Global Postal Packaging Market

Market Size in USD Billion

CAGR :

%

USD

13.79 Billion

USD

21.09 Billion

2024

2032

USD

13.79 Billion

USD

21.09 Billion

2024

2032

| 2025 –2032 | |

| USD 13.79 Billion | |

| USD 21.09 Billion | |

|

|

|

|

Postal Packaging Market Size

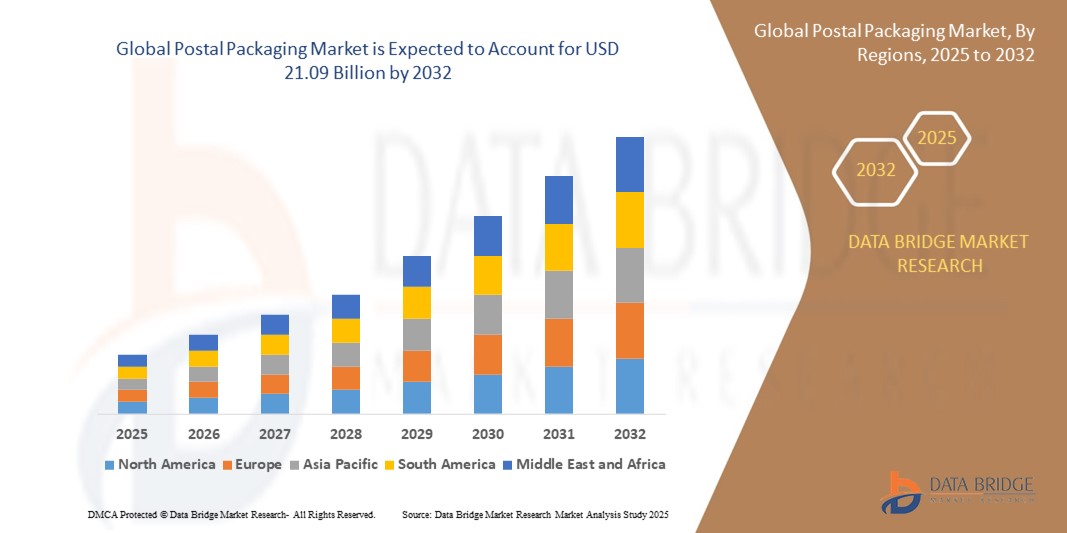

- The global postal packaging market size was valued at USD 13.79 billion in 2024 and is expected to reach USD 21.09 billion by 2032, at a CAGR of 5.45% during the forecast period

- The market growth is primarily driven by the rapid expansion of e-commerce, increasing demand for sustainable packaging solutions, and advancements in packaging technologies that enhance durability and efficiency

- Rising consumer awareness of eco-friendly materials and the need for secure, cost-effective packaging solutions for postal and courier services are further propelling market growth

Postal Packaging Market Analysis

- Postal packaging, encompassing materials and formats used for shipping and mailing goods, is a critical component of the logistics and e-commerce sectors, offering protection, durability, and sustainability for diverse applications

- The surge in demand for postal packaging is fueled by the global boom in online shopping, heightened focus on sustainable and recyclable materials, and the need for efficient, lightweight packaging to reduce shipping costs

- Asia-Pacific dominated the postal packaging market with the largest revenue share of 42.5% in 2024, driven by the region's robust e-commerce growth, large consumer base, and increasing adoption of sustainable packaging solutions, particularly in countries such as China, India, and Japan

- North America is expected to be the fastest-growing region during the forecast period, attributed to rising e-commerce penetration, technological advancements in packaging, and increasing consumer preference for eco-friendly materials

- The Paper & Paperboard segment dominated the largest market revenue share of 48.2% in 2024, driven by its eco-friendly properties, recyclability, and versatility in meeting diverse packaging needs across industries such as e-commerce, healthcare, and retail

Report Scope and Postal Packaging Market Segmentation

|

Attributes |

Postal Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Postal Packaging Market Trends

“Increasing Adoption of Sustainable and Eco-Friendly Materials”

- The global postal packaging market is experiencing a significant shift toward the use of sustainable and eco-friendly materials, driven by growing environmental awareness and regulatory pressures

- Technologies such as biodegradable polymers and recyclable paper-based solutions are being integrated to reduce the environmental impact of packaging

- Companies are developing innovative packaging solutions, such as recyclable padded envelopes and paper-based mailers, to replace traditional plastic-based options, enhancing sustainability

- For instances, major players such as Mondi have collaborated with e-commerce giants to produce fully recyclable paper mailers, eliminating the need for plastic bubble wrap

- This trend is increasing the appeal of postal packaging solutions for environmentally conscious consumers and businesses, particularly in the e-commerce and retail sectors

- Advanced analytics are being used to optimize packaging designs, ensuring minimal material waste while maintaining durability and protection during transit

Postal Packaging Market Dynamics

Driver

“Surge in E-Commerce and Demand for Efficient Packaging”

- The rapid growth of e-commerce, fueled by increasing internet penetration and changing consumer purchasing patterns, is a primary driver for the global postal packaging market

- Postal packaging solutions, such as envelopes, mailing bags, and boxes, provide lightweight, durable, and cost-effective options for safely shipping products to consumers

- Government initiatives to expand postal services, particularly in emerging economies such as India and China, are boosting demand for reliable packaging solutions

- The adoption of advanced technologies, such as automated packaging systems and tamper-evident features, enhances efficiency and security, further driving market growth

- Manufacturers are increasingly offering customizable packaging formats to meet the specific needs of e-commerce businesses, improving brand visibility and customer satisfaction

Restraint/Challenge

“High Costs and Environmental Regulations”

- The high initial costs associated with developing and implementing sustainable postal packaging solutions, such as biodegradable materials or advanced manufacturing processes, can be a barrier, particularly for small and medium-sized enterprises

- Retrofitting existing packaging systems to incorporate eco-friendly materials can be complex and expensive, limiting adoption in cost-sensitive markets

- In addition, stringent environmental regulations and varying regional standards for packaging waste management pose challenges for manufacturers, requiring compliance with diverse recycling and disposal requirements

- Concerns about the durability of sustainable materials compared to traditional plastics may deter some businesses, particularly for shipping fragile or high-value items

- The fragmented regulatory landscape across countries complicates operations for global manufacturers, potentially slowing market expansion in regions with strict environmental policies

Postal Packaging market Scope

The market is segmented on the basis of material type, packaging format, and end-use.

- By Material Type

On the basis of material type, the postal packaging market is segmented into Paper & Paperboard, Plastic, Tyvek, and Others. The Paper & Paperboard segment dominated the largest market revenue share of 48.2% in 2024, driven by its eco-friendly properties, recyclability, and versatility in meeting diverse packaging needs across industries such as e-commerce, healthcare, and retail. Its biodegradability and cost-effectiveness make it a preferred choice for manufacturers and consumers asuch as.

The Tyvek segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032, owing to its exceptional strength, tear resistance, and durability in challenging shipping conditions. The increasing adoption of Tyvek for high-value and sensitive shipments, coupled with advancements in sustainable synthetic materials, is driving its rapid growth.

- By Packaging Format

On the basis of packaging format, the postal packaging market is segmented into Envelopes, Mailing Bags, Boxes & Cartons, Wraps, and Others. The Envelopes segment accounted for the largest market revenue share of 42.7% in 2024, driven by their widespread use for documents, financial transactions, and small items, particularly in institutional and commercial applications. Envelopes are favored for their lightweight design, cost-effectiveness, and association with credibility for sensitive correspondence.

The Boxes & Cartons segment is anticipated to experience the fastest growth rate of 6.9% from 2025 to 2032, fueled by the surge in e-commerce and the need for durable, customizable, and eco-friendly packaging solutions. The increasing demand for reusable and recyclable boxes, particularly in the healthcare and retail sectors, supports this segment's rapid expansion.

- By End-Use

On the basis of end-use, the postal packaging market is segmented into Institutional/Commercial and Household. The Institutional/Commercial segment dominated the market with a revenue share of 68.3% in 2024, driven by the high demand for reliable and secure packaging solutions in industries such as e-commerce, healthcare, and logistics. The need for tamper-evident and customized packaging for institutional applications further bolsters this segment.

The Household segment is expected to witness significant growth from 2025 to 2032, with a projected CAGR of 6.4%. The rise in online shopping, particularly in developing countries, and the increasing adoption of subscription-based services are driving demand for postal packaging in household applications. The focus on sustainable and convenient packaging solutions also contributes to this segment's growth.

Postal Packaging Market Regional Analysis

- Asia-Pacific dominated the postal packaging market with the largest revenue share of 42.5% in 2024, driven by the region's robust e-commerce growth, large consumer base, and increasing adoption of sustainable packaging solutions, particularly in countries such as China, India, and Japan

- Consumers prioritize postal packaging for product protection, cost efficiency, and environmental sustainability, particularly in regions with high online retail penetration

- Growth is supported by advancements in packaging materials, such as recyclable paperboard and biodegradable plastics, alongside rising adoption in both commercial and household segments

Japan Postal Packaging Market Insight

Japan’s postal packaging market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainable packaging materials that enhance product safety and environmental responsibility. The presence of major e-commerce players and the integration of advanced packaging formats in logistics accelerate market penetration. Rising interest in customized packaging for household use also contributes to growth.

China Postal Packaging Market Insight

China holds the largest share of the Asia-Pacific postal packaging market, propelled by rapid e-commerce growth, increasing consumer demand for sustainable and cost-effective packaging, and widespread adoption of advanced materials. The country’s expanding logistics networks and focus on smart packaging solutions support market growth. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

North America Postal Packaging Market Insight

North America is expected to witness the fastest growth rate in the global postal packaging market in 2024, propelled by the surge in e-commerce, increasing consumer demand for sustainable packaging, and advancements in logistics infrastructure. The region benefits from strong adoption of eco-friendly materials such as recyclable paperboard and Tyvek, driven by regulatory support and consumer awareness. Growth is evident in both institutional/commercial and household segments, with the U.S. leading due to its robust online retail and last-mile delivery systems.

U.S. Postal Packaging Market Insight

The U.S. postal packaging market is expected to witness significant growth, fueled by robust e-commerce demand and growing consumer preference for sustainable packaging. The trend toward customized and branded packaging solutions, coupled with stringent regulations promoting eco-friendly materials, drives market expansion. The integration of advanced packaging formats in logistics and last-mile delivery complements both institutional and household demand.

Europe Postal Packaging Market Insight

The Europe postal packaging market is expected to witness significant growth, supported by regulatory focus on sustainability and circular economy principles. Consumers demand packaging that ensures product safety while minimizing environmental impact. Growth is prominent in both commercial and household applications, with countries such as Germany and the U.K. showing strong adoption due to rising e-commerce and environmental awareness.

U.K. Postal Packaging Market Insight

The U.K. market for postal packaging is expected to witness rapid growth, driven by increasing e-commerce penetration and consumer demand for sustainable packaging solutions in urban and suburban settings. Growing awareness of recyclable materials and lightweight packaging encourages adoption. Evolving regulations promoting eco-friendly packaging influence consumer choices, balancing functionality with compliance.

Germany Postal Packaging Market Insight

Germany is expected to witness rapid growth in the postal packaging market, attributed to its advanced logistics infrastructure and high consumer focus on sustainability and efficiency. German consumers prefer innovative packaging materials, such as recyclable paperboard and Tyvek, that reduce environmental impact and optimize shipping costs. The integration of these materials in e-commerce and institutional applications supports sustained market growth.

Postal Packaging Market Share

The postal packaging industry is primarily led by well-established companies, including:

- Mondi (U.K.)

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- WestRock Company (U.S.)

- Rengo Co., Ltd. (Japan)

- Cenveo Worldwide Limited (U.S.)

- Neenah, Inc. (U.S.)

- Papier-Mettler KG (Germany)

- Bong Group (Sweden)

- GWP Group (U.K.)

- Shillington Box Company (U.S.)

- Capital Envelopes LLC (U.A.E.)

- WB PACKAGING LTD (U.K.)

- Polypak Packaging (U.S.)

- United Envelope (U.S.)

- Lil Packaging (U.K.)

- Poly Postal Packaging Ltd. (U.K.)

What are the Recent Developments in Global Postal Packaging Market?

- In May 2025, Berry Global unveiled a new line of reclosable bags at the Packaging Innovations & Empack 2025 event, showcasing its dedication to sustainable packaging solutions. These bags are made with up to 50% recycled content, designed to be both reusable and recyclable, aligning with Berry’s broader mission to advance the circular economy. The launch reflects the company’s ongoing efforts to reduce virgin plastic usage, enhance material recovery, and deliver eco-friendly alternatives without compromising performance or visual appeal

- In February 2025, Rottneros Packaging AB introduced its NATURE™ range of sustainable food packaging trays at the Packaging Innovations & Empack 2025 event in Birmingham. Crafted from FSC-certified raw materials and produced using 100% renewable energy, these trays contain up to 98% renewable content and less than 10% plastic, making them fully recyclable in paper streams under CEPI and 4EverGreen protocols. Designed to extend food shelf life and reduce waste, the trays feature biobased inner liners, customizable barrier properties, and compatibility with MAP and VSP systems, offering a high-performance, eco-friendly alternative to traditional plastic packaging

- In January 2025, Huhtamaki India, in collaboration with the Embassy of Finland, hosted the second edition of the Think Circle event in New Delhi. The gathering spotlighted the launch of “Design for Recyclability Guidelines for Films & Flexible Packaging”, developed under the India Plastics Pact (IPP) by the Confederation of Indian Industry (CII). These guidelines aim to tackle recyclability challenges by promoting mono-material designs, reducing harmful pigments such as carbon black, and encouraging the use of recyclable barrier layers. The initiative sets new benchmarks for sustainable packaging and supports India’s transition toward a circular economy

- In July 2024, Smurfit Kappa and WestRock finalized their merger to form Smurfit WestRock, a global powerhouse in sustainable paper-based packaging. Valued at approximately $12.7 billion, the deal united two industry leaders with complementary geographic footprints—Smurfit Kappa in Europe and WestRock in the Americas. The newly formed company operates 63 paper mills and 500 converting facilities across 40 countries, consuming an estimated 15 million tons of recycled fiber annually. Headquartered in Dublin, with regional offices in Atlanta, Smurfit WestRock is now listed on both the NYSE and London Stock Exchange, marking a major milestone in packaging innovation and scale

- In March 2024, International Paper announced its acquisition of UK-based DS Smith Plc through an all-share combination valued at approximately $9.9 billion, not $7.2 billion as initially estimated. The merger is expected to create a global leader in sustainable packaging, combining DS Smith’s strong European footprint with International Paper’s North American operations. The deal will integrate 500,000 to 600,000 tons of containerboard into International Paper’s mill system, boosting its corrugated packaging and recycling capabilities and achieving a 90% integration rate. The transaction is slated to close in Q4 2024, pending regulatory approvals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Postal Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Postal Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Postal Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.