Global Polyethylene Terephthalate Pet Resins Market

Market Size in USD Million

CAGR :

%

USD

91.17 Million

USD

158.06 Million

2024

2032

USD

91.17 Million

USD

158.06 Million

2024

2032

| 2025 –2032 | |

| USD 91.17 Million | |

| USD 158.06 Million | |

|

|

|

|

Polyethylene Terephthalate (PET) Resins Market Analysis

The polyethylene terephthalate (PET) resins market has seen significant technological advancements, particularly in recycling and production methods. One of the most notable innovations is the development of advanced recycling techniques, including chemical recycling and enzyme-based technologies, which enable PET to be broken down and reused into high-quality resin. This method reduces plastic waste and lowers the environmental impact, meeting the growing demand for sustainable practices.

Another key advancement is the use of renewable resources in PET production. Bio-based PET, produced from renewable sources such as plant sugars, has gained traction as a more sustainable alternative to traditional petroleum-based PET. The integration of this technology has driven the growth of the PET market, especially in packaging applications where consumer demand for eco-friendly materials is rising.

Furthermore, the growing demand for lightweight, durable packaging materials in industries such as food and beverage, personal care, and pharmaceuticals has boosted the PET resin market. PET’s recyclability, combined with innovations in production, is expected to support its continued market growth, valued at billions globally.

Polyethylene Terephthalate (PET) Resins Market Size

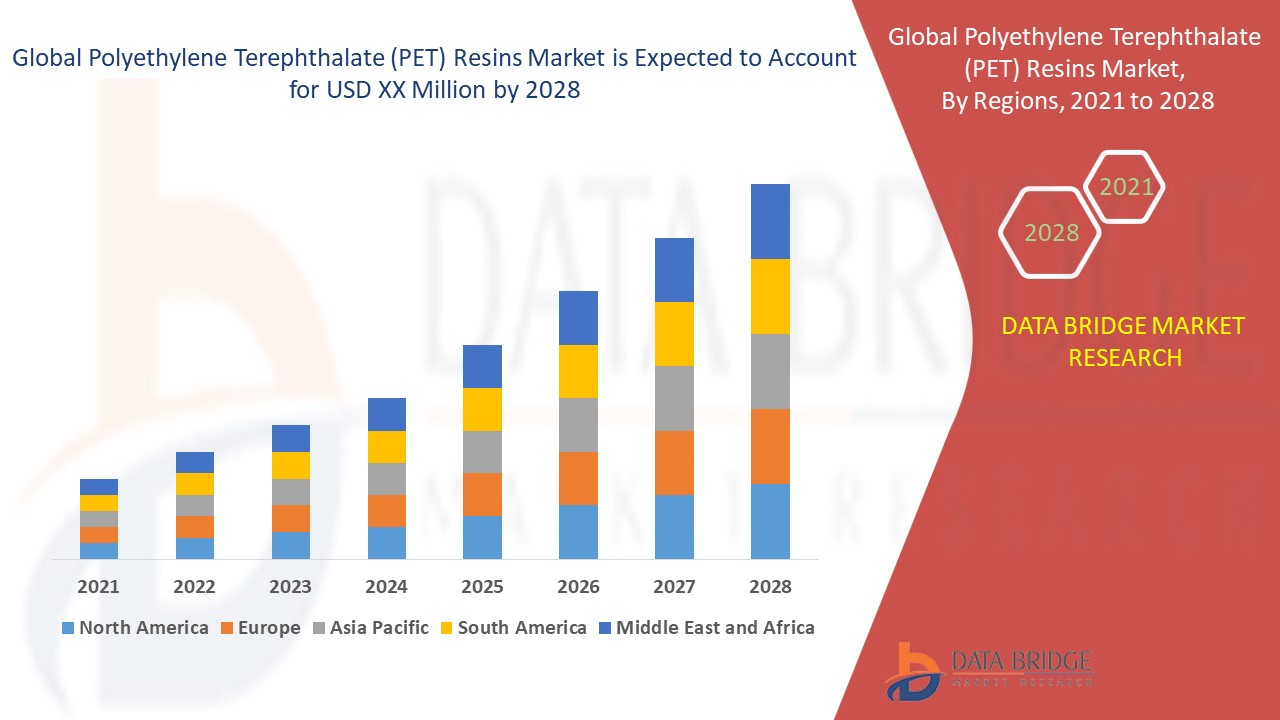

The global polyethylene terephthalate (PET) resins market size was valued at USD 91.17 million in 2024 and is projected to reach USD 158.06 million by 2032, with a CAGR of 7.12% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Polyethylene Terephthalate (PET) Resins Market Trends

“Increasing Demand for Sustainable PET Packaging”

A key trend driving growth in the polyethylene terephthalate (PET) resins market is the growing demand for sustainable and recyclable PET packaging. As businesses and consumers increasingly prioritize environmental responsibility, there is a rising shift towards using PET in packaging due to its recyclability and lower environmental impact compared to other materials. For instance, Coca-Cola and PepsiCo are investing heavily in using rPET (recycled PET) for their bottles, aiming to reduce plastic waste. This trend is expected to accelerate as governments implement stricter regulations on plastic waste, pushing manufacturers to adopt PET for eco-friendly packaging solutions, further boosting the market's growth.

Report Scope and Polyethylene Terephthalate (PET) Resins Market Segmentation

|

Attributes |

Polyethylene Terephthalate (PET) Resins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Alpek S.A.B. de C.V. (Mexico), Indorama Ventures Public Company Limited (Thailand), JBF Industries Ltd (India), LOTTE Chemical CORPORATION (South Korea), Far Eastern New Century Corporation (Taiwan), China Petrochemical Corporation (Sinopec) (China), SABIC (Saudi Arabia), Reliance Industries Limited (India), RTP Company (U.S.), Vikas Ecotech Ltd. (India), TEIJIN LIMITED (Japan), Hitachi, Ltd. (Japan), NEO GROUP, UAB (Lithuania), DuPont (U.S.), Filatex India Limited (India), Polyplex (India), Retal Industries LTD. (U.A.E.), Persian Gulf Petrochemical Industries Co. (Iran), Mitsubishi Chemical Group of companies (Japan), and Verdeco Recycling (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyethylene Terephthalate (PET) Resins Market Definition

Polyethylene terephthalate (PET) resins are a type of thermoplastic polymer widely used in the production of bottles, containers, films, and fibers. PET is known for its strength, durability, and excellent clarity, making it ideal for packaging materials, especially in the food and beverage industry. It is also resistant to moisture and gases, preserving the contents of containers effectively. PET can be recycled multiple times, contributing to sustainability. The resin is formed through a polymerization process involving terephthalic acid and ethylene glycol, making it an essential material in manufacturing lightweight, cost-effective, and eco-friendly products.

Polyethylene Terephthalate (PET) Resins Market Dynamics

Drivers

- Rising Demand for Automotive Applications

The growing use of PET resins in the automotive industry is a key driver of market growth. PET's lightweight, durable, and cost-effective properties make it ideal for applications such as interior panels, trim, insulation materials, and under-the-hood components. For instance, BMW has adopted PET-based materials for their vehicle interiors, reducing overall vehicle weight and improving fuel efficiency. The automotive sector’s shift towards lightweight materials to meet fuel efficiency standards and reduce CO2 emissions is propelling PET demand. As car manufacturers increasingly prioritize sustainability and energy efficiency, PET resin’s ability to replace heavier metals and plastics in automotive parts is fueling their adoption and driving market expansion.

- Expanding E-Commerce Sector

The surge in e-commerce has significantly boosted the demand for PET packaging, as online shopping requires reliable, secure packaging for shipping products. PET's strength, flexibility, and lightweight properties make it an ideal material for protecting goods during transit while reducing shipping costs. For instance, Amazon's widespread use of PET-based packaging, such as bubble wraps and protective films, showcases the material's ability to keep products safe from damage. As e-commerce continues to grow globally, especially in regions such as Asia Pacific and North America, the demand for PET packaging solutions is expected to rise, driving further growth in the PET resins market.

Opportunities

- Shift Towards Light-Weighting

The shift towards light-weighting in industries such as automotive and packaging presents significant opportunities for PET resins. PET’s lightweight nature makes it an ideal alternative to heavier materials such as glass and metal, especially in packaging applications. For instance, the beverage industry increasingly adopts PET bottles over glass bottles to reduce weight and improve shipping efficiency, cutting transportation costs. In automotive manufacturing, PET is used to replace metal components, contributing to fuel efficiency and lower carbon emissions due to reduced vehicle weight. This trend supports cost savings and aligns with sustainability goals, enhancing PET's demand across sectors and driving market growth.

- Technological Advancements in PET Production

Recent technological advancements in PET resin production have created significant opportunities in the market. Improved processing techniques, such as enhanced extrusion and injection molding methods, have led to stronger, more lightweight PET products, reducing production costs and improving efficiency. In addition, the development of bio-based PET, made from renewable sources such as plant-based materials, offers an eco-friendly alternative to traditional petroleum-based PET. For instance, Coca-Cola has pioneered the use of "PlantBottle," a partially plant-based PET, which has reduced their carbon footprint. These innovations meet growing consumer demand for sustainable solutions and open new avenues for growth in the packaging, textile, and automotive sectors.

Restraints/Challenges

- Fluctuating Raw Material Prices

Fluctuating raw material prices pose a significant challenge to the polyethylene terephthalate (PET) resins market. The cost of key raw materials such as terephthalic acid and ethylene glycol can vary due to factors such as supply chain disruptions, changes in crude oil prices, and market demand. This volatility leads to unpredictable production costs for manufacturers, making it difficult to maintain stable profit margins. As raw material prices rise, manufacturers may face increased production costs, which could be passed on to consumers, potentially reducing demand. Such price fluctuations disrupt the overall market stability, hindering the growth of the PET resins industry.

- Challenges in Recycling

Recycling challenges significantly hinder the growth of the polyethylene terephthalate (PET) resins market. Although PET is recyclable, the recycling process is complex and costly, leading to limitations in the quality of recycled PET. The recycling process often faces contamination issues, as PET is commonly mixed with other materials, which affects the efficiency and quality of the recycling output. Moreover, the lack of widespread recycling infrastructure in many regions further complicates the recycling of PET. This results in an insufficient amount of recycled PET entering the market, limiting its potential as a sustainable alternative to virgin PET. These barriers contribute to a slower market adoption of recycled PET.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Polyethylene Terephthalate (PET) Resins Market Scope

The market is segmented on the basis of product type, end-user industry, application and material. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Bottles

- Films and Sheets

- Cups

- Cans

- Pouches

- Others

End- User Industry

- Food and Beverage

- Automotive

- Electrical and Electronics

- Healthcare

- Consumer Goods

- Others

Application

- Beverages

- Sheets and Films

- Consumer Goods

- Food Packaging

- Others

Material

- Glass

- Plastics

- Metal

- Paperboard

- Others

Polyethylene Terephthalate (PET) Resins Market Regional Analysis

The market is analysed and market size insights and trends are provided by product type, end-user industry, application and material as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate the polyethylene terephthalate (PET) resins market, driven by changing lifestyles and an increased demand for PET bottles. The region's growing focus on packaging, beverage industries, and sustainability initiatives further fuels market growth. In addition, the rising consumption of packaged goods and bottled drinks supports PET resin demand in Asia-Pacific.

Middle East and Africa is expected to show significant growth in the polyethylene terephthalate (PET) resins market, driven by the increasing demand for sustainable and recyclable materials. In addition, the rising popularity of frozen and processed foods among the region's population is fueling the demand for PET resins in packaging applications.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Polyethylene Terephthalate (PET) Resins Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Polyethylene Terephthalate (PET) Resins Market Leaders Operating in the Market Are:

- Alpek S.A.B. de C.V. (Mexico)

- Indorama Ventures Public Company Limited (Thailand)

- JBF Industries Ltd (India)

- LOTTE Chemical CORPORATION (South Korea)

- Far Eastern New Century Corporation (Taiwan)

- China Petrochemical Corporation (Sinopec) (China)

- SABIC (Saudi Arabia)

- Reliance Industries Limited (India)

- RTP Company (U.S.)

- Vikas Ecotech Ltd. (India)

- TEIJIN LIMITED (Japan)

- Hitachi, Ltd. (Japan)

- NEO GROUP, UAB (Lithuania)

- DuPont (U.S.)

- Filatex India Limited (India)

- Polyplex (India)

- Retal Industries LTD. (U.A.E.)

- Persian Gulf Petrochemical Industries Co. (Iran)

- Mitsubishi Chemical Group of companies (Japan)

- Verdeco Recycling (U.S.)

Latest Developments in Polyethylene Terephthalate (PET) Resins Market

- In July 2024, Indorama Ventures announced plans to expand its PET recycling facility in Poland, increasing its recycling capacity by 20%. This strategic move supports the European Union’s Circular Economy Action Plan, which sets ambitious recycling targets for PET by 2025. The expansion will contribute to more sustainable packaging solutions and meet growing environmental demands

- In March 2024, Eastman Chemical Company expanded its PBT production line in the United States to address the increasing demand from the automotive and electronics sectors. This expansion aligns with U.S. government efforts to promote advanced manufacturing, enhance the sustainability of the automotive industry, and reduce its carbon footprint through innovative material solutions

- In June 2022, Alpek acquired OCTAL, boosting its PET resin production capacity by 576,000 tons annually. This acquisition allows Alpek to meet the growing demand for PET from various industries, including packaging and textiles. With enhanced production capabilities, Alpek strengthens its position as a leader in the global PET market and offers superior products

- In February 2022, Alpek finalized its acquisition of OCTAL Holding SAOC, significantly enhancing its global market presence. This strategic purchase increases Alpek’s capacity for producing high-quality PET sheets, meeting the growing demand in diverse industries. The acquisition positions Alpek as a stronger player in the global PET production and distribution landscape

- In January 2022, Indorama Ventures proposed acquiring NN, a Vietnamese PET converter, as part of its strategy to strengthen its position in the fast-growing packaging sector in Asia-Pacific. The acquisition aims to enhance Indorama’s presence in key markets and expand its capabilities in producing high-quality PET products, aligning with the region’s rising demand for sustainable packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyethylene Terephthalate Pet Resins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyethylene Terephthalate Pet Resins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyethylene Terephthalate Pet Resins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.