Global Post Combustion Carbon Capture And Storage Market

Market Size in USD Million

CAGR :

%

USD

322.50 Million

USD

1,897.78 Million

2024

2032

USD

322.50 Million

USD

1,897.78 Million

2024

2032

| 2025 –2032 | |

| USD 322.50 Million | |

| USD 1,897.78 Million | |

|

|

|

|

What is the Global Post Combustion Carbon Capture and Storage Market Size and Growth Rate?

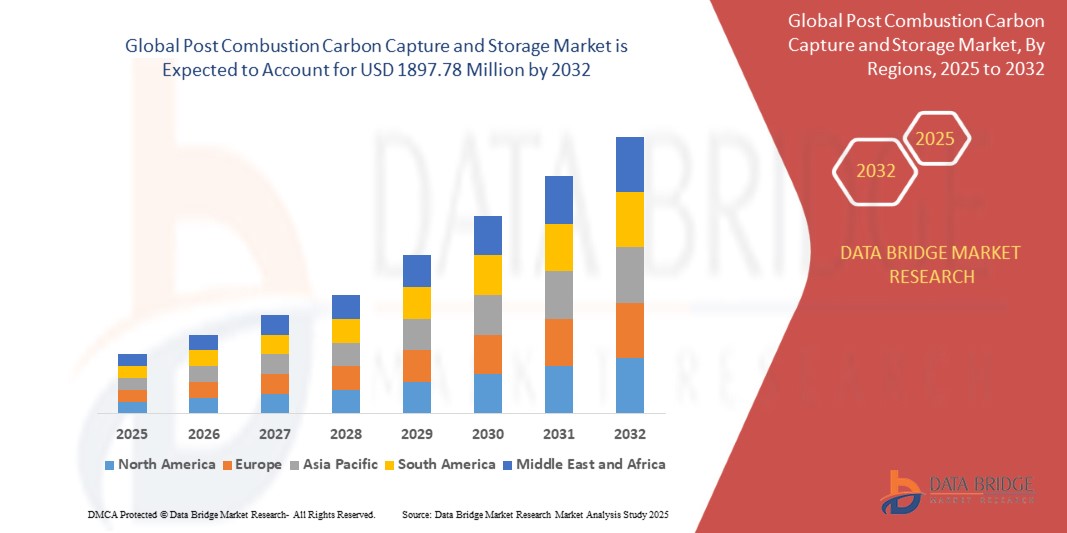

- The global post combustion carbon capture and storage market size was valued at USD 322.5 million in 2024 and is expected to reach USD 1897.78 million by 2032, at a CAGR of 24.8% during the forecast period

- The market growth is primarily driven by increasing industrial emissions regulations, technological advancements in carbon capture systems, and the global push for decarbonization across power generation and heavy industries

- In addition, rising government incentives for carbon reduction, growing awareness of climate change mitigation, and adoption of sustainable energy strategies are accelerating the deployment of post combustion carbon capture and storage solutions, thereby significantly boosting industry expansion

What are the Major Takeaways of Post Combustion Carbon Capture and Storage Market?

- Post combustion carbon capture and storage systems are becoming critical in industrial settings, providing efficient CO₂ capture from flue gases and facilitating long-term storage or utilization, supporting corporate sustainability targets

- The market demand is driven by stringent environmental regulations, increasing carbon pricing mechanisms, and growing adoption of greenhouse gas mitigation technologies by energy-intensive industries such as power, cement, and steel

- Rising interest in integrated carbon management solutions, coupled with advancements in capture efficiency and cost reduction, is further propelling the adoption of post combustion carbon capture and storage systems globally

- North America dominated the post combustion carbon capture and storage market with the largest revenue share of 36.9% in 2024, driven by stringent emission regulations, industrial decarbonization initiatives, and widespread adoption of advanced PCCS technologies

- Asia-Pacific PCCS market is poised to grow at the fastest CAGR of 8.1% from 2025 to 2032, driven by rapid industrialization, urbanization, and government incentives promoting clean energy technologies

- The Power Generation segment dominated the market in 2024, accounting for the largest revenue share of 46.5%, driven by stringent emission regulations and the urgent need for carbon mitigation in coal- and gas-fired power plants

Report Scope and Post Combustion Carbon Capture and Storage Market Segmentation

|

Attributes |

Post Combustion Carbon Capture and Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Post Combustion Carbon Capture and Storage Market?

Advancements in AI-Driven Efficiency and Process Optimization

- A major and accelerating trend in the global post combustion carbon capture and storage market is the integration of artificial intelligence (AI) and machine learning to enhance process efficiency, reduce energy consumption, and optimize carbon capture rates

- For instance, companies such as Equinor and Shell are implementing AI-driven monitoring systems to predict CO₂ absorption efficiency and dynamically adjust operational parameters in real time, improving capture performance while lowering operational costs

- AI-enabled PCCS systems also provide predictive maintenance features, helping operators identify potential equipment failures before they occur and ensuring uninterrupted operation. For instance, Mitsubishi Heavy Industries has developed AI models that analyze flue gas characteristics to optimize amine-based capture processes

- The integration of digital twin technology with PCCS plants allows operators to simulate plant operations under various scenarios, enhancing process reliability and minimizing downtime. Siemens and Fluor are leveraging these digital solutions to optimize large-scale carbon capture systems

- This trend toward intelligent, automated, and adaptive PCCS solutions is redefining operational expectations in the energy sector. As a result, more companies are investing in AI-powered process monitoring and control technologies to improve efficiency and reduce carbon emissions

- The adoption of these advanced systems is increasing across both industrial and utility-scale power generation sectors, as regulators and stakeholders emphasize sustainability and decarbonization goals

What are the Key Drivers of Post Combustion Carbon Capture and Storage Maret?

- Stringent environmental regulations and net-zero commitments by governments and corporations are driving the demand for PCCS technologies to reduce CO₂ emissions from existing power plants and industrial facilities

- For instance, in 2024, TotalEnergies announced the deployment of a large-scale PCCS project in Europe, designed to capture over 1 million tons of CO₂ annually, demonstrating the growing regulatory-driven market expansion

- Rising corporate sustainability initiatives and investor pressure to adopt greener technologies are encouraging industrial and power generation sectors to implement PCCS solutions as part of their decarbonization strategies

- Technological improvements in solvents, sorbents, and capture systems are enhancing capture efficiency and reducing operational costs, making PCCS solutions more economically viable. For instance, Fluor and Linde have introduced next-generation amine-based systems with lower energy requirements

- Increasing global awareness of climate change impacts and the need for carbon mitigation is fostering investment in PCCS infrastructure, with both private and public stakeholders actively supporting pilot projects and commercial-scale implementations

Which Factor is Challenging the Growth of the Post Combustion Carbon Capture and Storage Market?

- High capital and operational costs remain a major challenge, as PCCS technologies require significant investment in equipment, energy, and maintenance. Smaller industrial players may find adoption financially challenging without subsidies or incentives

- For instance, despite technological improvements, the installation of full-scale PCCS units by companies such as NRG Energy or Shell can exceed hundreds of millions of dollars, limiting market penetration in cost-sensitive regions

- Energy consumption and efficiency concerns also pose challenges, as PCCS systems can reduce net power plant output due to the additional energy required for CO₂ capture and compression. Optimizing the energy footprint is essential to maintain economic feasibility

- Regulatory uncertainty and varying carbon pricing frameworks across regions can hinder large-scale deployment, as investors and operators weigh financial risks against environmental benefits

- Overcoming these barriers requires continued R&D to reduce costs, policy support, and scalable technology solutions that balance operational efficiency with environmental performance

How is the Post Combustion Carbon Capture and Storage Market Segmented?

The market is segmented on the basis of application.

- By Application

On the basis of application, the post combustion carbon capture and storage market is segmented into Oil and Gas, Chemical Processing, Power Generation, and Others. The Power Generation segment dominated the market in 2024, accounting for the largest revenue share of 46.5%, driven by stringent emission regulations and the urgent need for carbon mitigation in coal- and gas-fired power plants. Power generation facilities are increasingly adopting PCCS solutions to comply with environmental standards, reduce greenhouse gas emissions, and enhance operational sustainability. Large-scale projects and pilot installations by companies such as Shell, Equinor, and NRG Energy further reinforce this dominance.

The Oil and Gas segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising carbon reduction mandates and increased adoption of enhanced oil recovery (EOR) processes using captured CO₂. The growing integration of PCCS solutions in upstream and downstream operations, coupled with rising investments in industrial decarbonization initiatives, is expected to propel rapid market growth in this sector.

Which Region Holds the Largest Share of the Post Combustion Carbon Capture and Storage Market?

- North America dominated the post combustion carbon capture and storage market with the largest revenue share of 36.9% in 2024, driven by stringent emission regulations, industrial decarbonization initiatives, and widespread adoption of advanced PCCS technologies

- Utilities and industrial operators in the region are increasingly investing in carbon capture solutions to comply with government mandates and corporate net-zero goals

- This strong adoption is supported by high technological readiness, favorable policy frameworks, and substantial investments in clean energy projects, positioning North America as a leader in PCCS deployment

U.S. Post Combustion Carbon Capture and Storage Market Insight

U.S. PCCS market captured the largest revenue share in 2024 within North America, fueled by extensive adoption in coal- and gas-fired power plants, alongside industrial facilities such as refineries and chemical plants. Government incentives, research grants, and tax credits for carbon capture projects are accelerating deployments. Companies such as Chevron, NRG Energy, and Fluor are spearheading advanced PCCS projects, enhancing operational efficiency and sustainability.

Europe Post Combustion Carbon Capture and Storage Market Insight

Europe PCCS market is projected to expand at a substantial CAGR during the forecast period, driven by stringent carbon emission regulations and the adoption of decarbonization technologies in power generation and industrial processes. Germany, France, and Norway are investing in pilot and commercial-scale PCCS projects, with increased focus on integrating captured CO₂ into industrial applications or storage solutions.

U.K. Post Combustion Carbon Capture and Storage Market Insight

U.K. PCCS market is anticipated to grow at a noteworthy CAGR, driven by government-supported decarbonization initiatives, net-zero commitments, and industrial adoption in power plants and refineries. Policy support for CO₂ storage and utilization projects is accelerating market expansion.

Germany Post Combustion Carbon Capture and Storage Market Insight

Germany’s PCCS market is expected to expand significantly during the forecast period, fueled by strict emissions standards and sustainability mandates. Industrial and power generation facilities are increasingly adopting PCCS solutions, leveraging advanced technologies from companies such as Linde and Siemens to optimize capture efficiency and reduce environmental impact.

Which Region is the Fastest Growing in the Post Combustion Carbon Capture and Storage Market?

Asia-Pacific PCCS market is poised to grow at the fastest CAGR of 8.1% from 2025 to 2032, driven by rapid industrialization, urbanization, and government incentives promoting clean energy technologies. Countries such as China, Japan, and India are investing heavily in PCCS infrastructure to meet rising energy demand while adhering to emission reduction targets.

Japan Post Combustion Carbon Capture and Storage Market Insight

Japan’s PCCS market is gaining momentum due to high energy demand, technological advancement, and emphasis on sustainable industrial operations. The government and private sector are collaborating on pilot and commercial projects integrating PCCS with power plants and industrial facilities.

China Post Combustion Carbon Capture and Storage Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by its rapid industrial growth, urbanization, and strong focus on climate change mitigation. Local companies and government-supported projects are expanding PCCS adoption in power generation, chemical, and cement industries, positioning China as a critical market for carbon capture deployment.

Which are the Top Companies in Post Combustion Carbon Capture and Storage Market?

The post combustion carbon capture and storage industry is primarily led by well-established companies, including:

- Air Products (U.S.)

- Aker Solutions (Norway)

- Chevron (U.S.)

- Dakota Gasification Company (U.S.)

- Equinor (Norway)

- ExxonMobil (U.S.)

- Fluor (U.S.)

- General Electric (U.S.)

- Halliburton (U.S.)

- Linde (Ireland)

- Mitsubishi Heavy Industries (Japan)

- NRG Energy (U.S.)

- Shell (U.K.)

- Siemens (Germany)

- SLB (formerly Schlumberger) (U.S.)

- Sulzer (Switzerland)

- TotalEnergies (France)

What are the Recent Developments in Global Post Combustion Carbon Capture and Storage Market?

- In October 2024, Linde Engineering entered into an agreement with NEXTCHEM to supply carbon capture technology for Abu Dhabi National Oil Company’s (ADNOC) Hail and Ghasha project, the company will provide its latest adsorption-based carbon capture solution designed to efficiently capture and purify carbon dioxide (CO₂) for sequestration (CCS), thereby significantly reducing greenhouse gas emissions in natural gas and oil production processes, this collaboration highlights Linde’s commitment to advancing sustainable energy solutions globally

- In September 2024, Europe’s first post-combustion carbon capture plant began operations using MHI technology as part of the Ravenna CCS Project, Phase 1, launched by Eni and Snam, the facility captures approximately 25,000 tonnes of CO₂ per year from flue gas with the lowest CO₂ concentration of any commercial capture plant to date, this milestone marks a significant advancement in Europe’s carbon capture and storage initiatives

- In February 2024, Carbfix hf. expanded its global footprint by launching a new carbon capture plant in Iceland, the facility is expected to capture 3,000 tons of carbon annually, this expansion strengthens Carbfix’s role in innovative CO₂ sequestration and climate change mitigation

- In June 2023, Technip Energies N.V. launched CaptureNow, a platform that consolidates all carbon capture, storage, and utilization technologies under a single platform, this initiative streamlines access to advanced carbon management solutions for global industries

- In June 2023, CHN ENERGY Investment Group Co., LTD. announced the launch of Asia’s largest carbon capture project in China, which is expected to produce 500,000 tons of carbon dioxide annually, this project underscores China’s commitment to large-scale carbon reduction and sustainable industrial growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.