Global Positron Emission Tomography Pet Scanners Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

2.00 Billion

2024

2032

USD

1.39 Billion

USD

2.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.39 Billion | |

| USD 2.00 Billion | |

|

|

|

|

Positron Emission Tomography (PET) Scanner’s Market Size

- The global positron emission tomography (PET) scanner’s market size was valued at USD 1.39 billion in 2024 and is expected to reach USD 2.00 billion by 2032, at a CAGR of 4.67 % during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, rising demand for early and accurate diagnostic imaging, and technological advancements in hybrid imaging systems such as PET-CT and PET-MRI

Positron Emission Tomography (PET) Scanner’s Market Analysis

- The global positron emission tomography scanners market is experiencing steady growth, driven by the increasing demand for advanced diagnostic imaging technologies that offer precise and early detection of diseases

- Technological advancements, such as the development of hybrid imaging systems combining positron emission tomography with computed tomography or magnetic resonance imaging, are enhancing diagnostic capabilities and expanding the applications of positron emission tomography scanners in various medical fields

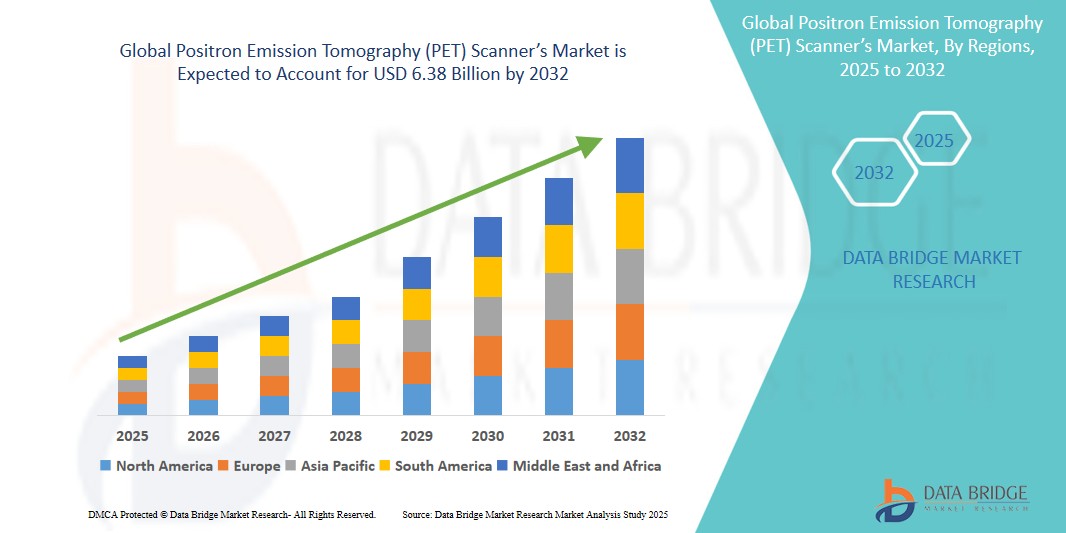

- North America is expected to dominate the positron emission tomography (PET) scanner market due to advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the presence of major market players

- Asia-Pacific is expected to be the fastest growing region in the positron emission tomography (PET) scanner market during the forecast period due to increasing healthcare investments, rising awareness, and growing demand for advanced diagnostic technologies.

- The full ring PET scanners segment is expected to dominate the positron emission tomography (PET) Scanner’s market with the largest share of 71.8% in 2025 due to its superior imaging quality, enhanced sensitivity, and high-resolution capabilities, which are crucial for detecting early-stage diseases and providing accurate diagnostics.

Report Scope and Positron Emission Tomography (PET) Scanner’s Market Segmentation

|

Attributes |

Positron Emission Tomography (PET) Scanner’s Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Positron Emission Tomography (PET) Scanner’s Market Trends

“Rising Adoption of Hybrid PET Imaging Systems”

- Hybrid PET systems such as PET/CT and PET/MRI are gaining popularity due to their ability to provide both functional and anatomical imaging in a single scan, enhancing diagnostic accuracy and clinical decision-making

- These systems improve diagnostic efficiency by reducing the need for separate imaging sessions, allowing clinicians to assess complex conditions faster and more effectively

- For instance, Siemens Healthineers’ Biograph Vision PET/CT has been adopted by major hospitals such as Cleveland Clinic for early cancer detection and treatment planning

- In addition, GE Healthcare’s SIGNA PET/MR is utilized at Mayo Clinic for neurological imaging, offering higher resolution with reduced radiation, supporting research and clinical care in brain disorders

- Hospitals using hybrid PET systems report improved workflow, increased patient throughput, and optimized resource utilization, which makes them ideal for high-demand clinical environments

Positron Emission Tomography (PET) Scanner’s Market Dynamics

Driver

“Rising Demand for Early and Accurate Diagnosis of Chronic Diseases”

- The growing global prevalence of chronic illnesses such as cancer, neurological disorders, and heart diseases is a major factor driving demand for PET scanners

- For instance, cancer cases are expected to rise to 28.4 million by 2040 according to the IARC, underscoring the need for early and accurate diagnostics

- PET imaging enables visualization of metabolic and physiological processes, making it ideal for detecting diseases at early stages. It provides functional data that other imaging methods such as CT or MRI cannot, allowing for more informed treatment decisions

- In oncology, PET scans help in cancer detection, staging, biopsy guidance, and therapy monitoring FDG-PET is widely adopted for assessing lung cancer and lymphoma progression, offering better clinical outcomes through precise tumor localization

- In neurology, PET plays a key role in detecting disorders such as Alzheimer’s before visible symptoms appear

- With aging populations and rising awareness of preventive care, healthcare systems are adopting PET scanners at a faster rate

Opportunity

“Expansion into Emerging Markets with Growing Healthcare Infrastructure”

- Emerging markets in Asia-Pacific, Latin America, and parts of the Middle East and Africa offer strong growth potential for PET scanner manufacturers

- For instance, India’s healthcare sector is projected to reach USD 372 billion by 2025, creating demand for modern diagnostic technologies

- These regions are experiencing improvements in healthcare infrastructure, greater healthcare budgets, and increased awareness of advanced diagnostics

- For instance, China's Healthy China 2030 initiative supports such improvements by emphasizing early detection and modern medical equipment adoption

- Government and private sector investments are driving the establishment of diagnostic centers and hospitals with advanced imaging technologies

- Rising disposable incomes and broader health insurance coverage are making high-end diagnostics such as PET scans more accessible to patients

- Manufacturers offering affordable, compact, or mobile PET scanners can gain competitive advantages and expand their reach in these regions

Restraint/Challenge

“High Cost of PET Scanners and Associated Procedures”

- The high cost of PET scanners, often exceeding a million dollars per unit, acts as a major barrier to widespread adoption

- For instance, advanced hybrid PET/CT systems such as Siemens Biograph Vision come with high acquisition and installation costs

- Operational expenses such as radiotracer production, equipment maintenance, and shielding infrastructure add to the overall financial burden

- For instance, Facilities must also invest in cyclotrons or rely on radiopharmaceutical suppliers, increasing logistics and handling costs

- Small hospitals and diagnostic centers, especially in low-resource settings, struggle to justify or afford these expenses

- Inconsistent reimbursement policies and partial coverage further discourage healthcare providers and patients from utilizing PET imaging

- Overcoming these financial barriers requires innovative low-cost PET solutions, scalable models, and supportive reimbursement frameworks

Positron Emission Tomography (PET) Scanner’s Market Scope

The market is segmented on the basis of product type, applications, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Applications |

|

|

By End User |

|

In 2025, the full ring PET scanners is projected to dominate the market with a largest share in product type segment

The full ring PET scanners segment is expected to dominate the positron emission tomography (PET) Scanner’s market with the largest share of 71.8% in 2025 due to its superior imaging quality, enhanced sensitivity, and high-resolution capabilities, which are crucial for detecting early-stage diseases and providing accurate diagnostics.

The oncology is expected to account for the largest share during the forecast period in applications market

In 2025, the oncology segment is expected to dominate the market with the largest market share of 47.5% due to its pivotal role in detecting, staging, and monitoring cancer. PET scans are highly effective in identifying metabolic activity in tumors, assessing cancer progression, and evaluating the effectiveness of treatment regimens, which makes them indispensable in oncology care.

Positron Emission Tomography (PET) Scanner’s Market Regional Analysis

“North America Holds the Largest Share in the Positron Emission Tomography (PET) Scanner’s Market”

- North America is dominating the positron emission tomography (PET) scanner market with a projected share of approximately 45.8%, driven by the presence of advanced healthcare infrastructure and high adoption rates of innovative imaging technologies

- The region's dominance is also attributed to strong governmental and private investments in medical imaging

- North America is home to leading manufacturers and healthcare providers adopting the latest PET scanner technologies

- The U.S. is the largest market, with high demand for PET scans in oncology, cardiology, and neurology

- Government reimbursement policies in the U.S. support the widespread use of advanced diagnostic tools such as PET scanners

- Ongoing research and development in the region continue to drive innovation in PET imaging technology

“Asia-Pacific is Projected to Register the Highest CAGR in the Positron Emission Tomography (PET) Scanner’s Market”

- Asia-Pacific is the fastest-growing region in the PET scanner market, with rapid improvements in healthcare infrastructure and an increasing focus on advanced diagnostic tools

- Healthcare spending in countries such as China, India, and Japan is significantly boosting the adoption of PET scanners

- The rising prevalence of chronic diseases such as cancer and neurological disorders is increasing the demand for diagnostic imaging

- Government initiatives and funding for healthcare modernization are accelerating market growth in Asia-Pacific

- Affordable, portable PET systems are gaining popularity in emerging economies within the region, broadening market access

Positron Emission Tomography (PET) Scanner’s Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Positron Corporation (U.S.)

- CellSight Technologies (U.S.)

- RefleXion (Canada)

- Clarity Pharmaceuticals (Australia)

- PETsys Electronics SA (Portugal)

- Blue Earth Diagnostics Limited (U.K.)

- Qubiotech Health Intelligence S.L. (Spain)

- Advanced Accelerator Applications (France)

- Lilly (U.S.)

- Agfa-Gevaert Group (Belgium)

- CMR Naviscan (U.S.)

- Neusoft Corporation (China)

- Siemens (Germany)

- Segamicorp (U.S.)

- ONCOVISION (Spain)

- MedX Holdings, Inc. (U.S.)

- Modus Medical Devices Inc (Canada)

- Radiology Oncology Systems (U.S.)

- TOSHIBA CORPORATION (Japan)

- General Electric Company (U.S.)

Latest Developments in Global Positron Emission Tomography (PET) Scanner’s Market

- In February 2023, United Imaging Healthcare (China) announced strategic partnerships at Arab Health 2023, including a collaboration with I-ONE Nuclear Medicine & Oncology Center (Saudi Arabia) to establish a research academy for advanced PET/MR imaging. This initiative aims to enhance clinical applications in neuro and cardiac imaging, focusing on AI integration, low-dose PET imaging, and early detection of small lesions. The impact on the market includes expanded access to cutting-edge imaging technologies in the Middle East, fostering regional advancements in medical diagnostics and research

- In April 2022, Mediso Ltd (Hungary) acquired Bartec Technologies Ltd (U.K.), a company specializing in the supply, installation, and support of nuclear medicine and molecular imaging equipment. This acquisition aims to strengthen Mediso's market presence in the U.K. and Ireland by transitioning from a long-standing partnership to direct operations. The integration is expected to enhance customer relationships, streamline service delivery, and foster strategic alliances in the region. By consolidating its operations, Mediso anticipates improved responsiveness to market needs and bolstered competitiveness in the European medical imaging sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.