Global Polypropylene And Polypropylene Composites Market

Market Size in USD Billion

CAGR :

%

USD

187.09 Billion

USD

319.93 Billion

2024

2032

USD

187.09 Billion

USD

319.93 Billion

2024

2032

| 2025 –2032 | |

| USD 187.09 Billion | |

| USD 319.93 Billion | |

|

|

|

|

Polypropylene and Polypropylene Composites Market Size

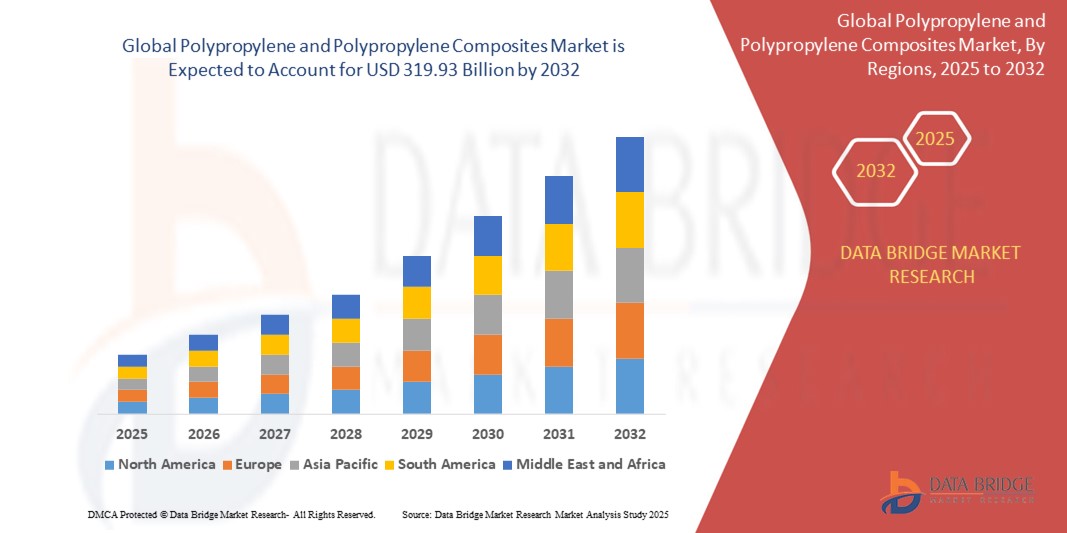

- The Global Polypropylene and Polypropylene Composites Market size was valued at USD 187.09 Billion in 2024 and is expected to reach USD 319.93 Billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by the increasing demand for lightweight, durable, and cost-effective materials across key industries such as automotive, packaging, consumer goods, and construction. Polypropylene and its composites are gaining prominence due to their superior mechanical properties, chemical resistance, and recyclability—making them ideal for meeting both performance and sustainability targets in high-volume applications

- Moreover, the global emphasis on reducing carbon emissions and improving fuel efficiency is accelerating the integration of polypropylene composites in automotive and aerospace components. Simultaneously, advancements in polymer compounding, fiber reinforcement technologies, and manufacturing techniques such as injection molding and 3D printing are enhancing material versatility and functional performance. These developments are fostering strategic alliances, regional capacity expansions, and increased investments in R&D—driving market innovation, product differentiation, and broader adoption across end-use sector

Polypropylene and Polypropylene Composites Market Analysis

- Polypropylene and polypropylene composites, widely used for their lightweight, high impact resistance, and chemical durability, play a critical role in enhancing structural efficiency, reducing material costs, and enabling design flexibility across automotive, packaging, construction, and consumer goods industries

- The growing emphasis on fuel efficiency, carbon footprint reduction, and circular economy principles is driving increased adoption of polypropylene composites, particularly in the automotive and electrical & electronics sectors—highlighting the importance of material recyclability, mechanical strength, and thermal stability

- North America dominates the Polypropylene and Polypropylene Composites Market with the largest revenue share of 38.01% in 2024, supported by robust manufacturing capabilities, established automotive OEM networks, and technological advancements in polymer compounding and composite processing. The U.S. leads the region, driven by innovation in lightweight vehicle components and demand for sustainable packaging solutions

- Asia-Pacific is expected to be the fastest-growing region in the Polypropylene and Polypropylene Composites Market during the forecast period, propelled by rapid industrialization, expanding automotive production, and increasing investments in infrastructure development across countries such as China, India, and Southeast Asian nations

- Glass fiber-reinforced polypropylene composites dominate the polypropylene composites segment with a market share of 40.3% in 2024, attributed to their superior stiffness-to-weight ratio, dimensional stability, and cost-efficiency—especially in high-volume applications such as automotive interiors, under-the-hood components, and consumer electronics housings

Report Scope and Polypropylene and Polypropylene Composites Market Segmentation

|

Attributes |

Sustained Release Coating Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polypropylene and Polypropylene Composites Market Trends

“Material Innovation and Sustainability-Driven Engineering in Polypropylene Composites”

- A significant and accelerating trend in the Global Polypropylene and Polypropylene Composites Market is the development of advanced reinforced compounds and high-performance polymer blends engineered to meet demanding structural, thermal, and aesthetic requirements in automotive, construction, and consumer goods applications. These innovations are driving the substitution of traditional materials like metal and wood.

- Leading companies such as LyondellBasell Industries, SABIC, and Borealis AG are pioneering glass fiber-reinforced and mineral-filled polypropylene composites with enhanced impact strength, dimensional stability, and flame retardancy—enabling lightweight, durable solutions critical to vehicle electrification, appliance housings, and infrastructure components

- There is a growing emphasis on recycled and bio-based polypropylene grades as sustainability becomes a core design and procurement criterion. Recyclate-enhanced composites and closed-loop recycling initiatives are gaining traction, particularly among OEMs seeking to meet regulatory mandates and consumer expectations for circular economy practices

- In parallel, process innovations such as advanced compounding, long fiber thermoplastic (LFT) molding, and hybrid injection-compression techniques are being widely adopted to enable complex part geometries, reduce cycle times, and improve filler dispersion—contributing to higher production efficiency and material performance consistency

- Functional integration through overmolding, co-extrusion, and additive manufacturing is also expanding the scope of polypropylene applications, allowing manufacturers to reduce assembly costs and improve product functionality

- This focus on high-performance, sustainable, and application-specific polypropylene composites is redefining product development strategies. Companies investing in polymer innovation, lifecycle assessments, and process automation are well-positioned to capture value across evolving end-user industries—especially in e-mobility, smart packaging, and energy-efficient building systems

Polypropylene and Polypropylene Composites Market Dynamics

Driver

“Rising Demand for Lightweight, Durable, and Sustainable Engineering Materials”

- The growing emphasis on energy efficiency, environmental sustainability, and high-performance materials is a key driver propelling the growth of the Polypropylene and Polypropylene Composites Market across automotive, packaging, construction, and consumer goods sectors. Manufacturers are increasingly shifting toward lightweight, corrosion-resistant, and cost-effective alternatives to traditional materials like metal and glass.

- For example, in January 2024, SABIC launched a new range of long glass fiber-reinforced polypropylene (LGFPP) composites designed to reduce vehicle weight by up to 30% without compromising structural integrity—supporting automakers’ efforts to meet stringent fuel economy and emissions regulations across Europe and North America.

- As electric vehicle (EV) adoption accelerates and regulatory bodies tighten carbon reduction targets, OEMs are intensifying their use of polypropylene composites in under-the-hood components, battery housings, and interior trims. These applications demand materials with high thermal resistance, dimensional stability, and recyclability—attributes that advanced PP composites are engineered to deliver.

- In the construction and infrastructure sector, polypropylene is being adopted for piping systems, insulation panels, and formwork due to its resistance to moisture, chemicals, and wear. The shift toward sustainable building materials and green certifications (e.g., LEED, BREEAM) further amplifies demand for recyclable and low-emission polymer solutions.

- Consumer product manufacturers are also utilizing polypropylene for its moldability, color retention, and durability—particularly in packaging, household goods, and electronics casings. With increasing regulatory pressure to reduce single-use plastics, companies are innovating with bio-based and post-consumer recycled (PCR) polypropylene grades.

- This convergence of regulatory momentum, material innovation, and cross-industry sustainability targets is accelerating the integration of polypropylene and its composites into mainstream manufacturing ecosystems. Companies that invest in closed-loop recycling technologies, application-specific compounding, and localized production capacity are poised to benefit from long-term structural growth in this evolving global market

Restraint/Challenge

“High Capital Investment and Regulatory Challenges in Key Markets”

- The capital-intensive nature of polypropylene composite manufacturing presents a significant restraint to market expansion, particularly for small- and medium-sized enterprises (SMEs) and new entrants. Establishing production facilities for compounding, reinforcement integration, and high-precision molding requires substantial upfront investment in specialized machinery, tooling, and quality assurance systems

- For instance, developing long fiber-reinforced polypropylene (LFPP) or mineral-filled polypropylene composites demands advanced extrusion-compounding lines, controlled environmental conditions, and continuous process monitoring to ensure uniform dispersion and mechanical performance—resulting in high operational and maintenance costs that can deter adoption

- In highly regulated industries such as automotive, aerospace, and medical devices, stringent compliance requirements related to flammability, recyclability, and mechanical specifications further compound entry barriers. Meeting standards such as REACH (EU), TSCA (U.S.), and ISO certifications requires rigorous material testing, documentation, and third-party validation, adding complexity and cost to product development cycles

- Moreover, global disparities in regulatory frameworks and environmental mandates (e.g., plastic taxes, recycling quotas, and bans on certain additives) pose additional challenges for multinational manufacturers. The lack of harmonization between markets can slow product rollouts, increase administrative burdens, and necessitate region-specific formulations, thereby hindering economies of scale

- The fluctuating prices of raw materials—particularly virgin polypropylene resin and glass or carbon fiber reinforcements—also present a constraint, as volatility in petrochemical feedstocks can compress margins and impact procurement strategies. Smaller players, in particular, may struggle to absorb cost fluctuations or secure stable supply contracts in times of global supply chain disruptions

- Overcoming these restraints requires strategic investment in scalable, energy-efficient production technologies, streamlined regulatory navigation, and regional material sourcing. Industry stakeholders are increasingly forming joint ventures and public-private partnerships to share technical expertise, reduce capital risk, and accelerate compliance through collaborative innovation platforms and digitalized quality control systems

Polypropylene and Polypropylene Composites Market Scope

The market is segmented on the basis of product type, fiber type, application

- By Product Type

On the basis of product type, the Polypropylene and Polypropylene Composites Market is segmented into Polypropylene (PP) and Polypropylene Composites

The Polypropylene Composites segment dominates the market with the largest revenue share of 54.7% in 2024, attributed to their superior mechanical properties, lightweight nature, and enhanced thermal stability compared to conventional PP

- By Fiber Type

On the basis of fiber type, the Polypropylene and Polypropylene Composites Market is segmented into Glass Fiber, Carbon Fiber, and Others

The Glass Fiber segment dominates the market with the largest revenue share of 47.2% in 2024, driven by its cost-effectiveness, excellent reinforcement properties, and broad availability. Glass fiber-reinforced polypropylene composites deliver enhanced stiffness, impact resistance, and dimensional stability, making them the preferred choice in automotive interiors, electrical housings, and construction materials

- By Application

On the basis of application, the Polypropylene and Polypropylene Composites Market is segmented into Packaging, Building and Construction, Automotive, Electrical and Electronics, Aerospace and Defence, and Others.

The Automotive segment dominates the market with the largest revenue share of 39.8% in 2024, driven by the increasing demand for lightweight, fuel-efficient vehicles and stringent emission regulations globally. Polypropylene composites are widely used in automotive applications such as interior trims, battery housings, and structural components due to their excellent strength-to-weight ratio, thermal stability, and recyclability

Polypropylene and Polypropylene Composites Market Regional Analysis

- North America dominates the Polypropylene and Polypropylene Composites Market with the largest revenue share of 39.01% in 2024, driven by increasing demand for lightweight, high-performance materials across automotive, packaging, and construction sectors. The region benefits from a strong manufacturing infrastructure, advanced R&D capabilities, and stringent regulatory frameworks that promote innovation in composite materials and sustainability initiatives

- Manufacturers in North America are investing heavily in developing novel polypropylene composites with enhanced mechanical properties, recyclability, and reduced carbon footprint. The U.S. leads the region, supported by government incentives for green technologies, growing adoption of electric vehicles, and robust infrastructure development

U.S. Polypropylene and Polypropylene Composites Market Insight

The U.S. Polypropylene and Polypropylene Composites Market captured the largest revenue share of 80% in North America in 2024, propelled by extensive applications in automotive lightweighting, packaging innovation, and electrical components. Rising environmental regulations and the push for energy-efficient materials are accelerating market expansion. Additionally, strong industrial demand and investment in sustainable manufacturing practices are driving adoption of high-performance composites

Europe Polypropylene and Polypropylene Composites Market Insight

The Europe Polypropylene and Polypropylene Composites Market is projected to expand steadily throughout the forecast period, supported by growing construction activities, automotive sector electrification, and stringent environmental regulations. Countries such as Germany, France, and the UK are leading market adoption due to their advanced manufacturing ecosystems and government initiatives promoting circular economy principles

U.K. Polypropylene and Polypropylene Composites Market Insight

The U.K. market is expected to grow at a notable CAGR, driven by increasing focus on lightweight materials for automotive and aerospace applications, enhanced recycling infrastructure, and government support for innovation in sustainable polymers. Collaborations between academia and industry are accelerating development of next-generation polypropylene composites with improved performance and environmental profiles

Germany Polypropylene and Polypropylene Composites Market Insight

Germany remains a key market within Europe, propelled by its strong automotive manufacturing base and leadership in engineering innovation. Companies are adopting automated production technologies and advanced composite formulations to meet EU emission targets and rising demand for electric and hybrid vehicles. Growth is also supported by government policies incentivizing resource efficiency and material circularity

Asia-Pacific Polypropylene and Polypropylene Composites Market Insight

The Asia-Pacific Polypropylene and Polypropylene Composites Market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by rapid industrialization, expanding automotive production, and increasing infrastructure development. Countries such as China, India, Japan, and Australia are witnessing substantial investments in composite manufacturing capacity and government initiatives supporting sustainable material innovation

Japan Polypropylene and Polypropylene Composites Market Insight

Japan’s market growth is driven by its expertise in precision manufacturing and increasing demand for high-performance polypropylene composites in automotive, electronics, and medical device applications. The aging population also fuels demand for innovative materials with enhanced durability and safety features. Strict quality control standards encourage adoption of cutting-edge composite technologies

China Polypropylene and Polypropylene Composites Market Insight

China holds the largest revenue share in Asia-Pacific as of 2024, supported by vast investments in industrial expansion, automotive electrification, and packaging modernization. The growing middle-class consumer base and government policies promoting domestic production and environmental sustainability contribute significantly to market growth. Increasing focus on reducing carbon emissions and improving material recyclability is driving the development and adoption of advanced polypropylene composite materials

Polypropylene and Polypropylene Composites Market Share

The sustained release coating is primarily led by well-established companies, including:

- LyondellBasell Industries N.V. (Netherlands)

- ExxonMobil Chemical Company (U.S.)

- SABIC (Saudi Arabia)

- Borealis AG (Austria)

- Braskem S.A. (Brazil)

- TotalEnergies SE (France)

- China Petroleum & Chemical Corporation (Sinopec) (China)

- Formosa Plastics Corporation (Taiwan)

- INEOS Group Holdings S.A. (U.K.)

- Mitsui Chemicals, Inc. (Japan)

- China National Petroleum Corporation (CNPC) (China)

- JSR Corporation (Japan)

- Hyundai Engineering Plastics Co., Ltd. (South Korea)

- RTP Company (U.S.)

- Washington Penn Plastic Co., Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- SK Geo Centric Co., Ltd. (South Korea)

- Tosaf Compounds Ltd. (Israel)

- MG Polyplast Industries Pvt. Ltd. (India)

- Kingfa Science & Technology Co., Ltd. (China)

Latest Developments in Global Polypropylene and Polypropylene Composites Market

- In April 2025, BASF SE launched a new line of lightweight polypropylene composite materials engineered for enhanced mechanical strength and improved recyclability. This development supports the automotive and packaging industries’ sustainability targets while enabling manufacturers to meet stringent emission and weight reduction standards

- In March 2025, Evonik Industries AG announced a strategic partnership with a leading automotive OEM to co-develop high-performance polypropylene composites optimized for electric vehicle battery housings. The collaboration aims to accelerate adoption of flame-retardant, durable, and lightweight materials in next-generation electric vehicles

- In February 2025, LyondellBasell expanded its production capacity for polypropylene composites incorporating natural fibers, responding to growing demand in the building and construction sector for eco-friendly, cost-effective materials. This investment aligns with global trends toward sustainable construction solutions

- In January 2025, Mitsubishi Chemical Corporation unveiled a new range of polypropylene composites reinforced with carbon fibers, designed for aerospace and defense applications requiring superior strength-to-weight ratios and enhanced thermal stability. The product line aims to support increased use of composites in lightweight aircraft components

- In January 2025, SABIC introduced a portfolio of polypropylene-based electrically conductive composites targeting the electrical and electronics industry. These materials enable improved electromagnetic interference (EMI) shielding and thermal management in compact, high-performance electronic devices, addressing critical industry challenges

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polypropylene And Polypropylene Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polypropylene And Polypropylene Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polypropylene And Polypropylene Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.