Global Point Of Care Immunoassay Analyzers Market

Market Size in USD Billion

CAGR :

%

USD

1.78 Billion

USD

4.31 Billion

2025

2033

USD

1.78 Billion

USD

4.31 Billion

2025

2033

| 2026 –2033 | |

| USD 1.78 Billion | |

| USD 4.31 Billion | |

|

|

|

|

Point-of-Care Immunoassay Analyzers Market Size

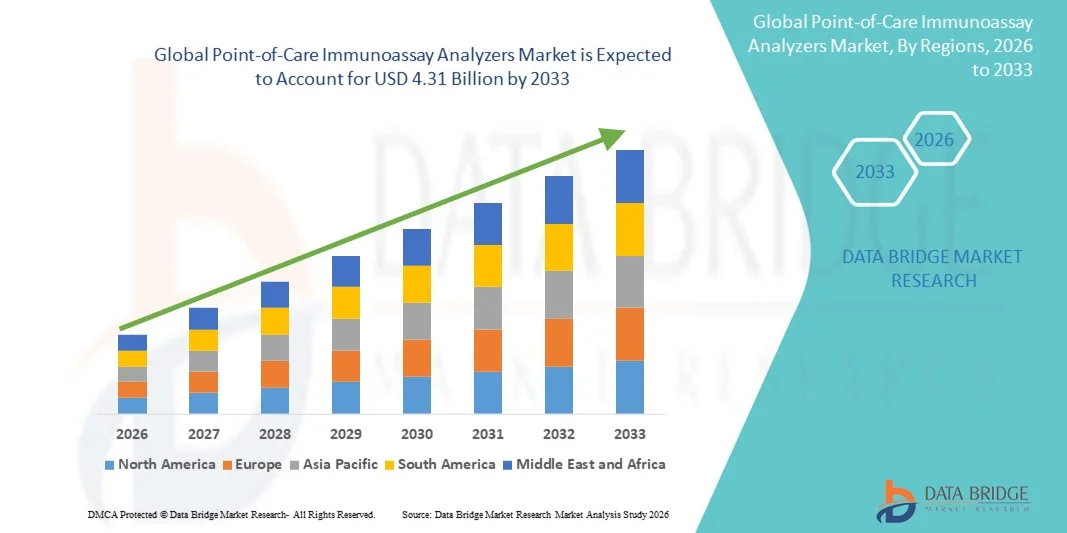

- The global point-of-care immunoassay analyzers market size was valued at USD 1.78 billion in 2025 and is expected to reach USD 4.31 billion by 2033, at a CAGR of 11.70% during the forecast period

- The market growth is largely fueled by the rising adoption of rapid diagnostic technologies and continuous advancements in point-of-care testing platforms, enabling faster clinical decision-making across emergency care, outpatient settings, and remote healthcare environments

- Furthermore, increasing demand for user-friendly, portable, and highly accurate diagnostic solutions—driven by the need for early disease detection, improved patient outcomes, and reduced laboratory turnaround times—is accelerating the uptake of Point-of-Care Immunoassay Analyzers, thereby significantly boosting the industry's growth

Point-of-Care Immunoassay Analyzers Market Analysis

- Point-of-care immunoassay analyzers, enabling rapid, on-site diagnostic testing for infectious diseases, cardiac markers, metabolic conditions, and critical care parameters, are increasingly vital components of modern healthcare systems due to their ability to provide fast, reliable results in both hospital and decentralized settings, including emergency departments, clinics, and remote care environments

- The escalating demand for point-of-care immunoassay analyzers is primarily fueled by the widespread adoption of rapid diagnostic technologies, growing emphasis on early disease detection, and rising preference for decentralized testing, driven by increasing patient volumes, burden of chronic diseases, and the need for quicker clinical decisions to improve outcomes

- North America dominated the point-of-care immunoassay analyzers market with the largest revenue share of 42.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, strong presence of leading medical device manufacturers, and increasing demand for rapid testing across hospitals, urgent care centers, and home-care settings. The U.S. experienced substantial growth in point-of-care analyzer installations, driven by technological advancements, supportive reimbursement, and rising use in emergency and outpatient facilities

- Asia-Pacific is expected to be the fastest-growing region in the point-of-care immunoassay analyzers market during the forecast period, projected to grow at a CAGR of 13.8% from 2026 to 2033, driven by expanding healthcare access, rising diagnostic investments, increasing prevalence of infectious diseases, and a growing focus on decentralized and home-based testing solutions

- The Benchtop Analyzers segment dominated the largest market revenue share of 41.6% in 2025, driven by their high analytical precision, broad test menu compatibility, and suitability for medium-to-large diagnostic settings where accuracy and throughput are essential

Report Scope and Point-of-Care Immunoassay Analyzers Market Segmentation

|

Attributes |

Point-of-Care Immunoassay Analyzers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Point-of-Care Immunoassay Analyzers Market Trends

Enhanced Convenience Through Next-Generation Diagnostic Integration

- A significant and accelerating trend in the global point-of-care immunoassay analyzers market is the rapid integration of advanced diagnostic technologies with portable, user-friendly platforms designed to deliver high-accuracy results directly at the patient’s bedside. This shift is fundamentally improving clinical decision-making speed and accessibility across hospitals, clinics, and decentralized healthcare settings

- For instance, several next-generation Point-of-Care Immunoassay Analyzers now integrate enhanced analytical modules that allow clinicians to perform tests such as cardiac markers, infectious disease panels, and hormone assays with faster turnaround times, enabling immediate intervention when required. Similarly, compact analyzers are increasingly engineered to support multi-parameter testing while maintaining high analytical sensitivity, making them suitable for emergency rooms and remote care environments

- Integration of advanced biochemical detection technologies enables features such as improved reagent stability, faster reaction kinetics, and enhanced signal detection — helping healthcare providers achieve more reliable and timely diagnostic outcomes. For example, several modern analyzers utilize refined fluorescence and chemiluminescence-based detection techniques to deliver greater accuracy and provide alerts when results fall outside expected ranges. Furthermore, the portability and intuitive interfaces of these analyzers offer healthcare professionals a convenient workflow that significantly improves bedside testing efficiency

- The seamless integration of Point-of-Care Immunoassay Analyzers with digital reporting systems and broader hospital information platforms enables streamlined test management, faster reporting, and real-time access to patient results. Through a single interface, clinicians can review diagnostic data alongside electronic health records, treatment plans, and laboratory histories, resulting in a more coordinated and automated care environment

- This trend toward more intelligent, rapid, and interconnected diagnostic systems is reshaping expectations in emergency care, acute care, and outpatient settings. Consequently, companies are increasingly developing advanced Point-of-Care Immunoassay Analyzers with improved analytical performance, expanded test menus, and enhanced interoperability with hospital digital ecosystem

- The growing demand for rapid diagnostic solutions that deliver laboratory-grade accuracy at the point of care is accelerating adoption across both developed and developing healthcare systems, as providers increasingly prioritize faster clinical workflows and comprehensive diagnostic capabilities

Point-of-Care Immunoassay Analyzers Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Infectious & Chronic Diseases

- The rising global burden of infectious diseases, chronic conditions such as cardiovascular disorders, and the expanding need for rapid diagnostic testing in emergency and outpatient settings are major drivers for the increasing adoption of Point-of-Care Immunoassay Analyzers

- For instance, in April 2025, several healthcare technology manufacturers introduced upgraded rapid immunoassay platforms capable of delivering improved accuracy for cardiac biomarkers, respiratory infection markers, and sepsis-related analytes — supporting faster triage decisions in critical care environments. These strategic advancements by key companies are expected to drive the Point-of-Care Immunoassay Analyzers industry growth throughout the forecast period

- As clinicians increasingly prioritize rapid, actionable diagnostic information to guide treatment decisions, Point-of-Care Immunoassay Analyzers provide essential capabilities such as short turnaround times, high specificity, and ease of use for frontline healthcare workers

- Furthermore, the growing emphasis on decentralized and value-based care models is making point-of-care testing a critical component of modern healthcare delivery, offering benefits such as earlier diagnosis, reduced laboratory burden, and improved patient management

- The convenience of immediate testing, reduced dependence on centralized laboratory systems, and the ability to conduct assays at bedside or near-patient locations are key factors supporting adoption across emergency departments, primary care clinics, and rural healthcare facilities. The shift toward portable, user-friendly analyzers with expanded test menus further contributes to market growth

Restraint/Challenge

Concerns Regarding High Operational Costs and Technical Complexity

- Concerns surrounding the high operational costs associated with consumables, calibration materials, and maintenance of advanced Point-of-Care Immunoassay Analyzers pose a significant challenge to broader market penetration. As these systems rely on specialized reagents and precision components, they can be more expensive to operate than conventional laboratory-based testing equipment — creating cost-related barriers for smaller clinics and resource-constrained healthcare settings

- For instance, recurring expenditures for single-use cartridges, assay kits, and reagent packs have made some healthcare facilities hesitant to adopt point-of-care immunoassay solutions, particularly when managing high testing volumes

- Addressing these financial concerns through optimized reagent design, improved device durability, and competitive pricing models is crucial for expanding adoption. Companies increasingly highlight cost-efficiency, extended reagent stability, and lower per-test pricing in their product strategies to reassure buyers. In addition, the relatively high upfront cost of advanced Point-of-Care Immunoassay Analyzers compared to basic point-of-care devices can be a barrier for cost-sensitive markets. While compact analyzers have become more affordable, models offering multiplexing capabilities or high-sensitivity detection typically require higher investment

- While prices are gradually decreasing, the perceived premium for advanced diagnostic technology can still hinder widespread adoption, especially in developing regions where budgets for rapid diagnostic tools remain limited

- Overcoming these challenges through improved affordability, user training, optimized maintenance protocols, and continued innovation in cost-efficient assay designs will be essential for sustained market expansion

Point-of-Care Immunoassay Analyzers Market Scope

The market is segmented on the basis of product type and application

- By Product Type

On the basis of product type, the Point-of-Care Immunoassay Analyzers market is segmented into Benchtop Analyzers, Portable/Handheld Analyzers, Fully-Automated Analyzers, Semi-Automated Analyzers, and Others. The Benchtop Analyzers segment dominated the largest market revenue share of 41.6% in 2025, driven by their high analytical precision, broad test menu compatibility, and suitability for medium-to-large diagnostic settings where accuracy and throughput are essential. These systems are widely used in hospital laboratories and reference centers due to their robust architecture and ability to process a high volume of immunoassay tests with minimal variability. Their integration with LIS/HIS platforms enhances workflow automation, supporting rapid clinical decision-making. The segment also benefits from rising demand for high-sensitivity biomarkers, especially in cardiac and oncology testing. Benchtop analyzers continue to gain traction as hospitals prioritize devices capable of supporting emergency diagnostics and multidisciplinary care. Growing investments in technology upgrades, including improved optical detection and reduced assay times, further reinforce dominance. Expanding adoption in emerging markets, supported by government healthcare modernization programs, strengthens the segment’s market hold.

The Portable/Handheld Analyzers segment is expected to witness the fastest CAGR of 13.8% from 2026 to 2033, driven by increasing utilization in point-of-care settings such as emergency rooms, ambulances, physician offices, and rural clinics. These compact systems provide rapid, near-patient diagnostic capabilities, enabling clinicians to initiate treatment without delays associated with lab-based testing. Advancements in microfluidics and biosensor miniaturization have significantly improved the accuracy and reliability of portable devices, making them comparable to laboratory analyzers. Rising demand for decentralized diagnostics during infectious disease outbreaks further accelerates adoption. Portable analyzers are increasingly preferred for home-based monitoring, chronic disease management, and remote testing programs. Their battery-powered mobility, low sample requirement, and connectivity with mobile apps support telemedicine integration. Manufacturers increasingly focus on developing multi-analyte portable devices, expanding their usability across multiple clinical applications. Growing adoption in low-resource settings strengthens long-term market expansion.

- By Application

On the basis of application, the Point-of-Care Immunoassay Analyzers market is segmented into Cardiac Markers, Infectious Disease Testing, Oncology Biomarkers, Endocrinology Testing, Therapeutic Drug Monitoring, and Others. The Cardiac Markers segment accounted for the largest market revenue share of 36.4% in 2025, driven by the global rise in cardiovascular disease, increasing emergency department visits, and growing need for rapid troponin and BNP/NT-proBNP testing. Point-of-care cardiac assays significantly reduce diagnostic turnaround time, enabling rapid triage and early intervention in acute coronary syndrome cases. Hospitals and emergency medical services rely heavily on POC cardiac diagnostics to improve patient outcomes and reduce hospital admissions. The increasing elderly population and rising hypertension and diabetes prevalence further elevate test demand. Technological improvements have enhanced assay precision and reproducibility, making POC cardiac tests comparable to central laboratory analyzers. Integration of cardiac POC devices with connected care platforms supports remote monitoring and data continuity across care settings. Adoption is also rising in ambulatory surgical centers and urgent care facilities seeking fast, risk-stratified decision-making.

The Infectious Disease Testing segment is expected to witness the fastest CAGR of 14.6% from 2026 to 2033, propelled by growing global outbreaks, rising public health surveillance efforts, and increasing need for rapid onsite diagnostics for conditions such as influenza, HIV, hepatitis, RSV, and emerging pathogens. Point-of-care infectious disease tests enable immediate isolation, treatment initiation, and contact tracing, crucial for controlling disease spread. Increasing government focus on decentralized diagnostics, especially in developing countries, further accelerates adoption. Technological advancements, including high-sensitivity antigen/antibody detection and multiplex POC platforms, are improving diagnostic accuracy and expanding the test menu. Adoption is rapidly rising in airports, community health centers, pharmacies, and workplace screening programs. The segment also benefits from the expansion of home-based POC test kits, driven by biotechnology innovation and increased consumer awareness. Integration with AI-driven result interpretation tools enhances usability and expands accessibility in resource-limited settings.

Point-of-Care Immunoassay Analyzers Market Regional Analysis

- North America dominated the point-of-care immunoassay analyzers market with the largest revenue share of 42.6% in 2025, characterized by advanced healthcare infrastructure, high adoption of point-of-care diagnostics, strong presence of leading medical device manufacturers, and increasing demand for rapid testing across hospitals, urgent care centers, and home-care settings

- The market experienced substantial growth in point-of-care analyzer installations, driven by technological advancements, supportive reimbursement policies, and rising use in emergency and outpatient facilities

- The region’s established laboratory networks, widespread clinical awareness, and robust R&D ecosystem further support continuous adoption of advanced immunoassay analyzers

U.S. Point-of-Care Immunoassay Analyzers Market Insight

The U.S. point-of-care immunoassay analyzers market captured the largest revenue share in 2025 within North America, fueled by growing demand for rapid, reliable testing in hospitals, clinics, and home-care settings. Increasing prevalence of chronic and infectious diseases, combined with reimbursement support for point-of-care testing, has accelerated market growth. Furthermore, ongoing technological innovations, such as high-throughput benchtop analyzers and portable devices for decentralized testing, are driving adoption across both emergency and routine care workflows.

Europe Point-of-Care Immunoassay Analyzers Market Insight

The Europe point-of-care immunoassay analyzers market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by supportive healthcare policies, increasing adoption of decentralized diagnostics, and rising prevalence of chronic and infectious diseases. Countries such as Germany, France, and the U.K. are witnessing growing demand for rapid testing solutions across hospitals, diagnostic laboratories, and outpatient clinics. The region’s emphasis on healthcare modernization, clinical efficiency, and patient-centric care is fostering adoption of advanced point-of-care immunoassay analyzers.

U.K. Point-of-Care Immunoassay Analyzers Market Insight

The U.K. point-of-care immunoassay analyzers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing need for rapid diagnostic solutions and the rising prevalence of infectious and chronic diseases. Expanding outpatient care facilities, laboratory modernization initiatives, and supportive government programs for point-of-care testing contribute to the market’s growth. Furthermore, rising awareness of early diagnosis and decentralized testing solutions is stimulating adoption across both clinical and home-based settings.

Germany Point-of-Care Immunoassay Analyzers Market Insight

The Germany point-of-care immunoassay analyzers market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing investment in healthcare infrastructure, growing emphasis on clinical efficiency, and rising demand for rapid and accurate diagnostic testing. Germany’s well-developed healthcare ecosystem, combined with increasing laboratory automation and point-of-care initiatives, supports widespread adoption of immunoassay analyzers across hospitals, specialty clinics, and home-care applications.

Asia-Pacific Point-of-Care Immunoassay Analyzers Market Insight

The Asia-Pacific Point-of-Care Immunoassay Analyzers market is expected to be the fastest-growing region during the point-of-care immunoassay analyzers market of 13.8% from 2026 to 2033. Growth is driven by expanding healthcare access, rising investments in diagnostic infrastructure, increasing prevalence of infectious and chronic diseases, and a growing focus on decentralized and home-based testing solutions. Countries such as China, India, and Japan are witnessing strong adoption due to government initiatives supporting healthcare modernization, increasing laboratory installations, and growing patient awareness for rapid diagnostics.

Japan Point-of-Care Immunoassay Analyzers Market Insight

The Japan point-of-care immunoassay analyzers market is gaining momentum due to rapid technological adoption, increasing investments in healthcare infrastructure, and a strong emphasis on early and rapid diagnostics. Rising demand for point-of-care solutions in hospitals, clinics, and home-care settings, coupled with an aging population, is driving adoption. Government support for advanced diagnostic technologies further enhances market growth in Japan.

China Point-of-Care Immunoassay Analyzers Market Insight

The China point-of-care immunoassay analyzers market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by the expanding middle class, rapid urbanization, and increasing healthcare spending. Rising prevalence of infectious and chronic diseases, combined with strong government initiatives to promote early diagnostics and decentralized healthcare, is fueling demand for point-of-care immunoassay analyzers. China’s growing healthcare infrastructure and increasing hospital and clinic installations further propel market growth in the region.

Point-of-Care Immunoassay Analyzers Market Share

The Point-of-Care Immunoassay Analyzers industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Beckman Coulter (U.S.)

- BioMerieux (France)

- Quidel Corporation (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Nova Biomedical (U.S.)

- Cepheid (U.S.)

- Samsung Medison (South Korea)

- DiaSorin (Italy)

- Biocartis (Belgium)

- LumiraDx (U.K.)

- Spectrum Diagnostics (U.S.)

- Hologic (U.S.)

Latest Developments in Global Point-of-Care Immunoassay Analyzers Market

- In May 2023, Beckman Coulter unveiled the DxI 9000 Access Immunoassay Analyzer — a next-generation immunoassay analyzer that delivers up to 215 tests/hour per square meter. The system emphasizes high throughput, sensitivity and reliability with minimal maintenance requirements, supporting laboratories facing increasing demand for faster, high-volume immunoassay testing

- In July 2025, a market-forecast update projected that the automated immunoassay analyzers market revenue — which includes POC and near-patient systems — is expected to continue expanding significantly through 2033, driven by increasing demand for point-of-care testing, rising burden of infectious and chronic diseases, and global healthcare infrastructure investments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.