Global Polyvinyl Alcohol Films Market

Market Size in USD Million

CAGR :

%

USD

450.00 Million

USD

654.79 Million

2024

2032

USD

450.00 Million

USD

654.79 Million

2024

2032

| 2025 –2032 | |

| USD 450.00 Million | |

| USD 654.79 Million | |

|

|

|

|

Polyvinyl Alcohol Films Market Size

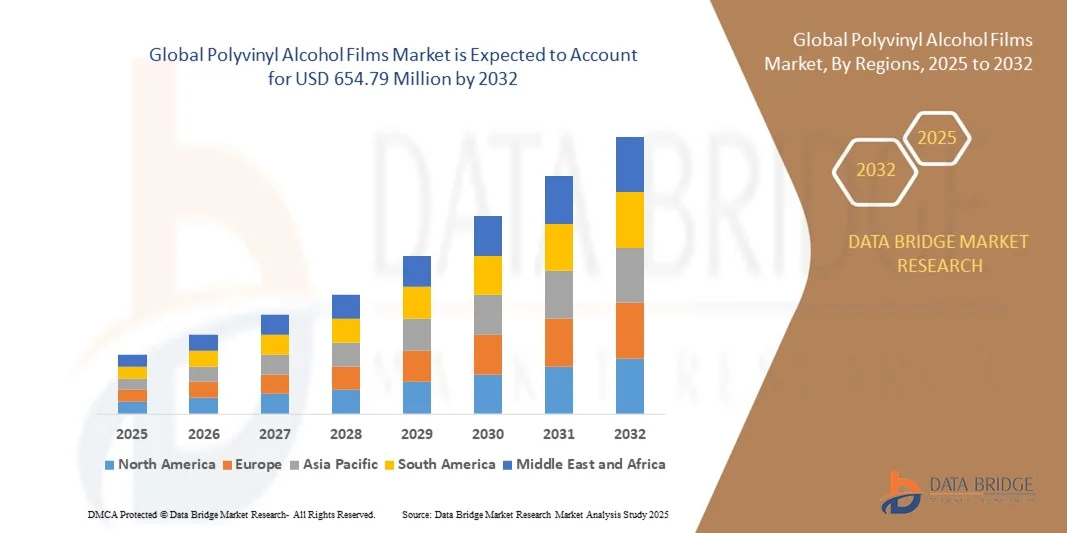

- The global polyvinyl alcohol films market size was valued at USD 450.00 million in 2024 and is expected to reach USD 654.79 million by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and biodegradable packaging materials

- Rising usage of water-soluble films in detergent packaging, agrochemicals, and healthcare applications is further supporting market expansion

Polyvinyl Alcohol Films Market Analysis

- The market is experiencing steady growth due to the growing emphasis on environmental sustainability and stringent government regulations against plastic waste

- Manufacturers are increasingly focusing on developing high-performance and eco-friendly PVA films for diverse applications such as packaging, medical products, and agriculture

- North America dominated the polyvinyl alcohol films market with the largest revenue share of 38.24% in 2024, driven by the strong presence of packaging, healthcare, and electronics industries utilizing biodegradable materials for sustainability compliance

- Asia-Pacific region is expected to witness the highest growth rate in the global polyvinyl alcohol films market, driven by rising demand from food, pharmaceutical, and agricultural sectors, along with supportive government initiatives promoting eco-friendly materials

- The Water-Soluble Polyvinyl Alcohol (PVA) Films segment held the largest market revenue share in 2024, driven by rising demand for sustainable and eco-friendly packaging materials. These films are widely used in applications such as detergents, agrochemicals, and food packaging due to their biodegradability, solubility, and ability to reduce plastic waste

Report Scope and Polyvinyl Alcohol Films Market Segmentation

|

Attributes |

Polyvinyl Alcohol Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyvinyl Alcohol Films Market Trends

Rising Demand for Water-Soluble Packaging Films

- The global packaging industry is witnessing a major transformation with the increasing adoption of water-soluble films made from polyvinyl alcohol (PVA). These films dissolve completely in water, eliminating packaging waste and reducing plastic pollution, which aligns with growing sustainability goals across various industries. Their ability to degrade safely without leaving microplastic residues makes them ideal for use in eco-friendly consumer products and industrial applications

- Manufacturers in sectors such as detergents, agrochemicals, and food packaging are rapidly shifting toward PVA-based films to comply with eco-friendly packaging regulations and consumer expectations for biodegradable materials. These films offer high tensile strength, transparency, and flexibility, ensuring durability during handling while maintaining their environmentally friendly characteristics

- The convenience of unit-dose packaging, particularly for household cleaning products and single-use applications, is further boosting the demand for PVA films. This packaging format minimizes product wastage, enhances portion control, and ensures safety in handling hazardous materials such as concentrated cleaning agents

- For instance, in 2024, several leading detergent brands in the U.S. and Europe launched PVA-based pods and sachets to replace traditional plastic packaging, resulting in lower carbon footprints and improved product sustainability perception. The trend is being reinforced by major retail chains adopting sustainable packaging goals, further promoting market expansion for PVA films

- The rising demand for water-soluble packaging films is expected to continue as global industries focus on circular economy models, encouraging the development of cost-effective and high-performance PVA films. Manufacturers are increasingly investing in R&D to enhance barrier properties and moisture resistance, allowing these films to enter new markets such as pharmaceuticals and personal care

Polyvinyl Alcohol Films Market Dynamics

Driver

Increasing Adoption of Biodegradable and Eco-Friendly Materials

- The surging environmental concerns related to conventional plastics have significantly increased the demand for biodegradable materials such as polyvinyl alcohol. Its water solubility, biodegradability, and non-toxic properties make it an ideal substitute for petroleum-based plastics across multiple industries. This shift is further supported by growing consumer awareness of sustainability and green product labelling

- Governments and regulatory bodies worldwide are implementing strict norms to reduce plastic waste generation, driving companies to adopt PVA films in applications ranging from packaging and agriculture to medical and textiles. Initiatives such as plastic bans and carbon reduction targets are directly contributing to higher demand for bio-based materials

- In the food packaging industry, the use of PVA films ensures safe handling and environmental compatibility, while in agriculture, these films serve as effective carriers for pesticides and fertilizers without leaving residue in soil. Their water solubility allows for controlled release, improving efficiency and reducing environmental contamination

- For instance, in 2023, Asian manufacturers expanded PVA film production facilities to meet the growing demand for eco-friendly packaging and water-soluble laundry pods across emerging markets. The rise of sustainable brands in Asia-Pacific, particularly in China and India, has accelerated the use of PVA as an alternative to polyethylene films

- As the global sustainability movement strengthens, industries are expected to increasingly integrate biodegradable PVA films to align with green packaging targets and consumer demand for environmentally responsible products. This growing emphasis on lifecycle assessment and eco-certification is set to shape the future of the polyvinyl alcohol films market

Restraint/Challenge

High Production Cost and Sensitivity to Moisture

- The production of polyvinyl alcohol films involves complex polymerization and casting processes that contribute to high manufacturing costs, making them less competitive compared to conventional plastic films. The dependence on high-quality raw materials and energy-intensive drying methods further elevates overall production expenditure

- The inherent sensitivity of PVA films to moisture exposure poses challenges for storage and transportation, particularly in humid environments where they may lose mechanical integrity or performance. This restricts their usage in open or moisture-rich applications unless combined with protective layers or modified formulations

- Manufacturers face additional costs related to moisture-resistant coatings or multi-layer barrier systems, which increase overall product expenses and restrict their use in certain applications. These added treatments are necessary to maintain durability and usability during long-term storage and global distribution

- For instance, in 2023, several PVA film producers in Southeast Asia reported production delays and higher costs due to fluctuating raw material prices and humidity-related quality control issues. These operational challenges have prompted manufacturers to explore automation and improved drying technologies to stabilize output quality

- To overcome these challenges, ongoing research focuses on developing modified PVA formulations with improved moisture resistance and cost-efficient production techniques to expand their usability across global markets. Advancements in blending PVA with bio-based polymers and nanomaterials are expected to enhance film performance and lower overall production costs

Polyvinyl Alcohol Films Market Scope

The polyvinyl alcohol films market is segmented on the basis of type and application.

- By Type

On the basis of type, the polyvinyl alcohol films market is segmented into Water-Soluble Polyvinyl Alcohol (PVA) Films, Polarizer Polyvinyl Alcohol (PVA) Films, and Others. The Water-Soluble Polyvinyl Alcohol (PVA) Films segment held the largest market revenue share in 2024, driven by rising demand for sustainable and eco-friendly packaging materials. These films are widely used in applications such as detergents, agrochemicals, and food packaging due to their biodegradability, solubility, and ability to reduce plastic waste.

The Polarizer Polyvinyl Alcohol (PVA) Films segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing usage in the electronics and display industries. Their critical role in the manufacturing of LCD panels, optical filters, and polarizing lenses makes them essential in consumer electronics and automotive displays. Rapid technological advancements and the growing demand for high-quality screens are expected to drive further adoption in this segment.

- By Application

On the basis of application, the polyvinyl alcohol films market is segmented into Automotive, Building and Construction, Electronics, Medical, Aerospace, and Others. The Packaging segment held the largest market share in 2024, attributed to its extensive use in creating water-soluble, biodegradable packaging solutions for detergents, pharmaceuticals, and food products. This segment’s dominance is supported by increasing global efforts to replace traditional plastics with eco-friendly materials.

The Electronics segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for PVA-based polarizer films in LCD panels, optical displays, and touchscreens. Continuous advancements in display technologies and the growing adoption of electronic devices across consumer and automotive sectors are key factors propelling market expansion in this application category.

Polyvinyl Alcohol Films Market Regional Analysis

- North America dominated the polyvinyl alcohol films market with the largest revenue share of 38.24% in 2024, driven by the strong presence of packaging, healthcare, and electronics industries utilizing biodegradable materials for sustainability compliance

- The region’s robust adoption of water-soluble films in detergents and agrochemicals is further supported by rising environmental regulations and consumer preference for eco-friendly packaging solutions

- The growing demand for green packaging materials, combined with technological advancements in polymer processing, positions North America as a leading region in the adoption of PVA films across diverse applications

U.S. Polyvinyl Alcohol Films Market Insight

The U.S. polyvinyl alcohol films market captured the largest revenue share in 2024 within North America, driven by a surge in demand from the packaging and pharmaceutical sectors. The country’s strong regulatory framework supporting biodegradable and compostable packaging materials is propelling market growth. Moreover, the presence of major detergent and personal care brands utilizing water-soluble packaging formats has expanded the use of PVA films in domestic production. The U.S. market is further benefiting from ongoing R&D investments focused on improving moisture resistance and mechanical strength of PVA-based films.

Europe Polyvinyl Alcohol Films Market Insight

The Europe polyvinyl alcohol films market is expected to witness substantial growth from 2025 to 2032, primarily driven by strict sustainability mandates and the widespread ban on single-use plastics. European manufacturers are actively transitioning to biodegradable alternatives such as PVA films for packaging, medical applications, and agriculture. The region’s growing focus on circular economy practices and recycling innovation is accelerating adoption. Moreover, demand from electronics and optical industries, particularly for polarizer films, continues to strengthen Europe’s position in the global market.

U.K. Polyvinyl Alcohol Films Market Insight

The U.K. polyvinyl alcohol films market is projected to grow at a significant rate from 2025 to 2032, fuelled by increasing emphasis on sustainable packaging and government-led plastic reduction policies. The adoption of PVA films is rising across sectors such as consumer goods, pharmaceuticals, and agriculture, driven by environmental awareness and innovation in water-soluble film applications. Furthermore, collaborations between local manufacturers and research institutions are advancing new formulations with enhanced performance and cost efficiency.

Germany Polyvinyl Alcohol Films Market Insight

The Germany polyvinyl alcohol films market is expected to grow notably from 2025 to 2032, supported by the country’s strong industrial base and emphasis on high-quality, eco-friendly materials. German manufacturers are investing heavily in advanced polymer technologies for moisture-resistant and high-strength PVA films used in electronics, automotive, and construction sectors. Moreover, the demand for polarizer films in display manufacturing and sustainable packaging continues to contribute significantly to market expansion.

Asia-Pacific Polyvinyl Alcohol Films Market Insight

The Asia-Pacific polyvinyl alcohol films market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid industrialization, increasing environmental awareness, and expanding packaging and electronics sectors in countries such as China, Japan, and India. The growing shift toward sustainable materials and strong government support for eco-friendly innovations are key factors supporting growth. In addition, regional manufacturers are expanding production capacities to meet global demand for cost-effective, biodegradable films.

Japan Polyvinyl Alcohol Films Market Insight

The Japan polyvinyl alcohol films market is expected to witness significant growth from 2025 to 2032 due to the country’s advanced chemical processing capabilities and strong focus on environmentally responsible manufacturing. Japan remains a global leader in producing high-quality PVA polarizer films used in electronics and display technologies. The rising use of PVA films in packaging and medical applications, supported by strict environmental standards, continues to enhance Japan’s market position. Furthermore, continuous R&D in water-soluble formulations is driving innovation and export potential.

China Polyvinyl Alcohol Films Market Insight

The China polyvinyl alcohol films market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s large-scale packaging and detergent manufacturing industries. The growing emphasis on sustainable materials and the expansion of domestic PVA film production facilities are strengthening China’s dominance in the market. In addition, government regulations promoting biodegradable packaging and the rapid adoption of water-soluble films across consumer and industrial products are boosting overall market demand. The increasing export of cost-effective PVA films further enhances China’s global market footprint.

Polyvinyl Alcohol Films Market Share

The Polyvinyl Alcohol Films industry is primarily led by well-established companies, including:

• Aicello Corporation (Japan)

• AMC Network Entertainment LLC (U.S.)

• Arrow GreenTech Ltd (India)

• Cortec Corporation (U.S.)

• Biodegradable Product Institute (U.S.)

• Kuraray Co. Ltd (Japan)

• Sekisui Specialty Chemicals America (U.S.)

• Shanghai Yuking Water Soluble Material Tech Co., Ltd (China)

• Anhui Wanwei Group Co., Ltd (China)

• BASF SE (Germany)

• Carst & Walker (South Africa)

• Japan VAM & Poval Co. Ltd (Japan)

• Polychem (U.S.)

• Polysciences, Inc. (U.S.)

• Spectrum Chemical Manufacturing Corp. (U.S.)

• Weifang Huawei New Materials Technology Co., Ltd (China)

• DuPont (U.S.)

• Dow (U.S.)

• Ecomavi (Brazil)

Latest Developments in Global Polyvinyl Alcohol Films Market

- In October 2024, the Mitsubishi Chemical Group announced the expansion of its OPL Film optical PVOH film production facility at the Central Japan-Ogaki (Kanda) Plant in Gifu Prefecture, Japan. The upgraded plant, featuring the largest single-line capacity of 27 million square meters per year, is expected to begin operations in the second half of fiscal year 2027. This expansion aims to meet the rising demand for larger liquid crystal display (LCD) screens while increasing the group’s total OPL Film capacity to 154 million square meters per year. The development will enhance production efficiency, improve quality standards, and strengthen the group’s global market competitiveness

- In July 2024, Colorcon, Inc. introduced a new titanium dioxide (TiO₂)-free, high-opacity film coating system for pharmaceutical tablets formulated with polyvinyl alcohol (PVA). This innovative Opadry coating system was designed to address regulatory concerns regarding TiO₂ in the EU while offering superior adhesion, moisture protection, and faster processing. The launch reinforces Colorcon’s commitment to sustainable and compliant pharmaceutical solutions, positioning the company as a key contributor to advancing PVA-based coating technologies in the global market

- In August 2022, Sekisui Chemical Co., Ltd. announced the expansion of its polyvinyl alcohol (PVOH) manufacturing capacity by up to 25% to address the increasing demand from downstream customers. This strategic move aims to enhance the company’s production efficiency and ensure a stable supply of high-quality products. The expansion strengthens Sekisui’s market presence and supports the growing global demand for water-soluble and eco-friendly films, thereby contributing to the overall advancement of the polyvinyl alcohol films market

- In May 2021, Mitsubishi Chemical Corporation completed the acquisition of major shares in Nakai Industrial Co., Ltd., a prominent film coating manufacturer. This acquisition allows Mitsubishi Chemical to enhance its product portfolio and respond more effectively to the evolving requirements for polyester and polyvinyl alcohol films. The move is expected to improve the company’s competitive edge and accelerate innovation within the film industry, ultimately driving market growth and customer satisfaction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyvinyl Alcohol Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyvinyl Alcohol Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyvinyl Alcohol Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.