Global Plastics Gap Packaging Filler Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

1.81 Billion

2024

2032

USD

1.30 Billion

USD

1.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Plastics Gap Packaging Filler Market Size

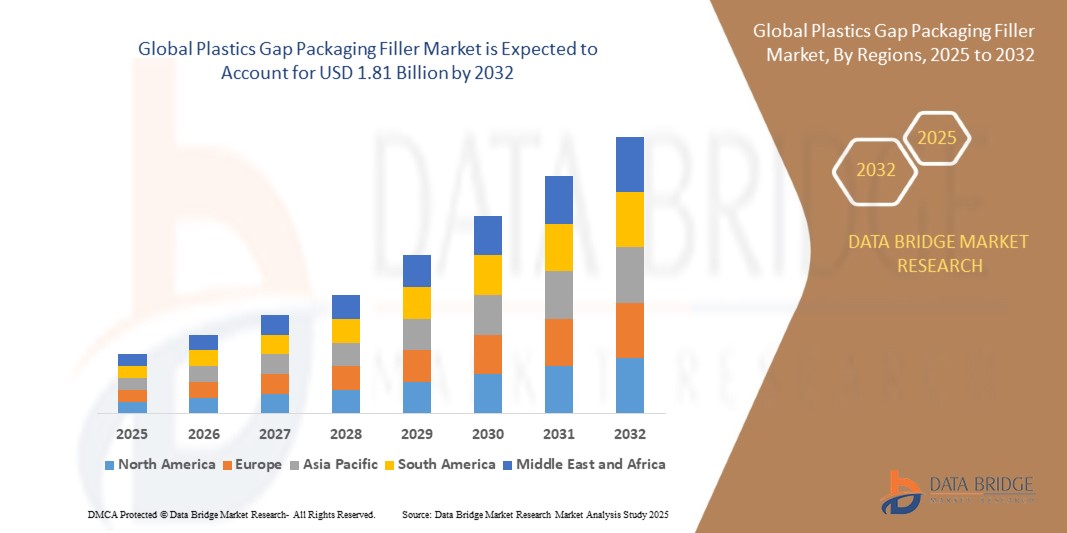

- The global plastics gap packaging filler market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 1.81 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by the rising demand for lightweight, cost-effective, and performance-enhancing additives across the packaging sector, driven by increasing pressure on manufacturers to reduce raw material usage and improve environmental sustainability in end products

- Furthermore, growing regulatory focus on reducing plastic waste, along with expanding adoption of bio-based and recycled fillers in flexible and rigid packaging, is accelerating market uptake, positioning plastics gap packaging fillers as a critical enabler of eco-efficient packaging innovation

Plastics Gap Packaging Filler Market Analysis

- Plastics gap packaging fillers are particulate materials added to polymer matrices to reduce cost, enhance mechanical properties, and improve processability of plastic packaging. These fillers—ranging from inorganic compounds such as calcium carbonate to organic and nano-structured materials—play a vital role in customizing packaging performance and sustainability

- The increasing demand for high-performance and sustainable packaging solutions across FMCG, food and beverages, and pharmaceuticals is driving the market forward, supported by innovation in biodegradable fillers, increased use of post-consumer recyclates, and a growing shift toward circular packaging systems

- Asia-Pacific dominated the plastics gap packaging filler market with a share of 38.1% in 2024, due to the rapid expansion of packaging industries, high demand for cost-efficient fillers, and a strong push toward eco-friendly materials across emerging economies

- North America is expected to be the fastest growing region in the plastics gap packaging filler market during the forecast period due to growing demand for lightweight and functional packaging in e-commerce and healthcare sectors

- Inorganic segment dominated the market with a market share of 64% in 2024, due to its widespread use, cost-effectiveness, and superior mechanical properties. Inorganic fillers such as calcium carbonate, silica, and talc are favored in high-volume packaging applications due to their ability to enhance strength, reduce material costs, and improve barrier properties. Their thermal stability and compatibility with various polymers also make them ideal for large-scale production in FMCG and food packaging applications

Report Scope and Plastics Gap Packaging Filler Market Segmentation

|

Attributes |

Plastics Gap Packaging Filler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plastics Gap Packaging Filler Market Trends

Increasing Number of Product Innovations

- The plastics gap packaging filler market is rapidly evolving with continuous innovations aimed at improving protective performance, sustainability, and customization to meet diverse industry needs

- For instance, companies such as Amcor plc and Sonoco Products Company are developing advanced plastic fillers with enhanced shock absorption, lightweight formulations, and eco-friendly materials, specifically tailored for delicate sectors such as medical devices and electronics

- Innovations also focus on biodegradable and recyclable fillers that reduce environmental impact while maintaining high cushioning efficacy, responding to growing regulatory and consumer pressure for sustainable packaging

- Integration of smart packaging solutions with plastic fillers is gaining traction, enabling condition monitoring during transit for pharmaceuticals and perishable products, thus improving supply chain transparency and reducing spoilage

- Customizable filler shapes, densities, and sizes allow optimization for specific packaging configurations, reducing material usage and waste while maintaining product security during transport

- Increasing automation in packaging processes demands fillers compatible with high-speed filling equipment that deliver consistent quality and reduce downtime

Plastics Gap Packaging Filler Market Dynamics

Driver

Increased Demand in the Medical Industry

- The medical industry's expansion notably drives the demand for plastics gap packaging fillers, as safe and secure packaging is vital for sensitive medical devices and supplies amid growing healthcare infrastructure globally

- For instance, surge in medical device demand during and post-COVID-19 spurred companies such as Sealed Air and Berry Global Inc. to expand their product lines to include packaging fillers optimized for ventilators, oxygen concentrators, and diagnostic equipment

- Stringent regulatory requirements for sterile, contamination-resistant packaging in medical and pharmaceutical sectors require advanced filler materials that meet safety and hygiene standards

- The growth of medical device manufacturing hubs in Asia-Pacific and Europe further fuels demand for specialized plastic fillers that protect delicate biomedical instruments during global distribution

- Pharmaceutical packaging also drives demand for gap fillers that can protect fragile vials, syringes, and temperature-sensitive medicines, supporting cold chain logistics and patient safety

Restraint/Challenge

High Cost Considerations

- Higher production costs for advanced plastics fillers, particularly sustainable or specialty variants, challenge market growth by limiting adoption in cost-sensitive sectors and emerging markets

- For instance, companies such as Coveris and WINPAK LTD face pricing pressures as customers weigh protective performance against budget constraints, particularly in large volume or fast-moving consumer goods packaging

- Environmental compliance costs related to recyclable materials, biodegradability standards, and waste management add to the overall expense of premium plastics fillers

- Fluctuations in raw material prices, including polymers and additives, create instability in pricing, complicating procurement planning and budgeting for manufacturers and end-users

- End-users in price-sensitive regions or industries may opt for alternative packaging solutions (such as paper-based or foam fillers), potentially limiting market penetration of advanced plastic fillers

Plastics Gap Packaging Filler Market Scope

The market is segmented on the basis of type, physical form, and end-users.

• By Type

On the basis of type, the plastics gap packaging filler market is segmented into inorganic and organic fillers. The inorganic segment dominated the largest market revenue share of 64% in 2024, primarily due to its widespread use, cost-effectiveness, and superior mechanical properties. Inorganic fillers such as calcium carbonate, silica, and talc are favored in high-volume packaging applications due to their ability to enhance strength, reduce material costs, and improve barrier properties. Their thermal stability and compatibility with various polymers also make them ideal for large-scale production in FMCG and food packaging applications.

The organic segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising sustainability trends and increasing regulatory pressure to reduce environmental impact. Organic fillers, often derived from renewable sources such as starch, cellulose, or wood flour, are gaining traction as eco-friendly alternatives. Their biodegradability and alignment with circular economy goals are appealing to brands in the food, beverage, and pharmaceutical industries that are increasingly adopting green packaging initiatives.

• By Physical Form

On the basis of physical form, the market is segmented into continuous, discontinuous, and nano fillers. The continuous fillers segment held the largest revenue share in 2024, supported by its efficiency in enhancing structural integrity and resistance across large packaging surfaces. These fillers are commonly used in high-volume industrial packaging where consistent reinforcement and durability are critical. Their uniform distribution improves dimensional stability and enhances the mechanical performance of plastic materials used in packaging.

The nano fillers segment is projected to experience the highest CAGR from 2025 to 2032, owing to their exceptional surface-to-volume ratio and the resulting superior enhancement of thermal, barrier, and mechanical properties. Nano fillers, including nanoclays and carbon nanotubes, enable thinner and lighter packaging with enhanced functionality. Their use is expanding in premium packaging applications in the pharmaceutical and food sectors where product protection and shelf life are paramount.

• By End-Users

On the basis of end-users, the plastics gap packaging filler market is segmented into FMCG, food and beverages, pharmaceuticals, and others. The FMCG segment dominated the market revenue in 2024, largely driven by high consumption rates of personal care, household, and convenience goods that demand robust, lightweight, and cost-effective packaging solutions. The large-scale manufacturing and diverse product formats in this sector create continuous demand for fillers that enhance packaging functionality while controlling production costs.

The pharmaceutical segment is expected to register the fastest growth from 2025 to 2032, propelled by stringent safety requirements and the need for high-barrier, contamination-resistant packaging. Fillers in pharmaceutical packaging help maintain structural stability under various storage conditions and are increasingly engineered to comply with regulatory standards for biocompatibility and sustainability. The growing focus on precision packaging for temperature-sensitive and high-value drugs is further driving demand for advanced filler technologies in this sector.

Plastics Gap Packaging Filler Market Regional Analysis

- Asia-Pacific dominated the plastics gap packaging filler market with the largest revenue share of 38.1% in 2024, driven by the rapid expansion of packaging industries, high demand for cost-efficient fillers, and a strong push toward eco-friendly materials across emerging economies

- The region’s growing manufacturing base, increasing consumer goods consumption, and government support for sustainable packaging practices are significantly contributing to market growth

- The availability of abundant raw materials, lower production costs, and the presence of numerous local filler suppliers are further accelerating regional market expansion

China Plastics Gap Packaging Filler Market Insight

China held the largest share in the Asia-Pacific plastics gap packaging filler market in 2024, supported by its dominance in global packaging production, favorable government policies for plastic modification, and large-scale demand from FMCG and food sectors. Rapid industrialization and increased investment in sustainable fillers are enhancing market growth.

India Plastics Gap Packaging Filler Market Insight

India is emerging as the fastest-growing market in the region, driven by rising demand for affordable, lightweight packaging across diverse sectors and government initiatives promoting biodegradable packaging alternatives. The expansion of food processing and pharmaceutical industries is also boosting filler consumption.

Europe Plastics Gap Packaging Filler Market Insight

The Europe plastics gap packaging filler market is projected to grow at a steady CAGR over the forecast period, fueled by stringent environmental regulations, the shift toward recyclable and bio-based packaging, and growing adoption of nano and organic fillers. Western Europe leads in adopting sustainable filler technologies.

U.K. Plastics Gap Packaging Filler Market Insight

The U.K. market is witnessing stable growth, driven by increased use of packaging fillers in personal care and food sectors and alignment with extended producer responsibility (EPR) laws. Strong demand for bio-fillers and emphasis on plastic reduction targets are encouraging innovation in filler formulations.

Germany Plastics Gap Packaging Filler Market Insight

Germany’s market continues to expand steadily due to its advanced packaging industry, high standards for material performance, and strong focus on environmental compliance. The integration of high-performance fillers into recyclable packaging and technological advancements in nano filler applications are supporting growth.

North America Plastics Gap Packaging Filler Market Insight

North America is anticipated to register the fastest CAGR from 2025 to 2032, driven by growing demand for lightweight and functional packaging in e-commerce and healthcare sectors. Rising focus on circular economy practices, increasing investment in R&D, and advancements in bio-based filler materials are catalyzing market expansion.

U.S. Plastics Gap Packaging Filler Market Insight

The U.S. accounted for the largest revenue share in the North American market in 2024, owing to strong industrial packaging demand, robust innovation in filler technologies, and the presence of leading packaging and chemical companies. The push toward sustainable and high-performance packaging materials is further fueling market adoption.

Plastics Gap Packaging Filler Market Share

The plastics gap packaging filler industry is primarily led by well-established companies, including:

- Imerys (Paris)

- Omya AG (Switzerland)

- J.M. Huber Corporation (U.S.)

- Plastika Kritis.S.A (Greece)

- Teknor Apex (U.S.)

- Colortek (India)

- Dolphin Poly Plast Pvt Ltd. (India)

- CLARIANT (Switzerland)

- Hoffman minerals (Germany)

- Evonik Industries (Germany)

- Dhruvraj Syndicate. (India)

- Arihant Flexpack (India)

Latest Developments in Global Plastics Gap Packaging Filler Market

- In October 2024, Vaseline launched a new recyclable pump for its pump-action bottles in North America, marking a significant step forward in sustainable packaging within the personal care industry. Traditional pump mechanisms often contain a metal spring encased in plastic, making them difficult to recycle due to the need for material separation. By redesigning the pump to eliminate the metal component, Vaseline has removed a major barrier to full recyclability. This innovation aligns with increasing consumer demand for environmentally friendly products and also sets a new benchmark for packaging recyclability in the health and beauty market

- In 2024 (date unspecified), Polymateria expanded deployment of its “Lyfecycle” biodegradable plastic masterbatch technology to Indian packaging markets through a partnership with Toppan Specialty Films, following earlier global rollouts. This innovation enables polyolefin-based plastics to biodegrade under real‑world conditions within a year, reducing microplastic pollutants—an advancement with potential to reshape regulations and adoption in packaging fillers across Asia-Pacific

- In June 2024, Dow introduced its REVOLOOP family of recycled plastic resins, including grades made entirely from post‑consumer recycled materials and up to 85% recycled content. These resins support circularity in non‑food contact packaging, laying the groundwork for filler materials incorporating high‑PCR content, thereby driving demand for sustainable plastics in filler applications

- In March 2022, Berry Global Inc. collaborated with Koa to manufacture body cleanser and moisturizer bottles entirely from 100% recycled plastic. This initiative highlights a growing industry shift toward circular packaging models, particularly in the personal care segment. Berry’s focus on streamlined, sustainable processes and Koa’s brand ethos around environmental stewardship created a strong synergy that demonstrates how collaborative sustainability efforts can influence packaging trends. The project reinforces the demand for high-performance, recycled-content packaging solutions that meet both regulatory standards and consumer expectations for eco-conscious products

- In January 2022, Novolex introduced a novel recyclable tray for packaging meat, fish, and poultry, branded as Piranha. This solution represents a major innovation in modified atmosphere packaging (MAP), as it replaces the conventional polyethylene or adhesive layer with a mechanical seal formed by raised teeth along the sealing flange. The elimination of difficult-to-recycle materials enhances end-of-life processing while preserving the product’s shelf life and safety. This development addresses growing regulatory pressures on food packaging waste and offers retailers and processors a viable path toward more sustainable and recyclable food-grade materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastics Gap Packaging Filler Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastics Gap Packaging Filler Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastics Gap Packaging Filler Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.