Global Point Of Care Infectious Disease Market

Market Size in USD Billion

CAGR :

%

USD

18.17 Billion

USD

31.69 Billion

2024

2032

USD

18.17 Billion

USD

31.69 Billion

2024

2032

| 2025 –2032 | |

| USD 18.17 Billion | |

| USD 31.69 Billion | |

|

|

|

|

Point of Care Infectious Disease Market Size

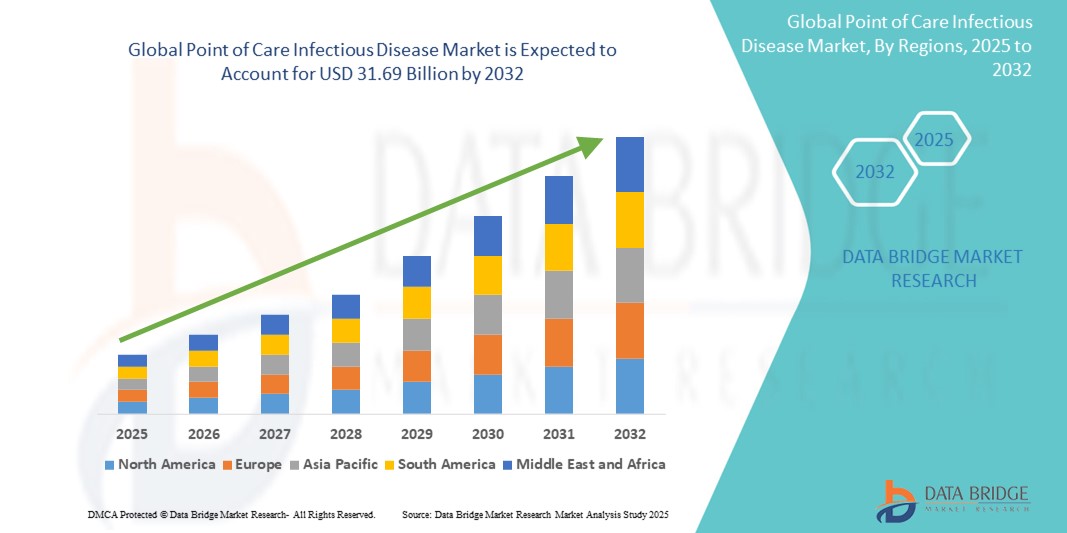

- The global point of care infectious disease market size was valued at USD 18.17 billion in 2024 and is expected to reach USD 31.69 billion by 2032, at a CAGR of 7.2% during the forecast period

- The market growth is largely fueled by the rising incidence of infectious diseases, the demand for precise diagnostic tools, and technological advancements such as molecular diagnostics and agglutination tests

- Increasing consumer awareness regarding early diagnosis and timely treatment of infectious diseases is further propelling the demand for point of care infectious disease diagnostics across various healthcare settings

Point of Care Infectious Disease Market Analysis

- The point of care infectious disease market is witnessing steady growth as more consumers and healthcare providers prioritize rapid and accurate diagnostic solutions for efficient disease management

- Growing demand from both developed and developing regions is encouraging manufacturers to innovate with high-performance, portable, and user-friendly diagnostic solutions

- North America dominates the point of care infectious disease market with the largest revenue share of 51.5% in 2024, driven by a rising number of infectious diseases and advancements in technology, coupled with advanced healthcare infrastructure

- Asia-Pacific is expected to be the fastest growing region in the point of care infectious disease market during the forecast period, driven by a rapid increase in the geriatric population, rising cases of infectious diseases, and substantial investments in healthcare infrastructure enhancement, particularly in countries such as China, India, and Southeast Asian nations

- The molecular diagnostic segment holds the largest market share of 43.5% in 2024, driven by its superior sensitivity and capability to identify multiple pathogens simultaneously. Its precision and rapid results enhance disease detection, supporting efficient clinical decision-making and advancing diagnostic technologies globally

Report Scope and Point of Care Infectious Disease Market Segmentation

|

Attributes |

Point of Care Infectious Disease Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Point of Care Infectious Disease Market Trends

“Advancements in Molecular Diagnostics and Miniaturized Devices”

- The point of care infectious disease market is increasingly favoring molecular diagnostic technologies due to their high accuracy, sensitivity, and rapid turnaround times for detecting pathogens

- Miniaturized and portable diagnostic devices are becoming prevalent, enabling testing at or near the patient's bedside, in remote locations, and even for home-based care

- These advancements facilitate quick diagnosis and immediate treatment initiation, particularly crucial in managing infectious disease outbreaks

- For instance, the development of rapid PCR tests and lab-on-a-chip technologies has significantly expanded the capabilities of POC infectious disease testing

- In high-burden regions such as Sub-Saharan Africa, molecular POC tests are favored for detecting diseases such as HIV and TB, reducing diagnostic turnaround time

- Clinics and hospitals are incorporating molecular POC testing as a standard for infectious disease management

Point of Care Infectious Disease Market Dynamics

Driver

“Rising Demand for Rapid and Accessible Diagnostics”

- Growing awareness of the importance of early diagnosis for infectious diseases, such as HIV, TB, and respiratory infections, is increasing demand for POC testing solutions

- POC tests reduce diagnostic delays, enabling faster treatment and improved patient outcomes, particularly in resource-limited settings

- These tests enhance accessibility in remote areas, reducing the burden on centralized laboratories and improving disease management in regions such as India and Africa

- Healthcare providers are partnering with diagnostic companies to integrate POC testing into routine care

- For instance, Abbott’s ID NOW platform provides rapid molecular testing for influenza and COVID-19, enhancing diagnostic efficiency

- The rise of antimicrobial resistance, such as MRSA, is further driving demand for rapid diagnostics to guide targeted treatments

Restraint/Challenge

“Regulatory and Reimbursement Challenges”

- Stringent regulatory requirements for POC diagnostic devices can delay market entry and increase development costs for manufacturers

- Variability in reimbursement policies across countries complicates market expansion, particularly for high-cost molecular diagnostic tests

- Limited sensitivity of some POC tests compared to laboratory-based methods may raise concerns about accuracy in critical cases

- For instance, some rapid antigen tests for infectious diseases face scrutiny for false negatives, limiting their adoption in certain settings

- These challenges discourage widespread adoption and may limit market growth in regions with underdeveloped healthcare systems

Point of Care Infectious Disease Market Scope

The market is segmented on the basis of technological offering, clinical application, disease, and end users.

- By Technology Offering

On the basis of technological offering, the global point of care infectious disease market is segmented into molecular diagnostic, solid phase, lateral flow, agglutination assays, and flow-through. The molecular diagnostic segment holds the largest market share of 43.5% in 2024, driven by its superior sensitivity and capability to identify multiple pathogens simultaneously. Its precision and rapid results enhance disease detection, supporting efficient clinical decision-making and advancing diagnostic technologies globally.

The lateral flow segment is expected to witness the fastest growth rate of 6.2% from 2025 to 2032, due to its cost-effectiveness, user-friendly design, and increasing adoption in resource-limited environments. Its rapid results and minimal infrastructure needs further drive market expansion.

- By Clinical Application

On the basis of clinical application, the global point of care infectious disease market is segmented into tropical diseases, inflammatory diseases, liver disorders, HIV, respiratory disorders, HAIs, sexually transmitted diseases, and others. The respiratory disorders segment is projected to hold the largest market revenue share in 2025, primarily due to the high global prevalence of respiratory infections such as influenza, RSV, and COVID-19 diagnostics and the critical need for rapid diagnosis to prevent widespread transmission. The demand for immediate results in emergency settings and primary care for conditions such as pneumonia and bronchitis further solidifies its leading position.

The HIV segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by global initiatives for early HIV diagnosis, increased awareness programs, and advancements in point-of-care testing technologies. The push for accessible testing in remote areas, coupled with the long-term management requirements for HIV, necessitates convenient and rapid diagnostic solutions that POC tests offer. The expansion of testing in antenatal care and at-risk populations also contributes significantly to this growth.

- By Disease

On the basis of disease, the global point of care infectious disease market is segmented into Hepatitis B Virus, Pneumonia/ Streptococcus Associated Infections, Influenza, Clostridium Difficile Infections, Hepatitis C Virus, CDI, MRSA, and TB. The Influenza segment is expected to account for the largest market revenue share in 2025, owing to the seasonal outbreaks and high global incidence of influenza, necessitating widespread and rapid testing to inform public health responses and initiate timely treatment. The availability of effective antiviral therapies further emphasizes the need for quick diagnosis to minimize disease burden.

The Tuberculosis (TB) segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by the persistent global health burden of TB, especially in developing regions, and the urgent need for rapid, accurate diagnostics to curb its spread. Innovations in molecular point-of-care tests that can detect drug-resistant TB strains are crucial drivers, supporting global efforts for TB elimination and effective patient management.

- By End Users

On the basis of end users, the global point of care infectious disease market is segmented into hospitals, nursing home, home-care, clinics, diagnostic and research laboratories, and others. The hospitals segment is projected to hold the largest market revenue share in 2025, driven by the high volume of patient admissions, the need for rapid diagnosis in emergency departments, and the increasing prevalence of healthcare-associated infections. Hospitals serve as central hubs for complex diagnostic procedures and have the infrastructure to integrate various POC testing platforms.

The home-care segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing preference for home-based healthcare, advancements in user-friendly POC devices, and the increasing aging population. The convenience of at-home testing, coupled with the ability to remotely monitor chronic conditions and infectious diseases, makes home-care a rapidly expanding segment. The development of connected health devices and telemedicine further supports this growth.

Point of Care Infectious Disease Market Regional Analysis

- North America dominates the point of care infectious disease market with the largest revenue share of 51.5% in 2024, driven by a rising number of infectious diseases and advancements in technology, coupled with advanced healthcare infrastructure

- Consumers and healthcare providers prioritize POC tests for enhancing rapid diagnosis, facilitating timely treatment, and contributing to overall public health, especially with the high incidence of various infectious diseases

- Growth is supported by advancements in diagnostic technologies and rising adoption in both clinical and home care settings

U.S. Point of Care Infectious Disease Market Insight

The U.S. is expected to dominate the North America point of care infectious disease market with the highest revenue share, fueled by strong demand for rapid and accurate diagnostic solutions and growing consumer awareness of the benefits of early disease detection. The trend towards decentralized healthcare and increasing regulatory support for point of care tests further boost market expansion. The growing incorporation of advanced molecular and immunoassay technologies by manufacturers complements the market growth.

Europe Point of Care Infectious Disease Market Insight

The Europe point of care infectious disease market is expected to witness significant growth, supported by regulatory emphasis on disease surveillance and rapid intervention strategies. Consumers and healthcare professionals seek tests that improve diagnostic turnaround times while offering high accuracy. The growth is prominent in both hospital and primary care settings, with countries such as Germany and France showing significant uptake due to rising public health concerns and the need for efficient disease management.

U.K. Point of Care Infectious Disease Market Insight

The U.K. market for point of care infectious disease is expected to witness strong growth, driven by demand for improved diagnostic accessibility and rapid results in urban and suburban settings. Increased interest in public health initiatives and rising awareness of early detection benefits encourage adoption. In addition, evolving healthcare policies and investments in decentralized testing influence consumer choices, balancing test accuracy with convenience.

Germany Point of Care Infectious Disease Market Insight

Germany is expected to witness significant growth in point of care infectious disease diagnostics, attributed to its advanced healthcare infrastructure and high consumer focus on efficient and precise diagnostics. German healthcare providers prefer technologically advanced tests that enable quick and reliable identification of pathogens. The integration of these tests in hospitals, clinics, and emergency settings supports sustained market growth.

Asia-Pacific Point of Care Infectious Disease Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding healthcare infrastructure and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of infectious disease prevention, rapid diagnosis, and accessible healthcare solutions is boosting demand. Government initiatives promoting public health and disease surveillance further encourage the use of advanced POC infectious disease tests.

Japan Point of Care Infectious Disease Market Insight

Japan's point of care infectious disease market is expected to witness strong growth due to robust consumer preference for high-quality, technologically advanced diagnostic tests that enhance patient care and public health safety. The presence of major diagnostic manufacturers and integration of POC tests in clinical settings accelerate market penetration. Rising interest in early disease detection and personalized medicine also contributes to growth.

China Point of Care Infectious Disease Market Insight

The China holds a significant share of the Asia-Pacific point of care infectious disease market, propelled by rapid urbanization, increasing healthcare expenditure, and rising demand for rapid and accessible diagnostic solutions. The country's growing middle class and focus on improving healthcare accessibility support the adoption of advanced POC infectious disease tests. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Point of Care Infectious Disease Market Share

The point of care infectious disease industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- PTS Diagnostics (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Samsung Medison Co., Ltd. (South Korea)

- Bio-Rad Laboratories, Inc. (U.S.)

- The Menarini Group (Italy)

- Nova Biomedical (U.S.)

- AccuBioTech Co., Ltd. (China)

- BD (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- Danaher Corporation (U.S.)

- EKF DIAGNOSTICS HOLDINGS PLC (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- Siemens (Germany)

Latest Developments in Global Point of Care Infectious Disease Market

-

In January 2025, Abbott launched a new lateral flow assay for rapid HIV detection, focusing on low-resource settings in Africa and Asia. This high-sensitivity test delivers quick and reliable results, enhancing early diagnosis and treatment accessibility. Designed for cost-effectiveness, it supports widespread adoption in community healthcare programs. The innovation strengthens Abbott’s presence in the global point-of-care (POC) market, reinforcing its commitment to affordable and scalable diagnostic solutions

- In March 2024, bioMérieux secured U.S. FDA clearance and a CLIA waiver for its BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel, reinforcing its leadership in respiratory infection diagnostics. This multiplex PCR test detects up to 15 common pathogens in about 15 minutes, enabling rapid and accurate diagnoses. The approval enhances bioMérieux’s competitive edge, allowing broader clinical adoption in urgent care, pharmacies, and outpatient settings. By streamlining syndromic testing, the panel supports antimicrobial stewardship and modernized patient care

- In January 2024, Roche acquired LumiraDx’s point-of-care technology, integrating its advanced immunoassay and clinical chemistry platform into its diagnostics portfolio. This acquisition enhances Roche’s capabilities in decentralized patient care, expanding access to rapid and accurate testing in primary care settings. LumiraDx’s multi-assay system consolidates various tests on a single instrument, streamlining workflows and improving diagnostic efficiency. Roche aims to leverage this technology to advance molecular testing, supporting global healthcare accessibility

- In February 2023, Thermo Fisher Scientific partnered with Mylab Discovery Solutions to introduce made-in-India RT-PCR kits for infectious disease diagnostics. This collaboration enhances accessibility and affordability, targeting a broader population in India and globally. The kits, licensed by CDSCO, support rapid and accurate detection of tuberculosis, hepatitis, HIV, and other diseases. By leveraging advanced molecular diagnostics, the partnership aims to strengthen healthcare infrastructure and meet disease elimination targets

- In November 2022, LumiraDx Healthcare introduced its highly sensitive C-Reactive Protein (CRP) point-of-care antigen test across India, aiming to combat antimicrobial resistance (AMR). This rapid diagnostic tool delivers results within four minutes using a finger-prick blood sample, enabling clinicians to make informed antibiotic decisions. By reducing unnecessary prescriptions, the test supports AMR stewardship programs and enhances patient care in ICUs, pediatric departments, emergency rooms, and outpatient clinics. The launch aligns with India’s healthcare priorities, ensuring effective infection management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.