Global Polyalphaolefin Pao Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

21.31 Billion

2024

2032

USD

4.92 Billion

USD

21.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 21.31 Billion | |

|

|

|

|

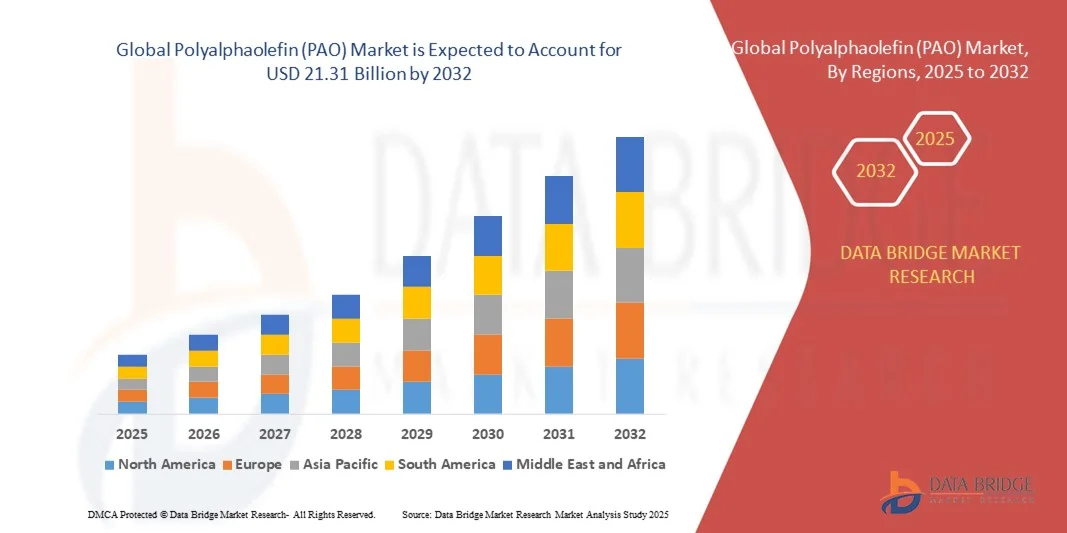

What is the Global Polyalphaolefin (PAO) Market Size and Growth Rate?

- The global polyalphaolefin (PAO) market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 21.31 billion by 2032, at a CAGR of 2.82% during the forecast period

- ise in application of polyalphaolefin (PAO) for automotive applications is the root cause fuelling up the polyalphaolefin (PAO) market growth rate. Rising industrialization coupled with growing demand for synthetic base fluids in drilling industry will also directly and positively impact the growth rate of the polyalphaolefin (PAO) market

- Growth and expansion of automotive especially in the emerging economies such as India and China coupled with surge in the urbanization will further carve the way for the growth of the polyalphaolefin (PAO) market

What are the Major Takeaways of Polyalphaolefin (PAO) Market?

- Rising offshore drilling activities is other indirect determinant which will also foster the polyalphaolefin (PAO) market growth rate

- However, COVID-19 pandemic posed a major challenge to the growth of the polyalphaolefin (PAO) market. Fluctuations in the prices of raw materials will dampen the polyalphaolefin (PAO) market growth rate. Also, surge in the environmental pollution and rising concerns over greenhouse gas emissions will further derail the polyalphaolefin (PAO) market growth rate. Risks associated with seal shrinkage and limited biodegradability of polyalphaolefin (PAO) will also impede the market growth rate

- Europe dominated the polyalphaolefin (PAO) market with the largest revenue share of 36.47% in 2024, driven by stringent industrial standards, strong regulatory frameworks, and growing demand for high-performance lubricants across automotive and industrial sectors

- The Asia-Pacific polyalphaolefin (PAO) market is poised to grow at the fastest CAGR of 10.45% during 2025 to 2032, fueled by rapid industrialization, increasing automotive production, and rising disposable incomes in countries such as China, Japan, and India

- The industrial segment dominated the market with the largest revenue share of 52% in 2024, driven by high demand for PAO-based lubricants and hydraulic fluids in manufacturing, heavy machinery, and power generation equipment

Report Scope and Polyalphaolefin (PAO) Market Segmentation

|

Attributes |

Polyalphaolefin (PAO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyalphaolefin (PAO) Market?

Rising Adoption of High-Performance Synthetic Lubricants

- A significant trend in the global polyalphaolefin (PAO) market is the increasing use of high-performance synthetic lubricants across automotive, industrial, and aerospace applications. PAOs are valued for their superior thermal stability, low volatility, and enhanced lubrication properties, making them ideal for advanced engines and machinery

- For instance, major automotive OEMs are increasingly specifying PAO-based engine oils and transmission fluids to meet stringent emission regulations and improve fuel efficiency. Similarly, industrial gearboxes and compressors are adopting PAO lubricants to reduce maintenance cycles and extend equipment life

- PAOs enable higher performance under extreme temperature conditions, providing enhanced oxidative stability, improved wear protection, and reduced sludge formation. Leading lubricant manufacturers are incorporating polyalphaolefin into multi-grade and fully synthetic formulations to meet evolving performance requirements

- The trend towards polyalphaolefin adoption is further driven by regulatory mandates for energy-efficient and environmentally friendly lubricants, encouraging companies to shift from mineral oils to synthetic alternatives

- This trend is fundamentally reshaping end-user expectations for performance, durability, and sustainability, with companies such as ExxonMobil, Shell, and Chevron increasingly developing polyalphaolefin -based products tailored to specific industrial and automotive applications

- The demand for high-quality, high-performance PAO lubricants is rising across both commercial and industrial sectors, driven by growing focus on efficiency, engine protection, and environmental compliance

What are the Key Drivers of Polyalphaolefin (PAO) Market?

- The rising demand for energy-efficient and high-performance lubricants in automotive and industrial sectors is a key driver for polyalphaolefin adoption. PAOs offer superior oxidation stability, thermal resistance, and extended service life compared to conventional mineral oils

- For instance, in 2024, ExxonMobil introduced its polyalphaolefin -based synthetic lubricants for heavy-duty engines, emphasizing extended drain intervals and improved fuel economy. Such initiatives by industry leaders are accelerating polyalphaolefin adoption globally

- Environmental regulations mandating lower emissions and reduced oil waste are propelling the use of polyalphaolefin, as these lubricants improve operational efficiency while minimizing carbon footprints

- Furthermore, the growing industrialization and expansion of automotive production in Asia-Pacific and North America are driving demand for polyalphaolefin -based lubricants in engines, gear systems, and industrial machinery

- Technological advancements in polyalphaolefin formulations, including blend optimization and additive enhancements, allow manufacturers to meet diverse application requirements, encouraging adoption among OEMs and end-users seeking long-term performance and reliability

Which Factor is Challenging the Growth of the Polyalphaolefin (PAO) Market?

- The high production cost of polyalphaolefin compared to conventional mineral oils poses a key challenge to market growth, limiting adoption in cost-sensitive regions and applications

- For instance, in emerging markets, some industrial operators still prefer mineral oil-based lubricants due to lower upfront costs despite lower performance

- Availability of alternative synthetic lubricants such as esters and polyalkylene glycols also creates competitive pressure, especially in niche industrial applications

- While polyalphaolefin offer superior performance, end-users must balance cost, supply chain reliability, and compatibility with existing equipment, which can slow market penetration

- Overcoming these challenges will require innovations to reduce manufacturing costs, improve polyalphaolefin availability, and increase awareness about long-term operational savings and environmental benefits

How is the Polyalphaolefin (PAO) Market Segmented?

The market is segmented on the basis of end user, application, and type.

- By End User

On the basis of end user, the polyalphaolefin (PAO) market is segmented into industrial and automobile sectors. The industrial segment dominated the market with the largest revenue share of 52% in 2024, driven by high demand for PAO-based lubricants and hydraulic fluids in manufacturing, heavy machinery, and power generation equipment. PAOs provide superior thermal stability, reduced oxidation, and extended service life, which are critical for industrial applications requiring consistent and reliable lubrication under extreme conditions. Leading industrial operators prioritize PAO lubricants to reduce downtime, minimize maintenance costs, and improve energy efficiency across operations.

The automobile segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, fueled by the growing adoption of synthetic engine oils, gear oils, and transmission fluids in passenger vehicles and commercial fleets. Rising awareness regarding engine protection, emission reduction, and fuel efficiency is driving the preference for PAO-based automotive lubricants globally.

- By Application

On the basis of application, the polyalphaolefin (PAO) market is segmented into lubricants, industrial oils, hydraulic fluids, greases, compressor oils, engine oils, gear oils, and others. The lubricant segment accounted for the largest market revenue share of 45% in 2024, as PAO-based lubricants deliver superior performance under high temperatures and extreme pressures, ensuring long-term equipment protection and operational efficiency. Industrial oils, hydraulic fluids, and greases are increasingly adopting PAOs due to their excellent viscosity stability and reduced deposit formation.

The engine oil segment is anticipated to witness the fastest CAGR of 22% from 2025 to 2032, driven by growing demand for high-performance automotive lubricants in passenger cars, commercial vehicles, and electric vehicles. Technological advancements in PAO formulations, such as low-friction and multi-grade oils, are further boosting adoption across industrial and automotive applications.

- By Type

On the basis of type, the polyalphaolefin (PAO) market is segmented into low viscosity PAO, medium viscosity PAO, and high viscosity PAO. The medium viscosity PAO segment dominated the market with the largest revenue share of 48% in 2024, attributed to its versatile performance in industrial machinery, automotive engines, and hydraulic systems. Medium viscosity PAOs provide an ideal balance of lubrication efficiency, thermal stability, and pumpability across a wide temperature range, making them suitable for most commercial and industrial applications.

The high viscosity PAO segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by the increasing requirement for high-load gear oils, greases, and specialty hydraulic fluids. High viscosity PAOs ensure enhanced wear protection, long service intervals, and superior performance under heavy-duty conditions, supporting the growing demand in industrial and automotive sectors worldwide.

Which Region Holds the Largest Share of the Polyalphaolefin (PAO) Market?

- Europe dominated the polyalphaolefin (PAO) market with the largest revenue share of 36.47% in 2024, driven by stringent industrial standards, strong regulatory frameworks, and growing demand for high-performance lubricants across automotive and industrial sectors

- Consumers and industries in the region prioritize high-quality PAO-based lubricants and hydraulic fluids due to their superior thermal stability, extended service life, and efficiency under extreme operating conditions

- This widespread adoption is further supported by the presence of major automotive manufacturers, developed industrial infrastructure, and a technology-driven workforce, establishing Europe as a critical market for Polyalphaolefin (PAO) products

Germany Polyalphaolefin (PAO) Market Insight

The Germany polyalphaolefin market captured the largest revenue share within Europe in 2024, fueled by increasing adoption of synthetic lubricants and hydraulic oils in automotive, industrial, and energy sectors. The country’s emphasis on advanced manufacturing, innovation, and sustainability promotes polyalphaolefin usage across heavy machinery and high-performance automotive applications. Continuous R&D and stringent regulatory compliance further strengthen Germany’s position as a leading regional contributor to market growth.

U.K. Polyalphaolefin (PAO) Market Insight

The U.K. polyalphaolefin market is anticipated to grow steadily during the forecast period, driven by increasing industrial automation, automotive production, and demand for eco-friendly, high-performance lubricants. Growth is also supported by rising awareness regarding energy efficiency, emission reduction, and enhanced machinery protection, making PAOs a preferred choice among industrial and automotive end-users.

Which Region is the Fastest Growing Region in the Polyalphaolefin (PAO) Market?

The Asia-Pacific polyalphaolefin (PAO) market is poised to grow at the fastest CAGR of 10.45% during 2025 to 2032, fueled by rapid industrialization, increasing automotive production, and rising disposable incomes in countries such as China, Japan, and India. The region’s growing preference for synthetic lubricants and PAO-based fluids, coupled with government initiatives promoting industrial modernization and smart manufacturing, is accelerating adoption. Furthermore, APAC is emerging as a major manufacturing hub for PAO components and formulations, enhancing affordability and accessibility to a broader consumer base.

China Polyalphaolefin (PAO) Market Insight

The China polyalphaolefin market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s booming automotive sector, rapid industrial growth, and high synthetic lubricant adoption rates. The development of smart factories and increased demand for high-performance industrial oils and automotive fluids are key factors supporting market expansion.

Japan Polyalphaolefin (PAO) Market Insight

The Japan polyalphaolefin market is witnessing steady growth due to the country’s advanced industrial and automotive sectors, coupled with the demand for high-quality, durable lubricants. Adoption is fueled by technological advancements, increasing industrial automation, and the growing need for environmentally friendly, long-lasting PAO-based fluids in both residential and commercial applications.

Which are the Top Companies in Polyalphaolefin (PAO) Market?

The polyalphaolefin (PAO) industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- TULSTAR PRODUCTS INC. (U.S.)

- LANXESS (Germany)

- NACO Corporation (U.S.)

- Shell plc (U.K.)

- Chevron Corporation (U.S.)

- INEOS AG (U.K.)

- Lubricon (Australia)

- Idemitsu Kosan Co., Ltd. (Japan)

- Mitsui Chemicals, Inc. (Japan)

- RB PRODUCTS, INC. (U.S.)

- Labdhi Chemicals (India)

- Novvi, LLC. (U.S.)

- Sasol (South Africa)

- FUCHS (Germany)

- LUKOIL Marine Lubricants DMCC (U.A.E.)

- Croda International Plc (U.K.)

- Valero (U.S.)

- Phillips 66 Company (U.S.)

What are the Recent Developments in Global Polyalphaolefin (PAO) Market?

- In September 2023, ExxonMobil announced a USD 2 billion investment for the expansion of its chemical production at Baytown, Texas, U.S., as part of its strategy to produce high-quality products from its Gulf refining and chemical facilities, including two new units, Vistamaxx and Exact-branded polymers, to enhance the performance of its chemical portfolio, strengthening the company's position in the global chemicals market

- In April 2023, DL Chemical announced that its subsidiary, D-REX Polymer, had completed a new APAO plant in Yeosu, South Korea, following the joint venture formation between REXtac, U.S., and DL Chemical, Korea, in September 2021 to manufacture environmentally friendly amorphous poly-alpha-olefin (APAO), marking a key milestone in the growth of sustainable PAO production in Asia

- In January 2023, ExxonMobil, one of the world's largest oil and gas companies, reportedly invested USD 2 billion to expand the capacity of its Beaumont petroleum refinery in the U.S., reinforcing the company’s commitment to scaling up energy and chemical production to meet growing demand globally

- In November 2022, Chevron Phillips Chemical (CPChem; The Woodlands, Texas, U.S.) held a groundbreaking ceremony to expand its polyalphaolefin (PAO) unit at Beringen, Belgium, reflecting a significant regional investment and highlighting CPChem's dedication to addressing the rising global demand for PAO products, thereby strengthening its international footprint

- In June 2022, INEOS Oligomers announced the startup of its new 120,000 tpy Low Viscosity Polyalphaolefin (LV PAO) unit at Chocolate Bayou, Texas, U.S., enhancing its production capabilities and capacity to supply high-performance PAO products to meet increasing industrial and automotive demand globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyalphaolefin Pao Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyalphaolefin Pao Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyalphaolefin Pao Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.