Global Polyvinyl Chloride Pvc Cling Film Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

2.20 Billion

2024

2032

USD

1.46 Billion

USD

2.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.46 Billion | |

| USD 2.20 Billion | |

|

|

|

|

Polyvinyl Chloride (PVC) Cling Film Market Size

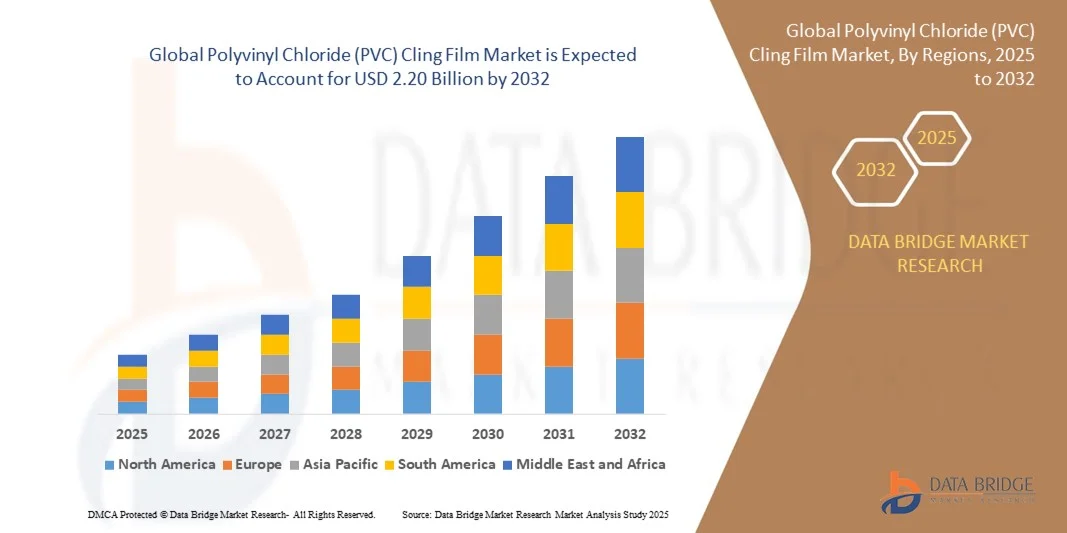

- The global polyvinyl chloride (PVC) cling film market size was valued at USD 1.46 billion in 2024 and is expected to reach USD 2.20 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for convenient and hygienic food packaging solutions across residential, commercial, and industrial sectors

- Rising awareness regarding food safety and shelf-life extension is boosting the adoption of PVC cling films in supermarkets, restaurants, and food processing units

Polyvinyl Chloride (PVC) Cling Film Market Analysis

- The growing preference for sustainable and recyclable packaging materials is encouraging manufacturers to innovate eco-friendly PVC cling films

- Expanding applications across the pharmaceutical, bakery, and fresh produce segments are driving further adoption and increasing market penetration globally

- Asia-Pacific dominated the PVC cling film market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged food, ready-to-eat meals, and pharmaceuticals

- North America region is expected to witness the highest growth rate in the global polyvinyl chloride (PVC) cling film market, driven by technological advancements in cling film production, strong regulatory compliance for food safety, and increasing adoption of eco-friendly and recyclable films

- The Machine Films segment held the largest market revenue share in 2024, driven by its high efficiency in automated packaging lines and consistent sealing quality for large-scale industrial applications. Machine films are widely adopted in food processing, pharmaceuticals, and commercial packaging due to their uniform thickness, enhanced durability, and compatibility with high-speed machinery

Report Scope and Polyvinyl Chloride (PVC) Cling Film Market Segmentation

|

Attributes |

Polyvinyl Chloride (PVC) Cling Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Polyvinyl Chloride (PVC) Cling Film Market Trends

Rising Adoption of PVC Cling Film in Food Packaging and Pharmaceuticals

- The increasing demand for convenient, hygienic, and tamper-evident packaging is driving the adoption of PVC cling films across the food and pharmaceutical industries. Their transparency, flexibility, and sealability enable effective product protection and extended shelf life. This trend is particularly significant in packaged foods and perishable items where maintaining freshness is critical, while also reducing spoilage-related economic losses and ensuring compliance with stringent safety standards

- The growing emphasis on sustainable and recyclable packaging solutions is accelerating the shift toward high-quality PVC films with eco-friendly formulations. Manufacturers are innovating to reduce material waste, enhance recyclability, and comply with global environmental regulations. These developments are fostering wider adoption among environmentally conscious consumers, and encouraging companies to explore hybrid or bio-based PVC films that balance performance with reduced environmental impact

- The affordability and ease of use of PVC cling films are making them suitable for both industrial and household applications, supporting seamless packaging and storage. Retailers and consumers benefit from reduced product spoilage, improved visibility, and enhanced convenience, driving consistent market demand. In addition, the lightweight and flexible nature of PVC cling films reduces logistics costs and simplifies handling for both retailers and end-users

- For instance, in 2023, several European food processing companies reported reduced spoilage rates and improved packaging efficiency after adopting advanced PVC cling film solutions, resulting in cost savings and better product quality. These improvements also strengthened brand reputation and customer satisfaction, encouraging further investments in modern cling film technologies

- While PVC cling films are widely adopted, the market’s growth depends on continued innovation in biodegradable formulations, regulatory compliance, and consumer education to ensure sustainable usage. Efforts to educate end-users and retailers about proper disposal and recycling practices will be critical to mitigate environmental concerns and sustain market momentum

Polyvinyl Chloride (PVC) Cling Film Market Dynamics

Driver

Increasing Demand for Hygienic and Durable Packaging Solutions

- The rising need for hygienic packaging in the food and pharmaceutical sectors is pushing manufacturers to adopt PVC cling films as a preferred solution. Their excellent barrier properties, transparency, and flexibility enhance product protection, maintain quality, and extend shelf life. This is especially important in high-moisture and perishable food products, where contamination risks are high and regulatory oversight is strict

- Retailers and consumers increasingly demand convenient, ready-to-use packaging formats that reduce handling and waste. PVC cling films offer easy sealing and application, supporting both commercial and household usage. The films also allow for visually appealing product presentation, which positively influences purchasing decisions in competitive retail markets

- Regulatory requirements for food safety and tamper-evident packaging are further promoting the adoption of PVC cling films, especially in developed regions with strict compliance standards. These standards push companies to upgrade packaging to meet certifications such as ISO 22000, HACCP, and FDA regulations, thereby driving consistent demand for high-quality films

- For instance, in 2022, North American and European packaged food companies implemented PVC cling films to improve hygiene and comply with regulatory mandates, boosting demand in these markets. The adoption of these films also allowed manufacturers to streamline production lines, reduce manual labor, and ensure product traceability

- While rising awareness and regulatory support drive growth, manufacturers must focus on cost-effective production, sustainable materials, and product innovation to maintain market expansion. Companies that integrate smart packaging solutions, such as oxygen barrier layers or antimicrobial coatings, are likely to gain a competitive edge in the PVC cling film sector

Restraint/Challenge

Environmental Concerns and Fluctuating Raw Material Prices

- The environmental impact of traditional PVC materials and increasing scrutiny over plastic waste are posing challenges for the market. Manufacturers need to innovate eco-friendly or recyclable films to address sustainability concerns. Public pressure and corporate ESG commitments are accelerating the push for alternatives, increasing research in bio-based or partially biodegradable PVC films

- Price volatility of raw materials such as PVC resin affects production costs, making cling film products less predictable in pricing and potentially limiting adoption in cost-sensitive regions. These fluctuations can impact smaller manufacturers disproportionately, reducing margins and affecting supply chain stability

- Limited recycling infrastructure in several countries also restricts the full environmental benefits of PVC cling films, contributing to regulatory pressure and market hesitancy. Without proper collection, sorting, and recycling programs, a significant portion of PVC waste ends up in landfills, which can provoke stricter regulations and hinder market growth

- For instance, in 2023, several Southeast Asian markets reported slower growth due to raw material price fluctuations and stricter environmental guidelines, impacting overall market expansion. Manufacturers had to delay investments in new production lines or reformulate products to comply with environmental norms, creating temporary supply shortages

- While PVC cling films remain a preferred packaging solution, addressing environmental sustainability, raw material costs, and regulatory challenges is essential for long-term market stability and growth. Companies that invest in sustainable innovations, backward integration, and raw material diversification are likely to sustain profitability and market leadership

Polyvinyl Chloride (PVC) Cling Film Market Scope

The market is segmented on the basis of product type, thickness, sales channel, and end use.

- By Product Type

On the basis of product type, the PVC cling film market is segmented into Machine Films and Manual or Handheld Films. The Machine Films segment held the largest market revenue share in 2024, driven by its high efficiency in automated packaging lines and consistent sealing quality for large-scale industrial applications. Machine films are widely adopted in food processing, pharmaceuticals, and commercial packaging due to their uniform thickness, enhanced durability, and compatibility with high-speed machinery.

The Manual or Handheld Films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for convenient, small-batch packaging solutions in households, small retailers, and local food outlets. Handheld films offer portability, ease of application, and flexibility, making them ideal for individual usage and on-demand sealing applications.

- By Thickness

On the basis of thickness, the market is segmented into Up to 10 microns, 10–15 microns, 15–20 microns, and Above 20 microns. The 10–15 microns segment dominated the market in 2024, owing to its optimal balance between strength, flexibility, and cost-effectiveness for commercial and household applications. Films within this range provide sufficient barrier protection and clarity while remaining easy to handle and seal.

The Above 20 microns segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by applications requiring higher mechanical strength, enhanced puncture resistance, and better protection of delicate or high-value products, such as premium fruits, bakery items, and pharmaceutical packaging.

- By Sales Channel

On the basis of sales channel, the market is segmented into Direct Sales and Indirect Sales. The Direct Sales segment dominated the market in 2024, driven by strong manufacturer-to-consumer distribution networks in industrial and commercial applications, which enable bulk orders, customized film specifications, and consistent supply reliability.

The Indirect Sales segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing e-commerce platforms, retail partnerships, and distribution through wholesalers and dealers. This channel caters to small-scale users, households, and localized businesses seeking convenient access to high-quality PVC cling films.

- By End Use

On the basis of end use, the market is segmented into Dairy Products, Fruits and Vegetables, Bakery and Confectionery, Meat, Poultry, and Seafood, Cosmetics and Healthcare Products, Consumer Goods and Household, Food Service Outlets, and Other Industrial Uses. The Bakery and Confectionery segment dominated the market in 2024, owing to the growing demand for hygienic, transparent packaging that preserves product freshness, enhances visual appeal, and supports extended shelf life in retail and industrial baking operations.

The Fruits and Vegetables segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing preference for packaged fresh produce, supermarket-ready offerings, and reduced spoilage during transportation and storage. The segment benefits from the protective properties and clarity of PVC cling films, which allow visibility and quality assurance for perishable products.

Polyvinyl Chloride (PVC) Cling Film Market Regional Analysis

- Asia-Pacific dominated the PVC cling film market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged food, ready-to-eat meals, and pharmaceuticals

- Consumers and manufacturers in the region highly value the convenience, hygiene, and product preservation offered by PVC cling films, along with their transparency, flexibility, and sealability

- This widespread adoption is further supported by the expansion of modern retail chains, e-commerce growth, and government initiatives promoting food safety and packaging standards, establishing PVC cling films as a preferred solution for industrial and household applications

China PVC Cling Film Market Insight

The China PVC cling film market captured the largest revenue share in Asia-Pacific in 2024, fueled by a booming packaged food industry, growing middle-class population, and rising awareness of food hygiene. Manufacturers benefit from strong domestic production capabilities and cost-effective PVC cling films, which are widely used across dairy, fruits and vegetables, bakery, meat, and seafood sectors. The expansion of modern retail chains and online grocery platforms further drives market adoption.

Japan PVC Cling Film Market Insight

The Japan PVC cling film market is expected to witness the fastest growth rate from 2025 to 2032 due to high demand for convenience, food safety, and quality preservation. The widespread presence of supermarkets, convenience stores, and online food delivery services boosts PVC cling film usage. In addition, environmentally conscious consumers are driving the adoption of biodegradable and recyclable formulations, enhancing market growth.

Europe PVC Cling Film Market Insight

Europe dominated the PVC cling film market is expected to witness the fastest growth rate from 2025 to 2032, driven by high demand for packaged food and pharmaceutical products, coupled with strict regulatory requirements for hygiene and tamper-evident packaging. Consumers and manufacturers in the region highly value the transparency, flexibility, and sealability offered by PVC cling films, which ensure product safety and prolonged shelf life. This widespread adoption is further supported by strong industrial infrastructure, technological awareness, and growing demand for convenient and sustainable packaging solutions, making PVC cling films a preferred choice for both commercial and household applications.

Germany PVC Cling Film Market Insight

The Germany PVC cling film market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rapid industrialization, stringent food safety regulations, and increasing adoption of ready-to-eat and packaged foods. Companies are increasingly prioritizing hygienic and durable packaging solutions, while demand for eco-friendly formulations is driving innovation. The integration of advanced sealing technologies and compliance with EU food standards are further propelling market growth.

U.K. PVC Cling Film Market Insight

The U.K. PVC cling film market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of packaged foods, consumer preference for convenience, and demand for tamper-evident solutions. In addition, regulatory compliance and emphasis on hygiene and food safety encourage both manufacturers and retailers to adopt high-quality PVC cling films. The U.K.’s strong retail and e-commerce infrastructure also facilitates consistent market expansion.

North America PVC Cling Film Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for packaged and processed foods, convenience products, and pharmaceuticals. Consumers prioritize hygiene, tamper-evident packaging, and product preservation, which supports widespread PVC cling film adoption. The presence of leading manufacturers, advanced production technologies, and a well-established cold chain infrastructure further bolsters market growth. Retailers and food service providers increasingly adopt PVC cling films to reduce spoilage, extend shelf life, and maintain quality, making it a preferred solution across industrial and household applications

U.S. PVC Cling Film Market Insight

The U.S. PVC cling film market is expected to witness the fastest growth rate from 2025 to 2032, fueled by high consumer awareness regarding food safety, convenience, and sustainable packaging. The expanding packaged food industry, coupled with growing adoption in dairy, bakery, fruits and vegetables, meat, and seafood sectors, drives demand. In addition, regulatory standards and initiatives promoting hygienic, tamper-evident, and eco-friendly packaging reinforce PVC cling film adoption across commercial, industrial, and household applications.

Polyvinyl Chloride (PVC) Cling Film Market Share

The Polyvinyl Chloride (PVC) Cling Film industry is primarily led by well-established companies, including:

- UNITIKA LTD. (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- WINPAK LTD. (Canada)

- Kolon Industries, Inc. (South Korea)

- HYOSUNG (South Korea)

- Honeywell International Inc. (U.S.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- TOYOBO CO., LTD. (Japan)

- Domo Chemicals (Belgium)

- BASF SE (Germany)

- Mondi (Austria)

- Sealed Air (U.S.)

- Bemis Company, Inc. (U.S.)

- Berry Global Inc. (U.S.)

- ProAmpac (U.S.)

- Nampak Ltd. (South Africa)

- ELOPAK (Norway)

- OLON Industries Inc. (Italy)

- SIG Combibloc Group AG (Switzerland)

- Uflex Limited (India)

Latest Developments in Global Polyvinyl Chloride (PVC) Cling Film Market

- In February 2025, IPG, a global provider of packaging and protective solutions, launched its new American brand Plastic Sheeting, featuring both Performance and Ultra films. This development is aimed at providing superior surface protection across multiple applications, enhancing durability and reducing product damage during handling and storage. The introduction of these high-quality films is expected to strengthen IPG’s presence in the protective packaging market and drive adoption among industrial and commercial users seeking reliable solutions

- In April 2024, Berry Global introduced a new version of its Omni Xtra polyethylene cling film for fresh food applications. This high-performance film offers enhanced elasticity, uniform stretching, and improved impact resistance compared to traditional PVC cling films. The innovation is designed to extend shelf life, maintain food quality, and reduce spoilage, thereby supporting broader adoption in the food packaging sector and boosting Berry Global’s market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Polyvinyl Chloride Pvc Cling Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Polyvinyl Chloride Pvc Cling Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Polyvinyl Chloride Pvc Cling Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.