Global Platinum Group Metals Market

Market Size in USD Billion

CAGR :

%

USD

43.69 Billion

USD

55.34 Billion

2025

2033

USD

43.69 Billion

USD

55.34 Billion

2025

2033

| 2026 –2033 | |

| USD 43.69 Billion | |

| USD 55.34 Billion | |

|

|

|

|

Global Platinum Group Metals Market Size

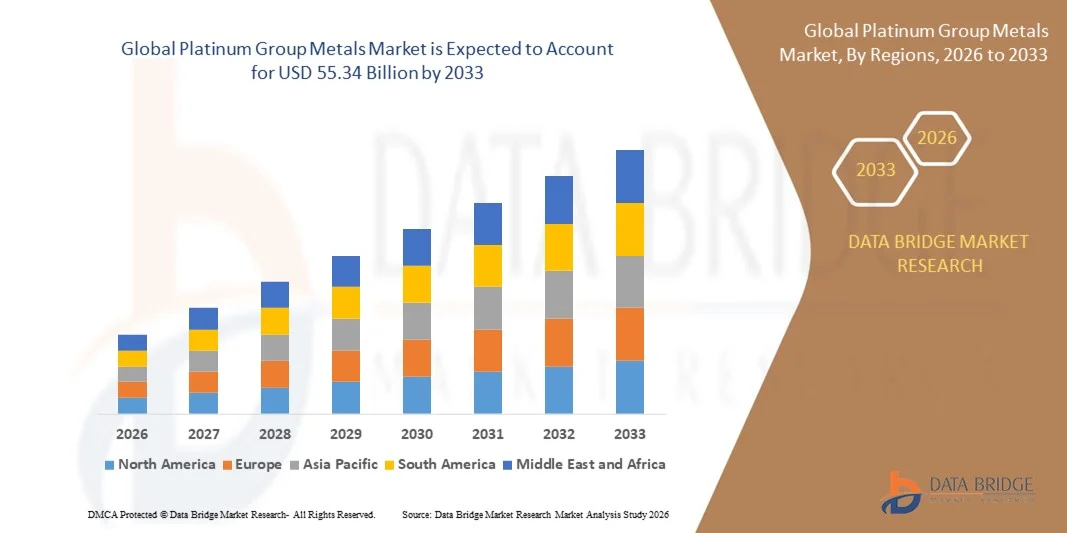

- The global Platinum Group Metals (PGM) market size was valued at USD 43.69 billion in 2025 and is projected to reach USD 55.34 billion by 2033, growing at a CAGR of 3.00% during the forecast period.

- The market growth is primarily driven by the rising demand for catalytic converters in the automotive sector, alongside increasing industrial applications in electronics, chemical processing, and jewelry manufacturing.

- Additionally, the shift toward cleaner energy solutions, including fuel cells and hydrogen technologies, is creating significant demand for platinum and related metals. These factors combined are propelling the adoption of PGMs across multiple sectors, thereby fueling the overall market expansion.

Global Platinum Group Metals Market Analysis

- Platinum Group Metals (PGMs), including platinum, palladium, rhodium, and others, are critical materials widely used in automotive catalytic converters, industrial applications, and jewelry, owing to their exceptional corrosion resistance, catalytic properties, and durability across diverse sectors.

- The growing demand for PGMs is primarily driven by stricter emission regulations in the automotive industry, increasing adoption in fuel cell technologies, and expanding use in chemical processing and electronics, positioning PGMs as indispensable for sustainable industrial growth.

- Asia-Pacific dominated the Global Platinum Group Metals Market with the largest revenue share of 36% in 2025, supported by a robust automotive industry, early adoption of clean energy technologies, and strong mining and refining infrastructure, with the U.S. witnessing significant growth in fuel cell deployment and industrial applications.

- North America is expected to be the fastest-growing region in the Global Platinum Group Metals Market during the forecast period, fueled by rapid industrialization, expanding automotive production, and rising investments in clean energy and electronics manufacturing.

- The platinum segment dominated the market with the largest revenue share of 38.6% in 2025, driven by its extensive use in automotive catalytic converters, fuel cells, and industrial applications due to its exceptional catalytic properties, corrosion resistance, and high durability.

Report Scope and Global Platinum Group Metals Market Segmentation

|

Attributes |

Platinum Group Metals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Anglo American Platinum (South Africa) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Platinum Group Metals Market Trends

Technological Advancements in Catalytic and Industrial Applications

- A significant and accelerating trend in the global Platinum Group Metals (PGM) market is the increasing adoption of advanced technologies in automotive catalytic converters, fuel cells, and industrial processes. This integration of innovative solutions is enhancing efficiency, reducing emissions, and improving overall performance.

- For instance, Johnson Matthey and Umicore are developing next-generation catalytic converters that use optimized platinum, palladium, and rhodium combinations to achieve higher emission reduction while minimizing metal usage. Similarly, fuel cell manufacturers like Ballard Power Systems utilize platinum in membrane electrode assemblies to increase energy efficiency and durability.

- Technological advancements in PGMs enable applications such as hydrogen fuel cells, where platinum acts as a highly effective catalyst for hydrogen oxidation and oxygen reduction reactions. These innovations improve energy output, reduce costs, and support the transition toward cleaner energy solutions.

- The seamless integration of PGMs in automotive, chemical, and electronic systems facilitates higher performance and sustainability across multiple industries. For example, in electronics, PGMs are used in hard disk drives and sensors, allowing more compact, reliable, and efficient designs.

- This trend toward smarter, more efficient, and technologically advanced PGM applications is fundamentally reshaping industrial expectations for performance and sustainability. Consequently, companies such as Anglo American Platinum, Sibanye Stillwater, and Johnson Matthey are investing heavily in R&D to develop high-efficiency catalysts, fuel cell solutions, and industrial PGM innovations.

- The demand for technologically advanced PGMs is growing rapidly across automotive, energy, and industrial sectors, as businesses increasingly prioritize sustainability, performance, and cost-effective solutions.

Global Platinum Group Metals Market Dynamics

Driver

Growing Demand Driven by Environmental Regulations and Clean Energy Initiatives

- The increasing stringency of environmental regulations, coupled with the accelerating shift toward clean energy technologies, is a significant driver for the heightened demand for Platinum Group Metals (PGMs).

- For instance, in 2025, Johnson Matthey announced advancements in low-platinum catalytic converters designed to meet stricter Euro 7 emission standards, reflecting how regulatory pressures are driving innovation and market growth. Such initiatives by key companies are expected to sustain PGM demand throughout the forecast period.

- As automotive manufacturers and industrial players face mounting pressure to reduce emissions, PGMs offer essential catalytic properties that enable vehicles and industrial processes to meet regulatory requirements. This includes applications in catalytic converters, fuel cells, and hydrogen energy systems.

- Furthermore, the global push toward sustainable energy solutions and fuel cell technologies is increasing the integration of PGMs in both automotive and industrial sectors. Their use in hydrogen fuel cells, for example, supports cleaner energy generation and aligns with governments’ decarbonization targets.

- The combination of regulatory compliance, sustainability goals, and technological adoption is propelling the uptake of PGMs across multiple sectors, establishing them as critical materials in the transition toward low-emission and energy-efficient solutions.

Restraint/Challenge

Price Volatility and Supply Constraints

- Fluctuations in PGM prices and potential supply constraints pose significant challenges to broader market growth. PGMs are rare and largely concentrated in specific geographic regions, making the market highly susceptible to geopolitical and economic disruptions.

- For instance, labor strikes in South African mines or fluctuations in global demand can significantly impact platinum, palladium, and rhodium supply, driving price volatility and affecting industrial planning.

- Managing these challenges requires strategic sourcing, long-term supply agreements, and investments in recycling and alternative materials. Companies such as Anglo American Platinum and Sibanye Stillwater are increasingly focusing on PGM recycling and production optimization to mitigate supply risks.

- Additionally, the relatively high cost of PGMs compared to substitute materials can limit adoption in price-sensitive applications, especially in developing economies or for cost-conscious industrial users. While technological advancements are improving efficiency, the inherent scarcity of PGMs continues to pose economic challenges.

- Overcoming these challenges through supply chain diversification, recycling initiatives, and price stabilization strategies will be crucial to sustaining growth in the Global Platinum Group Metals Market.

Global Platinum Group Metals Market Scope

The platinum group metals market is segmented on the basis of material and application.

- By Material

On the basis of material, the Global Platinum Group Metals Market is segmented into platinum, palladium, rhodium, iridium, ruthenium, and osmium. The platinum segment dominated the market with the largest revenue share of 38.6% in 2025, driven by its extensive use in automotive catalytic converters, fuel cells, and industrial applications due to its exceptional catalytic properties, corrosion resistance, and high durability. Platinum is also widely used in jewelry and medical devices, which further strengthens its market position.

The palladium segment is expected to witness the fastest CAGR of 17.8% from 2026 to 2033, supported by its rising adoption in gasoline engine catalytic converters, increasing demand for emission control solutions, and growing industrial applications in electronics and chemical processes. Additionally, palladium’s relative cost-effectiveness compared to platinum encourages its adoption across automotive and industrial sectors. Overall, the material segment reflects the critical role of PGMs in driving sustainability and technological innovation across industries.

- By Application

On the basis of application, the Global Platinum Group Metals Market is segmented into auto catalysts, electrical and electronics, fuel cells, glass, ceramics and pigments, jewelry, medical, chemicals, and other applications. The auto catalysts segment dominated the market with the largest revenue share of 42.1% in 2025, fueled by stringent emission regulations, the widespread adoption of catalytic converters, and increasing automotive production globally. PGMs in auto catalysts help significantly reduce harmful emissions from vehicles, making them indispensable for both gasoline and diesel engines.

The fuel cells segment is expected to witness the fastest CAGR of 18.3% from 2026 to 2033, driven by the growing deployment of hydrogen fuel cell technologies, clean energy initiatives, and increasing investments in sustainable mobility solutions. Additionally, expanding applications in electronics, medical devices, and jewelry provide diversified demand channels, highlighting the versatility and indispensable nature of PGMs across industries worldwide.

Global Platinum Group Metals Market Regional Analysis

- Asia-Pacific dominated the Global Platinum Group Metals Market with the largest revenue share of 36% in 2025, driven by strong demand from the automotive sector, stringent emission regulations, and growing adoption of clean energy technologies such as fuel cells.

- Consumers and industries in the region prioritize the use of PGMs for automotive catalytic converters, industrial applications, and electronics due to their superior catalytic properties, corrosion resistance, and efficiency in reducing emissions.

- This widespread adoption is further supported by advanced manufacturing infrastructure, high technological expertise, and well-established mining and refining operations, establishing North America as a key hub for both production and consumption of PGMs across automotive, industrial, and energy sectors.

U.S. Platinum Group Metals Market Insight

The U.S. PGM market captured the largest revenue share of 42% in 2025 within North America, fueled by the country’s strong automotive industry, stringent emission standards, and growing adoption of fuel cell and clean energy technologies. Consumers and industrial users are increasingly prioritizing PGMs for catalytic converters, electronics, and hydrogen fuel cells due to their exceptional catalytic properties and durability. The increasing integration of PGMs in advanced automotive and industrial applications, combined with ongoing R&D investments by leading companies such as Johnson Matthey and Umicore, is significantly driving market growth.

Europe Platinum Group Metals Market Insight

The Europe PGM market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strict environmental regulations and the growing emphasis on emission control technologies in both automotive and industrial sectors. The rise in electric and hybrid vehicle production, alongside the demand for sustainable energy solutions such as hydrogen fuel cells, is boosting PGM consumption. Western European countries are witnessing strong adoption of PGMs in catalytic converters, industrial equipment, and electronics, supported by advanced infrastructure and well-established industrial ecosystems.

Germany Platinum Group Metals Market Insight

The Germany PGM market is expected to grow at a considerable CAGR during the forecast period, fueled by the country’s automotive dominance, focus on emission reduction, and investment in fuel cell technologies. Germany’s emphasis on innovation and sustainability encourages the adoption of PGMs in automotive catalytic converters, industrial applications, and clean energy systems. Additionally, regulatory support and the integration of PGMs into emerging technologies such as hydrogen mobility are strengthening market demand.

Asia-Pacific Platinum Group Metals Market Insight

The Asia-Pacific PGM market is poised to grow at the fastest CAGR of 19% during the forecast period of 2026 to 2033, driven by rapid industrialization, expanding automotive production, and increasing adoption of clean energy technologies in countries such as China, Japan, and India. The region’s growing automotive manufacturing hubs, coupled with government initiatives supporting emission control and sustainable energy, are driving PGM demand. Moreover, rising investments in electronics, fuel cells, and jewelry manufacturing are contributing to the region’s robust market growth.

Japan Platinum Group Metals Market Insight

The Japan PGM market is gaining momentum due to the country’s focus on clean energy, fuel cell technologies, and advanced automotive solutions. Japan places significant emphasis on environmental sustainability and industrial efficiency, fueling demand for PGMs in catalytic converters, fuel cells, and industrial applications. Additionally, strong technological adoption, government support for hydrogen mobility, and ongoing innovation in automotive and electronics sectors are driving market expansion in the country.

China Platinum Group Metals Market Insight

The China PGM market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s massive automotive industry, rapid urbanization, and increasing adoption of emission reduction technologies. China is a key market for catalytic converters, fuel cells, electronics, and jewelry applications, with strong domestic PGM producers and growing industrial demand supporting market growth. Government initiatives for clean energy, coupled with investments in hybrid and electric vehicles, are further propelling PGM consumption across residential, commercial, and industrial sectors.

Global Platinum Group Metals Market Share

The Platinum Group Metals industry is primarily led by well-established companies, including:

• Anglo American Platinum (South Africa)

• Johnson Matthey (U.K.)

• Sibanye Stillwater (South Africa)

• ImpalA Platinum Holdings (South Africa)

• Northam Platinum (South Africa)

• Platinum Group Metals Ltd. (Canada)

• Eurasian Resources Group (Luxembourg)

• Stillwater Mining Company (U.S.)

• Rhodium Group (U.S.)

• Merafe Resources (South Africa)

• Anglo Platinum (South Africa)

• Barplats Holdings (South Africa)

• PtX Group (Australia)

• PLATINEX (Australia)

• Syrah Resources (Australia)

• Western Platinum Ltd. (South Africa)

• Amplats Recycling (South Africa)

• Rhodium International (U.K.)

• PGM Resources (South Africa)

• Johnson Matthey Fuel Cells (U.K.)

What are the Recent Developments in Global Platinum Group Metals Market?

- In April 2024, Anglo American Platinum, a leading global producer of platinum group metals, announced a strategic expansion of its South African operations to enhance the production of high-purity PGMs for automotive catalytic converters and fuel cell applications. This initiative highlights the company’s commitment to meeting growing industrial and clean energy demand, leveraging advanced mining and refining technologies to strengthen its position in the rapidly expanding Global Platinum Group Metals Market.

- In March 2024, Johnson Matthey, a UK-based specialty chemicals and PGMs company, launched its next-generation low-platinum catalytic converter solutions aimed at European automotive manufacturers. The new product lineup improves emission reduction efficiency while optimizing platinum usage, reflecting Johnson Matthey’s dedication to sustainable innovation and reinforcing its leadership in advanced PGM applications.

- In March 2024, Sibanye Stillwater successfully commissioned its first fully integrated fuel cell catalyst production facility in the U.S., designed to support clean energy and hydrogen mobility initiatives. This project underscores the increasing significance of PGMs in sustainable energy solutions and demonstrates Sibanye Stillwater’s commitment to delivering high-performance materials for the global market.

- In February 2024, Impala Platinum Holdings entered a strategic partnership with a European automaker to supply rhodium and palladium for next-generation catalytic converters. The collaboration aims to optimize emission control performance while securing reliable PGM supply for automotive production, highlighting Impala Platinum’s focus on innovation and market responsiveness.

- In January 2024, Johnson Matthey unveiled its advanced platinum- and palladium-based fuel cell catalysts at the International Hydrogen Energy Expo 2024. These high-efficiency catalysts enhance durability and energy output for industrial and automotive applications, emphasizing the company’s commitment to integrating cutting-edge PGM technology into sustainable solutions while supporting the global transition to cleaner energy systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Platinum Group Metals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Platinum Group Metals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Platinum Group Metals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.