Global Polycarbonate Diol Market

Market Size in USD Million

CAGR :

%

USD

291.58 Million

USD

444.11 Million

2025

2033

USD

291.58 Million

USD

444.11 Million

2025

2033

| 2026 –2033 | |

| USD 291.58 Million | |

| USD 444.11 Million | |

|

|

|

|

Polycarbonate Diol Market Size

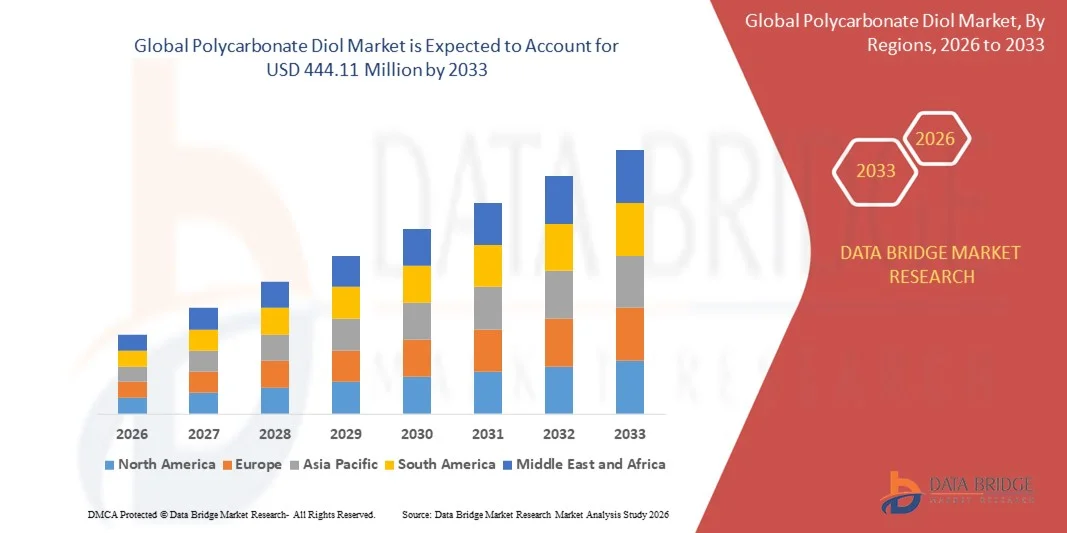

- The global polycarbonate diol market size was valued at USD 291.58 million in 2025 and is expected to reach USD 444.11 million by 2033, at a CAGR of 5.40% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance polycarbonate diols in applications such as synthetic leather, coatings, adhesives, and elastomers, driven by their superior mechanical, thermal, and chemical resistance properties

- Furthermore, rising industrial focus on sustainable and bio-based materials is encouraging manufacturers to adopt eco-friendly polycarbonate diols, with companies introducing biomass-based and recycled-content grades to meet regulatory and consumer sustainability requirements. These converging factors are accelerating the uptake of polycarbonate diols across multiple industries, thereby significantly boosting the market's growth

Polycarbonate Diol Market Analysis

- Polycarbonate diols, providing high-performance polyurethane intermediates, are increasingly essential in industries requiring durable, flexible, and chemically resistant materials, including automotive, footwear, coatings, and industrial elastomers

- The escalating demand for polycarbonate diols is primarily driven by the growing need for sustainable and high-performance polyurethane products, rising industrial automation, and the expansion of end-use sectors seeking advanced materials with superior thermal, mechanical, and chemical stability

- Asia-Pacific dominated the polycarbonate diol market with a share of 48.60% in 2025, due to rapid growth in synthetic leather, coatings, adhesives, and elastomer production, along with a strong presence of chemical manufacturing hubs

- North America is expected to be the fastest growing region in the polycarbonate diol market during the forecast period due to rising demand for polycarbonate diols in coatings, adhesives, elastomers, and synthetic leather applications

- Synthetic leather segment dominated the market with a market share of 32% in 2025, due to rising demand for flexible, durable, and eco-friendly leather alternatives in footwear, automotive interiors, and fashion products. Polycarbonate diols enhance the mechanical strength, softness, and scratch resistance of synthetic leather, making them ideal for high-end applications. Manufacturers are increasingly prioritizing synthetic leather due to consumer preference for cruelty-free and sustainable materials. The segment also benefits from innovations in hybrid formulations that combine performance with aesthetic appeal. Strong growth in emerging economies with expanding automotive and fashion industries contributes to the leading position of synthetic leather

Report Scope and Polycarbonate Diol Market Segmentation

|

Attributes |

Polycarbonate Diol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polycarbonate Diol Market Trends

Rising Adoption of Bio-Based and Recycled Polycarbonate Diols

- The polycarbonate diol market is witnessing a strong trend toward the adoption of bio-based and recycled feedstocks as manufacturers aim to enhance sustainability and reduce reliance on fossil-based raw materials. These bio-based variants offer comparable chemical properties, including excellent flexibility and hydrolytic stability, while aligning with environmental and regulatory expectations related to carbon footprint reduction

- For instance, companies such as Covestro AG and Mitsubishi Chemical Group are focusing on developing bio-based polycarbonate diols derived from renewable carbon sources. Covestro’s Desmophen eco-grade range, formulated using plant-based materials, maintains performance standards similar to petroleum-derived counterparts while offering improved environmental credentials

- Increasing global emphasis on circular polymer development has accelerated investments in recyclable and renewable polycarbonate diol production technologies. Integration of advanced chemical recycling processes enables conversion of end-of-life plastics into high-purity diol monomers suitable for polyurethane and coating formulations

- The expanding interest in sustainable coatings, adhesives, and elastomers is encouraging adoption of recyclable or renewable intermediate materials. Bio-based polycarbonate diols provide high mechanical and chemical resistance and also reinforce ESG-focused procurement strategies across end-use industries

- In addition, governments and regulatory bodies promoting green chemistry practices are supporting commercialization of low-carbon polyols to minimize emissions from chemical manufacturing. The focus on supply chain transparency and material traceability has also motivated formulators to source from renewable polycarbonate diol suppliers

- This ongoing transition toward bio-based and recycled raw materials marks a critical step in aligning the polycarbonate diol industry with circular economy principles. As consumer and regulatory pressures continue to increase, sustainable product innovations are expected to dominate future growth trajectories of the market

Polycarbonate Diol Market Dynamics

Driver

Growing Demand for High-Performance Polyurethane Applications

- The increasing demand for high-performance polyurethane materials across coatings, adhesives, elastomers, and sealants industries serves as a major driver for the polycarbonate diol market. Polycarbonate diols provide superior mechanical strength, weatherability, and chemical resistance compared to conventional polyether or polyester polyols, supporting performance enhancement in demanding industrial applications

- For instance, Asahi Kasei Corporation and Tosoh Corporation have expanded their production capacities to cater to polyurethane manufacturers developing specialized materials for automotive interiors, industrial machinery, and footwear applications. These high-durability compounds improve thermal stability, elasticity, and abrasion resistance across versatile end-use environments

- Polycarbonate diols play a critical role in extending the lifetime of polyurethane products by improving hydrolytic and oxidative resistance. Their consistent performance under dynamic stresses makes them particularly suitable for high-end coatings, where long-term durability and gloss retention are key quality parameters

- In addition, the growing global automotive and construction sectors are fueling the demand for polyurethane-based protective coatings and adhesives. Enhanced performance attributes such as flexibility, adhesion strength, and weather resistance are driving polycarbonate diol utilization in modern manufacturing systems

- The rising emphasis on superior quality and sustainability continues to strengthen the adoption of polycarbonate diols in next-generation polyurethane formulations. As industries shift toward advanced materials that offer balance between performance durability and eco-compliance, the demand for polycarbonate diols is set to expand consistently across multiple sectors

Restraint/Challenge

High Production Costs and Complex Synthesis Processes

- High production costs and the intricate synthesis routes associated with polycarbonate diol manufacturing represent major challenges to the market’s scalability. Production involves multi-step polymerization and purification processes that require precision control, high-quality catalysts, and specialized equipment, increasing operational costs for manufacturers

- For instance, companies such as Ube Corporation and Perstorp Holding AB face high initial investment requirements in developing catalyst systems and high-purity carbonates essential for producing consistent molecular weight polycarbonate diols. These factors limit economies of scale and discourage small and mid-scale producers from entry

- The dependence on costly raw materials such as dimethyl carbonate and diols further compounds the economic challenges. Price fluctuations of these intermediates, combined with energy-intensive production operations, can significantly affect pricing stability and profit margins across the supply chain

- In addition, synthesis complexity often constrains mass production flexibility, making it difficult to adapt product properties quickly to evolving customer specifications. Limited technical know-how in bio-based synthesis and controlled polymerization techniques adds further barriers to cost-effective scalability

- Addressing these obstacles through process optimization, adoption of continuous production technologies, and expansion of bio-based feedstock integration will be key to improving cost efficiency. Innovations in catalyst design and energy management are expected to make polycarbonate diol production more commercially viable and sustainable over the long term

Polycarbonate Diol Market Scope

The market is segmented on the basis of form, molecular weight, and application.

- By Form

On the basis of form, the polycarbonate diol market is segmented into solid and liquid. The liquid segment dominated the market with the largest revenue share in 2025, driven by its superior processability and ease of integration into diverse polymer formulations. Liquid polycarbonate diols offer better compatibility with various reactants, enabling manufacturers to produce high-performance polyurethanes with consistent quality. The segment benefits from increasing adoption in coatings, adhesives, and elastomers where uniform dispersion and controlled viscosity are critical. Furthermore, liquid forms facilitate large-scale industrial production due to their straightforward handling and reduced processing time. Demand is also strengthened by their application in flexible and durable synthetic leather production.

The solid segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in specialized adhesive and coating formulations. Solid polycarbonate diols provide higher thermal stability and targeted molecular structure control, making them suitable for premium elastomeric products. Industries focusing on high-performance paints and industrial coatings prefer solid forms due to their enhanced mechanical properties and storage stability. The ability to customize solid diols for specific end-use applications drives adoption across emerging industrial segments. Manufacturers are increasingly investing in solid polycarbonate diols to expand product portfolios and cater to niche applications requiring precise formulation control.

- By Molecular Weight

On the basis of molecular weight, the polycarbonate diol market is segmented into below 1,000 g/mol, 1,000 g/mol – below 2,000 g/mol, and 2,000 g/mol and above. The 1,000 g/mol – below 2,000 g/mol segment dominated the market in 2025, supported by its balanced mechanical and thermal properties that suit a wide range of polyurethane applications. Polycarbonate diols in this molecular weight range are preferred for synthetic leather and flexible elastomers due to their optimal chain length, which ensures toughness without compromising elasticity. Industries benefit from the versatility of these diols in producing coatings and adhesives that require consistent viscosity and high performance. The segment also enjoys strong demand from emerging regions with expanding automotive and construction sectors. Its adaptability to both industrial and consumer-grade applications strengthens its position as the leading molecular weight category.

The below 1,000 g/mol segment is projected to register the fastest CAGR from 2026 to 2033, driven by its increasing use in high-performance coatings, sealants, and low-viscosity adhesives. These low-molecular-weight diols enable faster curing and better reactivity, supporting efficient production processes and enhanced product quality. For instance, companies developing high-end elastomers and specialty coatings prefer these diols for their improved crosslinking behavior and compatibility with other polyols. Their ability to provide superior flexibility and chemical resistance in compact formulations is encouraging adoption across niche industrial applications. The growing trend toward lightweight and high-performance materials in automotive and electronics further propels the segment’s growth trajectory.

- By Application

On the basis of application, the polycarbonate diol market is segmented into synthetic leather, paints and coatings, adhesives and sealants, elastomers, and others. The synthetic leather segment dominated the market with the largest share of 32% in 2025, supported by rising demand for flexible, durable, and eco-friendly leather alternatives in footwear, automotive interiors, and fashion products. Polycarbonate diols enhance the mechanical strength, softness, and scratch resistance of synthetic leather, making them ideal for high-end applications. Manufacturers are increasingly prioritizing synthetic leather due to consumer preference for cruelty-free and sustainable materials. The segment also benefits from innovations in hybrid formulations that combine performance with aesthetic appeal. Strong growth in emerging economies with expanding automotive and fashion industries contributes to the leading position of synthetic leather.

The adhesives and sealants segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing industrial automation and demand for high-performance bonding solutions. Polycarbonate diols provide excellent chemical resistance, flexibility, and adhesion properties, which are critical in construction, automotive, and electronics applications. For instance, manufacturers producing industrial sealants and specialized adhesives leverage these diols to improve durability and performance under harsh conditions. The segment’s growth is further supported by rising adoption of eco-friendly and solvent-free formulations. Expanding use in emerging markets, coupled with innovations in adhesive technology, is expected to accelerate the uptake of polycarbonate diols in this application segment.

Polycarbonate Diol Market Regional Analysis

- Asia-Pacific dominated the polycarbonate diol market with the largest revenue share of 48.60% in 2025, driven by rapid growth in synthetic leather, coatings, adhesives, and elastomer production, along with a strong presence of chemical manufacturing hubs

- The region’s cost-effective production landscape, rising investments in specialty polyols, and expanding exports of high-performance diols are accelerating market expansion

- The availability of skilled labor, favorable government policies, and increasing industrialization across developing economies are contributing to higher consumption of polycarbonate diols across multiple applications

China Polycarbonate Diol Market Insight

China held the largest share in the Asia-Pacific polycarbonate diol market in 2025, owing to its strong chemical manufacturing base and leadership in polyurethane and synthetic leather production. The country’s established industrial infrastructure, supportive government policies, and significant export capabilities for high-performance diols are key growth drivers. Rising domestic demand for advanced coatings, adhesives, and elastomeric materials further supports market expansion, alongside increasing investments in R&D and specialty chemicals production.

India Polycarbonate Diol Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a booming automotive, footwear, and synthetic leather industry, and rising investments in specialty chemical production. Government initiatives promoting domestic manufacturing, industrial self-reliance, and “Make in India” strategies are strengthening demand for polycarbonate diols. Expanding applications in paints, adhesives, and high-performance elastomers, coupled with growing export opportunities for polyurethane-based products, are further accelerating market growth.

Europe Polycarbonate Diol Market Insight

The Europe polycarbonate diol market is expanding steadily, supported by stringent regulatory frameworks, high demand for sustainable and high-performance polyurethane products, and investments in specialty chemical production. The region emphasizes product quality, environmental compliance, and advanced material formulations, particularly in coatings, adhesives, and elastomers. Rising adoption of polycarbonate diols in custom polyurethane systems and green material initiatives is enhancing market growth.

Germany Polycarbonate Diol Market Insight

Germany’s market is driven by its leadership in high-precision chemical manufacturing, well-established R&D networks, and export-oriented production of specialty polyols. Strong collaborations between academia and industry support continuous innovation in polycarbonate diols for synthetic leather, elastomers, and industrial coatings. Demand is particularly robust for high-performance polyurethane applications requiring precise molecular weight control and superior mechanical properties.

U.K. Polycarbonate Diol Market Insight

The U.K. market is supported by a mature chemical and coatings industry, increasing focus on sustainable and high-performance polyurethane materials, and strong R&D capabilities. Growing academic-industry collaborations, localized production initiatives, and adoption of advanced polycarbonate diols in adhesives and elastomers are driving market expansion. The U.K.’s focus on specialty applications and innovative formulations is further strengthening its position.

North America Polycarbonate Diol Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for polycarbonate diols in coatings, adhesives, elastomers, and synthetic leather applications. Expansion of the automotive, electronics, and construction sectors, along with advancements in high-performance polyurethane materials, is boosting consumption. Increasing reshoring of chemical manufacturing and strategic partnerships between polyurethane producers and specialty chemical companies are supporting rapid market growth.

U.S. Polycarbonate Diol Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its strong chemical and polyurethane industry, robust R&D infrastructure, and high investment in specialty diol production. Focus on innovation, regulatory compliance, and sustainability is encouraging the adoption of high-performance polycarbonate diols in coatings, adhesives, and elastomers. Presence of leading manufacturers, mature distribution channels, and growing demand from industrial and consumer applications solidify the U.S.’s leading position in the region.

Polycarbonate Diol Market Share

The polycarbonate diol industry is primarily led by well-established companies, including:

- UBE Industries, Ltd. (Japan)

- Tosoh Corporation (Japan)

- Perstorp AB (Sweden)

- Mitsubishi Chemical Corporation (Japan)

- Daicel Corporation (Japan)

- Covestro AG (Germany)

- Bayer AG (Germany)

- Kuraray Co., Ltd. (Japan)

- Sumitomo Bakelite Co., Ltd. (Japan)

- Caffaro Industrie (Italy)

- Cromogenia-Units, S.A. (Spain)

- DuPont (U.S.)

- ICC Industries, Inc. (U.S.)

- SpecialChem (France)

- Merck KGaA (Germany)

- CASE & Plastics (Italy)

- Asahi Kasei Corporation (Japan)

Latest Developments in Global Polycarbonate Diol Market

- In May 2024, Mitsubishi Chemical Group expanded the use of its biomass-based polycarbonate diol BENEBiOL™ in interior wood coatings for retail stores in Japan. This move highlights the increasing adoption of sustainable materials in commercial applications, reflecting a shift toward bio-based PCDs in response to rising environmental awareness. The expansion strengthens Mitsubishi’s position in eco-friendly polyurethane markets and signals growing demand for high-performance, renewable diols in coatings, adhesives, and synthetic leather industries. By scaling the use of biomass-derived PCDs, Mitsubishi is also setting a benchmark for sustainability standards in the global PCD market

- In April 2024, Covestro introduced the Makrolon RP range — a mass-balanced, chemically recycled polycarbonate product made from post-consumer waste. This launch expands the availability of recycled polycarbonate feedstocks suitable for PCD production, enabling manufacturers to produce high-performance polycarbonate diols with reduced environmental impact. The development supports sustainability initiatives in polyurethane applications, including coatings, elastomers, and adhesives, and demonstrates the growing market preference for circular economy solutions. By integrating recycled content, Covestro is enhancing material traceability and appealing to industries targeting ESG-compliant and eco-conscious product portfolios

- In October 2023, Covestro launched a mechanical recycling compounding line for polycarbonates in Shanghai with a production capacity of 25,000 tons per year. This initiative strengthens the PCD market’s shift toward circular manufacturing, allowing greater use of recycled polycarbonate in high-performance diols. The line supports industrial-scale production of sustainable PCDs and positions Covestro as a market leader in environmentally responsible materials. The development also reflects growing customer demand for lower-carbon, recycled-content polyols in coatings, adhesives, and elastomeric applications, aligning with broader industry trends in sustainability and resource efficiency

- In August 2023, UBE Corporation developed a new generation of highly durable polycarbonate-based polyurethane elastomers, including advanced polycarbonate diols and urethane prepolymers. These products are engineered to maintain long-term performance even under harsh environmental conditions, providing enhanced durability for synthetic leather, coatings, adhesives, and elastomer applications. This innovation addresses the market’s need for high-performance PCDs with superior mechanical and chemical resistance. The development is expected to strengthen UBE’s competitive edge and drive increased adoption of polycarbonate-based diols in industrial and consumer applications

- In April 2023, UBE, in collaboration with Osaka Metropolitan University and Nippon Steel, initiated an R&D project to develop a one-step synthesis process for polycarbonate diols using CO₂ and diols. If successfully commercialized, this technology could revolutionize PCD production by converting CO₂ into high-value diols, significantly reducing the carbon footprint of manufacturing. The innovation has the potential to create sustainable supply chains for polycarbonate diols, meeting growing industrial demand for environmentally friendly materials. It also positions UBE as a pioneer in integrating carbon capture with specialty chemical production, which could accelerate market-wide adoption of green PCD technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polycarbonate Diol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polycarbonate Diol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polycarbonate Diol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.