Global Polyolefin Pof Shrink Film Market

Market Size in USD Million

CAGR :

%

USD

6.75 Million

USD

10.60 Million

2025

2033

USD

6.75 Million

USD

10.60 Million

2025

2033

| 2026 –2033 | |

| USD 6.75 Million | |

| USD 10.60 Million | |

|

|

|

|

Global Polyolefin (POF) Shrink Film Market Size

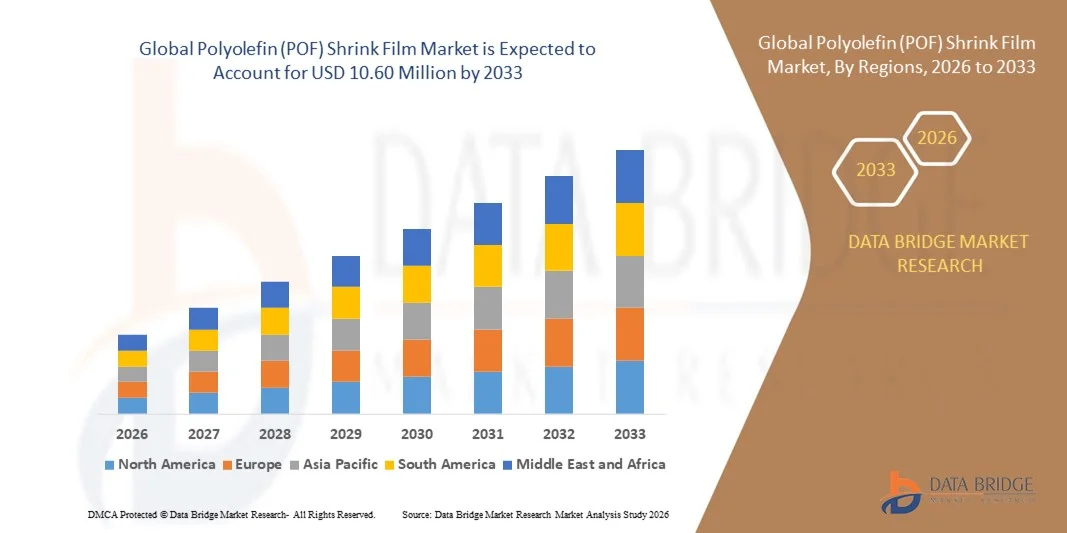

- The global Polyolefin (POF) Shrink Film Market size was valued at USD 6.75 million in 2025 and is expected to reach USD 10.60 million by 2033, at a CAGR of 5.80% during the forecast period.

- The market growth is primarily driven by the expanding demand for sustainable and high-performance packaging solutions across food & beverage, consumer goods, and pharmaceutical industries, where POF shrink films offer superior clarity, strength, and puncture resistance.

- Additionally, increasing e-commerce activities and the need for tamper-evident, lightweight, and cost-effective packaging are fueling the adoption of POF shrink films, while ongoing innovations in eco-friendly and recyclable films are further accelerating the market expansion globally.

Global Polyolefin (POF) Shrink Film Market Analysis

- Polyolefin (POF) shrink films, widely used for packaging applications across food & beverage, consumer goods, and pharmaceutical industries, are increasingly essential due to their superior clarity, puncture resistance, and ability to provide tamper-evident, durable packaging solutions in both retail and industrial settings.

- The rising demand for POF shrink films is primarily driven by the growth of e-commerce, the need for lightweight and cost-effective packaging, and increasing regulatory emphasis on recyclable and environmentally friendly materials.

- Asia-Pacific dominated the Global Polyolefin (POF) Shrink Film Market with the largest revenue share of 35.5% in 2025, fueled by early adoption of advanced packaging technologies, strong e-commerce growth, and the presence of leading packaging solution providers, with the U.S. showing significant demand for high-clarity, high-strength films in both consumer and industrial applications.

- Europe is expected to be the fastest-growing region in the Global Polyolefin (POF) Shrink Film Market during the forecast period due to rapid urbanization, expanding manufacturing sectors, and rising disposable incomes, particularly in countries like China and India.

- The general POF segment dominated the market with the largest revenue share of 52.6% in 2025, driven by its cost-effectiveness, versatility, and widespread use across food & beverage, consumer goods, and industrial packaging applications.

Report Scope and Global Polyolefin (POF) Shrink Film Market Segmentation

|

Attributes |

Polyolefin (POF) Shrink Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Polyolefin (POF) Shrink Film Market Trends

Enhanced Functionality Through Advanced Film Technologies

- A significant and accelerating trend in the Global Polyolefin (POF) Shrink Film Market is the development and adoption of advanced film technologies that enhance packaging performance, including improved clarity, puncture resistance, and shrink efficiency. These innovations are significantly improving product protection and consumer appeal across multiple industries.

- For instance, high-clarity POF shrink films are widely used in food and beverage packaging to showcase products while maintaining freshness, whereas multi-layer POF films provide superior barrier properties and mechanical strength for pharmaceutical and consumer goods applications.

- Innovative coatings and additive technologies are enabling films to deliver enhanced functionality, such as anti-fog properties, UV protection, and heat-seal optimization. Some manufacturers are also incorporating recyclable and bio-based materials to meet sustainability demands without compromising durability or performance.

- The integration of these advanced POF shrink films into automated packaging lines facilitates higher efficiency, reduced material waste, and consistent package quality. This allows manufacturers to maintain tight production tolerances while providing visually appealing and secure packaging.

- This trend toward more functional, durable, and sustainable films is fundamentally reshaping packaging standards and consumer expectations. Consequently, companies such as Amcor, Sealed Air, and Winpak are developing next-generation POF shrink films with multi-layer structures, eco-friendly formulations, and enhanced mechanical properties.

- The demand for high-performance and sustainable POF shrink films is growing rapidly across both food & beverage and industrial packaging sectors, as businesses increasingly prioritize product protection, operational efficiency, and environmental responsibility.

Global Polyolefin (POF) Shrink Film Market Dynamics

Driver

Growing Need Driven by E-commerce Expansion and Packaging Efficiency

- The rapid growth of e-commerce and the increasing demand for efficient, secure, and visually appealing packaging solutions are significant drivers for the heightened demand for Polyolefin (POF) shrink films.

- For instance, in 2025, Sealed Air Corporation introduced advanced POF shrink film solutions optimized for automated packaging lines, focusing on reducing material waste while maintaining product protection. Strategies such as these by key companies are expected to drive market growth during the forecast period.

- As businesses aim to improve product presentation, reduce damage during transit, and meet consumer expectations for sustainable packaging, POF shrink films offer superior clarity, strength, and puncture resistance, providing a compelling alternative to traditional packaging materials.

- Furthermore, the increasing adoption of automated packaging systems and the desire for consistent, high-quality packaging are making POF shrink films a preferred choice across food & beverage, consumer goods, and pharmaceutical industries.

- The lightweight nature, tamper-evident properties, and compatibility with various packaging equipment are key factors propelling the adoption of POF shrink films in both small-scale and large-scale operations. Innovations in recyclable and eco-friendly film formulations further contribute to market expansion.

Restraint/Challenge

Concerns Regarding Environmental Impact and Cost of Advanced Films

- Environmental concerns related to plastic use and the disposal of shrink films pose a challenge to broader market adoption. While POF shrink films are recyclable, improper disposal or lack of recycling infrastructure can create environmental issues, affecting consumer perception and regulatory compliance.

- For instance, increasing regulations on single-use plastics in North America and Europe have prompted manufacturers to invest in recyclable or bio-based POF films, though adoption remains gradual.

- Addressing these environmental concerns through sustainable film innovations, clear recycling guidelines, and consumer education is crucial for building trust and ensuring long-term market growth. Companies such as Amcor and Winpak are emphasizing recyclable and eco-friendly POF film solutions to meet sustainability demands.

- Additionally, the relatively higher cost of advanced multi-layer or specialty POF films compared to standard packaging materials can be a barrier for price-sensitive businesses, particularly in emerging markets. While standard POF films are cost-effective, premium films offering superior clarity, barrier properties, or eco-friendly formulations often come with a higher price tag.

- Overcoming these challenges through continued innovation in cost-effective, sustainable films, expansion of recycling infrastructure, and awareness campaigns will be vital for sustained growth in the Global Polyolefin (POF) Shrink Film Market.

Global Polyolefin (POF) Shrink Film Market Scope

Polyolefin (POF) shrink film market is segmented on the basis of product, segmentation and application.

- By Product

On the basis of product, the Global Polyolefin (POF) Shrink Film Market is segmented into general POF and cross-linked POF films. The general POF segment dominated the market with the largest revenue share of 52.6% in 2025, driven by its cost-effectiveness, versatility, and widespread use across food & beverage, consumer goods, and industrial packaging applications. General POF films are preferred for standard shrink wrapping needs, providing excellent clarity, moderate strength, and compatibility with conventional packaging machinery. Their ease of processing and ability to protect products during storage and transit make them a reliable choice for manufacturers seeking high-quality yet economical packaging solutions.

The cross-linked POF segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, fueled by growing demand for high-strength, puncture-resistant films that offer superior performance in heavy-duty industrial packaging and high-value product shipments.

- By Segmentation

On the basis of thickness, the Global Polyolefin (POF) Shrink Film Market is segmented into 12 µm, 15 µm, 19 µm, and 25 µm films. The 19 µm segment accounted for the largest market revenue share of 45.3% in 2025, driven by its optimal balance of strength, flexibility, and cost-efficiency, making it highly suitable for a broad range of packaging applications including consumer goods and food products.

The 25 µm segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, as rising demand for heavy-duty, high-durability films grows in industrial and bulk packaging sectors, where enhanced puncture resistance and mechanical strength are critical for safe product handling and long-distance transportation.

- By Application

On the basis of application, the Global Polyolefin (POF) Shrink Film Market is segmented into industrial packaging, food, consumer goods, pharmaceuticals, and beverages. The industrial packaging segment dominated the market with the largest revenue share of 48.5% in 2025, driven by the extensive use of POF shrink films for pallet wrapping, protective packaging, and safe transit of machinery, spare parts, and bulk goods. Industrial applications benefit from the superior strength, puncture resistance, and shrink performance of POF films, which ensure product integrity during logistics.

The food segment is expected to witness the fastest CAGR of 23.0% from 2026 to 2033, fueled by the growing demand for tamper-evident, visually appealing, and hygienic packaging solutions for processed foods, fresh produce, and ready-to-eat meals, as manufacturers increasingly prioritize shelf appeal and product safety.

Global Polyolefin (POF) Shrink Film Market Regional Analysis

- Asia-Pacific dominated the Global Polyolefin (POF) Shrink Film Market with the largest revenue share of 35.5% in 2025, driven by the growing demand for high-performance packaging solutions across food & beverage, consumer goods, and industrial sectors.

- Manufacturers and businesses in the region prioritize POF shrink films for their superior clarity, puncture resistance, and tamper-evident properties, which help enhance product presentation and ensure safe transportation.

- This widespread adoption is further supported by advanced packaging infrastructure, strong e-commerce growth, high consumer awareness regarding product safety, and the presence of major market players, establishing POF shrink films as the preferred packaging material for both small-scale and large-scale operations.

U.S. Polyolefin (POF) Shrink Film Market Insight

The U.S. POF shrink film market captured the largest revenue share of 81% in 2025 within North America, fueled by the strong growth of e-commerce, retail packaging, and food & beverage industries. Manufacturers are increasingly prioritizing high-clarity, puncture-resistant films to ensure product safety, reduce transit damage, and enhance visual appeal. The growing adoption of automated packaging lines, coupled with rising consumer awareness of sustainable and tamper-evident packaging, further propels the market. Moreover, advanced packaging infrastructure, technological innovation in film formulations, and the presence of major industry players are significantly contributing to market expansion.

Europe Polyolefin (POF) Shrink Film Market Insight

The Europe POF shrink film market is projected to expand at a substantial CAGR during the forecast period, driven by stringent packaging and sustainability regulations as well as the increasing demand for tamper-evident and eco-friendly solutions. Rapid urbanization and the growth of retail and pharmaceutical sectors are fostering the adoption of POF films. European manufacturers are leveraging recyclable and high-performance film variants, while demand spans across industrial, food, and consumer goods applications, including both new production lines and retrofitted packaging systems.

U.K. Polyolefin (POF) Shrink Film Market Insight

The U.K. POF shrink film market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing need for protective, high-clarity packaging and the expansion of e-commerce and retail sectors. Businesses are seeking efficient, lightweight, and tamper-evident films to enhance product presentation and ensure logistics safety. Additionally, rising consumer demand for sustainable and recyclable packaging materials is encouraging manufacturers to adopt advanced POF shrink films in both industrial and commercial applications.

Germany Polyolefin (POF) Shrink Film Market Insight

The Germany POF shrink film market is expected to expand at a considerable CAGR during the forecast period, driven by high demand for innovative, sustainable, and recyclable packaging solutions. The country’s well-established industrial and manufacturing infrastructure, coupled with increasing automation in packaging processes, promotes the use of POF shrink films. Industries such as food & beverage, pharmaceuticals, and consumer goods are increasingly integrating high-performance films that provide product protection, clarity, and eco-friendliness, meeting stringent regulatory standards and consumer expectations.

Asia-Pacific Polyolefin (POF) Shrink Film Market Insight

The Asia-Pacific POF shrink film market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rising industrialization, urbanization, and increasing disposable incomes in countries such as China, India, and Japan. Growing e-commerce, retail packaging, and food processing industries are key drivers of demand. Government initiatives supporting manufacturing modernization and digitalization in packaging processes are further encouraging adoption. The region’s emergence as a manufacturing hub for POF films also improves affordability and accessibility, expanding the market to a wider range of industrial and commercial users.

Japan Polyolefin (POF) Shrink Film Market Insight

The Japan POF shrink film market is gaining momentum due to the country’s focus on advanced packaging technologies, high-quality standards, and automation in production lines. Manufacturers prioritize films that provide superior clarity, puncture resistance, and compatibility with automated shrink-wrapping systems. The demand is further fueled by growth in e-commerce, retail, and food sectors, along with the increasing adoption of sustainable and recyclable film options, catering to both industrial and commercial applications.

China Polyolefin (POF) Shrink Film Market Insight

The China POF shrink film market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding manufacturing sectors, and the growing e-commerce industry. High rates of technological adoption and a push towards modern, automated packaging lines are fueling demand. Affordable POF shrink film options, coupled with strong domestic manufacturing capabilities and rising awareness of packaging efficiency and product protection, are key factors driving market growth across industrial, food, and consumer goods sectors.

Global Polyolefin (POF) Shrink Film Market Share

The Polyolefin (POF) Shrink Film industry is primarily led by well-established companies, including:

• Berry Global Inc. (U.S.)

• Sealed Air Corporation (U.S.)

• Amcor PLC (Australia)

• Uflex Ltd. (India)

• Innovia Films Ltd. (U.K.)

• Mondi Group (Austria)

• Constantia Flexibles (Austria)

• Winpak Ltd. (Canada)

• Coveris Holdings S.A. (Austria)

• Huhtamaki PPL Ltd. (Finland)

• Wipak Group (Finland)

• RPC Group (U.K.)

• Clondalkin Group (Netherlands)

• Toyo Seikan Group Holdings Ltd. (Japan)

• LINPAC Packaging (U.K.)

• Plastipak Holdings Inc. (U.S.)

• Toppan Printing Co., Ltd. (Japan)

• Flex Films (India)

• Taghleef Industries (U.A.E.)

• Jindal Poly Films Ltd. (India)

What are the Recent Developments in Global Polyolefin (POF) Shrink Film Market?

- In April 2024, Berry Global Inc., a leading global manufacturer of packaging solutions, launched a strategic initiative in South Africa to expand its POF shrink film production capacity for industrial and retail packaging applications. This initiative underscores the company’s commitment to providing high-quality, sustainable packaging solutions tailored to the needs of the local market. By leveraging its global expertise and advanced film technologies, Berry Global is addressing regional demand while strengthening its presence in the rapidly growing global POF shrink film market.

- In March 2024, Sealed Air Corporation, a pioneer in protective packaging, introduced an upgraded high-clarity POF shrink film designed specifically for food and beverage packaging. The innovative film offers enhanced puncture resistance, superior shrink performance, and compatibility with automated packaging systems. This advancement highlights Sealed Air’s focus on developing cutting-edge solutions that improve product protection, shelf appeal, and operational efficiency across commercial and industrial applications.

- In March 2024, Amcor PLC successfully deployed a large-scale POF shrink film solution for the Bengaluru food processing and beverage sector, aimed at enhancing packaging durability and product safety. This initiative utilizes advanced film technologies to reduce packaging waste, improve transport resilience, and maintain product quality, underscoring Amcor’s commitment to sustainable and innovative packaging solutions that address the evolving needs of emerging markets.

- In February 2024, Uflex Ltd., a global flexible packaging company, announced a strategic partnership with leading retail chains in North America to develop customized POF shrink film solutions for consumer goods packaging. The collaboration is designed to improve operational efficiency, enhance product presentation, and ensure secure transportation, demonstrating Uflex’s commitment to innovation and its ability to provide tailored solutions for large-scale commercial applications.

- In January 2024, Innovia Films Ltd., a specialist in high-performance films, unveiled its latest cross-linked POF shrink film at the PACK EXPO 2024. This advanced film offers superior clarity, strength, and shrink consistency, enabling manufacturers to achieve better product visibility and reduced material usage. The launch highlights Innovia’s dedication to integrating technological innovation into packaging solutions, providing end-users with enhanced efficiency, sustainability, and visual appeal.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyolefin Pof Shrink Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyolefin Pof Shrink Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyolefin Pof Shrink Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.