Global Polypropylene Copolymer Market

Market Size in USD Billion

CAGR :

%

USD

59.70 Billion

USD

89.55 Billion

2024

2032

USD

59.70 Billion

USD

89.55 Billion

2024

2032

| 2025 –2032 | |

| USD 59.70 Billion | |

| USD 89.55 Billion | |

|

|

|

|

Polypropylene Copolymer Market Size

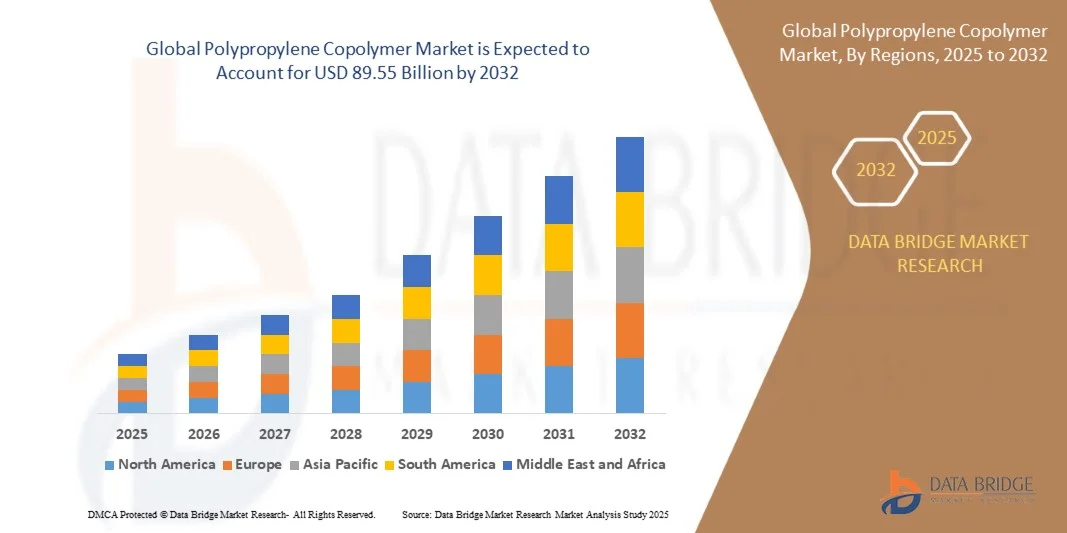

- The global polypropylene copolymer market size was valued at USD 59.7 billion in 2024 and is expected to reach USD 89.55 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, durable, and recyclable materials across packaging, automotive, and consumer goods industries, driving the widespread adoption of polypropylene copolymers as a preferred material solution for performance and sustainability needs

- Furthermore, rising investments in polymer innovation, coupled with advancements in processing technologies such as extrusion and injection molding, are enhancing the versatility and mechanical strength of polypropylene copolymers, thereby expanding their application scope across multiple end-use sectors

Polypropylene Copolymer Market Analysis

- Polypropylene copolymers, known for their superior impact resistance, flexibility, and chemical stability, are extensively utilized across industries including packaging, automotive, construction, and textiles, where they provide high performance with reduced material weight and improved recyclability

- The growing emphasis on sustainability, supported by regulatory policies promoting eco-friendly materials, is accelerating the development of advanced polypropylene copolymer grades. This, combined with expanding industrial applications and increased global polymer production capacity, continues to drive robust market growth

- Asia-Pacific dominated the polypropylene copolymer market with a share of 55.91% in 2024, due to expanding automotive manufacturing, rising demand for sustainable packaging materials, and a strong base of petrochemical production facilities across the region

- North America is expected to be the fastest growing region in the polypropylene copolymer market during the forecast period due to strong demand in packaging, automotive, and consumer goods applications

- Packaging segment dominated the market with a market share of 39% in 2024, due to the increasing use of polypropylene copolymers in food containers, caps, closures, and flexible films. Their high impact resistance, lightweight nature, and recyclability make them a preferred choice for sustainable packaging solutions. Growing e-commerce and rising demand for hygienic, durable packaging materials further strengthen the segment’s dominance, particularly in food and beverage applications. Continuous innovation in packaging design and material performance enhances product shelf life and appeal, reinforcing the segment’s leadership position

Report Scope and Polypropylene Copolymer Market Segmentation

|

Attributes |

Polypropylene Copolymer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polypropylene Copolymer Market Trends

“Growing Shift Toward Sustainable and Recyclable Polypropylene Copolymers”

- The polypropylene copolymer market is experiencing a significant transition toward sustainable and recyclable material development driven by increasing environmental regulations and corporate sustainability initiatives. Manufacturers are emphasizing eco-friendly production processes and circular economy practices to enhance polymer recyclability while maintaining high performance standards across end-use applications

- For instance, LyondellBasell Industries has introduced mechanically recycled polypropylene copolymers through its CirculenRecover product line, designed for use in packaging and automotive interior components. This reflects the industry’s broader effort to reduce carbon emissions while creating value through recycled content integration in polymer production

- Technological advancements in chemical recycling and polymer reprocessing are enabling the production of high-quality recyclable polypropylene copolymers without compromising flexibility, impact resistance, or clarity. Such innovations are improving material consistency and expanding their applicability across packaging, construction, and consumer goods sectors

- The adoption of bio-based polypropylene copolymers derived from renewable feedstocks such as bio-naphtha and plant-based propylene is gaining traction among producers aiming to minimize carbon footprints. These sustainable variants offer comparable performance characteristics to conventional grades while aligning with global green manufacturing initiatives

- Leading petrochemical companies are establishing collaborations and investment programs to enhance the closed-loop recycling ecosystem. For instance, Borealis AG and TotalEnergies are scaling their joint polymer recycling operations in Europe to convert post-consumer waste into sustainable polypropylene copolymers for high-value industrial applications

- The ongoing shift toward recyclable and sustainable polypropylene copolymer production signifies a major evolution in the polymer value chain. As industries prioritize resource efficiency, these environmentally responsible materials are expected to play a crucial role in meeting future circular economy goals and regulatory compliance requirements globally

Polypropylene Copolymer Market Dynamics

Driver

“Rising Demand from Automotive and Packaging Industries”

- The increasing use of polypropylene copolymers in automotive and packaging industries is one of the major factors driving market growth. Their superior impact strength, lightweight nature, and processability make them ideal for applications requiring durability, cost-effectiveness, and design flexibility

- For instance, in 2024, SABIC expanded its automotive-grade polypropylene copolymer portfolio used for bumpers, door panels, and interior trims to support vehicle weight reduction and improved fuel efficiency. Such developments highlight the rising preference for polypropylene copolymers as substitutes for metal and other heavier polymers in automotive manufacturing

- In the packaging industry, polypropylene copolymers are widely utilized for producing flexible films, containers, and caps that require high transparency and sealing performance. Their ability to provide excellent moisture resistance and product protection makes them a preferred material for food, pharmaceutical, and consumer goods packaging

- The growing focus on sustainable and recyclable packaging solutions is encouraging packaging manufacturers to adopt modified polypropylene copolymers with improved recyclability and lower environmental impact. These materials support brand commitments to sustainability and align with international waste reduction frameworks

- As automotive and packaging sectors continue to expand globally, the demand for efficient, versatile, and eco-compatible materials is expected to intensify. The multifunctional performance of polypropylene copolymers ensures their continued role as indispensable materials supporting industrial innovation and sustainability objectives

Restraint/Challenge

“Volatility in Raw Material Prices”

- Fluctuating raw material prices pose a significant challenge to the polypropylene copolymer market, primarily driven by the dependency on petrochemical-based feedstocks such as propylene. Changes in crude oil and natural gas prices directly impact polymer production costs, influencing profit margins across the supply chain

- For instance, price fluctuations in propylene monomers during 2023–2024 affected manufacturers such as ExxonMobil and Braskem, leading to periodic pricing adjustments and tighter supply-demand dynamics. Such volatility increases operational uncertainty for converters and end-users relying on stable input costs for production planning

- The limited availability of cost-effective alternative feedstocks further intensifies exposure to global energy market fluctuations. Economic and geopolitical disruptions affecting oil-exporting regions can rapidly impact raw material sourcing and logistics expenses for polypropylene copolymer producers

- The increasing investment in sustainable manufacturing and the adoption of bio-based propylene present potential solutions; however, scaling these alternatives remains costly and technically complex. Feedstock volatility continues to challenge the predictability of production expenses for both virgin and recycled polymer producers

- To counter these fluctuations, companies are entering long-term raw material supply agreements and investing in integrated production facilities to stabilize costs. Developing diversified sourcing strategies and advancing bio-based feedstock innovation will be crucial to achieving pricing stability and long-term resilience in the polypropylene copolymer market

Polypropylene Copolymer Market Scope

The market is segmented on the basis of application and end-use.

• By Application

On the basis of application, the polypropylene copolymer market is segmented into fibre and fabrics, automotive, packaging, construction, medical, consumer goods, and others. The packaging segment dominated the market with the largest market revenue share of 39% in 2024, attributed to the increasing use of polypropylene copolymers in food containers, caps, closures, and flexible films. Their high impact resistance, lightweight nature, and recyclability make them a preferred choice for sustainable packaging solutions. Growing e-commerce and rising demand for hygienic, durable packaging materials further strengthen the segment’s dominance, particularly in food and beverage applications. Continuous innovation in packaging design and material performance enhances product shelf life and appeal, reinforcing the segment’s leadership position.

The automotive segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rising emphasis on lightweight materials to improve vehicle fuel efficiency and reduce emissions. Polypropylene copolymers are widely used in manufacturing bumpers, interior panels, and under-the-hood components due to their superior impact strength and flexibility. For instance, major automotive manufacturers such as Toyota and Volkswagen are incorporating advanced polypropylene copolymer composites to achieve enhanced durability and weight reduction. The shift toward electric vehicles and sustainable materials further accelerates demand, positioning the automotive segment as the most rapidly expanding application category.

• By End-Use

On the basis of end-use, the polypropylene copolymer market is segmented into rigid packaging, textiles, technical parts, films, consumer products, and others. The rigid packaging segment dominated the market with the largest market share in 2024, primarily driven by its extensive utilization in food storage containers, bottles, and industrial packaging. Polypropylene copolymers offer excellent chemical resistance, high transparency, and cost efficiency, making them ideal for packaging sensitive goods. The growing demand for reusable and recyclable materials across food, pharmaceutical, and household sectors further propels market growth. Manufacturers are also adopting advanced molding technologies to improve rigidity and clarity, enhancing the market potential for rigid packaging applications.

The technical parts segment is projected to witness the fastest growth rate from 2025 to 2032, owing to its increasing usage in electrical, automotive, and industrial components. These copolymers are preferred for their dimensional stability, high impact strength, and ability to perform under varying temperature conditions. For instance, companies such as Borealis AG and LyondellBasell Industries are developing reinforced polypropylene copolymer grades suitable for precision-engineered technical applications. The ongoing industrial automation trend and the demand for durable, lightweight components are expected to boost the adoption of polypropylene copolymers in technical part manufacturing throughout the forecast period.

Polypropylene Copolymer Market Regional Analysis

- Asia-Pacific dominated the polypropylene copolymer market with the largest revenue share of 55.91% in 2024, driven by expanding automotive manufacturing, rising demand for sustainable packaging materials, and a strong base of petrochemical production facilities across the region

- The region’s cost-effective manufacturing landscape, growing industrialization, and significant investments in polymer processing technologies are accelerating market expansion

- The availability of skilled labor, supportive government initiatives, and increasing consumption of lightweight materials in automotive and consumer goods sectors are contributing to higher adoption of polypropylene copolymers

China Polypropylene Copolymer Market Insight

China held the largest share in the Asia-Pacific polypropylene copolymer market in 2024, supported by its extensive polymer production capacity and dominance in automotive, construction, and packaging industries. The country’s well-developed supply chain, favorable government policies promoting high-performance plastics, and growing demand for lightweight and recyclable materials are major drivers. Rising investments in advanced polymer processing and an expanding export base further strengthen China’s leadership in the regional market.

India Polypropylene Copolymer Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding packaging and automotive sectors, rising consumer goods production, and rapid industrialization. The government’s “Make in India” initiative and focus on domestic polymer manufacturing are driving local demand. Increasing foreign investments, coupled with rising adoption of polypropylene copolymers in films, rigid packaging, and textiles, are contributing to the country’s strong growth trajectory.

Europe Polypropylene Copolymer Market Insight

The Europe polypropylene copolymer market is expanding steadily, supported by growing demand for recyclable and sustainable materials in automotive and packaging sectors. The region’s strict environmental regulations, innovation in polymer compounding, and focus on lightweight and energy-efficient materials are key factors driving growth. Rising investments in circular economy initiatives and advanced polymer recycling infrastructure are further enhancing market development.

Germany Polypropylene Copolymer Market Insight

Germany’s polypropylene copolymer market is driven by its advanced automotive manufacturing base, strong chemical industry, and leadership in polymer innovation. The country’s emphasis on lightweight materials and sustainable production practices is boosting demand. Collaborative R&D efforts between polymer producers and automotive OEMs are fostering new product development for enhanced performance and recyclability.

U.K. Polypropylene Copolymer Market Insight

The U.K. market is supported by a well-established packaging and consumer goods industry, along with growing adoption of eco-friendly materials. Efforts to enhance domestic recycling capacity and localize polymer production post-Brexit are fueling market growth. Increasing innovation in high-performance copolymers and collaborations between academic and industrial sectors are strengthening the U.K.’s position in the regional market.

North America Polypropylene Copolymer Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by strong demand in packaging, automotive, and consumer goods applications. The region’s focus on lightweight vehicles, sustainability goals, and advancements in polymer manufacturing technologies are key factors accelerating market expansion. Strategic investments in polymer research and recycling initiatives are supporting long-term growth.

U.S. Polypropylene Copolymer Market Insight

The U.S. accounted for the largest share in the North America market in 2024, attributed to its robust manufacturing base, strong R&D ecosystem, and increasing use of polypropylene copolymers in packaging and industrial applications. The country’s focus on innovation, regulatory compliance, and sustainable material development continues to drive demand. Presence of major polymer producers and extensive application diversity reinforce the U.S.’s leading role in the regional market.

Polypropylene Copolymer Market Share

The polypropylene copolymer industry is primarily led by well-established companies, including:

- LyondellBasell Industries Holdings B.V. (Netherlands)

- China Petrochemical Corporation (Sinopec Group) (China)

- SABIC (Saudi Arabia)

- PetroChina Company Limited (China)

- Braskem S.A. (Brazil)

- Borealis AG (Austria)

- ExxonMobil Chemical Company, Inc. (U.S.)

- TotalEnergies SE (France)

- Reliance Industries Limited (India)

- Formosa Plastics Corporation (Taiwan)

- INEOS Group Holdings S.A. (U.K.)

- Chevron Phillips Chemical Company LLC (U.S.)

- Mitsui Chemicals, Inc. (Japan)

- Lotte Chemical Corporation (South Korea)

- Sumitomo Chemical Co., Ltd. (Japan)

Latest Developments in Global Polypropylene Copolymer Market

- In March 2024, Borealis AG announced the expansion of its polypropylene copolymer production facility in Kallo, Belgium, marking a significant investment to enhance capacity for advanced and sustainable polymer grades. The expansion focuses on producing high-performance copolymers for use in lightweight automotive components and recyclable packaging solutions. This strategic move strengthens Borealis’s footprint in the European market, addressing growing customer demand for eco-friendly and durable materials while aligning with EU sustainability and circular economy goals. The project also positions the company to better serve downstream industries seeking energy-efficient and recyclable plastic alternatives

- In September 2023, ExxonMobil Chemical introduced a new line of high-performance polypropylene copolymers designed for clear, impact-resistant packaging applications across food, beverage, and personal care sectors. The new grades feature improved mechanical strength and processability, allowing manufacturers to achieve better product protection with reduced material usage. This development reinforces ExxonMobil’s commitment to material innovation and sustainability, expanding its market reach in the premium packaging segment. By addressing the increasing global demand for recyclable and high-clarity plastics, the company is supporting the industry’s transition toward circular packaging solutions

- In July 2022, LyondellBasell joined the NEXTLOOPP initiative to develop circular food-grade recycled polypropylene (FGrPP) derived from post-consumer packaging waste. This collaboration plays a critical role in advancing closed-loop recycling technologies that can safely reintroduce recycled polypropylene into food packaging. Through this partnership, LyondellBasell aims to reduce reliance on virgin polymers and promote the production of sustainable, high-quality recycled materials. The initiative is expected to accelerate industry-wide adoption of food-safe recycled polypropylene, strengthening the company’s position as a leader in sustainable polymer innovation

- In December 2020, Russia approved the participation of Sinopec Group in a major petrochemical project designed to produce 2.3 million tonnes of polyethylene and 400,000 tonnes of polypropylene annually, starting in 2024–2025. This development represents a key milestone in Russia’s industrial expansion strategy, significantly boosting its polymer output and export potential. The project enhances regional self-sufficiency in polypropylene production and fosters technological collaboration between Chinese and Russian companies. By expanding production capacity, the project is expected to stabilize polypropylene supply in global markets and support the growing demand for industrial and consumer applications

- In June 2020, Braskem Group completed construction of its advanced polypropylene production facility in La Porte, Texas, marking one of the largest investments in North America’s polypropylene sector in recent years. The facility is capable of producing a full range of polypropylene products, including homopolymers, random copolymers, and impact copolymers. This expansion enhances Braskem’s ability to serve diverse industries such as packaging, automotive, and consumer goods with reliable, high-quality polymer solutions. The facility also strengthens regional supply chains, improves production flexibility, and supports the company’s goal of meeting the increasing demand for lightweight, sustainable, and high-performance materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polypropylene Copolymer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polypropylene Copolymer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polypropylene Copolymer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.