Global Polydimethylsiloxane Pdms Market

Market Size in USD Million

CAGR :

%

USD

710.30 Million

USD

1,115.13 Million

2024

2032

USD

710.30 Million

USD

1,115.13 Million

2024

2032

| 2025 –2032 | |

| USD 710.30 Million | |

| USD 1,115.13 Million | |

|

|

|

|

Polydimethylsiloxane (PDMS) Market Size

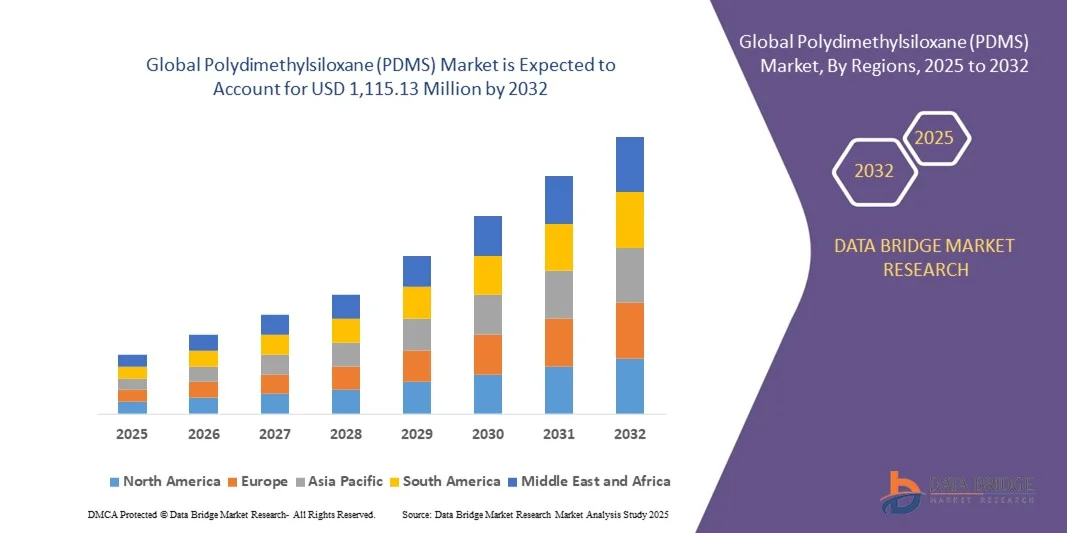

- The global polydimethylsiloxane (PDMS) market size was valued at USD 710.3 million in 2024 and is expected to reach USD 1,115.13 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by increasing demand for PDMS in personal care, cosmetics, healthcare, and industrial applications due to its unique properties such as thermal stability, chemical resistance, and flexibility

- Rising adoption of PDMS in medical devices, electronics, and automotive applications is further driving market expansion

Polydimethylsiloxane (PDMS) Market Analysis

- The PDMS market is witnessing steady growth due to its wide range of applications across healthcare, electronics, construction, and personal care industries

- Increasing R&D activities focused on developing advanced PDMS formulations with enhanced properties are boosting market adoption

- North America dominated the polydimethylsiloxane (PDMS) market with the largest revenue share in 2024, driven by increasing demand from personal care, healthcare, and industrial applications. The growing adoption of PDMS in cosmetics, haircare, medical devices, and lubricants, coupled with high manufacturing standards and technological expertise, supports widespread utilization in the region

- Asia-Pacific region is expected to witness the highest growth rate in the global polydimethylsiloxane (PDMS) market, driven by increasing urbanization, technological advancements, strong industrial expansion, and rising demand for PDMS in personal care, healthcare, and electronics applications

- The High-Molecular Weight PDMS segment held the largest market revenue share in 2024, driven by its superior viscosity, thermal stability, and mechanical strength, making it suitable for industrial, personal care, and healthcare applications. High-Molecular Weight PDMS provides enhanced durability and performance in coatings, sealants, and medical devices, boosting its adoption across multiple industries

Report Scope and Polydimethylsiloxane (PDMS) Market Segmentation

|

Attributes |

Polydimethylsiloxane (PDMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polydimethylsiloxane (PDMS) Market Trends

Rising Adoption of PDMS in Personal Care and Industrial Applications

- The growing use of polydimethylsiloxane (PDMS) across personal care, cosmetics, and healthcare is transforming the market by offering versatile, high-performance solutions. Its properties, such as thermal stability, chemical resistance, and flexibility, enable formulation of advanced products in skincare, hair care, and medical devices, improving performance and user satisfaction. Rising consumer preference for premium, long-lasting cosmetic products is further driving the adoption of PDMS in formulations globally. Enhanced product efficacy and texture customization are encouraging manufacturers to integrate PDMS into innovative personal care lines

- Increasing demand for PDMS in industrial applications, such as electronics, automotive, and construction, is accelerating adoption. Its insulating, lubricating, and water-repellent properties are critical in high-tech manufacturing, helping improve efficiency, durability, and product quality. The material’s stability under extreme conditions and compatibility with other polymers make it indispensable for advanced industrial solutions. Companies are leveraging PDMS to improve performance of coatings, sealants, and electronic components, boosting industrial productivity and reducing maintenance costs

- The affordability and ease of processing modern PDMS formulations are making them attractive for research, commercial, and industrial use, enabling frequent innovation without excessive costs. Manufacturers benefit from adaptable production techniques, enabling rapid development of customized formulations for diverse applications. PDMS’s versatility allows simultaneous use in multiple industries, from cosmetics to electronics, reducing R&D costs and shortening time-to-market for new products. The ability to tailor viscosity, molecular weight, and functional additives further enhances its utility in specialized applications

- For instance, in 2023, several cosmetic companies in Europe and North America reported enhanced product performance and customer satisfaction after integrating PDMS in haircare and skincare formulations. The material allowed improved texture, spreadability, and long-lasting effects, strengthening brand differentiation. Enhanced water-repellency and film-forming capabilities also helped reduce product greasiness while improving moisturization, elevating overall user experience. Manufacturers observed higher repeat purchases and increased brand loyalty as a result of these improvements

- While PDMS adoption is expanding across multiple sectors, its impact depends on continued innovation, regulatory compliance, and cost efficiency. Manufacturers must focus on developing eco-friendly, high-performance, and application-specific PDMS solutions to fully capitalize on market opportunities. Integration with emerging technologies such as bio-based PDMS and hybrid formulations can further enhance sustainability and functionality, supporting long-term growth

Polydimethylsiloxane (PDMS) Market Dynamics

Driver

Increasing Demand Across Personal Care, Healthcare, and Industrial Applications

- Rising demand in personal care and cosmetics for smooth texture, shine, and skin protection is driving PDMS adoption. Its versatility enables formulations that improve product efficacy and customer experience, accelerating market growth. The ability to combine PDMS with natural and organic ingredients allows manufacturers to cater to the growing trend of sustainable and eco-conscious personal care products. Frequent product launches in premium cosmetic segments are further contributing to market expansion

- Industrial adoption in electronics, automotive, and construction is increasing due to PDMS’s insulating, lubricating, and chemical-resistant properties. These applications require reliable, durable, and high-performance materials, boosting consumption. PDMS enhances durability of automotive coatings, electronic encapsulants, and construction sealants, reducing maintenance and improving operational efficiency. Companies are increasingly preferring PDMS over alternative polymers due to its thermal stability, chemical resistance, and flexibility under stress conditions

- Expanding R&D initiatives are focused on creating specialty PDMS grades for advanced medical devices, coatings, and electronic components. These innovations are enhancing product performance and widening the scope of use. Collaborations between chemical manufacturers and end-users are enabling development of application-specific PDMS formulations, increasing adoption in niche industries. Advances in polymer modification and functionalization are improving compatibility with other materials, driving industrial and healthcare applications

- For instance, in 2022, leading electronics manufacturers in Asia integrated PDMS-based coatings in flexible circuit boards, improving durability and thermal resistance. The material also enhanced electrical insulation and moisture protection, extending product life and reliability. The successful integration of PDMS in high-tech electronics demonstrates its critical role in innovation and performance optimization

- While rising demand is driving growth, manufacturers must maintain consistent quality, regulatory compliance, and cost-effectiveness to sustain adoption across multiple industries. Adapting to evolving environmental standards and consumer preferences is essential for long-term competitiveness. Companies investing in sustainable PDMS production, recycling initiatives, and bio-based alternatives are likely to gain a strategic advantage in the global market

Restraint/Challenge

High Cost Of Specialty PDMS And Regulatory Compliance Requirements

- The high price of specialty PDMS grades limits accessibility for small and mid-sized manufacturers, especially in cost-sensitive markets. Advanced formulations with unique properties are often reserved for large-scale or high-value applications. Price volatility of raw materials and fluctuating production costs further add to market challenges, restricting adoption in emerging economies. Small manufacturers often face budget constraints, delaying product development and expansion

- In many regions, strict regulatory requirements for medical, cosmetic, and food-grade PDMS restrict market penetration. Compliance with safety and environmental standards increases production costs and limits adoption in emerging markets. Obtaining certifications and approvals can be time-consuming, creating barriers for new entrants. Companies must allocate significant resources to meet local and international regulatory standards, impacting overall profitability

- Supply chain challenges for raw materials and specialty additives further constrain consistent availability and scalability. These barriers can slow product development and delay market entry. Logistic disruptions, import restrictions, and dependency on limited suppliers exacerbate accessibility issues. Ensuring reliable sourcing while maintaining quality and sustainability is critical for continuous market growth

- For instance, in 2023, several small cosmetic manufacturers in Africa and Southeast Asia reported delays in product launches due to the high cost and limited availability of pharmaceutical-grade PDMS. These delays affected production schedules, profitability, and competitive positioning in the market. The need for alternative sourcing and localized production strategies became evident to overcome supply chain limitations

- While PDMS technology continues to advance, addressing cost, compliance, and supply chain challenges remains crucial. Market stakeholders must focus on scalable, affordable, and eco-friendly solutions to unlock long-term growth potential. Investment in R&D, strategic partnerships, and sustainable sourcing are key strategies to mitigate challenges and enhance market resilience

Polydimethylsiloxane (PDMS) Market Scope

The market is segmented on the basis of type, form, end-user, and application

- By Type

On the basis of type, the PDMS market is segmented into Low-Molecular Weight PDMS, High-Molecular Weight PDMS, and Ultra-High Molecular Weight PDMS. The High-Molecular Weight PDMS segment held the largest market revenue share in 2024, driven by its superior viscosity, thermal stability, and mechanical strength, making it suitable for industrial, personal care, and healthcare applications. High-Molecular Weight PDMS provides enhanced durability and performance in coatings, sealants, and medical devices, boosting its adoption across multiple industries.

The Low-Molecular Weight PDMS segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its fluidity, easy processability, and versatility in cosmetics, medical, and electronics applications. Its compatibility with various formulations and ability to improve texture, spreadability, and performance in personal care products is fueling rapid adoption.

- By Form

On the basis of form, the PDMS market is segmented into PDMS Elastomers, PDMS Fluids, PDMS Resins, and Others. The PDMS Elastomers segment held the largest revenue share in 2024, driven by high elasticity, chemical resistance, and durability, which are essential for construction, industrial, and healthcare applications. Elastomers provide long-lasting performance in sealants, gaskets, and flexible medical devices.

The PDMS Fluids segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its widespread use as lubricants, anti-foaming agents, and in personal care formulations. The low viscosity and excellent spreadability of PDMS Fluids make them ideal for enhancing product performance and user experience in cosmetics and industrial applications.

- By End-User

On the basis of end-user, the PDMS market is segmented into Industrial Process, Building & Construction, Household & Personal Care, Transportation, Electrical & Electronics, Healthcare, and Others. The Household & Personal Care segment held the largest market revenue share in 2024, driven by the increasing use of PDMS in skincare, haircare, and cosmetic formulations. Its ability to improve product texture, stability, and efficacy is fueling adoption in personal care products.

The Industrial Process segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising demand for PDMS in lubricants, coatings, sealants, and adhesives used across various manufacturing and industrial applications. High performance and durability make PDMS a preferred choice for industrial processes.

- By Application

On the basis of application, the PDMS market is segmented into Lubricants and Greases, Food & Beverages Industry, Surfactants and Antifoaming Agents, Pharmaceutical and Cosmetic Industry, and Others. The Pharmaceutical and Cosmetic Industry segment held the largest revenue share in 2024, driven by the high demand for PDMS in haircare, skincare, and medical products. Its benefits in improving texture, spreadability, and long-term stability enhance product performance and consumer satisfaction.

The Surfactants and Antifoaming Agents segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing industrial and household applications where PDMS reduces foam, improves efficiency, and enhances overall product performance.

Polydimethylsiloxane (PDMS) Market Regional Analysis

- North America dominated the polydimethylsiloxane (PDMS) market with the largest revenue share in 2024, driven by increasing demand from personal care, healthcare, and industrial applications. The growing adoption of PDMS in cosmetics, haircare, medical devices, and lubricants, coupled with high manufacturing standards and technological expertise, supports widespread utilization in the region

- Consumers and manufacturers in the region highly value PDMS for its versatility, thermal stability, chemical resistance, and performance-enhancing properties, which improve product quality and efficiency. North America’s strong R&D capabilities and well-established supply chains further facilitate the integration of PDMS into innovative formulations

- This widespread adoption is further supported by high disposable incomes, growing industrialization, and an emphasis on sustainable, high-performance materials, establishing PDMS as a preferred solution across multiple end-use sectors

U.S. PDMS Market Insight

The U.S. PDMS market captured the largest revenue share in 2024 within North America, fueled by the increasing demand for high-performance materials in personal care, industrial, and healthcare applications. Manufacturers are leveraging PDMS for cosmetics, lubricants, electronics, and medical device formulations due to its superior stability and functional benefits. Strong R&D infrastructure, along with government initiatives promoting industrial innovation, is significantly contributing to market expansion.

Europe PDMS Market Insight

The Europe PDMS market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulatory standards, increasing industrial automation, and the rising need for high-quality, sustainable materials. Adoption in cosmetics, healthcare, electronics, and industrial applications is growing steadily, supported by innovation in specialty PDMS grades and advanced processing technologies. The region is witnessing significant utilization in both new product development and reformulations across multiple industries.

U.K. PDMS Market Insight

The U.K. PDMS market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use in personal care, cosmetics, and healthcare applications, alongside rising awareness regarding material performance and sustainability. Manufacturers are focusing on high-quality, specialized PDMS for formulations requiring enhanced stability, spreadability, and chemical resistance. The growing trend of eco-friendly and high-performance products in cosmetics and industrial applications further supports market growth.

Germany PDMS Market Insight

The Germany PDMS market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness about high-performance materials and stringent environmental regulations. The country’s emphasis on innovation, industrial automation, and sustainability encourages the adoption of PDMS in industrial, personal care, and healthcare applications. Integration with advanced manufacturing processes and eco-conscious product development is driving market expansion in both residential and commercial sectors.

Asia-Pacific PDMS Market Insight

The Asia-Pacific PDMS market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrialization, rising disposable incomes, and technological advancements in countries such as China, India, and Japan. The growing demand for PDMS in personal care, cosmetics, electronics, and automotive applications is accelerating market adoption. In addition, government initiatives promoting industrial development and the availability of cost-effective PDMS grades are expanding accessibility across the region.

Japan PDMS Market Insight

The Japan PDMS market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, rising urbanization, and emphasis on product quality and safety. The market is driven by increasing adoption in personal care, cosmetics, and medical device applications. Integration of PDMS in high-performance formulations, along with demand for precise, durable, and efficient materials, supports market expansion in both industrial and consumer sectors.

China PDMS Market Insight

The China PDMS market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrial growth, a rising middle class, and strong adoption of innovative materials. PDMS is increasingly utilized in personal care, healthcare, electronics, and industrial applications. The push towards smart manufacturing, availability of cost-effective PDMS products, and strong domestic production capabilities are key factors propelling market growth in China.

Polydimethylsiloxane (PDMS) Market Share

The Polydimethylsiloxane (PDMS) industry is primarily led by well-established companies, including:

• Dow (U.S.)

• Wacker Chemie AG (Germany)

• KCC Corporation (South Korea)

• Alfa Aesar (U.S.)

• Thermo Fisher Scientific (U.S.)

• CHT Group (Germany)

• BRB International b.v. (Netherlands)

• Spectrum Chemical Manufacturing Corp. (U.S.)

• Siltech Corporation (Canada)

• Wynca Group (China)

• Iota Silicone Oil (Anhui) Co., Ltd (China)

• Clearco Products Co., Inc. (U.S.)

• Specialty Silicone Products, Inc. (U.S.)

• Santa Cruz Biotechnology, Inc. (U.S.)

• GELEST, INC. (U.S.)

• Tokyo Chemical Industry Co., Ltd (Japan)

• Merck KGaA (Germany)

• Quzhou Ruilijie Chemical Industry Co., Ltd. (China)

• Elkay Chemicals Pvt. Ltd. (India)

• KCC Basildon (U.K.)

• ARIHANT SOLVENTS AND CHEMICALS (India)

Latest Developments in Global Polydimethylsiloxane (PDMS) Market

- In April 2023, Chengdu Silike Technology introduced a range of silicone-based additives, including anti-scratch and anti-abrasion masterbatches, at the Chinaplas 2023 exhibition. This development focuses on sustainable, eco-friendly solutions for modified plastics, aiming to enhance material performance while reducing environmental impact. The launch attracted considerable attention from industry stakeholders, strengthening Silike’s position in the market and paving the way for potential collaborations with key partners

- In early 2023, Momentive Performance Materials launched HARMONI, a silicone-based additive targeted at the beauty and personal care sector. The product is designed to improve the texture and sensory experience of cosmetic formulations, offering smoother feel and enhanced user satisfaction. This development highlights Momentive’s strategic expansion into high-value applications, aligning with growing consumer demand for premium, functional ingredients in skincare and cosmetics, and boosting its market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.