Global Point Of Care Poc Hematology And Flow Cytometry Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

7.18 Billion

2025

2033

USD

3.92 Billion

USD

7.18 Billion

2025

2033

| 2026 –2033 | |

| USD 3.92 Billion | |

| USD 7.18 Billion | |

|

|

|

|

Point of Care (POC) Hematology and Flow Cytometry Market Size

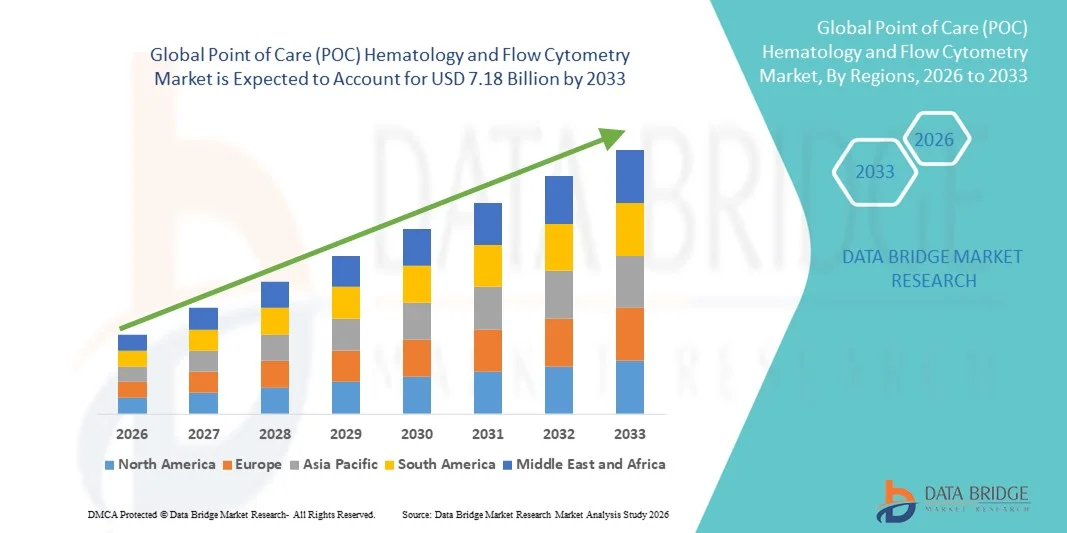

- The global point of care (POC) hematology and flow cytometry market size was valued at USD 3.92 billion in 2025 and is expected to reach USD 7.18 billion by 2033, at a CAGR of 7.86% during the forecast period

- The market growth is largely fueled by the increasing adoption of rapid diagnostic solutions and technological advancements in hematology and flow cytometry, enabling faster, accurate, and decentralized patient testing across hospitals, clinics, and diagnostic centers

- Furthermore, rising demand for point-of-care testing, early disease detection, and streamlined laboratory workflows is driving the adoption of advanced POC hematology and flow cytometry solutions, thereby significantly boosting the market's growth

Point of Care (POC) Hematology and Flow Cytometry Market Analysis

- Point-of-care hematology and flow cytometry devices, offering rapid and accurate blood analysis at the patient’s location, are increasingly vital components in both clinical and research settings due to their enhanced diagnostic efficiency, portability, and integration with healthcare IT systems

- The escalating demand for point-of-care hematology and flow cytometry solutions is primarily fueled by the rising prevalence of hematological disorders, increasing adoption of decentralized testing, and the need for faster, real-time diagnostic results in hospitals, clinics, and ambulatory care centers

- North America dominated the point of care (POC) hematology and flow cytometry market with the largest revenue share of approximately 38.7% in 2025, driven by the early adoption of advanced diagnostic technologies, a strong presence of key industry players, and high healthcare expenditure. The U.S., in particular, is witnessing substantial growth in POC hematology and flow cytometry installations across hospitals, clinics, and diagnostic centers, fueled by innovations in compact analyzers, automated workflows, and AI-assisted data interpretation

- Asia-Pacific is expected to be the fastest-growing region in the point of care (POC) hematology and flow cytometry market during the forecast period, registering a CAGR of around 10.5%. Growth in this region is supported by increasing healthcare infrastructure investments, rising prevalence of chronic diseases, growing awareness of early diagnostics, and expanding adoption of POC testing in emerging economies such as China and India

- The Cell-Based Flow Cytometry segment accounted for the largest market revenue share of 52.1% in 2025, owing to its widespread application in clinical diagnostics, immunophenotyping, oncology, and stem cell research. Hospitals and clinics rely on cell-based systems for precise cell counting, sorting, and characterization, which enhances patient management and therapy monitoring

Report Scope and Point of Care (POC) Hematology and Flow Cytometry Market Segmentation

|

Attributes |

Point of Care (POC) Hematology and Flow Cytometry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Point of Care (POC) Hematology and Flow Cytometry Market Trends

Advancements in Rapid Diagnostic and Flow Cytometry Technologies

- A significant and accelerating trend in the global point of care (POC) hematology and flow cytometry market is the increasing adoption of compact, rapid, and user-friendly diagnostic devices. These innovations are enabling faster test results, improving clinical decision-making, and expanding testing accessibility in decentralized healthcare settings

- For instance, companies such as Abbott and Sysmex have introduced portable POC hematology analyzers capable of delivering complete blood counts within minutes, allowing healthcare providers to initiate timely interventions in emergency and remote care environments

- There is a growing integration of multiplex flow cytometry systems in POC testing, enabling simultaneous analysis of multiple cellular markers, which improves diagnostic accuracy and efficiency.

- Furthermore, the development of miniaturized microfluidic platforms and automated sample preparation modules is enhancing the portability, speed, and reliability of POC hematology and flow cytometry devices

- The increasing emphasis on early disease detection, personalized patient management, and rapid monitoring of treatment response is driving healthcare providers to adopt advanced POC systems

- These technological advancements are facilitating decentralized healthcare delivery, particularly in resource-limited or outpatient settings, improving patient outcomes and operational efficiency

Point of Care (POC) Hematology and Flow Cytometry Market Dynamics

Driver

Rising Demand for Rapid and Accurate Diagnostics

- The growing need for quick and reliable blood testing and immune profiling is a major driver for the Point of Care (POC) Hematology and Flow Cytometry market

- For instance, in June 2024, Abbott launched the Alinity POC system, designed to provide rapid hematology testing in outpatient clinics and small hospitals, supporting faster clinical decisions and reducing patient wait times

- The increasing prevalence of chronic diseases such as anemia, leukemia, and immunological disorders is fueling demand for frequent and precise blood analysis

- In addition, the expansion of home healthcare services and outpatient testing facilities is increasing the adoption of portable hematology and flow cytometry devices

- Healthcare providers are increasingly seeking solutions that combine efficiency, accuracy, and ease of use, particularly in emergency and remote care settings, further propelling market growth

Restraint/Challenge

High Device Costs and Regulatory Barriers

- The high cost of advanced POC hematology and flow cytometry systems remains a significant barrier for widespread adoption, especially among small clinics and healthcare facilities in developing regions

- For instance, the integration of multi-parameter flow cytometry in portable analyzers often results in premium pricing, which may limit procurement in budget-conscious settings

- Strict regulatory requirements for device approval, including compliance with FDA, CE, and other regional standards, can delay product launches and increase development costs

- In addition, the need for trained personnel to operate and maintain these sophisticated devices may restrict their use in decentralized or rural healthcare settings

- Addressing these challenges through cost-effective designs, simplified user interfaces, and broader training initiatives will be critical for sustainable market expansion and adoption worldwide

Point of Care (POC) Hematology and Flow Cytometry Market Scope

The market is segmented on the basis of product type, technology and end user.

- By Product Type

On the basis of product type, the Point of Care (POC) Hematology and Flow Cytometry market is segmented into Flow Cytometry Instruments, Reagents and Consumables, and Accessories. The Flow Cytometry Instruments segment dominated the market with a revenue share of 46.8% in 2025, driven by the increasing adoption of automated hematology analyzers and multiparameter flow cytometers in hospitals, clinics, and research centers. Instruments enable rapid, accurate cellular analysis, essential for diagnosing hematological disorders, monitoring therapy, and conducting research. Hospitals and clinics prefer instruments for immunophenotyping, oncology, and infectious disease testing due to their high throughput and reproducibility. Technological advancements, such as miniaturized and portable instruments, allow bedside testing and decentralized diagnostics. Integration with data analysis software improves efficiency, workflow, and reporting. Rising prevalence of blood disorders and early detection initiatives fuel demand. Expansion of POC hematology in emerging markets further drives growth. Academic and research laboratories increasingly adopt instruments for translational research and clinical trials. Government initiatives promoting advanced diagnostics support segment growth. Continuous product upgrades and innovation maintain dominance. Versatility, reliability, and compatibility with digital healthcare systems strengthen adoption.

The Reagents and Consumables segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, fueled by recurring demand for antibodies, staining kits, tubes, and other consumables essential for every test. Growth is driven by increasing prevalence of hematological disorders, rising clinical trials, and expanding research activities in biotechnology and pharmaceutical sectors. Laboratories and research centers favor standardized reagents for accuracy, regulatory compliance, and reproducibility. Innovations in multi-color staining panels and optimized formulations improve sensitivity and efficiency. Adoption of POC diagnostics in decentralized and bedside testing environments boosts demand. Collaborations between reagent suppliers and instrument manufacturers further accelerate growth. Quick setup kits and user-friendly consumables enhance adoption in clinical and academic laboratories. R&D pipelines in immunology, oncology, and stem cell research increase recurring consumption. Expansion of healthcare infrastructure globally supports segment growth. Increasing focus on personalized medicine and biomarker testing drives further demand. The recurring nature of consumables ensures sustainable revenue and strengthens its fastest-growing position.

- By Technology

On the basis of technology, the market is segmented into Bead-Based Flow Cytometry and Cell-Based Flow Cytometry. The Cell-Based Flow Cytometry segment accounted for the largest market revenue share of 52.1% in 2025, owing to its widespread application in clinical diagnostics, immunophenotyping, oncology, and stem cell research. Hospitals and clinics rely on cell-based systems for precise cell counting, sorting, and characterization, which enhances patient management and therapy monitoring. The technology enables rapid bedside analysis, making it essential for POC hematology testing. Integration with automated systems reduces errors, improves workflow, and accelerates result turnaround. Rising prevalence of hematological disorders and growing demand for personalized medicine contribute to adoption. Academic and research institutions increasingly use cell-based technology for translational research, vaccine development, and drug discovery. Compatibility with multiplexed assays improves laboratory efficiency. Government initiatives promoting advanced diagnostics support market penetration. Emerging markets show increasing uptake due to improving healthcare infrastructure. Continuous technological upgrades maintain accuracy, throughput, and reproducibility. Hospitals and research centers favor cell-based systems for their versatility across multiple applications. High reliability and efficiency ensure its dominating position.

The Bead-Based Flow Cytometry segment is projected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by increasing applications in multiplex immunoassays, cytokine profiling, and high-throughput drug screening. Researchers prefer bead-based technology for its rapid, high-sensitivity analysis using minimal sample volumes. Growth is fueled by expanding biotechnology and pharmaceutical R&D and clinical trials. The technology enables simultaneous detection of multiple biomarkers, saving time and resources. Adoption in POC testing environments and research laboratories is growing rapidly. Continuous innovations in bead chemistries and assay panels enhance accuracy and reproducibility. Pharmaceutical companies increasingly use bead-based systems for immunotherapy and vaccine development. Collaborations between instrument and assay developers accelerate adoption. The technology is suitable for both centralized labs and decentralized POC settings. Its role in personalized medicine and translational research drives demand. Recurring reagent and consumable consumption ensures sustainable growth. Global expansion of high-throughput testing strengthens its market position.

- By End User

On the basis of end user, the market is segmented into Biotechnology and Pharmaceutical Companies, Hospitals, Clinics, Research Centers, Clinical Testing Laboratories, Academics, and Others. The Hospitals and Clinics segment held the largest market revenue share of 48.5% in 2025, driven by the increasing adoption of POC hematology and flow cytometry instruments for rapid bedside testing. Hospitals rely on these technologies for early detection of blood disorders, immunophenotyping, oncology diagnostics, and therapy monitoring. Integration with electronic medical record systems enhances workflow and patient management. The segment benefits from rising healthcare infrastructure investments and government initiatives promoting advanced diagnostics. Academic hospitals and research centers adopt POC instruments for translational studies and clinical trials. Hospitals value high-throughput instruments and accurate reagents for reliable results. Expansion in emerging markets supports adoption. Growing awareness of personalized medicine and precision diagnostics drives uptake. Continuous technological improvements in instruments and software maintain dominance. Hospitals favor solutions that reduce turnaround time and increase diagnostic accuracy. Recurring consumption of reagents and consumables ensures stable revenue. The segment’s critical role in patient care strengthens its leading position.

The Biotechnology and Pharmaceutical Companies segment is expected to witness the fastest CAGR of 20.2% from 2026 to 2033, driven by rising R&D activities, drug discovery pipelines, and clinical trials requiring high-throughput cellular analysis. Companies adopt flow cytometry and POC hematology solutions for screening compounds, analyzing cellular responses, and developing immunotherapies. The recurring demand for reagents, consumables, and instrument upgrades in research applications accelerates revenue growth. Innovations in bead-based and cell-based technologies support faster and more sensitive analysis. Growing adoption of personalized medicine and biomarker testing drives increased usage. Integration with automated systems and data analytics enhances laboratory efficiency. Expansion of biotech and pharmaceutical research in emerging markets further fuels demand. Collaborations with instrument and reagent manufacturers strengthen capabilities. Shorter drug development timelines increase reliance on POC diagnostics. Increasing investments in immunology and oncology research drive growth. The segment benefits from regulatory support for advanced R&D initiatives. Recurring consumption and critical role in product development make it the fastest-growing end-user segment.

Point of Care (POC) Hematology and Flow Cytometry Market Regional Analysis

- North America dominated the point of care (POC) hematology and flow cytometry market with the largest revenue share of approximately 38.7% in 2025

- Driven by the early adoption of advanced diagnostic technologies, a strong presence of key industry players, and high healthcare expenditure

- The market, in particular, is witnessing substantial growth in POC hematology and flow cytometry installations across hospitals, clinics, and diagnostic centers, fueled by innovations in compact analyzers, automated workflows, and AI-assisted data interpretation

U.S. Point of Care (POC) Hematology and Flow Cytometry Market Insight

The U.S. point of care (POC) hematology and flow cytometry market is experiencing strong growth and is expected to continue expanding significantly over the coming years. This growth is supported by the increasing prevalence of chronic and hematological conditions, advancing diagnostic technologies, and a strong healthcare infrastructure that facilitates rapid adoption of point‑of‑care diagnostic tools.

Europe Point of Care (POC) Hematology and Flow Cytometry Market Insight

The Europe point of care (POC) hematology and flow cytometry market is projected to expand at a substantial CAGR throughout the forecast period, supported by increasing investments in healthcare infrastructure, the rising demand for rapid diagnostics, and the presence of a well-established network of hospitals and diagnostic laboratories. The region is experiencing notable growth across both clinical and research applications.

U.K. Point of Care (POC) Hematology and Flow Cytometry Market Insight

The U.K. point of care (POC) hematology and flow cytometry market is expected to grow at a significant CAGR during the forecast period, driven by rising adoption of POC diagnostics in hospitals, clinics, and research centers, along with government initiatives promoting early detection of hematological disorders and flow cytometry applications.

Germany Point of Care (POC) Hematology and Flow Cytometry Market Insight

Germany’s point of care (POC) hematology and flow cytometry market is expected to expand steadily, fueled by a robust healthcare system, advanced laboratory infrastructure, and ongoing investments in automation and AI-assisted diagnostic platforms. Increasing prevalence of chronic and hematological diseases is also supporting demand for POC hematology and flow cytometry devices.

Asia-Pacific Point of Care (POC) Hematology and Flow Cytometry Market Insight

Asia-Pacific point of care (POC) hematology and flow cytometry market is expected to be the fastest-growing region in the Point of Care (POC) Hematology and Flow Cytometry market during the forecast period, registering a CAGR of around 10.5%. Growth in this region is supported by increasing healthcare infrastructure investments, rising prevalence of chronic diseases, growing awareness of early diagnostics, and expanding adoption of POC testing in emerging economies such as China and India.

Japan Point of Care (POC) Hematology and Flow Cytometry Market Insight

Japan’s point of care (POC) hematology and flow cytometry market is gaining momentum due to its technologically advanced healthcare infrastructure, emphasis on preventive care, and growing adoption of compact, automated POC hematology and flow cytometry analyzers in hospitals and clinical laboratories.

China Point of Care (POC) Hematology and Flow Cytometry Market Insight

China point of care (POC) hematology and flow cytometry market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by the expanding healthcare infrastructure, rising middle-class population, rapid urbanization, and increasing adoption of POC hematology and flow cytometry devices across hospitals, clinics, and diagnostic centers. Government initiatives supporting early diagnostics and digital healthcare solutions are also contributing to market growth.

Point of Care (POC) Hematology and Flow Cytometry Market Share

The Point of Care (POC) Hematology and Flow Cytometry industry is primarily led by well-established companies, including:

• Abbott (U.S.)

• Sysmex Corporation (Japan)

• Bio-Rad Laboratories (U.S.)

• Beckman Coulter (U.S.)

• Siemens Healthineers (Germany)

• Ortho Clinical Diagnostics (U.S.)

• HemoCue AB (Sweden)

• BD (Becton, Dickinson and Company) (U.S.)

• Horiba Ltd. (Japan)

• Nova Biomedical (U.S.)

• Abacus Diagnostics (U.S.)

• Instrumentation Laboratory (U.S.)

• DiaSys Diagnostic Systems (Germany)

• Partec GmbH (Germany)

• Mindray Medical (China)

• Fresenius Kabi (Germany)

• Quidel Corporation (U.S.)

• Accelix Inc. (U.S.)

• Thermo Fisher Scientific (U.S.)

• Orion Diagnostica (Finland)

Latest Developments in Global Point of Care (POC) Hematology and Flow Cytometry Market

- In August 2023, PixCell Medical announced that its HemoScreen point‑of‑care Complete Blood Count (CBC) analyzer received enhanced FDA 510(k) clearance for direct capillary (finger‑prick) sampling, significantly simplifying blood collection at the point of care and enabling rapid hematology testing outside traditional laboratory settings. The device offers a five‑part differential CBC in minutes using microfluidics and AI‑powered imaging, expanding rapid hematology diagnostics in decentralized care

- In January 2024, PixCell Medical entered strategic distribution agreements with major healthcare distributors (Medline, Henry Schein, and Thermo Fisher Scientific) to broaden access to the HemoScreen POC CBC analyzer across the United States, enhancing market penetration and availability of rapid hematology testing solutions in clinics, emergency departments, and laboratories

- In May 2024, Agilent Technologies launched the NovoCyte Opteon spectral flow cytometer, a next‑generation full‑spectrum flow cytometry system featuring three to five lasers and advanced detector arrays designed for deeper immunophenotyping and high‑dimensional cell analysis, significantly advancing flow cytometry capabilities for research and clinical applications

- In September 2024, flow cytometry technology adoption expanded globally with the Agilent NovoCyte Opteon becoming available in the Australia and New Zealand market, bringing advanced spectral flow cytometry solutions to new regional research and clinical users and supporting broader use of multiparameter cell analysis

- In March 2025, Beckman Coulter Life Sciences announced the launch of the CytoFLEX Mosaic Spectral Detection Module, positioning the industry’s first modular spectral capability upgrade for existing flow cytometry instruments, enabling flexible multi‑color analysis and improving throughput and data quality for POC and lab workflows

- In May 2025, Becton, Dickinson and Company (BD) introduced a new high‑parameter flow cytometry cell analyzer that combines advanced spectral capabilities with real‑time cell imaging technologies, aiming to deliver deeper phenotyping and automated data analysis for complex clinical diagnostics and POC research workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.