Global Porcine Plasma Feed Market

Market Size in USD Billion

CAGR :

%

USD

1.29 Billion

USD

1.97 Billion

2024

2032

USD

1.29 Billion

USD

1.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.29 Billion | |

| USD 1.97 Billion | |

|

|

|

|

Porcine Plasma Feed Market Size

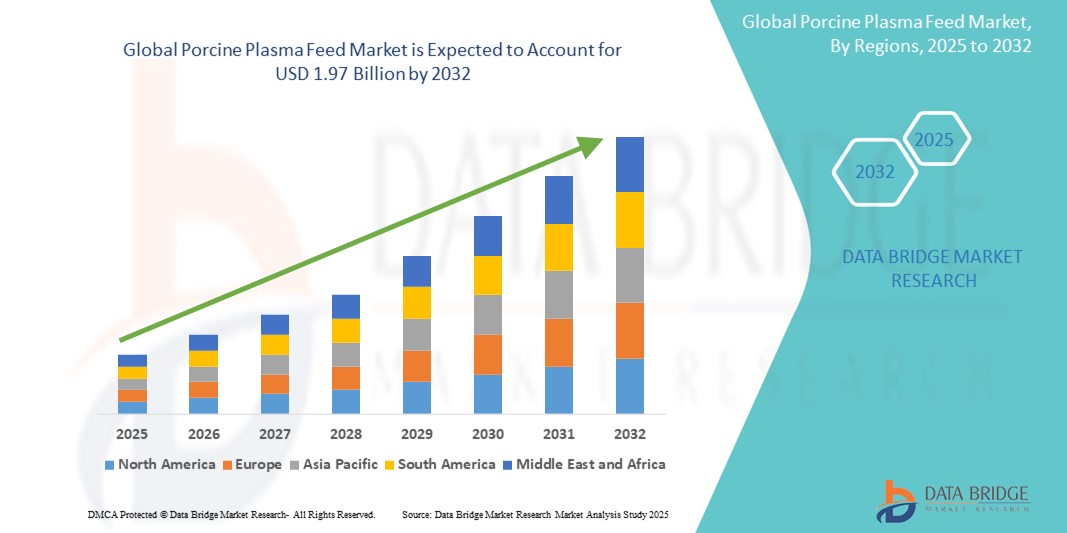

- The global porcine plasma feed market size was valued at USD 1.29 billion in 2024 and is expected to reach USD 1.97 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by the increasing demand for high-quality animal feed to enhance livestock health and productivity, particularly in swine and aquaculture industries

- Rising consumer awareness of the nutritional benefits of porcine plasma feed, coupled with advancements in feed processing technologies, is fueling market expansion. In addition, the growing pet food industry is contributing to the demand for porcine plasma as a premium ingredient

Porcine Plasma Feed Market Analysis

- Porcine plasma feed, derived from the blood of pigs, is a high-protein ingredient used in animal feed to improve growth rates, immunity, and overall health in livestock, pets, and aquatic species

- The demand for porcine plasma feed is driven by its high digestibility, rich amino acid profile, and functional properties, making it a preferred choice in swine feed, pet food, and aquafeed applications

- North America dominated the porcine plasma feed market with the largest revenue share of 32.9% in 2024, driven by advanced livestock farming practices, high adoption of premium feed ingredients, and the presence of key market players. The U.S. is a major contributor, with significant use in swine and pet food industries

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing meat consumption, and growing aquaculture activities in countries such as China, India, and Thailand

- The swine feed segment dominated the largest market revenue share of 68% in 2024, primarily driven by the critical role of porcine plasma in enhancing piglet health, growth, and immune function, especially during weaning periods, leading to improved feed efficiency and reduced mortality rates in commercial pig farming

Report Scope and Porcine Plasma Feed Market Segmentation

|

Attributes |

Porcine Plasma Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Porcine Plasma Feed Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global porcine plasma feed market is witnessing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into animal health, growth rates, and predictive nutrition needs

- AI-powered feed solutions allow for more proactive problem-solving, identifying potential issues in animal health and optimizing feed formulations to enhance efficiency and reduce waste.

- For instance, several companies are developing AI-driven platforms that analyze data on nutrient digestibility to optimize feed recipes for livestock, ensuring balanced nutrition and improved feed conversion ratios

- This trend is enhancing the value proposition of porcine plasma feed, making it a more precise and effective tool for farmers and feed additive companies

- AI algorithms can analyze a vast array of data, including feed intake, growth performance, and environmental conditions, to provide personalized feeding schedules and optimize breeding strategies

Porcine Plasma Feed Market Dynamics

Driver

“Rising Demand for Healthy Swine Feed and Advanced Nutritional Features”

- The increasing consumer demand for high-quality, antibiotic-free pork and improved animal welfare is a major driver for the porcine plasma feed market

- Porcine plasma feed enhances animal health by providing essential nutrients and antibodies, which can help piglets combat diseases and improve gut health

- The proliferation of advancements in animal nutrition and feed formulation are further enabling the expansion of porcine plasma feed applications, offering higher protein content and improved digestibility

- Farmers and farming organizations are increasingly adopting porcine plasma feed as a natural and safe ingredient to meet consumer expectations and enhance the value of their livestock

- The growing focus on feed efficiency and the need to replace antibiotics in animal feed are also contributing to the widespread adoption of porcine plasma feed

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The substantial initial investment required for processing, quality control, and integration of porcine plasma feed into existing feed production can be a significant barrier to adoption for many farmers and smaller farming organizations, especially in emerging markets

- Integrating new feed additives and technologies can be complex and costly

- In addition, data security and privacy concerns pose a major challenge. The use of AI and Big Data in feed production collects and transmits sensitive data related to animal health, genetics, and farm operations, raising concerns about potential breaches and misuse of information

- The fragmented regulatory landscape across different countries regarding the sourcing, processing, and use of animal-derived feed ingredients further complicates operations for international manufacturers and service providers

- These factors can deter potential buyers and limit market expansion, particularly in regions where cost sensitivity is a significant factor or where awareness of data privacy is high

Porcine Plasma Feed market Scope

The market is segmented on the basis of application and end-user.

- By Application

On the basis of application, the Global Porcine Plasma Feed Market is segmented into swine feed, pet food, aquafeed, and others. The swine feed segment dominated the largest market revenue share of 68% in 2024, primarily driven by the critical role of porcine plasma in enhancing piglet health, growth, and immune function, especially during weaning periods, leading to improved feed efficiency and reduced mortality rates in commercial pig farming.

The aquafeed segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapidly expanding aquaculture industry's demand for highly digestible and palatable protein sources that promote robust growth and health in aquatic species. The functional properties of porcine plasma, including its immunomodulatory effects, make it a valuable ingredient in high-performance aquafeed formulations.

- By End-User

On the basis of end-user, the Global Porcine Plasma Feed Market is segmented into farmers, farming organizations, feed additive companies, and users of animal feed for pets. The farmers and farming organizations segment is expected to hold the largest market revenue share of 62% in 2024, primarily driven by their direct and widespread adoption of porcine plasma as a vital feed ingredient to optimize animal performance, health, and profitability across their livestock operations, particularly in swine production.

The feed additive companies segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing research and development activities, strategic collaborations, and product innovations by these companies to incorporate porcine plasma into advanced and specialized feed formulations. Their ability to cater to diverse nutritional needs and distribute across broader markets accelerates the adoption of plasma-based solutions.

Porcine Plasma Feed Market Regional Analysis

- North America dominated the porcine plasma feed market with the largest revenue share of 32.9% in 2024, driven by advanced livestock farming practices, high adoption of premium feed ingredients, and the presence of key market players. The U.S. is a major contributor, with significant use in swine and pet food industries

- Consumers prioritize porcine plasma feed for its nutritional benefits, enhancing animal health and growth, particularly in swine and pet food applications

- Growth is supported by advancements in processing technologies, such as spray-dried porcine plasma, and strong adoption by farmers, farming organizations, feed additive companies, and pet food manufacturers. The U.S. leads due to its well-established market for organic meat and stringent regulations promoting natural feed ingredients

U.S. Porcine Plasma Feed Market Insight

The U.S. porcine plasma feed market captured the largest revenue share of 88.9% in 2024 within North America, fueled by strong aftermarket demand and growing awareness of the benefits of porcine plasma in improving livestock and pet health. The trend toward sustainable and antibiotic-free feed solutions, coupled with increasing consumer spending on high-quality pet food, drives market expansion. The integration of porcine plasma in swine feed and pet food formulations, supported by advanced manufacturing capabilities, creates a diverse product ecosystem.

Europe Porcine Plasma Feed Market Insight

The Europe porcine plasma feed market is expected to witness significant growth, supported by regulatory emphasis on sustainable livestock nutrition and animal welfare. Consumers and farmers seek porcine plasma for its high protein content and ability to enhance animal immunity, particularly in swine and aquafeed applications. Growth is prominent in both commercial farming and pet food sectors, with countries such as Germany and France showing notable adoption due to rising environmental concerns and advanced feed production technologies.

U.K. Porcine Plasma Feed Market Insight

The U.K. market for porcine plasma feed is anticipated to experience rapid growth, driven by increasing demand for high-quality animal nutrition in urban and rural farming settings. The focus on improving livestock productivity and pet health, combined with rising awareness of the benefits of porcine plasma in feed, encourages adoption. Evolving regulations on animal-based protein in feed influence end-user choices, balancing nutritional efficacy with compliance.

Germany Porcine Plasma Feed Market Insight

Germany is expected to witness rapid growth in the porcine plasma feed market, attributed to its advanced livestock sector and strong focus on sustainable and efficient animal nutrition. German farmers and feed additive companies prefer porcine plasma for its ability to enhance animal growth and reduce reliance on antibiotics, contributing to improved feed efficiency. The integration of porcine plasma in premium swine feed and pet food formulations supports sustained market growth.

Asia-Pacific Porcine Plasma Feed Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global porcine plasma feed market, driven by expanding swine farming, rising meat consumption, and increasing disposable incomes in countries such as China, India, and Japan. Growing awareness of the nutritional benefits of porcine plasma in swine feed, pet food, and aquafeed applications boosts demand. Government initiatives promoting sustainable feed practices and animal health further accelerate the adoption of advanced porcine plasma feed solutions.

Japan Porcine Plasma Feed Market Insight

Japan’s porcine plasma feed market is expected to grow rapidly due to strong consumer preference for high-quality, nutrient-rich feed that enhances livestock and pet health. The presence of major feed manufacturers and the integration of porcine plasma in swine and pet food formulations drive market penetration. Rising interest in sustainable feed additives and aftermarket demand for premium pet food further contribute to growth.

China Porcine Plasma Feed Market Insight

China holds the largest share of the Asia-Pacific porcine plasma feed market, propelled by rapid urbanization, increasing meat consumption, and a growing middle class. The demand for porcine plasma in swine feed, pet food, and aquafeed is driven by its ability to improve animal health and productivity. Strong domestic manufacturing capabilities, competitive pricing, and government support for sustainable feed practices enhance market accessibility and growth.

Porcine Plasma Feed Market Share

The porcine plasma feed industry is primarily led by well-established companies, including:

- Apcproteins (U.S.)

- SARIA A/S GmbH & Co. KG (Germany)

- Sera-Scandia A/S (Denmark)

- Lican Food (Chile)

- PURETEIN AGRI LLC. (U.S.)

- Veos (Belgium)

- Kraeber & Co Gmbh (Germany)

- Ridley Corporation Limited (Australia)

- Allanasons Private Limited (India)

- ROCKY MOUNTAIN BIOLOGICALS (U.S.)

- Lihme Protein Solutions (Denmark)

- Ekofood (U.S.)

- FeedWorks Pty. Ltd. (Australia)

- Darling Ingredients (U.S.)

- Nutreco (Netherlands)

- West Coast Reduction Ltd. (U.S.)

- Valley Proteins, Inc. (U.S.)

- FASA Group (Brazil)

What are the Recent Developments in Global Porcine Plasma Feed Market?

- In February 2025, companies began forming strategic partnerships with animal feed manufacturers to expand the use of porcine plasma feed beyond its traditional role in swine nutrition. These collaborations aim to integrate plasma feed into pet food, aquaculture, and poultry diets, driven by rising demand for sustainable, antibiotic-free protein sources. The trend reflects a broader shift toward functional feed ingredients that enhance animal immunity, digestibility, and growth performance. With over 35% growth in plasma-based pet food and 28% increase in aquaculture demand, the market is rapidly diversifying across global regions

- In October 2024, APC reaffirmed its commitment to animal health and nutrition by continuing to focus on its flagship product, AP920 spray-dried plasma powder. Widely recognized as a benchmark ingredient, AP920 is used globally in swine, poultry, ruminant, aquaculture, and companion animal diets. It supports immune health, enhances feed efficiency, and improves growth performance, making it a vital component in both livestock and pet food formulations. APC’s sustained emphasis on AP920 underscores its role in advancing functional protein solutions and maintaining high standards in animal agriculture

- In August 2023, Kalmbach Feeds announced the acquisition of Ware Milling, a family-owned feed business based in Houston, Mississippi. This strategic move expands Kalmbach’s operational footprint and supports its mission to meet the growing demand for high-quality animal nutrition products and services. The acquisition reflects a broader industry trend of consolidation, as companies seek to enhance their market presence, resource efficiency, and customer reach. Both organizations share a strong commitment to customer service and product excellence, making the integration a natural fit for long-term growth

- In January 2023, Purina Animal Nutrition introduced two innovative feed additives—EnduraSow and EnduraPig to support livestock productivity during health challenges. EnduraSow is a low-inclusion supplement formulated to enhance sow performance, with commercial trials showing an increase in piglets weaned per sow per year. Meanwhile, EnduraPig targets piglet respiratory health and immune function, especially during the vulnerable post-weaning period. These launches reflect Purina’s commitment to science-driven nutrition and its focus on improving reproductive efficiency and animal resilience across swine operations

- In May 2022, Darling Ingredients Inc. completed the acquisition of Valley Proteins, one of the largest independent rendering companies in the U.S., for approximately $1.1 billion. The deal significantly expanded Darling’s network with 18 rendering and used cooking oil facilities across the southern, southeast, and mid-Atlantic regions. This strategic move bolstered Darling’s ability to supply low-carbon intensity feedstocks for renewable diesel and other sustainable products, reinforcing its leadership in the circular economy. The acquisition also reflects a broader industry trend of consolidation to enhance market reach and product diversification

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.