Global Polyacrylamide Market

Market Size in USD Billion

CAGR :

%

USD

6.24 Billion

USD

10.32 Billion

2024

2032

USD

6.24 Billion

USD

10.32 Billion

2024

2032

| 2025 –2032 | |

| USD 6.24 Billion | |

| USD 10.32 Billion | |

|

|

|

|

What is the Global Polyacrylamide Market Size and Growth Rate?

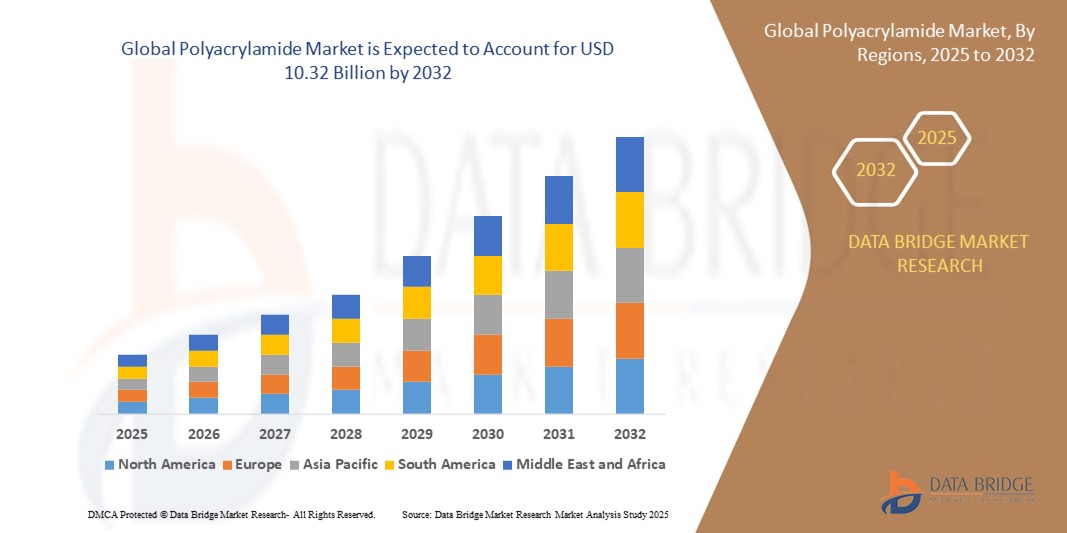

- The global polyacrylamide market size was valued at USD 6.24 billion in 2024 and is expected to reach USD 10.32 billion by 2032, at a CAGR of 6.50% during the forecast period

- Polyacrylamide market growth is driven by advancements in water treatment technologies, enhanced oil recovery, and paper manufacturing. Innovations include bio-based polyacrylamide, which offers improved biodegradability and environmental sustainability

- In addition, novel synthesis methods improve polymer performance and reduce costs. The rising demand for efficient wastewater treatment solutions and sustainable industrial practices fuels polyacrylamide market expansion

What are the Major Takeaways of Polyacrylamide Market?

- The increasing application of polyacrylamide in enhanced oil recovery (EOR) processes drives market growth. For instance, in shale oil extraction, polyacrylamide is used to improve water viscosity and enhance oil recovery rates. As companies such as ExxonMobil and Chevron intensify their EOR efforts to maximize extraction efficiency, the demand for polyacrylamide surges, boosting its market presence significantly

- North America dominated the Polyacrylamide market with the largest revenue share of 32.87% in 2024, driven by stringent environmental regulations and rising demand for wastewater treatment and enhanced oil recovery solutions

- Asia-Pacific Polyacrylamide market is poised to grow at the fastest CAGR of 9.45% from 2025 to 2032, driven by rapid industrialization, increasing population, and rising environmental concerns in countries such as China, India, and Japan

- The anionic segment dominated the market with the largest revenue share of 47.8% in 2024, owing to its extensive use in wastewater treatment, mineral processing, and enhanced oil recovery

Report Scope and Polyacrylamide Market Segmentation

|

Attributes |

Polyacrylamide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyacrylamide Market?

“Shift Towards Sustainable and Bio-Based Polyacrylamides”

- A major trend shaping the polyacrylamide market is the growing emphasis on eco-friendly and bio-based formulations, driven by increasing regulatory scrutiny and global sustainability goals. Manufacturers are investing in the development of biodegradable and plant-based alternatives to conventional synthetic polymers

- For instance, SNF Group and Kemira have expanded their R&D programs to produce environmentally safe polyacrylamides tailored for municipal water treatment and agriculture applications, aiming to reduce long-term ecological impact

- These innovations support green initiatives by reducing reliance on acrylamide monomers derived from non-renewable sources and minimizing toxicity in sludge treatment and runoff

- Bio-based polyacrylamides are particularly gaining traction in Europe and North America, where stringent regulations such as REACH and EPA standards drive demand for sustainable water treatment and enhanced soil conditioning

- This transition is encouraging companies to explore biomass-derived raw materials and greener synthesis methods, fostering innovation across sectors such as mining, oil recovery, and wastewater treatment

- As industries prioritize ESG compliance and carbon footprint reduction, the demand for sustainable polyacrylamide solutions is expected to accelerate, making bio-based variants a cornerstone of the next generation of flocculants and coagulants

What are the Key Drivers of Polyacrylamide Market?

- The rising demand for efficient water treatment solutions across municipal and industrial sectors is a major growth driver. Polyacrylamides play a critical role in flocculation, sludge dewatering, and wastewater recycling, supporting global clean water initiatives

- For instance, in May 2024, BASF SE launched an advanced cationic polyacrylamide product for industrial effluent treatment, aiming to increase water recovery efficiency by up to 25%

- The expanding oil and gas sector also boosts market growth, as polyacrylamides are key agents in enhanced oil recovery (EOR) techniques, especially in shale formations

- In addition, the agricultural sector increasingly relies on anionic polyacrylamides for soil conditioning and erosion control, particularly in arid regions where water conservation is crucial

- Regulatory mandates for zero liquid discharge (ZLD) in industrial processes and stricter wastewater discharge norms are compelling companies to adopt advanced polymer-based treatment technologies, further driving market demand

- Overall, the polyacrylamide market is benefiting from its versatile application range, from mining and paper processing to textiles and personal care

Which Factor is challenging the Growth of the Polyacrylamide Market?

- A key challenge limiting broader adoption is the toxicity and environmental persistence of certain synthetic polyacrylamides, especially those with residual acrylamide monomer, which is considered carcinogenic

- For instance, multiple European countries have imposed limits on acrylamide content in water treatment chemicals, prompting stricter product approvals and regulatory delays

- These concerns are especially prominent in drinking water and food-related applications, where any contamination risk is subject to intense regulatory oversight

- Moreover, fluctuating raw material prices and supply chain disruptions—particularly for acrylonitrile can impact production costs and affect the competitiveness of polyacrylamide products

- The need for specialized storage, handling precautions, and disposal of polyacrylamide sludge adds operational complexity and cost, discouraging adoption in small-scale or underfunded facilities

- To overcome these barriers, companies are investing in low-toxicity formulations, implementing green chemistry principles, and enhancing product transparency through eco-labeling and third-party certifications. This will be crucial to align with evolving environmental regulations and maintain long-term market viability

How is the Polyacrylamide Market Segmented?

The market is segmented on the basis of product, form, application, and end-use industry.

- By Product

On the basis of product, the polyacrylamide market is segmented into anionic, cationic, and non-ionic. The anionic segment dominated the market with the largest revenue share of 47.8% in 2024, owing to its extensive use in wastewater treatment, mineral processing, and enhanced oil recovery. Anionic polyacrylamides are preferred for their superior flocculation efficiency in treating industrial and municipal wastewater containing suspended solids.

The cationic segment is projected to witness the fastest growth rate of 22.1% from 2025 to 2032, driven by rising demand in sludge dewatering applications and increased adoption in the paper and textile industries. Their high reactivity with negatively charged particles makes cationic polyacrylamides effective in solid-liquid separation.

- By Form

On the basis of form, the polyacrylamide market is segmented into powder, emulsion, gel, and others. The powder segment held the largest market revenue share in 2024, primarily due to its ease of storage, cost-effectiveness, and long shelf life. Powdered polyacrylamide is widely used in municipal and industrial water treatment and soil erosion control applications.

The emulsion segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its rapid solubility, high molecular weight, and ease of application in oil recovery and paper processing. Emulsion-based formulations also provide better dispersion and dosing flexibility, especially in automated treatment systems.

- By Application

On the basis of application, the polyacrylamide market is segmented into enhanced oil recovery, flocculants for water treatment, soil conditioner, binders and stabilizers in cosmetics, and others. The flocculants for water treatment segment dominated the market in 2024, capturing the largest share due to its widespread use in municipal sewage treatment, industrial effluent treatment, and drinking water purification.

The enhanced oil recovery (EOR) segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for polymer flooding techniques in mature oilfields and rising exploration in unconventional oil reserves. Polyacrylamide's ability to improve oil displacement and reduce water mobility makes it an essential EOR agent.

- By End-Use Industry

On the basis of end-use industry, the polyacrylamide market is segmented into municipal and commercial, oil and gas, pulp and paper, cosmetics, mining, and others. The municipal and commercial segment held the largest market revenue share in 2024, attributed to the growing need for efficient water and sludge treatment solutions amid urban expansion and regulatory mandates for wastewater management.

The oil and gas segment is anticipated to register the highest CAGR during 2025 to 2032, fueled by the increasing use of polyacrylamides in EOR, drilling muds, and produced water treatment. As global energy demand grows and oil producers focus on boosting recovery rates, the sector’s demand for polyacrylamide-based solutions will continue to expand.

Which Region Holds the Largest Share of the Polyacrylamide Market?

- North America dominated the polyacrylamide market with the largest revenue share of 32.87% in 2024, driven by stringent environmental regulations and rising demand for wastewater treatment and enhanced oil recovery solutions

- The region benefits from a well-established oil & gas sector, extensive municipal water treatment infrastructure, and a strong presence of key industry players

- Growing environmental awareness, coupled with technological advancements in polymer-based solutions, continues to support the widespread application of polyacrylamide across industries such as mining, paper, and oil recovery

U.S. Polyacrylamide Market Insight

The U.S. polyacrylamide market captured the largest revenue share in 2024 within North America, fueled by expanding water treatment initiatives and the use of polyacrylamide in shale gas extraction. Rising investments in environmental sustainability, combined with increased adoption in the mining and paper sectors, are further strengthening the market. Regulatory bodies such as the EPA are enforcing stricter water discharge norms, promoting the use of high-efficiency flocculants such as Polyacrylamide across industrial applications.

Europe Polyacrylamide Market Insight

The Europe polyacrylamide market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising concerns over industrial waste management and sustainable chemical usage. The region is witnessing increasing demand for polyacrylamide in municipal sewage treatment, agriculture, and oil recovery. With growing emphasis on eco-friendly and biodegradable materials, Europe is accelerating the shift towards non-toxic, high-performance polymers in water purification and soil conditioning.

U.K. Polyacrylamide Market Insight

The U.K. polyacrylamide market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising demand for efficient flocculants in municipal water treatment and growing infrastructure modernization. The U.K.'s commitment to achieving net-zero emissions has increased the focus on eco-friendly chemicals, with polyacrylamide gaining traction as a sustainable solution in agriculture and sludge dewatering applications. Government support for smart and green infrastructure also supports the market expansion.

Germany Polyacrylamide Market Insight

The Germany polyacrylamide market is expected to expand at a considerable CAGR during the forecast period, owing to robust investments in industrial wastewater treatment and environmental protection. With a well-regulated industrial sector and high awareness of sustainable practices, Germany is adopting polyacrylamide-based solutions in sectors such as paper production, chemicals, and construction. The country's focus on circular economy initiatives further boosts demand for effective and reusable flocculants.

Which Region is the Fastest Growing in the Polyacrylamide Market?

Asia-Pacific polyacrylamide market is poised to grow at the fastest CAGR of 9.45% from 2025 to 2032, driven by rapid industrialization, increasing population, and rising environmental concerns in countries such as China, India, and Japan. Growing awareness about water conservation and government policies mandating the treatment of industrial effluents are pushing the adoption of polyacrylamide in water-intensive industries. In addition, rising oil exploration and mining activities in the region are contributing to the demand for Polyacrylamide in enhanced oil recovery and mineral processing.

Japan Polyacrylamide Market Insight

The Japan polyacrylamide market is gaining momentum due to its advanced wastewater management practices and a strong focus on environmental conservation. Rising demand from the paper, cosmetics, and textile industries, coupled with increasing use of polyacrylamide in agriculture and slope stabilization, is driving market growth. Japan’s mature regulatory framework ensures high-quality standards for water treatment polymers, encouraging continued investment in innovative Polyacrylamide products.

China Polyacrylamide Market Insight

The China polyacrylamide market accounted for the largest revenue share in Asia-Pacific in 2024, propelled by the country’s booming industrial base, government-led water treatment initiatives, and infrastructure projects. China is among the top consumers of polyacrylamide in mining, oil recovery, and municipal applications. The presence of several domestic manufacturers, along with R&D investments in green polymers, is reinforcing China's leadership in regional market growth.

Which are the Top Companies in Polyacrylamide Market?

The polyacrylamide industry is primarily led by well-established companies, including:

- ANHUI JUCHENG FINE CHEMICALS CO., LTD. (China)

- Ashland Inc. (U.S.)

- BASF SE (Germany)

- Kemira (Finland)

- SNF Group (France)

- Shanghai Danfan Network Science & Technology Co., Ltd. (China)

- Shandong Keda Group Co., Ltd. (China)

- Anhui Tianrun Chemistry Industry Company Limited (China)

- Yixing Bluwat Chemicals Co., Ltd. (China)

- Nuocor Group (China)

- Chinafloc (China)

- Beijing Hengju Chemical Group Corporation (China)

- Arakawa Chemical Industries, Ltd. (Japan)

- Envitech (U.S.)

- Shandong Tongli Chemical Co., Ltd. (China)

- Sinopec (China)

What are the Recent Developments in Global Polyacrylamide Market?

- In June 2023, Kemira acquired the polyacrylamide business of Nalco Water, a strategic acquisition designed to bolster Kemira’s position in the global polyacrylamide market. This move is anticipated to enhance Kemira’s market share and strengthen its competitive edge in the polyacrylamide sector

- In April 2023, Ashland Inc. announced a significant expansion of its polyacrylamide production capacity in China. This strategic move aims to meet growing market demand and is expected to be completed in the latter half of 2023, enhancing Ashland's ability to serve the global market effectively

- In February 2022, Kemira began full-scale production of a new polyacrylamide polymer based on biobased feedstock. This initiative underscores Kemira's commitment to sustainable chemistry solutions, targeting water-intensive industries and positioning itself as a leader in environmentally friendly polymer production

- In January 2022, Solenis acquired SCL GmbH, including all outstanding shares. SCL specializes in DMA3, a key raw material for cationic polyacrylamide production. This acquisition supports Solenis' strategic insourcing goals and strengthens its global growth plan in the polyacrylamide market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyacrylamide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyacrylamide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyacrylamide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.