Global Potash Nitrate Fertilizer Market

Market Size in USD Million

CAGR :

%

USD

463.82 Million

USD

744.86 Million

2025

2033

USD

463.82 Million

USD

744.86 Million

2025

2033

| 2026 –2033 | |

| USD 463.82 Million | |

| USD 744.86 Million | |

|

|

|

|

Potash Nitrate Fertilizer Market Size

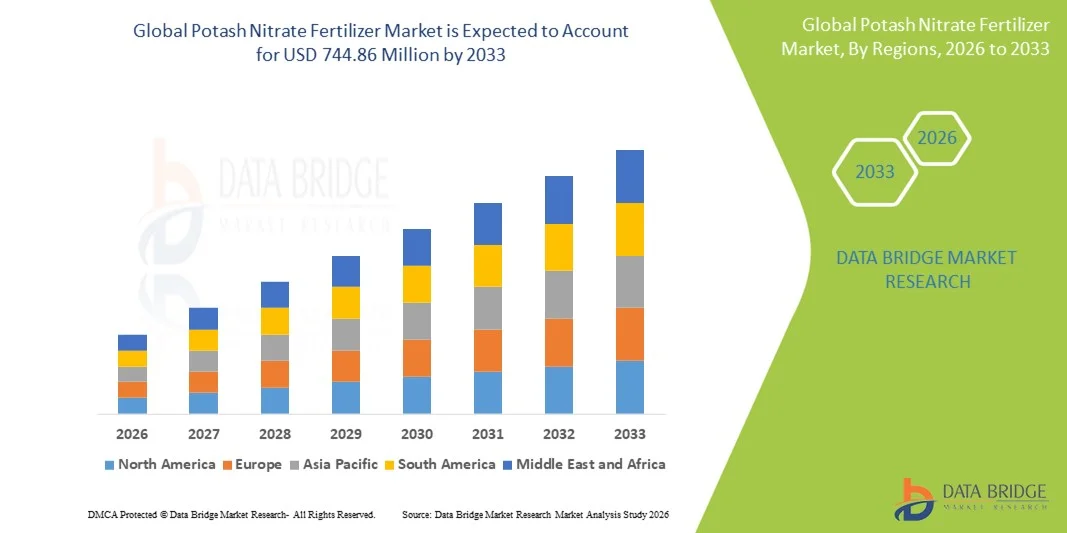

- The global potash nitrate fertilizer market size was valued at USD 463.82 million in 2025 and is expected to reach USD 744.86 million by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by increasing adoption of high-efficiency fertilizers and advanced nutrient management practices, which are driving farmers to optimize crop yield and quality across cereals, fruits, vegetables, and other high-value crops

- Furthermore, rising demand for precision agriculture, fertigation, and soil-specific nutrient solutions is establishing potash nitrate as a preferred source of potassium and nitrogen for balanced fertilization. These converging factors are accelerating the adoption of potash nitrate fertilizers, thereby significantly boosting the market’s expansion

Potash Nitrate Fertilizer Market Analysis

- Potash nitrate fertilizers, providing both potassium and nitrogen in a highly soluble form, are increasingly vital for modern farming practices due to their rapid nutrient availability, compatibility with fertigation systems, and ability to improve crop growth and stress resistanc

- The escalating demand for potash nitrate is primarily fueled by the need to enhance nutrient use efficiency, growing cultivation of high-value crops, and increasing awareness among farmers regarding sustainable and yield-optimizing fertilization techniques

- Asia-Pacific dominated the potash nitrate fertilizer market with a share of over 45% in 2025, due to extensive agricultural activities, high demand for cereal and grain crops, and the presence of major fertilizer manufacturing hubs

- North America is expected to be the fastest growing region in the potash nitrate fertilizer market during the forecast period due to increasing demand for high-yield crops, adoption of precision farming, and rising investments in sustainable agricultural inputs

- Cereals and grains segment dominated the market with a market share of 42.5% in 2025, due to the extensive cultivation of staple crops such as wheat, rice, and maize worldwide. Farmers prioritize cereals and grains for potash nitrate application due to its ability to enhance crop yield, improve nutrient uptake, and strengthen resistance to stress conditions. The high demand for cereals and grains for both human consumption and livestock feed further fuels the widespread adoption of potash nitrate fertilizers in this segment

Report Scope and Potash Nitrate Fertilizer Market Segmentation

|

Attributes |

Potash Nitrate Fertilizer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Potash Nitrate Fertilizer Market Trends

Rising Adoption of Precision Agriculture and Fertigation Practices

- A significant trend in the potash nitrate fertilizer market is the increasing adoption of precision agriculture and fertigation techniques, driven by the growing need to optimize nutrient use efficiency, crop yield, and quality across cereals, fruits, vegetables, and other high-value crops. This adoption is positioning potash nitrate as a preferred fertilizer for modern farming systems that demand targeted and efficient nutrient delivery

- For instance, companies such as ICL Fertilizers and Haifa Group supply high-solubility potassium nitrate products that are widely used in drip irrigation and fertigation systems, enabling uniform nutrient distribution and supporting sustainable farming practices. Such products enhance plant growth, improve stress resistance, and increase overall crop productivity

- The demand for potash nitrate fertilizers is growing rapidly in greenhouse and hydroponic cultivation, where precise nutrient management is critical for maximizing yield and quality. This is establishing potassium nitrate as an essential input for controlled-environment agriculture

- Horticulture and high-value crop farming are increasingly integrating potash nitrate fertilizers to improve fruit size, sugar content, and nutrient composition. The trend is accelerating the adoption of specialty nutrient solutions and balanced fertilization practices

- Large-scale cereal and grain farms are leveraging fertigation and precision application of potash nitrate to optimize input efficiency, reduce wastage, and maintain soil fertility. This is enhancing operational efficiency and reinforcing the importance of potassium nitrate in intensive farming

- The market is witnessing strong growth in regions with supportive agricultural policies and investments in modern irrigation infrastructure, where potassium nitrate adoption is further facilitated. This rising incorporation of potash nitrate fertilizers is reinforcing the transition toward more sustainable, high-efficiency, and technologically advanced farming systems

Potash Nitrate Fertilizer Market Dynamics

Driver

Growing Demand for High-Value Crops and Improved Crop Yield

- The growing global focus on high-value crops such as fruits, vegetables, and specialty horticultural products is driving the demand for potash nitrate fertilizers, which provide essential potassium and nitrogen in a highly soluble form for optimized growth. These fertilizers enable farmers to enhance crop yield, improve quality parameters, and maintain soil health

- For instance, companies such as Nutrien Ltd. and Yara International provide potassium nitrate fertilizers tailored for high-value crops in greenhouse and open-field applications, supporting nutrient-specific management practices. This helps growers achieve higher productivity and profitability while addressing market demand for premium produce

- Increasing adoption of modern farming techniques and precision nutrient management is further fueling the need for efficient fertilizers such as potassium nitrate. These practices support optimized fertilizer application rates, better crop performance, and sustainable input usage

- Rising consumer demand for nutrient-rich and high-quality agricultural produce is encouraging farmers to use fertilizers that directly enhance yield and quality. This trend reinforces the importance of potassium nitrate as a preferred fertilizer for intensive crop production

- The shift toward intensive and sustainable agriculture across developed and emerging markets continues to strengthen this driver. The requirement for fertilizers that improve crop outcomes and support efficient farming practices is positioning potash nitrate as an essential tool for modern agriculture

Restraint/Challenge

Seasonal Supply Fluctuations and Price Volatility

- The potash nitrate fertilizer market faces challenges due to seasonal fluctuations in raw material availability, regional production constraints, and volatility in prices of potassium and nitrogen sources. These factors can disrupt supply chains and impact fertilizer affordability for farmers

- For instance, sudden changes in potash production or transportation bottlenecks from major producing countries affect the availability of potassium nitrate fertilizers globally. Such fluctuations increase procurement costs and can limit adoption among small and medium-scale farmers

- Market dependence on a limited number of key manufacturers and regional supply hubs exposes the industry to risks from geopolitical issues, climatic disruptions, or logistical challenges. These vulnerabilities affect both production planning and pricing stability

- The high cost of potassium nitrate compared with conventional fertilizers may discourage widespread use in cost-sensitive regions, particularly among low-margin crop producers. This limits the growth potential of the market in certain geographies

- The market continues to encounter constraints related to balancing supply, demand, and pricing while maintaining consistent quality. These challenges collectively place pressure on manufacturers and distributors to ensure reliable and economically viable potassium nitrate availability for farmers worldwide

Potash Nitrate Fertilizer Market Scope

The market is segmented on the basis of crop type, form, composition, and application method.

- By Crop Type

On the basis of crop type, the Potash Nitrate Fertilizer market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and others. The cereals and grains segment dominated the market with the largest market revenue share of 42.5% in 2025, driven by the extensive cultivation of staple crops such as wheat, rice, and maize worldwide. Farmers prioritize cereals and grains for potash nitrate application due to its ability to enhance crop yield, improve nutrient uptake, and strengthen resistance to stress conditions. The high demand for cereals and grains for both human consumption and livestock feed further fuels the widespread adoption of potash nitrate fertilizers in this segment. The segment also benefits from government programs and subsidies supporting cereal crop production in major agricultural regions. In addition, the ease of integrating potash nitrate into conventional fertilization schedules ensures consistent usage across large-scale cereal and grain farms.

The fruits and vegetables segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for high-quality horticultural produce with improved shelf life and nutrient content. For instance, companies such as Haifa Chemicals promote potash nitrate fertilizers for vegetable cultivation to enhance fruit size, sugar content, and overall plant health. The rising consumer preference for fresh and nutrient-dense fruits and vegetables encourages farmers to adopt targeted nutrient solutions such as potash nitrate. The segment benefits from the integration of precision agriculture techniques, which optimize fertilizer application and reduce waste. The growing focus on intensive horticulture in emerging markets further supports rapid adoption in this crop type.

- By Form

On the basis of form, the market is segmented into solid and liquid fertilizers. The solid segment dominated the market with the largest revenue share in 2025, driven by its ease of storage, transportation, and application across diverse crop types. Farmers often prefer solid potash nitrate for large-scale field applications due to its cost-effectiveness and uniform nutrient delivery. The solid form also allows for controlled release and compatibility with conventional fertilizer blends, enhancing operational convenience. In addition, solid fertilizers can be easily integrated with mechanized spreading equipment, making them suitable for high-acreage cultivation. The reliability and established usage of solid potash nitrate in global agricultural practices reinforce its leading position in the market.

The liquid segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing adoption in precision agriculture and fertigation systems. For instance, Yara International promotes liquid potash nitrate formulations that can be directly applied through drip irrigation systems to optimize nutrient uptake. Liquid fertilizers offer quick absorption and immediate nutrient availability, which is particularly beneficial for high-value crops and intensive farming. The flexibility of liquid formulations allows for blending with other nutrients, enhancing overall crop performance. Increasing investments in modern irrigation infrastructure support the rapid adoption of liquid potash nitrate fertilizers.

- By Composition

On the basis of composition, the market is segmented into organic and inorganic fertilizers. The inorganic segment dominated the market with the largest revenue share in 2025, driven by its high nutrient concentration, cost efficiency, and predictable performance across various crop types. Farmers widely use inorganic potash nitrate to achieve consistent results in terms of crop yield, growth rate, and resistance to environmental stressors. The segment also benefits from established production infrastructure and the availability of globally recognized brands. In addition, the ease of formulation with other chemical fertilizers makes inorganic potash nitrate the preferred choice for large-scale commercial agriculture.

The organic segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness and adoption of sustainable farming practices. For instance, companies such as ICL Specialty Fertilizers promote organically sourced potash nitrate for eco-friendly agriculture. Organic fertilizers improve soil health over time while providing essential nutrients, aligning with the growing consumer demand for sustainably produced crops. The segment also benefits from government incentives supporting organic farming in various regions. Rising demand from niche markets such as organic fruits, vegetables, and specialty crops further supports its rapid growth.

- By Application Method

On the basis of application method, the market is segmented into broadcasting, foliar, and fertigation. The broadcasting segment dominated the market with the largest revenue share in 2025, driven by its simplicity and suitability for large-scale field applications. Farmers widely adopt broadcasting for cereal and grain crops as it allows uniform nutrient distribution over extensive areas, enhancing overall crop growth and yield. The method is compatible with both solid and liquid formulations, offering flexibility and operational efficiency. In addition, mechanized broadcasting equipment reduces labor requirements and ensures consistent application rates across farms. The long-standing use of broadcasting in traditional agricultural practices reinforces its leading position in the market.

The fertigation segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising adoption of modern irrigation systems and precision farming techniques. For instance, Netafim promotes fertigation methods using potash nitrate to deliver nutrients directly to the root zone through drip irrigation systems. Fertigation enhances nutrient use efficiency, reduces wastage, and allows targeted application based on crop growth stages. The increasing focus on high-value crops, vegetables, and horticultural plantations drives rapid adoption in this segment. In addition, fertigation systems support sustainable agriculture by minimizing environmental runoff and improving resource efficiency.

Potash Nitrate Fertilizer Market Regional Analysis

- Asia-Pacific dominated the potash nitrate fertilizer market with the largest revenue share of over 45% in 2025, driven by extensive agricultural activities, high demand for cereal and grain crops, and the presence of major fertilizer manufacturing hubs

- The region’s cost-effective production capabilities, growing adoption of modern farming practices, and government support for agricultural input subsidies are accelerating market expansion

- The availability of skilled agronomists, favorable policies promoting crop yield enhancement, and rapid adoption of precision farming techniques across developing economies are contributing to increased consumption of potash nitrate fertilizers

China Potash Nitrate Fertilizer Market Insight

China held the largest share in the Asia-Pacific potash nitrate fertilizer market in 2025, owing to its vast arable land, strong focus on cereal and grain production, and well-established fertilizer manufacturing sector. The country’s supportive agricultural policies, high investment in crop yield improvement, and extensive export capabilities for fertilizers are major growth drivers. Demand is also bolstered by increasing adoption of fertigation and precision farming practices for high-value crops.

India Potash Nitrate Fertilizer Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising demand for fruits, vegetables, and oilseed crops, along with government initiatives promoting balanced fertilization. For instance, fertilizer programs encouraging the use of potash nitrate for horticulture and cereal crops are strengthening adoption. In addition, increasing investments in modern irrigation systems and farm mechanization are driving robust market expansion.

Europe Potash Nitrate Fertilizer Market Insight

The Europe potash nitrate fertilizer market is expanding steadily, supported by strict regulatory standards, growing focus on sustainable and efficient farming, and demand for high-nutrient crops. The region emphasizes precision agriculture and environmentally responsible fertilizer use, particularly in horticulture and high-value crop cultivation. Increasing use of advanced nutrient management solutions is further enhancing market growth.

Germany Potash Nitrate Fertilizer Market Insight

Germany’s market is driven by its leadership in high-value crop production, adoption of modern agricultural technologies, and strong emphasis on sustainable farming. The country has well-established R&D and agricultural extension services, fostering continuous innovation in fertilizer application techniques. Demand is particularly strong for fertigation and foliar application of potash nitrate in fruits and vegetables.

U.K. Potash Nitrate Fertilizer Market Insight

The U.K. market is supported by a mature agricultural sector, increasing adoption of precision farming, and focus on high-quality produce for domestic and export markets. With rising investments in controlled-environment agriculture, academic-industry collaborations, and modern fertilizer solutions, the U.K. continues to play a significant role in high-value crop fertilization.

North America Potash Nitrate Fertilizer Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for high-yield crops, adoption of precision farming, and rising investments in sustainable agricultural inputs. A strong focus on soil health, crop optimization, and nutrient efficiency is boosting demand. In addition, reshoring of fertilizer production and growing collaborations between agritech companies and farmers are supporting market expansion.

U.S. Potash Nitrate Fertilizer Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its extensive arable land, advanced farming technologies, and strong agritech infrastructure. The country’s focus on crop yield optimization, soil nutrient management, and high-value crop production is encouraging the use of potash nitrate fertilizers. Presence of key manufacturers and an established distribution network further solidify the U.S.'s leading position in the region.

Potash Nitrate Fertilizer Market Share

The potash nitrate fertilizer industry is primarily led by well-established companies, including:

- Yara International (Norway)

- Nutrien Ltd. (Canada)

- EuroChem Group (Switzerland)

- Mosaic Company (U.S.)

- HELM AG (Germany)

- ICL Fertilizers (Israel)

- Borealis AG (Austria)

- Sinofert Holdings Limited (China)

- K+S Aktiengesellschaft (Germany)

- Migao Corporation (China)

- SESODA Corporation (Japan)

- SQM S.A. (Chile)

- ArrMaz (U.S.)

Latest Developments in Global Potash Nitrate Fertilizer Market

- In February 2025, Haifa introduced a high-purity potassium nitrate product, Multi-K Absolute, designed for hydroponic and soilless agriculture. The product provides low sodium content and high solubility, addressing the requirements of controlled-environment farming. Its launch expands the application of KNO₃ beyond conventional field crops into greenhouse and hydroponic systems, catering to the growing global trend of intensive and high-value crop production. This development is expected to stimulate market growth in premium and specialty fertilizer segments

- In August 2024, ICL Group signed a five-year distribution agreement worth approximately USD 170 million with AMP Holdings Group in China. This move significantly strengthens ICL’s supply chain in one of the largest agricultural markets and expands the availability of potassium-nitrate-based fertilizers for high-value crops such as vegetables and fruits. The agreement is expected to drive adoption of fertigation and specialty fertilizers, increasing overall market penetration of KNO₃ products in China. It also positions ICL to capitalize on the rising demand for precision agriculture and high-efficiency nutrient solutions

- In July 2024, ICL completed the acquisition of Custom Ag Formulators (CAF), a U.S.-based manufacturer of liquid and water-soluble fertilizers. This acquisition broadens ICL’s product portfolio and enhances its ability to provide customized fertilizer solutions, including potassium-nitrate variants. The integration of CAF’s manufacturing capabilities is expected to improve supply consistency, reduce lead times, and support the growing North American demand for high-quality, precision fertilizers, thereby boosting market growth for liquid and soluble KNO₃ products

- In June 2024, Coromandel International Ltd. began establishing an integrated phosphoric-acid and sulfuric-acid production complex at its Kakinada plant in India. This development strengthens its fertilizer production infrastructure and ensures a stable raw-material supply, enabling higher production of potassium-based fertilizers. The project is likely to reduce import dependence, improve affordability, and expand accessibility of KNO₃ fertilizers across India, supporting adoption among both large-scale and smallholder farmers

- In May 2024, Haifa Group launched a new granular fertilizer line, Haifa Turbo-K™, based on potassium nitrate. The product offers improved nutrient uptake efficiency and balanced macro- and micronutrient supply for various crops. This innovation enhances the fertilizer portfolio available to farmers, particularly for high-value horticultural crops, and supports sustainable agriculture by improving nutrient use efficiency. The introduction of this product is expected to increase market demand for potassium-nitrate-based fertilizers in both open-field and greenhouse cultivation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.