Global Platform As A Service Market

Market Size in USD Billion

CAGR :

%

USD

93.40 Billion

USD

509.07 Billion

2024

2032

USD

93.40 Billion

USD

509.07 Billion

2024

2032

| 2025 –2032 | |

| USD 93.40 Billion | |

| USD 509.07 Billion | |

|

|

|

|

Platform-as-a-Service Market Size

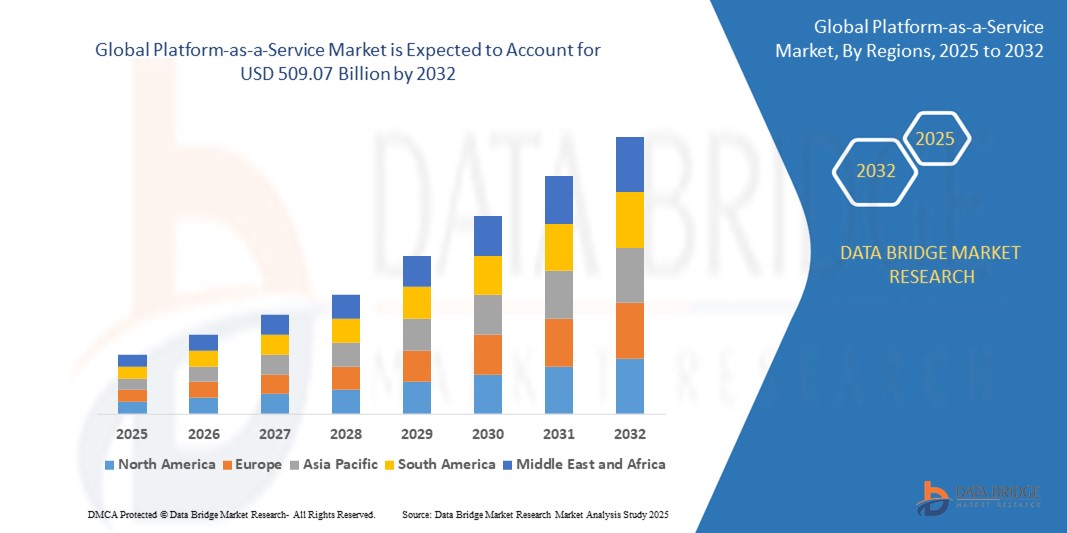

- The Global Platform-as-a-Service Market size was valued at USD 93.40 Billion in 2024 and is expected to reach USD 509.07 Billion by 2032, at a CAGR of 23.61% during the forecast period

- Organizations are increasingly turning to PaaS to minimize the expenses associated with building, testing, and deploying applications, as PaaS eliminates the need for costly on-premise infrastructure and maintenance.

- PaaS platforms streamline the development lifecycle, allowing businesses to launch applications more rapidly and respond to market changes or customer needs with greater agility.

Platform-as-a-Service Market Analysis

- The PaaS market is witnessing a rapid increase in the integration of artificial intelligence (AI) and automation tools. Modern PaaS platforms are embedding AI-driven services such as natural language processing, machine learning model deployment, and automated workflow orchestration. This trend enables developers and businesses to build, train, and deploy intelligent applications more efficiently, reducing time-to-market and operational complexity.

- Organizations are increasingly adopting multi-cloud and hybrid cloud strategies to enhance flexibility, avoid vendor lock-in, and ensure business continuity. PaaS providers are responding by offering platforms that support seamless integration across public, private, and on-premises environments. This interoperability allows enterprises to optimize workloads, manage resources dynamically, and comply with data residency requirements.

- There is a notable rise in demand for industry-tailored PaaS offerings, particularly in sectors such as healthcare, finance, and manufacturing. These specialized platforms provide pre-built modules, compliance features, and data models designed for sector-specific needs, accelerating digital transformation and regulatory adherence.

- North America dominates the Platform-as-a-Service Market with the largest revenue share of 39.51% in 2024, due to high rate of adoption of platform-as-a-service by the end user verticals. Also, increased research and development proficiencies to improve the technology will expand the scope of growth in future.

- Asia-Pacific is expected to be the fastest growing region in the Platform-as-a-Service Market due to increased focus of the major players to expand in this region.

- Business Application Platforms System segment dominates the Platform-as-a-Service Market with a market share of 40.2% in 2024, driven by worldwide shift toward digitization and the broad adoption of cloud technologies are accelerating PaaS uptake, as enterprises seek scalable, flexible, and accessible development environments.

Report Scope and Platform-as-a-Service Market Segmentation

|

Attributes |

Platform-as-a-Service Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Platform-as-a-Service Market Trends

“Growing Emphasis on Cybersecurity and Identity Management”

- A defining trend in the global Platform-as-a-Service (PaaS) market is the rapid integration of artificial intelligence (AI) and machine learning (ML) capabilities into PaaS offerings. Providers are embedding AI-driven analytics, automation, and predictive modeling tools directly into their platforms, enabling developers and enterprises to build, deploy, and scale intelligent applications with greater ease and efficiency. This integration is driving demand for AI-enabled PaaS, particularly as organizations seek to leverage data-driven insights and automation to enhance business outcomes.

- Organizations are increasingly adopting multi-cloud and hybrid cloud approaches to avoid vendor lock-in, optimize costs, and ensure business continuity. Modern PaaS platforms are evolving to support seamless integration across public, private, and on-premises environments, providing flexibility and centralized management for diverse application workloads. This trend is fostering innovation in interoperability and orchestration tools within the PaaS ecosystem.

- There is a notable rise in industry-tailored PaaS offerings designed to address the unique regulatory, security, and operational needs of sectors such as healthcare, finance, and manufacturing. These specialized platforms provide pre-built compliance frameworks, data models, and integration capabilities, accelerating digital transformation initiatives in highly regulated industries.

- North America currently leads the market, due PaaS platforms provide pre-built tools, APIs, and middleware, reducing manual effort and enabling teams to focus on innovation and core business functions, thus enhancing operational efficiency.

- Asia Pacific is emerging as the fastest-growing region fueled by businesses adopt hybrid and multi-cloud environments for flexibility and risk mitigation, PaaS solutions that support these architectures are in high demand.

Platform-as-a-Service Market Dynamics

Driver

“Rising Demand for Scalable, Flexible, and Cost-Efficient Application Deployment”

- The global Platform-as-a-Service (PaaS) market is experiencing significant growth driven by the increasing need for scalable and flexible application development and deployment solutions across industries such as finance, healthcare, retail, and manufacturing.

- For instance, in early 2025 Microsoft strengthened its Azure App Service capabilities by launching new AI-integrated developer tools under Azure PaaS. These features aimed to boost productivity for enterprise developers by offering more scalable and intelligent web application hosting environments.

- Companies across sectors are investing in digital transformation to remain competitive, and PaaS is a key enabler by supporting rapid application development and integration with modern technologies.

- The expanding use of Internet of Things (IoT) devices requires robust backend platforms for data processing and management, a need effectively met by PaaS offerings.

Restraint/Challenge

“Security, Compliance, and Integration Complexities”

- Despite its advantages, the PaaS market faces challenges related to data security, regulatory compliance, and integration with legacy systems.

- Organizations must ensure that sensitive data stored and processed on third-party cloud platforms complies with industry regulations (such as GDPR, HIPAA, or PCI DSS), which can be complex and resource-intensive.

- Integration with existing on-premises systems and applications can be technically challenging, often requiring custom connectors, API management, and data migration strategies, which can increase project complexity and cost.

- Additionally, as PaaS platforms abstract away much of the underlying infrastructure, organizations may face difficulties in monitoring, troubleshooting, and optimizing performance, particularly in hybrid or multi-cloud environments.

Platform-as-a-Service Market Scope

The market is segmented on the basis of Solution, Deployment, Type, Organization Size, End Users.

- By Solution

On the basis of Solution, the Platform-as-a-Service Market is segmented into Business Application Platforms, Raw Computing Platforms, Social Application Platforms and Web Application Platforms. The Business Application Platforms segment dominates the largest market revenue share of 40.2% in 2024, driven by PaaS platforms provide pre-built tools, APIs, and middleware, reducing manual effort and enabling teams to focus on innovation and core business functions, thus enhancing operational efficiency.

The Business Application Platforms segment is anticipated to witness the fastest growth rate of 11.7% from 2025 to 2032, fueled by businesses adopt hybrid and multi-cloud environments for flexibility and risk mitigation, PaaS solutions that support these architectures are in high demand.

- By Deployment, Type

On the basis of Deployment, Type, the Platform-as-a-Service Market is segmented into Public Cloud, Private Cloud and Hybrid Cloud. The Public Cloud segment held the largest market revenue share in 2024 driven by Companies across sectors are investing in digital transformation to remain competitive, and PaaS is a key enabler by supporting rapid application development and integration with modern technologies.

The Private Cloud segment is expected to witness the fastest CAGR from 2025 to 2032, driven by seamless integration of AI and ML capabilities into PaaS solutions enables organizations to create smarter, data-driven applications and automate complex processes, driving market growth.

- By Type

On the basis of Type, the Platform-as-a-Service Market is segmented into Application, Application Development and Management, Application Infrastructure and Middleware (AIM), Integration, Business Intelligence Platform (BIP), Business Process Management (BPM) and Data Management/DBMS. The Application segment held the largest market revenue share in 2024, driven by Demand for Operational Efficiency.

The Application Infrastructure and Middleware (AIM) is expected to witness the fastest CAGR from 2025 to 2032, driven by Proliferation of Hybrid and Multi-Cloud Strategies.

- By Organization Size

On the basis of Organization Size, the Platform-as-a-Service Market is segmented into Large-Scale, Medium Scale and Small-Scale. The Large-Scale segment held the largest market revenue share in 2024, driven by businesses adopt hybrid and multi-cloud environments for flexibility and risk mitigation, PaaS solutions that support these architectures are in high demand.

The Medium Scale is expected to witness the fastest CAGR from 2025 to 2032, driven by Companies across sectors are investing in digital transformation to remain competitive, and PaaS is a key enabler by supporting rapid application development and integration with modern technologies.

- By End Users

- On the basis of End Users, the Platform-as-a-Service Market is segmented into BFSI, Healthcare and Life Sciences, Telecom, Technology, E-Commerce, Electronics, Media and Entertainment, Educational Services, Professional Services, Public Sector, Retail and Distribution of CPG, Manufacturing, Travel and Transport, Energy and Utility and Others. The BFSI segment held the largest market revenue share in 2024, driven by Proliferation of Hybrid and Multi-Cloud Strategies.

- The Telecom is expected to witness the fastest CAGR from 2025 to 2032, driven expanding use of Internet of Things (IoT) devices requires robust backend platforms for data processing and management, a need effectively met by PaaS offerings.

Platform-as-a-Service Market Regional Analysis

- North America dominates the Platform-as-a-Service Market with the largest revenue share of 43.01% in 2024, driven by widespread implementation of DevOps methodologies is boosting PaaS adoption, as these platforms facilitate continuous integration, delivery, and collaboration among development teams.

- PaaS providers are tailoring solutions for industries such as healthcare, banking, and retail, addressing unique compliance, integration, and scalability requirements and driving sector-specific growth.

- The growing need for embedded video and communication features in applications (especially post-pandemic) is fueling demand for specialized video PaaS solutions.

U.S. Platform-as-a-Service Market Insight

The U.S. Platform-as-a-Service Market captured the largest revenue share of 53% in 2024 within North America, fueled by Expansion of Video and Communication PaaS.

Europe Platform-as-a-Service Market Insight

Companies across sectors are investing in digital transformation to remain competitive, and PaaS is a key enabler by supporting rapid application development and integration with modern technologies in Europe.

U.K. Platform-as-a-Service Market Insight

The U.K. Platform-as-a-Service Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by PaaS platforms streamline the development lifecycle, allowing businesses to launch applications more rapidly and respond to market changes or customer needs with greater agility.

Germany Platform-as-a-Service Market Insight

The Germany Platform-as-a-Service Market is expected to expand at a considerable CAGR during the forecast period, fueled by worldwide shift toward digitization and the broad adoption of cloud technologies are accelerating PaaS uptake, as enterprises seek scalable, flexible, and accessible development environments.

Asia-Pacific Platform-as-a-Service Market Insight

The Asia-Pacific Platform-as-a-Service Market is poised to grow at the fastest CAGR of 17% during the forecast period of 2025 to 2032, driven by Organizations are increasingly turning to PaaS to minimize the expenses associated with building, testing, and deploying applications, as PaaS eliminates the need for costly on-premise infrastructure and maintenance.

Japan Platform-as-a-Service Market Insight

The Japan Platform-as-a-Service Market is gaining momentum due to Global Digitization and Cloud Adoption.

China Platform-as-a-Service Market Insight

The China Platform-as-a-Service Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by Integration of Artificial Intelligence (AI) and Machine Learning (ML).

Platform-as-a-Service Market Share

The Platform-as-a-Service Market is primarily led by well-established companies, including:

- Oracle

- SAP

- IBM

- Microsoft

- Amazon Web Services, Inc.

- Alibaba Cloud

- Google LLC

- Salesforce.com, inc.

- Bloomberg Finance L.P.

- FactSet

- Atos SE

- Engine Yard

- FUJITSU

- Red Hat, Inc.

- ActiveState Software Inc.

- Dell

- Software AG

- VMware, Inc.

- AT&T Intellectual Property

- CloudBees, Inc.

Latest Developments in Global Platform-as-a-Service Market

- In September 2023, Oracle introduced new application development capabilities for Oracle Cloud Infrastructure (OCI), targeting cloud-native and Java developers. These enhancements aim to simplify and accelerate the development, deployment, and management of applications while reducing costs. Additionally, Oracle is integrating generative AI services into OCI to assist developers with tasks like code generation and summarization.

- In August 2024, SAP unveiled AI-assisted capabilities in its SAP S/4HANA Cloud Private Edition 2023 FPS02 release. Notable features include AI-assisted sales order fulfillment, conversational planning in transportation management, automated inbound cargo document creation, and maintenance order recommendations, all designed to enhance operational efficiency.

- In April 2025, IBM partnered with Scuderia Ferrari to enhance fan engagement through a reimagined app powered by IBM's watsonx AI platform. The app transforms complex race data into immersive experiences for fans, showcasing IBM's capabilities in AI-driven innovation.

- In February 2024, Microsoft announced the general availability of Amazon Q Developer, a generative AI–powered assistant that reimagines the software development lifecycle. It offers capabilities like conversational coding, inline code generation, and integration with IDEs to streamline development processes.

- In January 2023, At the 2024 Apsara Conference, Alibaba Cloud unveiled its latest large language model, Qwen2.5, featuring improved coding and mathematics capabilities. The company also introduced advancements in its Tongyi large model family, including a new text-to-video model and an enhanced vision language model, aiming to empower developers and stimulate growth in the open-source community.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PLATFORM AS A SERVICE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PLATFORM AS A SERVICE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PLATFORM AS A SERVICE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

5.4.4 COMPETITIVE INTELLIGENCE (PROMINENT PLAYERS)

5.4.4.1. STRATEGIC DEVELOPMENT

5.4.4.2. TECHNOLOGY/PLATFORM COMPARATIVE MATRIX

5.4.4.3. TECHNOLOGY IMPLEMENTATION PROCESS

5.4.4.3.1. CHALLENGES

5.4.4.3.2. INHOUS IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.4.4.4. TECHNOLOGY SPEND OF COMPANY

5.4.4.5. COMPANY COMPARATIVE ANALYSIS

5.4.4.5.1. CUSTOMER BASE

5.4.4.5.2. SERVICE POSITIONING

5.4.4.5.3. CUSTOMER FEEDBACK/RATING

5.4.4.5.4. APPLICATION REACH

5.4.4.5.5. MARKET SHARE

5.5 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

6 GLOBAL PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE

6.1 OVERVIEW

6.2 CLOUD SERVICE ORCHESTRATION

6.2.1 REPORTING AND ANALYTICS

6.2.2 TRAINING, CONSULTING, AND INTEGRATION

6.2.3 CLOUD SERVICE AUTOMATION

6.2.4 SUPPORT AND MAINTENANCE

6.3 DATA TRANSFORMATION

6.4 APPLICATION PROGRAMMING INTERFACE MANAGEMENT (API)

6.4.1 API PORTAL

6.4.2 API GATEWAY

6.4.3 API ANALYTICS

6.4.4 ADMINISTRATION

6.4.5 SECURITY

6.4.6 MONETIZATION

6.5 DATA INTEGRATION

6.5.1 MARKETING

6.5.2 SALES

6.5.3 OPERATIONS

6.5.4 FINANCE

6.5.5 HR

6.6 REAL-TIME MONITORING AND INTEGRATION

6.7 BUSINESS-TO-BUSINESS AND CLOUD INTEGRATION

6.8 APPLICATION INTEGRATION

6.9 PROCESS INTEGRATION

6.1 OTHERS

7 GLOBAL PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD

7.3.1 PUBLIC CLOUD

7.3.2 PRIVATE CLOUD

7.3.3 HYBRID CLOUD

8 GLOBAL PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 SMALL & MEDIUM SIZE ENTERPRISE

8.3 LARGE SIZE ENTERPRISE

9 GLOBAL PLATFORM AS A SERVICE MARKET, BY SUBSCRIPTION MODEL

9.1 OVERVIEW

9.2 PAID

9.3 FREE

10 GLOBAL PLATFORM AS A SERVICE MARKET, BY END USER

10.1 OVERVIEW

10.2 BFSI

10.2.1 BY DEPLOYMENT MODEL

10.2.1.1. ON-PREMISE

10.2.1.2. CLOUD

10.2.1.2.1. PUBLIC CLOUD

10.2.1.2.2. PRIVATE CLOUD

10.2.1.2.3. HYBRID CLOUD

10.3 CONSUMER GOODS

10.3.1 BY DEPLOYMENT MODEL

10.3.1.1. ON-PREMISE

10.3.1.2. CLOUD

10.3.1.2.1. PUBLIC CLOUD

10.3.1.2.2. PRIVATE CLOUD

10.3.1.2.3. HYBRID CLOUD

10.4 GOVERNMENT & PUBLIC SECTOR

10.4.1 BY DEPLOYMENT MODEL

10.4.1.1. ON-PREMISE

10.4.1.2. CLOUD

10.4.1.2.1. PUBLIC CLOUD

10.4.1.2.2. PRIVATE CLOUD

10.4.1.2.3. HYBRID CLOUD

10.5 HEALTHCARE & LIFE SCIENCE

10.5.1 BY DEPLOYMENT MODEL

10.5.1.1. ON-PREMISE

10.5.1.2. CLOUD

10.5.1.2.1. PUBLIC CLOUD

10.5.1.2.2. PRIVATE CLOUD

10.5.1.2.3. HYBRID CLOUD

10.6 MANUFACTURING

10.6.1 BY DEPLOYMENT MODEL

10.6.1.1. ON-PREMISE

10.6.1.2. CLOUD

10.6.1.2.1. PUBLIC CLOUD

10.6.1.2.2. PRIVATE CLOUD

10.6.1.2.3. HYBRID CLOUD

10.7 E-COMMERCE & RETAIL

10.7.1 BY DEPLOYMENT MODEL

10.7.1.1. ON-PREMISE

10.7.1.2. CLOUD

10.7.1.2.1. PUBLIC CLOUD

10.7.1.2.2. PRIVATE CLOUD

10.7.1.2.3. HYBRID CLOUD

10.8 MEDIA & ENTERTAINMENT

10.8.1 BY DEPLOYMENT MODEL

10.8.1.1. ON-PREMISE

10.8.1.2. CLOUD

10.8.1.2.1. PUBLIC CLOUD

10.8.1.2.2. PRIVATE CLOUD

10.8.1.2.3. HYBRID CLOUD

10.9 IT & TELECOMMUNICATION

10.9.1 BY DEPLOYMENT MODEL

10.9.1.1. ON-PREMISE

10.9.1.2. CLOUD

10.9.1.2.1. PUBLIC CLOUD

10.9.1.2.2. PRIVATE CLOUD

10.9.1.2.3. HYBRID CLOUD

10.1 OTHERS

11 GLOBAL PLATFORM AS A SERVICE MARKET, BY GEOGRAPHY

GLOBAL PLATFORM AS A SERVICE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 NETHERLANDS

11.2.10 NORWAY

11.2.11 FINLAND

11.2.12 SWITZERLAND

11.2.13 DENMARK

11.2.14 SWEDEN

11.2.15 POLAND

11.2.16 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA

11.3.6 NEW ZEALAND

11.3.7 SINGAPORE

11.3.8 THAILAND

11.3.9 MALAYSIA

11.3.10 INDONESIA

11.3.11 PHILIPPINES

11.3.12 TAIWAN

11.3.13 VIETNAM

11.3.14 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 OMAN

11.5.6 BAHRAIN

11.5.7 ISRAEL

11.5.8 KUWAIT

11.5.9 QATAR

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL PLATFORM AS A SERVICE MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL PLATFORM AS A SERVICE MARKET, SWOT & DBMR ANALYSIS

14 GLOBAL PLATFORM AS A SERVICE MARKET, COMPANY PROFILE

14.1 GOOGLE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 MICROSOFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SAP

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 IBM

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 SALESFORCE, INC. (MULESOFT)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 CLOUD SOFTWARE GROUP, INC. (TIBCO)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 BOOMI

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 KFIN TECHNOLOGIES LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 WORKATO

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.1 SNAPLOGIC INC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 TALEND

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENT

14.12 INFORMATICA INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 YOUREDI LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 APPSECONNECT CORP

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENT

14.15 ELASTIC.IO

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENT

14.16 SOFTWARE AG

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENT

14.17 JITTERBIT

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 INTEGRATE.IO

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENT

14.19 CELIGO, INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENT

14.2 CHAKRAY

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENT

14.21 MÆSN

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENT

14.22 SYSTEMS TECHNOLOGY GROUP, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENT

14.23 EPICOR SOFTWARE CORPORATION

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENT

14.24 FLOWGEAR

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENT

14.25 ZAPIER INC.

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 GEOGRAPHIC PRESENCE

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENT

14.26 BMC SOFTWARE, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 REVENUE ANALYSIS

14.26.3 GEOGRAPHIC PRESENCE

14.26.4 PRODUCT PORTFOLIO

14.26.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.