Global Population Health Management Solutions Market

Market Size in USD Billion

CAGR :

%

USD

74.58 Billion

USD

458.98 Billion

2024

2032

USD

74.58 Billion

USD

458.98 Billion

2024

2032

| 2025 –2032 | |

| USD 74.58 Billion | |

| USD 458.98 Billion | |

|

|

|

|

Population Health Management Solutions Market Size

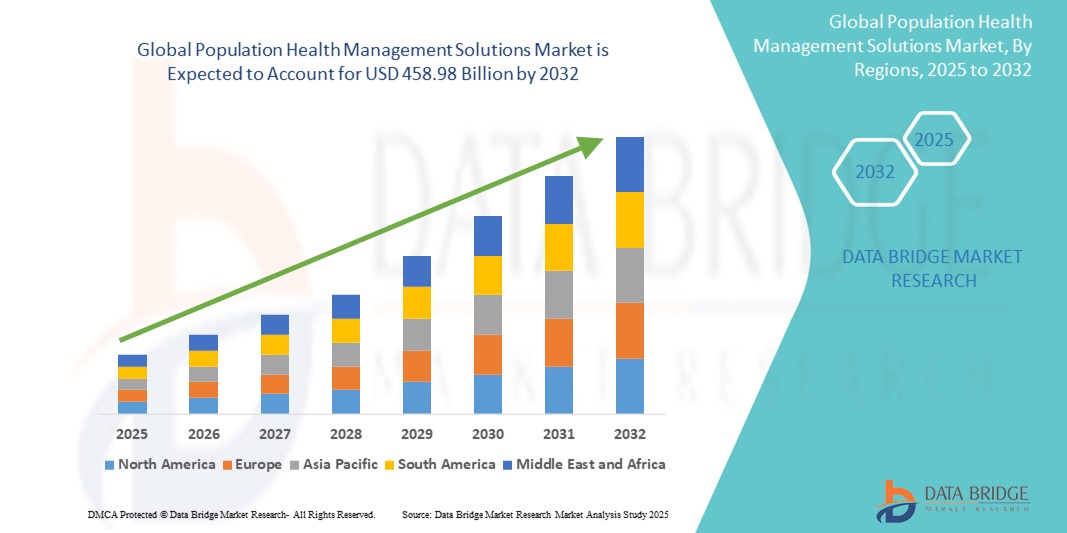

- The global population health management solutions market size was valued at USD 74.58 billion in 2024 and is expected to reach USD 458.98 billion by 2032, at a CAGR of 25.50% during the forecast period

- The market growth is largely fuelled by the growing adoption of value-based care models and technological advancements within healthcare, leading to increased digitalization in both clinical and public health settings. The shift from fee-for-service to outcome-based payments incentivizes healthcare providers to proactively manage patient populations for better health outcomes and cost reduction

- Furthermore, rising demand for secure, user-friendly, and integrated solutions for managing chronic diseases, improving patient engagement, and coordinating care across various healthcare settings is establishing Population Health Management (PHM) solutions as the modern approach to healthcare delivery. These converging factors are accelerating the uptake of Population Health Management Solutions, thereby significantly boosting the industry's growth

Population Health Management Solutions Market Analysis

- Population health management (PHM) Solutions are increasingly vital components of modern healthcare delivery, offering comprehensive platforms to improve patient outcomes, reduce costs, and enhance care coordination across diverse patient populations. These solutions leverage data analytics and technology to proactively manage health, moving beyond traditional reactive care

- The escalating demand for PHM solutions is primarily fueled by the widespread shift from fee-for-service to value-based care models, growing awareness of chronic disease burdens, and a rising preference for data-driven, preventive healthcare approaches

- North America dominated the population health management solutions market, holding a significant revenue share of 37.7% in 2024. This is characterized by early adoption of advanced healthcare IT, high healthcare expenditure, and a strong presence of key industry players and innovators

- Asia-Pacific is expected to be the fastest-growing region in the population health management solutions market during the forecast period. This rapid expansion is due to increasing urbanization, rising disposable incomes leading to greater healthcare access, and significant government investments in healthcare infrastructure and digitalization in countries such as China, India, and Japan. The growing burden of chronic diseases and increasing awareness of preventive care further propel market adoption

- The software segment dominated the population health management solutions market with a market share of 66.70% in 2024, driven by the essential need for comprehensive platforms that enable data aggregation, risk stratification, care coordination, and patient engagement within PHM initiatives. Healthcare organizations heavily rely on robust software for data analysis, predictive modeling, and automating key population health workflows

Report Scope and Population Health Management Solutions Market Segmentation

|

Attributes |

Population Health Management Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Population Health Management Solutions Market Trends

“Enhanced Convenience Through AI and Voice Integration in Population Health Management Solutions”

- A significant and accelerating trend in the global population health management (PHM) Solutions market is the deepening integration of Artificial Intelligence (AI) and advanced voice technology. This fusion of technologies is profoundly enhancing convenience for both healthcare providers and patients, streamlining workflows, and improving engagement within healthcare ecosystems

- For instance, AI-powered voice agents are increasingly being adopted in healthcare for various applications. They can automate appointment scheduling, manage prescription refill requests, and provide pre-visit assessments, allowing patients to interact with healthcare systems hands-free. Similarly, AI-driven voice assistants are being integrated into patient portals and mobile applications to offer medication reminders, post-discharge follow-ups, and wellness check-ins, ensuring continuous support and adherence

- AI integration in PHM solutions enables features such as learning patient health patterns to potentially suggest personalized care plans and providing more intelligent alerts based on health data. For instance, AI can analyze vocal biomarkers to detect early signs of certain health conditions or analyze vast datasets from electronic health records to identify at-risk populations and generate targeted interventions. Furthermore, voice control capabilities offer healthcare professionals the ease of hands-free documentation, allowing them to transcribe doctor-patient interactions in real-time, automate SOAP note generation, and update electronic medical records (EMRs) with simple verbal commands, significantly reducing administrative burden and allowing more focus on patient care

- The seamless integration of voice AI with PHM platforms facilitates centralized control over various aspects of population health initiatives. Through a unified interface, healthcare providers can manage patient communications, monitor health trends, and coordinate care plans, creating a more cohesive and automated healthcare delivery experience. Patients benefit from easier access to health information and personalized support

- This trend towards more intelligent, intuitive, and interconnected PHM systems is fundamentally reshaping user expectations for healthcare engagement and efficiency. Consequently, companies are developing AI-enabled PHM solutions with features such as predictive modeling for disease risk, automated patient outreach, and voice-controlled interfaces for patient support and data entry

- The demand for Population Health Management Solutions that offer seamless AI and voice integration is growing rapidly across healthcare providers, payers, and government organizations, as they increasingly prioritize convenience, operational efficiency, and comprehensive patient engagement for better health outcomes

Population Health Management Solutions Market Dynamics

Driver

“Key Market Drivers Fueling the Growth of Population Health Management (PHM) Solutions”

- The increasing prevalence of chronic diseases, the aging global population, and the escalating cost of healthcare, coupled with the accelerating adoption of digital health ecosystems, are significant drivers for the heightened demand for population health management solutions

- For instance, in late 2024 / early 2025, major healthcare IT companies and service providers are focusing on integrating advanced analytics and interoperability features into their PHM platforms. Such strategies by key companies are expected to drive the Population Health Management Solutions industry growth in the forecast period, by enabling more proactive and coordinated care

- As healthcare providers and payers become more aware of the inefficiencies of reactive care and seek enhanced strategies for improving patient outcomes and reducing costs, PHM solutions offer advanced features such as risk stratification, care coordination tools, patient engagement platforms, and robust analytics, providing a compelling upgrade over traditional, siloed healthcare data management

- Furthermore, the growing popularity of value-based care models and the desire for integrated healthcare delivery are making PHM solutions an integral component of these systems, offering seamless integration with electronic health records (EHRs), claims data, and social determinants of health (SDOH) platforms

- The convenience of centralized patient data management, remote patient monitoring integration, and the ability to manage population-level health initiatives through user-friendly interfaces are key factors propelling the adoption of PHM solutions across hospitals, clinics, and payer organizations. The trend towards preventative care models and the increasing availability of sophisticated, interoperable PHM options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Data Security, Privacy, and High Initial Costs”

- Concerns surrounding the data security and privacy vulnerabilities of connected healthcare IT systems, including Population Health Management Solutions, pose a significant challenge to broader market penetration. As PHM solutions rely on extensive data exchange and cloud connectivity, they are susceptible to cyber threats and data breaches, raising anxieties among healthcare organizations and patients about the confidentiality and integrity of sensitive health information

- For instance, high-profile reports of cybersecurity incidents involving patient data have made some healthcare entities hesitant to fully adopt comprehensive digital health solutions, including PHM platforms, due to regulatory compliance risks and potential reputational damage

- Addressing these cybersecurity and privacy concerns through robust encryption, secure authentication protocols, strict adherence to regulations such as HIPAA and GDPR, and regular security audits is crucial for building trust among healthcare stakeholders. Companies offering PHM solutions must emphasize their advanced security frameworks and privacy-by-design principles in their marketing to reassure potential clients. In addition, the relatively high initial cost of implementing some advanced Population Health Management Solutions systems, including software licenses, integration expenses, and training, can be a barrier to adoption for smaller healthcare providers or those with limited IT budgets

- While cost-benefit analyses often demonstrate long-term savings and improved outcomes, the perceived premium for comprehensive PHM technology can still hinder widespread adoption, especially for organizations that do not see an immediate return on investment for the advanced features offered

Population Health Management Solutions Market Scope

The global population health management solutions market is segmented on the basis of component, mode of delivery, and end-user.

- By Component

On the basis of component, the population health management solutions market is segmented into software and services. The software segment held the largest market revenue share of 66.70% in 2024, driven by the foundational need for advanced platforms that enable data aggregation, risk stratification, predictive analytics, care coordination, and patient engagement within PHM initiatives. The sophisticated functionalities embedded within PHM software, including interoperability with EHRs and other clinical systems, are critical for effective population-level health management. The increasing demand for cloud-based software solutions further contributes to its dominance due to scalability, accessibility, and cost-efficiency.

The services segment is expected to witness a significant growth rate throughout the forecast period. This growth is fueled by the increasing need for implementation services, consulting, training, data analytics support, and ongoing maintenance. As healthcare organizations adopt complex PHM platforms, they require expert assistance to ensure seamless integration, optimal utilization, and to derive actionable insights from their data. The rising trend of outsourcing certain PHM functions also contributes to the robust growth of the services segment.

- By Mode of Delivery

On the basis of mode of delivery, the Population health management solutions market is segmented into web-based, on-premise, and cloud-based. The cloud-based segment held the largest market revenue share in 2024, driven by the inherent advantages of cloud technology, including enhanced scalability, lower upfront infrastructure costs, improved accessibility for remote users, and simplified maintenance and updates. Cloud-based PHM solutions facilitate seamless data sharing across diverse healthcare settings and enable real-time analytics for large datasets, which are crucial for effective population health management.

The web-based mode of delivery, is expected to witness the fastest CAGR from 2025 to 2032, since it leverages cloud infrastructure for accessibility.

- By End-User

On the basis of end-user, the population health management solutions market is segmented into healthcare providers, healthcare payers, employer groups, and government bodies. The healthcare providers segment held the largest market revenue share in 2024, driven by the direct imperative for hospitals, integrated delivery networks, and physician groups to manage patient populations, improve care quality, and succeed under value-based care models. Providers utilize PHM solutions for chronic disease management, preventive care, care coordination, and reducing readmissions.

The healthcare payers segment is expected to witness a significant CAGR throughout the forecast period. This growth is fueled by payers' increasing need to manage member health, control costs, improve quality metrics, and identify at-risk populations for targeted interventions. Employer Groups are also increasingly adopting PHM solutions to manage employee health and wellness programs, control healthcare benefit costs, and enhance productivity.

Population Health Management Solutions Market Regional Analysis

- North America dominated the population health management solutions market, holding a significant revenue share of around 37.7% in 2024. This leadership position is primarily driven by a growing demand for value-based care models, a robust healthcare IT infrastructure, and increased awareness of the benefits of proactive health management

- Healthcare providers and payers in the region highly value the comprehensive data analytics, care coordination capabilities, and seamless integration offered by PHM solutions with other healthcare IT systems such as Electronic Health Records (EHRs) and claims processing platforms. These solutions are crucial for improving patient outcomes, managing chronic conditions, and reducing healthcare cost

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced healthcare ecosystem, and the growing preference for data-driven clinical decision-making and remote patient monitoring, establishing Population Health Management Solutions as a favored approach for both provider organizations and health insurance payers

U.S. Population Health Management Solutions Market Insight

The U.S. population health management solutions market captured a largest revenue share of the global market, in 2024. This growth is primarily fueled by the accelerating shift from fee-for-service to value-based care models, increasing government initiatives for healthcare IT adoption, and the rising burden of chronic diseases. Healthcare providers are increasingly prioritizing proactive disease management and care coordination to improve outcomes and control costs. The robust demand for advanced analytics, interoperable platforms, and integrated solutions that support patient engagement further propels the Population Health Management Solutions industry. Moreover, significant investments in digital health infrastructure and the presence of key market players are substantially contributing to the market's expansion.

Europe Population Health Management Solutions Market Insight

The Europe population health management solutions market is projected to expand at a substantial CAGR from 2025 to 2032. This growth is primarily driven by stringent healthcare regulations promoting data-driven care, the escalating need for efficient chronic disease management, and a growing focus on preventative health. The increase in digitalization within European healthcare systems, coupled with the demand for integrated solutions, is fostering the adoption of PHM platforms. European healthcare organizations are also drawn to the efficiency and cost-saving potential these solutions offer. The region is experiencing significant growth across various end-user segments, with PHM solutions being incorporated into both public health initiatives and private healthcare systems.

U.K. Population Health Management Solutions Market Insight

The U.K. population health management solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on integrated care systems and a desire for improved public health outcomes and cost efficiencies within the NHS. In addition, concerns regarding the management of long-term conditions and the need to reduce hospital readmissions are encouraging healthcare providers and payers to adopt comprehensive PHM solutions. The UK's embrace of digital health technologies, alongside its robust health data infrastructure, is expected to continue to stimulate market growth.

Germany Population Health Management Solutions Market Insight

The Germany population health management solutions market is expected to expand at a considerable CAGR from 2025 to 2032, fueled by increasing awareness of digital health's benefits and the demand for technologically advanced, patient-centric solutions. Germany's well-developed healthcare infrastructure, combined with its emphasis on innovation and data-driven healthcare, promotes the adoption of PHM solutions, particularly in managing chronic diseases and improving care coordination. The integration of PHM platforms with electronic health records (EHRs) and other health information systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer and regulatory expectations.

Asia-Pacific Population Health Management Solutions Market Insight

The Asia-Pacific population health management solutions market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032. This rapid growth is driven by increasing urbanization, rising disposable incomes, and significant technological advancements in countries such as China, Japan, and India. The region's growing inclination towards digital health initiatives, supported by government efforts promoting healthcare digitalization and access, is driving the adoption of PHM solutions. Furthermore, as APAC emerges as a crucial hub for healthcare IT innovation and component manufacturing, the affordability and accessibility of PHM solutions are expanding to a wider consumer base.

China Population Health Management Solutions Market Insight

The China population health management solutions market for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption in healthcare. China stands as one of the largest markets for digital health solutions, and PHM platforms are becoming increasingly popular in addressing the healthcare needs of its vast population. The push towards smart hospitals and national health initiatives, alongside the availability of increasingly sophisticated and affordable PHM options from strong domestic manufacturers, are key factors propelling the market in China.

India Population Health Management Solutions Market Insight

The India population health management solutions market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, making it one of the fastest-growing markets in Asia-Pacific. This surge is driven by a rapidly expanding healthcare sector, increasing prevalence of chronic diseases, and growing government initiatives promoting digital health and universal health coverage. The rising adoption of health insurance, coupled with the need for efficient healthcare delivery in a large and diverse population, is fostering the demand for PHM solutions. India's strong IT talent pool and focus on cost-effective innovations also contribute to the development and adoption of tailored PHM platforms.

Population Health Management Solutions Market Share

The population health management solutions industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Oracle (U.S.)

- McKesson Corporation (U.S.)

- Veradigm LLC (U.S.)

- Aetna Inc. (U.S.)

- Optum, Inc. (U.S.)

- IBM (U.S.)

- Conifer Health Solutions, LLC (U.S.)

- Health Catalyst (U.S.)

- i2i Population Health (U.S.)

- Accenture (Ireland)

- Deloitte (U.K.)

- NXGN Management, LLC (U.S.)

- Fonemed (Canada)

- Xerox Corporation (U.S.)

- Medecision (U.S.)

- ZeOmega (U.S.)

Latest Developments in Global Population Health Management Solutions Market

- In April 2024, Oracle Corporation, a global leader in cloud and data management, launched an enhanced version of its Oracle Health Management Platform to support integrated population health analytics across hospitals and payers in the U.S. This update includes advanced AI-driven predictive modeling and risk stratification tools designed to improve chronic disease management and care coordination. The development reflects Oracle’s commitment to advancing data-centric healthcare solutions and strengthening its presence in the global Population Health Management Solutions market

- In March 2024, IBM Watson Health partnered with Mayo Clinic to implement cognitive AI technologies for population health monitoring and predictive disease prevention. This collaboration leverages IBM’s powerful machine learning algorithms to analyze large-scale patient datasets and identify high-risk populations in real-time. The partnership underscores IBM's strategic focus on harnessing advanced analytics for value-based care delivery and preventative health outcomes

- In March 2024, Philips Healthcare expanded its population health platform, Philips Wellcentive, into the Asia-Pacific region, starting with a pilot project in Singapore. The solution supports healthcare organizations in tracking chronic disease patterns, reducing hospital readmissions, and engaging patients through personalized digital health tools. This move demonstrates Philips’ ongoing efforts to globalize its digital health footprint and address region-specific health challenges with scalable solutions

- In February 2024, Veradigm LLC, a healthcare technology subsidiary of Allscripts, introduced a real-time population health dashboard tailored for accountable care organizations (ACOs) and payer-provider networks. This solution offers dynamic insights into cost drivers, clinical outcomes, and care quality metrics. The innovation reflects Veradigm’s mission to improve healthcare quality through actionable data and analytics

- In January 2024, Optum, Inc., a part of UnitedHealth Group, launched the Optum Care Intelligence Platform, a next-generation population health solution integrating claims, EHR, social determinants of health (SDoH), and genomics data. Designed to support personalized interventions and population stratification, this platform aims to enhance health equity and improve overall care outcomes. This initiative reinforces Optum’s leadership in data-driven healthcare innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.