Global Playing Cards And Board Games Market

Market Size in USD Billion

CAGR :

%

USD

19.91 Billion

USD

32.81 Billion

2025

2033

USD

19.91 Billion

USD

32.81 Billion

2025

2033

| 2026 –2033 | |

| USD 19.91 Billion | |

| USD 32.81 Billion | |

|

|

|

|

Playing Cards and Board Games Market Size

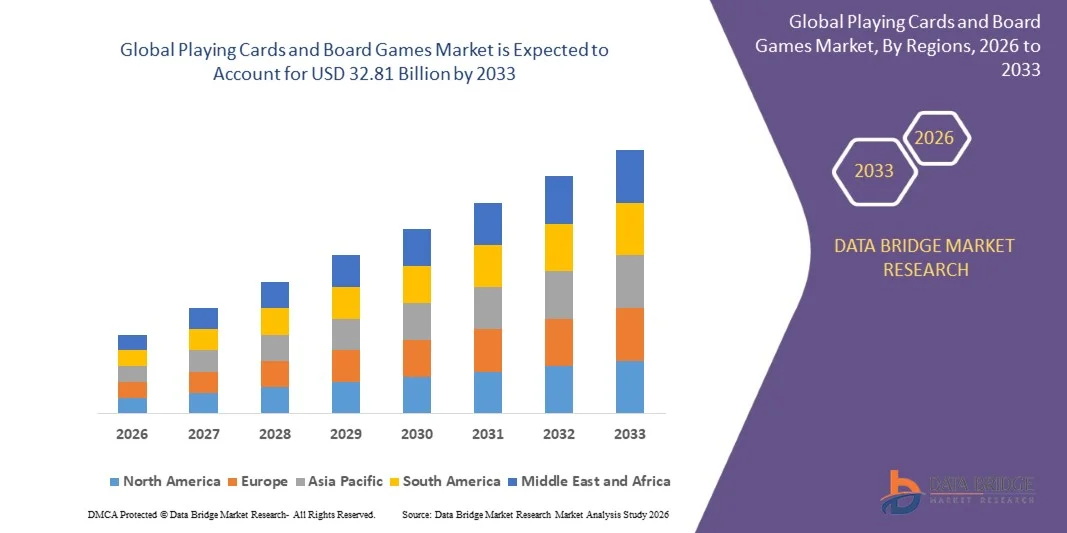

- The global playing cards and board games market was valued at USD 19.91 billion in 2025 and is expected to reach USD 32.81 billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 6.5%, primarily driven by increasing consumer interest in recreational, social, and family-oriented activities, along with a notable rise in demand for strategy-based and educational board games. Advancements in automation and AI are further optimizing production, packaging, and distribution, improving overall operational efficiency across the value chain.

- Additionally, expanding manufacturing capacity, stronger transportation networks, and higher trade volumes—especially across North America—are accelerating the adoption of modern gaming products and contributing to sustained market growth.

Playing Cards and Board Games Market Analysis

- The global playing cards and board games market is evolving rapidly, driven by digital integration, growing consumer preference for social and strategy-based entertainment, and continued product innovation. Technologies such as digitalization, AI-driven analytics, and automated production systems are increasingly influencing how manufacturers enhance product quality, manage distribution, and strengthen consumer engagement.

- Automation and AI-enabled supply chain systems—including automated stacking, robotics-assisted handling, and smart inventory management—are becoming essential for efficient global distribution of gaming products. These systems help reduce manual labor, improve delivery timelines, optimize warehouse operations, and support expanding retail and e-commerce networks.

- Technologies like Automated Stacking Systems (ASCs) and AI-based logistics platforms are enabling better storage optimization, faster handling, and real-time monitoring of stock levels. As the industry grows through online retail, licensed board games, and global collaborations, such systems help reduce operational costs and maintain supply reliability..

- Smarter distribution platforms and predictive demand planning are helping manufacturers respond quickly to fluctuations in demand. These capabilities are especially valuable during festive seasons, new game releases, and promotional periods, where timely and precise order fulfilment is critical.

- Asia-Pacific is expected to dominate the playing cards and board games market with the largest revenue share of 35.61% in 2026, supported by strong investments in digital commerce infrastructure, automated warehousing, and advanced logistics systems, which together enhance the efficiency of regional distribution networks.

- Asia-Pacific is expected to be the fastest-growing region in the playing cards and board games market during the forecast period with a CAGR of 7.2%, fueled by rising e-commerce penetration, expanding export activity, and adoption of AI-powered logistics tools including automated inventory monitoring, autonomous vehicles, and digitally operated handling systems.

- In 2026, the board games segment is expected to dominate the market with a 72.80% market share due to its strong global appeal, adaptability across age groups, and balanced production costs. Board games offer scalable growth potential and operational flexibility, making them a preferred focus area for manufacturers and distributors.

Report Scope and Playing Cards and Board Games Market Segmentation

|

Attributes |

Playing Cards and Board Games Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Playing Cards and Board Games Market Trends

“Subscription-Model Expansion”

- The subscription-based model offers a compelling growth avenue for the global playing cards and board games market. By transitioning from traditional one-time purchases to recurring delivery of curated game experiences, manufacturers and retailers can benefit from improved customer lifetime value, predictability of demand, and deeper engagement. Subscription services facilitate discovery of new titles, reduce the risk of consumer choice overload, and allow brands to bundle exclusive or limited-edition content.

- Additionally, the model supports incremental monetisation through tiered memberships, themed boxes, and community-driven features. As e-commerce logistics and digital payments mature, subscription frameworks become more feasible across geographies and consumer segments, creating a scalable channel for the tabletop games industry to diversify revenue streams and foster brand loyalty.

- In May 2022, Gibsons (company announcement) launched a monthly jigsaw-puzzle subscription offering, demonstrating publisher-level adoption of recurring-revenue product formats in adjacent tabletop/puzzle categories.

- In October 2024, Build Game Box published a company press release announcing the launch of a monthly subscription box for game design and desktop game kits, indicating new entrant activity in curated game-box subscriptions.

- The global playing cards and board games market is increasingly positioned to benefit from the expansion of subscription-based models. Publisher acquisitions of digital platforms, integration of premium membership services, and the emergence of curated game-box offerings all indicate growing institutional commitment to recurring-revenue formats. These developments are reinforced by maturing digital-commerce infrastructure, rising consumer interest in curated physical experiences, and the steady adoption of hybrid physical-digital engagement models.

- As subscription ecosystems scale, they strengthen pathways for product discovery, customer retention, and portfolio monetisation. Collectively, these factors point toward a market environment that supports sustained subscription adoption, enabling industry participants to diversify revenue, stabilize demand, and enhance long-term strategic positioning within the tabletop entertainment landscape.

Playing Cards and Board Games Market Dynamics

Driver

“Rise in Demand for Thematic and Strategy-Based Board Games”

- Demand for thematic and strategy-based board games has been observed to increase significantly, providing a substantial growth driver for the global playing cards and board games market. Consumers are increasingly seeking games that go beyond simple mechanics and offer deeper narrative engagement, strategic decision-making, and immersive thematic settings.

- These preferences reflect broader shifts in leisure-time allocation: players seek social interaction, intellectual stimulation and replay value rather than just casual or party-style formats. The growth in immersive themes (fantasy, historical, scientific), complex strategy mechanics (resource management, area control, legacy elements) and community-driven play (clubs, cafés, competitive frameworks) has broadened the addressable market and allowed game-publishers to launch premium variants and expansions with higher price-points. As a result, thematic and strategy-based titles are enhancing product differentiation, supporting longer shelf-life, and strengthening consumer loyalty in the tabletop segment.

- In April 2025, The Times reported that the board game Wingspan had seen UK sales increase by 166 % since its introduction to major retail in 2022; the article noted that its bird-watching theme and strategic gameplay had attracted adult players and younger demographics alike

- In March 2023, Yahoo Finance reported that strategy-based board games were witnessing higher demand, noting that while preschool children preferred chance-based tabletop games, adults were moving toward more strategic titles.

- The reviewed instances collectively indicate a clear and sustained shift toward deeper thematic engagement and strategic gameplay within the global board-games market. Across multiple regions and sources, rising consumer interest in narrative-rich mechanics, cooperative formats, intellectually stimulating play structures and immersive social environments has been consistently documented. This trend reflects changing leisure preferences, where players increasingly prioritise depth, replay value and meaningful interaction.

- The convergence of retail demand patterns, evolving design approaches and growing social-play ecosystems reinforces the view that thematic and strategy-based titles are becoming central to market expansion, strengthening long-term growth prospects and shaping future product-development priorities across the value chain.

Restraint/Challenge

“Competitive Displacement from the Larger Digital/Video Games”

- The growth of digital and video game platforms is exerting competitive pressure on the physical playing cards and board games market. As consumers allocate more leisure time and spending towards immersive digital entertainment—including mobile games, consoles, and online multiplayer experiences—the analog tabletop segment faces a displacement risk. Digital formats offer convenience, frequent content updates, subscription models, and social connectivity, which heighten competitive intensity. Consequently, manufacturers and retailers of board games and playing cards must contend with not only traditional leisure alternatives, but also a rapidly expanding digital ecosystem that weakens analog market share, increases consumer-acquisition costs, and heightens the need for differentiated positioning and hybridisation of physical-digital blends.

- In August 2025, PC Gamer reported that 90 % of European gaming revenue in 2024 was generated via digital purchases, with only 10 % derived from physical boxed game sales, illustrating the dominance of digital formats in the broader gaming-entertainment ecosystem

- In January 2025, The Guardian published data showing that UK boxed-video-game sales fell by 35 % in 2024 while digital and subscription revenues grew, underscoring the migration of entertainment spend away from physical formats.

- In March 2023, a peer-reviewed study in PLOS ONE observed that video-game play time was a significant predictor of cognitive-function metrics whereas board-game play was not, suggesting higher engagement levels and longer sessions in digital formats.

- It is concluded that displacement risk from the larger digital/video game sector constitutes a significant challenge for the playing cards and board games market. The evidence demonstrates that digital gaming has achieved dominant revenue share, sustained consumer engagement and rapid innovation, thereby reducing the available leisure time and spend for physical tabletop formats. For analogue-game producers, this means increased urgency to enhance value through hybrid digital integration, augment social-play propositions, and strengthen marketing differentiation. Without such strategic adaptation, the analog segment may face slower growth, thinner margins and diminished competitive standing within an entertainment landscape increasingly dominated by digital experiences.

Playing Cards and Board Games Market Scope

The market is segmented on the basis of product type, age group, distribution channel, and end user.

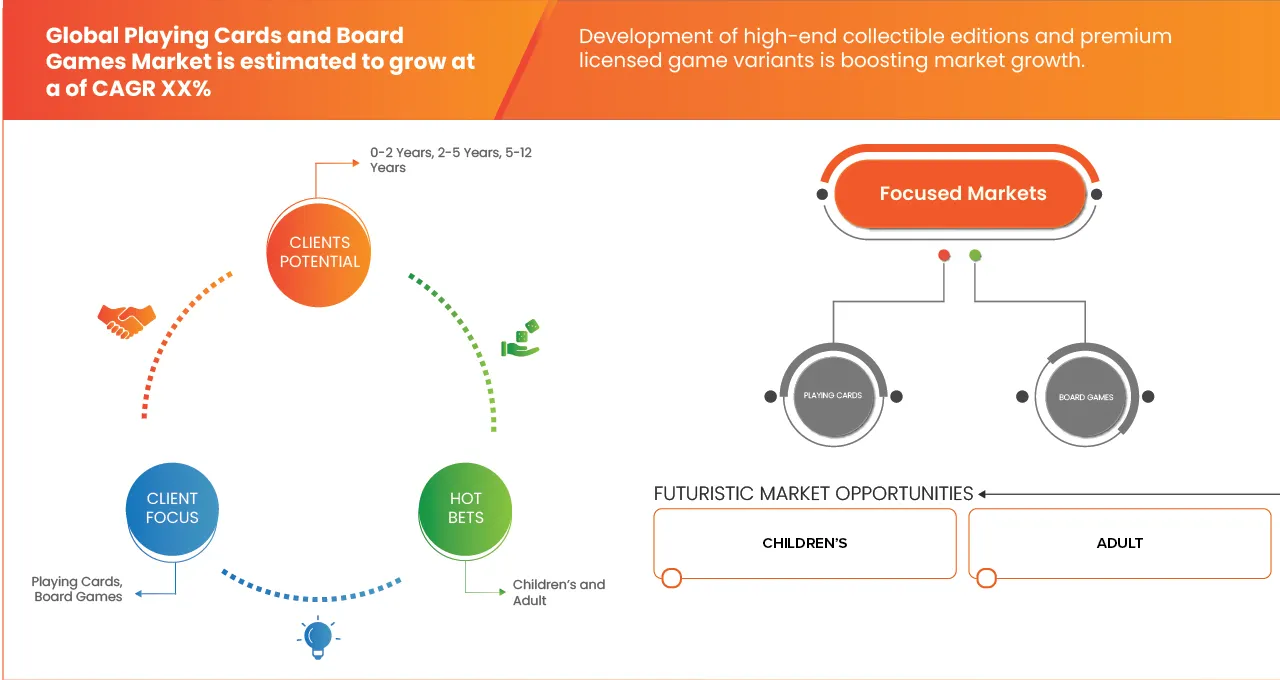

- By Product Type

On the basis of product type, the global playing cards and board games market is segmented into board games, playing cards. In 2026, the board games segment is expected to dominate the market with a 72.80% market share, driven by growing consumer preference for strategy-based and cooperative gameplay, increasing popularity of family-oriented and educational board games, strong uptake of licensed and themed game titles, and the rise of board-game cafés and community gaming events that continue to boost engagement and sales globally.

The playing cards segment is the fastest-growing in the global playing cards and board games market, with a CAGR of 6.7%, driven by rising popularity of collectible and themed card decks, increasing interest in casual and social card games, growing adoption of playing cards in family entertainment and travel-friendly gaming, and the expansion of online retail channels that offer wider variety and easier accessibility.

- By Age Group

On the basis of age group, the global playing cards and board games market is segmented into 5–12 years, above 12 years, 2–5 years, 0–2 years. In 2026, the 5–12 years segment is expected to dominate with a 46.10% market share, driven by strong demand for educational, skill-building, and interactive games; increasing parental focus on cognitive development; widespread adoption of board and card games in schools and learning centers; and the popularity of character-based and themed gaming products among children in this age group.

The above 12 years segment is the fastest-growing segment in the global playing cards and board games market, with a CAGR of 6.9%, driven by the increasing interest in strategy-based and complex tabletop games, rising engagement among teenagers and young adults, the growing popularity of hobby gaming communities, and the strong influence of social media, gaming events, and pop-culture trends that encourage participation in advanced board and card games.

- By Distribution Channel

On the basis of distribution channel, the global playing cards and board games market is segmented into offline, online. In 2026, the offline segment is expected to dominate the market with 64.19% market share, driven by the strong presence of specialty game stores, toy retailers, supermarkets, and hobby shops; consumers’ preference for in-store product evaluation; the rise of board-game cafés and experiential retail formats; and the continued popularity of physical shopping environments that allow hands-on engagement and immediate product availability.

Online is the fastest-growing segment with a CAGR of 6.9% in the global playing cards and board games market driven by rapid expansion of e-commerce platforms, increasing consumer preference for convenient home delivery, wider product availability compared to offline channels, frequent online discounts and promotions, and the growing influence of digital marketing and social media in shaping purchasing decisions for gaming products.

- By End User

On the basis of end user, the global playing cards and board games market is segmented into children's and adult. In 2026, the children’s segment is expected to dominate the market with 60.41% market share, driven by rising demand for educational and skill-enhancing games, increasing adoption of play-based learning in schools and homes, strong popularity of character-themed and licensed game titles, and the growing influence of online and offline toy retailers that actively promote children-focused board and card games.

Children's is the fastest-growing segment with CAGR of 6.7% in the global playing cards and board games market driven by increasing parental focus on educational and skill-building games, rising popularity of character-themed and licensed products, expanding online retail accessibility, and the growing adoption of board games as a tool for cognitive development and social interaction among young players.

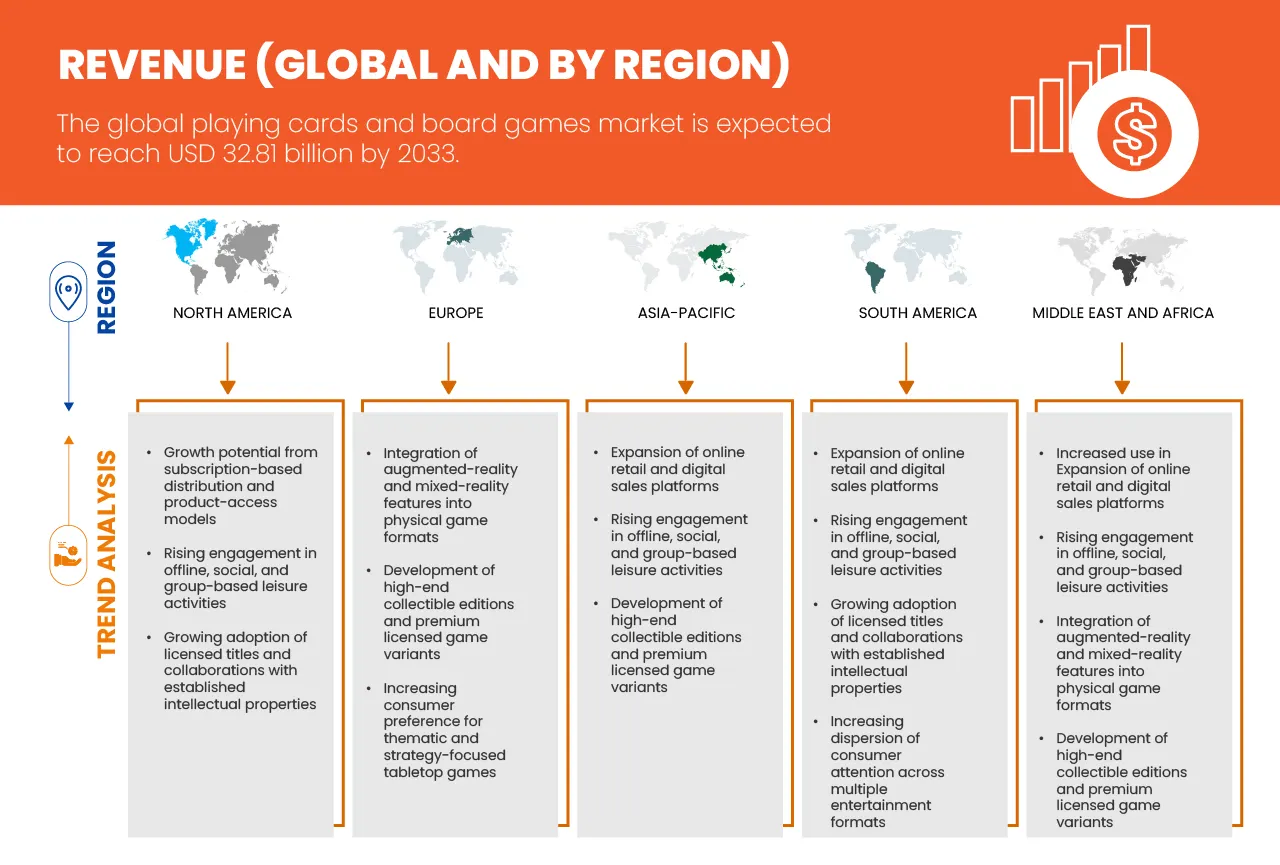

Playing Cards and Board Games Market Regional Analysis

- Asia-Pacific is expected to dominate the global playing cards and board games market, capturing an estimated 35.61% share by 2026. This leadership is supported by strong investments in digital commerce infrastructure, automated warehousing, and advanced logistics systems, which together enhance the efficiency of regional distribution networks.

- Asia-Pacific is also expected to be the fastest-growing market, with a projected CAGR of 7.2%, driven by rising e-commerce penetration, expanding export activity, and adoption of AI-powered logistics tools including automated inventory monitoring, autonomous vehicles, and digitally operated handling systems.

China Playing Cards and Board Games Market Insight

The China playing cards and board games market holds a strong position in the global industry, supported by rising consumer spending on indoor entertainment, the rapid popularity of board-game cafés, and the cultural revival of tabletop gaming. China’s expanding retail and distribution ecosystem — strengthened by major online platforms like Tmall, JD.com, and Pinduoduo — continues to improve nationwide accessibility for gaming products. Additionally, the growth of domestic manufacturing, increasing localization of game design, and reduced reliance on imports are further boosting the market’s competitiveness and self-sufficiency.

Japan Playing Cards and Board Games Market Insight

The Japan playing cards and board games market is projected to grow steadily, supported by rising consumer spending on indoor recreation, expanding retail and hobby-store networks, and strong international trade partnerships. The increasing popularity of specialty game shops, board-game cafés, and robust online sales channels is enhancing product accessibility and market penetration across the country. Major urban centers such as Tokyo, Osaka, and Yokohama are emerging as key hubs for organized tabletop gaming communities, tournaments, and hobbyist events, further strengthening Japan’s position in the global gaming landscape.

Germany Playing Cards and Board Games Market Insight

The Germany playing cards and board games market is expected to grow steadily, supported by rising consumer spending on indoor recreation, a strong culture of tabletop gaming, and well-established retail and distribution networks. The increasing presence of specialty game stores, board-game cafés, and expanding e-commerce platforms is enhancing product accessibility and deepening market penetration. Major urban centers such as Berlin, Munich, Hamburg, and Cologne are emerging as key hubs for organized tabletop gaming communities, hobbyist conventions, and large-scale board game events — further strengthening Germany’s position as one of Europe’s leading board game markets.

Saudi Arabia Playing Cards and Board Games Market Insight

The Saudi Arabia playing cards and board games market is expected to grow steadily, fueled by rising consumer spending on indoor entertainment, expanding modern retail networks, and increasing cultural openness to social and family-oriented leisure activities. The growth of specialty game stores, board-game cafés, and strengthened e-commerce channels is improving product accessibility and accelerating market penetration. Major urban centers such as Riyadh, Jeddah, and Dammam are emerging as key hubs for organized tabletop gaming communities, hobby events, and pop-culture conventions, further contributing to the market’s expansion.

Brazil Playing Cards and Board Games Market Insight

The Brazil playing cards and board games market is expected to grow steadily, supported by rising consumer spending on indoor recreation, expanding retail networks, and strong domestic and international trade activity. The increasing presence of specialty game stores, board-game cafés, and rapidly growing e-commerce platforms is enhancing product accessibility and deepening market penetration. Major urban centers such as São Paulo, Rio de Janeiro, Brasília, and Porto Alegre are emerging as key hubs for organized tabletop gaming communities, hobbyist events, and large-scale gaming conventions, further accelerating market growth.

The Major Market Leaders Operating in the Market Are:

- Mattel (U.S.)

- Hasbro (U.S.)

- Asmodee Nordics (Denmark)

- Spin Master (Canada)

- Cartamundi (Belgium)

- NINGBO THREE A GROUP CO., LTD (China)

- Ravensburger Group (Germany)

- Buffalo Games (U.S.)

- HABA USA (U.S.)

- CMON (Singapore)

- UNIVERSITY GAMES CORPORATION (U.S.)

- Z-MAN Games (U.S.)

- USAOPOLY, Inc. (U.S.)

- GOLIATH GAMES LLC (Netherlands)

- LongPack Games (China)

- CZECH GAMES EDITION (Czech Republic)

- Piatnik (Austria)

- R&R Games (U.S.)

- NECA/WizKids LLC (WizKids) (U.S.)

- Hicreate Games (China)

Latest Developments in Playing Cards and Board Games

- In April 2025, Z-MAN Games announced Disney Stitch: The Fix for 626, a fast-paced deduction card game inspired by the beloved Lilo & Stitch franchise and the award-winning mechanics of Love Letter. Designed for 2–5 players, the game tasks participants with capturing Stitch while managing a unique double-sided token that switches between “Good Stitch” and “626,” directly influencing gameplay and scoring. With a focus on family-friendly, interactive mechanics and minimal player elimination, the game is accessible and engaging for younger audiences. Completing the experience is a plush, collectible Stitch-shaped storage bag that enhances both portability and appeal for Disney fans, families, and casual gamers alike.

- In May 2024, The Op Games has launched MONOPOLY®: One Piece Edition under license from Hasbro, celebrating the 25th anniversary of the iconic manga and anime series. This edition features a custom gameboard, nine special character tokens, and gameplay focused on assembling powerful teams from Dressrosa. Fans can buy, sell, and trade beloved characters like Luffy, Zoro, and Nami, and this launch helps The Op Games expand its market reach, attract anime fans, and strengthen its portfolio of licensed games.

- In July 2025, Hansen Company announced a global distribution agreement granting University Games exclusive worldwide rights to distribute the entire Hansen product line, including Hoberman Spheres, Fame Master models, handheld electronic games, Hansen-branded classic games, and various distributed games and dolls. This exclusive agreement will enhance University Games' product portfolio and strengthen its position in the global market.

- In February 2022, Ravensburger AG announced a strategic investment in Gamefound, the crowdfunding platform dedicated to board games. As part of this partnership, Ravensburger will provide industry expertise and support the platform’s growth and development, helping creators bring more games to market. This marks Ravensburger’s first investment through its “Next Ventures” program, aiming to expand innovation in games, toys, and puzzles, while Gamefound benefits from enhanced tools and resources to serve the global board gaming community.

- In November, R&R Games announced the release of Amalfi: Renaissance, a strategic worker placement game where players act as merchant families sailing to establish trade routes and collect treasures. The game features unique ships that serve both as workers and resource markers, emphasizing economic strategy and resource management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PLAYING CARDS AND BOARD GAMES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPETITIVE INSIGHTS

4.1.1 MARKET STRUCTURE AND ROLES

4.1.2 MANUFACTURING CAPACITY AND SCALE ADVANTAGES

4.1.3 PRODUCT, IP, AND LICENSING STRATEGIES

4.1.4 DIGITAL, HYBRID, AND TECHNOLOGY COMPETITION

4.1.5 HOBBY PUBLISHERS, MINIATURES AND COMMUNITY ECONOMICS

4.1.6 REGIONAL MANUFACTURERS, CHINA OEMS AND SUPPLY OPTIONS

4.1.7 DISTRIBUTION CHANNELS AND GO-TO-MARKET COMPETITION

4.1.8 QUALITY, PROVENANCE, AND ANTI-COUNTERFEIT POSITIONING

4.1.9 SUSTAINABILITY, COMPLIANCE AND REGULATORY PRESSURES

4.1.10 CONSOLIDATION, FINANCING, AND STRATEGIC MOVES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 PRICE SENSITIVITY AND VALUE CONSIDERATION

4.2.2 ROLE OF SOCIAL INFLUENCE, FAMILY ENGAGEMENT, AND GROUP

4.2.3 IMPACT OF CLIMATE AND REGIONAL CONDITIONS

4.2.4 IMPORTANCE OF BRAND TRUST AND PRODUCT RELIABILITY

4.2.5 SHIFT TOWARD THEMATIC DEPTH, AESTHETICS AND COLLECTIBILITY

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 RAW MATERIALS

4.3.3 MANUFACTURING AND PACKAGING

4.3.4 DISTRIBUTION

4.3.5 END USERS

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4.1 AUTOMATION, ROBOTICS & INDUSTRY 4.0 IN PRINTING, CUTTING & PACKAGING

4.4.2 ADVANCED MATERIALS & SURFACE ENGINEERING

4.4.3 DIGITAL–PHYSICAL HYBRIDIZATION (NFC, BLUETOOTH, APP INTEGRATION)

4.4.4 AUGMENTED REALITY (AR) & ARTIFICIAL INTELLIGENCE (AI) INTEGRATION

4.4.5 RAPID PROTOTYPING & SHORT-RUN CUSTOMIZATION

4.4.6 SUSTAINABILITY TECHNOLOGIES & ECO-FRIENDLY MATERIALS

4.4.7 QUALITY ASSURANCE & ANTI-COUNTERFEIT TECHNOLOGIES

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE AND R&D SUPPORT

4.5.3 SUPPLY-CHAIN RELIABILITY AND LOGISTICS COVERAGE

4.5.4 COMPLIANCE, SAFETY, AND REGULATORY DOCUMENTATION

4.5.5 SUSTAINABILITY AND ENVIRONMENTAL CREDENTIALS

4.5.6 COST STRUCTURE, PRICING TRANSPARENCY AND TOTAL COST OF OWNERSHIP

4.5.7 FINANCIAL STABILITY AND BUSINESS CONTINUITY CAPACITY

4.5.8 FLEXIBILITY, CUSTOMIZATION, AND COLLABORATION CAPABILITIES

4.5.9 RISK MANAGEMENT, CONTINGENCY PLANNING AND TRACEABILITY

5 MARKET OVERVIEW

5.1 DRIVERS-

5.1.1 RISE IN DEMAND FOR THEMATIC AND STRATEGY-BASED BOARD GAMES

5.1.2 ONLINE COMMERCE AND DIGITAL RETAIL CHANNELS

5.1.3 GROWING INTEREST IN OFFLINE SOCIAL ENTERTAINMENT

5.1.4 HIGH-PROFILE INTELLECTUAL-PROPERTY TIE-UPS AND LICENSED PROJECTS

5.2 RESTRAINTS

5.2.1 COMPETITIVE DISPLACEMENT FROM THE LARGER DIGITAL/VIDEO GAMES

5.2.2 PRONOUNCED SEASONAL DEMAND PATTERNS, PARTICULARLY AROUND HOLIDAY PERIODS, RESULTING IN UNEVEN REVENUE CYCLES AND COMPLEX INVENTORY MANAGEMENT REQUIREMENTS

5.3 OPPORTUNITIES

5.3.1 AUGMENTED-REALITY (AR) AND MIXED-REALITY INTEGRATIONS

5.3.2 PREMIUM COLLECTOR AND LICENSED-IP PRODUCTS

5.3.3 SUBSCRIPTION-MODEL EXPANSION

5.4 CHALLENGES

5.4.1 COMPLIANCE BURDENS AND COST OF MEETING EVOLVING PACKAGING/WASTE LAWS

5.4.2 FRAGMENTATION OF CONSUMER ATTENTION

6 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

6.1 OVERVIEW

6.2 GAMES

6.3 PLAYING CARDS

6.4 GLOBAL BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.4.1 ASIA-PACIFIC

6.4.2 NORTH AMERICA

6.4.3 EUROPE

6.4.4 MIDDLE EAST AND AFRICA

6.4.5 SOUTH AMERICA

6.5 GLOBAL PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST AND AFRICA

6.5.5 SOUTH AMERICA

7 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

7.1 OVERVIEW

7.2 5–12 YEARS

7.3 ABOVE 12 YEARS

7.4 2–5 YEARS

7.4.1 0–2 YEARS

7.5 GLOBAL 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5.1 ASIA-PACIFIC

7.5.2 NORTH AMERICA

7.5.3 EUROPE

7.5.4 MIDDLE EAST AND AFRICA

7.5.5 SOUTH AMERICA

7.6 GLOBAL ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.6.1 ASIA-PACIFIC

7.6.2 NORTH AMERICA

7.6.3 EUROPE

7.6.4 MIDDLE EAST AND AFRICA

7.6.5 SOUTH AMERICA

7.7 GLOBAL 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.7.1 ASIA-PACIFIC

7.7.2 NORTH AMERICA

7.7.3 EUROPE

7.7.4 MIDDLE EAST AND AFRICA

7.7.5 SOUTH AMERICA

7.8 GLOBAL 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 NORTH AMERICA

7.8.3 EUROPE

7.8.4 MIDDLE EAST AND AFRICA

7.8.5 SOUTH AMERICA

8 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.2.1 SUPERMARKETS AND HYPERMARKETS

8.2.2 SPECIALTY STORES

8.2.3 OTHERS

8.3 ONLINE

8.3.1 3RD PARTY DISTRIBUTOR

8.3.2 COMPANY OWN WEBSITE

9 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY END USER

9.1 OVERVIEW

9.2 CHILDREN'S

9.2.1 BOY

9.2.2 GIRL

9.3 ADULT

10 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY REGION

10.1 OVERVIEW

10.2 ASIA-PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 INDIA

10.2.4 SOUTH KOREA

10.2.5 AUSTRALIA & NEW ZEALAND

10.2.6 INDONESIA

10.2.7 THAILAND

10.2.8 PHILIPPINES

10.2.9 MALAYSIA

10.2.10 REST OF ASIA-PACIFIC

10.3 NORTH AMERICA

10.3.1 U.S.

10.3.2 CANADA

10.3.3 MEXICO

10.4 EUROPE

10.4.1 GERMANY

10.4.2 U.K.

10.4.3 FRANCE

10.4.4 ITALY

10.4.5 SPAIN

10.4.6 RUSSIA

10.4.7 NETHERLANDS

10.4.8 BELGIUM

10.4.9 SWITZERLAND

10.4.10 TURKEY

10.4.11 LUXEMBOURG

10.4.12 REST OF EUROPE

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 SAUDI ARABIA

10.5.3 UNITED ARAB EMIRATES

10.5.4 EGYPT

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET: COMPANY LANDSCAPE

11.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: EUROPE

11.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.4 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 COMPANY PROFILES

12.1 MATTEL

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HASBRO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 ASMODEE NORDICS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 SPIN MASTER

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 CARTAMUNDI

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BUFFALO GAMES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 CMON

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 CZECH GAMES EDITION (CGE)

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 GOLIATH GAMES

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 HABA USA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 HICREATE GAMES

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LONGPACK GAMES

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NECA/WIZKIDS LLC (WIZKIDS)

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NINGBO THREE A GROUP CO., LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 PIATNIK

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 R&R GAMES

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 THE RAVENSBURGER GROUP

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 UNIVERSITY GAMES CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 THE OP GAMES

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 Z-MAN GAMES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 GLOBAL BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL ADULT IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033, (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 31 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 CHINA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 CHINA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 34 CHINA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 CHINA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 36 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 37 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 CHINA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 39 CHINA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 40 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 41 CHINA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 42 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 JAPAN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 JAPAN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 45 JAPAN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 JAPAN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 47 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 48 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 49 JAPAN OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 JAPAN ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 52 JAPAN CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 53 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 INDIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 INDIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 56 INDIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 INDIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 58 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 59 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 INDIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 61 INDIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 62 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 63 INDIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 64 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SOUTH KOREA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SOUTH KOREA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 67 SOUTH KOREA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 SOUTH KOREA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 69 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 70 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 SOUTH KOREA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 SOUTH KOREA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 74 SOUTH KOREA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 75 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 AUSTRALIA & NEW ZEALAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 AUSTRALIA & NEW ZEALAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 78 AUSTRALIA & NEW ZEALAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 86 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 INDONESIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 INDONESIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 89 INDONESIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 INDONESIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 91 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 92 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 93 INDONESIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 94 INDONESIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 95 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 96 INDONESIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 97 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 THAILAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 THAILAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 100 THAILAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 THAILAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 102 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 103 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 THAILAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 105 THAILAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 106 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 107 THAILAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 108 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 PHILIPPINES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 PHILIPPINES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 111 PHILIPPINES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 PHILIPPINES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 113 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 114 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 115 PHILIPPINES OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 PHILIPPINES ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 117 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 118 PHILIPPINES CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 119 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 MALAYSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 MALAYSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 122 MALAYSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 MALAYSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 124 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 125 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 126 MALAYSIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 127 MALAYSIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 128 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 129 MALAYSIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 130 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 SINGAPORE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 SINGAPORE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 133 SINGAPORE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 SINGAPORE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 135 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 136 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 137 SINGAPORE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 138 SINGAPORE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 139 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 140 SINGAPORE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 141 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 REST OF ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 REST OF ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 144 REST OF ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 REST OF ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 146 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 147 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 REST OF ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 149 REST OF ASIA-PACIFIC ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 150 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 151 REST OF ASIA-PACIFIC CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 152 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 153 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 NORTH AMERICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 156 NORTH AMERICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 NORTH AMERICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 158 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 159 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 160 NORTH AMERICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 161 NORTH AMERICA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 162 NORTH AMERICA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 163 NORTH AMERICA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 164 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 U.S. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 U.S. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 167 U.S. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 U.S. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 169 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 170 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 171 U.S. OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 172 U.S. ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 173 U.S. PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 174 U.S. CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 175 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 CANADA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 CANADA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 178 CANADA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 CANADA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 180 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 181 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 182 CANADA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 183 CANADA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 184 CANADA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 185 CANADA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 186 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 MEXICO BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 MEXICO BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 189 MEXICO PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 MEXICO PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 191 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 192 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 193 MEXICO OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 194 MEXICO ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 195 MEXICO PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 196 MEXICO CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 197 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 198 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 201 EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 203 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 204 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 205 EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 206 EUROPE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 208 EUROPE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 209 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 GERMANY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 GERMANY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 212 GERMANY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 GERMANY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 214 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 215 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 216 GERMANY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 GERMANY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 218 GERMANY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 219 GERMANY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 220 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 U.K. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 U.K. BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 223 U.K. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 U.K. PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 225 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 226 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 227 U.K. OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 228 U.K. ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 229 U.K. PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 230 U.K. CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 231 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 FRANCE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 FRANCE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 234 FRANCE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 FRANCE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 236 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 237 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 238 FRANCE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 239 FRANCE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 240 FRANCE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 241 FRANCE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 242 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 ITALY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 ITALY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 245 ITALY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 ITALY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 247 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 248 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 249 ITALY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 250 ITALY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 251 ITALY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 252 ITALY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 253 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 SPAIN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 SPAIN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 256 SPAIN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 SPAIN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 258 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 259 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 260 SPAIN OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 261 SPAIN ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 262 SPAIN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 263 SPAIN CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 264 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 RUSSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 RUSSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 267 RUSSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 RUSSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 269 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 270 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 271 RUSSIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 272 RUSSIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 273 RUSSIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 274 RUSSIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 275 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 NETHERLANDS BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 NETHERLANDS BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 278 NETHERLANDS PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 NETHERLANDS PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 280 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 281 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 282 NETHERLANDS OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 283 NETHERLANDS ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 284 NETHERLANDS PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 285 NETHERLANDS CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 286 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 BELGIUM BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 BELGIUM BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 289 BELGIUM PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 BELGIUM PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 291 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 292 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 293 BELGIUM OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 294 BELGIUM ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 295 BELGIUM PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 296 BELGIUM CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 297 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 SWITZERLAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 SWITZERLAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 300 SWITZERLAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 SWITZERLAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 302 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 303 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 304 SWITZERLAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 305 SWITZERLAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 306 SWITZERLAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 307 SWITZERLAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 308 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 309 TURKEY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 TURKEY BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 311 TURKEY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 TURKEY PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 313 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 314 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 315 TURKEY OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 316 TURKEY ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 317 TURKEY PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 318 TURKEY CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 319 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 LUXEMBOURG BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 LUXEMBOURG BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 322 LUXEMBOURG PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 LUXEMBOURG PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 324 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 325 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 326 LUXEMBOURG OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 327 LUXEMBOURG ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 328 LUXEMBOURG PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 329 LUXEMBOURG CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 330 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 REST OF EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 EST OF EUROPE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 333 REST OF EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 334 REST OF EUROPE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 335 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 336 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 337 REST OF EUROPE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 338 REST OF EUROPE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 339 REST OF EUROPE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 340 REST OF EUROPE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 341 MIDDLE EAST AND AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 342 MIDDLE EAST AND AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 343 MIDDLE EAST AND AFRICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 MIDDLE EAST AND AFRICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 345 MIDDLE EAST AND AFRICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 MIDDLE EAST AND AFRICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 347 MIDDLE EAST AND AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 348 MIDDLE EAST AND AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 349 MIDDLE EAST AND AFRICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 350 MIDDLE EAST AND AFRICA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 351 MIDDLE EAST AND AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 352 MIDDLE EAST AND AFRICA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 353 SOUTH AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 354 SOUTH AFRICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 355 SOUTH AFRICA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 356 SOUTH AFRICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 357 SOUTH AFRICA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 358 SOUTH AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 359 SOUTH AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 360 SOUTH AFRICA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 361 SOUTH AFRICA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 362 SOUTH AFRICA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 363 SOUTH AFRICA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 364 SAUDI ARABIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 365 SAUDI ARABIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 366 SAUDI ARABIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 367 SAUDI ARABIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 368 SAUDI ARABIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 369 SAUDI ARABIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 370 SAUDI ARABIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 371 SAUDI ARABIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 372 SAUDI ARABIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 373 SAUDI ARABIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 374 SAUDI ARABIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 375 UNITED ARAB EMIRATES PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 376 UNITED ARAB EMIRATES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 377 UNITED ARAB EMIRATES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 378 UNITED ARAB EMIRATES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 379 UNITED ARAB EMIRATES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 380 UNITED ARAB EMIRATES PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 381 UNITED ARAB EMIRATES PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 382 UNITED ARAB EMIRATES OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 383 UNITED ARAB EMIRATES ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 384 UNITED ARAB EMIRATES PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 385 UNITED ARAB EMIRATES CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 386 EGYPT PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 387 EGYPT BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 388 EGYPT BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 389 EGYPT PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 390 EGYPT PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 391 EGYPT PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 392 EGYPT PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 393 EGYPT OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 394 EGYPT ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 395 EGYPT PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 396 EGYPT CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 397 ISRAEL PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)