Global Post Consumer Recycled Plastic Packaging Pcr Market

Market Size in USD Billion

CAGR :

%

USD

54.00 Billion

USD

88.70 Billion

2025

2033

USD

54.00 Billion

USD

88.70 Billion

2025

2033

| 2026 –2033 | |

| USD 54.00 Billion | |

| USD 88.70 Billion | |

|

|

|

|

Post-Consumer Recycled Plastic Packaging (PCR) Market Size

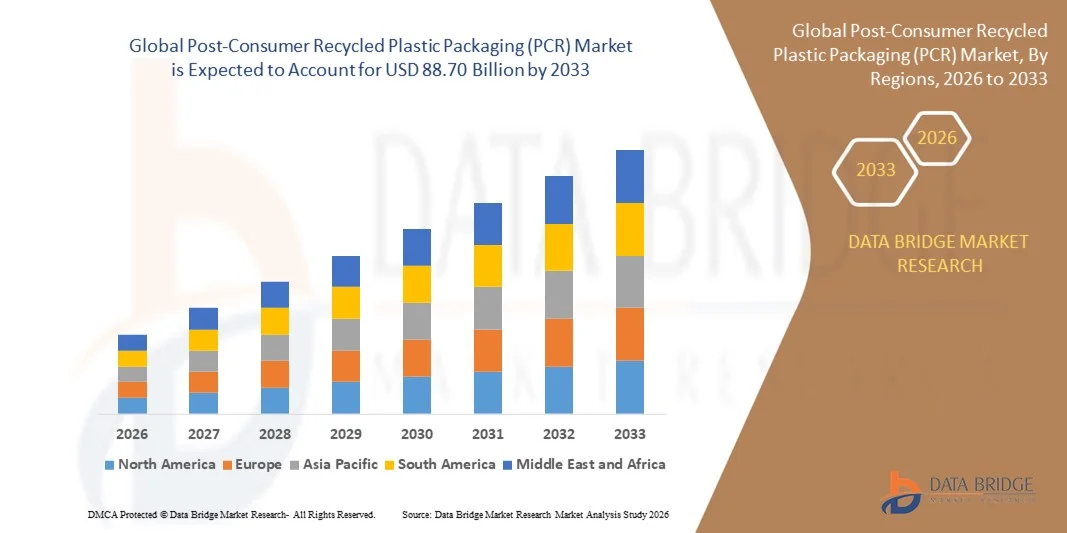

- The global post-consumer recycled plastic packaging (PCR) market size was valued at USD 54.0 billion in 2025 and is expected to reach USD 88.70 billion by 2033, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable packaging practices and growing environmental awareness among consumers and manufacturers, leading to higher demand for post-consumer recycled (PCR) plastics across food, beverage, and personal care industries

- Furthermore, rising regulatory pressure to reduce single-use plastics and the need for circular economy solutions are encouraging companies to integrate PCR materials into their packaging portfolios. These converging factors are accelerating the adoption of PCR plastic packaging, thereby significantly boosting the industry’s growth

Post-Consumer Recycled Plastic Packaging (PCR) Market Analysis

- Post-consumer recycled plastic packaging (PCR), made from recycled post-consumer materials, is increasingly recognized as a critical solution for reducing plastic waste and promoting sustainability across various industries. Its ability to maintain product protection, durability, and aesthetic appeal makes it suitable for food, beverage, personal care, and healthcare applications

- The escalating demand for PCR packaging is primarily driven by rising consumer preference for eco-friendly products, corporate sustainability commitments, and government initiatives to promote recycling and reduce plastic pollution. Enhanced recycling technologies and increased availability of high-quality PCR materials are further supporting market expansion

- Europe dominated the post-consumer recycled plastic packaging (PCR) market with a share of 42.62% in 2025, due to strong regulatory focus on sustainability, high consumer awareness of environmental impact, and widespread adoption of recycled materials across packaging applications

- Asia-Pacific is expected to be the fastest growing region in the post-consumer recycled plastic packaging (PCR) market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing awareness of environmental issues

- Bottles segment dominated the market with a market share of 41.7% in 2025, due to its extensive use in beverages and personal care products. For instance, Nestlé has adopted PCR bottles in its water lines to reduce environmental impact. Bottles offer durability, chemical resistance, and customization options, supporting widespread adoption

Report Scope and Post-Consumer Recycled Plastic Packaging (PCR) Market Segmentation

|

Attributes |

Post-Consumer Recycled Plastic Packaging (PCR) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Post-Consumer Recycled Plastic Packaging (PCR) Market Trends

Rising Adoption of Sustainable and Circular Packaging Solutions

- A significant trend in the post-consumer recycled plastic packaging (PCR) market is the increasing adoption of sustainable and circular packaging solutions, driven by growing environmental awareness and the need to reduce plastic waste. Manufacturers are progressively integrating PCR plastics into food, beverage, personal care, and healthcare packaging to meet consumer demand for eco-friendly alternatives

- For instance, companies such as Dow and Berry Global are developing high-performance PCR resins and recyclable packaging that support corporate sustainability goals. These initiatives enhance brand image and provide viable options for replacing virgin plastics in multiple packaging applications

- The market is witnessing strong growth as brands across industries commit to circular economy initiatives, emphasizing recyclable and reusable packaging. This is positioning PCR plastic packaging as a critical component in reducing environmental impact while maintaining product functionality

- Consumer preference for products with sustainable packaging is accelerating adoption, as packaging decisions increasingly influence purchasing behavior. The desire for visible eco-friendly credentials encourages manufacturers to expand the use of PCR materials in innovative packaging formats

- Technological advancements in mechanical and chemical recycling are improving the quality, availability, and performance of PCR plastics, enabling their wider application in durable and aesthetically appealing packaging

- Rising collaborations between recyclers, packaging manufacturers, and brands are enhancing supply chain efficiency and promoting standardized use of PCR plastics. These partnerships are reinforcing the transition toward more sustainable, circular packaging practices across global industries

Post-Consumer Recycled Plastic Packaging (PCR) Market Dynamics

Driver

Growing Regulatory Pressure and Corporate Sustainability Initiatives

- The post-consumer recycled plastic packaging (PCR) market is primarily driven by regulatory mandates and corporate sustainability commitments aimed at reducing plastic waste and increasing recycled content in packaging. Governments worldwide are introducing policies to encourage the use of recycled plastics and minimize single-use plastics in consumer goods packaging

- For instance, companies such as Coca-Cola and Nestlé are incorporating PCR materials in their bottles and containers to comply with environmental regulations and meet their sustainability pledges. These initiatives support the adoption of PCR packaging while enhancing brand credibility

- Increasing consumer awareness and demand for environmentally responsible packaging is encouraging manufacturers to prioritize sustainable solutions, creating a strong market pull for PCR plastics

- Policies promoting circular economy practices, such as Extended Producer Responsibility (EPR), are incentivizing businesses to adopt PCR packaging and reduce overall environmental footprint

- The convergence of regulatory requirements, consumer expectations, and corporate sustainability goals continues to accelerate the uptake of PCR plastic packaging, strengthening market growth prospects

Restraint/Challenge

Limited Availability and High Cost of High-Quality PCR Materials

- The post-consumer recycled plastic packaging (PCR) market faces challenges due to the limited availability of high-quality recycled plastics and the higher cost of producing consistent, food-grade PCR materials. Ensuring material purity, durability, and regulatory compliance requires advanced processing techniques, which increase operational expenses

- For instance, manufacturers must invest in specialized sorting, cleaning, and extrusion technologies to produce PCR resins suitable for sensitive applications such as food and healthcare packaging. These requirements constrain supply and elevate cost structures

- Variability in recycled material quality and contamination risks further complicate large-scale adoption, limiting manufacturers’ flexibility in product design and production planning

- Dependence on regional recycling infrastructure creates supply inconsistencies, which can hinder the scalability of PCR packaging solutions in certain markets

- These factors collectively challenge manufacturers to balance cost efficiency with quality and sustainability standards, restraining market growth despite strong demand

Post-Consumer Recycled Plastic Packaging (PCR) Market Scope

The market is segmented on the basis of material type, application, and end-user industry.

- By Material Type

On the basis of material type, the post-consumer recycled plastic packaging (PCR) market is segmented into polystyrene, HDPE, LDPE, PVC, and PET. The HDPE segment dominated in 2025 due to its durability, chemical resistance, and recyclability, making it suitable for bottles and containers across multiple industries. For instance, manufacturers prefer HDPE PCR packaging to meet sustainability goals while maintaining product integrity. Its lightweight nature, cost-effectiveness, and compatibility with food-grade products reinforce market dominance.

The PET segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing use in beverage bottles and food containers. For instance, Coca-Cola has expanded PCR PET usage in bottles to reduce virgin plastic. PET offers transparency, strength, and recyclability, attracting brand-conscious products. Technological advancements in PET recycling further support market growth.

- By Application

On the basis of application, the market is segmented into bottles, trays, clamshells, blister packs, bags & sacks, pouches & sachets, cups & jars, and tubs. The bottles segment dominated the market with the largest share of 41.7% in 2025 due to its extensive use in beverages and personal care products. For instance, Nestlé has adopted PCR bottles in its water lines to reduce environmental impact. Bottles offer durability, chemical resistance, and customization options, supporting widespread adoption.

The pouches & sachets segment is expected to witness the fastest growth from 2026 to 2033, driven by lightweight design and convenience. For instance, PepsiCo uses PCR pouches for ready-to-drink beverages to lower plastic use. Their flexibility, reduced transportation costs, and barrier performance accelerate adoption.

- By End-User Industry

On the basis of end-user industry, the market is segmented into food, beverages, pharmaceuticals, cosmetics & personal care, homecare & toiletries, and electronics. The beverages segment dominated in 2025 due to high demand for bottled water and soft drinks in sustainable packaging. For instance, Coca-Cola uses PCR content in PET bottles to support circular economy goals. Regulatory pressure and consumer preference for eco-friendly packaging reinforce dominance.

The cosmetics & personal care segment is expected to witness the fastest growth from 2026 to 2033, fueled by sustainable beauty trends. For instance, L’Oréal has adopted PCR packaging for shampoos and skincare products. PCR plastics offer durability, aesthetic flexibility, and regulatory compliance, driving growth in this sector.

Post-Consumer Recycled Plastic Packaging (PCR) Market Regional Analysis

- Europe dominated the post-consumer recycled plastic packaging (PCR) market with the largest revenue share of 42.62% in 2025, driven by strong regulatory focus on sustainability, high consumer awareness of environmental impact, and widespread adoption of recycled materials across packaging applications

- The region shows significant adoption of PCR packaging in food, beverages, and personal care industries due to strict recycling regulations, circular economy initiatives, and growing demand for eco-friendly packaging solutions

- This dominance is further reinforced by advanced recycling infrastructure, supportive policies promoting recycled content, and increasing brand commitment to sustainability, positioning Europe as a key consumption hub for PCR plastic packaging

Germany Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The Germany market accounted for the largest share within Europe, driven by strong manufacturing and packaging industries and high demand for sustainable products across food and beverage sectors. German consumers’ environmental consciousness and regulatory emphasis on recycled content support steady demand for PCR packaging. Advanced recycling technologies and well-established supply chains further strengthen market growth.

U.K. Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The U.K. market is expected to grow at a notable CAGR during the forecast period, supported by increasing demand for sustainable packaging in food and personal care sectors. Government initiatives to reduce plastic waste and rising consumer preference for eco-friendly alternatives encourage manufacturers to adopt PCR solutions. Growth in premium and sustainable product segments further contributes to market expansion.

North America Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The North America market is witnessing steady growth, driven by rising environmental awareness, extended producer responsibility policies, and growing adoption in beverages and packaged foods. Strong integration of PCR materials in brand sustainability strategies supports market development. Continuous innovations in recycling processes and expanding retail distribution channels further enhance adoption.

U.S. Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The U.S. market holds the largest share in North America, fueled by increasing corporate commitments to use recycled content and growing consumer demand for environmentally responsible packaging. Food and beverage companies are actively incorporating PCR packaging to meet sustainability targets. Expanding applications across personal care and household products continue to drive growth.

Asia-Pacific Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The Asia-Pacific market is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness of environmental issues. Expanding food, beverage, and personal care manufacturing industries support strong demand across the region.

China Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, supported by a growing middle class, increasing demand for sustainable packaging, and rapid expansion of the food and beverage industry. Government incentives and investments in recycling infrastructure continue to drive PCR adoption.

Japan Post-Consumer Recycled Plastic Packaging (PCR) Market Insight

The Japan market is gaining traction due to strong consumer preference for eco-friendly products and regulatory support for recycled content. High awareness of sustainability and innovative packaging solutions in food and personal care sectors contribute to steady market growth. Premium and functional packaging offerings further support adoption.

Post-Consumer Recycled Plastic Packaging (PCR) Market Share

The post-consumer recycled plastic packaging (PCR) industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Bemis Company Inc. (U.S.)

- Tetra Laval International S.A. (Switzerland)

- Mondi (U.K.)

- WestRock Company (U.S.)

- BASF SE (Germany)

- Sonoco Products Company (U.S.)

- Smurfit Kappa (Ireland)

- Sealed Air (U.S.)

- Huhtamaki (Finland)

- Gerresheimer AG (Germany)

- Ball Corporation (U.S.)

- Ardagh Group S.A. (Luxembourg)

- Crown Holdings (U.S.)

- DS Smith (U.K.)

- International Paper (U.S.)

- Berry Global Inc. (U.S.)

- Reynolds (U.S.)

- Genpak LLC (U.S.)

- DuPont (U.S.)

- Uflex Ltd. (India)

- Evergreen Packaging LLC (U.S.)

Latest Developments in Global Post-Consumer Recycled Plastic Packaging (PCR) Market

- In October 2024, Berry Global introduced a line of healthcare-use clarified polypropylene (PP) bottles designed to reduce CO2 emissions by approximately 71% and offer enhanced recyclability compared with conventional colored PET pill bottles. These ClariPPil bottles cater to vitamins, nutraceuticals, nutritional supplements, beauty supplements, and over-the-counter treatments, providing improved product protection, functionality, and aesthetics. The launch strengthens Berry Global’s position in the sustainable packaging segment, addressing growing consumer and regulatory demand for recyclable healthcare packaging. The RecyClass A certification further enhances market confidence, positioning the company as a leader in eco-friendly and compliant packaging solutions

- In June 2024, Dow, the materials science company, launched its REVOLOOP™ Recycled Plastics Resins family, marking a key milestone in advancing circular economy initiatives and transforming plastic waste. Dow aims to bring three million metric tons of sustainable and circular solutions to market annually by 2030, and the introduction of REVOLOOP™ resins aligns with this goal. Two new grades were introduced: one made entirely of post-consumer recycled (PCR) materials and another comprising up to 85% PCR derived from household waste, authorized for non-food-contact packaging. This launch reinforces Dow’s market leadership in sustainable materials, providing partners with high-performance recycled resins to meet increasing corporate and consumer demand for circular packaging solutions

- In August 2023, Berry Global merged its M&H and PET Power divisions to establish a Europe-wide entity, Berry Agile Solutions, offering shorter lead times and lower minimum order quantities (MOQs), including multi-product orders. This strategic consolidation enhances Berry Global’s operational efficiency, strengthens its market presence across Europe, and enables rapid response to evolving packaging demands. The move positions the company competitively in the regional sustainable packaging market, supporting both small-scale and large-scale manufacturers with flexible, eco-friendly packaging solutions

- In February 2023, ExxonMobil utilized 50% PCR plastic in its pails in India and recycled over 90% of lubricant operations waste annually for new applications. These initiatives reflect the company’s commitment to sustainability and resource efficiency, reinforcing its leadership in the recycled plastics market. By integrating high levels of PCR content and recycling operational waste, ExxonMobil reduces environmental impact and also sets a benchmark for circular practices in industrial packaging, influencing regional and global market trends toward sustainable materials

- In November 2023, Berlin Packaging, the global Hybrid Packaging developer®, announced the acquisition of Nest-Filler PKG Co., Ltd., a provider of beauty and cosmetics packaging. This strategic move strengthens Berlin Packaging’s position in the premium and sustainable cosmetics packaging market, expands its product portfolio, and enhances its ability to serve global beauty brands with innovative and customizable packaging solutions. The acquisition supports market growth by enabling faster response to evolving consumer preferences and increasing demand for high-quality, aesthetically appealing packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Post Consumer Recycled Plastic Packaging Pcr Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Post Consumer Recycled Plastic Packaging Pcr Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Post Consumer Recycled Plastic Packaging Pcr Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.