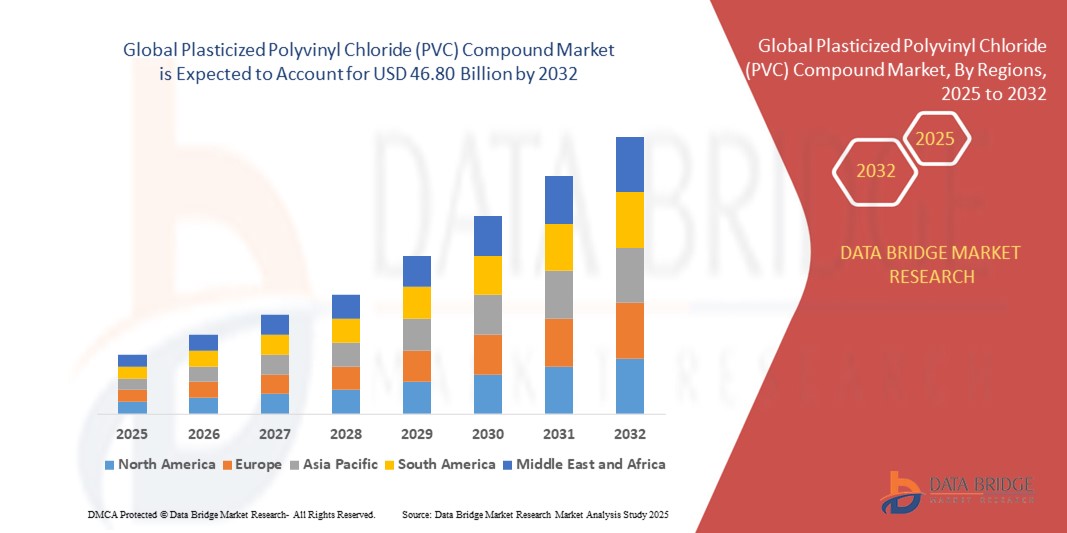

- The global plasticized polyvinyl chloride (PVC) compound market size was valued at USD 32.66 billion in 2024 and is expected to reach USD 46.80 billion by 2032, at a CAGR of 4.6% during the forecast period

- The market growth is primarily driven by increasing demand for lightweight, durable, and cost-effective materials across industries such as construction, automotive, and packaging, coupled with advancements in PVC compounding technologies

- Rising awareness of sustainable and recyclable PVC solutions, along with growing applications in medical and electrical sectors, is further boosting market demand through both OEM and aftermarket channels

Plasticized Polyvinyl Chloride (PVC) Compound Market Analysis

- The plasticized PVC compound market is experiencing robust growth due to its versatility, cost-effectiveness, and widespread adoption in applications requiring flexibility and durability

- Growing demand from both developed and emerging economies is driving manufacturers to innovate with eco-friendly, high-performance, and customized PVC compounds

- Asia-Pacific dominates the plasticized PVC compound market with the largest revenue share of 56.69% in 2024, driven by rapid industrialization, urbanization, and a booming construction sector in countries such as China, India, and Southeast Asian nations

- North America is expected to be the fastest-growing region during the forecast period, fueled by increasing investments in infrastructure, advancements in automotive applications, and rising demand for sustainable PVC compounds

- The dry segment dominated the largest market revenue share of 60% in 2024, driven by its stability, ease of processing, and widespread use in applications such as pipes, profiles, and cables across industries such as construction and electrical

Report Scope and Plasticized Polyvinyl Chloride (PVC) Compound Market Segmentation

|

Attributes |

Plasticized Polyvinyl Chloride (PVC) Compound Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plasticized Polyvinyl Chloride (PVC) Compound Market Trends

Increasing Adoption of Sustainable and Bio-Based Plasticizers

- The Global Plasticized Polyvinyl Chloride (PVC) Compound Market is experiencing a significant trend toward the adoption of sustainable and bio-based plasticizers to reduce environmental impact

- These eco-friendly plasticizers, derived from renewable sources such as vegetable oils, are being integrated into PVC formulations to meet stringent environmental regulations and consumer demand for greener products

- Advanced technologies are enabling manufacturers to develop bio-based PVC compounds with enhanced performance characteristics, such as improved flexibility and durability, without compromising cost-effectiveness

- For instance, companies are innovating with phthalate-free plasticizers to cater to the medical and consumer goods sectors, where safety and sustainability are critical

- This trend is making plasticized PVC compounds more appealing across various applications, particularly in environmentally conscious markets such as Europe and North America

- Sustainable PVC formulations are also supporting recycling initiatives, with programs such as VinylPlus in Europe aiming to recycle significant volumes of PVC waste, further enhancing the market’s sustainability profile

Plasticized Polyvinyl Chloride (PVC) Compound Market Dynamics

Driver

Growing Demand in Construction and Automotive Sectors

- The rising demand for durable, cost-effective, and flexible materials in construction and automotive industries is a major driver for the Global Plasticized Polyvinyl Chloride (PVC) Compound Market

- Plasticized PVC compounds are widely used in applications such as pipes, fittings, profiles, tubes, wire insulation, and automotive components due to their flexibility, durability, and resistance to moisture and chemicals

- Government initiatives promoting infrastructure development, particularly in the Asia-Pacific region, which dominates the market, are boosting the demand for plasticized PVC in building and construction applications

- The proliferation of lightweight automotive components, driven by the need for fuel efficiency and electric vehicle production, is further accelerating the adoption of flexible PVC compounds

- Manufacturers are increasingly incorporating plasticized PVC in factory-fitted automotive parts and construction materials to meet performance requirements and enhance product value

Restraint/Challenge

High Production Costs and Regulatory Restrictions

- The significant costs associated with producing plasticized PVC compounds, including raw materials such as plasticizers, stabilizers, and additives, as well as manufacturing processes such as injection molding and extrusion, pose a barrier to market growth, particularly in cost-sensitive emerging markets

- Integrating advanced, sustainable plasticizers into PVC formulations can further increase production costs, limiting adoption in price-sensitive regions

- In addition, stringent regulations on the use of certain plasticizers, such as phthalates, due to health and environmental concerns, create challenges for manufacturers, particularly in the medical and packaging sectors

- The complex and varying regulatory landscape across regions, such as differing standards in Asia-Pacific and North America complicates compliance for global manufacturers

- These factors, combined with growing consumer awareness of environmental and health impacts, may deter adoption and restrict market expansion in certain applications and regions

Plasticized Polyvinyl Chloride (PVC) Compound market Scope

The market is segmented on the basis of form, manufacturing process, application, and end use.

- By Form

On the basis of form, the Global Plasticized Polyvinyl Chloride (PVC) Compound Market is segmented into dry and wet. The dry segment dominated the largest market revenue share of 60% in 2024, driven by its stability, ease of processing, and widespread use in applications such as pipes, profiles, and cables across industries such as construction and electrical. Dry PVC compounds are favored for their compatibility with high-volume manufacturing processes such as extrusion and injection molding.

The wet segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of approximately 5.2%. This growth is attributed to its versatility in specialized applications requiring enhanced flexibility and moisture resistance, such as cables, flooring, and automotive components, where precise material properties are critical.

- By Manufacturing Process

On the basis of manufacturing process, the Global Plasticized Polyvinyl Chloride (PVC) Compound Market is segmented into injection molding, extrusion, and others. The extrusion segment dominated the market with a revenue share of 55% in 2024, owing to its efficiency in producing continuous profiles, pipes, and tubing used in construction, plumbing, and electrical applications. Its cost-effectiveness and ability to create uniform products drive its widespread adoption.

The injection molding segment is anticipated to experience the fastest growth rate of approximately 5.8% from 2025 to 2032. This is driven by its ability to produce high-precision, complex parts for automotive, consumer goods, and electronics, where intricate designs and high performance are essential.

- By Application

On the basis of application, the Global Plasticized Polyvinyl Chloride (PVC) Compound Market is segmented into film and sheet, wire and cabling, pipe and fitting, profiles and tubes, and others. The pipe and fitting segment held the largest market revenue share of 40% in 2024, driven by its extensive use in construction for water distribution, drainage systems, and plumbing due to its durability, corrosion resistance, and cost-effectiveness.

The wire and cabling segment is expected to witness the fastest growth rate of approximately 6.1% from 2025 to 2032. This growth is fueled by increasing demand for reliable insulation and sheathing in the electrical and electronics sector, particularly for advanced wiring systems in automotive and smart infrastructure applications.

- By End Use

On the basis of end use, the Global Plasticized Polyvinyl Chloride (PVC) Compound Market is segmented into medical, building and construction, packaging, automotive, consumer goods, electrical and electronics, and others. The building and construction segment dominated the market with a revenue share of 45% in 2024, driven by the high demand for pipes, fittings, profiles, and flooring in infrastructure and urbanization projects, particularly in Asia-Pacific.

The medical segment is anticipated to experience the fastest growth rate of approximately 6.5% from 2025 to 2032. This is driven by the increasing use of plasticized PVC in flexible medical tubing, blood bags, and IV tubes, owing to its flexibility, durability, and compatibility with sterilization processes, alongside growing healthcare investments globally.

Plasticized Polyvinyl Chloride (PVC) Compound Market Regional Analysis

- Asia-Pacific dominates the plasticized PVC compound market with the largest revenue share of 56.69% in 2024, driven by rapid industrialization, urbanization, and a booming construction sector in countries such as China, India, and Southeast Asian nations

- Consumers prioritize plasticized PVC compounds for their versatility, durability, and cost-effectiveness, particularly in industries such as construction, automotive, and packaging in regions with rapid urbanization

- Growth is supported by advancements in compounding technologies, such as improved plasticizers and eco-friendly formulations, alongside rising adoption in both industrial and consumer goods sectors

Japan Plasticized PVC Compound Market Insight

Japan’s plasticized PVC compound market is expected to witness strong growth, driven by consumer preference for high-quality, durable materials in automotive, electronics, and construction applications. The presence of major manufacturers and the integration of advanced PVC compounds in OEM products accelerate market penetration. Growing interest in sustainable and recyclable materials also contributes to market expansion.

China Plasticized PVC Compound Market Insight

China holds the largest share of the Asia-Pacific plasticized PVC compound market, propelled by rapid urbanization, rising infrastructure projects, and increasing demand for cost-effective and versatile materials. The country’s growing middle class and focus on smart manufacturing support the adoption of advanced PVC compounds. Strong domestic production capabilities and competitive pricing further enhance market accessibility.

U.S. Plasticized Polyvinyl Chloride (PVC) Compound Market Insight

The U.S. plasticized polyvinyl chloride (PVC) compound market is expected to witness significant growth, fueled by strong demand in construction, automotive, and medical applications. Increasing consumer awareness of durable and cost-effective materials, coupled with stringent regulations promoting sustainable PVC formulations, drives market expansion. The trend towards lightweight automotive components and eco-conscious building materials further boosts demand.

Europe Plasticized Polyvinyl Chloride (PVC) Compound Market Insight

The Europe plasticized PVC compound market is poised for significant growth, driven by regulatory emphasis on sustainable materials and energy-efficient construction. Consumers seek flexible PVC compounds for applications in wire and cabling, pipes, and profiles that enhance durability and recyclability. Countries such as Germany and France show notable uptake due to advancements in green manufacturing and urban infrastructure development.

U.K. Plasticized PVC Compound Market Insight

The U.K. market for plasticized PVC compounds is expected to experience rapid growth, driven by demand for high-performance materials in building, packaging, and automotive sectors. Increased focus on sustainability and compliance with environmental regulations encourages adoption. The rising popularity of customized PVC solutions for aesthetic and functional applications further supports market growth.

Germany Plasticized PVC Compound Market Insight

Germany is anticipated to witness significant growth in the plasticized PVC compound market, attributed to its advanced manufacturing sector and high consumer demand for energy-efficient and durable materials. German industries prioritize technologically advanced PVC compounds for applications in automotive components, medical devices, and construction, contributing to reduced environmental impact and enhanced product longevity.

Plasticized Polyvinyl Chloride (PVC) Compound Market Share

The plasticized polyvinyl chloride (PVC) compound industry is primarily led by well-established companies, including:

- INEOS (U.K.)

- Westlake Corporation (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Ercros SA (Spain)

- Teknor Apex (U.S.)

- Aurora Plastics LLC (U.S.)

- Roscom Inc. (U.S.)

- PKN ORLEN (Poland)

- BENVIC (France)

- Zhonglian Chemical (China)

- Rainmaker Polymers LLC (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Orbia (Mexico)

- PolyOne Corporation (U.S.)

- Kaneka Corporation (Japan)

- Siamvic Chemicals (Thailand)

What are the Recent Developments in Global Plasticized Polyvinyl Chloride (PVC) Compound Market?

- In December 2023, INEOS Inovyn launched NEOVYN, a new range of PVC products engineered to support sustainability goals across industries. This innovative line boasts a 37% lower carbon footprint compared to the European industry average for suspension PVC, reducing emissions to just 1.3 kg CO₂ per kg of PVC. NEOVYN is produced using renewable energy, electrified processes, and low-carbon hydrogen, aligning with INEOS’s broader commitment to decarbonization and circularity. The launch complements other sustainable offerings such as BIOVYN and RECOVYN, reinforcing INEOS Inovyn’s leadership in delivering low-carbon, high-performance vinyl solutions

- In July 2023, Chemplast Sanmar Ltd. announced a strategic investment of USD 120 million to expand its manufacturing footprint across two key segments. The company plans to enhance production capacity at its Specialty Paste PVC unit in Cuddalore, addressing growing demand in high-performance vinyl applications. Simultaneously, it will scale operations at the Custom Manufactured Chemicals Division (CMCD) in Berigai, which serves global agrochemical innovators. This expansion aligns with Chemplast Sanmar’s long-term growth strategy to strengthen its position in specialty chemicals and deliver value through innovation and capacity enhancement

- In May 2023, Arvand Petrochemical, based in Iran, announced the launch of its second polyvinyl chloride (PVC) production plant in Mahshahr, Khuzestan Province. The new facility is expected to add 300,000 tons/year of PVC production capacity, complementing the company’s existing 320,000 tons/year plant. Once operational, Arvand’s total PVC output will reach 620,000 tons/year, significantly boosting its ability to meet domestic demand and expand export potential. This strategic expansion underscores Iran’s ambition to strengthen its position in the global PVC market and support local industries with high-quality polymer materials.

- In August 2021, Formosa Plastics Corporation U.S.A. announced the expansion of its PVC production facility in Baton Rouge, Louisiana, with operations at the new unit scheduled to begin in Q4 of 2022. This strategic investment aimed to boost production capacity by nearly 300 million pounds annually, representing a 20% increase. The expansion included new machinery for PVC resin production and utilities upgrades to support the enhanced output. The move was part of Formosa’s broader commitment to meet rising demand, improve supply reliability, and contribute to local economic growth through job creation

- In January 2021, Shin-Etsu Chemical Co., Ltd. completed a major expansion of its production facilities in Plaquemine, Louisiana, through its U.S. subsidiary Shintech Inc.. Initiated in 2018 with a total investment of USD 1.25 billion, the project significantly increased capacity for vinyl chloride monomer (VCM), polyvinyl chloride (PVC), and caustic soda. The expansion added 580,000 metric tons/year of VCM, 380,000 metric tons/year of PVC, and 390,000 metric tons/year of caustic soda, boosting Shintech’s total output and reinforcing its position as a global leader in PVC production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plasticized Polyvinyl Chloride Pvc Compound Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plasticized Polyvinyl Chloride Pvc Compound Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plasticized Polyvinyl Chloride Pvc Compound Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.