Global Polyphthalamide Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

2.07 Billion

2024

2032

USD

1.39 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.39 Billion | |

| USD 2.07 Billion | |

|

|

|

|

What is the Global Polyphthalamide Market Size and Growth Rate?

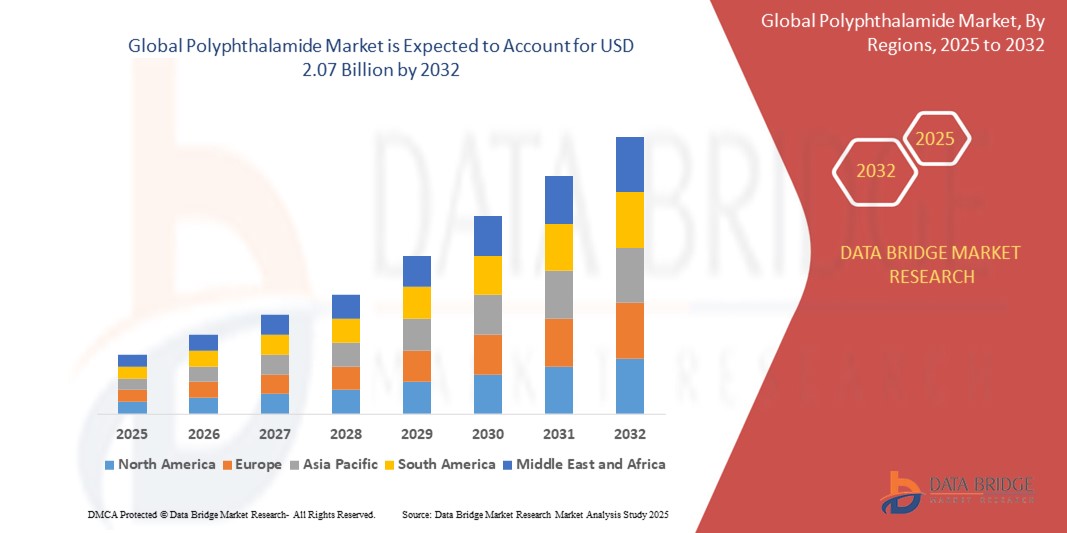

- The global polyphthalamide market size was valued at USD 1.39 billion in 2024 and is expected to reach USD 2.07 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is primarily driven by the increasing demand for high-performance thermoplastics in automotive, electrical & electronics, and industrial applications

- Enhanced thermal stability, chemical resistance, and mechanical strength of Polyphthalamides make them a preferred alternative to metals and other engineering plastics, particularly in applications requiring miniaturization and durability under harsh environments

What are the Major Takeaways of Polyphthalamide Market?

- Polyphthalamides (PPAs) are semi-crystalline, high-performance thermoplastics that are extensively used in components such as engine parts, connectors, and under-the-hood automotive applications due to their superior heat resistance and strength

- The automotive sector remains the largest end-use industry, with growing substitution of metal components to reduce weight and improve fuel efficiency, boosting the demand for PPA

- Asia-Pacific dominated the Polyphthalamide market with the largest revenue share of 46.8% in 2024, driven by rapid industrialization, rising demand in automotive and electronics sectors, and favorable government initiatives supporting domestic manufacturing

- Asia-Pacific is projected to grow at the fastest CAGR of 7.5% from 2025 to 2032, supported by strong industrial growth, rising disposable incomes, and the shift towards lightweight, durable materials in next-gen electronics and vehicles

- The Unfilled segment dominated the Polyphthalamide market with the largest market revenue share of 48.6% in 2024, due to its superior mechanical strength, dimensional stability, and heat resistance. Unfilled polyphthalamide refers to the pure, unreinforced form of PPA resins

Report Scope and Polyphthalamide Market Segmentation

|

Attributes |

Polyphthalamide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Polyphthalamide Market?

“Rising Demand for Lightweight and High-Performance Materials in Automotive and Electronics”

- A major trend shaping the Polyphthalamide (PPA) market is the increasing demand for lightweight, high-performance materials in industries such as automotive, electrical & electronics, and industrial manufacturing

- PPA’s superior thermal resistance, mechanical strength, and dimensional stability make it a preferred alternative to metals and conventional plastics in engine components, connectors, and housing units

- For instance, automotive OEMs are using PPA in cooling systems, fuel system components, and transmission parts to reduce vehicle weight and improve fuel efficiency. In electronics, the miniaturization of devices has increased demand for compact, heat-resistant materials, driving PPA adoption in circuit breakers and electronic connectors

- The market is also seeing innovations in glass-fiber-reinforced and flame-retardant grades of PPA, which are extending its use in high-voltage automotive and industrial applications

- As manufacturers prioritize sustainability, lightweighting, and operational efficiency, the role of Polyphthalamide as a metal replacement and performance polymer is expected to expand significantly across high-growth sectors

What are the Key Drivers of Polyphthalamide Market?

- The growing automotive industry is a key driver of PPA demand, as manufacturers seek lightweight materials that offer durability and chemical resistance under high temperatures, especially in electric vehicles (EVs) and fuel-efficient models

- For instance, in February 2024, Evonik Industries expanded its PPA product line for e-mobility applications, citing rising demand for thermally stable polymers in electric drivetrains and battery systems

- In addition, the electrical & electronics sector is driving adoption due to the need for materials with high dielectric strength and excellent dimensional stability in compact components such as connectors, switches, and sensors

- The industrial segment is also experiencing growth as manufacturers opt for PPA in pumps, valves, and fittings that require chemical and wear resistance in aggressive environments

- PPA’s compatibility with high-volume injection molding processes and its recyclability potential further support its market expansion as industries push for greener and more efficient production methods

Which Factor is challenging the Growth of the Polyphthalamide Market?

- A key challenge restraining the polyphthalamide market is the high cost of raw materials and production, which makes PPA more expensive than standard engineering plastics such as polyamides and polyesters

- The complex manufacturing process of aromatic diacids and diamines, essential for PPA synthesis, leads to higher production costs, limiting its affordability especially in price-sensitive markets such as Asia-Pacific and Latin America

- In addition, processing challenges such as moisture sensitivity and higher melting points can require specialized equipment, increasing total production costs and reducing scalability for small manufacturers

- For instance, companies with limited budgets may prefer cheaper alternatives such as PA6 or PA66 for non-critical applications, even if performance trade-offs are involved

- Addressing this challenge through technological advancements in compounding, expanded recycling capabilities, and the development of cost-effective blends or bio-based PPAs will be essential for broader market adoption and long-term growth

How is the Polyphthalamide Market Segmented?

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the polyphthalamide market is segmented into Unfilled, Mineral Filled, Glass Fiber Filled, and Carbon Fiber Filled. The Unfilled segment dominated the Polyphthalamide market with the largest market revenue share of 48.6% in 2024, due to its superior mechanical strength, dimensional stability, and heat resistance. Unfilled polyphthalamide refers to the pure, unreinforced form of PPA resin. This type offers excellent thermal resistance, low moisture absorption, and chemical resistance while maintaining a lightweight structure. It is widely used in electrical connectors, medical devices, and automotive applications where dimensional stability and precision are crucial.

The Carbon Fiber Filled segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for lightweight, high-stiffness materials in aerospace, automotive, and advanced electronics. These composites offer exceptional mechanical performance and conductivity, making them suitable for next-gen applications requiring thermal management and weight reduction.

• By Application

On the basis of application, the polyphthalamide market is segmented into Automotive, Electronics & Electrical, Industrial Equipment & Apparatus, Consumer & Personal Care, and Others. The Automotive segment accounted for the largest market revenue share of 59.9% in 2024, driven by the growing need for lightweight materials that can replace metals in engine parts, fuel systems, cooling modules, and electric vehicle components. PPA's resistance to chemicals, heat, and wear makes it highly suitable for demanding automotive environments, especially as manufacturers aim to improve fuel efficiency and reduce emissions.

The Electronics & Electrical segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the miniaturization of devices and the need for thermally stable, high-performance plastics in connectors, circuit breakers, and high-voltage components. PPA’s excellent dielectric properties and dimensional accuracy make it a preferred material for precision electronics used in consumer devices, power tools, and industrial systems.

Which Region Holds the Largest Share of the Polyphthalamide Maret?

- Asia-Pacific dominated the polyphthalamide market with the largest revenue share of 46.8% in 2024, driven by rapid industrialization, rising demand in automotive and electronics sectors, and favorable government initiatives supporting domestic manufacturing

- Countries such as China, Japan, South Korea, and India are spearheading adoption due to growing production of electric vehicles (EVs), miniaturized consumer electronics, and high-performance industrial components using PPA materials

- The presence of a robust manufacturing base, combined with expanding end-use industries and improving export competitiveness, reinforces Asia-Pacific’s position as the leading region in global Polyphthalamide consumption

China Polyphthalamide Market Insight

The China polyphthalamide market accounted for the largest market share within Asia-Pacific in 2024, fueled by a booming automotive sector, domestic electronics production, and the strong presence of raw material suppliers. As the country continues to dominate global exports of electrical and automotive components, demand for high-temperature resistant and lightweight materials such as PPA is surging. Government policies encouraging the use of eco-friendly and fuel-efficient materials further drive adoption across sectors.

Japan Polyphthalamide Market Insight

The Japan polyphthalamide market is expanding steadily due to its technologically advanced manufacturing ecosystem and the nation's focus on precision electronics and hybrid vehicles. PPA’s durability, heat resistance, and miniaturization capabilities make it ideal for connectors, sensors, and engine components used in compact systems. Japan’s high standards for quality and performance are further encouraging innovation in PPA formulations and applications.

South Korea Polyphthalamide Market Insight

The South Korea Polyphthalamide market is gaining traction due to a robust semiconductor and consumer electronics industry, as well as its growing role in EV battery production and telecommunications infrastructure. With increasing investment in 5G technology, automotive electrification, and smart manufacturing, South Korea continues to drive demand for high-performance thermoplastics such as Polyphthalamide.

Which Region is the Fastest Growing in the Polyphthalamide Market?

Asia-Pacific is projected to grow at the fastest CAGR of 7.5% from 2025 to 2032, supported by strong industrial growth, rising disposable incomes, and the shift towards lightweight, durable materials in next-gen electronics and vehicles. The region is also emerging as a global manufacturing hub for Polyphthalamide-based components, offering cost-effective production, high availability of skilled labor, and increasing regional R&D activity. The continued push for energy efficiency, smart mobility, and advanced consumer electronics will drive long-term demand for Polyphthalamide across the Asia-Pacific region, solidifying its status as the key growth engine for the global market.

Latin America Polyphthalamide Market Insight

The Latin America polyphthalamide market is experiencing gradual growth, supported by the expansion of the automotive manufacturing sector, particularly in Brazil and Mexico. As global OEMs invest in regional production, the demand for high-performance polymers such as PPA—known for their thermal stability and lightweight properties—is rising. The region is also seeing moderate uptake in consumer electronics and industrial applications, although growth is somewhat constrained by limited local production capacity and high import reliance.

Middle East & Africa (MEA) Polyphthalamide Market Insight

The MEA polyphthalamide market is in its nascent stages but shows potential due to increasing industrial development, automotive assembly, and infrastructure modernization. The United Arab Emirates, Saudi Arabia, and South Africa are witnessing a shift towards advanced materials in automotive and electronics, creating a niche market for Polyphthalamide. However, challenges such as limited R&D infrastructure and dependency on imported materials continue to affect large-scale adoption.

Which are the Top Companies in Polyphthalamide Market?

The Polyphthalamide industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- Dow (U.S.)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- KRATON CORPORATION (U.S.)

- DuPont (U.S.)

- RTP Company (U.S.)

- 3M (U.S.)

- DSM (Netherlands)

- Solvay (Belgium)

- Evonik Industries AG (Germany)

- Eurostar Engineering Plastics (France)

- KURARAY CO., LTD. (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- DIC CORPORATION (Japan)

- KUREHA CORPORATION (Japan)

- PolyOne Corporation (U.S.)

- Ryan Plastics Ltd. (U.K.)

- Polyplastics Co., Ltd. (Japan)

- Sumitomo Corporation (Japan)

What are the Recent Developments in Global Polyphthalamide Market?

- In January 2025, BASF launched Ultramid T6000, a flame-retardant polyphthalamide (PPA) specifically engineered for electric vehicle (EV) applications, including inverters and motor systems. This material enhances safety by replacing conventional non-flame-retardant components in terminal blocks. This innovation is expected to significantly improve fire resistance and reliability in critical EV systems

- In May 2024, Clariant introduced AddWorks PPA, a PFAS-free polymer processing aid for polyolefin film extrusion, and AddWorks PKG, an antioxidant solution for maintaining color integrity in recycled polyolefins. These products were developed to provide sustainable alternatives to traditional fluoropolymer-based additives. This launch highlights Clariant’s commitment to environmental responsibility and innovation in plastics processing

- In September 2023, Solvay unveiled new PPE grades manufactured using 100% renewable electricity during the Fakuma trade fair, reinforcing their sustainability agenda. These high-performance materials fall under the new Echo brand, which incorporates bio-based and recycled content. This development strengthens Solvay’s positioning as a leader in eco-conscious material science

- In May 2021, Solvay announced the creation of a bio-based polyamide designed for use in electric motor components, power electronics, and other EV subsystems. This material supports advanced engineering requirements while offering sustainability benefits. This innovation marks a strategic step toward greener mobility and reinforces Solvay's focus on sustainable electric vehicle technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyphthalamide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyphthalamide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyphthalamide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.