Global Polylysine Market

Market Size in USD Million

CAGR :

%

USD

951.08 Million

USD

1,459.61 Million

2024

2032

USD

951.08 Million

USD

1,459.61 Million

2024

2032

| 2025 –2032 | |

| USD 951.08 Million | |

| USD 1,459.61 Million | |

|

|

|

|

Polylysine Market Size

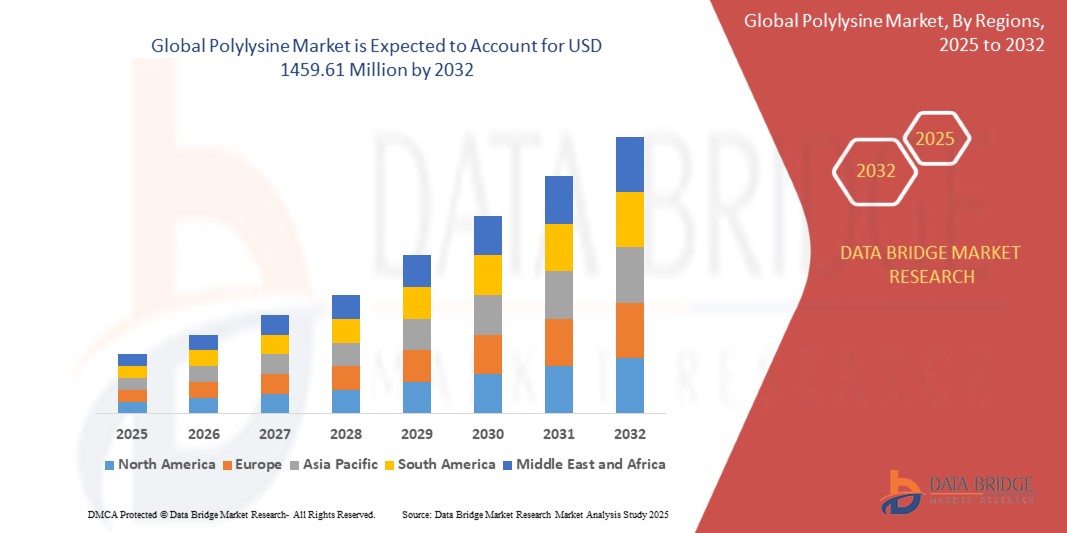

- The global polylysine market size was valued at USD 951.08 million in 2024 and is expected to reach USD 1459.61 million by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the rising demand for natural and bio-based preservatives across the food and beverage industry, as manufacturers shift away from synthetic additives to meet clean-label and regulatory requirements

- Furthermore, expanding applications of polylysine in pharmaceuticals, personal care, and dietary supplements, coupled with its antimicrobial and biocompatible properties, are establishing it as a versatile ingredient across multiple industries. These converging factors are accelerating adoption, thereby significantly boosting the polylysine market growth

Polylysine Market Analysis

- Polylysine is a naturally derived biopolymer widely used as an antimicrobial and preservative agent in food, pharmaceuticals, dietary supplements, and personal care products. Its strong ability to inhibit bacterial growth and extend product shelf life makes it a valuable clean-label ingredient across multiple industries

- The escalating demand for polylysine is primarily fueled by the rising shift toward natural preservatives, increasing regulatory restrictions on synthetic additives, and growing consumer preference for safe, bio-based, and sustainable solutions in food and healthcare applications

- Asia-Pacific dominated the polylysine market with a share of 45.5% in 2024, due to rising demand for natural preservatives in the food and beverage sector, strong pharmaceutical manufacturing activity, and the region’s leadership in fermentation-based ingredient production

- Europe is expected to be the fastest growing region in the polylysine market during the forecast period due to stringent food safety regulations, high demand for natural preservatives, and rising R&D investments in biocompatible polymers

- Natural segment dominated the market with a market share of 63.2% in 2024, due to growing consumer preference for clean-label and bio-based preservatives. Naturally derived polylysine, typically produced through microbial fermentation, is widely accepted in food and pharmaceutical applications owing to its safety and regulatory approvals. Increasing awareness about the harmful effects of synthetic additives is encouraging food manufacturers to adopt natural preservatives such as polylysine. The strong alignment of natural polylysine with sustainability trends and organic product labeling further supports its dominance in the market

Report Scope and Polylysine Market Segmentation

|

Attributes |

Polylysine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polylysine Market Trends

Expanding Applications of Polylysine in the Pharmaceutical Industry

- The pharmaceutical industry is increasingly integrating polylysine due to its antimicrobial and biodegradable properties, making it a valuable additive in drug formulations and delivery systems. Its natural origin and safety profile distinguish it as an attractive option for pharmaceutical innovation focused on clean-label and patient-friendly solutions

- For instance, Nagase & Co. Ltd., a leading producer of ε-polylysine, has been actively expanding applications in biomedical fields by leveraging the compound’s antimicrobial efficiency. This has found relevance in topical creams, wound-healing agents, and drug delivery systems, enhancing its role in modern pharmaceutical applications

- Polylysine is gaining traction in controlled drug-release formulations due to its ability to form stable complexes with varying pH levels, enabling regulated and sustained delivery of pharmaceutical agents. This is particularly advantageous in formulations where gradual and targeted drug release enhances treatment efficacy

- The use of polylysine in combination with other natural biopolymers such as chitosan is encouraging the development of bio-based composites in pharmaceutical applications. These combinations are often used in encapsulation technologies for delivering sensitive compounds such as peptides and vaccines, offering higher stability and efficiency

- Ongoing research is highlighting polylysine’s potential in regenerative medicine where it supports cell adhesion and tissue engineering scaffolds. Such applications create new opportunities for polylysine beyond traditional food preservation, positioning it as a key material in advanced pharmaceutical development

- The increasing shift toward clean-label and natural excipients across pharmaceutical production is reinforcing the relevance of polylysine. As regulatory agencies and consumers alike emphasize safety and sustainability, companies are utilizing polylysine as an alternative to synthetic or less environmentally sustainable excipients in pharmaceutical innovations

Polylysine Market Dynamics

Driver

Growing Demand for Natural Preservatives

- The growing consumer preference for natural and safe food preservatives is a major driver for polylysine adoption across industries. Its broad-spectrum antimicrobial activity combined with a natural fermentation-based origin appeals to both regulatory authorities and health-conscious consumers

- For instance, Chisso Corporation has been a key player offering ε-polylysine for food preservation applications, partnering with global food producers to incorporate it in ready-to-eat meals, sauces, and baked goods. Such advancements are driving broader adoption across regions as companies move toward natural alternatives

- The rise of clean-label food products is significantly boosting the demand for natural preservatives such as polylysine. Brands are increasingly highlighting preservation methods using natural ingredients to align with consumer demand for transparency, trustworthiness, and safety

- In addition, the increasing concerns over antibiotic resistance and chemical exposure from synthetic preservatives are further pushing food and pharmaceutical companies to adopt polylysine. The product’s strong antimicrobial efficiency supports shelf-life extension while meeting health and regulatory expectations

- The growing importance of global food safety standards is encouraging larger manufacturers to opt for consistent and effective natural preservatives. Polylysine, with its proven track record in Asian markets, is steadily expanding into North American and European industries driven by demand for safer and innovative preservation solutions

Restraint/Challenge

Increasing Usage of Synthetic Preservatives

- Despite the advantages of polylysine, the widespread availability and low cost of synthetic preservatives present a significant challenge to its adoption. Synthetic options remain the dominant choice for large-scale manufacturers seeking cost efficiency and long-established performance assurances

- For instance, sodium benzoate and potassium sorbate continue to dominate the global food preservative market, with companies such as Archer Daniels Midland (ADM) and Cargill investing in the production and distribution of these synthetic solutions. Their cost-effectiveness creates stiff competition for polylysine-based alternatives

- Limited awareness of polylysine among mainstream manufacturers and consumers further restricts its adoption. Many companies remain hesitant due to established familiarity with synthetics and slower acceptance of new formulations, especially in markets where regulatory approvals are stringent or unclear

- In addition, production costs associated with fermentation-derived preservatives remain higher, which can limit competitive pricing for polylysine. This price gap restricts scalability for smaller and mid-sized manufacturers in cost-sensitive markets

- The absence of standardized global regulations on natural preservatives leads to uncertainty when introducing polylysine in new markets. While it is approved in several regions such as Japan, expanding consistently into other territories faces hurdles that delay global adoption and limit widespread usage

Polylysine Market Scope

The market is segmented on the basis of form, source, function, and application.

• By Form

On the basis of form, the polylysine market is segmented into powder and liquid. The powder segment dominated the largest market revenue share in 2024, attributed to its extended shelf life, ease of storage, and high stability across diverse applications. Powdered polylysine is widely used in the food and beverage industry as it ensures uniform blending with other ingredients while maintaining antimicrobial efficacy. Its cost-effectiveness and ability to be transported over long distances without degradation have further strengthened its dominance in global supply chains. In addition, powdered polylysine is preferred by pharmaceutical and cosmetic manufacturers due to its compatibility with dry formulations.

The liquid segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its increasing use in ready-to-use formulations in food processing and cosmetic applications. Liquid polylysine provides greater ease of application during production processes, offering direct solubility in solutions without requiring additional processing steps. Manufacturers are favoring liquid formulations for customized antimicrobial coatings, beverages, and personal care products where instant dispersibility is a key advantage. Rising demand for clean-label and minimally processed ingredients is further boosting the adoption of liquid polylysine.

• By Source

On the basis of source, the polylysine market is segmented into natural and synthetic. The natural segment held the largest revenue share of 63.2% in 2024, driven by growing consumer preference for clean-label and bio-based preservatives. Naturally derived polylysine, typically produced through microbial fermentation, is widely accepted in food and pharmaceutical applications owing to its safety and regulatory approvals. Increasing awareness about the harmful effects of synthetic additives is encouraging food manufacturers to adopt natural preservatives such as polylysine. The strong alignment of natural polylysine with sustainability trends and organic product labeling further supports its dominance in the market.

The synthetic segment is expected to witness the fastest CAGR from 2025 to 2032, as research and development in biotechnology and polymer science advance. Synthetic polylysine offers manufacturers greater control over molecular structure and functional properties, making it suitable for specialized pharmaceutical and industrial uses. Its potential in drug delivery systems and biomedical applications, where specific molecular modifications are required, is fueling demand. Moreover, synthetic sources are increasingly viewed as a scalable solution to meet rising global demand, especially where natural fermentation processes face production limitations.

• By Function

On the basis of function, the polylysine market is segmented into antimicrobial agent, preservative, drug delivery agent, and antioxidant. The antimicrobial agent segment dominated the market in 2024, attributed to the extensive use of polylysine in extending shelf life and preventing microbial spoilage in food and beverage products. Its broad-spectrum activity against bacteria and fungi makes it highly valuable in packaged and ready-to-eat food categories. The rising demand for natural antimicrobial solutions in the clean-label trend is further strengthening its adoption in food processing industries worldwide. In addition, the safety recognition of polylysine by global regulatory agencies supports its leading role in the market.

The drug delivery agent segment is projected to witness the fastest growth from 2025 to 2032, fueled by the increasing interest in biocompatible and biodegradable polymers in pharmaceutical research. Polylysine’s unique cationic structure enhances cellular uptake and improves drug encapsulation efficiency, making it highly suitable for advanced therapies such as gene delivery and nanomedicine. Growing investment in targeted drug delivery technologies and precision medicine is driving the rapid adoption of polylysine in clinical research. Its ability to minimize side effects and improve therapeutic efficacy positions it as a key enabler in next-generation drug delivery systems.

• By Application

On the basis of application, the polylysine market is segmented into food and beverage, pharmaceutical, personal care and cosmetics, dietary supplements, and others. The food and beverage segment dominated the largest market revenue share in 2024, driven by rising global demand for natural preservatives and safe antimicrobial agents in packaged food products. Polylysine is extensively used in meat, dairy, bakery, and ready-to-eat items to extend shelf life without altering taste or quality. Increasing consumer awareness of food safety and the regulatory push toward reducing synthetic preservatives have further strengthened the application of polylysine in this sector. Its proven ability to reduce spoilage losses provides food manufacturers with significant cost benefits, cementing its dominance.

The pharmaceutical segment is expected to witness the fastest growth from 2025 to 2032, supported by the rising use of polylysine in drug formulation and delivery systems. Its biocompatibility and biodegradability make it highly attractive for controlled-release formulations, gene therapy, and nanoparticle-based drug carriers. Growing demand for safer and more effective drug delivery technologies is boosting adoption across pharmaceutical R&D pipelines. In addition, collaborations between biotechnology firms and pharmaceutical companies are accelerating innovation, paving the way for polylysine’s wider application in advanced therapeutics.

Polylysine Market Regional Analysis

- Asia-Pacific dominated the polylysine market with the largest revenue share of 45.5% in 2024, driven by rising demand for natural preservatives in the food and beverage sector, strong pharmaceutical manufacturing activity, and the region’s leadership in fermentation-based ingredient production

- The region’s cost-efficient production infrastructure, expanding dietary supplements market, and increasing adoption of clean-label solutions are accelerating polylysine consumption across multiple industries

- Rapid industrialization, favorable government initiatives promoting bio-based ingredients, and the presence of large-scale food exporters are further supporting the widespread use of polylysine in the region

China Polylysine Market Insight

China held the largest share in the Asia-Pacific polylysine market in 2024, supported by its dominance in large-scale fermentation production and widespread application in food preservation. The country benefits from robust investments in biotechnology and strong export capabilities in food ingredients. Growing demand for safe and natural antimicrobial agents in processed food and pharmaceuticals is fueling expansion, with regulatory approvals strengthening domestic adoption.

India Polylysine Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising investments in food processing, dietary supplements, and pharmaceutical manufacturing. Supportive government initiatives to boost biotechnology capacity and reduce dependence on synthetic additives are enhancing polylysine demand. Increasing health-conscious consumer behavior and a growing export base in functional foods and nutraceuticals are further contributing to rapid market expansion.

North America Polylysine Market Insight

North America maintained a strong position in the global polylysine market in 2024, supported by rising demand for natural antimicrobial agents in packaged food, pharmaceuticals, and personal care products. Consumer preference for clean-label and safe ingredients, coupled with advanced manufacturing and distribution networks, is boosting adoption. Strong innovation pipelines in biotechnology and pharmaceuticals further reinforce the region’s importance in the global market.

U.S. Polylysine Market Insight

The U.S. accounted for the largest share in the North America polylysine market in 2024, underpinned by its expansive processed food industry, significant investment in biopolymer research, and growing nutraceutical demand. Regulatory approval for polylysine as a safe food additive, coupled with high adoption in dietary supplements and personal care, is fueling market growth. The presence of leading biotech companies and robust consumer demand for natural solutions solidify the U.S.'s dominance in the region.

Europe Polylysine Market Insight

The Europe polylysine market is expected to grow at the fastest CAGR from 2025 to 2032, driven by stringent food safety regulations, high demand for natural preservatives, and rising R&D investments in biocompatible polymers. The region’s emphasis on sustainable ingredients and advanced formulations in pharmaceuticals and personal care is fostering adoption. Increasing partnerships between food producers, biotech firms, and research institutions are also enhancing the role of polylysine in clean-label product development.

Germany Polylysine Market Insight

Germany’s polylysine market is driven by its leadership in biotechnology and pharmaceutical innovation. Strong demand from the food and beverage sector for natural antimicrobial agents, coupled with a robust research base for biopolymer applications, is accelerating growth. The country’s regulatory alignment with sustainability and preference for high-quality bio-based additives further positions Germany as a key market within Europe.

U.K. Polylysine Market Insight

The U.K. market benefits from its strong life sciences industry and increasing focus on food safety and clean-label innovation. Post-Brexit efforts to localize supply chains are encouraging adoption of natural preservatives, while growing R&D in drug delivery systems and functional foods strengthens polylysine applications. Collaboration between universities, biotech firms, and food manufacturers supports innovation in polylysine-based solutions.

Polylysine Market Share

The polylysine industry is primarily led by well-established companies, including:

- Chisso Corporation (Japan)

- Okuna Chemical Industries Co., Ltd. (Japan)

- SunBio Co., Ltd. (Japan)

- JNC Corporation (Japan)

- Nanjing Shine King Biotech Co., Ltd. (China)

- Chengdu Jinkai Biology Engineering Co., Ltd. (China)

- Zhengzhou Bainafo Bioengineering Co., Ltd. (China)

- Yiming Biological Products Co., Ltd. (China)

- Siveele Biotech Corporation (Japan)

- Lion King Biotechnology Inc. (Taiwan)

- Ajinomoto Co., Inc. (Japan)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Kyowa Hakko Bio Co., Ltd. (Japan)

Latest Developments in Global Polylysine Market

- In January 2024, JNC Corporation announced the commissioning of a new production facility in Japan dedicated to expanding polylysine output. This development reflects the company’s strategy to strengthen its position as a key global supplier of fermentation-based ingredients. The facility is expected to significantly improve production scalability and ensure a stable supply chain, addressing rising global demand across food, pharmaceutical, and biotechnology industries. By boosting capacity, JNC is meeting current market requirements and also positioning itself to capture emerging opportunities in clean-label and natural preservative segments

- In March 2024, Ajinomoto Co., Inc. launched a new polylysine-based food preservative product line, reinforcing its commitment to innovation in natural additives. The new product line caters to the rapidly growing consumer preference for safe, natural, and transparent ingredients in processed food. Ajinomoto’s strong global distribution network will support the commercial success of this launch, helping food manufacturers reduce reliance on synthetic preservatives. The introduction also reflects the company’s long-term sustainability strategy, as polylysine offers both safety and functionality in extending shelf life while aligning with regulatory approvals for clean-label claims

- In August 2023, Thomas Scientific acquired Quintana Supply, expanding its national footprint and strengthening its presence in the advanced technology and industrial markets. This acquisition enhances Thomas Scientific’s distribution capabilities, particularly in cleanroom and controlled environment products, which are critical for bioprocessing and pharmaceutical applications. The integration of Quintana’s operations allows the company to scale up its customer service and supply chain efficiency, ultimately supporting greater accessibility of essential laboratory and production materials across the U.S.

- In 2023, Evonik Industries invested to expand its liquid polylysine production capacity in Europe, highlighting its strategic focus on sustainable and bio-based solutions. The investment comes at a time when demand for polylysine in pharmaceuticals, personal care, and cosmetics is rapidly rising due to stricter regulations and consumer preference for natural ingredients. By scaling production, Evonik strengthens its regional supply chain resilience and positions itself as a key player meeting the sustainability-driven needs of European industries. This move also supports the company’s broader vision of reducing reliance on synthetic preservatives while capturing market share in high-value biopolymers

- In April 2022, Merck KGaA (via its U.S./Canada life sciences business MilliporeSigma) acquired the MAST® (Modular Automated Sampling Technology) platform from Lonza, reinforcing its leadership in digital bioprocessing. The acquisition integrated an advanced, automated sampling system into Merck’s BioContinuumTM ecosystem, enabling real-time monitoring of bioprocesses. This significantly reduced process development timelines, lowered manual labor requirements, and improved production efficiency across large-scale biopharmaceutical operations. By incorporating the MAST® platform, Merck enhanced its capacity to deliver cost-efficient, high-quality biologics, ultimately strengthening competitiveness in the fast-evolving bioprocessing market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polylysine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polylysine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polylysine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.