Global Point Of Sale System Requirement Market

Market Size in USD Billion

CAGR :

%

USD

13.28 Billion

USD

30.17 Billion

2024

2032

USD

13.28 Billion

USD

30.17 Billion

2024

2032

| 2025 –2032 | |

| USD 13.28 Billion | |

| USD 30.17 Billion | |

|

|

|

|

Point of Sale System Requirement Market Size

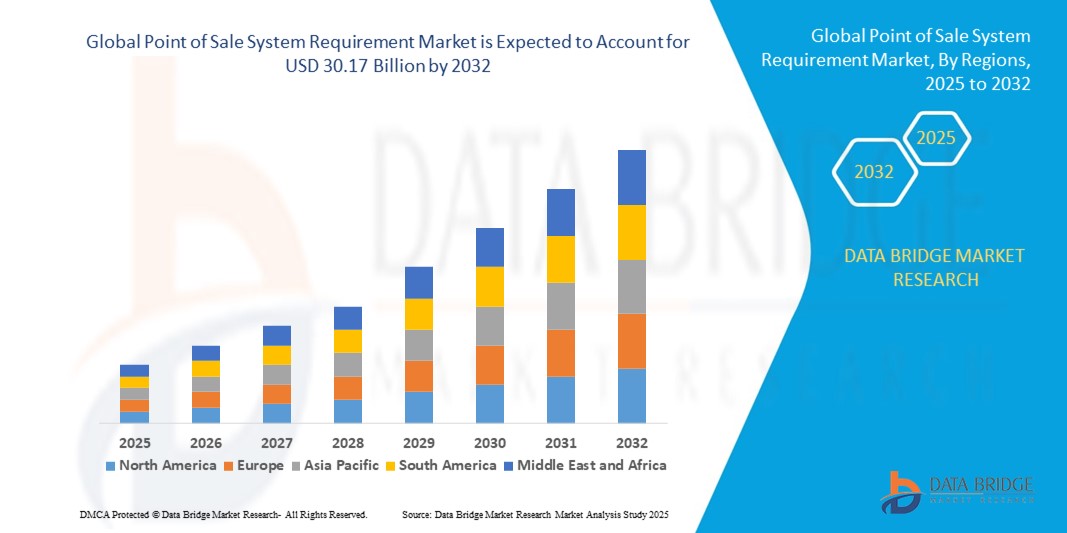

- The global point of sale system requirement market size was valued at USD 13.28 billion in 2024 and is expected to reach USD 30.17 billion by 2032, at a CAGR of 10.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital payment solutions across retail, hospitality, and e-commerce sectors, along with rising demand for real-time inventory management and enhanced customer experience

- The surge in cloud-based POS solutions, mobile payment integration, and omnichannel retailing is further accelerating market expansion, providing businesses with operational efficiency, scalability, and data-driven insights

Point of Sale System Requirement Market Analysis

- The global point of sale (POS) system requirement market is witnessing strong growth, driven by the increasing adoption of digital payment solutions across retail, hospitality, and e-commerce sectors. POS systems are enabling faster transactions, improved inventory management, and enhanced customer experience

- Growing demand for cloud-based POS solutions is fueling market expansion, as these systems provide real-time data analytics, remote management capabilities, and seamless integration with other business software. Businesses are leveraging cloud POS for operational efficiency and cost reduction

- North America dominated the POS system requirement market with the largest revenue share of 38.5% in 2024, driven by the widespread adoption of digital payment solutions, increased retail modernization, and rising awareness of advanced POS technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global point of sale system requirement market, driven by rapid urbanization, increasing smartphone and internet penetration, rising e-commerce activities, and the adoption of mobile and cloud-based POS solutions in retail, hospitality, and other service sectors

- The fixed POS segment held the largest market revenue share in 2024, driven by widespread adoption in retail outlets, supermarkets, and large restaurants. These systems offer stability, robust functionality, and seamless integration with payment gateways, inventory management, and accounting software, making them popular among established businesses

Report Scope and Point of Sale System Requirement Market Segmentation

|

Attributes |

Point of Sale System Requirement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of Cloud-Based Point Of Sale Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Point of Sale System Requirement Market Trends

Rise of Cloud-Based and Mobile POS Solutions

• The growing shift toward cloud-based POS solutions is transforming the retail and hospitality sectors by enabling real-time transaction tracking and centralized management. These systems allow immediate access to sales data, inventory levels, and analytics, helping businesses make faster and more informed decisions, which enhances operational efficiency and customer satisfaction

• The high demand for mobile POS and contactless payment solutions is accelerating adoption among small and medium enterprises as well as large retailers. Mobile POS systems are particularly effective for businesses operating in remote locations or pop-up stores, allowing seamless payments and improving checkout experiences. The trend is further supported by banks and fintech companies promoting digital transactions

• The affordability and ease of integration of modern POS systems make them attractive for multi-store management and franchise operations. Businesses benefit from reduced operational costs, simplified bookkeeping, and improved customer engagement, leading to higher revenue generation

• For instance, in 2023, several retail chains across India reported a 25% reduction in checkout time after implementing mobile POS systems with cloud integration. These systems allowed real-time inventory updates, faster billing, and better customer experience while reducing errors and operational costs

• While cloud-based and mobile POS solutions are accelerating digital transformation and improving operational efficiency, their impact depends on secure network connectivity, user training, and integration with existing business systems. Vendors must focus on scalable solutions and localized deployment strategies to fully capitalize on growing demand

Point of Sale System Requirement Market Dynamics

Driver

Increasing Adoption of Digital Payment Methods and Omnichannel Retailing

• The rise in digital payments and the adoption of omnichannel retailing is pushing businesses to prioritize advanced POS systems as a key tool for seamless customer experiences. POS systems now integrate payment gateways, loyalty programs, and inventory management, supporting efficient operations and enhanced sales

• Merchants are increasingly aware of the operational benefits and revenue potential offered by POS systems, including faster checkout, reduced human error, and real-time sales analytics. This awareness drives adoption across retail, hospitality, and healthcare sectors, including small and medium enterprises

• Government initiatives and regulatory frameworks promoting cashless transactions are strengthening market adoption. Incentives for digital payments, subsidized POS installation for small businesses, and the growth of e-commerce platforms are further driving demand

• For instance, in 2022, the European Union launched a campaign encouraging digital payment adoption across small and medium retailers, boosting demand for cloud-based and mobile POS systems in the region

• While the adoption of POS systems is growing rapidly, businesses must ensure seamless integration with other enterprise systems, user training, and cybersecurity measures to maximize efficiency and secure transaction processing

Restraint/Challenge

High Cost of Advanced POS Systems and Integration Complexity

• The high price of advanced POS hardware and subscription-based software makes them less accessible for small-scale merchants or startups. These systems are often preferred by large retailers, while smaller businesses face financial and technical barriers to adoption

• In many regions, there is a lack of trained personnel capable of managing or maintaining complex POS systems. Inadequate IT support and integration challenges with existing accounting and ERP systems further restrict adoption

• Market penetration is also limited by inconsistent network connectivity and security concerns, especially in remote or rural areas, where digital infrastructure may be underdeveloped. These factors often lead businesses to rely on traditional cash-based methods, reducing efficiency and data insights

• For instance, in 2023, several small retailers in Sub-Saharan Africa reported delayed adoption of POS systems due to high initial investment costs and lack of local technical support

• While POS technologies continue to evolve, addressing cost, integration, and training challenges is essential. Market participants must focus on affordable, user-friendly, and scalable solutions to expand adoption and drive long-term growth

Point of Sale System Requirement Market Scope

The market is segmented on the basis of application, deployment mode, organization size, and end-user.

- By Application

On the basis of application, the point of sale (POS) system requirement market is segmented into fixed POS and mobile POS. The fixed POS segment held the largest market revenue share in 2024, driven by widespread adoption in retail outlets, supermarkets, and large restaurants. These systems offer stability, robust functionality, and seamless integration with payment gateways, inventory management, and accounting software, making them popular among established businesses.

The mobile POS segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing demand for flexible, on-the-go payment solutions in small and medium enterprises (SMEs) and pop-up stores. Mobile POS systems are increasingly preferred for their portability, contactless payment options, and ability to streamline operations in remote or temporary setups.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into on-premise and cloud. The on-premise segment held the largest market revenue share in 2024, favored by organizations requiring secure and controlled access to transaction data. These systems offer high customization, data privacy, and reliability for enterprise operations.

The cloud segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of SaaS solutions, real-time analytics, and remote management capabilities. Cloud-based POS systems are attractive due to scalability, lower upfront costs, and ease of integration with mobile devices and e-commerce platforms.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprise segment held the largest market revenue share in 2024, supported by the adoption of advanced POS systems capable of handling high-volume transactions, multi-store management, and sophisticated reporting tools.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising awareness of cost-effective POS solutions that simplify operations, reduce errors, and support business growth through mobile and cloud-based deployment options.

- By End-User

On the basis of end-user, the market is segmented into restaurants, hospitality, healthcare, retail, warehouse, entertainment, and other sectors. The retail segment held the largest market revenue share in 2024, driven by the increasing need for efficient checkout, inventory tracking, and integration with loyalty programs.

The restaurant segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising adoption of mobile POS, table-side ordering systems, and cloud-enabled management solutions that enhance customer experience and operational efficiency.

Point of Sale System Requirement Market Regional Analysis

• North America dominated the POS system requirement market with the largest revenue share of 38.5% in 2024, driven by the widespread adoption of digital payment solutions, increased retail modernization, and rising awareness of advanced POS technologies.

• Businesses in the region highly value the convenience, real-time transaction processing, and integration capabilities offered by modern POS systems with other enterprise management software, including inventory and customer relationship management tools.

• This widespread adoption is further supported by high technological readiness, a large number of retail chains, and growing demand for omnichannel payment solutions, establishing POS systems as an essential tool for efficient business operations.

U.S. Point of Sale System Requirement Market Insight

The U.S. POS system requirement market captured the largest revenue share in 2024 within North America, fueled by the rapid shift toward cashless transactions and the integration of mobile and cloud-based POS solutions. Businesses are increasingly prioritizing seamless payment experiences, faster checkout processes, and secure transaction processing. The growing deployment of contactless and mobile POS devices, combined with strong adoption across restaurants, retail stores, and healthcare facilities, further drives market expansion. Moreover, the increasing use of analytics and AI-enabled POS systems enhances operational efficiency and customer insights.

Europe Point of Sale System Requirement Market Insight

The Europe POS system requirement market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by regulatory compliance requirements, increased retail automation, and demand for contactless payment solutions. Urbanization, coupled with the growth of e-commerce and omnichannel retailing, is fostering the adoption of modern POS systems. European businesses are drawn to the convenience, efficiency, and data-driven decision-making offered by integrated POS platforms. The region is witnessing significant adoption across restaurants, hospitality, and retail sectors, with both new establishments and existing businesses upgrading their POS infrastructure.

U.K. Point of Sale System Requirement Market Insight

The U.K. POS system market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for digital payment acceptance, efficient transaction management, and enhanced customer experience. In addition, the expansion of retail and hospitality chains, alongside government initiatives promoting cashless payments, is encouraging businesses to adopt modern POS systems. The country’s well-established digital infrastructure and strong e-commerce ecosystem continue to stimulate the market growth across multiple verticals.

Germany Point of Sale System Requirement Market Insight

The Germany POS system market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of digital payments, compliance with tax regulations, and demand for technologically advanced, secure payment solutions. Germany’s mature retail and service sectors, combined with an emphasis on operational efficiency and innovation, promote POS adoption across restaurants, retail outlets, and healthcare facilities. Cloud-based and integrated POS solutions are gaining popularity for streamlining operations, enabling real-time reporting, and enhancing customer satisfaction.

Asia-Pacific Point of Sale System Requirement Market Insight

The Asia-Pacific POS system requirement market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising smartphone penetration, and the growing adoption of digital payments in countries such as China, India, and Japan. The region’s increasing inclination toward cashless transactions, supported by government initiatives and fintech innovations, is boosting POS adoption across retail, hospitality, and entertainment sectors. In addition, as APAC emerges as a hub for POS software and hardware manufacturing, affordability and accessibility are expanding to a wider consumer and business base.

Japan Point of Sale System Requirement Market Insight

The Japan POS system market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technological infrastructure, growing retail modernization, and focus on enhancing customer experiences. Businesses in Japan are increasingly adopting cloud-based and mobile POS solutions for faster transactions, inventory tracking, and analytics-driven decision-making. The integration of POS systems with digital wallets, contactless payments, and enterprise management software is further fueling growth. Japan’s aging population and rising preference for efficient, easy-to-use payment solutions are expected to sustain demand in both commercial and retail sectors.

China Point of Sale System Requirement Market Insight

The China POS system market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s booming e-commerce sector, expanding retail chains, and increasing consumer preference for cashless transactions. POS systems are becoming essential across restaurants, retail stores, healthcare facilities, and entertainment venues. Government support for digital payment infrastructure, combined with the availability of cost-effective POS solutions and strong domestic technology providers, is significantly propelling market growth across urban and semi-urban regions.

Point of Sale System Requirement Market Share

The Point of Sale System Requirement industry is primarily led by well-established companies, including:

- Square, Inc. (U.S.)

- Toast, Inc. (U.S.)

- Shopify Inc. (Canada)

- Lightspeed (Canada)

- Ingenico Group (France)

- Verifone (U.S.)

- Toshiba Corporation (Japan)

- PAX Technology (China)

- NCR Corporation (U.S.)

- Clover Network, Inc. (U.S.)

- Fujitsu Limited (Japan)

- Panasonic Corporation (Japan)

- Oracle Corporation (U.S.)

- Diebold Nixdorf (U.S.)

- ShopKeep (U.S.)

- Vend Limited (New Zealand)

- Revel Systems (U.S.)

- Heartland Payment Systems (U.S.)

- TouchBistro (Canada)

- Paytm (India)

Latest Developments in Global Point of Sale System Requirement Market

- In October 2023, Ingenico Group, a leading provider of payment solutions, has recently launched its new point of sale (POS) system with integrated payment processing. This new system is designed to streamline the checkout process for businesses and make it easier for customers to pay. The system includes a variety of features, such as a touch screen interface, a built-in payment terminal, and support for multiple payment methods. It is also compatible with a variety of business management software, making it easy for businesses to integrate it into their existing systems

- In September 2023, Verifone, a global leader in payment solutions, has recently introduced its new contactless POS system specifically designed for small businesses. This new system is designed to make it easy for small businesses to accept contactless payments, which are becoming increasingly popular among consumers. The system includes a variety of features, such as a touch screen interface, a built-in contactless payment reader, and support for multiple payment methods. It is also easy to set up and use, making it ideal for small businesses that don't have a lot of IT resources

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Point Of Sale System Requirement Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Point Of Sale System Requirement Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Point Of Sale System Requirement Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.