Global Pop Up Sorters Market

Market Size in USD Billion

CAGR :

%

USD

3.62 Billion

USD

7.82 Billion

2024

2032

USD

3.62 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 3.62 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Pop-Up Sorters Market Size

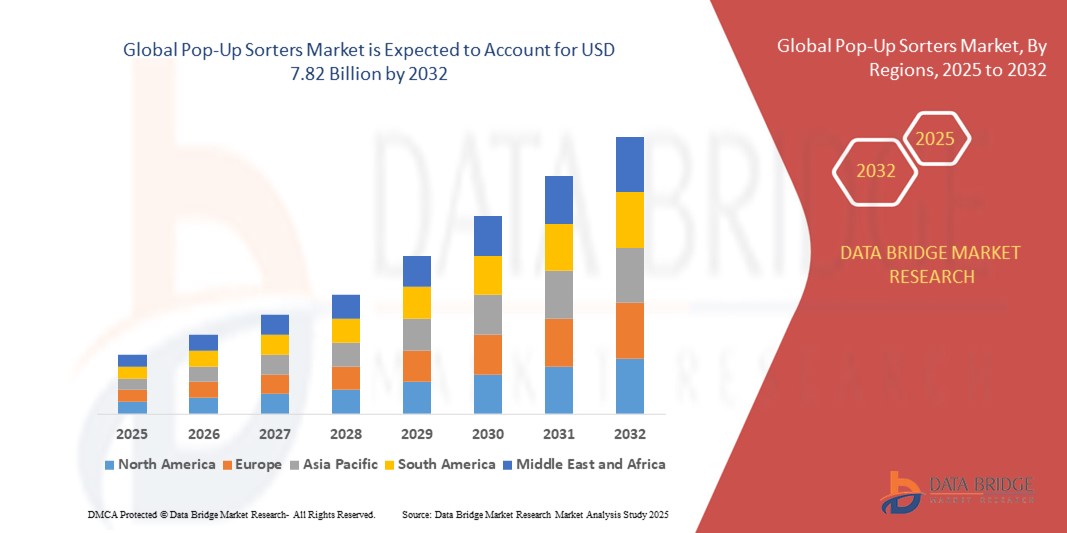

- The global pop-up sorters market size was valued at USD 3.62 billion in 2024 and is expected to reach USD 7.82 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce and logistics industries, which are driving the need for high-speed, space-efficient, and automated parcel handling solutions. Pop-up sorters are gaining traction as they offer cost-effective, scalable, and modular alternatives to traditional sortation systems in warehouses and distribution centers

- Furthermore, increasing demand for faster delivery, real-time parcel tracking, and labor-saving automation is accelerating the deployment of intelligent sortation systems. These converging factors are significantly boosting the adoption of pop-up sorters, especially in last-mile delivery networks and urban micro-fulfillment hubs

Pop-Up Sorters Market Analysis

- Pop-up sorters are automated material handling systems used for sorting parcels by dynamically lifting and diverting them to designated exits. These systems are compact, flexible, and suitable for high-throughput environments such as e-commerce, courier services, and retail distribution

- The rising demand for efficient and accurate sorting is driven by increased parcel volumes, reduced delivery times, and the need for automation in constrained spaces. Pop-up sorters address these challenges by providing fast, reliable, and scalable solutions that optimize warehouse operations and reduce manual handling errors

- North America dominated the pop-up sorters market in 2024, due to high parcel volumes, especially from e-commerce and last-mile delivery services

- Asia-Pacific is expected to be the fastest growing region in the pop-up sorters market during the forecast period due to

- Hardware segment dominated the market with a market share of 61.7% in 2024, due to the capital-intensive nature of sortation infrastructure. It includes core mechanical and electrical components such as belts, drives, sensors, diverters, and control units essential for system functionality. Long operational lifespans and continuous usage requirements necessitate robust hardware investments. Hardware reliability directly impacts overall parcel handling efficiency and downtime, making it critical for 24/7 operations. Increasing demand for modular, scalable systems has further driven hardware innovation and spending

Report Scope and Pop-Up Sorters Market Segmentation

|

Attributes |

Pop-Up Sorters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pop-Up Sorters Market Trends

Modular and Plug-and-Play System Adoption

- The pop-up sorters market is increasingly embracing modular and plug-and-play designs that allow rapid installation, easy scalability, and flexible integration into existing conveyor systems, reducing downtime and customization costs

- For instance, companies such as Tomra Systems ASA and Bühler Group offer modular pop-up sorter units that can be deployed individually or in clusters, enabling operators in food processing, recycling, and parcel sorting industries to tailor systems to varying throughput and product types

- The trend supports dynamic order fulfillment and high SKU variety environments by enabling quick reconfiguration without expensive system overhauls or prolonged shutdowns

- Enhanced software interfaces and smart control systems complement modular hardware, offering automated sorting logic, remote diagnostics, and seamless syncing with warehouse management systems

- Growing demand for ‘plug and play’ sorters aligns with Industry 4.0 initiatives aimed at accelerating digital transformation and operational agility in logistics, e-commerce, and manufacturing

- Sustainability considerations motivate the use of modular sorters optimized for energy efficiency, reducing overall power consumption while maintaining high-speed sorting capabilities

Pop-Up Sorters Market Dynamics

Driver

Increasing Demand for Data Security

- Growing concerns over data protection and intellectual property at sorting facilities, especially in e-commerce and pharmaceutical sectors, drive demand for pop-up sorters with enhanced security features to prevent product mix-ups and ensure chain-of-custody integrity

- For instance, leading players such as Bekuplast and Sesotec integrate RFID tracking, barcode scanning, and vision systems with pop-up sorters to guarantee accurate identification and secure handling of sensitive or high-value items

- Regulatory compliance for privacy and product traceability further incentivizes deployment of secure sorting solutions that can generate audit trails and real-time data reporting

- Technological improvements focus on ensuring tamper-proof sorting mechanisms and access controls, minimizing risks related to theft, counterfeit, or misrouting

- Data-centric sorting systems improve inventory accuracy and reduce fraud risk by linking sorting operations with enterprise resource planning (ERP) and inventory management platforms

Restraint/Challenge

High Cost Associated with Implementation

- The initial cost outlay for pop-up sorter systems—covering hardware, software integration, installation, and training—poses a barrier for small and medium enterprises or those operating under tight budget constraints

- For instance, the complexity and customization requirements reported by logistics firms and food processors have resulted in extended ROI timelines and cautious investment approaches despite proven operational benefits

- High maintenance and technical support expenses further influence purchasing decisions, particularly when comparing to simpler, less costly manual sorting methods

- Adoption delays can occur due to the need for compatibility with legacy conveyor infrastructure, requiring additional capital investment in system upgrades

- Economic volatility and budgetary pressures in some industries can reduce readiness to invest in advanced sorting technologies, limiting broader market penetration in emerging regions

Pop-Up Sorters Market Scope

The market is segmented on the basis of type, offering, tray size, parcel handling capacity, and end user.

- By Type

On the basis of type, the pop-up sorters market is segmented into linear parcel sortation systems and loop parcel sortation systems. The linear parcel sortation systems segment dominated the market in 2024 due to its compact design, cost-effectiveness, and compatibility with straight-line conveyor layouts. These systems are widely adopted in mid-sized warehouses and distribution centers where layout simplicity and moderate throughput are prioritized. Their lower installation and maintenance costs make them ideal for small to medium businesses expanding automation. The linear design ensures a predictable and easily controllable flow of parcels. This segment is also favored in settings with limited floor space and streamlined sorting requirements.

The loop parcel sortation systems segment is projected to grow at the fastest rate from 2025 to 2032, driven by increasing demand for continuous, high-throughput operations. These systems support multiple sortation points on a closed-loop path, allowing simultaneous processing of large parcel volumes. They are particularly suited to large-scale e-commerce hubs and 3PL logistics centers requiring efficiency and flexibility. Loop systems offer improved scalability and system redundancy, reducing the risk of downtime. Their ability to handle complex routing demands makes them vital for peak-season logistics operations.

- By Offering

On the basis of offering, the market is segmented into hardware, software, and services. The hardware segment accounted for the largest revenue share of 61.7% in 2024 due to the capital-intensive nature of sortation infrastructure. It includes core mechanical and electrical components such as belts, drives, sensors, diverters, and control units essential for system functionality. Long operational lifespans and continuous usage requirements necessitate robust hardware investments. Hardware reliability directly impacts overall parcel handling efficiency and downtime, making it critical for 24/7 operations. Increasing demand for modular, scalable systems has further driven hardware innovation and spending.

The software segment is expected to register the fastest growth through 2032, spurred by rising demand for intelligent control and analytics. Software enhances sorter productivity through route optimization, real-time parcel tracking, and system diagnostics. Integration with warehouse management systems and AI-powered analytics enables dynamic response to fluctuating parcel volumes. Cloud-based platforms and IoT connectivity support centralized monitoring across multiple facilities. As facilities grow more digitized, software becomes essential for maximizing operational agility and visibility.

- By Tray Size

On the basis of tray size, the market is segmented into small, medium, and large trays. The medium tray size segment led the market in 2024 owing to its flexibility in handling a broad range of parcel sizes efficiently. Medium trays are suitable for general-purpose operations, accommodating everything from apparel and books to standard-sized packages. They offer an optimal balance between throughput and versatility, reducing the need for frequent changeovers. Their widespread use in e-commerce and retail distribution centers contributes to consistent demand. These trays support high-speed operations while minimizing jamming or product damage risks.

The small tray size segment is projected to experience the fastest growth during the forecast period, fueled by rising shipment volumes of compact items. This includes electronics accessories, cosmetics, pharmaceuticals, and personal care products often packed in smaller parcels. With the expansion of direct-to-consumer models, more companies are optimizing sortation systems for lightweight products. Small trays allow tighter spacing, higher density, and faster sorting cycles. Their design supports precise handling, making them ideal for operations where accuracy and delicacy are critical.

- By Parcel Handling Capacity

On the basis of parcel handling capacity, the market is segmented into less than 20,000 parcels/hr, 20,000 to 30,000 parcels/hr, and more than 30,000 parcels/hr. The 20,000 to 30,000 parcels/hr segment held the highest revenue share in 2024, meeting the operational needs of regional and national logistics hubs. These systems strike a balance between speed and infrastructure investment, offering scalability without the complexity of mega-capacity sorters. Ideal for growing e-commerce firms and postal services, they enable consistent performance during regular and peak loads. Facilities prefer this capacity range to maintain efficiency without overdesigning for fluctuating demand.

The more than 30,000 parcels/hr segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by increasing parcel volumes and delivery speed expectations. Large e-commerce warehouses and multinational logistics centers require ultra-high-speed sorting to meet same-day and next-day shipping targets. These systems are highly automated with advanced sensors and AI-driven routing to minimize errors. Their high throughput reduces labor dependency and speeds up distribution timelines. Demand is further fueled by rapid urban fulfillment models and centralized hub-and-spoke networks.

- By End User

On the basis of end user, the market is segmented into e-commerce, logistics, pharmaceuticals and medical supply, food & beverages, and others. The e-commerce segment captured the largest revenue share in 2024, propelled by soaring order volumes, increasing SKUs, and rapid delivery expectations. Pop-up sorters streamline fulfillment workflows by automating the sorting of thousands of parcels per hour. E-retailers depend on these systems to reduce manual handling, increase order accuracy, and support seasonal demand surges. Their compatibility with barcode scanning, dimensioning, and smart labeling makes them integral to omnichannel retail strategies.

The pharmaceuticals and medical supply segment is expected to grow at the fastest rate, driven by rising global demand for precise, traceable delivery of medical goods. The sector requires advanced sortation systems to ensure product integrity, batch tracking, and regulatory compliance. Pop-up sorters support temperature-sensitive logistics and help prevent cross-contamination by enabling customized routing. With the expansion of telehealth and medical e-commerce, the need for high-speed, error-free sortation is intensifying. Automated systems also support the secure transport of high-value or restricted medications.

Pop-Up Sorters Market Regional Analysis

- North America dominated the pop-up sorters market with the largest revenue share in 2024, driven by high parcel volumes, especially from e-commerce and last-mile delivery services

- The region’s well-established logistics infrastructure, coupled with the increasing need for automation in warehousing and distribution, has accelerated adoption of pop-up sorters

- Technological maturity, a strong presence of key market players, and rising labor costs are prompting logistics providers and retailers to invest in automated sortation to boost efficiency and accuracy

U.S. Pop-Up Sorters Market Insight

The U.S. pop-up sorters market captured the largest revenue share within North America in 2024, supported by the continued expansion of online retail and the growing demand for same-day or next-day delivery. The U.S. has witnessed strong automation investments across major fulfillment centers and regional sorting facilities. High shipping volumes from e-commerce giants, such as Amazon and Walmart, are driving need for scalable, high-speed sortation systems. Favorable economic conditions and digital infrastructure further support adoption across retail, logistics, and postal networks.

Europe Pop-Up Sorters Market Insight

The Europe pop-up sorters market is projected to register a significant CAGR during the forecast period, driven by tightening delivery timelines and rising labor shortages in warehousing operations. The region’s logistics sector is under increasing pressure to handle high parcel volumes efficiently, leading to greater automation uptake. Environmental regulations and a push for energy-efficient systems are encouraging the deployment of compact, intelligent sorters. Moreover, widespread e-commerce penetration across Western and Central Europe is enhancing demand for fast and accurate parcel sorting.

U.K. Pop-Up Sorters Market Insight

The U.K. pop-up sorters market is expected to grow at a healthy CAGR, propelled by the rising demand for streamlined last-mile logistics and high parcel throughput. The shift towards contactless deliveries and same-day services is prompting logistics companies to upgrade infrastructure. Retailers and postal networks are increasingly investing in modular sortation systems to adapt to fluctuating demand. With e-commerce maintaining its dominance, the need for smart, space-efficient parcel sorters continues to grow across the U.K.

Germany Pop-Up Sorters Market Insight

The Germany pop-up sorters market is forecast to grow steadily, fueled by the country’s advanced industrial base and strong logistics ecosystem. With Germany acting as a central distribution hub for Europe, there is substantial investment in automation and digitization of warehouse operations. High product variety and demand for customization are driving interest in flexible sortation systems. Adoption is also encouraged by growing labor shortages and rising operational costs, motivating logistics firms to optimize parcel processing speeds.

Asia-Pacific Pop-Up Sorters Market Insight

The Asia-Pacific pop-up sorters market is poised to grow at the fastest CAGR from 2025 to 2032, supported by rapid urbanization, expanding e-commerce, and industrial automation in countries such as China, India, and Japan. A growing middle class and rising internet penetration are fueling parcel volumes, creating a need for faster and more accurate sortation solutions. Government-led digital initiatives and investment in logistics infrastructure are also key growth drivers. The region’s role as a global manufacturing and supply chain hub further amplifies the demand for sortation automation.

Japan Pop-Up Sorters Market Insight

The Japan pop-up sorters market is expanding steadily due to its focus on precision logistics, aging workforce, and high technological adoption. Companies are investing in compact, high-speed sorters to maintain service quality in densely populated urban areas. Integration with AI and robotics is gaining traction to improve sorting accuracy and reduce manual intervention. As e-commerce and B2B logistics accelerate, Japan’s warehousing systems are increasingly adopting modular sorter solutions for real-time parcel handling.

China Pop-Up Sorters Market Insight

The China pop-up sorters market accounted for the largest revenue share in Asia-Pacific in 2024, driven by its vast e-commerce sector, growing consumer base, and government support for logistics modernization. Major Chinese logistics companies and tech firms are leading in smart warehouse automation, including AI-powered and high-capacity sortation systems. The country’s smart city initiatives and strong domestic manufacturing base further support wide-scale deployment of advanced sorters. High order density during peak sales events also boosts the need for scalable, high-efficiency solutions.

Pop-Up Sorters Market Share

The pop-up sorters industry is primarily led by well-established companies, including:

- DIC CORPORATION (U.S.)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- TOYO INK SC HOLDINGS CO. LTD (U.S.)

- SAKATA INX CORPORATION (U.S.)

- T&K TOKA Corporation (U.K.)

- Flint Group (U.S.)

- Braden Sutphin Ink Co (U.S.)

- Wikoff Color Corporation (China)

- Alden & Ott Printing Inks Co (Japan)

- Nazdar (U.S.)

- Color Resolutions International LLC (U.S.)

- BASF SE (U.S.)

- DuPont (U.S.)

- Dow (U.S.)

- Arkema (U.S.)

- Elementis plc (U.S.)

- Huntsman International LLC (China)

- Evonik Industries AG (Germany)

Latest Developments in Global Pop-Up Sorters Market

- In March 2024, OPEX Corporation announced the launch of Sure Sort X and OPEX Xtract technology, a high-speed robotic solution for small-item sorting and order retrieval. The system was designed to reduce manual handling, improve accuracy, and increase throughput across e-commerce and fulfillment operations. With this, the company expanded its portfolio to support fast, scalable sortation for high-volume warehouse environments

- In November 2023, Honeywell introduced an AI-powered sortation system designed to deliver 40% higher sorting accuracy and process over 50,000 packages per hour. The system leveraged adaptive handling and predictive maintenance to reduce operational costs and errors. This launch positioned Honeywell as a key innovator in intelligent parcel sortation across logistics and retail sectors

- In January 2024, Vanderlande Industries unveiled a sustainable, eco-friendly sortation system featuring energy recuperation and recyclable materials. The new system reduced energy consumption by up to 45% while maintaining high throughput, aligning with Europe’s growing demand for green logistics solutions and low-emission warehouse operations

- In June 2024, Honeywell completed the $1.9 billion acquisition of CAES Systems Holdings LLC, strengthening its capabilities in automated material handling and smart logistics. The acquisition supported Honeywell’s strategy to expand its portfolio in the parcel sortation and warehouse automation space

- In March 2022, Interroll Group announced the launch of Split Tray Sorter. The new product ensured maximum availability, a very long service life, and fast payback times for the automatic sortation of conveyed goods weighing up to 12 kilograms. With this, the company provided ideal solutions for logistics service providers and courier, express, and parcel service providers for making customer-oriented distribution centers even more productive by efficiently separating small parts sortation from other transport goods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pop Up Sorters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pop Up Sorters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pop Up Sorters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.