Global Plastics In Personal Protective Equipment Ppe Market

Market Size in USD Billion

CAGR :

%

USD

7.79 Billion

USD

19.30 Billion

2025

2033

USD

7.79 Billion

USD

19.30 Billion

2025

2033

| 2026 –2033 | |

| USD 7.79 Billion | |

| USD 19.30 Billion | |

|

|

|

|

What is the Global Plastics in Personal Protective Equipment (PPE) Market Size and Growth Rate?

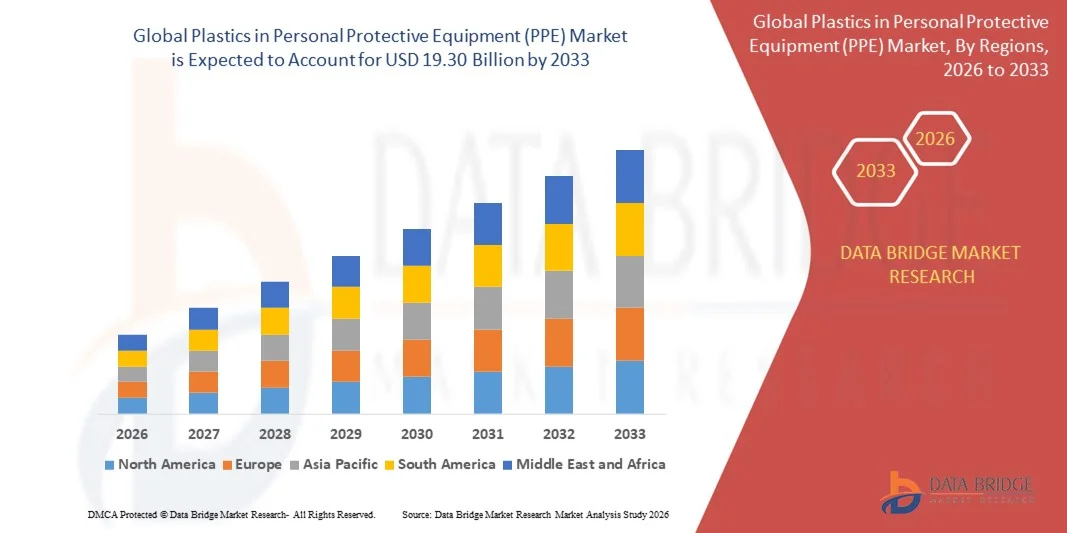

- The global plastics in personal protective equipment (PPE) market size was valued at USD 7.79 billion in 2025 and is expected to reach USD 19.30 billion by 2033, at a CAGR of12.00% during the forecast period

- Major factors that are expected to boost the growth of the plastics in the personal protective equipment (PPE) market in the forecast period are the need for several PPE products, such as face masks, gloves and shields, head covers, and protective measures gowns and shoe covers

- Furthermore, the increasing requirement from the pharmaceuticals and chemicals industries to handle the COVID-19 pandemic situation is further anticipated to propel the growth of the plastics in personal protective equipment (PPE) market

What are the Major Takeaways of Plastics in Personal Protective Equipment (PPE) Market?

- PE has brilliant resistance against chemicals such as solvents, alcohols, and dilute acids is further estimated to cushion the growth of the plastics in personal protective equipment (PPE) market. On the other hand, the growing automations is further projected to impede the growth of the plastics in personal protective equipment (PPE) market in the timeline period

- In addition, the attention of manifold construction advancement and continuous manufacturing projects will further provide potential opportunities for the growth of the plastics in personal protective equipment (PPE) market in the coming years

- Asia-Pacific dominated the plastics in personal protective equipment (PPE) market with a 41.8% revenue share in 2025, driven by rapid industrialization, expanding manufacturing capabilities, rising infrastructure projects, and strong government support for occupational safety standards across China, Japan, India, South Korea, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.8% from 2026 to 2033, driven by growing industrial safety awareness, regulatory compliance, and rising demand for lightweight, durable, and reusable PPE solutions

- The Polycarbonate (PC) segment dominated the market with a 32.5% share in 2025, due to its excellent impact resistance, high clarity, chemical stability, and wide adoption in helmets, face shields, goggles, and other protective gear

Report Scope and Plastics in Personal Protective Equipment (PPE) Market Segmentation

|

Attributes |

Plastics in Personal Protective Equipment (PPE) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Plastics in Personal Protective Equipment (PPE) Market?

Increasing Shift Toward Lightweight, Durable, and High-Performance Plastics in PPE

- The plastics in personal protective equipment (PPE) market is witnessing strong adoption of advanced, lightweight, and impact-resistant plastics such as polycarbonate, polypropylene, and polyethylene, designed to enhance user safety while maintaining comfort and mobility

- Manufacturers are introducing engineered plastics with chemical resistance, flame retardancy, and UV protection, offering better durability, extended service life, and compatibility with modular PPE designs

- Growing demand for ergonomic, portable, and easy-to-maintain PPE components is driving usage across healthcare, industrial, construction, and emergency response sectors

- For instance, companies such as DuPont, BASF, SABIC, Arkema, and Covestro have developed innovative plastic compounds for helmets, face shields, respirators, and protective eyewear, enhancing performance and compliance with international safety standards

- Increasing regulatory standards and heightened workplace safety awareness are accelerating the shift toward plastics that combine protection, lightweight design, and user comfort

- As industries prioritize employee safety and operational efficiency, plastics in PPE will remain central to innovation in protective equipment design

What are the Key Drivers of Plastics in Personal Protective Equipment (PPE) Market?

- Rising demand for cost-effective, lightweight, and high-performance PPE that meets strict occupational safety standards across multiple industries is fueling market growth

- For instance, in 2025, leading companies such as DuPont, BASF, and SABIC expanded their PPE plastic portfolios to include flame-retardant, chemical-resistant, and high-impact polymers

- Growing awareness of workplace safety, industrial accidents, and infection control is driving adoption in healthcare, construction, manufacturing, and oil & gas sectors

- Advancements in polymer chemistry, additive technologies, and molding techniques have strengthened product durability, comfort, and design flexibility

- Rising need for modular, reusable, and environmentally friendly PPE components is creating demand for innovative plastic materials with enhanced longevity and recyclability

- Supported by government safety regulations, industrial growth, and healthcare infrastructure expansion, the plastics in PPE market is expected to witness strong long-term adoption

Which Factor is Challenging the Growth of the Plastics in Personal Protective Equipment (PPE) Market?

- High production costs of engineered plastics with advanced properties, such as chemical resistance, flame retardancy, and UV protection, limit adoption in price-sensitive markets

- For instance, during 2024–2025, fluctuations in raw material prices, resin shortages, and supply chain disruptions increased manufacturing costs for several global PPE suppliers

- Complexity in designing PPE that balances safety, ergonomics, and regulatory compliance increases R&D expenses and product development cycles

- Limited awareness of material performance and certification standards in emerging markets slows adoption of advanced plastic-based PPE

- Competition from low-cost plastics, textiles, and traditional materials used in PPE creates pricing pressure and reduces differentiation

- To address these issues, companies are focusing on material innovations, cost-efficient manufacturing, certification support, and training programs to increase global adoption of plastics in PPE

How is the Plastics in Personal Protective Equipment (PPE) Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Plastics in personal protective equipment (PPE) market is segmented into Polyethylene (PE), Polypropylene (PP), Polyurethane (PU), Polyvinyl chloride (PVC), Polyethylene terephthalate (PET), Polystyrene (PS), Acrylonitrile butadiene styrene (ABS), Polycarbonate (PC), and Others. The Polycarbonate (PC) segment dominated the market with a 32.5% share in 2025, due to its excellent impact resistance, high clarity, chemical stability, and wide adoption in helmets, face shields, goggles, and other protective gear. PC plastics provide superior durability while maintaining lightweight characteristics, making them ideal for industrial, healthcare, and construction applications.

The Polyurethane (PU) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for flexible, abrasion-resistant, and comfortable protective clothing, gloves, and footwear. Increasing adoption of PU in chemical-resistant PPE and ergonomic protective designs is further accelerating its growth across manufacturing, healthcare, and emergency response sectors.

- By Application

On the basis of application, the plastics in personal protective equipment (PPE) market is segmented into Head, Eye and Face Protection, Hearing Protection, Protective Clothing, Respiratory Protection, Protective Footwear, Fall Protection, Hand Protection, and Others. The Head, Eye and Face Protection segment dominated the market with a 35.8% share in 2025, owing to strong adoption of helmets, face shields, goggles, and visors in industrial, construction, and healthcare environments. Plastics such as polycarbonate, ABS, and PET are widely used in these applications for their combination of clarity, impact resistance, and lightweight characteristics, ensuring both safety and comfort for users.

The Protective Clothing segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for chemical-resistant, flame-retardant, and ergonomic protective apparel in manufacturing, oil & gas, and healthcare industries. Rising awareness of workplace safety and compliance with stringent regulations is further boosting the adoption of advanced plastic-based protective clothing globally.

Which Region Holds the Largest Share of the Plastics in Personal Protective Equipment (PPE) Market?

- Asia-Pacific dominated the plastics in personal protective equipment (PPE) market with a 41.8% revenue share in 2025, driven by rapid industrialization, expanding manufacturing capabilities, rising infrastructure projects, and strong government support for occupational safety standards across China, Japan, India, South Korea, and Southeast Asia. High adoption of advanced polymers, lightweight materials, and ergonomic PPE continues to fuel demand in construction, mining, healthcare, and industrial sectors

- Leading companies in Asia-Pacific are introducing innovative polymer-based PPE solutions, including impact-resistant helmets, chemical-resistant clothing, and high-performance gloves, strengthening the region’s technological advantage. Continuous investments in manufacturing automation, materials R&D, and smart protective gear drive long-term market expansion

- Growing industrial workforce, regulatory enforcement for workplace safety, and rising awareness of PPE benefits further reinforce regional market leadership

China Plastics in Personal Protective Equipment (PPE) Market Insight

China is the largest contributor to Asia-Pacific due to massive industrial growth, world-leading polymer production capacity, and strong government regulations promoting workplace safety. Rising demand for chemical-resistant PPE, high-impact helmets, and ergonomic protective clothing drives adoption of plastics-based solutions. Local manufacturing capabilities, cost advantages, and continuous product innovation expand both domestic and export market adoption.

Japan Plastics in Personal Protective Equipment (PPE) Market Insight

Japan shows steady growth, supported by advanced manufacturing infrastructure, precision polymer processing, and strong focus on occupational safety in construction, manufacturing, and healthcare. Increasing adoption of high-quality, durable, and lightweight PPE solutions reinforces demand. Rising interest in smart protective gear and advanced industrial automation strengthens long-term market expansion.

India Plastics in Personal Protective Equipment (PPE) Market Insight

India is emerging as a key market, driven by growing construction, manufacturing, and mining sectors. Expansion of polymer-based PPE production, government-led safety programs, and increasing awareness of workplace protection fuel adoption. Rising investments in industrial safety, infrastructure development, and local manufacturing accelerate market penetration.

South Korea Plastics in Personal Protective Equipment (PPE) Market Insight

South Korea contributes significantly due to strong industrial safety regulations, high adoption of advanced polymers, and increasing industrial automation. Rising demand for ergonomic protective clothing, impact-resistant helmets, and chemical-resistant PPE drives market adoption. Innovation in lightweight materials and compliance with workplace safety standards supports sustained growth.

North America Plastics in Personal Protective Equipment (PPE) Market

North America is projected to register the fastest CAGR of 9.8% from 2026 to 2033, driven by growing industrial safety awareness, regulatory compliance, and rising demand for lightweight, durable, and reusable PPE solutions. U.S. and Canada are increasingly adopting high-performance plastics in helmets, gloves, footwear, and protective clothing across construction, healthcare, and manufacturing sectors. Continuous innovation in polymer-based PPE and digital workplace safety tools further accelerates market growth.

Which are the Top Companies in Plastics in Personal Protective Equipment (PPE) Market?

The plastics in personal protective equipment (PPE) industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- Evonik Industries AG (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- Arkema (France)

- Celanese Corporation (U.S.)

- Eastman Chemical Company (U.S.)

- Chevron Phillips Chemical Company LLC (U.S.)

- Exxon Mobil Corporation (U.S.)

- Covestro AG (Germany)

- 3M (U.S.)

- Honeywell International Inc. (U.S.)

- COFRA SRL (Italy)

- Rock Fall Limited (U.K.)

- Lindstrom Group (Finland)

- BartelsRieger Atemschutztechnik GmbH & Co. KG (Germany)

- Lakeland Industries (U.S.)

What are the Recent Developments in Global Plastics in Personal Protective Equipment (PPE) Market?

- In May 2024, Supermax Corporation Berhad finalized the acquisition of Supermax Healthcare Canada Inc., making it a wholly owned subsidiary to strengthen its presence in the PPE industry and broaden its product portfolio across global markets, thereby reinforcing its long-term expansion strategy in the plastics-based PPE segment

- In February 2024, Ansell Ltd. launched the MICROFLEX Mega Texture 93-256, a highly textured orange disposable nitrile glove designed to deliver enhanced grip, tear resistance, and high visibility for industrial and automotive workers, thereby strengthening its industrial hand protection portfolio and supporting growing demand for durable plastic-based gloves

- In March 2023, Ansell inaugurated its Greenfield Manufacturing Plant in India with an investment of USD 80 million to produce advanced, high-quality surgical gloves for healthcare professionals, thereby expanding regional production capacity and reinforcing its footprint in the medical PPE plastics market

- In April 2022, Honeywell completed the acquisition of Norcross Safety Products L.L.C. for USD 1.2 billion to enhance its global PPE portfolio and establish a stronger position in the regulated industrial safety market, thereby creating significant growth opportunities in plastic-based protective equipment solutions

- In March 2022, 3M, MSA Safety, and Dentec Safety Specialists redesigned reusable elastomeric industrial face masks to improve healthcare worker protection and prevent mask shortages, achieving NIOSH approval through modifications such as removing or filtering exhalation valves, thereby strengthening the adoption of durable reusable plastic respirators in critical healthcare settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plastics In Personal Protective Equipment Ppe Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plastics In Personal Protective Equipment Ppe Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plastics In Personal Protective Equipment Ppe Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.