Global Polyoxymethylene Pom Market

Market Size in USD Billion

CAGR :

%

USD

5.45 Billion

USD

9.65 Billion

2024

2032

USD

5.45 Billion

USD

9.65 Billion

2024

2032

| 2025 –2032 | |

| USD 5.45 Billion | |

| USD 9.65 Billion | |

|

|

|

|

What is the Global Polyoxymethylene (POM) Market Size and Growth Rate?

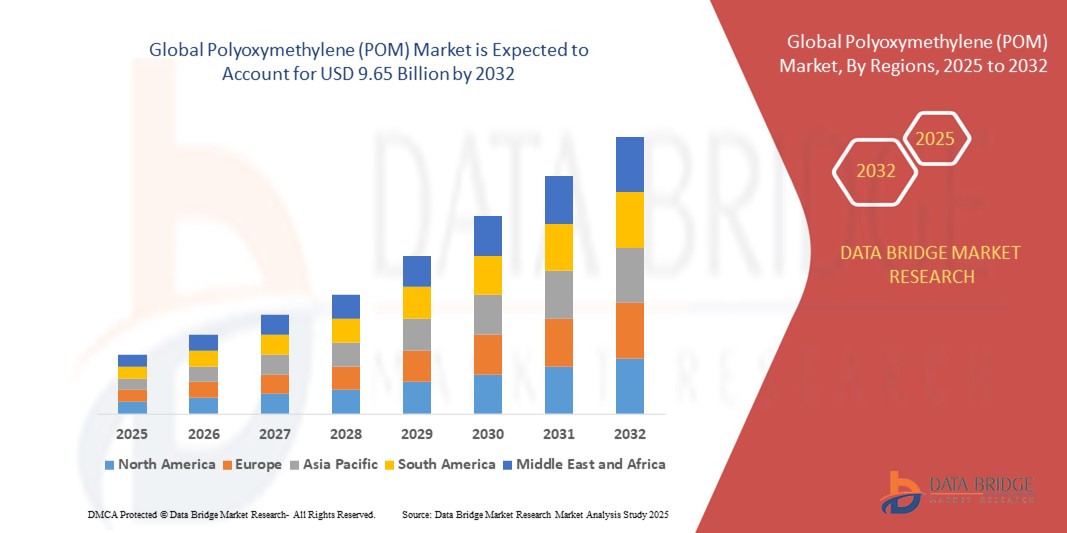

- The global polyoxymethylene (POM) market size was valued at USD 5.45 billion in 2024 and is expected to reach USD 9.65 billion by 2032, at a CAGR of 7.4% during the forecast period

- The polyoxymethylene (POM) market is being driven by rising applications in the electrical and electronics industry and rising usage in the transportation sector. Demand for polyoxymethylene in packaging and consumer electronics is likely to drive polyoxymethylene (POM) market expansion even faster. Another significant factor is the growing trend in autos to replace heavy metal component items with light plastic material as well as the acceptance for polyoxymethylene in medical applications

What are the Major Takeaways of Polyoxymethylene (POM) Market?

- The raw material manufacturing from natural gas and penetration of metal and UV detectable POM in the food and packaging industry will create ample opportunities for the polyoxymethylene (POM) market

- Other potential includes furniture, sports sectors, and rising polyoxymethylene usage in food contact materials, to name a few. As a result, the market has a lot of room to grow

- Asia-Pacific dominated the polyoxymethylene (POM) market with the largest revenue share of 41.34% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing industrial and residential automation across countries such as China, Japan, and India

- The North America polyoxymethylene (POM) market is poised to grow at the fastest CAGR of 9.8% during the forecast period 2025–2032, driven by increasing industrial automation, adoption of high-performance materials in automotive and electronics, and rising demand for lightweight, durable components

- The Homopolymer polyoxymethylene segment dominated the market with the largest revenue share of 62% in 2024, driven by its superior mechanical strength, high crystallinity, and excellent wear resistance, making it ideal for precision engineering applications in automotive, electronics, and industrial components

Report Scope and Polyoxymethylene (POM) Market Segmentation

|

Attributes |

Polyoxymethylene (POM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyoxymethylene (POM) Market?

Rising Demand for Lightweight, High-Performance Engineering Plastics

- A major and accelerating trend in the global polyoxymethylene (POM) market is the growing adoption of polyoxymethylene in high-performance and precision engineering applications across automotive, electronics, and industrial sectors. The material’s excellent mechanical properties, dimensional stability, and chemical resistance make it a preferred choice for manufacturers seeking durability and efficiency

- For instance, automotive OEMs are increasingly using polyoxymethylene in fuel system components, connectors, and gears, capitalizing on its wear resistance and low friction to improve overall vehicle performance. Similarly, consumer electronics manufacturers employ POM in small precision parts, ensuring long-lasting product quality and reliability

- The trend toward lightweighting in automotive and industrial applications is boosting POM usage, as manufacturers aim to reduce energy consumption and emissions while maintaining structural integrity. In addition, polyoxymethylene’s versatility allows integration in 3D-printed components, smart devices, and automated systems, enhancing production flexibility

- Suppliers such as Celanese and DuPont are innovating new polyoxymethylene grades tailored for high-temperature, chemically resistant, and precision molding applications, catering to the evolving demands of industrial and consumer markets

- The growing preference for eco-efficient and durable plastics, coupled with regulatory pressure to replace metals or other heavier materials, is reshaping design and material selection standards in multiple industries

- Overall, the demand for high-performance polyoxymethylene in automotive, electronics, and industrial sectors is increasing steadily, driven by performance benefits, versatility, and manufacturing efficiency

What are the Key Drivers of Polyoxymethylene (POM) Market?

- The expanding industrialization and rapid growth in automotive, electrical, and consumer electronics sectors are key drivers for polyoxymethylene demand. Its high mechanical strength, resistance to wear, and dimensional stability make it an ideal engineering plastic for precision parts

- For instance, in April 2024, Celanese introduced high-performance polyoxymethylene grades designed for automotive fuel and transmission components, addressing evolving standards for lightweight and durable materials. Such strategic innovations are expected to fuel market growth during the forecast period

- Manufacturers’ increasing focus on lightweight materials to reduce energy consumption in vehicles and machinery is accelerating polyoxymethylene adoption. The material’s low friction coefficient also reduces maintenance costs in moving parts, appealing to industrial clients

- Furthermore, growing automation and robotics deployment in production lines is creating demand for precision components made from polyoxymethylene, as it ensures consistent performance under high-speed and high-stress operations

- Other factors such as ease of molding, chemical resistance, and long-term stability make polyoxymethylene an attractive option for diverse applications, from automotive connectors to medical devices, thereby supporting both industrial and consumer segment growth

Which Factor is Challenging the Growth of the Polyoxymethylene (POM) Market?

- The relatively high raw material cost and fluctuating prices of polyoxymethylene pose a challenge for price-sensitive industries, limiting adoption in regions with lower purchasing power. Premium grades with enhanced chemical or thermal resistance can be particularly expensive

- For instance, high-performance polyoxymethylene materials for automotive or electronics components often command a significant price premium, which can impact overall manufacturing budgets

- Processing challenges, including sensitivity to moisture and the need for precise molding conditions, require technical expertise, potentially restricting adoption among smaller manufacturers

- Competition from alternative engineering plastics, such as nylon, polypropylene, and polycarbonate, also limits polyoxymethylene share in certain applications where cost optimization is prioritized

- Overcoming these challenges involves developing more cost-effective polyoxymethylene grades, improving processing technologies, and educating manufacturers on the long-term performance and durability advantages, which can offset higher initial costs

How is the Polyoxymethylene (POM) Market Segmented?

The market is segmented on the basis of type, process, grade, and end-user industry.

- By Type

On the basis of type, the polyoxymethylene (POM) market is segmented into Homopolymer POM and Copolymer POM. The Homopolymer polyoxymethylene segment dominated the market with the largest revenue share of 62% in 2024, driven by its superior mechanical strength, high crystallinity, and excellent wear resistance, making it ideal for precision engineering applications in automotive, electronics, and industrial components. Homopolymer polyoxymethylene is widely preferred for gears, bearings, and fuel system parts due to its dimensional stability and durability under high-stress conditions.

The Copolymer polyoxymethylene segment is expected to witness the fastest CAGR of 8.5% from 2025 to 2032, fueled by its enhanced chemical resistance and thermal stability, making it suitable for applications in food packaging, medical devices, and chemical processing industries. Manufacturers are increasingly adopting Copolymer polyoxymethylene to meet specialized requirements in corrosive and high-temperature environments.

- By Process

On the basis of process, the polyoxymethylene (POM) market is segmented into Injection Molding, Extrusion Molding, and Others. The Injection Molding segment held the largest revenue share of 70% in 2024, owing to its efficiency in producing complex and high-precision components for automotive, electrical, and consumer electronics sectors. Injection molding allows consistent dimensional accuracy, cost-effective high-volume production, and integration of reinforcement fillers to enhance mechanical performance.

The Extrusion Molding segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, driven by rising demand for POM rods, sheets, and tubes in industrial machinery, structural components, and conveyor systems. Growth in extrusion molding is further supported by the need for long, uniform profiles and customized shapes for specialized applications.

- By Grade

On the basis of grade, the polyoxymethylene (POM) market is segmented into Standard, Reinforced, Impact Modified, Recycled, UV Stabilized, and Special Grade. The Standard POM segment dominated the market with a revenue share of 55% in 2024, attributed to its balanced mechanical properties, cost-effectiveness, and widespread application in automotive, electronics, and industrial components. Reinforced and Impact Modified grades are gaining traction due to their enhanced mechanical strength, toughness, and suitability for high-load applications, particularly in transportation and industrial equipment.

Among these, the Reinforced POM segment is projected to witness the fastest CAGR of 9% from 2025 to 2032, driven by growing requirements for lightweight, high-strength materials in automotive gears, bearings, and housings, as well as industrial machinery.

- By End-User Industry

On the basis of end-user industry, the polyoxymethylene (POM) market is segmented into Electrical and Electronics, Transportation, Medical, Food Packaging, Consumer Goods and Appliances, Construction, and Other End-user Industries. The Transportation segment dominated the market with the largest revenue share of 40% in 2024, fueled by the adoption of POM for automotive fuel system components, connectors, gears, and precision mechanical parts due to its wear resistance and dimensional stability.

The Electrical and Electronics segment is expected to witness the fastest CAGR of 10% from 2025 to 2032, driven by rising demand for high-performance POM components in consumer electronics, home appliances, and industrial automation devices. Increasing urbanization, technological advancement, and the push for lightweight, durable components in electronic systems are key factors accelerating growth in this sector.

Which Region Holds the Largest Share of the Polyoxymethylene (POM) Market?

- Asia-Pacific dominated the polyoxymethylene (POM) market with the largest revenue share of 41.34% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing industrial and residential automation across countries such as China, Japan, and India

- Consumers and industries in the region highly value high-performance, durable, and lightweight polyoxymethylene materials for automotive, electronics, medical, and consumer goods applications

- This widespread adoption is further supported by government initiatives promoting digitalization and smart manufacturing, as well as the presence of leading domestic manufacturers, establishing Asia-Pacific as the central hub for both production and consumption of polyoxymethylene (POM)

China Polyoxymethylene (POM) Market Insight

In China, the polyoxymethylene (POM) market captured the largest revenue share in Asia-Pacific in 2024. Growth is fueled by rapid industrialization, increasing automation in manufacturing, and adoption of high-quality materials in automotive, electronics, and consumer goods sectors. Government incentives for smart factories and sustainable production practices are supporting the demand for POM. Moreover, China’s expanding middle class and rising urban infrastructure development further drive market expansion. The country remains a key production and consumption hub, propelling Asia-Pacific’s dominance in the global POM market.

Japan Polyoxymethylene (POM) Market Insight

In Japan, the polyoxymethylene (POM) market is gaining momentum due to the country’s high-tech industrial culture, robust manufacturing ecosystem, and rising emphasis on automation and precision engineering. Japanese manufacturers increasingly prefer POM for automotive parts, consumer electronics, and robotics due to its durability and dimensional stability. Integration of POM in high-performance applications, alongside government support for advanced manufacturing, is boosting demand in both residential and commercial sectors.

Which Region is the Fastest Growing Region in the Polyoxymethylene (POM) Market?

The North America polyoxymethylene (POM) market is poised to grow at the fastest CAGR of 9.8% during the forecast period 2025–2032, driven by increasing industrial automation, adoption of high-performance materials in automotive and electronics, and rising demand for lightweight, durable components. The region’s well-established manufacturing base, combined with technological innovation and a focus on smart materials, is accelerating POM adoption across multiple end-user industries.

U.S. Polyoxymethylene (POM) Market Insight

In the U.S., the polyoxymethylene (POM) market captured the largest revenue share of 80% within North America in 2024. Growth is fueled by rising adoption in automotive, aerospace, and electronics manufacturing, as well as the expansion of advanced robotics and smart manufacturing systems. Increasing awareness of POM’s advantages in terms of strength, wear resistance, and lightweight properties is driving market penetration. North America’s focus on industrial modernization, research & development, and sustainability initiatives is expected to sustain the region’s rapid growth, positioning it as the fastest-growing market globally.

Which are the Top Companies in Polyoxymethylene (POM) Market?

The polyoxymethylene (POM) industry is primarily led by well-established companies, including:

- Dow (U.S.)

- DuPont (U.S.)

- Polyplastics Company Ltd. (Japan)

- Asahi Kasei Chemicals Corporation (Japan)

- Celanese Corporation (U.S.)

- SABIC Innovative Plastics USA LLC (U.S.)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- China National Bluestar (Group) Co. Ltd (China)

- SABIC (Saudi Arabia)

- Polyone Corporation (U.S.)

- Korea Engineering Plastics Co. Ltd. (South Korea)

- Jet-Hot, Inc. (U.S.)

- ICD High Performance Coatings (U.S.)

- SPI Performance Coatings (U.S.)

- EverCoat Industries Sdn Bhd (Malaysia)

What are the Recent Developments in Global Polyoxymethylene (POM) Market?

- In May 2024, Celanese Corporation announced the inauguration of two new facilities, the India Technical Center in Silvassa and a Shared Service Center in Hyderabad, aimed at strengthening regional operations and providing enhanced technical support across Asia. This expansion reflects the company’s commitment to regional growth and operational efficiency

- In January 2024, BASF Group expanded the distribution of its engineering plastics portfolio across the U.S., Canada, and Mexico, offering select products such as Ultramid PA, Ultradur PBT, Ultraform POM, recycled Nypel PA6/PA66, and Petra PET through authorized distributors including Bamberger Amco Polymers, M. Holland Company, Nexeo Plastics, and Polimeros Nacionales in Mexico. This initiative improves product accessibility and strengthens market presence in North America

- In June 2023, BASF Group transferred the European direct business sales process for Ultraform to its trusted trading partners, ALBIS and Ultrapolymers Group, enhancing operational efficiency and distribution reliability. This move ensures consistent supply and better service for European customers

- In June 2023, The Polyplastics Co., Ltd., a subsidiary of Daicel Corporation, announced the commercial launch of its DURACON POM PM Series specifically for medical applications, highlighting the company’s focus on high-performance, healthcare-grade materials. This development expands their product portfolio for specialized applications

- In November 2022, Daicel Corporation’s subsidiary, Polyplastics Co., Ltd., announced the relocation of the head office and plant of Polyplastics (Nantong) Ltd. in China, aiming to streamline operations and increase production efficiency. The relocation supports better logistics and enhanced manufacturing capabilities

- In May 2022, Daicel Corporation entered into a capital participation agreement with Global Polyacetal Co., Ltd., investing 30% in a new manufacturing plant in China, intending to expand production capacity and meet growing demand. This strategic investment reinforces Daicel’s market position in Asia

- In May 2022, Mitsubishi Gas Chemical Company, Inc., acquired a 30% equity stake in P Holdings, Inc., a business management company overseeing a POM-producing firm in China via its subsidiary Global Polyacetal Co., Ltd., to strengthen its control over operations and secure raw material supply. This move enhances their strategic presence in the Chinese market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyoxymethylene Pom Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyoxymethylene Pom Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyoxymethylene Pom Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.