Global Point Of Sale Pos Display Market

Market Size in USD Billion

CAGR :

%

USD

13.02 Billion

USD

25.32 Billion

2024

2032

USD

13.02 Billion

USD

25.32 Billion

2024

2032

| 2025 –2032 | |

| USD 13.02 Billion | |

| USD 25.32 Billion | |

|

|

|

|

What is the Global Point of Sale (PoS) Display Market Size and Growth Rate?

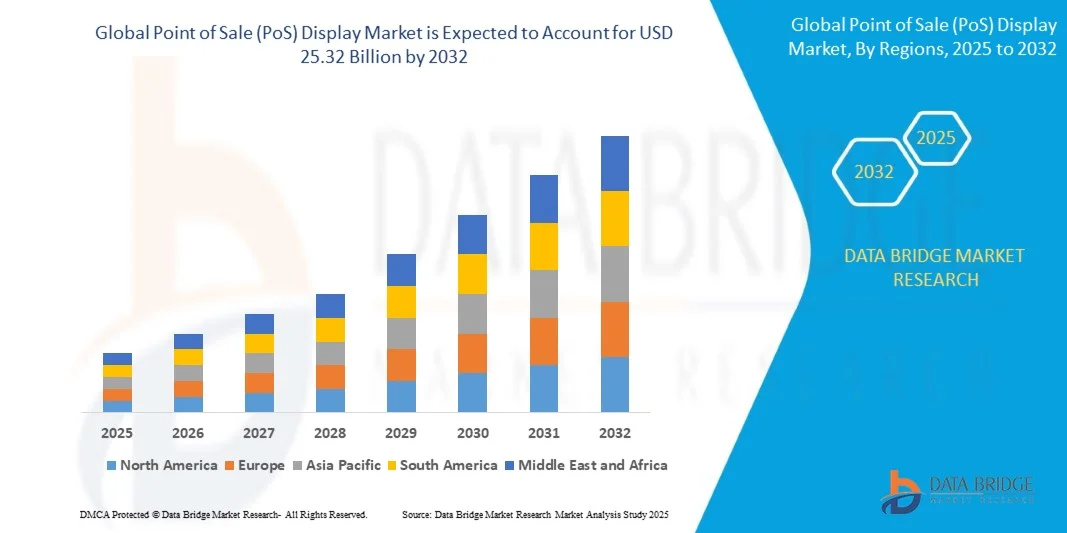

- The global Point of Sale (PoS) Display market size was valued at USD 13.02 billion in 2024 and is expected to reach USD 25.32 billion by 2032, at a CAGR of 8.67% during the forecast period

- The market expansion is primarily driven by the increasing adoption of retail automation technologies, the rise in modern trade formats such as supermarkets and hypermarkets, and the growing emphasis on visual merchandising to enhance in-store consumer engagement

- Furthermore, the rising trend of digitally enhanced retail environments and the shift toward sustainable display materials are encouraging brands and retailers to invest in innovative PoS display solutions, contributing significantly to global market growth

What are the Major Takeaways of Point of Sale (PoS) Display Market?

- Point of Sale (PoS) Displays play a crucial role in retail marketing and product visibility, helping brands influence purchasing decisions directly at the point of sale through visually appealing and strategically positioned display units

- The demand for customized and interactive PoS displays is growing rapidly, as brands increasingly focus on enhancing consumer engagement and brand recall through innovative designs, digital screens, and smart display technologies

- In addition, the shift toward eco-friendly materials and lightweight, recyclable display structures is reshaping the industry, with manufacturers adopting sustainable practices to align with global environmental regulations and corporate social responsibility initiatives

- North America dominated the Point of Sale (PoS) Display market with the largest revenue share of 34.6% in 2024, driven by the strong presence of organized retail chains, increasing adoption of digital displays, and the growing emphasis on in-store marketing effectiveness

- The Asia-Pacific (APAC) PoS Display market is projected to grow at the fastest CAGR of 9.8% from 2025 to 2032, fueled by rapid urbanization, the expansion of organized retail, and rising consumer spending in countries such as China, Japan, and India

- The floor display segment dominated the Point of Sale (PoS) Display market with the largest market revenue share of 38.4% in 2024, attributed to its widespread use in supermarkets, hypermarkets, and retail stores for promoting new or seasonal products

Report Scope and Point of Sale (PoS) Display Market Segmentation

|

Attributes |

Point of Sale (PoS) Display Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Point of Sale (PoS) Display Market?

“Enhanced Customer Engagement Through AI and Data-Driven Personalization”

- A major trend shaping the global point of sale (PoS) display market is the integration of artificial intelligence (AI) and data analytics to deliver more personalized and dynamic in-store experiences. Retailers are leveraging AI-powered PoS displays to analyze customer behavior and optimize content delivery in real time

- For instance, Samsung Electronics introduced AI-enabled digital signage systems that tailor promotional messages based on demographic and behavioral insights. Similarly, Panasonic Corporation offers smart PoS displays that use AI to adjust product advertisements according to audience profiles

- This trend enhances consumer engagement by providing interactive, context-aware displays that promote relevant products and improve decision-making. Integration with computer vision and facial recognition also enables automated inventory management and customer sentiment analysis

- In addition, cloud-based connectivity allows retailers to remotely update content and monitor performance across multiple locations, making operations more efficient. This convergence of AI, analytics, and cloud connectivity is revolutionizing how businesses communicate with customers at the point of purchase

- The growing emphasis on data-driven marketing and immersive retail experiences is expected to accelerate the adoption of intelligent PoS displays globally, transforming traditional retail environments into dynamic, customer-centric spaces

What are the Key Drivers of Point of Sale (PoS) Display Market?

- The rising demand for enhanced brand visibility and effective in-store marketing is a key driver of the point of sale (PoS) display market. Retailers and brands are investing in innovative display technologies to attract customers and boost impulse purchases

- For instance, in February 2024, LG Display unveiled advanced transparent OLED displays designed for retail environments, allowing brands to combine physical and digital advertising seamlessly

- The shift toward omnichannel retail strategies integrating online and offline experiences is encouraging brands to deploy digital PoS displays for consistent customer engagement. Moreover, the rise of retail automation and smart stores is further boosting demand for interactive, sensor-equipped displays

- Increasing adoption of eco-friendly materials and modular display systems also supports market growth, as brands focus on sustainability and flexibility in store design

- In addition, growing investments in retail digitization, coupled with rising consumer expectations for personalized shopping experiences, are fueling the global expansion of the PoS Display market across supermarkets, hypermarkets, and convenience stores

Which Factor is Challenging the Growth of the Point of Sale (PoS) Display Market?

- One of the major challenges facing the Point of Sale (PoS) Display market is the high implementation and maintenance cost associated with advanced digital and interactive display systems. Small and medium retailers often struggle to justify the investment due to limited budgets and uncertain ROI

- For instance, installation of smart PoS displays with integrated sensors and AI-driven analytics can significantly increase operational costs, particularly in developing regions

- Another critical issue is data security and privacy, as connected PoS displays collect and process customer information. Any data breach can damage brand reputation and deter consumer trust

- Furthermore, supply chain disruptions and fluctuating costs of display components such as semiconductors and OLED panels have also impacted production timelines and pricing

- To overcome these challenges, manufacturers are focusing on cost optimization, enhanced cybersecurity frameworks, and the development of energy-efficient, durable, and affordable PoS display solutions, which will be key to sustaining long-term market growth

How is the Point of Sale (PoS) Display Market Segmented?

The Point of Sale (PoS) Display market is segmented on the basis of type, material, application, and end-user industry.

• By Type

On the basis of type, the market is segmented into floor displays, countertop displays, pallet displays, digital displays, and others. The floor display segment dominated the Point of Sale (PoS) Display market with the largest market revenue share of 38.4% in 2024, attributed to its widespread use in supermarkets, hypermarkets, and retail stores for promoting new or seasonal products. Their high visibility and ability to influence impulse purchases make them a preferred choice among retailers.

The digital display segment is expected to witness the fastest CAGR of 10.6% from 2025 to 2032, driven by the growing integration of digital signage and interactive screens. These displays allow real-time content updates and enhance brand engagement through dynamic advertising, significantly improving in-store marketing efficiency.

• By Material

On the basis of material, the market is segmented into corrugated board, plastic, metal, glass, and wood. The corrugated board segment held the largest market share in 2024, owing to its low cost, recyclability, and flexibility in design customization. It remains the preferred choice for temporary retail displays and promotional campaigns.

The plastic segment is projected to register the fastest CAGR from 2025 to 2032, supported by its durability, light weight, and ability to create permanent PoS structures. Plastic displays are gaining popularity for long-term branding due to their modern aesthetic and resistance to wear and tear.

• By Application

On the basis of application, the market is segmented into retail stores, supermarkets/hypermarkets, convenience stores, specialty stores, and others. The supermarkets/hypermarkets segment accounted for the largest market revenue share in 2024, driven by large product assortments and the need for effective in-store promotions to boost impulse purchases.

The convenience store segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the expansion of urban convenience chains and the need for compact, space-efficient display solutions.

• By End-User Industry

On the basis of end-user industry, the market is segmented into food & beverages, cosmetics & personal care, pharmaceuticals, electronics, automotive, and others. The food & beverages segment held the largest market share in 2024, as PoS displays play a key role in driving quick purchase decisions and promoting new product launches. Brands use eye-catching displays to attract attention in competitive retail environments.

The cosmetics & personal care segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by premiumization trends and the need for visually appealing product presentations that align with luxury brand aesthetics.

Which Region Holds the Largest Share of the Point of Sale (PoS) Display Market?

- North America dominated the point of sale (PoS) display market with the largest revenue share of 34.6% in 2024, driven by the strong presence of organized retail chains, increasing adoption of digital displays, and the growing emphasis on in-store marketing effectiveness. Retailers across the U.S. and Canada are investing in advanced display technologies to enhance brand visibility and influence impulse purchasing behavior

- The region’s market growth is further propelled by technological advancements in digital signage, the integration of interactive and touch-based PoS displays, and the presence of global retail giants adopting omnichannel sales strategies

- High consumer spending power, coupled with retailers’ focus on data-driven visual merchandising, has positioned North America as the leading region for PoS display adoption across supermarkets, convenience stores, and specialty retail outlets

U.S. Point of Sale (PoS) Display Market Insight

The U.S. PoS Display market captured the largest share of over 80% of the North American market in 2024, supported by the country’s large retail footprint and early adoption of innovative display technologies. Major retailers such as Walmart, Target, and Best Buy are deploying interactive and digital displays to enhance customer engagement and drive real-time promotions. The growing trend of omnichannel retailing, coupled with the shift toward AI-driven analytics for understanding consumer behavior, is further enhancing market demand. In addition, the increasing adoption of eco-friendly and recyclable materials in PoS displays is aligning with sustainability goals among leading U.S. brands.

Europe Point of Sale (PoS) Display Market Insight

The Europe PoS Display market is projected to grow at a significant CAGR during the forecast period, driven by stringent regulations promoting sustainable retail materials and the rapid modernization of the retail infrastructure. Retailers in countries such as Germany, France, and the U.K. are increasingly embracing corrugated and recyclable PoS displays for brand promotion, emphasizing environmental responsibility. The rising number of convenience stores and boutique retail outlets across the region also contributes to the growing demand for compact and modular PoS display units.

U.K. Point of Sale (PoS) Display Market Insight

The U.K. PoS Display market is anticipated to expand notably during the forecast period, driven by the robust growth of e-commerce and the country’s strong hybrid retail ecosystem combining online and in-store experiences. Retailers are increasingly adopting digital and interactive displays to enhance visual merchandising and support click-and-collect models. Moreover, the growing emphasis on premium product presentation in cosmetic, fashion, and electronics sectors continues to boost market growth.

Germany Point of Sale (PoS) Display Market Insight

The Germany PoS Display market is witnessing substantial growth, supported by its advanced manufacturing capabilities and the growing trend of sustainable retail display solutions. German retailers prioritize high-quality materials, durability, and design innovation, with brands investing in smart PoS systems integrated with sensors and analytics tools to track consumer engagement. In addition, the increasing adoption of customized display units for product differentiation is driving demand across supermarkets and automotive showrooms.

Which Region is the Fastest Growing Region in the Point of Sale (PoS) Display Market?

The Asia-Pacific (APAC) PoS Display market is projected to grow at the fastest CAGR of 9.8% from 2025 to 2032, fueled by rapid urbanization, the expansion of organized retail, and rising consumer spending in countries such as China, Japan, and India. Growing investments in modern retail formats, shopping malls, and convenience stores, combined with the adoption of digital and modular display systems, are major factors accelerating market expansion. In addition, APAC’s manufacturing strength and cost advantages are enhancing global supply capabilities for PoS displays.

Japan Point of Sale (PoS) Display Market Insight

The Japan PoS Display market is experiencing steady growth, driven by the country’s strong technological innovation and focus on compact, space-efficient retail solutions. Retailers are embracing digital signage and interactive displays to optimize in-store experiences, especially in high-traffic urban areas. The rising use of AI-based analytics and automation in retail merchandising further supports this growth trend.

China Point of Sale (PoS) Display Market Insight

The China PoS Display market accounted for the largest share within the Asia-Pacific region in 2024, supported by the country’s booming retail and e-commerce sectors. Rapid store expansion by brands such as Alibaba’s Freshippo and JD.com is driving the integration of digital and smart PoS display systems. The strong presence of local display manufacturers, the government’s push for smart retail infrastructure, and increasing adoption of interactive digital displays in malls and supermarkets are propelling market growth. The availability of cost-effective production and a focus on innovation-driven retail modernization make China a pivotal growth hub for the global PoS Display market.

Which are the Top Companies in Point of Sale (PoS) Display Market?

The point of sale (PoS) display industry is primarily led by well-established companies, including:

- Elo Touch Solutions, Inc. (U.S.)

- Samsung Electronics (South Korea)

- Panasonic Corporation (Japan)

- Toshiba Corporation (Japan)

- LG Display (South Korea)

- Hewlett-Packard Development Company, L.P. (U.S.)

- NEC Corporation (Japan)

- Planar Systems, Inc. (U.S.)

- Christie Digital Systems USA, Inc. (U.S.)

- Sharp Corporation (Japan)

- Diebold Nixdorf, Inc. (U.S.)

- Fujitsu Limited (Japan)

- Ingenico Group (France)

- Dell Technologies Inc. (U.S.)

- Square, Inc. (U.S.)

- Innolux Corporation (Taiwan)

- Verifone Systems, Inc. (U.S.)

- Advantech Co., Ltd. (Taiwan)

- Posiflex Technology, Inc. (Taiwan)

- Shopify Inc. (Canada)

- Shenzhen Hopestar Sci-tech Co., Ltd. (China)

- NCR Corporation (U.S.)

What are the Recent Developments in Global Point of Sale (PoS) Display Market?

- In January 2024, Samsung Electronics launched its cloud-native Visual Experience Transformation (VXT) platform, designed to unify content and remote signage management into a single, secure system. The all-in-one platform offers a user-friendly interface that enables businesses to efficiently design and manage digital displays with greater control and flexibility. This launch strengthens Samsung’s position in the global digital display and PoS solutions market by offering advanced tools for enhanced visual experience and operational efficiency

- In January 2024, Revolut entered into a strategic collaboration with Jabil, a leading technology company, to advance the development of mobile point-of-sale (mPOS) solutions. Revolut’s CEO, Nik Storonsky, emphasized the company’s strengthened financial standing and global expansion, alongside product innovation and compliance improvements. This partnership is expected to accelerate Revolut’s growth in the mobile payment technology landscape, enhancing accessibility and convenience for retail and financial transactions

- In August 2022, Dutchie, a company providing comprehensive solutions for the cannabis industry, announced the launch of its Dutchie POS, a new point-of-sale system featuring a dual-screen terminal for dispensaries. This innovation followed closely after the introduction of Dutchie Pay, with both systems designed to work together for seamless operational management. The launch positions Dutchie as a key technology enabler for cannabis retail businesses, ensuring streamlined sales and payment experiences

- In May 2022, ParTech, Inc., a prominent restaurant technology company, announced that California Pizza Kitchen selected its Data Central restaurant back-office application to enhance data management and operational efficiency. ParTech specializes in enterprise-level commerce cloud solutions, and this collaboration strengthens its footprint in the restaurant PoS and back-office management sector, reinforcing its role in driving digital transformation in the food service industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Point Of Sale Pos Display Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Point Of Sale Pos Display Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Point Of Sale Pos Display Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.