Global Polyoxin Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.12 Billion

2025

2033

USD

1.57 Billion

USD

2.12 Billion

2025

2033

| 2026 –2033 | |

| USD 1.57 Billion | |

| USD 2.12 Billion | |

|

|

|

|

What is the Global Polyoxin Market Size and Growth Rate?

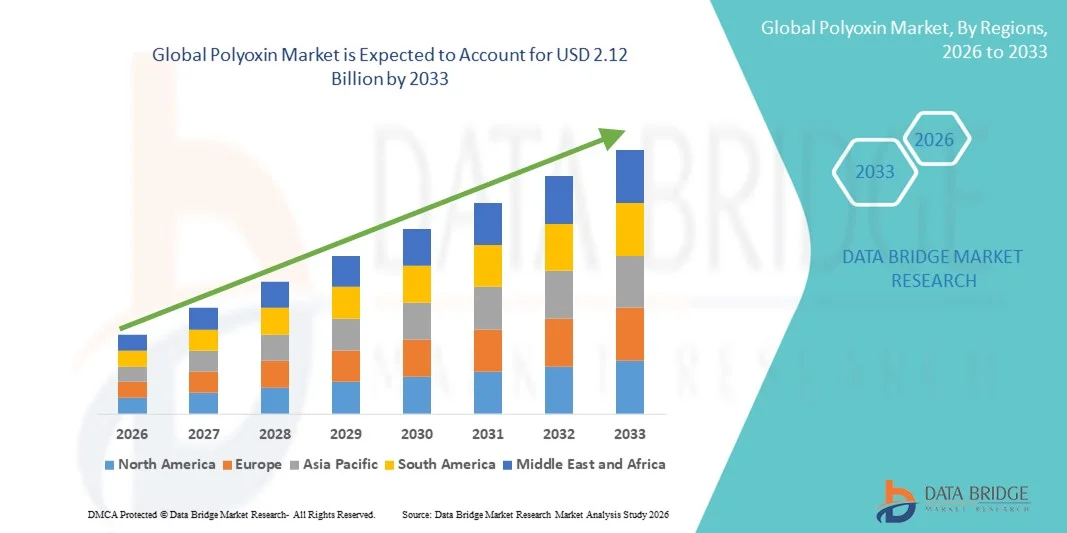

- The global polyoxin market size was valued at USD 1.57 billion in 2025 and is expected to reach USD 2.12 billion by 2033, at a CAGR of3.80% during the forecast period

- Growing awareness about the benefits of polyoxin such as minimal toxicity will emerge as the major factor fostering the growth of polyoxin market

- Also, rising environmental concerns in regards to soil quality conservation and increased crop production especially in the developing economies are other factors fostering the growth of polyoxin market

What are the Major Takeaways of Polyoxin Market?

- Growth in the expenditure for research and development proficiencies in regards to new product launches, rising food safety concerns and increasing personal disposable income will further create lucrative and remunerative growth opportunities for the polyoxin market

- Growth and expansion of agrochemicals industry in the developing economies, surging globalization and growing initiatives by the government to promote industrialization will also carve the way for the growth of the polyoxin market

- North America dominated the polyoxin market with a 42.26% revenue share in 2025, driven by strong growth in agrochemical adoption, advanced crop protection programs, and extensive R&D investments across the U.S. and Canada. Increasing demand for biofungicides, high-efficiency formulations, and sustainable agriculture practices continues to fuel Polyoxin adoption across rice, vegetable, and horticultural crops

- Asia-Pacific is projected to register the fastest CAGR of 8.19% from 2026 to 2033, driven by rising adoption of modern crop protection techniques, government incentives for sustainable agriculture, and rapid growth in rice, vegetable, and fruit cultivation across China, India, Japan, South Korea, and Southeast Asia

- The Polyoxin B segment dominated the market with a 52.3% share in 2025, owing to its broad-spectrum antifungal activity, high efficacy against major crop diseases such as rice blast and cucumber powdery mildew, and widespread adoption across both conventional and organic farming practices

Report Scope and Polyoxin Market Segmentation

|

Attributes |

Polyoxin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyoxin Market?

Increasing Shift Toward High-Efficiency, Sustainable, and Targeted Polyoxins

- The polyoxin market is witnessing strong adoption of innovative, environmentally friendly, and highly targeted formulations designed to improve crop protection, minimize chemical residues, and ensure sustainable agriculture practices

- Manufacturers are introducing multi-component, high-purity, and biocontrol-integrated Polyoxin products that offer enhanced stability, broad-spectrum efficacy, and compatibility with modern integrated pest management (IPM) systems

- Growing demand for cost-effective, scalable, and field-deployable Polyoxin solutions is driving usage across large-scale farms, greenhouse operations, and organic cultivation projects

- For instance, companies such as UPL, BASF SE, Bayer AG, Syngenta, and FMC Corporation have upgraded their Polyoxin portfolios with higher potency, extended shelf-life, and formulation innovations to support improved crop yields and reduced environmental impact

- Increasing need for precision agriculture, sustainable disease control, and reduced chemical dependency is accelerating the shift toward bio-based and hybrid Polyoxin solutions

- As crop protection strategies become more complex and regulatory pressures increase, Polyoxins will remain vital for effective fungal disease management and sustainable farming practices

What are the Key Drivers of Polyoxin Market?

- Rising demand for efficient, selective, and eco-friendly fungicides to support disease management in crops such as fruits, vegetables, and cereals is fueling polyoxin adoption

- For instance, in 2025, leading companies including UPL, BASF SE, and Bayer AG launched advanced Polyoxin formulations with improved solubility, broader crop compatibility, and enhanced antifungal activity

- Growing adoption of integrated pest management (IPM), organic farming, and precision agriculture practices is boosting demand for Polyoxins across the U.S., Europe, and Asia-Pacific

- Advancements in formulation technologies, controlled-release mechanisms, and field-applicable delivery systems have strengthened efficacy, safety, and convenience for end-users

- Increasing regulatory focus on reducing chemical residues and promoting sustainable agriculture is creating demand for highly targeted and biodegradable Polyoxin products

- Supported by steady investments in agricultural R&D, crop protection innovation, and sustainable farming programs, the polyoxin market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Polyoxin Market?

- High costs associated with premium, bio-based, and multi-component Polyoxins restrict adoption among smallholder farmers and emerging markets

- For instance, during 2024–2025, fluctuations in raw material prices, manufacturing lead times, and global supply chain constraints increased production costs for several Polyoxin manufacturers

- Complexity in developing stable, field-ready, and environmentally safe Polyoxin formulations increases the need for specialized expertise, testing, and regulatory compliance

- Limited awareness in certain emerging markets regarding Polyoxin efficacy, application methods, and disease-targeting advantages slows adoption

- Competition from conventional fungicides, alternative biopesticides, and multi-mode chemical formulations creates pricing pressure and reduces differentiation

- To address these challenges, companies are focusing on cost-optimized, high-efficacy formulations, farmer training programs, digital crop monitoring support, and regulatory-compliant innovations to increase global adoption of Polyoxins

How is the Polyoxin Market Segmented?

The market is segmented on the basis of product type, crop type, and formulation.

- By Product Type

On the basis of product type, the polyoxin market is segmented into Polyoxin B and Polyoxin D. The Polyoxin B segment dominated the market with a 52.3% share in 2025, owing to its broad-spectrum antifungal activity, high efficacy against major crop diseases such as rice blast and cucumber powdery mildew, and widespread adoption across both conventional and organic farming practices. Polyoxin B is preferred by large-scale farms and greenhouse operations due to its proven reliability, ease of application, and compatibility with integrated pest management (IPM) programs.

The Polyoxin D segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for targeted disease management, development of improved formulations with enhanced stability, and rising cultivation of high-value crops requiring precise fungal control. Ongoing R&D, farmer awareness programs, and regulatory support for bio-based fungicides are expected to accelerate the adoption of Polyoxin D globally.

- By Crop Type

On the basis of crop type, the polyoxin market is segmented into Polyoxin B by Crop Type and Polyoxin D by Crop Type. The Polyoxin B by Crop Type segment dominated the market in 2025 with a 49.6% share, largely due to its extensive use in staple crops such as rice, wheat, and vegetables, which face high susceptibility to fungal pathogens. Farmers and agribusinesses rely on Polyoxin B for its proven efficacy, safety profile, and cost-effectiveness in large-scale applications.

The Polyoxin D by Crop Type segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing cultivation of high-value fruits, vegetables, and horticultural crops that require precise fungal control and minimal residue. Enhanced formulations, compatibility with organic and IPM systems, and rising awareness of sustainable disease management practices are driving the global uptake of crop-specific Polyoxin D applications.

- By Formulation

On the basis of formulation, the polyoxin market is segmented into Wettable Powder (WP), Emulsifiable Concentrate (EC), and Dustable Powder (DP). The Wettable Powder (WP) segment dominated the market with a 46.8% share in 2025, driven by its ease of handling, water dispersibility, broad-spectrum effectiveness, and suitability for large-scale agricultural spraying systems. WP formulations remain widely preferred among farmers and agrochemical distributors due to their stability, affordability, and compatibility with most spraying equipment.

The Emulsifiable Concentrate (EC) segment is projected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing demand for concentrated, highly soluble formulations suitable for high-value crops and greenhouse applications. Innovations in formulation technology, improved solubility, and reduced application frequency are enhancing efficiency and boosting adoption across emerging and developed markets.

Which Region Holds the Largest Share of the Polyoxin Market?

- North America dominated the polyoxin market with a 42.26% revenue share in 2025, driven by strong growth in agrochemical adoption, advanced crop protection programs, and extensive R&D investments across the U.S. and Canada. Increasing demand for biofungicides, high-efficiency formulations, and sustainable agriculture practices continues to fuel Polyoxin adoption across rice, vegetable, and horticultural crops

- Leading companies in North America are introducing advanced Polyoxin formulations, including high-stability powders, emulsifiable concentrates, and wettable powders, strengthening the region’s technological advantage. Continuous investment in sustainable agriculture, digital crop monitoring, and precision farming supports long-term market expansion

- High farmer awareness, strong distribution networks, and government-backed agricultural innovation programs further reinforce regional market leadership

U.S. Polyoxin Market Insight

The U.S. is the largest contributor in North America, supported by growing adoption of integrated pest management (IPM) practices, organic farming, and high-value crop cultivation. Rising demand for Polyoxin B and D in rice, vegetables, and greenhouse crops drives market growth. Increasing investments by leading agrochemical companies in formulation optimization, field trials, and farmer training further accelerate Polyoxin adoption across the country.

Canada Polyoxin Market Insight

Canada contributes significantly to regional growth, driven by strong demand in cereal, potato, and horticultural crops. Farmers increasingly rely on Polyoxin for effective fungal disease control and yield improvement. Government-supported programs promoting sustainable crop protection, skilled agronomists, and growing awareness of biofungicides strengthen market penetration across the country.

Asia-Pacific Polyoxin Market

Asia-Pacific is projected to register the fastest CAGR of 8.19% from 2026 to 2033, driven by rising adoption of modern crop protection techniques, government incentives for sustainable agriculture, and rapid growth in rice, vegetable, and fruit cultivation across China, India, Japan, South Korea, and Southeast Asia. Increasing investments in Polyoxin B and D production, advanced formulations, and precision farming solutions continue to accelerate adoption across smallholder and commercial farms.

China Polyoxin Market Insight

China is the largest contributor to Asia-Pacific due to massive agricultural production, strong government support for crop protection programs, and growing demand for high-yield, disease-resistant crops. Expansion of Polyoxin manufacturing facilities, competitive pricing, and extensive farmer awareness campaigns further boost domestic and export market adoption.

Japan Polyoxin Market Insight

Japan shows steady growth supported by advanced agricultural infrastructure, greenhouse farming, and focus on premium crop quality. Rising use of Polyoxin formulations for fruits, vegetables, and ornamental plants drives market adoption. The demand for low-residue, environmentally friendly fungicides strengthens long-term market expansion.

India Polyoxin Market Insight

India is emerging as a key growth hub, driven by increasing rice, vegetable, and horticultural production, rising awareness of biofungicides, and government initiatives promoting sustainable crop protection. Polyoxin adoption is accelerating in commercial farms and greenhouse operations due to enhanced yield protection and resistance management.

South Korea Polyoxin Market Insight

South Korea contributes significantly due to high-value vegetable, rice, and fruit cultivation. Rapid adoption of modern agricultural techniques, greenhouses, and precision farming supports increasing Polyoxin demand. Strong R&D, advanced manufacturing capabilities, and growing awareness of bio-based crop protection solutions reinforce sustained market growth.

Which are the Top Companies in Polyoxin Market?

The polyoxin industry is primarily led by well-established companies, including:

- Jiangsu Fengyuan Bioengineering Co., Ltd. (China)

- Beijing Green Crop Science and Technology Co., Ltd. (China)

- Kaken Pharmaceutical Co., Ltd. (Japan)

- Nufarm Canada (Canada)

- Arysta LifeScience Corporation (U.S.)

- Certis (U.S.)

- OHP, Inc. (U.S.)

- Cleary Chemical Corp. (U.S.)

- DAYANG CHEM (HANGZHOU) CO., LTD. (China)

- Shanxi Lvhai Agrochemicals (China)

- MITSUI & CO., LTD. (Japan)

- UPL (India)

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta Crop Protection AG (Switzerland)

- FMC Corporation (U.S.)

- DuPont (U.S.)

- Dow (U.S.)

- LANXESS (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.