Global Polylactic Acid Pla Market

Market Size in USD Million

CAGR :

%

USD

1.39 Million

USD

3.36 Million

2024

2032

USD

1.39 Million

USD

3.36 Million

2024

2032

| 2025 –2032 | |

| USD 1.39 Million | |

| USD 3.36 Million | |

|

|

|

|

Polylactic Acid (PLA) Market Size

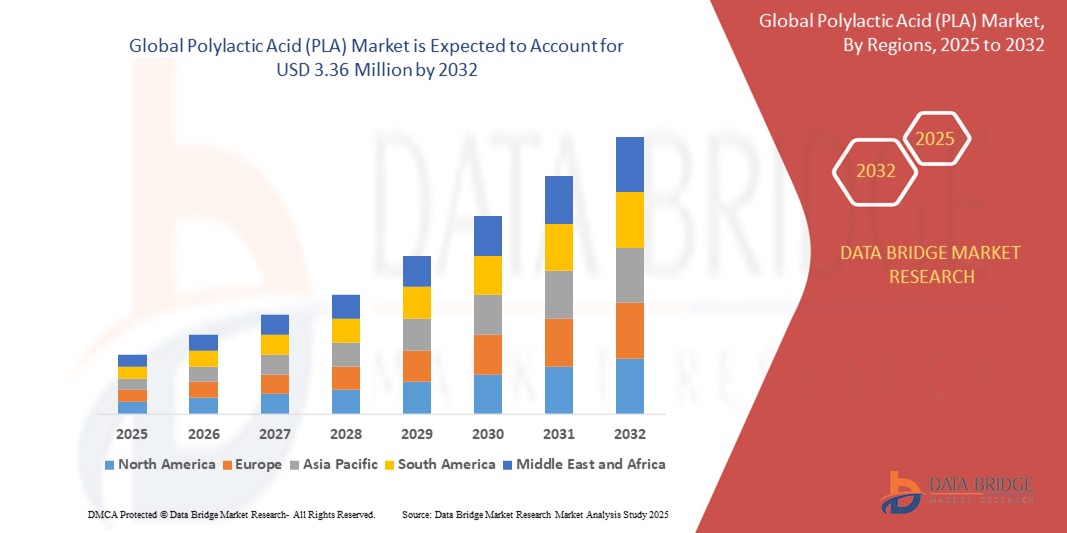

- The global polylactic acid (PLA) market was valued at USD 1.39 million in 2024 and is expected to reach USD 3.36 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.6%, primarily driven by the increased demand for sustainable and biodegradable materials

- This growth is driven by factors such as rising environmental concerns, stringent government regulations on single-use plastics, and growing demand from packaging, textiles, and biomedical industries

Polylactic Acid (PLA) Market Analysis

- Polylactic acid (PLA) is a biodegradable and bioactive thermoplastic derived from renewable resources such as corn starch and sugarcane. It is widely used across industries including packaging, textiles, agriculture, automotive, and biomedical due to its environmentally friendly nature

- The demand for PLA is significantly driven by increasing environmental regulations against petroleum-based plastics, growing consumer awareness regarding sustainability, and a shift toward bio-based alternatives

- Over half of the global demand is fueled by the packaging industry, with food and beverage packaging emerging as the primary segment due to the need for compostable and safe materials

- The Asia Pacific region stands out as one of the dominant regions for PLA production and consumption, driven by rapid industrial growth, supportive government initiatives, and rising demand from packaging and consumer goods sectors

- For instance, China and Thailand have ramped up PLA production capacities in recent years, with key players expanding biopolymer facilities to meet global and domestic demand

- Globally, PLA ranks as one of the most widely used bioplastics and plays a pivotal role in reducing reliance on fossil fuels, offering a sustainable solution for multiple applications while aligning with circular economy goals

Report Scope and Polylactic Acid (PLA) Market Segmentation

|

Attributes |

Polylactic Acid (PLA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polylactic Acid (PLA) Market Trends

“Expansion into Packaging, Textiles, and Automotive Applications”

- PLA is increasingly utilized in packaging due to its biodegradability and compostability, aligning with consumer and regulatory demands for sustainable materials

- In the textile industry, PLA fibers are gaining traction for producing eco-friendly fabrics, offering benefits like breathability and moisture-wicking properties

- For instance, companies are developing PLA-based nonwoven materials for sustainable hygiene products and fashion textiles, responding to rising demand for green alternatives

- The automotive sector is adopting PLA-based composites for interior components, providing lightweight and environmentally friendly alternatives to traditional plastics

- These expansions underscore PLA's versatility and its growing role in various industries seeking sustainable solutions

Polylactic Acid (PLA) Market Dynamics

Driver

“Rising Demand for Sustainable Packaging Solutions”

- The growing global emphasis on environmental sustainability is significantly contributing to the increased demand for polylactic acid (PLA) in various packaging applications

- As governments worldwide implement stricter regulations on single-use plastics, industries are seeking biodegradable alternatives to reduce their carbon footprint and comply with eco-friendly standards

- PLA, being compostable and derived from renewable resources like corn starch and sugarcane, is increasingly being adopted in food packaging, disposable tableware, and consumer goods packaging

- The material’s ability to maintain performance standards comparable to traditional plastics, while offering environmental benefits, positions PLA as a preferred choice for sustainable packaging

- As consumer awareness regarding plastic pollution continues to grow, more businesses are turning toward bio-based materials to align with sustainability goals and enhance brand value

For instance,

- In October 2023, TotalEnergies Corbion announced a major expansion of its PLA production capacity at its Thailand plant, aiming to reach 125,000 tons annually by 2024. The expansion was driven by surging global demand for compostable materials in packaging and consumer goods

- In September 2022, NatureWorks, a leading biopolymer producer, broke ground on a new USD 600 million fully integrated Ingeo™ PLA manufacturing facility in Thailand, expected to produce 75,000 metric tons of PLA annually to meet rising demand across packaging, agriculture, and hygiene markets

- Such initiatives are propelled by increased environmental regulations and a shift in consumer preferences toward sustainable products

- As a result, the global PLA market is seeing strong growth from the packaging industry, especially where companies seek to meet ESG goals and circular economy commitments

Opportunity

“Expanding Applications of PLA in the Biomedical Sector”

- The growing use of polylactic acid (PLA) in biomedical applications is creating significant opportunities for market expansion, particularly due to PLA’s biocompatibility, biodegradability, and safety for internal use

- PLA is increasingly being adopted in the production of absorbable sutures, orthopedic implants, drug delivery systems, and tissue engineering scaffolds — all of which require materials that degrade safely inside the human body

- The medical industry is witnessing greater interest in customized, patient-specific devices made using PLA, especially via 3D printing, supporting advances in regenerative medicine and minimally invasive procedures

For instance,

- In September 2023, Evonik launched its new biodegradable polymer platform, “Resomer® PLA”, tailored specifically for medical devices such as resorbable implants and controlled drug release systems. This launch responds to the growing demand for safe, bioresorbable materials across global healthcare markets

- In August 2022, NatureWorks partnered with the University of Minnesota’s Medical Devices Center to support the development of PLA-based 3D printed biomedical tools, especially in the areas of tissue scaffolding and surgical planning models

- These innovations align with the broader industry push for sustainable and functional biomaterials, opening new revenue channels for PLA manufacturers beyond packaging and consumer products

- As investment in medical-grade bioplastics continues to grow, PLA is positioned to become a key material in next-generation medical applications, offering both functional performance and environmental sustainability

Restraint/Challenge

“High Production Costs and Limited Feedstock Availability”

- One of the primary challenges facing the global polylactic acid (PLA) market is the high cost of production, particularly when compared to conventional petroleum-based plastics

- The reliance on agricultural feedstocks such as corn and sugarcane not only introduces price volatility due to seasonal and geopolitical factors, but also raises concerns around land use competition with food crops

- PLA production involves fermentation, polymerization, and other energy-intensive steps that contribute to higher processing costs, limiting its widespread adoption in price-sensitive markets

For instance,

- In March 2023, according to a report by European Bioplastics, production costs for PLA remain significantly higher than traditional plastics like polyethylene or polypropylene, primarily due to feedstock costs and the lack of large-scale production infrastructure in many regions

- In February 2022, TotalEnergies Corbion acknowledged that while demand is rising, scaling PLA production globally is hampered by supply chain limitations and the need for long-term investment in dedicated biopolymer facilities

- This cost disadvantage is particularly impactful in developing economies, where affordability often dictates material choices in sectors such as packaging, textiles, and agriculture

- As a result, high production costs and limited feedstock availability continue to act as key restraints, slowing down market penetration and the broader transition to sustainable bioplastics

Polylactic Acid (PLA) Market Scope

The market is segmented on the basis of type, raw material, form, application, end user, and grade.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Raw Material |

|

|

By Form |

|

|

By Application |

|

|

By End User |

|

|

By Grade

|

|

Polylactic Acid (PLA) Market Regional Analysis

“North America is the Dominant Region in the Polylactic Acid (PLA) Market”

- North America leads the global PLA market, fueled by strong consumer demand for sustainable packaging, robust bioplastics research, and favorable regulatory frameworks supporting the transition away from petroleum-based plastics

- The U.S., in particular, holds a substantial market share due to the presence of major PLA producers, such as NatureWorks LLC, and increasing investments in bio-based material innovations

- Supportive government initiatives, such as incentives for biodegradable packaging adoption and environmental sustainability programs, are propelling market growth in sectors including food service, medical, and agriculture

- The region’s advanced R&D ecosystem, combined with active collaborations between public agencies and private companies, continues to strengthen its dominance in PLA production and adoption

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to record the fastest growth in the global PLA market, driven by increasing industrialization, government policies favoring sustainable materials, and rising environmental awareness

- Countries like China, India, Japan, and South Korea are experiencing growing adoption of PLA in packaging, agriculture, consumer goods, and biomedical applications, as regional economies prioritize biodegradable alternatives to conventional plastics

- Supportive policies and initiatives — such as bans on single-use plastics and subsidies for bioplastic manufacturers — are accelerating the shift toward PLA-based products across the region

- Japan, with its advanced materials technology and sustainable packaging initiatives, remains a hub for high-end PLA innovations, while India and China are witnessing growth from agriculture films, compostable bags, and medical applications

Polylactic Acid (PLA) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE (Germany)

- Futerro (Belgium)

- NatureWorks LLC (U.S.)

- TotalEnergies Corbion (Netherlands)

- Sulzer Ltd (Switzerland)

- Mitsubishi Chemical Corporation (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- Merck KGaA (Germany)

- Musashino Chemical Laboratory, Ltd. (Japan)

- Evonik Industries AG (Germany)

- Polyvel Inc. (U.S.)

- UNITIKA LTD. (Japan)

- Jiangxi Academy of Sciences Biological New Materials Co., Ltd. (China)

- Shanghai Tong-jie-liang Biomaterials Co., Ltd. (China)

- Zhejiang Hisun Biomaterials Co., Ltd. (China)

- Radici Partecipazioni SpA (Italy)

Latest Developments in Global Polylactic Acid (PLA) Market

- In May 2023, TotalEnergies Corbion and Bluepha Co. Ltd partnered to develop sustainable biomaterials in China. They combined Bluepha polyhydroxyalkanoates (PHA) with Luminy polylactic acid (PLA) technology, creating high-performance, eco-friendly solutions aimed at advancing biomaterial innovation for diverse applications in the region

- In May 2023, TotalEnergies Corbion partnered with Xiamen Changsu Industrial Pte Ltd to advance the polylactic acid (PLA) market. Their collaboration focuses on market promotion, research, and product development for innovative applications and technologies of biaxially oriented polylactic acid (BOPLA)

- In April 2023, NatureWorks LLC partnered with Jabil Inc. to introduce a new polylactic acid-based powder for selective laser sintering 3D printing platforms. This innovative material offers a lower sintering temperature and an 89% smaller carbon footprint compared to traditional options

- In December 2022, Futerro announced its plans to establish an integrated biorefinery in Normandy, France, dedicated to the production and recycling of polylactic acid (PLA). This initiative aims to support the green economy by transitioning from fossil carbon to biomass-derived carbon

- In November 2022, NatureWorks LLC partnered with CJ Biomaterials to create an innovative biopolymer solution using polylactic acid (PLA) technology. This collaboration aims to replace fossil fuel-based plastics in applications such as compostable food service ware, packaging, personal care products, and other end uses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polylactic Acid Pla Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polylactic Acid Pla Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polylactic Acid Pla Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.