Global Polypropylene Nonwoven Fabric Market

Market Size in USD Billion

CAGR :

%

USD

32.69 Billion

USD

54.11 Billion

2025

2033

USD

32.69 Billion

USD

54.11 Billion

2025

2033

| 2026 –2033 | |

| USD 32.69 Billion | |

| USD 54.11 Billion | |

|

|

|

|

Polypropylene Nonwoven Fabric Market Size

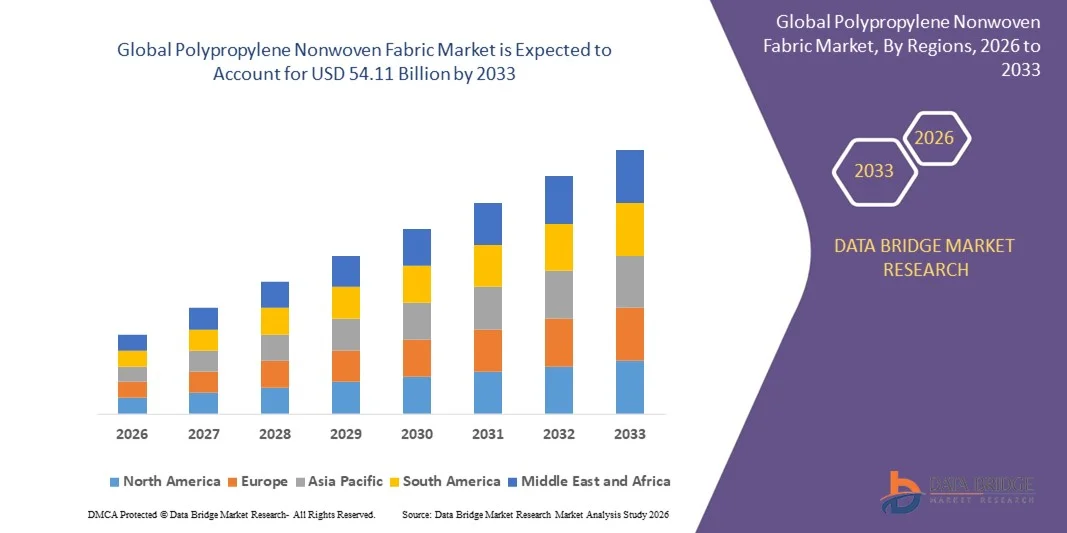

- The global polypropylene nonwoven fabric market size was valued at USD 32.69 billion in 2025 and is expected to reach USD 54.11 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the increasing demand from hygiene products, medical applications, and the automotive sector, where lightweight and durable materials are critical

- Rising adoption in filtration, construction, and packaging applications is further supporting market expansion, driven by growing awareness of product efficiency and sustainability

Polypropylene Nonwoven Fabric Market Analysis

- The market is witnessing steady growth due to the versatility of polypropylene nonwoven fabrics, which offer properties such as strength, flexibility, and resistance to chemicals and moisture

- Increasing regulatory support for sustainable and disposable hygiene products, along with rising industrial applications, is expected to continue driving the adoption of polypropylene nonwoven fabrics across global markets

- North America dominated the polypropylene nonwoven fabric market with the largest revenue share of 38.45% in 2025, driven by increasing demand in hygiene, medical, and industrial applications, as well as rising adoption of disposable and sustainable fabrics

- Asia-Pacific region is expected to witness the highest growth rate in the global polypropylene nonwoven fabric market, driven by rising population, growing awareness of hygiene standards, and increasing demand from medical, industrial, and personal care applications

- The spun-bonded segment held the largest market revenue share in 2025, driven by its high strength-to-weight ratio, cost-effectiveness, and versatility across hygiene, medical, and industrial applications. Spun-bonded fabrics are widely adopted for disposable products such as masks, surgical gowns, and wipes, offering excellent durability and comfort

Report Scope and Polypropylene Nonwoven Fabric Market Segmentation

|

Attributes |

Polypropylene Nonwoven Fabric Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polypropylene Nonwoven Fabric Market Trends

Rising Adoption of Polypropylene Nonwoven Fabrics Across End-Use Industries

- The increasing utilization of polypropylene nonwoven fabrics in medical, hygiene, and personal care products is transforming the market by enabling lightweight, durable, and cost-effective solutions. The versatility of these fabrics in applications such as surgical gowns, masks, wipes, and diapers is driving consistent demand, while manufacturers are investing in advanced layers and coatings to enhance barrier performance and comfort

- Growing demand in industrial applications, including filtration, automotive interiors, and packaging, is accelerating market adoption. Polypropylene nonwoven fabrics provide superior strength, chemical resistance, and easy manufacturability, making them ideal for diverse industrial needs. They are also increasingly being used in construction and geotextiles, further broadening their scope

- Advancements in production technologies, such as spunbond and meltblown processes, are improving fabric performance, softness, and barrier properties. These innovations are enabling manufacturers to expand into high-performance applications and meet evolving consumer and industrial requirements. In addition, hybrid nonwoven fabrics combining polypropylene with other fibers are emerging to cater to specialized applications

- For instance, in 2023, several hygiene product manufacturers in Europe upgraded to multi-layer polypropylene nonwoven fabrics, enhancing absorbency and comfort while reducing raw material usage, resulting in improved sustainability and operational efficiency. Similar initiatives were observed in Asia-Pacific, where cost-effective multilayer fabrics gained traction in consumer goods

- While polypropylene nonwoven fabrics are gaining traction across multiple sectors, long-term growth depends on innovations in production efficiency, recyclability, and cost optimization to meet large-scale industrial and consumer demand. The increasing focus on circular economy practices and biodegradable coatings is also expected to drive further adoption

Polypropylene Nonwoven Fabric Market Dynamics

Driver

Growing Demand From Medical, Hygiene, And Industrial Applications

- The rising focus on healthcare and hygiene standards is driving strong adoption of polypropylene nonwoven fabrics in masks, surgical gowns, and wipes. The COVID-19 pandemic reinforced the need for disposable, safe, and lightweight fabrics, accelerating industry growth, while ongoing awareness of infection prevention continues to support sustained demand

- Industrial and automotive sectors are increasingly adopting polypropylene nonwoven fabrics for filtration, insulation, and packaging applications. The fabrics’ versatility, durability, and chemical resistance make them an attractive solution for cost-effective and high-performance applications. They are also being leveraged in electronics, battery separators, and air/water filtration systems, expanding their industrial utility

- Government regulations and environmental safety standards are promoting the use of hygienic, nonwoven-based products. Supportive policies and standards for disposable and cleanroom products encourage manufacturers to invest in polypropylene nonwoven production capabilities, while incentives for eco-friendly materials further stimulate market growth

- For instance, in 2022, several North American automotive manufacturers integrated polypropylene nonwoven fabrics in vehicle interiors for insulation and soundproofing, enhancing product efficiency and market adoption. Similar measures were taken in medical device manufacturing, where high-quality nonwovens improved sterilization and barrier performance

- While demand across end-use industries is driving growth, continued investments in high-quality production processes, customization, and sustainable materials are critical for long-term expansion. Collaboration with research institutions for next-generation nonwoven technologies is also anticipated to strengthen market prospects

Restraint/Challenge

Volatility In Raw Material Prices And Environmental Concerns

- The fluctuating prices of polypropylene resin and other raw materials impact production costs and profit margins for nonwoven fabric manufacturers. Price volatility can affect supply contracts and long-term planning for large-scale industrial users, while sudden surges in global polymer demand intensify cost pressures

- Environmental concerns related to the disposal and recyclability of polypropylene nonwoven fabrics are creating regulatory and consumer pressures. Non-biodegradable nature of the material necessitates innovations in recycling and sustainable production practices, encouraging manufacturers to explore compostable blends and circular material loops

- Limited availability of advanced machinery and technical expertise for producing high-performance nonwoven fabrics in some regions hinders market penetration. Smaller manufacturers may struggle to meet quality and volume requirements for specialized applications, while the high capital investment required for advanced meltblown lines limits new entrants

- For instance, in 2023, several European nonwoven producers faced temporary price hikes and supply disruptions due to polypropylene resin shortages, affecting downstream industries such as hygiene and filtration. Concurrently, energy cost fluctuations added further strain on production operations

- While production technologies continue to evolve, addressing cost, sustainability, and regulatory challenges remains crucial for maintaining market competitiveness and fostering global expansion. Emphasis on circular economy models, strategic sourcing, and continuous technological upgrades will be key to mitigating risks and sustaining long-term growth

Polypropylene Nonwoven Fabric Market Scope

The polypropylene nonwoven fabric market is segmented on the basis of product and application.

- By Product

On the basis of product, the polypropylene nonwoven fabric market is segmented into spun-bonded, staples, meltblown, and composite. The spun-bonded segment held the largest market revenue share in 2025, driven by its high strength-to-weight ratio, cost-effectiveness, and versatility across hygiene, medical, and industrial applications. Spun-bonded fabrics are widely adopted for disposable products such as masks, surgical gowns, and wipes, offering excellent durability and comfort.

The meltblown segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior filtration efficiency, fine fiber structure, and increasing demand in high-performance applications. Meltblown polypropylene is particularly popular for air and liquid filtration, medical masks, and barrier fabrics, and its adoption is further accelerated by regulatory standards and heightened hygiene awareness.

- By Application

On the basis of application, the market is segmented into hygiene, geotextiles, furnishings, agriculture, automotive, carpet, industrial, medical, and others. The hygiene segment accounted for the largest share in 2025 due to growing awareness of personal and public hygiene, rising demand for disposable wipes, diapers, and sanitary products, and advancements in multilayer fabric technologies.

The medical segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising healthcare infrastructure development, increased adoption of disposable medical products, and stringent infection control measures. Medical nonwoven fabrics are increasingly used in surgical drapes, gowns, and masks, ensuring safety, sterility, and high-performance standards in hospitals and clinics.

Polypropylene Nonwoven Fabric Market Regional Analysis

- North America dominated the polypropylene nonwoven fabric market with the largest revenue share of 38.45% in 2025, driven by increasing demand in hygiene, medical, and industrial applications, as well as rising adoption of disposable and sustainable fabrics

- Manufacturers and consumers in the region highly value the versatility, durability, and lightweight properties of polypropylene nonwoven fabrics for applications such as masks, wipes, diapers, and filtration products

- This widespread adoption is further supported by advanced production infrastructure, high-quality standards, and growing awareness of hygiene and safety, establishing polypropylene nonwoven fabrics as a preferred choice across multiple end-use industries

U.S. Polypropylene Nonwoven Fabric Market Insight

The U.S. polypropylene nonwoven fabric market captured the largest revenue share in 2025 within North America, fueled by strong adoption in medical, hygiene, and industrial sectors. Rising demand for masks, surgical gowns, wipes, and filtration materials continues to propel the market. In addition, increasing investment in advanced production technologies such as spunbond and meltblown processes is enhancing fabric quality, softness, and barrier properties. The focus on sustainability and regulatory compliance in healthcare and hygiene products is also contributing to market expansion.

Europe Polypropylene Nonwoven Fabric Market Insight

The Europe polypropylene nonwoven fabric market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent hygiene standards, growing industrial applications, and increased adoption in the automotive and filtration sectors. European manufacturers are leveraging advanced fabric technologies to improve performance, durability, and sustainability. Rising urbanization and consumer awareness about disposable hygiene products further support market growth across residential, commercial, and industrial applications.

U.K. Polypropylene Nonwoven Fabric Market Insight

The U.K. polypropylene nonwoven fabric market is expected to witness strong growth from 2026 to 2033, driven by the increasing use of nonwoven fabrics in hygiene products, medical applications, and industrial filtration. Consumer demand for high-performance, disposable fabrics, alongside the expansion of healthcare and personal care sectors, is boosting adoption. Furthermore, investments in local manufacturing capabilities and regulatory support for hygiene standards are expected to stimulate market growth.

Germany Polypropylene Nonwoven Fabric Market Insight

The Germany polypropylene nonwoven fabric market is expected to witness significant growth from 2026 to 2033, fueled by strong industrial and medical sectors, as well as increasing awareness of hygiene and sustainability. Germany’s advanced manufacturing infrastructure and focus on eco-friendly production processes encourage the adoption of high-quality polypropylene nonwoven fabrics. Integration of fabrics into automotive, filtration, and industrial applications continues to drive market expansion, particularly in multi-layer and composite fabrics.

Asia-Pacific Polypropylene Nonwoven Fabric Market Insight

The Asia-Pacific polypropylene nonwoven fabric market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, industrialization, and healthcare infrastructure expansion in countries such as China, Japan, and India. The region’s growing hygiene awareness, combined with the availability of cost-effective production facilities, is accelerating adoption in medical, hygiene, and industrial applications. Moreover, APAC’s position as a manufacturing hub for nonwoven fabrics is enhancing affordability and accessibility, supporting widespread adoption across multiple end-use industries.

Japan Polypropylene Nonwoven Fabric Market Insight

The Japan polypropylene nonwoven fabric market is expected to witness strong growth from 2026 to 2033 due to the country’s high standards for healthcare, hygiene, and industrial products. Rising demand for disposable masks, surgical gowns, and filtration materials, coupled with investments in high-performance fabric production, is fueling market expansion. In addition, Japan’s aging population and focus on sustainable, hygienic materials are expected to drive continued adoption across residential, commercial, and industrial sectors.

China Polypropylene Nonwoven Fabric Market Insight

The China polypropylene nonwoven fabric market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, strong industrial growth, and rising hygiene awareness. China is one of the largest producers and consumers of polypropylene nonwoven fabrics, with widespread applications in hygiene, medical, automotive, and industrial sectors. Government initiatives promoting hygiene and healthcare products, alongside the presence of cost-effective domestic manufacturers, are key factors propelling market growth in China.

Polypropylene Nonwoven Fabric Market Share

The Polypropylene Nonwoven Fabric industry is primarily led by well-established companies, including:

• DuPont (U.S.)

• KCWW (U.K.)

• Berry Global Inc. (U.S.)

• Ahlstrom-Munksjö (Finland)

• Freudenberg (Germany)

• Glatfelter (U.S.)

• Suominen Corporation (Finland)

• Johns Manville (U.S.)

• Fitesa S.A. and Affiliates (Brazil)

• TWE GmbH & Co. KG (Germany)

• TORAY INDUSTRIES, INC (Japan)

• Avgol Ltd (Israel)

• Asahi Kasei Corporation (Japan)

• Fiberwebindia Ltd. (India)

• Sunshine Nonwoven Fabric Co., Ltd (China)

• Autotech Nonwovens Pvt Ltd (India)

• Hollingsworth & Vose Company (U.S.)

• PFNonwovens Czech s.r.o (Czech Republic)

• Fibertex Nonwovens A/S (Denmark)

• Cygnus Group (India)

Latest Developments in Global Polypropylene Nonwoven Fabric Market

- In July 2023, Berry Global initiated a partnership with Deaconess Midtown Hospital and Nexus Circular to launch a recycling program targeting sterile, non-hazardous plastic packaging and nonwoven fabrics from the hospital’s surgical center. The initiative aims to safely divert approximately 500 pounds of used plastics and nonwoven surgical gowns weekly from landfills, enhancing sustainability and promoting circular economy practices within the medical and healthcare sector. This program strengthens Berry Global’s environmental impact and sets a benchmark for hospital waste management

- In February 2023, Asahi Kasei announced a joint venture with Mitsui Chemicals, forming Mitsui Chemicals Asahi Life Materials Co., based in Tokyo, Japan. The integration combines Asahi Kasei’s Moriyama plant and Mitsui’s Nogoya Works and Sunrex sites, aiming to optimize nonwoven production and expand supply capabilities. This strategic move enhances operational efficiency, strengthens market presence, and supports growth in high-demand nonwoven applications across multiple industries

- In September 2022, Suominen launched its tri-layer nonwoven product, FIBRELLA Strata, targeting diverse industries, particularly the baby care segment. The innovative tri-layer design delivers superior softness and enhanced cleaning performance, improving user experience and product functionality. This launch reinforces Suominen’s market competitiveness and drives adoption of advanced nonwoven solutions in personal care and hygiene applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.