Global Polycythemia Vera Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

3.56 Billion

2024

2032

USD

1.70 Billion

USD

3.56 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 3.56 Billion | |

|

|

|

|

Polycythemia Vera Treatment Market Size

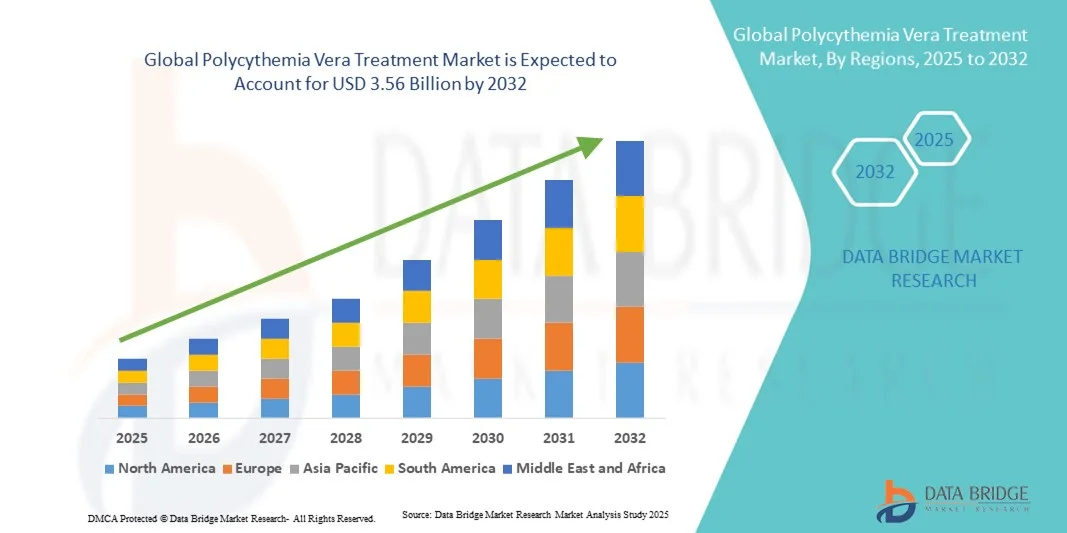

- The global polycythemia vera treatment market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 3.56 billion by 2032, at a CAGR of 9.70% during the forecast period

- The polycythemia vera treatment market is witnessing robust growth, primarily driven by the increasing prevalence of myeloproliferative disorders and the rising awareness of early disease management. Advancements in targeted therapies, particularly JAK inhibitors and biologics, are enhancing treatment outcomes and supporting long-term disease control

- The escalating demand for effective and personalized treatment options, coupled with ongoing clinical trials and regulatory approvals for novel drugs, is significantly contributing to the market’s expansion across major healthcare regions

Polycythemia Vera Treatment Market Analysis

- Polycythemia vera treatment, focusing on managing elevated red blood cell levels and reducing thrombotic complications, is becoming increasingly vital in modern hematology care due to advancements in therapeutic options, improved disease monitoring, and greater awareness of early diagnosis and long-term management

- The escalating demand for polycythemia vera treatments is primarily fueled by the rising prevalence of myeloproliferative disorders, growing adoption of targeted therapies, and an increasing focus on personalized medicine to optimize patient outcomes

- North America dominated the polycythemia vera treatment market with the largest revenue share of 41.65% in 2024, characterized by a well-established healthcare infrastructure, high diagnostic awareness, and strong presence of key pharmaceutical companies. The U.S. experienced substantial growth in polycythemia vera drug adoption, particularly across hospitals and specialty clinics, driven by advancements in JAK inhibitors and combination treatment approaches

- Asia-Pacific is expected to be the fastest-growing region in the polycythemia vera treatment market during the forecast period due to expanding healthcare access, increasing patient awareness, and growing investments in hematology research, particularly in China, Japan, and India

- Adults dominated the market with a revenue share of 87.6% in 2024, primarily due to the higher prevalence of Polycythemia Vera among the adult population, especially those aged 50 years and above

Report Scope and Polycythemia Vera Treatment Market Segmentation

|

Attributes |

Polycythemia Vera Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Polycythemia Vera Treatment Market Trends

Enhanced Convenience Through AI and Precision Diagnostics Integration

- A significant and accelerating trend in the global polycythemia vera (PV) treatment market is the deepening integration of artificial intelligence (AI) and advanced diagnostic technologies such as genomic sequencing, predictive analytics, and automated disease monitoring platforms. This technological synergy is revolutionizing how PV is diagnosed, monitored, and managed, ensuring faster and more precise patient outcomes

- For instance, in March 2024, Novartis AG introduced an AI-powered patient monitoring tool to optimize treatment plans for individuals on Jakafi (ruxolitinib) therapy, enhancing response tracking and reducing adverse events. Similarly, Incyte Corporation has been integrating AI algorithms to analyze real-world patient data to improve understanding of PV progression and therapeutic response trends across populations

- The integration of AI in PV management enables early detection of treatment resistance, dynamic dose adjustment, and improved prediction of thrombotic risk, all of which contribute to personalized patient care. This advancement has also driven collaborations between biopharmaceutical companies and digital health startups to create automated patient monitoring ecosystems

- Furthermore, precision medicine is increasingly gaining prominence, supported by next-generation sequencing (NGS) technologies that allow clinicians to identify JAK2 and CALR mutations with higher accuracy. For example, in May 2023, Thermo Fisher Scientific expanded its NGS panel specifically for myeloproliferative neoplasms (MPNs), including PV, facilitating rapid mutation detection and treatment planning

- The seamless integration of digital tools, AI analytics, and molecular testing technologies is enabling healthcare professionals to manage PV more effectively while improving long-term survival rates

- This ongoing trend toward data-driven, personalized, and technology-enabled PV management is reshaping patient expectations and redefining clinical protocols globally. Companies such as Novartis, Incyte, and Bristol Myers Squibb are at the forefront of this transformation, developing integrated care platforms that merge therapeutic intervention with advanced monitoring technologies

- The growing adoption of AI and precision diagnostics in hematological care is expected to accelerate substantially over the next five years, driven by demand for early intervention, treatment optimization, and cost-effective healthcare delivery

Polycythemia Vera Treatment Market Dynamics

Driver

Rising Prevalence of Myeloproliferative Disorders and Increased Availability of Targeted Therapies

- The global burden of polycythemia vera is increasing due to the aging population and rising awareness of hematologic malignancies, driving higher diagnostic and treatment rates

- For instance, according to the American Cancer Society (2024), approximately 1 in 100,000 individuals are affected by PV annually, with a noticeable rise in early detection owing to improved screening techniques

- Pharmaceutical innovations, particularly the introduction of JAK inhibitors (like ruxolitinib and fedratinib), have significantly transformed the therapeutic landscape. These drugs effectively control hematocrit levels and reduce thrombotic complications, leading to improved quality of life

- Government initiatives and increasing investments in hematology research are also promoting access to novel therapeutics, especially in developed regions such as North America and Europe

- In addition, the adoption of telehematology and e-health platforms during and after the COVID-19 pandemic has enabled better patient management and remote monitoring, contributing to market expansion

- The overall market growth is projected to maintain a steady CAGR of 7.8% from 2025 to 2032, fueled by continuous drug pipeline development, diagnostic advancements, and supportive reimbursement policies

- The strong emphasis on developing targeted therapies and combination treatment protocols will continue to drive innovation, addressing unmet clinical needs and expanding the eligible patient population worldwide

Restraint/Challenge

High Treatment Costs and Limited Accessibility to Advanced Therapeutics

- Despite therapeutic progress, the high cost of polycythemia vera medications—especially JAK inhibitors and biologics—remains a substantial barrier to widespread adoption

- For instance, the average annual treatment cost for ruxolitinib exceeds USD 90,000 in several developed markets, posing affordability challenges even with insurance coverage

- In low- and middle-income regions, the limited availability of advanced diagnostics and targeted therapies delays diagnosis and leads to suboptimal management, hindering overall treatment outcomes

- Furthermore, many healthcare systems continue to rely on traditional phlebotomy and hydroxyurea therapies, which, while cost-effective, offer limited disease-modifying potential

- Another major challenge involves managing long-term adverse effects such as cytopenia and infection risk associated with JAK inhibition, necessitating ongoing safety monitoring and dose adjustments

- Regulatory complexities and slow approval timelines for innovative hematology drugs further constrain rapid global market adoption

- Addressing these challenges through price rationalization, broader clinical access programs, and health technology assessments (HTA) will be critical for ensuring equitable PV treatment availability

Polycythemia Vera Treatment Market Scope

The market is segmented on the basis of disease type, treatment, drug type, population type, route of administration, and end user.

- By Disease Type

On the basis of disease type, the Polycythemia Vera Treatment market is segmented into Primary PV and Secondary PV. Primary PV dominated the market with a largest revenue share of 62.4% in 2024, driven by higher prevalence, early diagnosis, and long-term treatment requirements including drug therapy and phlebotomy. Advanced therapies, first-line drugs, and biologics support this dominance, particularly in North America and Europe. Routine monitoring and adherence to established treatment protocols for Primary PV enhance consistent market demand. Patient awareness programs, insurance coverage, and strong healthcare infrastructure further strengthen revenue share. Clinical guidelines favor the use of approved drug therapies, boosting adoption. The segment’s dominance is reinforced by combination therapy practices, ongoing R&D, and availability of targeted treatments.

Secondary PV is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by rising recognition of underlying conditions such as chronic hypoxia and myeloproliferative disorders. Increased physician awareness, improved diagnostic facilities, and guideline-based treatment adoption accelerate market growth. Expanding access in Asia-Pacific and the Middle East contributes to rising patient treatment rates. Secondary PV often requires individualized therapy plans, which enhances drug adoption. The development of targeted biologics and first-line drugs further boosts market potential. Growth is also supported by healthcare education campaigns and increasing patient awareness.

- By Treatment

On the basis of treatment, the market is segmented into Phlebotomy and Drug Therapy. Drug Therapy dominated with a market share of 58.7% in 2024, driven by the growing adoption of JAK inhibitors, biologics, and other pharmacological interventions. High-risk PV patients prefer drug therapy for better hematocrit control, thrombotic event reduction, and long-term management. R&D investments, drug approvals, and adoption in hospitals and specialty clinics sustain dominance. Oral therapies enhance patient compliance, and guideline recommendations support widespread use. Hospitals offer integrated care combining diagnostics and drug therapy, boosting market share. The presence of first-line and second-line drugs ensures consistent demand. Biologic treatments, insurance coverage, and patient adherence strengthen revenue contribution. Drug therapy dominance is further driven by combination treatment approaches and the increasing availability of advanced therapies.

Phlebotomy is expected to witness the fastest CAGR of 7.5% from 2025 to 2032, fueled by cost-effectiveness and widespread use in early-stage PV. Adoption is increasing in emerging markets due to low-cost accessibility and guideline-based recommendations. Rising awareness among physicians and patients regarding early PV management drives phlebotomy adoption. Combination with drug therapy enhances treatment effectiveness. Hospitals and specialty clinics encourage early intervention via phlebotomy. Expansion of healthcare infrastructure in developing regions further contributes to growth. Screening programs and early diagnosis initiatives support segment adoption. Routine hematocrit monitoring reinforces long-term usage. Rising patient preference for non-invasive procedures also fuels growth.

- By Drug Type

On the basis of drug type, the market is segmented into Biologics and BioSimilars. Biologics dominated the market with a revenue share of 54.3% in 2024, driven by high efficacy, first-line adoption, and strong clinical support. Biologics are preferred by physicians due to established treatment outcomes and guideline recommendations. Adoption in North America and Europe remains high due to healthcare infrastructure, patient awareness, and insurance coverage. The availability of multiple formulations and approved therapies strengthens the dominance. Ongoing R&D, combination therapy adoption, and physician familiarity contribute to revenue share. Long-term patient adherence and monitoring support consistent demand. Biologics also benefit from robust clinical evidence and established safety profiles. Market dominance is further enhanced by the presence of leading pharmaceutical companies.

BioSimilars are expected to witness the fastest CAGR of 9.2% from 2025 to 2032, driven by cost advantages and growing availability in emerging markets. Increasing regulatory approvals, physician awareness, and patient preference for affordable options drive adoption. Insurance coverage expansion supports bio-similar uptake. The segment benefits from the rising need for scalable treatment options. Growing PV prevalence in Asia-Pacific and Latin America boosts demand. Market penetration is supported by hospital and specialty clinic adoption. Clinical studies demonstrating efficacy equivalence reinforce confidence. Increasing production and competition lower costs, accelerating adoption rates.

- By Population Type

On the basis of population type, the market is segmented into Children and Adults. Adults dominated the market with a revenue share of 87.6% in 2024, primarily due to the higher prevalence of Polycythemia Vera among the adult population, especially those aged 50 years and above. The segment’s dominance is further reinforced by increased diagnosis rates and widespread adoption of established treatment regimens including hydroxyurea, ruxolitinib, and interferon therapies. Long-term disease management, frequent follow-up visits, and continued use of medications ensure sustained revenue generation. Developed regions such as North America and Europe drive dominance owing to advanced healthcare infrastructure, awareness campaigns, and reimbursement facilities. Physicians prefer standardized treatment guidelines in adult patients to reduce thrombotic complications. Moreover, adults often require combination therapies involving phlebotomy and drug-based regimens, which enhances hospital and specialty clinic utilization. Patient adherence to long-term pharmacotherapy, coupled with access to first-line and second-line drugs, further strengthens market presence. Rising clinical trials, increasing availability of biologics, and growing government support for hematologic disorders also contribute significantly to the dominance of the adult segment.

Children are expected to witness the fastest CAGR of 6.8% from 2025 to 2032, driven by improving pediatric diagnostic accuracy and the increasing recognition of congenital and secondary PV cases. Technological advancements in genetic testing and hematologic screening are enabling earlier detection of pediatric PV, fostering timely intervention. The segment benefits from growing R&D in pediatric hematology and the availability of safer, child-specific formulations of biologics and hydroxyurea. Awareness initiatives among pediatricians and caregivers are improving treatment uptake, especially in North America and Europe. Specialty clinics are expanding their pediatric hematology units, ensuring access to targeted therapies and multidisciplinary care. Furthermore, early intervention through routine blood tests enhances management outcomes, promoting steady growth. Pharmaceutical companies are investing in pediatric clinical studies to optimize drug safety and dosage profiles. Government support programs focusing on rare and childhood blood disorders add to market momentum. Rising parental awareness and healthcare funding in developing regions are expected to sustain long-term growth in this segment.

- By Drugs Type

On the basis of drugs type, the market is segmented into First-Line Drugs and Second-Line Drugs. First-Line Drugs dominated the market with a share of 61.2% in 2024, driven by their widespread adoption as the standard of care for newly diagnosed PV patients. Hydroxyurea and interferon-based therapies continue to be the mainstay treatments recommended by global clinical guidelines. These drugs are widely accepted due to their proven efficacy in controlling hematocrit levels, reducing thrombotic events, and improving survival outcomes. Accessibility and affordability contribute to consistent market share, particularly in developed nations. Oral formulations and well-established dosage protocols enhance patient compliance and convenience. Hospitals and specialty clinics prefer first-line therapies for their safety profile and cost-effectiveness. Insurance coverage and reimbursement support increase patient adherence. The continued dominance of this segment is also attributed to extensive clinical experience, robust physician preference, and the increasing availability of generic formulations in emerging economies. Ongoing research on optimizing first-line regimens ensures sustainable revenue generation throughout the forecast period.

Second-Line Drugs are projected to witness the fastest CAGR of 8.7% from 2025 to 2032, driven by rising demand among patients resistant or intolerant to first-line treatments. The development and adoption of advanced JAK inhibitors such as ruxolitinib and ropeginterferon alfa-2b are key growth catalysts. Expanding clinical studies are enhancing safety and efficacy profiles, driving physician confidence in second-line options. Specialty clinics and hospitals are increasingly adopting these drugs to manage complex and high-risk PV cases. The emergence of novel molecules, combination regimens, and targeted biologics further accelerates market expansion. Rising healthcare investments, favorable regulatory approvals, and improved access to advanced therapies in Asia-Pacific and Latin America contribute to segment growth. Patients seeking personalized treatment approaches are turning toward second-line options for better symptom control and disease management. The competitive landscape is evolving with biosimilar entries and cost optimization, ensuring broader adoption over the coming years.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral and Parenteral. Oral administration dominated the market with a revenue share of 69.5% in 2024, primarily due to its convenience, patient preference, and widespread use of oral formulations such as hydroxyurea and ruxolitinib. Oral drugs enable home-based management, reducing hospital visits and improving treatment adherence. The segment benefits from cost-effectiveness and high availability across retail and hospital pharmacies. Ease of storage and self-administration make oral therapies particularly suitable for chronic management of PV. Strong physician recommendation and guideline-based therapy further drive market share. The presence of multiple branded and generic options ensures accessibility in both developed and developing regions. Patient compliance is reinforced by reduced treatment complexity and improved quality of life. Moreover, oral administration aligns with increasing telehealth and remote care models, enhancing overall market penetration. Insurance coverage and reimbursement for oral medications also play a crucial role in segment dominance.

Parenteral administration is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, propelled by the growing adoption of biologics and injectable interferon therapies. This route is preferred for patients with high-risk PV or intolerance to oral medications. Parenteral drugs deliver rapid and targeted efficacy, ensuring better disease control in complex cases. The introduction of long-acting injectable formulations has improved dosing convenience and adherence. Specialty clinics and hospital infusion centers are increasingly offering parenteral treatment services to support personalized care. Rising acceptance of biosimilars and cost-effective injectable drugs enhances accessibility across various regions. Clinical advancements in intravenous biologics are further expanding the treatment landscape. The segment’s growth is also supported by improved cold-chain logistics and supply chain capabilities. Moreover, ongoing innovations in drug delivery mechanisms, including subcutaneous injections, are expected to fuel adoption through the forecast period.

- By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, Diagnostic Centers, Research Institutes, and Others. Hospitals dominated with a revenue share of 55.8% in 2024, primarily due to their comprehensive treatment capabilities and presence of multidisciplinary teams of hematologists. Hospitals serve as the first point of diagnosis and management for most PV cases, ensuring high patient footfall. They provide integrated services including phlebotomy, drug therapy, and diagnostic testing under one roof. Access to advanced biologics, emergency care, and continuous patient monitoring reinforces hospital dominance. Strong collaborations with research organizations and pharmaceutical firms enhance clinical trial activity within hospital settings. In developed markets, hospital-based reimbursement models and insurance coverage further support patient retention. In addition, hospitals act as referral centers for complex and resistant PV cases requiring specialized care. The expansion of tertiary care centers and adoption of digital monitoring tools further bolster segment dominance across global regions.

Specialty Clinics are projected to record the fastest CAGR of 9.1% from 2025 to 2032, driven by the increasing preference for focused, patient-centric hematology care. These clinics offer personalized treatment plans, shorter waiting times, and closer patient follow-ups, enhancing treatment adherence. Growth is supported by expanding clinic networks in North America, Europe, and Asia-Pacific. Specialty clinics are well-equipped with advanced diagnostic tools and infusion facilities for parenteral therapy. The rising number of trained hematologists and improved accessibility in urban and semi-urban regions further accelerate adoption. Partnerships between specialty clinics and pharmaceutical companies for clinical trials and patient education programs also enhance growth. Their increasing role in providing outpatient drug administration and genetic counseling strengthens their importance in the PV treatment ecosystem. With healthcare systems shifting toward decentralized and community-based care, specialty clinics are expected to remain a key growth driver through the forecast period.

Polycythemia Vera Treatment Market Regional Analysis

- North America dominated the polycythemia vera treatment market with the largest revenue share of 41.65% in 2024

- Driven by a well-established healthcare infrastructure, high diagnostic awareness, and strong presence of key pharmaceutical companies

- The market experienced substantial growth in polycythemia vera drug adoption, particularly across hospitals and specialty clinics, fueled by advancements in JAK inhibitors, combination therapies, and improved treatment protocols

U.S. Polycythemia Vera Treatment Market Insight

The U.S. polycythemia vera treatment market captured the largest revenue share within North America in 2024, supported by increasing awareness of disease management, availability of advanced therapeutics, and rising adoption of standardized treatment guidelines in hospitals and specialty clinics. Strong investment in research and development of novel therapies, coupled with initiatives to improve patient monitoring and long-term care, further drives market expansion.

Europe Polycythemia Vera Treatment Market Insight

The Europe polycythemia vera treatment market is projected to expand at a substantial CAGR throughout the forecast period, supported by increasing awareness of hematologic disorders, advanced healthcare facilities, and availability of targeted therapies. The region is witnessing growth across hospitals, specialty clinics, and research centers, with new treatment protocols being increasingly adopted for better patient outcomes.

U.K. Polycythemia Vera Treatment Market Insight

The U.K. polycythemia vera treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of hematological disorders, increasing focus on early diagnosis, and adoption of advanced treatment regimens in hospitals and clinics. National health programs promoting awareness and patient access to therapeutics further contribute to market growth.

Germany Polycythemia Vera Treatment Market Insight

The Germany polycythemia vera treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by a high standard of healthcare, strong presence of pharmaceutical companies, and growing emphasis on patient-centered treatment. Hospitals and specialty clinics are increasingly adopting JAK inhibitors and combination therapies, supporting broader market expansion.

Asia-Pacific Polycythemia Vera Treatment Market Insight

The Asia-Pacific polycythemia vera treatment market is poised to grow at the fastest CAGR during the forecast period due to expanding healthcare access, rising patient awareness, and increased investments in hematology research. Countries such as China, Japan, and India are witnessing substantial adoption of advanced therapeutics, improvements in diagnostic facilities, and establishment of specialty clinics, driving regional market growth.

Japan Polycythemia Vera Treatment Market Insight

The Japan polycythemia vera treatment market is gaining momentum due to the country’s advanced healthcare system, high patient awareness, and growing adoption of evidence-based treatment protocols. Specialty clinics and hospitals focusing on early diagnosis and long-term disease management further support market expansion. In addition, ongoing research initiatives and government support for hematology care are expected to bolster the market.

China Polycythemia Vera Treatment Market Insight

The China polycythemia vera treatment market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to expanding healthcare infrastructure, increasing number of hospitals and specialty clinics, rising prevalence of polycythemia vera, and growing public awareness regarding effective treatments. The region’s focus on improving access to novel therapeutics, coupled with strong government and private healthcare initiatives, continues to propel market growth.

Polycythemia Vera Treatment Market Share

The Polycythemia Vera Treatment industry is primarily led by well-established companies, including:

• Novartis AG (Switzerland)

• Bristol-Myers Squibb Company (U.S.)

• Incyte Corporation (U.S.)

• AbbVie Inc. (U.S.)

• Roche Holding AG (Switzerland)

• Pfizer Inc. (U.S.)

• Sanofi (France)

• AstraZeneca plc (U.K.)

• Amgen Inc. (U.S.)

• Takeda Pharmaceutical Company Limited (Japan)

• GSK plc (U.K.)

• Bayer AG (Germany)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Johnson & Johnson and its affiliates (U.S.)

• Celgene Corporation (U.S.)

Latest Developments in Global Polycythemia Vera Treatment Market

- In November 2021, the U.S. Food and Drug Administration (FDA) approved ropeginterferon alfa-2b-njft (brand name: BESREMi) for the treatment of adults with polycythemia vera (PV). This approval marked the first interferon therapy specifically approved for PV, offering a treatment option for patients regardless of their previous treatment history. Ropeginterferon alfa-2b is a long-acting monopegylated interferon alpha-2b, providing a new approach for managing this rare blood cancer

- In August 2025, the FDA granted Breakthrough Therapy Designation to rusfertide (PTG-300), a hepcidin-mimetic peptide, for the treatment of erythrocytosis in PV patients. This designation was based on positive findings from the Phase 3 VERIFY study, which demonstrated rusfertide's efficacy in reducing phlebotomy dependence and improving hematologic control in PV patients

- In August 2025, the FDA granted Orphan Drug Designation to VGT-1849B, an investigational selective JAK2 inhibitor, for the treatment of PV. This designation reflects the drug's potential to offer improved safety and efficacy in PV treatment, addressing the unmet needs of patients with this rare hematologic disorder

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.