Global Polylactic Acid (pla) Market For 3d Printing Market

Market Size in USD Million

CAGR :

%

USD

660.56 Million

USD

2,656.40 Million

2025

2033

USD

660.56 Million

USD

2,656.40 Million

2025

2033

| 2026 –2033 | |

| USD 660.56 Million | |

| USD 2,656.40 Million | |

|

|

|

|

Polylactic Acid (PLA) Market for 3D Printing Market Size

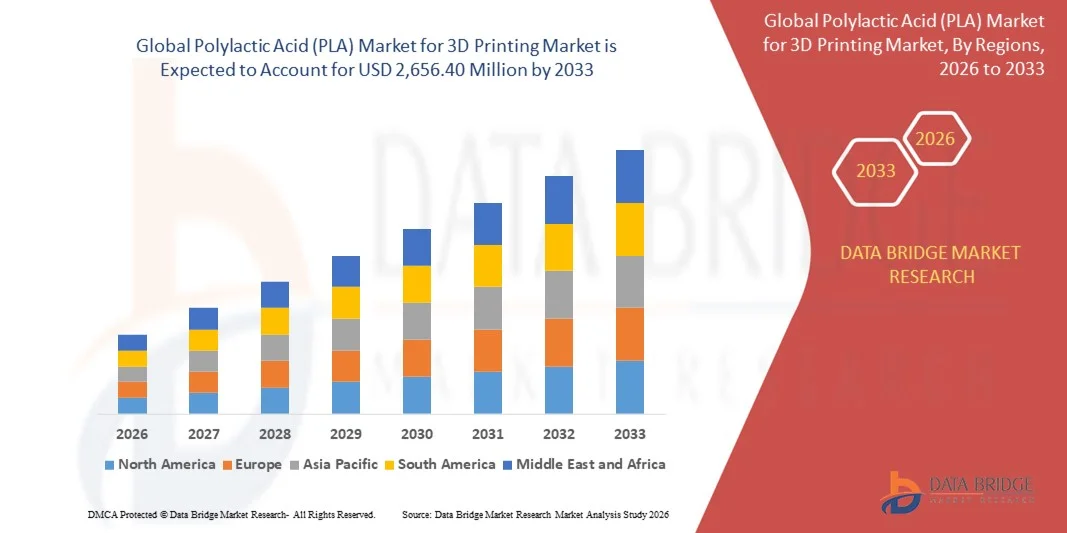

- The global polylactic acid (PLA) market for 3D printing market size was valued at USD 660.56 million in 2025 and is expected to reach USD 2,656.40 million by 2033, at a CAGR of 19.00% during the forecast period

- The market growth is largely fuelled by the increasing adoption of 3D printing across industries such as automotive, healthcare, and consumer goods, where PLA is preferred for its biodegradability and ease of processing

- Rising environmental concerns and the shift toward sustainable and eco-friendly materials are boosting the demand for PLA filaments in additive manufacturing

Polylactic Acid (PLA) Market for 3D Printing Market Analysis

- The market is witnessing strong growth due to the versatility, cost-effectiveness, and environmental benefits of PLA compared to conventional 3D printing materials

- Increasing R&D and technological innovations in PLA filament quality, color variety, and mechanical properties are enhancing its applicability across industrial and consumer applications

- North America dominated the polylactic acid (PLA) market for 3D printing with the largest revenue share in 2025, driven by the growing adoption of 3D printing technologies across industrial, healthcare, and educational sectors, as well as increased awareness of sustainable and biodegradable materials

- Asia-Pacific region is expected to witness the highest growth rate in the global polylactic acid (PLA) market for 3D printing market, driven by rapid industrialization, rising demand for eco-friendly materials, and increasing investment in 3D printing infrastructure

- The 1.75 mm segment held the largest market revenue share in 2025, driven by its compatibility with a wide range of desktop and professional 3D printers, ease of handling, and suitability for detailed prototyping. These filaments offer consistent extrusion and superior print quality, making them the preferred choice for both industrial and hobbyist users

Report Scope and Polylactic Acid (PLA) Market for 3D Printing Market Segmentation

|

Attributes |

Polylactic Acid (PLA) Market for 3D Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polylactic Acid (PLA) Market for 3D Printing Market Trends

Rise of Biodegradable PLA Filaments in 3D Printing

- The growing shift toward biodegradable PLA filaments is transforming the 3D printing landscape by enabling eco-friendly, sustainable production. PLA’s ease of use and versatility allow for rapid prototyping and production of complex designs, reducing waste and environmental impact. Manufacturers are increasingly integrating PLA into their production lines to meet global sustainability targets, driving broader market adoption and awareness of eco-friendly materials

- Increasing demand for PLA in consumer goods, automotive, and healthcare applications is accelerating adoption of sustainable 3D printing materials. The trend is further supported by regulatory frameworks and corporate sustainability initiatives promoting the use of bio-based plastics. Rising awareness among end-users about environmental responsibility and circular economy principles is reinforcing PLA’s adoption in both industrial and small-scale applications

- The affordability and compatibility of PLA with a wide range of 3D printers make it a preferred choice for both industrial and hobbyist applications. Frequent use of PLA in prototyping and small-scale manufacturing improves operational efficiency and product quality. In addition, advancements in filament formulations, such as composite blends and color variants, are enhancing functional versatility and application scope

- For instance, in 2024, several European and North American manufacturers reported significant reductions in plastic waste after switching to PLA filaments for prototyping and low-volume production runs, enhancing sustainability and reducing costs. These shifts also contributed to improved brand image and customer loyalty due to environmentally conscious manufacturing practices

- While PLA adoption in 3D printing is growing rapidly, its impact depends on continued material innovation, improved mechanical properties, and cost-effective production. Manufacturers are focusing on developing specialty PLA filaments and localized supply chains to meet rising demand. Collaboration with research institutions and investments in scalable, high-performance PLA production are further supporting long-term market growth

Polylactic Acid (PLA) Market for 3D Printing Market Dynamics

Driver

Increasing Demand for Sustainable and Eco-Friendly Materials

- Rising awareness of environmental issues and the benefits of biodegradable materials is driving the adoption of PLA in 3D printing. Companies are integrating PLA filaments to meet sustainability goals and reduce reliance on petroleum-based plastics. Growth is further fueled by consumer preference for greener products and increasing adoption of circular economy models across industries

- PLA’s versatility and wide compatibility with 3D printing technologies are encouraging manufacturers to develop innovative applications in automotive, healthcare, packaging, and consumer products. This has expanded market demand globally. Enhanced performance characteristics, such as improved dimensional stability and print precision, are boosting PLA’s applicability across professional and industrial 3D printing segments

- Government initiatives and corporate sustainability policies are promoting the use of bio-based polymers such as PLA, further boosting market growth. Educational and maker communities are also adopting PLA for eco-friendly prototyping and manufacturing. Incentives, subsidies, and research grants are encouraging small and medium enterprises to integrate PLA into their 3D printing workflows, further accelerating adoption

- For instance, in 2023, several North American 3D printing service providers reported higher adoption of PLA filaments for prototyping and educational purposes, supporting sustainability and reducing environmental footprint. These initiatives are also driving product innovation, such as the development of PLA blends for medical devices and lightweight automotive components

- While sustainability trends and technological advantages are driving growth, continued R&D to improve PLA’s mechanical properties, thermal stability, and production efficiency is critical for long-term market expansion. Companies investing in novel PLA composites and functional additives are better positioned to meet industry-specific requirements and capture new market opportunities

Restraint/Challenge

High Material Costs and Performance Limitations

- The relatively higher cost of specialty PLA filaments compared to conventional thermoplastics limits adoption in some industrial applications. Cost constraints are particularly significant for large-scale manufacturing and high-volume production runs. Companies are seeking economies of scale, optimized production processes, and bulk procurement strategies to make PLA more competitive

- PLA’s lower thermal and mechanical performance compared to ABS or PETG restricts its use in high-stress or temperature-sensitive applications. This limits its penetration in certain industrial and automotive 3D printing segments. Efforts to develop reinforced PLA composites, blended PLA filaments, and modified formulations aim to overcome these limitations and expand application areas

- Supply chain and raw material availability challenges can affect consistent PLA filament production and delivery, especially in emerging markets. Limited production capacity of high-quality PLA grades may slow adoption in some regions. Manufacturers are focusing on securing stable sources of lactic acid, enhancing bioplastic production infrastructure, and establishing regional supply chains to ensure reliable filament availability

- For instance, in 2024, several 3D printing service providers in Asia-Pacific reported delays in high-performance PLA filament supplies due to limited bio-based feedstock availability, impacting project timelines and production planning. These disruptions highlight the need for diversified sourcing and local manufacturing solutions to meet growing market demand

- While PLA technology continues to improve, addressing cost, performance, and supply chain challenges is essential to unlock its full potential in global 3D printing applications. Investments in R&D, strategic partnerships, and sustainable raw material sourcing will play a critical role in overcoming these barriers and sustaining long-term market growth

Polylactic Acid (PLA) Market for 3D Printing Market Scope

The market is segmented on the basis of type, application, and user type.

- By Type

On the basis of type, the global polylactic acid (PLA) market for 3D printing is segmented into 1.75 mm and 3 mm or 2.85 mm filaments. The 1.75 mm segment held the largest market revenue share in 2025, driven by its compatibility with a wide range of desktop and professional 3D printers, ease of handling, and suitability for detailed prototyping. These filaments offer consistent extrusion and superior print quality, making them the preferred choice for both industrial and hobbyist users.

The 3 mm or 2.85 mm segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its higher flow rate, suitability for large-scale printing, and enhanced mechanical strength. These filaments are particularly popular in industrial and commercial applications requiring faster production and robust 3D printed components.

- By Application

On the basis of application, the global polylactic acid (PLA) market for 3D printing is segmented into food packaging, household items, healthcare, automotive, and others. The healthcare segment held the largest market revenue share in 2025, driven by the increasing use of PLA for medical models, prosthetics, and surgical planning. PLA’s biocompatibility, ease of sterilization, and eco-friendly properties make it the preferred choice for precise and safe applications.

The automotive segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for sustainable, lightweight, and customizable 3D printed components. PLA’s use in rapid prototyping, custom parts, and interior components is enhancing efficiency and reducing production time in automotive manufacturing.

- By User Type

On the basis of user type, the global polylactic acid (PLA) market for 3D printing is segmented into industrial, hobbyist, and education. The industrial segment held the largest market revenue share in 2025, driven by the growing integration of 3D printing in manufacturing, prototyping, and product development. PLA’s reliability, cost-effectiveness, and compatibility with diverse printing technologies make it the preferred material for industrial applications.

The education segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of PLA filaments in schools, universities, and research institutions for STEM learning, training, and eco-friendly projects. PLA’s ease of use and safety make it ideal for educational and experimental purposes.

Polylactic Acid (PLA) Market for 3D Printing Market Regional Analysis

- North America dominated the polylactic acid (PLA) market for 3D printing with the largest revenue share in 2025, driven by the growing adoption of 3D printing technologies across industrial, healthcare, and educational sectors, as well as increased awareness of sustainable and biodegradable materials

- Consumers and businesses in the region highly value PLA for its ease of use, environmental benefits, and compatibility with a wide range of 3D printers, enabling rapid prototyping and small-scale production

- This widespread adoption is further supported by advanced manufacturing infrastructure, high R&D investments, and growing preference for eco-friendly materials, establishing PLA as a favored filament for both industrial and hobbyist applications

U.S. PLA Market for 3D Printing Market Insight

The U.S. PLA market captured the largest revenue share in 2025 within North America, fueled by the rapid uptake of 3D printing technologies in automotive, healthcare, and consumer product prototyping. Businesses are increasingly integrating PLA filaments to meet sustainability goals and reduce plastic waste. The growing preference for desktop 3D printing and educational initiatives promoting eco-friendly materials further drives market expansion, while innovations in specialty PLA filaments enhance functional applications.

Europe PLA Market for 3D Printing Market Insight

The Europe PLA market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and rising demand for biodegradable 3D printing materials. The increase in industrial automation and adoption of PLA filaments in healthcare, packaging, and automotive sectors is fostering market growth. European consumers and manufacturers are also attracted to the sustainability, ease of use, and versatility of PLA, supporting its integration across new industrial and educational applications.

U.K. PLA Market for 3D Printing Market Insight

The U.K. PLA market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of 3D printing adoption in schools, universities, and commercial prototyping facilities. In addition, the increasing focus on eco-friendly and sustainable materials is encouraging manufacturers and hobbyists to choose PLA. The U.K.’s strong technology adoption, combined with government initiatives promoting sustainable manufacturing and education, is expected to continue fueling market growth.

Germany PLA Market for 3D Printing Market Insight

The Germany PLA market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s advanced manufacturing infrastructure and emphasis on sustainability and innovation. PLA adoption is increasing in healthcare, automotive, and industrial prototyping applications. Integration with industrial 3D printers and the focus on environmentally friendly materials in both research and manufacturing are further boosting demand across commercial and educational sectors.

Asia-Pacific PLA Market for 3D Printing Market Insight

The Asia-Pacific PLA market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, increasing industrialization, and growing awareness of sustainable 3D printing materials in countries such as China, Japan, and India. Government initiatives supporting green technologies and additive manufacturing are accelerating PLA adoption. Moreover, as APAC emerges as a key manufacturing hub for 3D printing filaments, the affordability and accessibility of PLA are expanding to a wider industrial and consumer base.

Japan PLA Market for 3D Printing Market Insight

The Japan PLA market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, rapid adoption of 3D printing in education and industry, and emphasis on sustainable materials. PLA adoption is driven by the growing number of smart manufacturing facilities and educational initiatives promoting eco-friendly 3D printing. The integration of PLA filaments with advanced desktop and industrial 3D printers is supporting innovation, customization, and environmentally responsible production.

China PLA Market for 3D Printing Market Insight

The China PLA market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, high adoption of 3D printing technologies, and increasing environmental awareness. PLA is becoming a preferred material for prototyping, educational projects, healthcare models, and small-scale manufacturing. The government’s push toward smart cities, coupled with the presence of local filament manufacturers offering cost-effective PLA options, is driving widespread adoption across residential, commercial, and industrial applications.

Polylactic Acid (PLA) Market for 3D Printing Market Share

The Polylactic Acid (PLA) Market for 3D Printing industry is primarily led by well-established companies, including:

- colorFabb BV. (Netherlands)

- Fillamentum (Czech Republic)

- HATCHBOX (U.S.)

- BASF SE (Germany)

- MakerBot Industries, LLC (U.S.)

- SpecialChem (France)

- POLYMAKER (China)

- Shenzhen Esun Industrial Co., Ltd (China)

- Torwell Technologies (China)

- Ultimaker BV (Netherlands)

- Futerro (Belgium)

- NatureWorks LLC (U.S.)

- SYS Limited (China)

- SUPLA (U.K.)

- COFCO (China)

- Jiangxi Keyuan Bio-Material Co., Ltd. (China)

- Shanghai Tong-jie-liang Biomaterials Co., LTD. (China)

- Arkema (France)

- DSM (Netherlands)

- Evonik Industries AG (Germany)

Latest Developments in Global Polylactic Acid (PLA) Market for 3D Printing Market

- In 2024, MatterHackers launched its PRO Series PLA filament for professional 3D printing, targeting industrial users seeking high-quality, reliable materials. The product enhances print consistency, improves mechanical properties, and addresses growing demand for professional-grade PLA filaments, strengthening the company’s position in the industrial 3D printing market

- In 2024, Evonik Ventures made a strategic investment in Xact Metal to advance PLA 3D printing technologies. The investment aims to accelerate material innovation, support development of high-performance filaments, and expand PLA adoption in professional additive manufacturing, reinforcing Evonik’s role in the 3D printing ecosystem

- In 2024, FormFutura partnered with NatureWorks to develop next-generation PLA filaments with enhanced mechanical and thermal properties. This collaboration seeks to improve print quality, broaden industrial applications, and drive adoption of PLA in professional 3D printing markets, supporting sustainability and innovation

- In 2024, ColorFabb introduced PLA HT, a high-temperature resistant PLA filament designed for engineering and industrial 3D printing applications. The new filament improves thermal performance, expands application potential, and strengthens ColorFabb’s position in the professional and industrial 3D printing segment

- In 2024, 3D-Fuel expanded its PLA filament production facility in North Dakota to meet rising demand from the 3D printing sector. The expansion enhances supply capacity, reduces lead times, and strengthens 3D-Fuel’s competitiveness in North America, supporting industrial and commercial 3D printing growth

- In 2024, Raise3D launched an industrial-grade PLA filament for large-format 3D printing, designed for prototyping and manufacturing. The product improves material performance, supports large-scale production, and enhances the adoption of PLA in industrial 3D printing applications

- In 2024, Filamentive secured investment funding to scale production of recycled and bio-based PLA filaments. The funding increases production capacity, lowers costs, and strengthens Filamentive’s position in the sustainable 3D printing market, supporting eco-friendly additive manufacturing

- In 2024, TotalEnergies Corbion inaugurated a PLA bioplastics application development center in the Netherlands. The center accelerates innovation in PLA materials, supports 3D printing applications, and promotes adoption of bio-based polymers in industrial and consumer markets

- In 2024, BASF expanded its 3D printing materials portfolio with new PLA-based filaments. The development enhances BASF’s additive manufacturing offerings, delivers versatile and high-quality filaments, and strengthens its market position in industrial prototyping and sustainable 3D printing

- In 2024, eSUN launched a new PLA+ filament for desktop and industrial 3D printing applications. The filament improves strength, printability, and reliability, broadening PLA adoption among hobbyists and professionals and supporting growth in the 3D printing market

- In 2024, Polymaker partnered with Covestro to co-develop high-performance PLA filaments for industrial 3D printing. The collaboration enhances material properties, improves printing efficiency, and expands industrial PLA applications, reinforcing PLA’s role in professional additive manufacturing

- In 2024, NatureWorks completed a fully integrated Ingeo PLA manufacturing facility in Thailand to expand global production capacity. The facility strengthens supply reliability, meets growing demand, and solidifies NatureWorks’ leadership in sustainable PLA filaments for 3D printing and other applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polylactic Acid (pla) Market For 3d Printing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polylactic Acid (pla) Market For 3d Printing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polylactic Acid (pla) Market For 3d Printing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.