Global Portion Cups Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.92 Billion

2024

2032

USD

1.65 Billion

USD

2.92 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 2.92 Billion | |

|

|

|

|

Portion cups Market Size

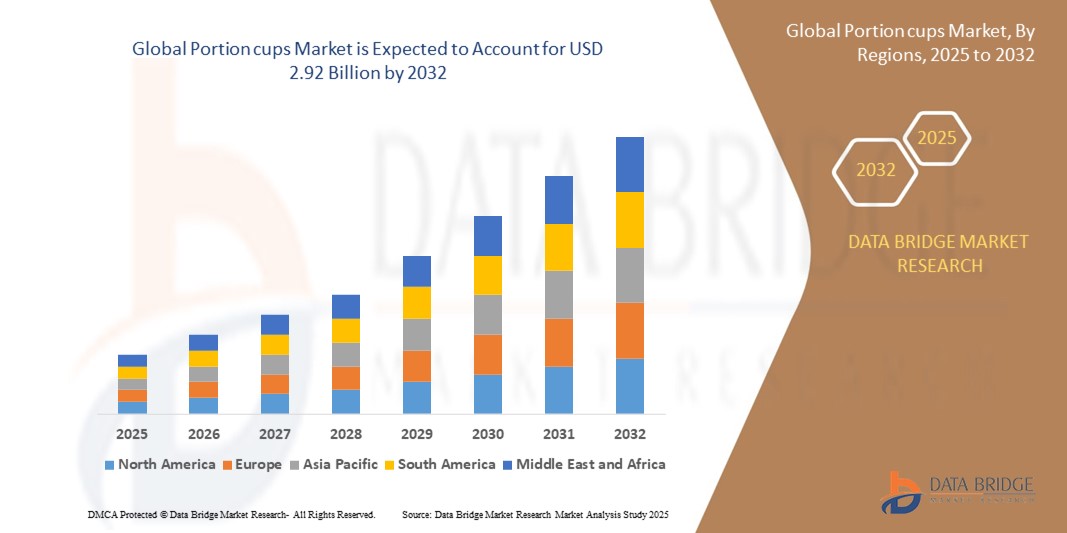

- The global portion cups market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.92 billion by 2032, at a CAGR of 7.4% during the forecast period

- The market growth is largely fuelled by the growing shift towards sustainable materials and customizable designs. This evolution is driven by increasing environmental concerns, regulatory pressures, and the demand for personalized branding in the food service industry.

- Furthermore, increasing consumer preference for convenient and hygienic food options is significantly driving the demand for portion cups globally

Portion cups Market Analysis

- Portion cups, used primarily for single servings of sauces, dressings, condiments, and other food items, are essential in foodservice, retail, and household applications due to their convenience, portion control, and hygienic packaging benefits.

- The rising demand for portion cups is driven by the growing food delivery industry, increased consumer preference for on-the-go eating, and expanding fast-food and casual dining sectors worldwide.

- Asia-Pacific dominates the portion cups market with the largest revenue share in 2024, supported by rapid urbanization, increasing disposable incomes, and the expansion of quick-service restaurants and food delivery services across countries like China and India.

- The region is also experiencing accelerated adoption of sustainable and eco-friendly portion cup materials, encouraged by government regulations and growing environmental awareness among consumers.

- The plastic segment leads the market, accounting for the largest share in 2024, due to its low cost, versatility, and strong presence in both retail and foodservice sectors. However, alternatives such as paper and sugarcane-based cups are gaining traction amid increasing environmental concerns.

Report Scope and Portion Cups Market Segmentation

|

Attributes |

Portion cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Portion Cups Market Trends

“Sustainability and Customization Driving Innovation in Portion Packaging”

- A significant and accelerating trend in the global portion cups market is the shift towards sustainable materials and customizable designs. This evolution is driven by increasing environmental concerns, regulatory pressures, and the demand for personalized branding in the food service industry.

- For instance, major food and beverage companies like Starbucks have introduced redesigned cold drink cups that use up to 20% less plastic, aiming to reduce plastic waste by over 13.5 million pounds annually. These cups also feature standardized lids and raised dots for easier identification, reflecting a commitment to both sustainability and user convenience

- Customization has become a pivotal aspect of product differentiation in the portion cups market. Food service providers are seeking portion cups that not only serve functional purposes but also enhance brand visibility. This has led to the development of portion cups with bespoke designs, colors, and logos, allowing businesses to reinforce their brand identity and connect with consumers more effectively

- Technological advancements are also playing a crucial role in shaping market trends. Innovations in manufacturing processes have enabled the production of portion cups with improved features such as better sealing capabilities, enhanced durability, and user-friendly designs. These improvements cater to the growing demand for convenience and hygiene, especially in the wake of increased takeout and delivery services

- The integration of smart packaging technologies, although still emerging, is another trend to watch. Features like QR codes and RFID tags are being explored to provide consumers with information about the product, such as nutritional content and sourcing, thereby enhancing transparency and trust

- The demand for portion cups that align with sustainability goals and offer customization options is growing rapidly across various sectors, including food service, healthcare, and retail. As consumers become more environmentally conscious and businesses seek to differentiate themselves, the market is expected to witness continued innovation and expansion in these areas

Portion Cups Market Dynamics

Driver

“Rising Demand for Convenient, Single-Serve Food Packaging”

- The increasing consumer preference for convenient and hygienic food options is significantly driving the demand for portion cups globally. With fast-paced lifestyles and growing urbanization, consumers are seeking quick, easy-to-use packaging solutions that allow for on-the-go consumption without compromising on freshness or safety.

- For instance, global quick-service restaurants (QSRs) like McDonald’s and KFC have expanded the use of portion cups for sauces, dips, and dressings to cater to the rising demand for delivery and takeaway services. This shift ensures portion control, reduces spillage, and enhances customer experience during off-premise dining.

- Furthermore, the growth of meal kit delivery services and ready-to-eat packaged foods is fueling demand for portion cups that provide precise servings. Brands such as HelloFresh and Blue Apron use portioned packaging to maintain food quality, reduce waste, and simplify meal preparation for consumers.

- Health and wellness trends are also influencing packaging choices. Portion cups enable better calorie control and nutritional management, appealing to diet-conscious customers. For example, yogurt brands like Chobani and Fage offer single-serve portion cups that cater to consumers seeking controlled snack sizes without sacrificing taste or quality.

- Additionally, heightened focus on food safety and hygiene, especially after the COVID-19 pandemic, has accelerated the adoption of sealed, disposable portion cups in foodservice outlets, catering, and institutional kitchens. This shift not only reduces contamination risks but also aligns with consumer expectations for safe and sanitary food packaging solutions.

- The convenience of portion cups combined with their ability to meet food safety regulations is expected to sustain strong market growth, especially in emerging economies where packaged food consumption is rapidly rising

Restraint/Challenge

“High Raw Material Costs and Environmental Concerns Limiting Market Expansion”

- The global portion cups market faces significant challenges due to the rising costs of raw materials such as plastics, paperboard, and biodegradable polymers, which directly impact production expenses and profit margins for manufacturers. For example, fluctuations in crude oil prices have recently caused price volatility in plastic resins, increasing manufacturing costs

- Additionally, increasing environmental concerns and stringent regulations regarding single-use plastics are putting pressure on manufacturers to innovate and adopt sustainable materials. This transition often involves higher costs and operational adjustments, creating barriers for smaller companies and affecting overall market growth

- For instance, several municipalities in Europe and North America have imposed bans or heavy taxes on single-use plastic products, including portion cups, pushing manufacturers to seek alternatives or face reduced market access.

- Furthermore, consumer awareness regarding plastic pollution and preference for eco-friendly packaging is reshaping demand patterns, requiring companies to invest in costly research and development to produce biodegradable or compostable portion cups that meet functional and safety standards

- The complexity of balancing cost, sustainability, and product performance remains a critical challenge hindering rapid market expansion, particularly in price-sensitive regions where alternatives may be less affordable or scalable

Portion Cups Market Scope

The market is segmented on the basis of material type, capacity, application, end user and distribution channel.

- By Material Type

On the basis of material type, the portion cups market is segmented into plastic, paper, aluminium foil, sugarcane, and others.

The plastic segment continues to dominate the global portion cups market, accounting for the largest market share of approximately 45.66% in 2024. This dominance is attributed to the material’s durability, cost-efficiency, and flexibility in molding for various food applications, especially in quick-service restaurants and food delivery services. However, mounting environmental concerns and regulatory pressures on single-use plastics are gradually shifting focus to alternatives.

The sugarcane segment is projected to be the fastest-growing during the forecast period, with an expected CAGR of over 7.5% from 2025 to 2032. Its growth is fueled by increasing demand for compostable and biodegradable packaging solutions across eco-conscious markets, particularly in Europe and parts of North America and Asia.

- By Communication Protocol

On the basis of communication protocol, the portion cups market is segmented into Bluetooth, Wi-Fi, Z-Wave, Zigbee, and Others. The Wi-Fi segment held the largest market revenue share in 2024 driven by the widespread availability of home Wi-Fi networks and the ease of direct internet connectivity for portion cupss. Wi-Fi-enabled portion cupss often offer seamless remote access and integration with cloud-based services and voice assistants, making them a popular choice for residential users.

The Bluetooth segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its low power consumption and direct peer-to-peer connectivity, making it ideal for smartphone-based unlocking and localized access control. Bluetooth-enabled portion cupss are particularly popular for their ease of setup and reliable performance within a limited range, often serving as a primary unlocking mechanism.

- By Capacity

By capacity, the market is segmented into up to 1 Oz, 1–2 Oz, 2–3 Oz, 3–4 Oz, 4–5 Oz, 5–6 Oz, and above 6 Oz.

The 1–2 Oz segment leads the market, with an estimated share of 35.25% in 2024. This range is widely preferred for condiments like ketchup, mustard, sauces, and salad dressings in restaurants and takeout packaging due to its versatility and portion control benefits.

The 2–3 Oz segment is witnessing notable growth as it caters to applications requiring slightly larger volumes such as hummus, dips, and yogurt portions, increasingly demanded in retail multipacks and institutional catering.

- By Application

The market is segmented into tomato sauce, BBQ sauce, guacamole, hummus, soups, dressings/toppings, bakery, dairy, ice creams, and others.

Dressings/Toppings constitute segment accounted for the largest market revenue share in 2024. This is driven by the popularity of salads, ready-to-eat meals, and pre-packaged fast foods, especially in North America and Europe.

The guacamole and hummus segments are among the fastest-growing applications, supported by increasing demand for ethnic and plant-based dips in Western markets. Rising consumer preference for healthy, on-the-go snacking options is also expanding demand for small, sealed portion cup packaging in this category.

- By End Users

Based on end users, the market is categorized into food service outlets, institutional, and households.

Food service outlets segment accounted for the largest market revenue share in 2024. Restaurants, QSRs, and catering services drive this demand by using portion cups to enhance hygiene, portion control, and delivery efficiency.

The food service outlets segment is also expected to expand significantly with the growing popularity of meal kits, pre-portioned snacks, and home-based dining, particularly in urban and suburban areas of developed economies.

- By Distribution Channel

By distribution channel, the market is segmented into retailers, e-retail, and direct sales.

Retailers dominate the distribution landscape, accounting for the largest share of the global revenue share. Supermarkets and hypermarkets stock various portion cup-based products in ready-to-eat and convenience food categories, sustaining strong consumer access.

The e-retail segment is anticipated to record the fastest growth rate of CAGR during 2025–2032. This growth is driven by rising online grocery shopping trends and the expansion of D2C (direct-to-consumer) food brands that bundle sauces, dips, and spreads in single-serve portion formats.

Portion Cups Market Regional Analysis

- Asia Pacific dominates the global portion cups market with the largest revenue share of approximately 42.5% in 2024, driven by the rapid expansion of the foodservice industry, rising urbanization, and changing consumer lifestyles across key countries like China, India, Japan, and Indonesia

- The region's growing middle-class population and increasing demand for takeaway food and convenient meal packaging have led to a surge in the use of portion cups, particularly in QSRs, street food vendors, and institutional catering.

- The proliferation of single-serve sauces, dips, and dessert packs in retail and food delivery services, supported by digital food platforms like Swiggy, Meituan, and GrabFood, also contributes significantly to regional market growth.

- As sustainability awareness rises, especially in Japan and South Korea, the demand for paper-based and compostable sugarcane portion cups is gradually accelerating, pushing innovation and eco-friendly packaging initiatives across the region.

U.S. Portion Cups Market Insight

The U.S. portion cups market captured the largest revenue share within North America in 2024, driven by the widespread adoption of takeaway and delivery food culture. The popularity of fast-casual dining chains, food trucks, and institutional catering services fuels strong demand for portion-controlled packaging for sauces, condiments, and dressings. The shift toward on-the-go eating habits and heightened hygiene awareness has encouraged both restaurants and food manufacturers to invest in single-serve, tamper-evident portion cups. Additionally, the growing demand for eco-friendly alternatives is prompting innovation in biodegradable and compostable portion cup formats, especially among health-conscious and sustainability-focused consumers.

Europe Portion Cups Market Insight

The Europe portion cups market is projected to witness substantial growth throughout the forecast period, supported by growing environmental regulations, increasing focus on food hygiene, and rising demand for sustainable packaging solutions. Many countries in the region are enforcing strict bans and taxes on single-use plastics, prompting a shift towards paper-based, aluminium foil, and sugarcane-based portion cups. The market is also benefiting from the rise in gourmet food delivery services and the expansion of chilled and ready-to-eat meal categories in retail. Additionally, premiumization in food presentation, especially in the bakery and dairy sectors, is further driving the adoption of aesthetically pleasing and functional portion packaging.

U.K. Portion Cups Market Insight

The U.K. portion cups market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the expansion of foodservice chains and the rising preference for pre-packaged, portion-controlled servings in meal kits and takeaways. With increased focus on hygiene and allergen control, food manufacturers and restaurants are turning to sealed, clearly labeled portion cups for sauces, toppings, and dips. Moreover, regulatory measures aimed at reducing single-use plastics are accelerating the transition to compostable and recyclable materials, positioning the market for further growth.

Germany Portion Cups Market Insight

The Germany portion cups market is expected to expand at a considerable pace, bolstered by the country's strong institutional catering, airline catering, and food retail industries. With heightened consumer awareness around food safety and portion control, there's a growing shift toward unitized packaging that maintains product integrity. The German market is particularly responsive to sustainable materials, with demand for bio-based and recyclable portion cups gaining traction. Additionally, the rising popularity of convenience foods and private-label ready-to-eat products is contributing to increasing utilization of portion cups across diverse applications.

Asia-Pacific Portion Cups Market Insight

The Asia-Pacific portion cups market is poised to grow at the fastest CAGR from 2025 to 2032, driven by the proliferation of food delivery platforms, rapid urbanization, and expanding middle-class populations across countries like China, India, Indonesia, and Vietnam. The surge in quick-service restaurants and institutional dining, coupled with rising consumer interest in international cuisines and condiments, is boosting the use of portion cups for sauces, dressings, and sides. Additionally, governments in the region are increasingly advocating for sustainable packaging practices, leading to a rise in demand for paper and sugarcane-based portion cups that align with eco-conscious values.

Japan Portion Cups Market Insight

The Japan portion cups market is gaining momentum, supported by a well-established convenience food culture and high standards for food presentation and hygiene. Single-serve packaging for dips, sauces, and ready-to-eat desserts is widespread in retail and convenience store chains. With a growing elderly population and increasing demand for safe, manageable portion sizes, manufacturers are focusing on ergonomic and easy-to-open portion cup designs. The Japanese emphasis on sustainability is also prompting growth in compostable and recyclable packaging formats, especially in premium product segments.

China Portion Cups Market Insight

The China portion cups market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s rapidly growing foodservice sector, expansion of e-commerce grocery platforms, and the rise of urban snack culture. Portion cups are increasingly used for sauces, ready meals, yogurt, and single-serve desserts across quick-service chains, online meal deliveries, and convenience retail outlets. As government policies begin to limit single-use plastics in major cities, domestic producers are innovating with paper, PLA, and bagasse-based alternatives. The availability of affordable, locally manufactured solutions also supports high-volume adoption across food and beverage segments.

Portion Cups Market Share

The portion cups industry is primarily led by well-established companies, including:

- Dart Container Corporation (U.S.)

- Placon (U.S.)

- Sabert Corporation (U.S.)

- BSIbio (Canada)

- Huhtamaki (Finland)

- Graphic Packaging International, LLC (U.S.)

- Georgia-Pacific Consumer Products LP (U.S.)

- WINPAK LTD. (Canada)

- D&W Fine Pack (U.S.)

- Eco-Products, Inc. (U.S.)

- Fabri-Kal (U.S.)

- Sonoco Products Company (U.S.)

- Pactiv Evergreen Inc. (U.S.)

- Amhil Enterprises (Canada)

- Dot It Restaurant Fulfillment (U.S.)

- POLAR PAK COMPANY (Canada)

- London Bio Packaging (U.K.)

- Berry Global Inc. (U.S.)

- NatureWorks (U.S.)

Latest Developments in Global Portion Cups Market

- In January 2022, Sonoco, a global leader in packaging, completed its acquisition of Ball Metalpack, formerly a subsidiary of Ball Corporation. This strategic acquisition strengthens Sonoco’s metal packaging portfolio and broadens its market footprint across the Americas.

- In April 2024, Malmö-based Duni Group, known for its sustainable catering solutions, acquired Australian reusable cup maker Huskee. Founded in 2017, Huskee uses coffee husk waste to produce its cups and runs the HuskeeSwap and Huskee Loop recycling initiatives. This acquisition enhances Duni’s packaging presence in the Asia-Pacific region and follows its recent purchases of New Zealand's Decent Packaging and a larger share in Germany’s Relevo.

- In February 2024, Faerch Group launched its Tumbler range—recyclable beverage containers made with at least 30% post-consumer recycled content. These tumblers are designed for closed-loop recycling, allowing them to be repurposed into new food packaging while preserving both safety and performance.

- In April 2025, Finnish packaging giant Huhtamaki acquired the majority of CupPrint, an Ireland-based company specializing in custom-printed paper cups. This strategic acquisition enhances Huhtamaki's capabilities in sustainable and personalized packaging solutions, aligning with the growing demand for eco-friendly and customizable portion cups in the foodservice industry.

- In August 2023, 360Pack, a rapidly growing packaging distribution company in North America, announced the acquisition of Team Packaging Inc., a Colorado-based provider of custom packaging solutions. This acquisition strengthens 360Pack's position in the Western United States, enabling them to offer a broader range of flexible and fiber-based packaging options, including portion cups, to various industries such as food production and retail.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Portion Cups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Portion Cups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Portion Cups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.