Global Platform As A Service Paas Health Cloud Market

Market Size in USD Billion

CAGR :

%

USD

22.47 Billion

USD

163.96 Billion

2025

2033

USD

22.47 Billion

USD

163.96 Billion

2025

2033

| 2026 –2033 | |

| USD 22.47 Billion | |

| USD 163.96 Billion | |

|

|

|

|

Platform-as-a-Service (PaaS) Health Cloud Market Size

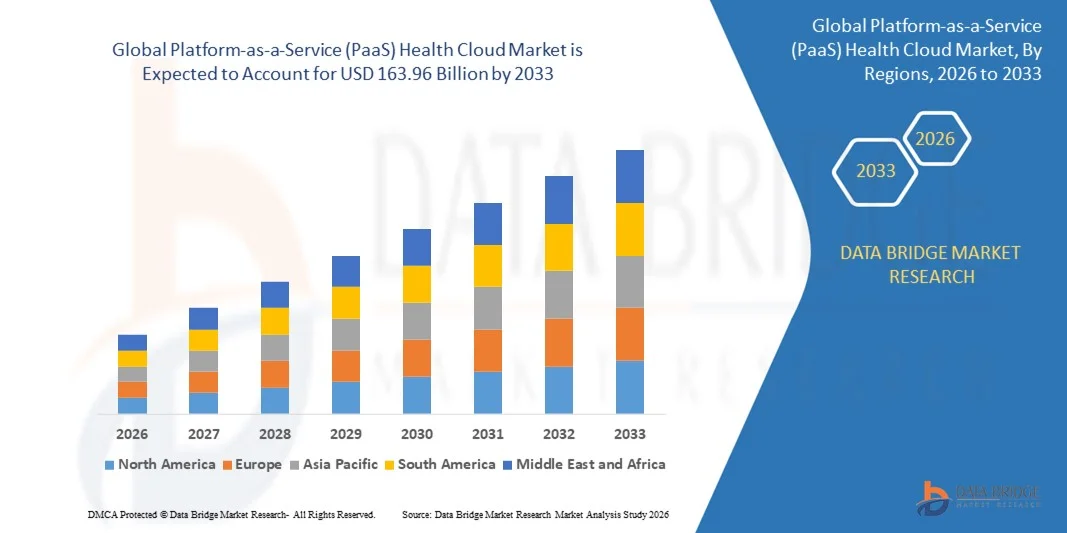

- The global platform-as-a-service (PaaS) health cloud market size was valued at USD 22.47 billion in 2025 and is expected to reach USD 163.96 billion by 2033, at a CAGR of 28.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud-based healthcare solutions, rising demand for secure data management, and the need for scalable and cost-effective IT infrastructure in hospitals and clinics

- Growing integration of advanced technologies such as AI, IoT, and big data analytics in healthcare platforms is further boosting demand for PaaS health cloud solutions

Platform-as-a-Service (PaaS) Health Cloud Market Analysis

- The market is witnessing rapid technological advancements, including enhanced interoperability, API-driven integrations, and real-time analytics capabilities, improving healthcare outcomes and operational efficiency

- Increasing government initiatives and regulations promoting digital health transformation and secure data storage are further supporting the expansion of the PaaS health cloud market

- North America dominated the global PaaS health cloud market with the largest revenue share in 2025, driven by increasing adoption of cloud-based platforms among hospitals, clinics, and diagnostic centers

- Asia-Pacific region is expected to witness the highest growth rate in the global platform-as-a-service (PaaS) health cloud market, driven by rapid urbanization, expanding healthcare infrastructure, growing demand for telehealth, and increased adoption of cloud-based health IT solutions

- The Healthcare Provider Solutions segment held the largest market revenue share in 2025, driven by the increasing adoption of cloud-based platforms by hospitals, clinics, and diagnostic centers to streamline patient data management, telemedicine services, and analytics. These solutions offer enhanced operational efficiency, secure storage, and seamless interoperability with existing health IT systems, making them highly attractive to healthcare providers

Report Scope and Platform-as-a-Service (PaaS) Health Cloud Market Segmentation

|

Attributes |

Platform-as-a-Service (PaaS) Health Cloud Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Platform-as-a-Service (PaaS) Health Cloud Market Trends

Rise of Cloud-Based Healthcare Solutions

- The growing shift toward cloud-based healthcare platforms is transforming the health IT landscape by enabling real-time data access, storage, and sharing across medical institutions. The scalability and flexibility of PaaS solutions allow healthcare providers to manage large patient volumes efficiently while maintaining data security and compliance. Cloud-based platforms also support advanced analytics and AI-driven insights, facilitating better clinical decision-making and personalized patient care

- The high demand for interoperable and remote-accessible healthcare systems is accelerating the adoption of PaaS health cloud platforms. These solutions are particularly effective in integrating electronic health records (EHRs), telemedicine applications, and mobile health apps, ensuring seamless continuity of care. In addition, the platforms enable collaboration across hospitals, labs, and diagnostic centers, enhancing workflow efficiency and reducing redundancies

- The cost-effectiveness and ease of deployment of modern PaaS platforms are making them attractive for hospitals, clinics, and diagnostic centers. Providers benefit from reduced IT infrastructure expenses and faster software implementation, leading to enhanced operational efficiency. Furthermore, the pay-as-you-go model of PaaS reduces upfront capital investment, making technology adoption feasible even for mid-sized healthcare providers

- For instance, in 2023, several healthcare networks across the U.S. reported improved patient engagement and streamlined workflow after implementing PaaS health cloud platforms that integrated telehealth, analytics, and EHR management. The integration enabled real-time remote monitoring, reduced administrative workload, and improved patient follow-up care. Such implementations also accelerated hospital digital transformation initiatives, supporting scalable growth

- While PaaS health cloud adoption is accelerating digital healthcare transformation, its impact depends on continued innovation, regulatory compliance, and user training. Vendors must focus on secure, scalable, and customizable platforms to fully capitalize on this growing demand. Moreover, continuous feature updates, API integrations, and multilingual support are vital to maintain competitiveness and expand market reach globally

Platform-as-a-Service (PaaS) Health Cloud Market Dynamics

Driver

Growing Adoption of Digital Health and Telemedicine Solutions

- The rapid adoption of digital health technologies is driving healthcare providers to implement PaaS cloud platforms as a centralized solution for managing patient data, telemedicine services, and AI-driven diagnostics. Cloud platforms ensure faster, secure, and scalable access to healthcare applications. They also allow integration with wearable devices and IoT-enabled monitoring tools, expanding remote patient care capabilities

- Hospitals and clinics are increasingly aware of the operational and clinical benefits offered by cloud-based platforms, including reduced downtime, remote accessibility, and integrated analytics for better patient outcomes. This awareness is fueling routine deployment across healthcare institutions globally. In addition, predictive analytics provided by these platforms help optimize resource allocation, reduce patient wait times, and improve overall operational efficiency

- Government initiatives and healthcare policies promoting digitalization, data interoperability, and remote care delivery are further supporting market growth. Incentives for telehealth adoption and cloud infrastructure investment encourage widespread implementation of PaaS solutions. National health programs and smart hospital initiatives also create an environment favorable for cloud adoption, particularly in emerging economies with expanding healthcare infrastructure

- For instance, in 2022, the European Union launched a digital health program supporting secure cloud adoption in member states, boosting demand for PaaS health cloud platforms across hospitals and research institutions. The program facilitated faster onboarding of EHR systems, interoperability between institutions, and compliance with EU-wide data protection standards. It also encouraged public-private partnerships in cloud-based healthcare development

- While digital adoption is rising, ensuring compliance, interoperability, and robust security remains essential to sustain market growth and long-term adoption of PaaS health cloud solutions. Continuous monitoring for cybersecurity threats, timely software updates, and integration with national healthcare IT standards are critical to maintaining provider trust and safeguarding patient information

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The initial investment required for PaaS health cloud platforms, including subscription fees, integration with legacy systems, and staff training, can limit adoption, particularly among small clinics and underfunded hospitals. Budget constraints often slow deployment despite long-term benefits. In addition, high costs of specialized modules such as AI analytics or population health management tools may deter smaller institutions from full-scale adoption

- Many healthcare providers and IT teams lack expertise in cloud infrastructure, leading to potential implementation challenges, system misconfigurations, or underutilization. Training and technical support are critical to maximizing platform efficiency. The lack of skilled personnel can also result in delayed deployment, inefficient workflows, and underutilized platform capabilities, reducing overall ROI for healthcare organizations

- Data privacy, security, and regulatory compliance concerns remain a key barrier for cloud adoption. Sensitive patient information must adhere to HIPAA, GDPR, and other regional healthcare regulations, complicating large-scale deployments. Cybersecurity threats, potential data breaches, and ransomware attacks further amplify hesitancy among institutions to migrate fully to cloud platforms without robust protection measures

- For instance, in 2023, surveys across Asia-Pacific revealed that over 55% of small hospitals delayed cloud adoption due to concerns about data protection, compliance, and cost of secure infrastructure. Many facilities opted for hybrid models rather than full cloud migration to mitigate risk, slowing broader adoption trends despite the recognized operational benefits

- While PaaS technology continues to evolve with enhanced security features and easier integration, addressing implementation cost, privacy, and compliance challenges is crucial. Stakeholders must focus on robust, secure, and user-friendly cloud solutions to unlock the long-term potential of the PaaS health cloud market. Continuous investment in cybersecurity, staff training, and regulatory compliance tools will drive confidence and adoption across both developed and emerging markets

Platform-as-a-Service (PaaS) Health Cloud Market Scope

The global platform-as-a-service (PaaS) health cloud market is segmented into five notable segments based on product, component, deployment model, pricing model, and end user.

- By Product

On the basis of product, the PaaS health cloud market is segmented into Healthcare Provider Solutions and Healthcare Payer Solutions. The Healthcare Provider Solutions segment held the largest market revenue share in 2025, driven by the increasing adoption of cloud-based platforms by hospitals, clinics, and diagnostic centers to streamline patient data management, telemedicine services, and analytics. These solutions offer enhanced operational efficiency, secure storage, and seamless interoperability with existing health IT systems, making them highly attractive to healthcare providers.

The Healthcare Payer Solutions segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the need for insurers and public health agencies to leverage cloud platforms for claims processing, population health management, and data analytics. Payer solutions enable improved decision-making, risk assessment, and regulatory compliance, fostering rapid adoption across private and public insurance providers.

- By Component

On the basis of component, the market is segmented into Services and Software. The Software segment held the largest market revenue share in 2025, fueled by its critical role in integrating electronic health records (EHRs), telehealth applications, and AI-powered analytics into a centralized cloud ecosystem.

Services is expected to witness the fastest growth from 2026 to 2033, driven by the increasing requirement for expert support in system implementation, customization, and optimization to ensure smooth operations and regulatory compliance.

- By Deployment Model

On the basis of deployment model, the market is segmented into Private Cloud, Hybrid Cloud, and Public Cloud. The Private Cloud segment dominated in 2025 due to stringent data privacy and security regulations, particularly in North America and Europe, where sensitive patient information must adhere to HIPAA and GDPR standards.

Hybrid Cloud and Public Cloud segments are expected to witness the fastest growth from 2026 to 2033, fueled by their flexibility, scalability, and cost-effectiveness for managing large datasets, supporting multi-institution collaboration, and enabling remote healthcare services.

- By Pricing Model

On the basis of pricing model, the market is segmented into Pay-As-You-Go Pricing Model and Spot Pricing Model. The Pay-As-You-Go segment held the largest market share in 2025, driven by its cost-efficiency and ability to allow healthcare providers to pay based on actual usage without heavy upfront investment.

The Spot Pricing Model is expected to witness the fastest growth from 2026 to 2033, particularly among large healthcare networks and research institutions requiring scalable computational resources for variable workloads and advanced analytics applications.

• By End User

On the basis of end user, the market is segmented into Hospitals, Pharmacies, Diagnostic and Imaging Centers, Ambulatory Centers, Private Payers, and Public Payers. The Hospitals segment dominated in 2025, driven by the growing need to centralize patient data, enhance operational efficiency, and integrate telehealth and analytics solutions.

Ambulatory Centers and Private Payers are expected to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of outpatient care services, telemedicine, and payer analytics platforms that enable better risk management, cost optimization, and improved patient outcomes.

Platform-as-a-Service (PaaS) Health Cloud Market Regional Analysis

- North America dominated the global PaaS health cloud market with the largest revenue share in 2025, driven by increasing adoption of cloud-based platforms among hospitals, clinics, and diagnostic centers

- Providers in the region highly value the efficiency, scalability, and interoperability offered by PaaS solutions, which enable secure management of electronic health records, telemedicine services, and analytics applications

- This widespread adoption is further supported by advanced IT infrastructure, high healthcare digitalization, and government incentives promoting cloud healthcare solutions, establishing PaaS platforms as a preferred choice for healthcare institutions

U.S. PaaS Health Cloud Market Insight

The U.S. PaaS health cloud market captured the largest revenue share in North America in 2025, fueled by rapid adoption of digital health solutions, telemedicine services, and AI-driven analytics. Healthcare providers are increasingly prioritizing cloud platforms for streamlined data management, improved patient engagement, and enhanced operational efficiency. The growing trend of remote care delivery, combined with regulatory support for HIPAA-compliant cloud adoption, further propels market growth. Moreover, the integration of cloud solutions with hospital information systems, mobile health applications, and telehealth platforms is significantly contributing to the expansion of the U.S. market.

Europe PaaS Health Cloud Market Insight

The Europe PaaS health cloud market is expected to witness the fastest growth rate from 2026 to 2033, driven by strict data privacy regulations, increasing government initiatives for digital healthcare, and rising demand for telemedicine and interoperable healthcare platforms. The region is experiencing significant adoption across hospitals, diagnostic centers, and research institutions, with cloud platforms helping improve workflow efficiency, data security, and patient outcomes. European healthcare providers are also increasingly leveraging cloud solutions for AI-based analytics, population health management, and remote patient monitoring.

U.K. PaaS Health Cloud Market Insight

The U.K. PaaS health cloud market is expected to witness the fastest growth rate from 2026 to 2033, driven by government-led digital health initiatives and an increasing demand for cloud-based platforms among healthcare providers. Cloud adoption is being accelerated by the need for integrated patient management systems, telehealth services, and efficient claims processing. The country’s robust healthcare IT infrastructure, combined with high cloud literacy among medical professionals, supports widespread deployment of PaaS solutions, enhancing service delivery and operational efficiency.

Germany PaaS Health Cloud Market Insight

The Germany PaaS health cloud market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of digital healthcare, advanced hospital IT infrastructure, and rising demand for secure and compliant cloud platforms. Healthcare providers in Germany are integrating cloud solutions for patient data management, telemedicine, and AI-driven diagnostics, improving workflow efficiency and reducing operational costs. The emphasis on innovation, compliance with GDPR, and growing adoption of smart healthcare technologies further promote market growth in the country.

Asia-Pacific PaaS Health Cloud Market Insight

The Asia-Pacific PaaS health cloud market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid digitalization of healthcare, government initiatives supporting cloud adoption, and rising telemedicine and e-health services in countries such as China, Japan, and India. The growing demand for cost-effective, scalable, and interoperable cloud solutions is encouraging hospitals, clinics, and diagnostic centers to adopt PaaS platforms. Furthermore, increasing smartphone penetration, digital health awareness, and expanding healthcare infrastructure are contributing to the region’s market expansion.

Japan PaaS Health Cloud Market Insight

The Japan PaaS health cloud market is expected to witness rapid growth from 2026 to 2033 due to the country’s advanced healthcare IT landscape, high adoption of digital health solutions, and demand for integrated cloud platforms. Providers are leveraging PaaS solutions to streamline patient management, telemedicine, and healthcare analytics. In addition, Japan’s aging population is driving the need for scalable and remote healthcare services, further boosting cloud platform adoption across both public and private healthcare institutions.

China PaaS Health Cloud Market Insight

The China PaaS health cloud market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digital transformation in healthcare, government initiatives promoting telehealth and cloud infrastructure, and growing demand for scalable healthcare IT solutions. Hospitals, clinics, and diagnostic centers are increasingly adopting cloud platforms for patient data management, analytics, and remote care. The emergence of domestic cloud solution providers and expanding healthcare IT capabilities are key factors propelling the growth of the PaaS health cloud market in China.

Platform-as-a-Service (PaaS) Health Cloud Market Share

The Platform-as-a-Service (PaaS) Health Cloud industry is primarily led by well-established companies, including:

- IBM Corporation (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- athenahealth, Inc. (U.S.)

- CareCloud Corporation (U.S.)

- Siemens Healthcare GmbH (Germany)

- eClinicalWorks (U.S.)

- Allscripts Healthcare, LLC (U.S.)

- NTT DATA, Inc. (Japan)

- Sectra AB (Sweden)

- GENERAL ELECTRIC COMPANY (U.S.)

- NXGN Management, LLC (U.S.)

- DXC Technology Company (U.S.)

- INFINITT North America Inc. (U.S.)

- Hyland Software, Inc. (U.S.)

- Orion Health Group of Companies (New Zealand)

- FUJIFILM Holdings America Corporation (U.S.)

- VEPRO AG (Germany)

- Dell Inc. (U.S.)

- ENSOFTEK INC. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.