Global Point Of Sale Software Market

Market Size in USD Billion

CAGR :

%

USD

17.13 Billion

USD

38.87 Billion

2025

2033

USD

17.13 Billion

USD

38.87 Billion

2025

2033

| 2026 –2033 | |

| USD 17.13 Billion | |

| USD 38.87 Billion | |

|

|

|

|

Point-of-Sale Software Market Size

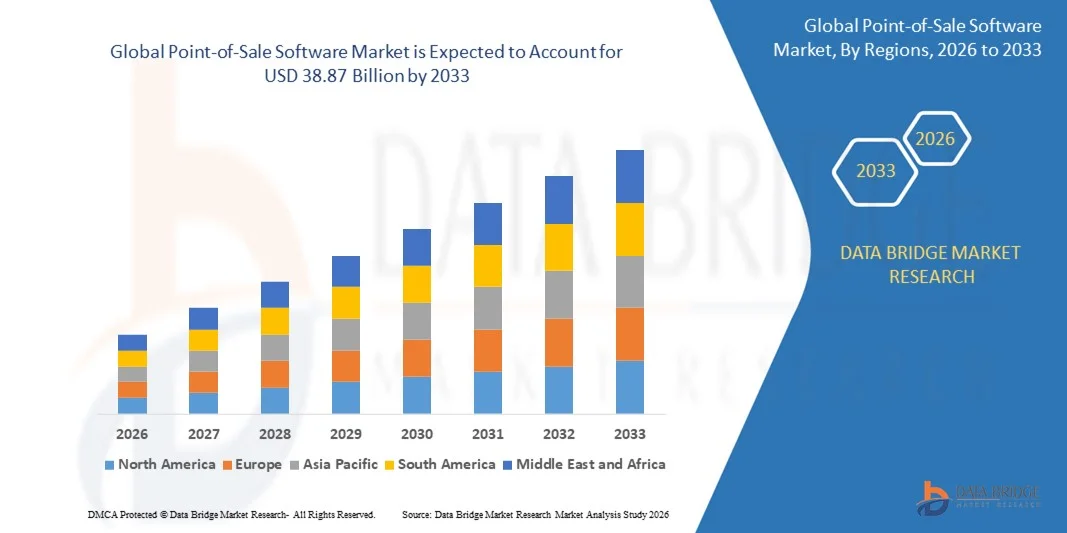

- The global point-of-sale software market size was valued at USD 17.13 billion in 2025 and is expected to reach USD 38.87 billion by 2033, at a CAGR of 10.78% during the forecast period

- The market growth is largely fueled by the growing adoption of digital payment systems, cloud-based solutions, and mobile POS technologies, leading to increased digitalization across retail, hospitality, and other commercial sectors

- Furthermore, rising demand from businesses for secure, user-friendly, and integrated solutions that streamline sales, inventory, and customer management is establishing modern POS software as an essential tool for operational efficiency. These converging factors are accelerating the adoption of POS systems, thereby significantly boosting the industry's growth

Point-of-Sale Software Market Analysis

- Point-of-Sale software, providing electronic management of sales, payments, and inventory, is increasingly vital for modern businesses due to its enhanced convenience, real-time reporting, and integration with other enterprise systems

- The escalating demand for POS solutions is primarily fueled by the widespread adoption of mobile and cloud-based technologies, growing emphasis on customer experience, and a rising preference for seamless, omnichannel retail operations

- Asia-Pacific dominated the point-of-sale software market with a share of 32.2% in 2025, due to rapid digitalization in retail and hospitality, increasing adoption of mobile and cloud-based POS solutions, and a growing presence of SMEs embracing modern payment technologies

- North America is expected to be the fastest growing region in the point-of-sale software market during the forecast period due to high adoption of cloud-based POS systems, AI-driven analytics, and omnichannel retail strategies

- Fixed POS segment dominated the market with a market share of 51.2% in 2025, due to its reliability, stability, and suitability for businesses with high transaction volumes. Fixed POS systems offer comprehensive functionality, including inventory management, customer analytics, and integrated payment processing, which makes them a preferred choice for large retail stores and hospitality chains

Report Scope and Point-of-Sale Software Market Segmentation

|

Attributes |

Point-of-Sale Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Point-of-Sale Software Market Trends

Growing Adoption of Cloud-Based and Mobile POS Solutions

- A significant trend in the point-of-sale software market is the accelerating adoption of cloud-based and mobile POS platforms, driven by the need for flexibility, remote access, and real-time data visibility across retail and hospitality operations. Cloud deployment allows businesses to centralize sales, inventory, and customer data while supporting multi-location operations and rapid scalability

- For instance, Square Inc. and Lightspeed offer cloud-native POS platforms that enable merchants to manage transactions, reporting, and inventory from any device. These solutions reduce on-premise infrastructure dependence and improve operational agility for small and mid-sized businesses

- Mobile POS adoption is expanding as retailers and restaurants seek to enhance customer experience through faster checkout, tableside ordering, and contactless payments. Handheld and tablet-based POS systems support queue reduction and personalized service, particularly in high-traffic environments

- Hospitality businesses are increasingly leveraging cloud POS systems to integrate front-of-house and back-of-house operations, enabling real-time order tracking and kitchen coordination. This improves service speed and order accuracy while supporting higher transaction volumes

- The rise of omnichannel retailing is further reinforcing this trend, as cloud POS platforms synchronize in-store and online sales channels into a unified system. This ensures consistent pricing, inventory accuracy, and customer engagement across touchpoints

- Overall, the shift toward cloud-based and mobile POS solutions is reshaping how businesses manage sales operations, positioning POS software as a dynamic and scalable backbone for modern commerce environments

Point-of-Sale Software Market Dynamics

Driver

Rising Demand for Integrated Sales, Inventory, and Customer Management Systems

- The increasing need for integrated business management solutions is a key driver of growth in the point-of-sale software market, as organizations seek unified platforms that combine sales processing, inventory tracking, and customer relationship management. Integrated POS systems reduce operational silos and improve decision-making through centralized data access

- For instance, Oracle delivers POS solutions that integrate seamlessly with enterprise resource planning and customer data platforms, enabling large retailers and hospitality chains to streamline operations and gain deeper customer insights. Such integration supports demand forecasting, loyalty management, and performance optimization

- Retailers are adopting integrated POS systems to maintain real-time inventory visibility, minimize stockouts, and improve replenishment planning across multiple locations. This capability is essential for businesses operating in competitive, fast-moving consumer environments

- The hospitality sector is driving demand for integrated POS platforms that connect ordering, billing, and guest data, improving service personalization and operational efficiency. These systems help restaurants and hotels manage peak demand while maintaining consistent service quality

- The convergence of sales, inventory, and customer management within POS software is reinforcing its role as a core business system rather than a standalone transaction tool

Restraint/Challenge

Data Security and Compliance Concerns in POS Software

- Data security and regulatory compliance remain significant challenges for the point-of-sale software market, as POS systems handle sensitive payment and customer information that is vulnerable to cyber threats. Breaches can lead to financial losses, reputational damage, and regulatory penalties for businesses

- For instance, Ingenico emphasizes secure POS architectures and compliance with PCI DSS standards to mitigate risks associated with card-present transactions. Ensuring end-to-end encryption and secure data handling increases development complexity and operational costs

- Compliance with regional data protection regulations such as GDPR in Europe requires POS vendors to implement strict data governance and privacy controls. These requirements can slow deployment timelines and increase the burden on software providers and merchants

- Small and medium enterprises often face challenges in managing security updates, software patches, and compliance audits, limiting their confidence in adopting advanced POS platforms. This creates hesitation in markets where digital maturity varies widely

- Collectively, data security and compliance challenges place pressure on POS software providers to balance innovation with robust protection measures, influencing adoption decisions and overall market dynamics

Point-of-Sale Software Market Scope

The market is segmented on the basis of application type, deployment type, enterprise size, and end-user.

- By Application Type

On the basis of application type, the POS software market is segmented into Fixed POS and Mobile POS. The Fixed POS segment dominated the market with the largest market revenue share of 51.2% in 2025, driven by its reliability, stability, and suitability for businesses with high transaction volumes. Fixed POS systems offer comprehensive functionality, including inventory management, customer analytics, and integrated payment processing, which makes them a preferred choice for large retail stores and hospitality chains. Businesses often prioritize fixed systems for their durability, multi-terminal support, and compatibility with existing hardware and enterprise software. The established presence of Fixed POS solutions in traditional business environments ensures sustained demand and continuous revenue growth.

The Mobile POS segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in small and medium-sized enterprises, pop-up stores, and on-the-go service providers. Mobile POS systems provide flexibility and convenience, enabling sales staff to process transactions anywhere within the premises or remotely using tablets and smartphones. The integration with cloud services, digital wallets, and mobile payment platforms further enhances their appeal. The rising focus on contactless payments and mobility-driven retail experiences also accelerates the uptake of mobile POS solutions.

- By Deployment Type

On the basis of deployment type, the POS software market is segmented into Cloud and On-Premise. The On-Premise segment held the largest market revenue share in 2025 due to its strong appeal among established businesses requiring complete control over data and system infrastructure. On-premise POS systems are preferred for their robust security, offline functionality, and customization options, making them suitable for enterprises with complex workflows and specific compliance requirements. Organizations often choose on-premise deployments to maintain operational continuity without relying on internet connectivity, ensuring consistent transaction processing.

The Cloud segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising demand for scalable, remotely accessible, and cost-efficient solutions. Cloud POS enables real-time data access, seamless software updates, and centralized management of multiple outlets, providing businesses with operational flexibility and enhanced decision-making capabilities. Cloud-based solutions are particularly attractive to SMEs and multi-location retail chains due to lower upfront costs and simplified maintenance. The growing adoption of SaaS business models and integration with digital payment systems further accelerates cloud POS adoption.

- By Enterprise Size

On the basis of enterprise size, the POS software market is segmented into Small & Medium Enterprises (SMEs) and Large Enterprise. The Large Enterprise segment dominated the market in 2025 owing to its significant investment capacity and complex operational needs. Large enterprises benefit from POS software for advanced inventory tracking, detailed sales analytics, multi-location management, and integrated financial reporting. The demand is driven by the need to enhance customer experience, streamline large-scale operations, and maintain consistency across multiple branches. Established brands also prefer scalable and secure POS solutions to ensure operational efficiency and compliance with corporate IT standards.

The SME segment is projected to witness the fastest growth from 2026 to 2033, fueled by the increasing adoption of affordable, user-friendly POS solutions tailored for smaller business environments. SMEs benefit from cloud-enabled POS solutions that reduce hardware dependency, lower costs, and simplify transaction management. The flexibility to integrate with e-commerce platforms, loyalty programs, and mobile payments makes POS software highly attractive for small retailers, cafes, and independent restaurants. Government initiatives supporting digitalization and cashless transactions also contribute to the rising adoption among SMEs.

- By End-User

On the basis of end-user, the POS software market is segmented into Restaurants, Hospitality, Healthcare, Retail, Warehouse, Entertainment, and Others. The Retail segment dominated the market in 2025, driven by the high volume of transactions and the increasing demand for integrated inventory management and customer engagement tools. Retailers prioritize POS systems to enhance operational efficiency, track sales in real-time, manage stock levels, and offer loyalty programs that improve customer retention. The adoption of multi-channel retail strategies and the need for seamless in-store and online integration further boost the demand for POS software in retail.

The Hospitality segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing deployment of POS solutions in hotels, cafes, and quick-service restaurants to optimize service delivery and payment processing. POS software in hospitality enables table management, menu customization, digital ordering, and seamless billing, improving overall guest experience. Integration with mobile apps, cloud-based management tools, and contactless payment options also supports the growing demand. The rising number of restaurants and hotels expanding operations across multiple locations drives rapid adoption of POS solutions in this segment.

Point-of-Sale Software Market Regional Analysis

- Asia-Pacific dominated the point-of-sale software market with the largest revenue share of 32.2% in 2025, driven by rapid digitalization in retail and hospitality, increasing adoption of mobile and cloud-based POS solutions, and a growing presence of SMEs embracing modern payment technologies

- The region’s cost-effective IT infrastructure, rising investments in cloud computing, and expanding e-commerce ecosystem are accelerating market expansion

- The availability of skilled IT professionals, favorable government policies supporting digital payments, and rapid growth of retail and hospitality sectors are contributing to increased adoption of POS software across the region

China Point-of-Sale Software Market Insight

China held the largest share in the Asia-Pacific POS software market in 2025, owing to its rapidly growing retail and hospitality sectors and strong digital payment ecosystem. The country’s emphasis on smart retail, extensive mobile payment adoption, and supportive government policies for fintech innovation are key growth drivers. Demand is further fueled by investments in cloud-based solutions, AI-enabled analytics, and multi-channel retail integration.

India Point-of-Sale Software Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by a surge in organized retail, expansion of e-commerce, and increased adoption of digital payment solutions. For instance, companies such as Zoho and POSist are enabling small and medium enterprises to implement cloud-based and mobile POS systems efficiently. In addition, rising government initiatives promoting digital transactions and fintech adoption are strengthening the market, while hospitality and healthcare sectors increasingly rely on integrated POS solutions.

Europe Point-of-Sale Software Market Insight

The Europe POS software market is expanding steadily, supported by growing demand for omnichannel retail solutions, advanced analytics for customer insights, and regulatory emphasis on data security and GDPR compliance. The region’s strong retail infrastructure, high penetration of digital payments, and focus on improving in-store customer experiences are enhancing adoption rates. Increasing investments in AI-enabled POS solutions and integrated loyalty programs are further contributing to market growth.

Germany Point-of-Sale Software Market Insight

Germany’s POS software market is driven by its advanced retail and hospitality sectors, high IT adoption rates, and strong focus on process automation and efficiency. For instance, companies such as Orderbird and Gastrofix provide cloud-based POS solutions tailored to restaurants and retail chains, boosting market demand. Continuous innovation, integration with ERP systems, and emphasis on customer experience management are strengthening Germany’s leadership in the European POS software market.

U.K. Point-of-Sale Software Market Insight

The U.K. market is supported by a mature retail and hospitality industry, increasing digitalization initiatives, and growing adoption of mobile and cloud-based POS solutions. Rising focus on seamless payment experiences, integration with e-commerce platforms, and advanced reporting and analytics capabilities are driving demand. For instance, Lightspeed and Vend are enabling businesses to implement robust POS systems, reinforcing the country’s position as a key market in Europe.

North America Point-of-Sale Software Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, fueled by high adoption of cloud-based POS systems, AI-driven analytics, and omnichannel retail strategies. The region’s mature retail ecosystem, robust IT infrastructure, and increasing demand for contactless and mobile payments are key growth drivers. Rising integration of POS solutions with CRM and inventory management systems further enhances operational efficiency and customer engagement.

U.S. Point-of-Sale Software Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by a highly developed retail and hospitality sector, strong technology infrastructure, and increasing adoption of advanced POS software. For instance, Square and Toast are driving cloud-based and mobile POS adoption across restaurants and small retailers. Emphasis on seamless omnichannel integration, real-time analytics, and personalized customer experience is solidifying the U.S.'s leading position in the POS software market.

Point-of-Sale Software Market Share

The point-of-sale software industry is primarily led by well-established companies, including:

- Zoho POS (India)

- Square Inc. (U.S.)

- KORONA POS (Germany)

- Toast, Inc. (U.S.)

- Epos Now (U.K.)

- SwiftPOS (Australia)

- Oracle (U.S.)

- Lightspeed (Canada)

- Clover Network, Inc. (U.S.)

- H&L POS (Australia)

- Revel Systems (U.S.)

- TouchBistro (Canada)

- Idealpos (Australia)

- Ingenico (France)

Latest Developments in Global Point-of-Sale Software Market

- In November 2025, Epos Now announced a strategic partnership with RMS to integrate its cloud-based point-of-sale system with RMS’s property management platform. This integration allows real-time syncing of guest billing and POS transactions, significantly reducing manual data entry and reconciliation errors. The development strengthens operational efficiency for hospitality operators by providing a comprehensive view of guest spending across accommodations, food and beverage, and other services. As a result, it enhances interdepartmental coordination, accelerates check-outs, and opens new upselling opportunities, reinforcing Epos Now’s position in the hospitality POS market as a provider of integrated, efficiency-focused solutions

- In May 2025, Clover Network, Inc. introduced Clover Hospitality by BentoBox, a specialized solution targeting the hospitality sector under the tagline, “There’s a Clover for Every Restaurant.” The platform delivers innovative tools to enhance the guest experience, including streamlined order management and analytics capabilities. By expanding Clover’s ecosystem for restaurants and hospitality businesses, this launch strengthens its market presence, supports adoption of tailored POS solutions, and positions Clover as a versatile player in hospitality-focused POS technologies

- In April 2025, Square launched its new Square Point of Sale app, a next-generation platform consolidating Square’s comprehensive commerce and payment features into a single, customizable application. The app allows businesses to personalize their POS experience, integrating payments, inventory management, and analytics into a unified system. This development reinforces Square’s market leadership by addressing the growing demand for flexible, scalable POS solutions that support diverse business models and long-term growth strategies

- In April 2025, Fiserv and Klarna integrated Buy Now, Pay Later (BNPL) installment functionality into Clover devices, with plans for full deployment across 3.5 million terminals by early 2026. This integration enhances the customer payment experience by providing flexible financing options, driving higher transaction volumes and increasing POS adoption among merchants seeking advanced payment capabilities. It positions Clover as a key player in supporting emerging payment trends in the POS market

- In March 2025, JPMorgan Chase launched an embedded-finance module for Walmart Marketplace sellers, offering in-panel payout control and greater financial management within the POS ecosystem. This development empowers sellers with improved liquidity and operational efficiency while streamlining financial workflows, strengthening JPMorgan’s influence in the integrated POS and fintech landscape, and supporting the adoption of embedded financial services across large-scale retail platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.