Global Polymerization Initiator Market

Market Size in USD Billion

CAGR :

%

USD

4.28 Billion

USD

6.06 Billion

2024

2032

USD

4.28 Billion

USD

6.06 Billion

2024

2032

| 2025 –2032 | |

| USD 4.28 Billion | |

| USD 6.06 Billion | |

|

|

|

|

Global Polymerization Initiator Market Size

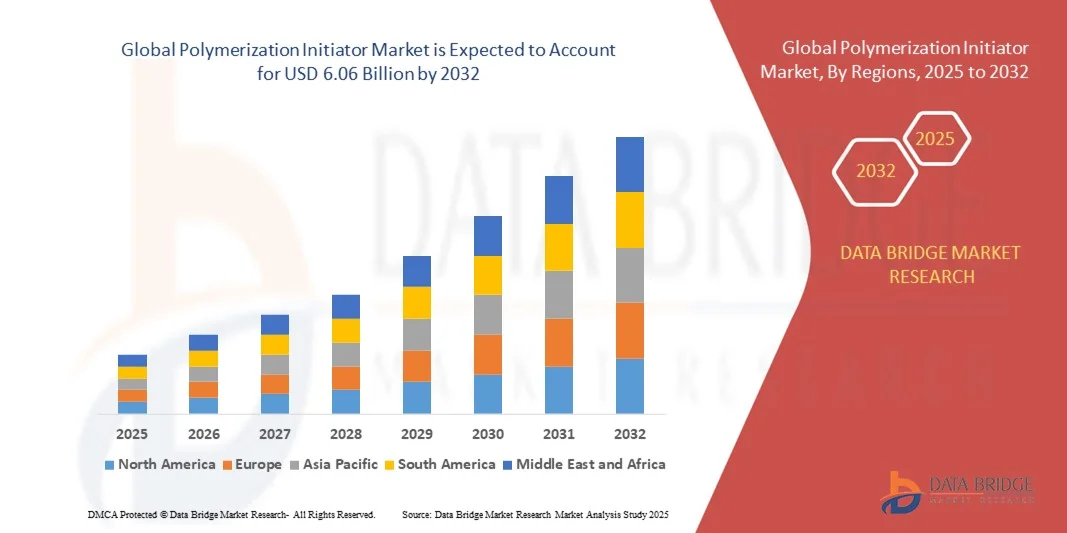

- The global Polymerization Initiator Market size was valued at USD 4.28 billion in 2024 and is projected to reach USD 6.06 billion by 2032, growing at a CAGR of 4.45% during the forecast period.

- The market expansion is primarily driven by increasing demand across the plastics, automotive, coatings, and adhesives industries, where polymerization initiators are vital for efficient and controlled polymer synthesis.

- Additionally, the rise in green chemistry practices, focus on sustainable polymer production, and continuous technological advancements in initiator formulations are fueling innovation and adoption, accelerating market growth on a global scale.

Global Polymerization Initiator Market Analysis

- Polymerization initiators, which trigger and control polymer formation reactions, are increasingly essential in the production of plastics, resins, and synthetic rubbers across multiple industries including automotive, construction, packaging, and electronics, due to their efficiency, reliability, and ability to support large-scale manufacturing processes.

- The rising demand for polymerization initiators is primarily driven by rapid industrialization, increasing consumption of polymer-based products, and growing emphasis on high-performance materials in emerging economies.

- Asia-Pacific dominated the Global Polymerization Initiator Market with the largest revenue share of 36.6% in 2024, supported by strong industrial infrastructure, high R&D investments, and the presence of major chemical manufacturers, with the U.S. leading in the adoption of advanced polymer technologies and sustainable production practices.

- North America is expected to be the fastest growing region in the Global Polymerization Initiator Market during the forecast period due to expanding manufacturing sectors, urban development, and rising investments in plastics and chemical processing industries.

- The peroxides segment dominated the market with the largest revenue share of 43.2% in 2024, driven by their widespread application in polymerizing monomers such as ethylene and propylene

Report Scope and Global Polymerization Initiator Market Segmentation

|

Attributes |

Polymerization Initiator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Polymerization Initiator Market Trends

Enhanced Efficiency Through AI and Process Automation

- A significant and accelerating trend in the Global Polymerization Initiator Market is the increasing integration of artificial intelligence (AI) and automated process control systems in polymer manufacturing. This technological shift is enhancing production efficiency, process safety, and product consistency across various polymer applications.

- For instance, AI-driven monitoring systems are now being employed in advanced production facilities to optimize initiator dosing, temperature control, and reaction timing, minimizing waste and improving overall yield. Companies such as BASF and Arkema are investing heavily in smart manufacturing initiatives to improve real-time data analysis and predictive maintenance within polymerization processes.

- AI integration enables features like predictive reaction modeling, where machine learning algorithms analyze historical data to forecast optimal initiator concentrations and reaction conditions. This helps in avoiding undesired polymer chain terminations and ensuring better control over molecular weight distribution, especially in complex polymer formulations.

- The seamless incorporation of polymerization initiators into automated and AI-enabled manufacturing lines also supports remote process monitoring, allowing operators to adjust critical parameters in real-time. This not only reduces manual errors but also enhances the scalability and adaptability of polymer production across different geographies and end-use industries.

- This trend toward intelligent, automated, and data-driven chemical production is fundamentally reshaping operational expectations across the polymer industry. As a result, companies such as United Initiators and Nouryon are focusing on integrating AI tools into their R&D and production ecosystems to develop more efficient and environmentally sustainable initiator solutions.

- The demand for smart initiator systems—capable of delivering higher performance with lower environmental impact—is rising rapidly, particularly in sectors such as automotive, electronics, and packaging, where precision, speed, and quality control are increasingly critical.

Global Polymerization Initiator Market Dynamics

Driver

Growing Need Due to Expanding Industrial Applications and Demand for Advanced Polymers

- The increasing demand for high-performance plastics, synthetic rubbers, and resins across industries such as automotive, electronics, construction, and packaging is a major driver for the rising use of polymerization initiators. These chemicals are critical in enabling precise polymer synthesis and improving production efficiency.

- For instance, in February 2024, LANXESS AG announced the expansion of its polymer additives division, focusing on high-efficiency initiator systems tailored for specialty applications like EV components and high-heat polymers. Strategic moves like these by leading companies are expected to fuel market growth over the forecast period.

- As manufacturers seek lightweight, durable, and customizable polymer solutions to meet evolving product requirements, polymerization initiators offer the necessary control over molecular structure, enabling the creation of tailored polymer formulations with enhanced properties such as impact resistance, thermal stability, and flexibility.

- Furthermore, with increasing regulatory pressure to reduce the environmental footprint of plastics production, polymer producers are adopting initiators compatible with green and bio-based monomers, supporting the transition to sustainable manufacturing practices.

- The demand for controlled/living polymerization techniques, such as RAFT and ATRP, is also increasing, requiring advanced initiator systems that allow precise molecular weight distribution and end-group functionality—vital in applications like biomedical polymers, smart packaging, and specialty coatings.

- These trends are collectively driving the market for polymerization initiators across both developed and emerging economies, as manufacturers upgrade their capabilities and invest in high-efficiency, eco-friendly chemical solutions.

Restraint/Challenge

Stringent Handling Regulations and Environmental Concerns

- Despite their importance, polymerization initiators—particularly organic peroxides and azo compounds—pose significant safety risks due to their reactive and sometimes hazardous nature. This results in strict regulatory scrutiny and handling requirements, especially during transportation and storage.

- For instance, numerous countries, including those in the EU and North America, have implemented hazard classification and labeling regulations under systems like GHS (Globally Harmonized System), impacting how companies manage and distribute these chemicals.

- To mitigate these risks, manufacturers must invest in specialized storage facilities, safety training, and compliant packaging—raising operational costs and creating barriers for small-scale or new entrants in the market. Additionally, compliance with REACH and EPA guidelines increases the regulatory burden on companies handling initiators.

- Environmental concerns are also a growing restraint, as certain initiators can produce harmful by-products or persist in the environment. This has spurred demand for low-toxicity and biodegradable alternatives, but such innovations often involve higher R&D costs and longer development cycles.

- Moreover, many emerging markets lack adequate infrastructure or regulatory clarity for safe handling of initiators, limiting their adoption despite strong demand for polymers.

- Overcoming these challenges will require greater investment in safety innovation, development of greener formulations, and collaboration between regulators and industry stakeholders to streamline approval processes while maintaining safety standards.

Global Polymerization Initiator Market Scope

The polymerization initiator market is segmented on the basis of type, active species, and application.

- By Type

On the basis of type, the Global Polymerization Initiator Market is segmented into persulfate, peroxides, aliphatic AZO compounds, and others. The peroxides segment dominated the market with the largest revenue share of 43.2% in 2024, driven by their widespread application in polymerizing monomers such as ethylene and propylene. Organic peroxides offer a high degree of reactivity and thermal stability, making them suitable for large-scale industrial polymer production. Their compatibility with various thermoplastics and thermosets further drives demand across industries like packaging, automotive, and construction.

The aliphatic AZO compounds segment is expected to witness the fastest CAGR from 2025 to 2032, owing to their clean decomposition, controllable reaction rates, and applicability in specialty polymers and biomedical applications. These initiators generate minimal by-products and are increasingly used in applications where product purity and controlled polymerization are critical, such as in electronics and pharmaceuticals.

- By Active Species

On the basis of active species, the Global Polymerization Initiator Market is segmented into free radical, anionic, and cationic initiators. The free radical initiator segment dominated the market with a revenue share of 58.7% in 2024, due to its versatility and compatibility with a wide range of monomers including vinyl and acrylate compounds. Free radical polymerization is widely used across multiple industries due to its ease of initiation, moderate reaction conditions, and cost-effectiveness. This method is highly suitable for mass production of plastics and resins, especially polyethylene and polystyrene.

The anionic initiator segment is anticipated to witness the fastest growth from 2025 to 2032, driven by rising demand for precision-controlled polymerization in specialty applications. Anionic polymerization offers narrow molecular weight distribution and high structural control, making it ideal for advanced materials in electronics, medical devices, and high-performance elastomers.

- By Application

On the basis of application, the Global Polymerization Initiator Market is segmented into polyethylene, polypropylene, polyvinyl chloride (PVC), polystyrene, A.B.S., and others. The polyethylene segment accounted for the largest revenue share of 34.6% in 2024, driven by its extensive use in packaging, construction materials, and consumer goods. Initiators are crucial for initiating the polymerization of ethylene monomers, especially in high-pressure processes used for LDPE and HDPE production. Growing demand for lightweight and durable packaging materials further supports this dominance.

The polypropylene segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by its increasing adoption in automotive, textiles, and medical applications. Initiators enhance the efficiency of polypropylene polymerization, enabling consistent quality and performance. Its chemical resistance, low cost, and recyclability are encouraging manufacturers to expand capacity, especially in emerging economies.

Global Polymerization Initiator Market Regional Analysis

- Asia-Pacific dominated the Global Polymerization Initiator Market with the largest revenue share of 36.6% in 2024, driven by strong industrial infrastructure, advanced manufacturing capabilities, and high demand from automotive, packaging, and electronics sectors.

- Manufacturers in the region benefit from well-established chemical production facilities, significant R&D investments, and stringent quality standards, supporting the use of high-performance polymerization initiators for specialty and bulk polymers.

- This dominance is further reinforced by rising adoption of sustainable and eco-friendly initiator technologies, favorable government regulations, and increasing collaborations between key players and research institutions to innovate advanced polymer solutions tailored for both commercial and industrial applications.

U.S. Polymerization Initiator Market Insight

The U.S. polymerization initiator market captured the largest revenue share of 38% in 2024 within North America, driven by the country’s advanced manufacturing base and strong presence of key chemical producers. The market growth is fueled by rising demand from automotive, packaging, and electronics industries, which require high-performance polymers. Increasing investments in sustainable and bio-based polymers, alongside advancements in polymerization technologies, further propel the market. Additionally, stringent environmental regulations encourage the adoption of eco-friendly initiators, boosting innovation and market expansion.

Europe Polymerization Initiator Market Insight

The Europe polymerization initiator market is projected to expand at a significant CAGR throughout the forecast period, primarily driven by strict regulatory frameworks focused on chemical safety and sustainability. The region’s established chemical industry, growing demand for high-performance materials, and shift towards green manufacturing processes are key growth factors. Increased urbanization and demand for advanced packaging and construction materials also support market development. The adoption of renewable feedstocks and biodegradable polymers is shaping market trends, especially in countries such as Germany, France, and the U.K.

U.K. Polymerization Initiator Market Insight

The U.K. polymerization initiator market is expected to grow steadily during the forecast period, propelled by increased investments in specialty polymer production and innovation hubs focused on advanced materials. Rising demand from automotive, healthcare, and construction sectors, coupled with supportive government initiatives for sustainable chemical manufacturing, underpin growth. The U.K.’s emphasis on research and development and strong export-oriented polymer industry further stimulate market expansion.

Germany Polymerization Initiator Market Insight

Germany’s polymerization initiator market is anticipated to grow at a notable CAGR, supported by the country’s strong industrial base and focus on innovation and sustainability. Demand for high-performance polymers in automotive, electrical engineering, and construction sectors drives market growth. Germany’s commitment to eco-friendly manufacturing practices and strict chemical regulations fosters the adoption of advanced, less hazardous initiators. Integration of polymerization technologies with Industry 4.0 initiatives enhances production efficiency and product quality, reinforcing market expansion.

Asia-Pacific Polymerization Initiator Market Insight

The Asia-Pacific polymerization initiator market is poised to register the fastest CAGR of 22% from 2025 to 2032, driven by rapid industrialization, increasing urbanization, and expanding polymer manufacturing capacity in countries like China, India, Japan, and South Korea. Rising consumption of polymer-based products in packaging, automotive, and consumer goods sectors propels demand. Government initiatives supporting smart manufacturing and chemical industry modernization, alongside growing investments in R&D and infrastructure, contribute to market growth. The presence of cost-competitive manufacturers and growing exports also enhance the region’s market position.

Japan Polymerization Initiator Market Insight

Japan’s polymerization initiator market is gaining traction due to its advanced chemical industry, focus on innovation, and demand for high-performance polymers in electronics, automotive, and healthcare applications. The market benefits from strong R&D capabilities and government policies promoting sustainable manufacturing. Japan’s aging population also spurs demand for specialized polymers used in medical devices and assistive technologies, supporting market growth. Integration of polymerization initiators with next-generation manufacturing technologies enhances production precision and efficiency.

China Polymerization Initiator Market Insight

China accounted for the largest market revenue share in Asia-Pacific at 45% in 2024, driven by its vast manufacturing base and rapid expansion of polymer production facilities. Growing urbanization, rising disposable incomes, and increased consumption of polymer-based products fuel demand. The government’s push towards smart cities, green manufacturing, and chemical industry upgrades further stimulate market growth. Strong domestic players and increasing foreign investments are accelerating innovation in initiator technologies, boosting China’s dominance in the global polymerization initiator market.

Global Polymerization Initiator Market Share

The Polymerization Initiator industry is primarily led by well-established companies, including:

- Arkema S.A. (France)

- LANXESS AG (Germany)

- BASF SE (Germany)

- Nouryon (Netherlands)

- United Initiators (Germany)

- ADEKA Corporation (Japan)

- Fujifilm (Japan)

- Otsuka Chemical Co. Ltd (Japan)

- TCI Chemicals (Japan)

- MPI Chemie (Netherlands)

- Chemorous (Malaysia)

- NOF Corporation (Japan)

- Jinan Qiumu Fine Chemical (China)

- Pergan GmbH (Germany)

- Mitsubishi Gas Chemical Company (Japan)

What are the Recent Developments in Global Polymerization Initiator Market?

- In April 2023, BASF SE (Germany), a global chemical leader, launched a strategic initiative in South Africa to expand its polymerization initiator production capabilities, aiming to meet rising demand in the African automotive and construction sectors. This move highlights BASF’s commitment to providing advanced, high-performance initiators tailored to local industrial needs while strengthening its footprint in emerging markets within the global polymerization initiator landscape.

- In March 2023, Arkema S.A (France) introduced a new line of sustainable organic peroxide initiators designed specifically for the packaging and automotive industries, emphasizing eco-friendly and high-efficiency polymerization processes. This development underlines Arkema’s dedication to innovation and sustainability, addressing increasing regulatory pressure and customer demand for greener chemical solutions worldwide.

- In March 2023, Lanxess AG (Germany) successfully expanded its polymerization initiator manufacturing capacity at its Asia-Pacific facilities to support growing demand from the electronics and construction sectors. This expansion aligns with Lanxess’s strategy to leverage its global expertise and localize production for faster market responsiveness, reinforcing its leadership in the polymerization initiator market.

- In February 2023, Nouryon (Netherlands) announced a strategic partnership with leading chemical distributors in North America to enhance supply chain resilience and accelerate the delivery of its peroxide-based initiators to polymer manufacturers. This collaboration aims to improve customer service and market penetration in key industrial segments such as packaging and automotive, underscoring Nouryon’s commitment to operational excellence and market growth.

- In January 2023, United Initiators (Germany) unveiled its latest generation of high-performance azo initiators at the European Coatings Show 2023, featuring improved thermal stability and efficiency for applications in coatings and adhesives. This product launch demonstrates United Initiators’ focus on advancing polymerization technology to meet evolving industrial requirements, boosting performance and sustainability in the polymer sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polymerization Initiator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polymerization Initiator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polymerization Initiator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.